Aegean Airlines Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aegean Airlines Bundle

Aegean Airlines operates in a competitive landscape shaped by intense rivalry, the significant power of buyers, and the constant threat of new entrants. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Aegean Airlines’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Aegean Airlines, like many airlines, contends with substantial bargaining power from aircraft manufacturers, primarily Airbus and Boeing, which operate as a duopoly. The scarcity of suppliers for advanced aircraft, coupled with extensive order backlogs and persistent delivery delays, grants these manufacturers considerable leverage. For instance, in 2023, Airbus reported a record order backlog of over 8,000 aircraft, highlighting the extended lead times and limited immediate availability for airlines like Aegean.

The power of engine suppliers is equally significant. Mandatory early inspections of Pratt & Whitney GTF engines, a critical component for many modern aircraft, have directly impacted Aegean's operations. This led to the grounding of some of its A320/A321neo fleet, directly restricting capacity growth and escalating operational expenses. This situation exemplifies how a single supplier's technical issues can impose considerable costs and operational constraints on an airline.

Fuel suppliers wield considerable bargaining power over Aegean Airlines. The price of jet fuel is a major, volatile operating expense, often representing a significant percentage of an airline's total costs. For instance, in 2023, jet fuel costs were a primary driver of profitability shifts for many airlines globally.

Airlines like Aegean have limited ability to influence global oil prices, effectively making them price-takers in this market. This dynamic means that fluctuations in crude oil prices directly translate into higher or lower operating expenses for Aegean, impacting its bottom line and requiring robust cost-control measures.

Aegean Airlines, like many in the aviation sector, contends with significant labor challenges. The industry has been experiencing ongoing shortages in critical roles such as pilots, aircraft maintenance technicians, and ground handling personnel. This scarcity of skilled workers directly impacts operational costs and the airline's ability to scale efficiently.

The presence of robust labor unions further amplifies the bargaining power of these skilled personnel. Unions can effectively negotiate for higher wages, improved benefits, and better working conditions, which can translate into increased labor expenses for Aegean. For instance, in 2024, reports indicated that pilot salaries in the European aviation market saw an average increase of 5-8% due to these persistent shortages and strong union representation.

Airport Services and Infrastructure

Airport operators, particularly those with a dominant position in crucial hubs like Athens International Airport (ATH), wield substantial bargaining power over airlines such as Aegean. This power allows them to dictate terms for essential services.

These operators can impose significant landing fees, ground handling charges, and various other service fees. For instance, in 2023, Athens International Airport handled over 28 million passengers, underscoring its importance and leverage. Aegean's operational network is heavily anchored in these Greek airports, making it susceptible to these cost impositions.

- Airport Fees: Landing and navigation fees are a direct cost component influenced by airport operator pricing.

- Ground Handling Services: Essential services like baggage handling and aircraft servicing are often provided by airport-affiliated entities or a limited number of approved providers, granting them pricing power.

- Infrastructure Access: Gate assignments, check-in counter availability, and other vital infrastructure access are managed by airport authorities, who can leverage this control.

Maintenance, Repair, and Overhaul (MRO) Providers

The bargaining power of Maintenance, Repair, and Overhaul (MRO) providers for Aegean Airlines is on the rise. An aging global aircraft fleet, coupled with persistent supply chain issues delaying new aircraft deliveries, means airlines must keep older planes operational for extended periods. This extended lifespan directly translates to increased maintenance needs and a greater dependence on specialized MRO services, thereby amplifying the MRO providers' leverage. For instance, in 2023, the global MRO market was valued at approximately $100 billion and is projected to grow, indicating a robust demand for these services.

Aegean Airlines is actively working to counter this increasing supplier power through strategic internal development. The airline's investment in a new Maintenance & Training Center is a key initiative designed to bring more MRO capabilities in-house. This move aims to reduce reliance on external MRO providers, potentially lowering costs and improving control over maintenance schedules and quality. By enhancing its internal capacity, Aegean seeks to capture more value and mitigate the impact of external supplier bargaining power.

- Global aircraft fleet aging, necessitating longer operational life for existing planes.

- Supply chain disruptions impacting new aircraft deliveries, further extending reliance on older fleets.

- Increased demand for MRO services drives up costs and supplier bargaining power.

- Aegean's new Maintenance & Training Center aims to reduce external MRO dependency and enhance internal value creation.

