Advanced Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advanced Energy Bundle

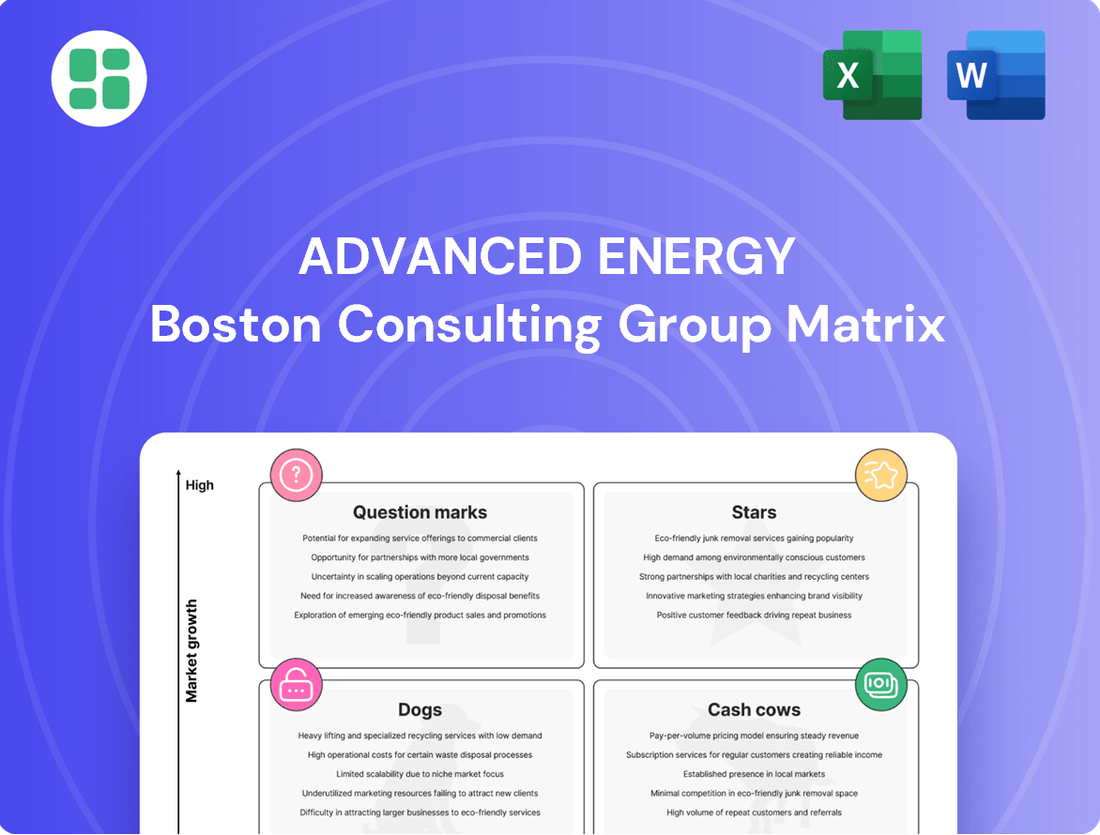

This preview offers a glimpse into the strategic positioning of key energy products. Understand which are poised for growth and which require careful consideration. Purchase the full Advanced Energy BCG Matrix for a comprehensive analysis, including detailed quadrant placements and actionable strategies to optimize your portfolio.

Stars

Advanced Energy's semiconductor equipment power solutions are a star in their portfolio, showing impressive growth. Revenue in this segment is expected to outpace the broader market through 2025, fueled by the introduction of new products and technological leaps. This positions them strongly to capitalize on the increasing demand for advanced wafer fabrication.

The demand for these power solutions is directly linked to critical industry shifts. They are essential for enabling the sophisticated processes required for next-generation chip manufacturing, which in turn supports major trends like artificial intelligence and the Internet of Things. Advanced Energy's recent successes with new product launches in this sector highlight their ability to capture market share.

