Advanced Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advanced Energy Bundle

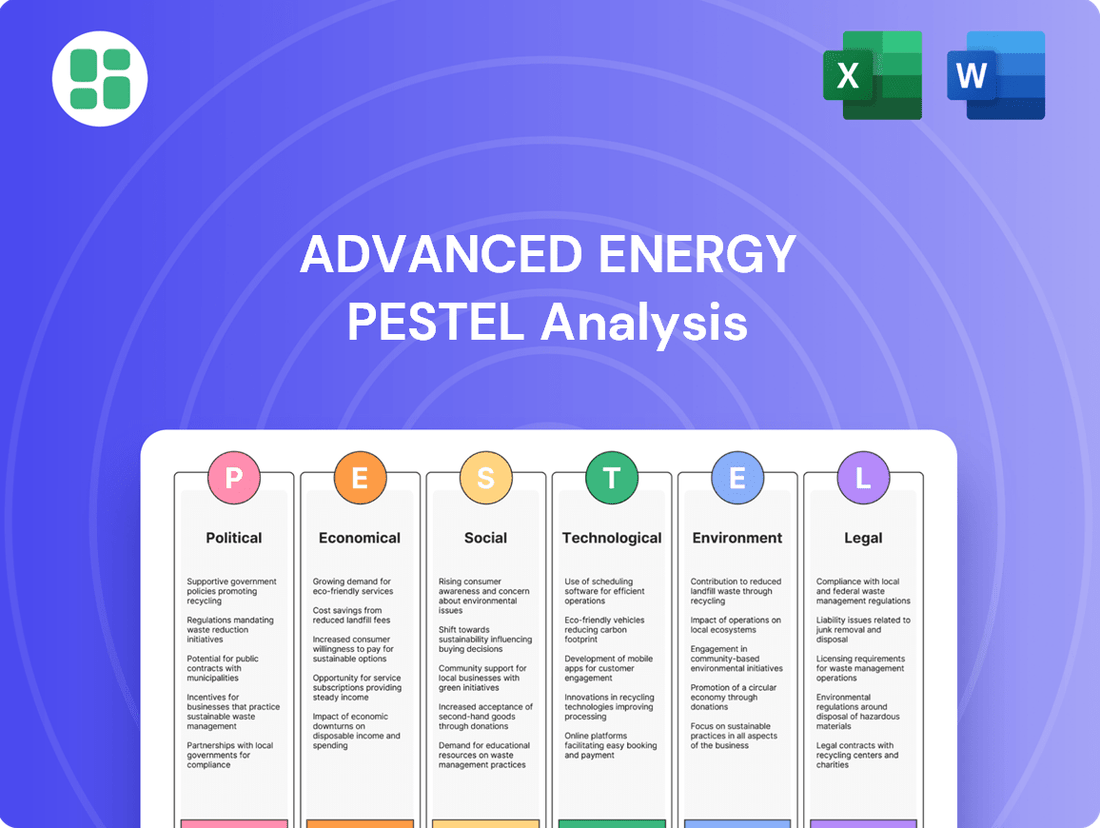

Navigate the complex external forces shaping Advanced Energy's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental regulations, and social trends are impacting its operations and future growth. Equip yourself with the strategic foresight needed to capitalize on opportunities and mitigate risks. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government policies, like the US CHIPS Act, are a major driver for Advanced Energy. This act, with its over $52 billion in funding for domestic semiconductor manufacturing, directly boosts demand for Advanced Energy's power and control solutions. These initiatives create a more favorable investment climate for their semiconductor customers.

Shifts in government support, such as the expiration of tax credits or the introduction of new trade barriers, can significantly alter investment timelines for Advanced Energy's clients. For instance, a reduction in renewable energy subsidies globally could temper the growth in that sector, impacting demand for related equipment.

Global trade relations are a significant political factor for Advanced Energy. In 2024, ongoing trade disputes, particularly between major economic blocs, continue to create uncertainty. For instance, the imposition of tariffs on critical components, such as those used in solar panel manufacturing, can directly increase production costs, potentially impacting the competitiveness of Advanced Energy's products. These trade tensions also affect market access, making it harder to export to certain regions, which is a key concern for a company with a global customer base.

Furthermore, export controls, often implemented for national security or economic policy reasons, can restrict the flow of advanced technologies essential for the energy transition. Advanced Energy, reliant on a complex international supply chain for specialized materials and equipment, must navigate these restrictions. For example, in 2024, certain semiconductor export controls have already shown their impact on various high-tech industries, and similar measures could affect the availability of components for renewable energy systems. This necessitates a proactive approach to supply chain diversification to mitigate risks and ensure continued operational efficiency.

Geopolitical stability is a significant concern for Advanced Energy. Regional conflicts, such as ongoing tensions in Eastern Europe and the Middle East, can disrupt global supply chains for critical components and raw materials, leading to increased costs. For instance, the semiconductor industry, a key market for Advanced Energy's power solutions, relies heavily on globalized manufacturing and logistics, making it vulnerable to such disruptions.