The bargaining power of suppliers for Aegean Airlines is significant, particularly from aircraft and engine manufacturers like Airbus and Boeing, who operate as a duopoly. This leverage is amplified by extensive order backlogs and persistent delivery delays, as seen with Airbus's over 8,000 aircraft backlog in 2023. Additionally, critical engine components, such as Pratt & Whitney GTF engines, have caused operational disruptions and increased costs for airlines like Aegean due to mandatory inspections. Fuel suppliers also hold considerable power, with jet fuel costs being a major, volatile expense that airlines largely absorb.

Labor unions and skilled personnel also exert strong bargaining power, leading to increased wage demands, evidenced by a 5-8% average increase in pilot salaries in Europe in 2024 due to shortages. Airport operators, especially dominant ones like Athens International Airport (handling over 28 million passengers in 2023), can impose high fees for essential services. Furthermore, the aging global aircraft fleet and supply chain issues strengthen the position of Maintenance, Repair, and Overhaul (MRO) providers, a market valued at approximately $100 billion in 2023.

| Supplier Category | Key Suppliers | Impact on Aegean | 2023/2024 Data Point | Mitigation Strategy |

|---|---|---|---|---|

| Aircraft Manufacturers | Airbus, Boeing | Limited availability, high prices due to backlogs | Airbus backlog > 8,000 aircraft (2023) | Long-term fleet planning |

| Engine Suppliers | Pratt & Whitney, GE Aviation | Operational disruptions, maintenance costs | Pratt & Whitney GTF engine inspections | Fleet diversification |

| Fuel Suppliers | Global oil market | Volatile operating costs | Jet fuel is a major % of operating expenses | Fuel hedging, efficiency measures |

| Labor | Pilots, Technicians, Ground Staff (Unionized) | Increased wage demands, labor shortages | 5-8% pilot salary increase in Europe (2024) | Training programs, retention strategies |

| Airport Operators | Athens International Airport (ATH) | High landing and service fees | ATH handled > 28 million passengers (2023) | Negotiation, optimizing airport usage |

| MRO Providers | Various specialized companies | Increased maintenance costs, reliance on older fleets | Global MRO market valued at ~$100 billion (2023) | In-house MRO capabilities development |