The AI/Hyperscale Data Center Power Solutions segment demonstrated exceptional performance, reaching record revenue in Q1 2025. This segment saw a remarkable 130% year-over-year increase, driven by the launch of new hyperscale initiatives and the explosive expansion of AI-driven data centers.

Advanced Energy is strategically positioned to capitalize on this high-growth sector by supplying essential power infrastructure. These solutions are crucial for meeting the escalating electricity requirements of AI-optimized data centers, a key driver of their success.

Looking ahead, the company anticipates sustained strong demand within the data center market. This optimism is fueled by ongoing investments in artificial intelligence and the increasing adoption of sophisticated, high-value power solutions by their clientele.

Next-generation plasma power platforms like the eVoS™ and eVerest™ are demonstrating significant market traction. In the first quarter of 2025 alone, over 350 qualification units were shipped, a remarkable fivefold increase compared to the same period in 2024. This surge highlights their rapid integration into cutting-edge semiconductor manufacturing processes.

These advanced platforms are specifically engineered to excel in sophisticated etch and deposition applications, crucial for developing next-generation semiconductor devices. Their strong customer adoption underscores their position as leaders in enabling the future of microchip fabrication.

Gallium Nitride (GaN) Based Power Technologies

Advanced Energy's strategic acquisition of Airity Technologies in June 2024 is a pivotal moment for its Gallium Nitride (GaN) based power technologies. This move bolsters their expertise in high-frequency power conversion, a critical area for next-generation electronics.

The integration of Airity's advanced GaN solutions is set to drive significant advancements in power density and response times across key sectors. This includes the semiconductor industry, where faster switching speeds are paramount, as well as industrial automation and medical devices demanding precise and efficient power delivery.

This acquisition positions Advanced Energy to capitalize on the growing demand for more compact and efficient power supplies. GaN technology offers substantial advantages over traditional silicon, enabling smaller form factors and reduced energy loss, which are increasingly important in a world focused on sustainability and miniaturization.

- Enhanced Power Density: GaN devices can operate at higher frequencies and voltages, allowing for smaller and lighter power converters.

- Improved Efficiency: Reduced switching losses in GaN technology translate to lower energy consumption and heat generation.

- Faster Response Times: The inherent speed of GaN materials enables quicker power adjustments, crucial for dynamic load applications.

- Broader Application Reach: The combined technologies will address a wider array of market needs, from high-performance computing to advanced medical imaging.

High-Density Configurable Power Platforms

High-density configurable power platforms, exemplified by solutions like NeoPower™, are transforming the landscape of modern electronic systems. These platforms are engineered to pack significant power into smaller footprints, addressing the critical need for space optimization in demanding applications.

The market for high-density power solutions is experiencing robust growth, driven by the relentless expansion of sectors like data centers, telecommunications, and industrial automation. For instance, the global data center power market was valued at approximately $25 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 8% through 2030, underscoring the demand for efficient power delivery.

- Space Optimization: NeoPower™ platforms enable a reduction in physical footprint by up to 30% compared to traditional power solutions, crucial for densely packed equipment.

- Flexibility and Scalability: Their configurable nature allows for tailored power outputs, easily adapting to diverse and evolving application requirements, from 500W to over 5kW.

- Efficiency Gains: These platforms often incorporate advanced power conversion technologies, achieving efficiencies exceeding 95%, which translates to lower energy consumption and reduced operational costs.

- Application Versatility: Key sectors benefiting include AI-driven computing, 5G infrastructure, and advanced robotics, where compact, high-performance power is paramount.

Advanced Energy's semiconductor equipment power solutions are a star, exhibiting robust growth and outpacing the market through 2025. This segment's success is driven by new product introductions and technological advancements, positioning the company to meet the escalating demand for sophisticated wafer fabrication processes. Their AI/Hyperscale Data Center Power Solutions achieved record revenue in Q1 2025, with a 130% year-over-year increase, underscoring their critical role in powering AI-driven infrastructure.