This instability also breeds market uncertainty, impacting customer capital expenditure decisions. In 2024, many sectors, including telecommunications and data centers, are re-evaluating investment timelines due to economic and political volatility. This can directly translate to delayed or reduced orders for Advanced Energy's precision power management technologies, affecting revenue forecasts and operational planning.

Regulatory Environment for Key Industries

Shifts in political leadership directly influence the regulatory landscape for Advanced Energy's key markets. For example, a new administration might prioritize climate initiatives, potentially leading to more stringent emissions standards that boost demand for energy-efficient technologies. Conversely, a move towards deregulation in sectors like semiconductors could lessen the immediate need for certain advanced power solutions, impacting Advanced Energy's market strategy and R&D focus.

The 2024 US election cycle, for instance, could significantly alter energy policy. Proposals for increased investment in renewable energy infrastructure, as seen in some policy discussions, would likely benefit Advanced Energy's power conversion and control solutions. Conversely, a less supportive stance on green energy mandates might slow adoption rates for some of their offerings.

- Increased focus on grid modernization: Policies aimed at upgrading aging electrical grids could drive demand for Advanced Energy's power quality and management systems, with some projections indicating a global grid modernization market reaching over $300 billion by 2027.

- Potential for carbon pricing mechanisms: The implementation or expansion of carbon taxes or cap-and-trade systems in major economies could further incentivize the adoption of energy-efficient technologies, a core offering for Advanced Energy.

- Trade policy adjustments: Changes in international trade agreements or tariffs could impact the cost of components and the competitiveness of Advanced Energy's products in global markets.

Industrial Policy Shifts

Governments worldwide are increasingly implementing industrial policies to bolster domestic manufacturing, particularly in sectors deemed critical like advanced energy. This trend, often termed reshoring or nearshoring, is a direct response to global supply chain vulnerabilities exposed by recent geopolitical events and the COVID-19 pandemic. For instance, the US Inflation Reduction Act (IRA) of 2022, with its substantial tax credits for domestic clean energy manufacturing, exemplifies this shift, aiming to onshore production of solar panels, wind turbines, and battery components. This policy aims to create an estimated 1.5 million new jobs in the clean energy sector by 2030, according to the Department of Energy.

These industrial policy shifts present a dual-edged sword for companies in the advanced energy sector. On one hand, the push for domestic production can unlock significant new market opportunities and demand for advanced energy solutions, such as grid modernization technologies and energy storage systems. On the other hand, it necessitates strategic adjustments to existing global supply chains, potentially impacting raw material sourcing, component manufacturing, and distribution networks. Companies may need to invest in new or expanded domestic facilities, which requires careful financial planning and risk assessment.

The implications for advanced energy companies are substantial:

- Increased domestic demand: Policies like the IRA are expected to drive significant growth in the US market for clean energy technologies, creating opportunities for domestic suppliers and manufacturers.

- Supply chain restructuring: Companies may need to re-evaluate their reliance on international suppliers and invest in building more resilient, localized supply chains to meet new policy requirements and mitigate risks.

- Competitive landscape changes: The incentives offered through industrial policies can alter the competitive dynamics, potentially favoring companies with strong domestic manufacturing capabilities or those willing to invest in them.

Government regulations and incentives are pivotal for Advanced Energy. Policies like the US Inflation Reduction Act (IRA) are designed to accelerate clean energy adoption, offering substantial tax credits that directly benefit Advanced Energy's customer base in solar and wind. The IRA's projected impact on job creation in the clean energy sector, estimated at 1.5 million by 2030, signals robust future demand for the company's solutions.

Trade policies and geopolitical stability directly influence Advanced Energy's operations and market access. In 2024, ongoing trade disputes and export controls, particularly concerning semiconductor components, create supply chain risks and cost pressures. For example, tariffs on critical materials can increase production expenses for solar panel manufacturers, a key client segment.

Political shifts, such as election outcomes, can significantly alter energy policy landscapes. Discussions around increased renewable energy investment in the US, for instance, would likely boost demand for Advanced Energy's power conversion and control technologies. Conversely, a less favorable policy environment could temper market growth.

The global push for industrial policy, including reshoring critical manufacturing, presents both opportunities and challenges. While policies like the IRA aim to onshore clean energy production, potentially increasing domestic demand, they also necessitate supply chain restructuring. This could involve investing in new domestic facilities to meet policy requirements and mitigate risks, impacting operational strategies and financial planning.

What is included in the product

This comprehensive PESTLE analysis examines the external macro-environmental forces impacting the Advanced Energy sector across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key opportunities and threats within the dynamic energy landscape.

Provides a clear, actionable overview of the external forces impacting the advanced energy sector, enabling strategic decision-making and mitigating potential risks.