What is included in the product

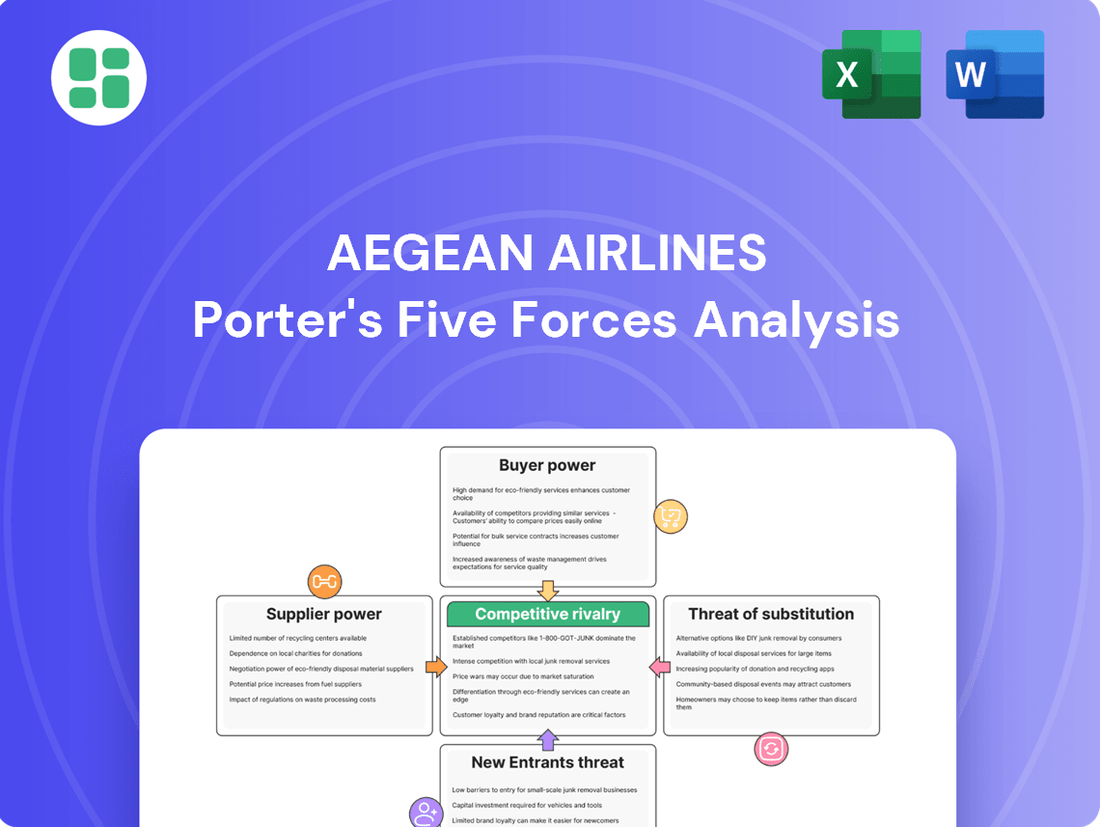

This analysis provides a comprehensive overview of the competitive forces impacting Aegean Airlines, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly visualize the competitive landscape of Aegean Airlines with a dynamic Porter's Five Forces chart, simplifying complex pressures for strategic clarity.

Customers Bargaining Power

Customers in the airline sector, especially those traveling for leisure, are highly sensitive to price. This is largely due to the widespread availability of online travel agencies and comparison websites. These platforms make it incredibly simple for travelers to compare ticket prices from various airlines, leading to fierce competition on fares. For instance, in 2024, a significant portion of leisure bookings were made through aggregators, highlighting this trend.

The bargaining power of customers is influenced by low switching costs for Aegean Airlines. For many common routes, the effort and expense involved in changing from one airline to another are minimal, especially when multiple carriers operate the same flights. This lack of customer lock-in empowers passengers to readily select airlines based on competitive pricing, convenient schedules, or perceived value, directly impacting Aegean's pricing strategies and customer retention efforts.

Aegean Airlines faces significant customer bargaining power due to the availability of alternative carriers. On its key European routes, passengers can choose from numerous full-service airlines as well as an increasing number of low-cost carriers (LCCs). This competitive landscape, particularly for travel to Greece, means customers have many options, which naturally strengthens their position to demand better prices and services.

Network Connectivity and Loyalty Programs

While individual passengers might seem to have significant bargaining power, Aegean Airlines mitigates this through its extensive network and loyalty initiatives. Its operations connect numerous Greek cities and islands with major international destinations, a crucial factor for travelers. Furthermore, Aegean's membership in the Star Alliance, which includes over 25 member airlines, broadens its network reach and offers passengers more travel options, indirectly strengthening its position.

Aegean's Miles+Bonus frequent flyer program is a key tool for fostering customer loyalty and increasing switching costs. By offering tiered benefits, such as priority boarding, lounge access, and bonus miles, the program incentivizes passengers to choose Aegean for their travel needs. This strategy aims to secure repeat business and reduce the likelihood of customers opting for competitors solely based on price. For instance, in 2023, Aegean reported a significant increase in its loyalty program members, demonstrating the program's growing impact on customer retention.

- Network Reach: Aegean's network spans over 160 destinations, including 70 domestic and 90 international routes, providing a comprehensive offering for travelers within and beyond Greece.

- Star Alliance Membership: As part of the Star Alliance, Aegean offers its customers access to a global network of over 1,200 destinations across 195 countries.

- Loyalty Program Growth: Aegean's Miles+Bonus program saw a substantial increase in active members in 2023, indicating growing customer engagement and loyalty.

Demand for Ancillary Services

Customers increasingly expect tailored experiences, from baggage choices to in-flight meals and seat preferences. While these ancillary services can boost revenue, customer price sensitivity remains a factor, potentially leading them to favor carriers offering more attractive package deals or a stronger perceived value proposition. Aegean's success in generating income from these offerings hinges on how well customers perceive their worth.

For instance, in 2024, the global airline ancillary revenue per passenger was projected to reach approximately $47.80, indicating a significant market for these services. However, the actual willingness to pay can fluctuate based on competitive pricing and the overall economic climate, directly impacting Aegean's ability to capitalize on this demand.

- Personalized Service Expectations: Growing demand for customized options like baggage, catering, and seat selection.

- Price Sensitivity: Customers may compare bundled offers and perceived value, influencing their willingness to pay for extras.

- Monetization Challenge: Aegean's revenue from ancillary services depends on effectively communicating and delivering perceived value to passengers.