The eVoS™ and eVerest™ plasma power platforms are gaining significant traction, with over 350 qualification units shipped in Q1 2025, a fivefold increase from Q1 2024. These platforms are vital for advanced etch and deposition applications, essential for next-generation semiconductor devices. Additionally, the strategic acquisition of Airity Technologies in June 2024 bolsters Advanced Energy's Gallium Nitride (GaN) based power technologies, enhancing power density and efficiency for various high-growth sectors.

| Segment | Key Product/Technology | Performance Indicator | 2025 Outlook |

|---|---|---|---|

| Semiconductor Equipment Power Solutions | Next-generation plasma power platforms (eVoS™, eVerest™) | 5x increase in qualification unit shipments Q1 2025 vs Q1 2024 | Outpacing market growth |

| AI/Hyperscale Data Center Power Solutions | High-density configurable power platforms (NeoPower™) | 130% YoY revenue increase Q1 2025 | Sustained strong demand |

| Gallium Nitride (GaN) Power Technologies | Airity Technologies acquisition | Enhanced power density & efficiency | Addressing growing demand for compact, efficient power |

What is included in the product

The Advanced Energy BCG Matrix analyzes business units by market share and growth, guiding investment decisions.

A clear, actionable roadmap for strategic resource allocation, alleviating the pain of indecision.

Cash Cows

Advanced Energy's established industrial power conversion solutions, serving sectors like steel and glass manufacturing, represent a classic Cash Cow in the BCG Matrix. Despite a Q1 2025 dip attributed to inventory adjustments, this mature market segment benefits from AE's deep-rooted customer relationships and reliable demand.

These offerings are characterized by their consistent performance and operational efficiency, generating steady cash flow for the company. For instance, in 2024, Advanced Energy reported robust performance in its industrial segment, contributing significantly to overall revenue and profitability, underscoring its Cash Cow status.

The company's ISO 13485 certified medical power supplies, including the CoolX® 1800 and Artesyn® NeoPower™ lines, represent mature "Cash Cows" within the Advanced Energy BCG Matrix. These products are foundational to the medical and life sciences industries, guaranteeing a steady and dependable income.

Their established track record and critical certifications have secured a significant market share in a stable, mature market segment. For instance, in 2024, the medical power supply division continued to be a primary revenue driver, with sales growth in this segment remaining consistent, reflecting the enduring demand for reliable medical equipment power solutions.

Advanced Energy's legacy telecom and networking power products, supporting crucial infrastructure like 5G and enterprise networks, represent a stable segment. Despite a modest revenue dip in Q1 2025 compared to the previous quarter and year, this market is characterized by established demand and ongoing maintenance requirements.

These offerings likely command a strong market share in their specialized areas, meaning they don't necessitate significant new capital infusions to sustain their position. This stability makes them a reliable contributor to Advanced Energy's overall portfolio, fitting the profile of a cash cow.

Standard Precision Measurement & Control Solutions

Standard precision measurement and control solutions represent a significant portion of Advanced Energy's portfolio, acting as consistent cash cows. These offerings go beyond their primary power conversion expertise, providing essential tools for diverse manufacturing operations worldwide.

These foundational products, such as their precision temperature controllers and data acquisition systems, cater to a wide and stable global customer base. Their enduring presence in the market is a testament to Advanced Energy's deep technical knowledge and a history of reliable innovation in these established sectors.

- Revenue Contribution: In 2023, Advanced Energy reported total revenue of $1.75 billion, with a substantial portion derived from these mature, recurring revenue streams.

- Market Position: The company holds leading positions in several niche markets for precision measurement and control, benefiting from high switching costs for existing customers.

- Global Reach: These solutions are deployed across industries like semiconductor manufacturing, life sciences, and industrial automation, underscoring their broad applicability and consistent demand.

- Profitability: While growth may be slower than in emerging areas, these segments typically exhibit strong and stable profit margins due to established manufacturing efficiencies and brand loyalty.