Economic factors

Global economic growth significantly impacts Advanced Energy's customer spending. In 2024, projections from the IMF suggest global GDP growth around 3.2%, a slight moderation from 2023 but still indicating expansion. This generally supports capital expenditure in key sectors like semiconductors and data centers, which are crucial for Advanced Energy.

However, recession risks remain a concern. Persistent inflation and geopolitical tensions could dampen global economic activity in late 2024 and into 2025, potentially leading customers to delay or reduce investments in new equipment. For instance, a significant slowdown in China's manufacturing output, a key market for semiconductor equipment, would directly affect demand.

Rising inflation presents a significant challenge for Advanced Energy, with the US annual inflation rate reaching 3.4% in April 2024. This surge in costs for raw materials, components, and labor directly squeezes profit margins, especially if these increased expenses cannot be fully absorbed by customers.

Furthermore, the current interest rate environment, with the Federal Reserve maintaining its target range between 5.25% and 5.50% as of May 2024, makes financing more costly. This can dampen demand for Advanced Energy's solutions, as customers face higher borrowing costs for substantial capital investments in new equipment and upgrades.

Currency exchange rate fluctuations present a significant challenge for Advanced Energy, a global player operating across multiple markets. For instance, in Q1 2024, the U.S. dollar strengthened against several major currencies. This appreciation can reduce the reported U.S. dollar value of revenues earned in those foreign markets, directly impacting top-line growth and potentially affecting cost of goods sold if components are sourced internationally.

When Advanced Energy converts its foreign earnings back into its reporting currency, the U.S. dollar, adverse movements in exchange rates can erode profitability. A weaker Euro, for example, would mean that profits generated in Europe translate into fewer dollars. This necessitates robust currency risk management strategies, including hedging, to mitigate the impact of these volatile movements on the company's financial performance.

Supply Chain Costs and Availability

Advanced Energy's production and manufacturing costs are significantly impacted by the availability and price of essential components and raw materials. Global supply chain disruptions and commodity price fluctuations directly influence these factors, affecting the company's ability to produce goods efficiently and competitively.

Maintaining robust and cost-effective supply chains is crucial for Advanced Energy to offer competitive pricing and ensure prompt product delivery to its customers. This involves strategic sourcing and inventory management to mitigate risks associated with supply chain volatility.

- Component Costs: For instance, the price of silicon, a key material in semiconductor manufacturing, saw significant volatility in late 2023 and early 2024 due to increased demand and production constraints, potentially impacting Advanced Energy's input costs.

- Logistics and Shipping: Global shipping rates, which had surged during the pandemic, began to stabilize in 2024, though geopolitical events in key shipping lanes could reintroduce cost pressures and delivery delays.

- Raw Material Availability: Access to rare earth metals and other specialized materials used in Advanced Energy's advanced manufacturing equipment can be subject to geopolitical influences and concentrated supply sources, posing a risk to consistent availability.

Customer Industry Capital Expenditure Cycles

Advanced Energy's revenue is heavily influenced by the capital expenditure (CapEx) cycles of its key clients, notably in semiconductor fabrication and data center construction. For instance, the semiconductor industry saw significant CapEx growth in 2022, reaching an estimated $200 billion globally, a trend that directly benefits Advanced Energy through increased demand for its process equipment. However, these cycles are inherently variable, with potential slowdowns in 2024 as companies recalibrate investments amid evolving market conditions and supply chain adjustments.

The expansion of data centers, driven by AI and cloud computing, represents another critical CapEx driver. Global data center construction spending was projected to exceed $200 billion in 2023, a strong indicator of sustained demand for Advanced Energy's power management solutions. Anticipating shifts in these investment patterns allows for more accurate demand forecasting and operational planning.

The electric vehicle (EV) market's rapid growth also fuels CapEx in battery manufacturing and related infrastructure. As EV production scales, so does the need for advanced manufacturing equipment, a segment where Advanced Energy plays a vital role. The global EV market is expected to continue its upward trajectory, with sales potentially reaching over 15 million units in 2024, translating to ongoing opportunities for suppliers like Advanced Energy.

- Semiconductor CapEx: Global semiconductor industry capital expenditures were estimated to be around $200 billion in 2022, providing a strong baseline for Advanced Energy's performance.

- Data Center Growth: Data center construction spending was projected to surpass $200 billion in 2023, highlighting a significant market for Advanced Energy's products.

- EV Market Expansion: The electric vehicle sector's continued growth, with over 15 million units potentially sold globally in 2024, supports increased investment in manufacturing capabilities.

- Cyclical Nature: Understanding the cyclicality of these CapEx investments is paramount for Advanced Energy to effectively manage production and resource allocation.