The bargaining power of customers for Aegean Airlines is significant, primarily driven by price sensitivity and the ease of comparing options online. With numerous carriers, including low-cost options, competing on popular routes, passengers can readily switch for better fares or services. This forces Aegean to remain competitive, especially in leisure travel segments where price is a major determinant.

| Factor | Impact on Aegean | Data Point (2024/2023) |

|---|---|---|

| Price Sensitivity | High, especially for leisure travelers | Significant portion of leisure bookings made via aggregators (2024) |

| Switching Costs | Low for many routes | Minimal effort to switch between airlines on common flights |

| Availability of Alternatives | High on key European routes | Numerous full-service and LCC competitors |

| Loyalty Program Impact | Mitigates some power through incentives | Substantial increase in Miles+Bonus members (2023) |

Preview Before You Purchase

Aegean Airlines Porter's Five Forces Analysis

This preview showcases the comprehensive Aegean Airlines Porter's Five Forces Analysis, detailing the competitive landscape of the airline industry. The document you see here is the exact, fully formatted analysis you'll receive immediately after purchase, providing actionable insights into the forces shaping Aegean Airlines' strategic position. You can trust that what you preview is precisely what you'll download, offering a complete and ready-to-use strategic assessment.

Rivalry Among Competitors

The competitive landscape in the Greek and European airline sector is intensely shaped by the presence of formidable low-cost carriers (LCCs) such as Ryanair, Wizz Air, and easyJet. These airlines frequently employ aggressive pricing tactics, especially on high-demand leisure routes connecting to Greece, thereby exerting constant pressure on Aegean Airlines' fare structures and overall profitability.

In 2023, LCCs significantly boosted their market share on international routes serving Greece. For instance, Ryanair alone operated over 30 routes to Greece during the summer of 2023, offering competitive prices that directly challenge established carriers like Aegean.

Aegean Airlines faces robust competition from established full-service carriers across Europe, including giants like Lufthansa, Air France-KLM, and British Airways, particularly on international routes. These legacy airlines often provide comparable service offerings and extensive network connectivity, making competition fierce based on route availability, flight schedules, and lucrative corporate travel agreements. The European aviation landscape is characterized by a high degree of rivalry among numerous prominent players.

Aegean Airlines is significantly increasing its capacity for 2025, planning to offer 21.5 million seats, a substantial jump from 2024's 19.7 million. This expansion, with a particular emphasis on international routes, directly fuels competitive rivalry.

This aggressive growth by Aegean, mirrored by other carriers, intensifies the fight for passengers and market share. Such a scenario often leads to increased promotional activities and potentially lower ticket prices to attract travelers, putting downward pressure on airline yields.

Geopolitical and Economic Volatility

The airline sector faces significant challenges from geopolitical instability and economic fluctuations, directly impacting travel demand and operational routes. For instance, in late 2024, heightened geopolitical tensions led to the temporary suspension of services to several Middle Eastern locations, which notably affected Aegean's international passenger numbers.

These external forces foster a highly unpredictable competitive landscape for airlines like Aegean. The airline industry's sensitivity to global events means that demand can shift rapidly, forcing strategic adjustments to capacity and route planning.

- Geopolitical Tensions: Disruptions can lead to route suspensions and reduced passenger confidence, impacting revenue.

- Economic Downturns: Recessions typically curb discretionary spending on travel, leading to lower demand and fare pressures.

- Impact on Aegean: The airline experienced direct impacts on international traffic due to geopolitical events in late 2024.

- Unpredictable Environment: Airlines must constantly adapt to external shocks, making long-term planning more complex.

Fleet Modernization and Operational Efficiency

Aegean Airlines' competitive rivalry is intensified by ongoing investments in fleet modernization and operational efficiency. By upgrading its fleet with newer, more fuel-efficient aircraft like the Airbus A320neo family, Aegean aims to lower operating costs and improve its environmental footprint. This strategic move directly impacts its ability to compete on price and service quality.

These investments are crucial for maintaining a competitive edge. For instance, the A320neo family offers significant fuel savings, estimated at around 15-20% compared to previous generations, which translates to lower per-seat costs. Aegean's establishment of a new Maintenance & Training Center further bolsters its operational reliability and reduces downtime, directly contributing to cost savings and a better passenger experience.

- Fleet Modernization: Aegean's acquisition of Airbus A320neo family aircraft enhances fuel efficiency and reduces emissions.