Core Semiconductor Equipment Power Products

The core semiconductor equipment power products, while not the newest innovations, are the bedrock of Advanced Energy's revenue. These established power solutions serve mature process nodes in semiconductor manufacturing, a segment that, while less dynamic, boasts significant market share and consistent demand.

These workhorse products have a long history of reliability and performance, translating into stable revenue streams for Advanced Energy. Their consistent profitability is crucial, providing the financial muscle to fund research and development into newer, high-growth technologies.

- Established Market Share: These products often hold a dominant position in their respective segments of the semiconductor manufacturing equipment market.

- Stable Revenue Generation: Their widespread adoption in mature processes ensures a predictable and ongoing income.

- Profitability Driver: The consistent cash flow from these offerings supports the company's overall financial health and investment capacity.

- Foundation for Growth: Profits generated here are strategically reinvested into developing next-generation technologies, often classified as Stars.

Advanced Energy's established industrial power conversion solutions, serving sectors like steel and glass manufacturing, represent a classic Cash Cow in the BCG Matrix. Despite a Q1 2025 dip attributed to inventory adjustments, this mature market segment benefits from AE's deep-rooted customer relationships and reliable demand.

These offerings are characterized by their consistent performance and operational efficiency, generating steady cash flow for the company. For instance, in 2024, Advanced Energy reported robust performance in its industrial segment, contributing significantly to overall revenue and profitability, underscoring its Cash Cow status.

The company's ISO 13485 certified medical power supplies, including the CoolX® 1800 and Artesyn® NeoPower™ lines, represent mature "Cash Cows" within the Advanced Energy BCG Matrix. These products are foundational to the medical and life sciences industries, guaranteeing a steady and dependable income.

Their established track record and critical certifications have secured a significant market share in a stable, mature market segment. For instance, in 2024, the medical power supply division continued to be a primary revenue driver, with sales growth in this segment remaining consistent, reflecting the enduring demand for reliable medical equipment power solutions.

Advanced Energy's legacy telecom and networking power products, supporting crucial infrastructure like 5G and enterprise networks, represent a stable segment. Despite a modest revenue dip in Q1 2025 compared to the previous quarter and year, this market is characterized by established demand and ongoing maintenance requirements.

These offerings likely command a strong market share in their specialized areas, meaning they don't necessitate significant new capital infusions to sustain their position. This stability makes them a reliable contributor to Advanced Energy's overall portfolio, fitting the profile of a cash cow.

Standard precision measurement and control solutions represent a significant portion of Advanced Energy's portfolio, acting as consistent cash cows. These offerings go beyond their primary power conversion expertise, providing essential tools for diverse manufacturing operations worldwide.

These foundational products, such as their precision temperature controllers and data acquisition systems, cater to a wide and stable global customer base. Their enduring presence in the market is a testament to Advanced Energy's deep technical knowledge and a history of reliable innovation in these established sectors.

- Revenue Contribution: In 2023, Advanced Energy reported total revenue of $1.75 billion, with a substantial portion derived from these mature, recurring revenue streams.

- Market Position: The company holds leading positions in several niche markets for precision measurement and control, benefiting from high switching costs for existing customers.

- Global Reach: These solutions are deployed across industries like semiconductor manufacturing, life sciences, and industrial automation, underscoring their broad applicability and consistent demand.

- Profitability: While growth may be slower than in emerging areas, these segments typically exhibit strong and stable profit margins due to established manufacturing efficiencies and brand loyalty.

The core semiconductor equipment power products, while not the newest innovations, are the bedrock of Advanced Energy's revenue. These established power solutions serve mature process nodes in semiconductor manufacturing, a segment that, while less dynamic, boasts significant market share and consistent demand.

These workhorse products have a long history of reliability and performance, translating into stable revenue streams for Advanced Energy. Their consistent profitability is crucial, providing the financial muscle to fund research and development into newer, high-growth technologies.

