Addiko Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Addiko Bank Bundle

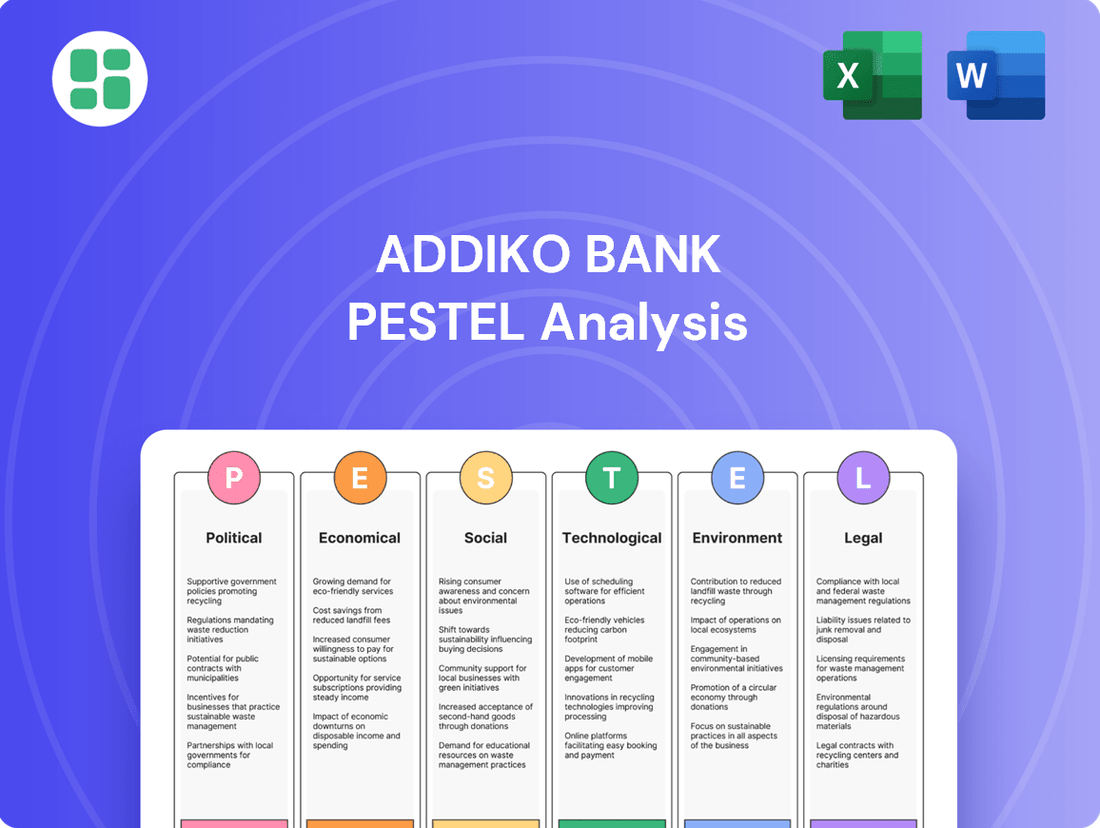

Navigate the complex external environment shaping Addiko Bank's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and threats to the bank's strategic direction. Gain a competitive advantage by leveraging these critical insights.

Unlock actionable intelligence on Addiko Bank's operating landscape. Our PESTLE analysis delivers expert-level insights into the forces driving industry change, enabling informed decision-making for investors, consultants, and strategic planners. Purchase the full version now for immediate access to this vital market intelligence.

Political factors

Political stability in Addiko Bank's core markets, primarily in Central and Southeastern Europe, remains a critical factor. For instance, in 2024, countries like Slovenia and Croatia, key markets for Addiko, have generally maintained stable political environments, fostering a more predictable business climate. However, potential shifts in government or policy, such as changes in banking supervision or capital requirements, could necessitate strategic adjustments for the bank.

The political will to enforce or reform banking regulations, including capital requirements, consumer protection, and anti-money laundering laws, is crucial for Addiko Bank. For instance, in 2024, the European Union continued discussions on strengthening the Capital Requirements Regulation (CRR III), which directly impacts how banks like Addiko must hold capital against their assets, influencing lending capacity and profitability across its operating regions.

Addiko Bank operates within diverse regulatory environments across Central and Eastern Europe (CEE), and political decisions can lead to harmonized or divergent legal frameworks. A key development in 2024 was the ongoing implementation of the Digital Operational Resilience Act (DORA) across the EU, aiming to standardize IT risk management for financial entities, which presents both compliance challenges and opportunities for operational efficiency for Addiko.