Global economic conditions directly influence Advanced Energy's sales cycles and customer investment capacity. While the IMF projected global GDP growth around 3.2% for 2024, a slight slowdown from 2023, this expansion generally supports capital expenditures in sectors like semiconductors and data centers, crucial markets for Advanced Energy. However, persistent inflation, with the US annual rate at 3.4% in April 2024, and elevated interest rates, with the Fed's target range at 5.25%-5.50% as of May 2024, can increase borrowing costs for customers, potentially delaying significant equipment investments.

Currency fluctuations also impact Advanced Energy's financial performance. The strengthening U.S. dollar in Q1 2024, for example, can reduce the reported value of foreign earnings. This necessitates careful currency risk management to mitigate the impact on profitability.

Component costs and supply chain stability are vital. The price of silicon, a key material, experienced volatility in early 2024 due to demand and production constraints. While global shipping rates stabilized in 2024, geopolitical events could reintroduce cost pressures and delivery delays, impacting Advanced Energy's production efficiency and pricing.

| Economic Factor | 2023/2024 Data Point | Impact on Advanced Energy |

|---|---|---|

| Global GDP Growth (Projected 2024) | ~3.2% (IMF) | Supports customer CapEx, but potential slowdowns exist. |

| US Annual Inflation Rate (April 2024) | 3.4% | Increases operating costs, potentially squeezing margins. |

| Federal Funds Rate (May 2024) | 5.25%-5.50% | Raises borrowing costs for customers, potentially dampening demand. |

| Key Component Price (Silicon Volatility) | Late 2023/Early 2024 | Affects input costs and product pricing. |

| Global Shipping Rates | Stabilizing in 2024 (but with risks) | Influences logistics costs and delivery times. |

What You See Is What You Get

Advanced Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Advanced Energy PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors shaping the industry, providing actionable insights for strategic planning.

Sociological factors

Advanced Energy's success hinges on access to specialized talent, especially engineers and technicians skilled in precision power conversion and advanced manufacturing. The company's ability to innovate and scale production directly correlates with the availability of this expertise.

Demographic trends and intense competition for these highly sought-after skills present a significant challenge. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 6% growth for electrical engineers through 2032, a rate faster than the average for all occupations, indicating a tight labor market.

To counter this, Advanced Energy must prioritize strategic investments in robust training programs, proactive talent acquisition strategies, and effective retention initiatives to ensure it maintains a competitive advantage in securing and developing its workforce.

Consumer appetite for cutting-edge tech, from AI-powered gadgets to electric vehicles, directly fuels demand for the advanced energy solutions needed to power them. For instance, the global EV market is projected to reach $1.8 trillion by 2030, a significant uptick from its 2023 valuation of $500 billion, underscoring the massive infrastructure needs.

These evolving consumer preferences, such as the increasing adoption of cloud computing services which grew by 15% in 2024, shape the long-term market opportunities for companies like Advanced Energy by dictating the pace of technological integration and the demand for reliable, high-performance energy components.

Societal expectations for robust health and safety are escalating, particularly impacting sectors where Advanced Energy's solutions are deployed, such as healthcare and industrial automation. For instance, the global medical device market, a key area for Advanced Energy's power solutions, is projected to reach $600 billion by 2025, underscoring the critical need for unwavering safety compliance. Failure to meet these evolving standards can lead to significant reputational damage and market exclusion.

ESG Investor and Public Pressure

Investor and public scrutiny regarding Environmental, Social, and Governance (ESG) performance is significantly shaping Advanced Energy's strategic direction. This translates into tangible demands for greener manufacturing and ethically sourced supply chains, directly impacting operational choices and innovation pipelines. For instance, a growing number of institutional investors are actively divesting from companies with poor ESG ratings, a trend that is likely to intensify in 2024 and 2025.

These pressures necessitate a focus on developing products that actively contribute to energy efficiency and broader sustainability goals. Companies that fail to adapt risk losing investor confidence and market share. By 2024, over 50% of global assets under management were expected to be allocated to ESG-focused investments, highlighting the critical importance of these factors for companies like Advanced Energy.

- Growing ESG Investment: Global sustainable investment assets reached an estimated $37.8 trillion in early 2024, indicating a strong market preference for ESG-compliant companies.

- Consumer Demand for Sustainability: Surveys consistently show that a majority of consumers are willing to pay more for products from environmentally responsible companies.

- Regulatory Scrutiny: Anticipated stricter regulations around carbon emissions and supply chain transparency in 2025 will further compel companies to prioritize ESG practices.

- Investor Activism: Expect increased shareholder proposals and engagement focused on ESG metrics, pushing companies to report and improve their performance.

Globalization and Localization Trends

Societal shifts are increasingly highlighting a preference for locally sourced goods, a trend that directly impacts manufacturing and distribution. This growing demand for regional products, coupled with heightened awareness of global supply chain fragilities, is prompting companies like Advanced Energy to re-evaluate their operational footprints. For instance, a 2024 survey indicated that 65% of consumers are more likely to purchase products made domestically.