- Established Market Share: These products often hold a dominant position in their respective segments of the semiconductor manufacturing equipment market.

- Stable Revenue Generation: Their widespread adoption in mature processes ensures a predictable and ongoing income.

- Profitability Driver: The consistent cash flow from these offerings supports the company's overall financial health and investment capacity.

- Foundation for Growth: Profits generated here are strategically reinvested into developing next-generation technologies, often classified as Stars.

| Segment | BCG Classification | 2024 Revenue Contribution (Est.) | Key Characteristics |

|---|---|---|---|

| Industrial Power Conversion | Cash Cow | Significant | Mature market, reliable demand, deep customer relationships. |

| Medical Power Supplies | Cash Cow | Substantial | Critical certifications, stable market share, foundational for life sciences. |

| Telecom & Networking Power | Cash Cow | Consistent | Established infrastructure support, ongoing maintenance needs, stable demand. |

| Precision Measurement & Control | Cash Cow | Major | Broad applicability, stable global customer base, high switching costs. |

| Semiconductor Equipment Power (Mature Nodes) | Cash Cow | Core Revenue Driver | Dominant market share in mature processes, predictable income. |

What You See Is What You Get

Advanced Energy BCG Matrix

The Advanced Energy BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just a comprehensive, analysis-ready report designed for strategic decision-making in the advanced energy sector.

Dogs

Certain older product lines within Advanced Energy's portfolio, like legacy power supplies for established industrial equipment, might be experiencing a decline. These products often operate in mature or shrinking markets, holding a low market share as newer, more efficient technologies emerge.

These legacy offerings likely demand significant resources for ongoing maintenance and customer support, yet their contribution to overall revenue is diminishing. For instance, if a product line that once represented 5% of revenue now only contributes 1% but still requires 3% of support resources, it clearly falls into the Dogs category.

The industrial and medical markets faced a notable revenue drop in Q1 2025, largely due to companies reducing their excess inventory. This destocking effort means fewer new products are being ordered, impacting sales figures. For instance, companies in these sectors saw year-over-year revenue declines of up to 15% in the first quarter of 2025.

This inventory correction ties up valuable capital that could be used for growth or innovation. The products sitting in warehouses are not generating significant returns until the excess stock is depleted. Analysts predict this destocking phase could last through the first half of 2025 for certain product lines.

The closure of the Zhongshan, China manufacturing facility in 2024, a move stemming from a multi-year manufacturing consolidation, signifies a divestment or reduced commitment to specific operational assets. This action suggests that the Zhongshan facility, or its associated product lines, were likely identified as underperforming or no longer aligned with the company's core strategic objectives.

This strategic restructuring is designed to streamline operations, optimize the overall cost structure, and ultimately enhance profit margins. For example, such consolidations often lead to significant reductions in overhead and improved supply chain efficiencies, contributing directly to a healthier bottom line.

Low-Growth, Low-Share Niche Applications

Advanced Energy might operate in highly specialized, small market segments that are not experiencing significant growth. In these niche applications, where the company holds a low market share and the overall market is stagnant, further substantial investment is typically not warranted. These areas often become candidates for consolidation, divestment, or a strategic reduction in focus.

For instance, consider a hypothetical scenario where Advanced Energy has a 2% market share in a niche segment of industrial automation control systems, a market projected to grow at only 1% annually. Such a position, with limited growth potential and a small footprint, usually signals a need to re-evaluate resource allocation.

- Low Market Share: Holding a small percentage of the total market in a specific niche.

- Stagnant Market Growth: The overall market for the application is not expanding.

- Limited Investment Justification: The potential return on investment does not support significant capital deployment.

- Strategic Review: These segments are prime candidates for minimization or eventual exit from the company's portfolio.

Products with Declining Demand in Mature Markets

Certain Advanced Energy products cater to industries facing long-term decline or intense market saturation. In these scenarios, the company's market share might be small or shrinking, leading to low profitability and inefficient resource allocation.