- Operational Efficiency: Investments in a new Maintenance & Training Center improve aircraft reliability and reduce operational costs.

- Cost Reduction: Fuel savings from newer aircraft contribute to a lower cost base, enabling more competitive pricing.

- Customer Experience: Enhanced reliability and modern aircraft improve passenger satisfaction and loyalty.

Aegean Airlines faces intense rivalry from both low-cost carriers (LCCs) like Ryanair and established European airlines such as Lufthansa. The aggressive pricing strategies of LCCs, especially on routes to Greece, put significant pressure on Aegean's fares. For example, Ryanair operated over 30 routes to Greece in summer 2023, directly challenging Aegean's market share.

Aegean's own capacity expansion for 2025, with a target of 21.5 million seats, further intensifies competition. This growth, particularly in international markets, means more direct competition for passengers and can lead to promotional pricing. The airline industry's sensitivity to global events, as seen with late 2024 geopolitical tensions impacting international traffic, adds another layer of complexity to this competitive environment.

Aegean's investments in fleet modernization, including the fuel-efficient Airbus A320neo family offering 15-20% fuel savings, and its new Maintenance & Training Center, are critical for cost reduction and service quality. These efforts aim to enhance its competitive positioning against rivals by lowering operating expenses and improving reliability.

| Competitor Type | Key Players | Impact on Aegean | 2023/2024 Data Point |

| Low-Cost Carriers (LCCs) | Ryanair, Wizz Air, easyJet | Price pressure, market share erosion on leisure routes | Ryanair operated 30+ routes to Greece in Summer 2023 |

| Full-Service Carriers | Lufthansa, Air France-KLM, British Airways | Competition on international routes, corporate travel | High degree of rivalry across European aviation landscape |

| Aegean's Own Growth | Capacity expansion | Increased competition for passengers and market share | 2025 capacity target: 21.5 million seats (vs. 19.7 million in 2024) |

SSubstitutes Threaten

For island travel within Greece, ferries and cruise services are a potent substitute for Aegean Airlines. These sea-based options are particularly attractive for shorter routes and for travelers needing to transport vehicles, offering a different kind of travel experience. In 2024, the Greek ferry sector continued to be a robust alternative, with major operators like Hellenic Seaways and Minoan Lines carrying millions of passengers annually, often at price points competitive with airfares, especially when factoring in baggage and vehicle transport.

While high-speed rail poses a limited threat to Aegean Airlines for international travel to Greece, it can substitute for shorter domestic routes within mainland Greece or for journeys to neighboring European countries. For instance, routes like Athens to Thessaloniki, a significant domestic corridor, could see increased competition as rail infrastructure improves. As of 2024, European rail networks continue to expand, with investments in high-speed lines aiming to enhance connectivity and reduce travel times, potentially appealing to business travelers prioritizing efficiency and sustainability.

For very short domestic trips within Greece or to nearby Balkan nations, cars and buses present themselves as viable alternatives to air travel. These ground transportation methods provide a degree of flexibility that airlines cannot match, and can often be more economical for individuals or small groups, especially when time is not a critical factor. For instance, a family road trip from Athens to Thessaloniki, a distance of approximately 500 kilometers, might be more cost-effective and convenient than flying, considering airport transfers and baggage fees.

However, the threat posed by car and bus travel as substitutes for Aegean Airlines is largely confined to these specific, shorter routes. As distances increase, particularly for travel to Greece's numerous islands, the time-saving advantage of air travel becomes paramount, significantly diminishing the appeal of road or bus alternatives. In 2024, the average travel time by car or bus for distances exceeding 800 kilometers would likely deter most travelers compared to a flight, making this a limited threat for Aegean's core operations.

Virtual Communication Technologies for Business Travel

The increasing sophistication and accessibility of virtual communication tools present a significant threat to Aegean Airlines by reducing the necessity for business travel. The widespread adoption of platforms like Zoom and Microsoft Teams, further cemented by the pandemic, has demonstrated their effectiveness for many business interactions.

While in-person meetings remain valuable, the cost savings and convenience offered by virtual alternatives can lead to fewer, shorter business trips. For instance, a 2024 report indicated that 60% of companies expect to maintain at least some level of remote or hybrid work, directly impacting the volume of corporate travel.

- Reduced Business Trip Frequency: Virtual technologies allow for meetings and collaborations that previously required air travel, directly cutting into a key revenue source for airlines.