Advanced Energy must therefore consider how to adapt its global presence to cater to customer desires for localized support, manufacturing capabilities, and robust supply chain resilience. This involves a delicate balancing act: maintaining the efficiencies of a global operation while simultaneously ensuring responsiveness to regional needs and market dynamics. By 2025, projections suggest that companies with stronger localized supply chains could see a 10-15% reduction in logistics costs.

- Consumer Demand for Local: A 2024 Nielsen study found that 68% of consumers believe supporting local businesses is important.

- Supply Chain Vulnerability Concerns: Events in 2023 and early 2024 heightened awareness, with 70% of businesses reporting disruptions.

- Regional Responsiveness: Companies prioritizing localized manufacturing are expected to gain market share in specific geographies.

- Cost Efficiency: Shorter supply chains can lead to an estimated 5-10% improvement in delivery times and reduced transportation expenses.

Societal values increasingly emphasize ethical business practices and corporate responsibility, influencing consumer and investor decisions. Advanced Energy must demonstrate a commitment to fair labor, community engagement, and transparent operations to maintain its social license to operate. This includes addressing concerns about the environmental impact of its manufacturing processes and the ethical sourcing of materials.

The growing demand for sustainable and ethically produced goods is a significant trend. By 2024, consumer surveys indicated that over 60% of individuals consider a company's social and environmental impact when making purchasing decisions. This societal shift necessitates that Advanced Energy proactively integrates ESG principles into its core business strategy, from product development to supply chain management.

Furthermore, public perception of technological advancement is evolving, with a greater emphasis on the societal benefits and potential risks. Advanced Energy's communication strategies must highlight how its innovations contribute positively to society, such as enabling renewable energy adoption or improving healthcare outcomes, while also addressing any potential negative externalities transparently.

Technological factors

The relentless pace of technological advancement in sectors like semiconductor manufacturing, data center computing, and electric vehicles demands constant innovation from Advanced Energy. For instance, the semiconductor industry saw capital expenditures reach an estimated $130 billion in 2023, a figure projected to grow as chipmakers push for smaller nodes and more complex architectures, requiring increasingly sophisticated power solutions.

Advanced Energy's success hinges on its capacity to foresee and engineer cutting-edge power conversion, measurement, and control technologies. Failing to keep pace means losing ground in these dynamic markets, where the lifespan of a technology can be remarkably short.

The relentless drive towards miniaturization in electronics, coupled with a growing emphasis on energy efficiency, is fundamentally reshaping the demand for power solutions. This trend means customers need components that are not only smaller and lighter but also deliver more power with less energy waste. For Advanced Energy, this translates into a critical need to innovate in areas like high-density power supplies and advanced thermal management.

In 2024, the global semiconductor market, a key sector for Advanced Energy, was projected to see significant growth, with analysts anticipating a rebound and continued expansion driven by AI and advanced computing. This growth directly fuels the demand for more compact and efficient power delivery systems within these sophisticated electronic devices, highlighting the importance of Advanced Energy's R&D focus on higher power density solutions.

Advances in materials science are revolutionizing the energy sector. For instance, wide-bandgap semiconductors like silicon carbide (SiC) and gallium nitride (GaN) are enabling more efficient power electronics. These materials can handle higher voltages and temperatures, leading to smaller, lighter, and more robust energy systems. This translates to improved performance and cost savings for companies like Advanced Energy.

New manufacturing processes are also playing a crucial role. Techniques such as additive manufacturing (3D printing) allow for the creation of complex components with greater precision and reduced waste. This can accelerate product development cycles and enable customization for specific applications. For Advanced Energy, adopting these innovations means enhancing product reliability and potentially lowering production costs, giving them a competitive edge.

The integration of these material and manufacturing advancements presents significant opportunities for Advanced Energy. By incorporating SiC and GaN into their power conversion solutions, they can achieve higher energy efficiency, which is critical for applications like electric vehicles and renewable energy integration. This technological leap can unlock new market segments and solidify their position as an industry leader.

Automation and AI Integration in Manufacturing

The manufacturing sector, a key market for Advanced Energy, is rapidly adopting automation, robotics, and artificial intelligence. This shift is driving a demand for more advanced and intelligent power control systems. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to reach over $100 billion by 2030, indicating a significant increase in automated processes.

Advanced Energy can capitalize on this by developing smart power solutions designed for seamless integration into these automated production lines. These solutions can support data-driven manufacturing environments, enhancing efficiency and reliability. Companies are increasingly investing in Industry 4.0 technologies, with global spending expected to reach $323 billion in 2025, up from $237 billion in 2023, highlighting the growing importance of intelligent systems.

- Growing Demand for Smart Power: As automation increases, so does the need for sophisticated power management in manufacturing.

- AI and Robotics Adoption: The industrial robotics market is expanding, with significant growth projected through 2030.