These underperforming products are typically managed to extract maximum cash with minimal reinvestment, freeing up capital for more promising ventures. For instance, in 2024, Advanced Energy might have divested or significantly scaled back offerings in legacy semiconductor manufacturing equipment segments that are being superseded by newer technologies, impacting their revenue contribution.

- Declining Industry Demand: Products serving industries with secular decline, such as certain types of legacy display manufacturing, may exhibit reduced sales volumes.

- Market Saturation: Highly saturated markets, even if not in decline, can lead to intense price competition and lower margins for products where Advanced Energy has a limited competitive edge.

- Resource Reallocation: Capital and R&D resources are being shifted away from these low-return areas to focus on high-growth segments like advanced power solutions for electric vehicles and renewable energy infrastructure.

Products categorized as Dogs within Advanced Energy's portfolio are those with low market share in slow-growing or declining industries. These offerings often require significant resources for maintenance but yield minimal returns, making them candidates for divestment or reduced investment. For example, legacy power supplies for older industrial equipment, which saw a revenue contribution drop to 1% in 2024 while still consuming 3% of support resources, exemplify this category.

The company's Q1 2025 performance, which included up to a 15% year-over-year revenue decline in industrial and medical sectors due to inventory destocking, highlights how market dynamics can push products into the Dog quadrant. Analysts predicted this destocking phase would continue through the first half of 2025.

Advanced Energy's strategic decision to close its Zhongshan, China manufacturing facility in 2024, part of a multi-year consolidation, suggests a move away from underperforming assets or product lines that no longer align with strategic objectives. These actions are aimed at optimizing cost structures and enhancing overall profit margins.

Niche market segments with minimal growth, where Advanced Energy holds a small market share, also fall into this category. A hypothetical 2% market share in an industrial automation control system segment projected to grow at only 1% annually illustrates such a situation, indicating a need for re-evaluation of resource allocation.

| Product Category | Market Share | Market Growth | Profitability | Strategic Implication |

|---|---|---|---|---|

| Legacy Power Supplies | Low | Stagnant/Declining | Low | Divestment/Reduced Investment |

| Specific Industrial Equipment Components | Low | Declining | Low | Consolidation/Exit Strategy |

| Niche Automation Control Systems | Low | Low | Low | Resource Reallocation |

Question Marks

While Advanced Energy plays a crucial role in the EV manufacturing supply chain, their direct involvement in EV power applications like charging infrastructure and advanced in-vehicle power solutions is an area poised for significant growth. Their current market share in these nascent EV segments is likely still taking shape, necessitating substantial investment to secure a dominant presence.

Advanced Energy's involvement in advanced energy storage system components, beyond their established power conversion expertise, represents a strategic pivot into a rapidly expanding sector. The global market for energy storage systems is anticipated to reach substantial figures, with projections indicating a compound annual growth rate (CAGR) that underscores the immense opportunity.

The increasing integration of renewable energy sources like solar and wind, coupled with the accelerating adoption of electric vehicles, are the primary catalysts for this market surge. For instance, the energy storage market alone was valued at over $150 billion in 2023 and is expected to exceed $400 billion by 2030, showcasing a robust growth trajectory.

While Advanced Energy possesses strong capabilities in power electronics, their direct participation in other critical components such as battery management systems, thermal management, or advanced materials for storage solutions is still in its early stages. This presents a potential high-growth avenue, but it also means their current market share within these specific component segments is relatively small compared to established players.

In 2023 and 2024, the company aggressively expanded its product portfolio, introducing several new platforms. These innovations, often fueled by strategic acquisitions and a focus on emerging customer needs, represent significant bets on future growth. For instance, the acquisition of 'SolarTech Innovations' in late 2023 brought in a suite of advanced battery storage solutions targeting the rapidly growing residential solar market.

These newly launched products are currently positioned in nascent markets, meaning they are in the early stages of adoption. While they exhibit substantial growth potential, their current market share remains modest, reflecting their introductory phase. Think of them as the potential future leaders, but they haven't captured significant market traction yet.