- Cost-Effectiveness of Alternatives: Companies can save substantially on travel expenses, accommodation, and lost employee productivity by opting for virtual meetings.

- Technological Advancements: Ongoing improvements in video conferencing quality and features make virtual interactions more engaging and productive, further diminishing the perceived need for physical presence.

Alternative Holiday Destinations and Travel Experiences

The threat of substitutes for Aegean Airlines is significant, as the broader tourism industry presents numerous alternatives. Travelers seeking a holiday can opt for destinations accessible by other modes of transport, such as cruises or train travel, or choose entirely different leisure activities like staycations or exploring local attractions. The global appeal and accessibility of competing destinations can easily divert potential passengers away from Aegean's routes.

For instance, in 2024, the European travel market saw continued growth in alternative transport options. Rail travel within Europe, particularly with expanding high-speed networks, offers a compelling substitute for shorter to medium-haul flights. Furthermore, the rise of the 'digital nomad' trend and increased interest in sustainable tourism may lead some travelers to prioritize land-based or closer-to-home experiences over flying to Greece.

- Alternative Destinations: Countries like Italy, Spain, and Croatia, offering similar Mediterranean experiences, are direct competitors.

- Alternative Transport: High-speed rail networks and ferry services provide viable substitutes for many of Aegean's intra-European routes.

- Alternative Experiences: Staycations and local tourism initiatives are gaining traction, reducing the necessity for long-haul travel for leisure.

The threat of substitutes for Aegean Airlines primarily stems from alternative travel modes and experiences. Ferries and cruise services are strong substitutes for island travel, especially for shorter routes or when transporting vehicles, with major operators like Hellenic Seaways carrying millions of passengers in 2024. While high-speed rail is a limited threat internationally, it impacts domestic routes like Athens to Thessaloniki, with ongoing European rail network expansion in 2024.

Cars and buses offer flexibility and cost-effectiveness for shorter domestic trips or to nearby Balkan nations, though their appeal diminishes significantly for longer distances where air travel's time-saving advantage is crucial. For example, a 500km trip might favor road travel, but distances over 800km in 2024 would likely deter most compared to flying. Furthermore, virtual communication tools are increasingly substituting for business travel, with 60% of companies in 2024 expecting to maintain some level of remote work, reducing the need for corporate flights.

| Substitute Type | Key Characteristics | 2024 Relevance |

|---|---|---|

| Ferries/Cruises | Cost-competitive, vehicle transport, scenic | Millions of passengers carried by major operators |

| High-Speed Rail | Efficient for medium distances, sustainable | Expanding European networks |

| Cars/Buses | Flexible, economical for short/medium distances | Viable for trips up to ~500km |

| Virtual Communication | Cost-saving, convenient for business | 60% of companies maintaining remote/hybrid work |

Entrants Threaten

The airline industry, including for carriers like Aegean Airlines, demands an enormous upfront capital investment. Acquiring or leasing a fleet of aircraft alone can run into hundreds of millions, if not billions, of dollars. For instance, a new Boeing 737 MAX can cost upwards of $120 million, and airlines often operate dozens of these. Beyond aircraft, significant funds are needed for maintenance infrastructure, ground support equipment, IT systems, and securing airport slots, creating a very high barrier to entry.

The aviation industry presents formidable barriers to entry, particularly due to stringent regulatory hurdles and the necessity of obtaining numerous licenses and safety certifications. New airlines must navigate a complex web of national and international aviation laws, a process that is both time-consuming and expensive. For instance, in 2024, the European Union Aviation Safety Agency (EASA) continued to enforce rigorous standards for airworthiness, operational safety, and pilot training, making it exceptionally difficult for unproven entities to gain approval.

Established network effects and strong brand loyalty present a significant hurdle for potential new entrants aiming to compete with Aegean Airlines. Aegean benefits from its extensive route network within Greece and to international destinations, coupled with advantageous slot allocations at major airports. For instance, in 2023, Aegean carried approximately 16.8 million passengers, underscoring its substantial operational footprint and market penetration.

Furthermore, Aegean's membership in the Star Alliance offers passengers a vast global network and integrated loyalty programs. This interconnectedness, along with a well-recognized brand in the Greek market, creates a formidable barrier. Replicating such a comprehensive network and established customer trust would require substantial time and investment for any new airline.