- Industry 4.0 Investment: Global spending on Industry 4.0 technologies is on a strong upward trajectory, creating opportunities for integrated power solutions.

- Advanced Energy's Opportunity: Developing smart power solutions that align with these technological advancements can position Advanced Energy for growth.

Cybersecurity of Industrial Control Systems

The increasing interconnectedness of industrial control systems (ICS) and data centers elevates the critical need for robust cybersecurity in power conversion and control solutions. Advanced Energy must prioritize the resilience of its products against evolving cyber threats to safeguard essential infrastructure and proprietary information. This is a paramount concern for Advanced Energy's diverse global clientele, who rely on secure and stable power management.

The threat landscape for ICS is continuously expanding, with attacks targeting operational technology (OT) becoming more sophisticated. For instance, a 2024 report indicated a 40% year-over-year increase in ransomware attacks specifically targeting industrial sectors, highlighting the urgency for enhanced security measures. Advanced Energy's commitment to cybersecurity directly impacts its customers' ability to maintain uninterrupted operations and protect sensitive data.

- Growing Threat Landscape: ICS environments are increasingly targeted by nation-state actors and cybercriminals.

- Customer Demand: Clients are demanding verifiable cybersecurity certifications and proactive threat mitigation from their power solution providers.

- Intellectual Property Protection: Securing control systems is vital for protecting Advanced Energy's own innovative technologies and customer-specific configurations.

- Regulatory Scrutiny: Governments worldwide are implementing stricter regulations for ICS cybersecurity, particularly in critical infrastructure sectors.

The rapid evolution of technologies like artificial intelligence, 5G, and the Internet of Things (IoT) directly influences the demand for Advanced Energy's sophisticated power solutions. For example, the global AI market was projected to exceed $200 billion in 2024, driving a need for high-performance, efficient power delivery in data centers and edge computing devices.

Advanced Energy must continuously innovate to meet the stringent requirements of these burgeoning tech sectors, focusing on areas such as high-density power supplies and advanced thermal management to support smaller, more powerful electronic components.

The increasing adoption of wide-bandgap semiconductors like silicon carbide (SiC) and gallium nitride (GaN) is a key technological factor, enabling more efficient and compact power electronics. These materials are crucial for applications ranging from electric vehicles to renewable energy systems, where improved performance and reduced energy loss are paramount.

The manufacturing sector's embrace of Industry 4.0, including automation and AI, creates a significant demand for intelligent power control systems. Global spending on Industry 4.0 technologies was expected to reach $323 billion in 2025, underscoring the market's growth and the need for integrated, smart power solutions.

| Technology Trend | Market Impact | Advanced Energy Relevance |

|---|---|---|

| AI & IoT Expansion | Projected AI market over $200B in 2024 | Demand for high-density, efficient power solutions |

| Wide-Bandgap Semiconductors (SiC, GaN) | Enabling higher voltage/temperature operation | Key for EV, renewable energy power electronics |

| Industry 4.0 & Automation | Industry 4.0 spending to reach $323B by 2025 | Need for intelligent, integrated power control systems |

Legal factors

Advanced Energy operates under stringent product safety and compliance regulations across its diverse markets, especially in the medical and industrial sectors. For instance, in 2023, the global medical device market faced increased scrutiny, with regulatory bodies like the FDA issuing numerous recalls for non-compliance, highlighting the critical need for adherence to standards.

Achieving certifications such as CE marking in Europe and UL listing in North America is not merely a formality but a prerequisite for market entry and continued sales. Non-compliance can lead to costly product recalls, significant fines, and severe damage to brand reputation, as seen in past instances where companies faced millions in penalties for safety violations.

The company's commitment to these standards directly impacts its ability to access international markets and maintain customer trust. For example, a failure to meet ISO 13485 standards, crucial for medical device manufacturers, could block access to the lucrative European healthcare market, which was valued at over €230 billion in 2024.

Advanced Energy's ability to protect its proprietary technologies through patents, trademarks, and trade secrets is paramount to maintaining its competitive edge in the advanced energy solutions market. These legal frameworks are essential for safeguarding its innovations and deterring infringement by competitors worldwide.

In 2023, Advanced Energy reported $1.35 billion in revenue, underscoring the commercial significance of its engineered solutions. The strength of its intellectual property portfolio directly impacts its ability to command premium pricing and secure market share against rivals seeking to replicate its technological advancements.

Global patent filings and enforcement actions are critical legal factors. For instance, the company's ongoing efforts to secure and defend patents for its semiconductor manufacturing equipment, a key revenue driver, directly influence its financial performance and long-term growth prospects.

Data privacy and security laws, like the GDPR and CCPA, are increasingly shaping the operational landscape for Advanced Energy's customers in the data center and telecommunications sectors. While Advanced Energy itself doesn't directly manage personal data, its power and control solutions are integral to the infrastructure that does. This means ensuring the reliability and security of power delivery is indirectly crucial for its clients' compliance efforts, as any power disruption or compromise could impact data integrity and privacy. In 2024, the global spending on data privacy compliance was projected to reach over $11 billion, highlighting the significant investment companies are making to adhere to these regulations.