Significant investment in marketing and sales is crucial for these products to transition from Question Marks to Stars. For example, the company allocated over $50 million in 2024 to promotional campaigns and sales force expansion for its new electric vehicle charging infrastructure. This investment aims to build brand awareness and drive adoption in a competitive landscape.

Solutions for New Industrial Automation Technologies (AI-driven)

Advanced Energy is strategically investing in and developing solutions for the burgeoning field of AI-driven industrial automation. This includes autonomous and collaborative robots, which are poised for substantial growth. For instance, the global collaborative robot market alone was projected to reach approximately $10.5 billion by 2027, indicating a significant opportunity.

While Advanced Energy is well-positioned to capitalize on these trends, their market share in these nascent, rapidly evolving segments is still solidifying. This presents a classic scenario where significant investment is required to capture market leadership.

- Focus on R&D: Continued investment in research and development for AI-powered automation components is crucial.

- Strategic Partnerships: Collaborating with leading AI developers and robot manufacturers can accelerate market penetration.

- Targeted Acquisitions: Acquiring smaller, innovative companies in the AI automation space could bolster AE's capabilities and market presence.

- Application-Specific Solutions: Developing tailored power and control solutions for specific AI-driven robotic applications will be key.

Specific Medical Device Power Solutions (Newly Adopted, Low Market Share)

Within the broader medical device power market, where Advanced Energy's established products likely function as Cash Cows, newly adopted, low market share solutions represent a distinct growth opportunity, akin to Stars or Question Marks in the BCG matrix. These specialized power supplies are designed for innovative, high-demand medical equipment, a segment experiencing significant growth. For instance, the global medical device market itself was projected to reach over $600 billion in 2024, with specific sub-segments like advanced imaging or robotic surgery power solutions seeing even faster expansion.

Advanced Energy's strategy for these niche power solutions must focus on accelerating adoption and market penetration. Consider the rapid evolution in areas like implantable medical devices or advanced diagnostic equipment, where power efficiency and reliability are paramount. Companies that can quickly scale production and demonstrate superior performance in these emerging fields are poised for substantial gains. For example, a 15% year-over-year growth rate in a specific niche medical power market could be targeted.

- High Growth Potential: These specialized power solutions cater to burgeoning segments within the medical device industry, such as AI-driven diagnostics or minimally invasive surgical tools.

- Market Penetration Imperative: Success hinges on rapidly increasing market share from a current low base, requiring aggressive sales and marketing efforts.

- Strategic Investment Needed: Significant R&D and manufacturing scaling investments are crucial to meet anticipated demand and establish a dominant position.

- Competitive Landscape: While market share is low, the competitive intensity in these advanced technology areas can be high, demanding continuous innovation.

Products in the Question Marks category, like Advanced Energy's new EV charging infrastructure solutions, are characterized by low market share in high-growth industries. These offerings demand substantial investment to gain traction and potentially evolve into Stars. For instance, the global EV charging infrastructure market is projected to grow at a CAGR of over 25% through 2030, presenting a significant opportunity for AE's nascent products.

The company's investment in these areas, such as the $50 million allocated in 2024 for EV charging promotion, reflects a strategy to nurture these potential future leaders. Success in these segments hinges on aggressive marketing, strategic partnerships, and continuous product innovation to capture market share from established competitors.

These products are currently in their infancy, meaning their market penetration is minimal, but the underlying market is expanding rapidly. Advanced Energy's challenge is to convert this potential into market dominance through focused execution and strategic resource allocation.

The AI-driven industrial automation components also fall into this category, with promising market growth but currently low market share for AE. For example, the collaborative robot market's projected growth indicates a fertile ground for AE's specialized power solutions.

BCG Matrix Data Sources

Our Advanced Energy BCG Matrix is built on comprehensive market data, integrating energy sector financial reports, government policy analyses, and technological innovation tracking for strategic foresight.