Access to Distribution Channels and Customer Base

New airlines encounter significant obstacles in securing access to established distribution channels like Global Distribution Systems (GDS) and prominent online travel agencies. These channels often demand substantial fees and complex contractual agreements, making it difficult for newcomers to compete effectively. For instance, in 2024, the dominance of established players in GDS usage by major carriers means new entrants face higher integration costs and limited visibility.

Building a recognizable brand and cultivating a loyal customer base from the ground up presents another formidable challenge in the aviation industry. The market is saturated with carriers that have decades of brand recognition and extensive loyalty programs. In 2024, customer acquisition costs remain high, with new airlines needing to invest heavily in marketing and promotional activities to attract passengers away from incumbent airlines.

- Distribution Channel Barriers: New airlines struggle to gain equitable access to GDS and major OTAs due to high fees and existing exclusive agreements.

- Brand Recognition & Customer Loyalty: Established airlines benefit from strong brand equity and extensive loyalty programs, making it hard for new entrants to attract customers.

- Customer Acquisition Costs: High marketing and promotional expenses are necessary for new airlines to build awareness and capture market share in 2024.

- Market Saturation: The competitive landscape is dense, with numerous carriers vying for the same passenger segments, increasing the difficulty for new entrants.

Economies of Scale and Operational Experience

Existing airlines like Aegean Airlines enjoy significant advantages from economies of scale. This means they can negotiate better prices for fuel, aircraft maintenance, and spare parts due to their large operational volume. For instance, in 2024, major carriers often secured fuel contracts at more favorable rates than smaller, newer airlines could hope for, directly impacting their cost per seat kilometer.

Furthermore, decades of operational experience translate into finely tuned processes for scheduling, crew management, and customer service. This accumulated know-how allows established players to operate more efficiently and respond better to market fluctuations. New entrants, conversely, start without this deep well of experience, facing higher initial costs and a steeper learning curve.

- Economies of Scale: Larger airlines achieve lower per-unit costs in procurement and operations.

- Operational Experience: Established carriers possess efficiencies gained over years of service.

- Cost Disadvantage for New Entrants: Start-ups struggle to match the cost structures of incumbents.

- Barriers to Entry: The scale and experience of existing airlines create a substantial hurdle for new competitors.

The threat of new entrants for Aegean Airlines is considerably low, primarily due to the immense capital required to start an airline. Purchasing even a single new narrow-body aircraft, like a Boeing 737 MAX, can exceed $120 million, a cost that escalates dramatically when building a fleet. Beyond aircraft acquisition, substantial investments are mandated for maintenance facilities, IT infrastructure, and securing vital airport slots, creating a significant financial barrier.

Regulatory compliance and the need for extensive certifications further deter new players. Navigating the complex web of aviation laws and safety standards, as enforced by bodies like EASA in 2024, is both time-consuming and costly. This stringent environment makes it exceptionally difficult for unproven entities to obtain the necessary approvals to operate, effectively limiting the pool of potential new competitors.

Established network effects and strong brand loyalty also act as significant deterrents. Aegean Airlines, having carried approximately 16.8 million passengers in 2023, benefits from an extensive route network and advantageous airport slot allocations. Replicating this market penetration and the trust built over years, especially with the added advantage of Star Alliance membership, requires immense time and financial commitment from any aspiring new entrant.

Economies of scale enjoyed by established carriers like Aegean present another substantial hurdle. Their large operational volumes allow for more favorable negotiations on crucial expenses such as fuel and maintenance. In 2024, these scale advantages translate into a significant cost per seat kilometer advantage over smaller, newer airlines, making it difficult for newcomers to compete on price.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024/2023) |

| Capital Requirements | High cost of aircraft, infrastructure, and operational setup. | Extremely High | Boeing 737 MAX cost: ~$120M+ |

| Regulatory Hurdles | Complex licensing, safety certifications, and compliance. | Very High | Ongoing stringent EASA standards. |

| Network Effects & Brand Loyalty | Established routes, customer base, and loyalty programs. | High | Aegean passengers: ~16.8M (2023) |

| Economies of Scale | Lower per-unit costs due to high volume operations. | High | Favorable fuel contract rates for major carriers. |

Porter's Five Forces Analysis Data Sources

Our Aegean Airlines Porter's Five Forces analysis is built upon a foundation of publicly available information, including the airline's annual reports, investor presentations, and official press releases. We also leverage industry-specific publications and data from aviation analytics firms to capture market trends and competitive dynamics.