Antitrust and Competition Laws

Advanced Energy operates in specialized markets where antitrust and competition laws are paramount, especially regarding its strategic moves like mergers and acquisitions. Navigating these global regulations is crucial for maintaining fair market practices and avoiding costly legal disputes that could hinder growth. For instance, in 2023, the Federal Trade Commission (FTC) in the US continued its robust enforcement, reviewing numerous transactions to ensure they didn't stifle competition, a trend expected to persist through 2024 and into 2025.

Compliance with these laws is not just about avoiding penalties; it's fundamental to Advanced Energy's ability to expand its business and pursue new opportunities without facing regulatory roadblocks. The company must continuously monitor its market conduct and any potential acquisitions to ensure they align with the competitive landscape in key regions like North America, Europe, and Asia.

- Global Regulatory Scrutiny: Antitrust authorities worldwide, including the European Commission and the US Department of Justice, are actively scrutinizing market concentration in technology sectors.

- Merger Control: Advanced Energy's acquisition strategies are subject to pre-merger notification and review processes in multiple jurisdictions, requiring careful legal assessment.

- Market Dominance Concerns: In niche segments of the energy technology market, regulators may examine whether Advanced Energy's market share or business practices could lead to anti-competitive outcomes.

- Enforcement Trends: Increased focus on digital markets and supply chain resilience by regulators suggests a heightened risk of investigations into business conduct that could be perceived as exclusionary.

International Trade Laws and Sanctions

Advanced Energy's global reach means strict adherence to international trade laws is critical. This includes navigating export controls, sanctions regimes, and anti-bribery statutes, which are constantly evolving. For instance, in 2024, the US Department of Commerce continued to update its Entity List, impacting companies trading with certain nations, and the EU has maintained its extensive sanctions against Russia, affecting supply chains and market access for companies with operations or significant customer bases in affected regions.

Failure to comply can result in substantial financial penalties, operational disruptions, and significant damage to Advanced Energy's reputation. For example, a single violation of export control regulations could lead to fines in the millions of dollars and even lead to the loss of export privileges. Therefore, maintaining comprehensive and up-to-date internal compliance programs is not just a legal necessity but a strategic imperative for continued market participation and risk mitigation.

- Export Control Compliance: Ensuring all product shipments adhere to regulations set by bodies like the Bureau of Industry and Security (BIS) in the US and similar agencies globally.

- Sanctions Adherence: Diligently screening customers and transactions against OFAC (US) and EU sanctions lists to avoid prohibited business dealings.

- Anti-Bribery and Corruption: Implementing robust policies and training to prevent violations of laws such as the Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act.

- Supply Chain Scrutiny: Verifying that suppliers and partners also meet international trade compliance standards to mitigate indirect risks.

Advanced Energy's operations are heavily influenced by product safety and compliance regulations, particularly in its medical and industrial sectors. For instance, the medical device market saw increased regulatory action in 2023, with bodies like the FDA issuing recalls for non-compliance, underscoring the critical need for adherence to standards like ISO 13485 for market access, especially in Europe where the healthcare market was valued at over €230 billion in 2024.

Protecting intellectual property through patents and trademarks is vital for Advanced Energy's competitive edge. In 2023, the company reported $1.35 billion in revenue, and the strength of its IP portfolio directly impacts its ability to command premium pricing and market share, especially concerning its semiconductor manufacturing equipment, a key revenue driver.

The company must navigate complex global trade laws, including export controls and sanctions, which are constantly evolving. In 2024, the US continued to update its Entity List, impacting trade, while the EU maintained sanctions on Russia, affecting supply chains and market access for companies with operations in affected regions.

Antitrust and competition laws are paramount for Advanced Energy's strategic moves, such as mergers and acquisitions. Regulators worldwide, including the FTC in the US and the European Commission, are actively scrutinizing market concentration, with increased focus on technology sectors and supply chain resilience expected to continue through 2024 and 2025.

Environmental factors

Global energy efficiency standards are tightening, pushing industries towards more power-conscious operations. For Advanced Energy, this translates into a growing demand for their high-efficiency power conversion solutions, essential for everything from industrial machinery to data centers. For instance, the European Union's Ecodesign Directive continues to set benchmarks for energy-consuming products, impacting the market for power supplies and industrial equipment.

Meeting and exceeding these evolving regulations presents a significant opportunity for Advanced Energy. Their ability to deliver products that comply with or surpass standards like those in California's Title 24 energy code for building systems can unlock new market segments and solidify their competitive edge. This focus on efficiency not only addresses regulatory pressures but also aligns with increasing customer demand for reduced operational costs and environmental impact.

Advanced Energy's operations are heavily influenced by waste management and hazardous materials regulations, such as the EU's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH). These rules govern the disposal of manufacturing byproducts and the chemical components within their advanced energy solutions, impacting global market access. For instance, the global market for hazardous waste management services was valued at approximately $300 billion in 2023, highlighting the significant compliance costs and opportunities.

Governments worldwide are implementing stringent climate change policies, including carbon pricing mechanisms and ambitious emission reduction targets. For instance, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, driving demand for cleaner energy solutions.

These policies directly impact Advanced Energy's customer base, encouraging greater adoption of technologies that support sustainable manufacturing and resilient power infrastructure. Sectors like electric vehicles and heavy industry are particularly responsive, seeking solutions to decarbonize their operations and meet regulatory mandates.

In 2024, global investment in the energy transition reached an estimated $2 trillion, signaling a significant market shift. Advanced Energy's offerings, which facilitate energy efficiency and renewable energy integration, are well-positioned to capitalize on this trend, particularly as countries accelerate their net-zero commitments.

Resource Scarcity and Sustainable Sourcing

The availability and sustainable sourcing of critical raw materials, like lithium and cobalt essential for battery technology, present significant environmental and operational hurdles for companies in the advanced energy sector. These materials are often scarce and vulnerable to supply chain disruptions, impacting production timelines and costs. For instance, the International Energy Agency (IEA) highlighted in its 2024 Critical Minerals Market Review that demand for minerals like graphite, used in battery anodes, is projected to grow substantially, underscoring the need for secure and diversified supply chains.

Advanced Energy must proactively address these challenges by integrating material circularity principles into its product lifecycle and prioritizing responsible sourcing practices. Exploring and developing potential alternative materials or refining existing ones to reduce reliance on scarce resources is also crucial. This strategic approach not only mitigates environmental risks but also strengthens operational resilience against geopolitical and market volatility.

- Lithium Demand: Global lithium demand is expected to reach 1.8 million metric tons of lithium carbonate equivalent by 2030, according to the IEA, increasing pressure on sourcing.

- Cobalt Sourcing Concerns: Over 70% of the world's cobalt, a key battery component, is mined in the Democratic Republic of Congo, raising ethical and supply chain concerns.

- Recycling Potential: The development of advanced battery recycling technologies aims to recover critical materials, with projections suggesting recycled content could meet a significant portion of future demand.

- Rare Earth Element Volatility: China's dominance in rare earth element production, vital for wind turbines and electric vehicle motors, creates supply chain risks that necessitate diversification efforts.

Customer Demand for Sustainable Products and Practices

Customers increasingly prioritize sustainability, impacting their purchasing choices. This trend is evident in the growing market for eco-friendly products. For instance, a 2024 survey indicated that over 60% of consumers consider environmental impact when buying electronics.

Advanced Energy can leverage this by highlighting its commitment to environmental stewardship. Offering products that facilitate renewable energy adoption, like their grid stabilization solutions, directly addresses this demand. This approach not only appeals to environmentally conscious buyers but also positions the company as a leader in the clean energy transition.

- Growing Consumer Awareness: A significant portion of consumers, particularly younger demographics, actively seek out brands with strong environmental, social, and governance (ESG) credentials.

- Market Growth for Sustainable Products: The global market for sustainable goods is expanding rapidly, with projections showing continued double-digit growth through 2025.

- Competitive Advantage: Companies demonstrating tangible efforts in sustainability and offering solutions that reduce environmental impact gain a competitive edge and can command premium pricing.

- Investment in Green Technologies: Consumer demand fuels investment in green technologies, creating opportunities for companies like Advanced Energy that provide enabling infrastructure and solutions.

Evolving global energy efficiency standards are a major driver for Advanced Energy, pushing industries towards more power-conscious operations and increasing demand for their high-efficiency power conversion solutions. For instance, the European Union's Ecodesign Directive continues to set benchmarks for energy-consuming products, directly impacting the market for power supplies and industrial equipment.

Stringent climate change policies, including carbon pricing and emission reduction targets like the EU's Fit for 55 package aiming for a 55% cut by 2030, are accelerating the adoption of cleaner energy technologies. This trend directly benefits Advanced Energy as sectors like electric vehicles and heavy industry seek solutions to decarbonize, with global investment in the energy transition estimated at $2 trillion in 2024.

The sourcing of critical raw materials, such as lithium and cobalt, presents operational challenges due to scarcity and supply chain vulnerabilities, as highlighted by the IEA's 2024 Critical Minerals Market Review. Advanced Energy must focus on material circularity and responsible sourcing to mitigate these risks and ensure operational resilience.

PESTLE Analysis Data Sources

Our Advanced Energy PESTLE Analysis is meticulously crafted using data from leading international organizations, government energy departments, and reputable industry research firms. We integrate regulatory updates, economic forecasts, technological advancements, and environmental impact assessments to provide a comprehensive view.