These evolving political stances and regulatory changes directly impact compliance costs and operational flexibility across Addiko's markets. For example, differing approaches to data privacy regulations, such as GDPR in some markets and potentially less stringent rules in others, can create complexities in data management and cross-border operations for the bank.

Geopolitical tensions, particularly those impacting the Central and Eastern European (CEE) region where Addiko Bank operates, present a significant political risk. For instance, the ongoing conflict in Ukraine and its spillover effects continue to create uncertainty. This can lead to disruptions in economic activity, potentially causing capital flight from affected markets and impacting the stability of local currencies like the Serbian Dinar or Croatian Kuna.

Addiko Bank must actively assess and mitigate these geopolitical risks to ensure business continuity and maintain the quality of its assets. The bank's exposure to markets like Serbia and Croatia means it is directly influenced by regional stability. For example, in 2023, the CEE region continued to grapple with inflation exacerbated by geopolitical events, impacting consumer spending and loan demand, which directly affects Addiko's operational environment.

Fiscal and Monetary Policies

Government fiscal policies, including taxation levels and public spending initiatives, significantly shape the economic landscape, directly impacting the demand for banking services. For instance, increased government spending on infrastructure projects can stimulate economic activity, leading to greater demand for corporate loans and investment banking services. Conversely, higher corporate taxes might dampen business expansion, reducing lending opportunities.

Central bank monetary policies are critical for Addiko Bank. Decisions on interest rates, like the European Central Bank's (ECB) key interest rates, directly influence Addiko Bank's net interest income and its ability to manage liquidity. For example, the ECB's rate hikes in 2022 and 2023, moving the deposit facility rate from -0.50% to 3.75% by September 2023, aimed to curb inflation but also increased funding costs for banks. Quantitative easing programs, if implemented, could inject liquidity but also potentially compress margins.

- Fiscal Policy Impact: Changes in corporate tax rates or government stimulus packages can alter business investment and consumer spending, thereby affecting loan demand and deposit growth for Addiko Bank.

- Monetary Policy Influence: The ECB's benchmark interest rates directly affect Addiko Bank's lending margins and the cost of its funding. For example, the ECB's deposit facility rate stood at 3.75% as of September 2023, a significant shift from previous negative rates.

- Political Stability and Volatility: Political instability or significant shifts in government economic ideology can introduce uncertainty into fiscal and monetary policy, creating volatility in interest rates and economic growth prospects, which in turn impacts Addiko Bank's operational environment.

International Relations and EU Integration

Addiko Bank's operations are significantly shaped by the political landscape of Central and Eastern Europe (CEE), particularly concerning European Union (EU) integration. As several CEE nations deepen their ties with the EU, or are already members, this political alignment brings a wave of harmonized regulations. For instance, the EU's Capital Requirements Regulation (CRR) and Capital Requirements Directive (CRD) continue to influence national banking frameworks, aiming for enhanced stability and investor protection across member states. This regulatory convergence, driven by political will for economic unity, impacts Addiko Bank's compliance costs and operational strategies.

The bank's regional strategy is also sensitive to political decisions regarding international trade and cross-border collaboration. Agreements that facilitate easier movement of capital and services within the EU, or between the EU and its neighbors, can open up new markets or streamline existing operations for Addiko Bank. Conversely, shifts in political sentiment towards protectionism or strained international relations could present challenges. For example, the EU's commitment to the Digital Single Market, a political initiative, encourages cross-border digital banking services, which Addiko Bank can leverage.

Political stability and the rule of law within the CEE region are paramount for banking sector confidence. Addiko Bank, like other financial institutions, relies on predictable legal frameworks and effective governance. Changes in government policies, such as those related to taxation, anti-money laundering (AML) measures, or consumer protection, directly affect the bank's profitability and risk management. The ongoing efforts by the EU to combat financial crime, reinforced by political consensus, mean that Addiko Bank must continuously adapt its compliance procedures.

Key political implications for Addiko Bank in 2024-2025 include:

- EU Regulatory Harmonization: Continued implementation of EU directives, such as those related to consumer credit or digital banking, will necessitate ongoing adaptation of Addiko Bank's product offerings and compliance frameworks. For example, the EU's Payment Services Directive (PSD3) proposals, expected to be finalized in this period, will further shape digital transaction regulations.

- Geopolitical Stability: Political developments in Eastern Europe, including the ongoing conflict in Ukraine, create a volatile environment that can impact regional economic sentiment and cross-border investment flows, potentially affecting Addiko Bank's market stability and risk appetite.

- Economic Policy Alignment: National governments' fiscal and monetary policies, often influenced by EU economic governance frameworks, will continue to shape the interest rate environment and credit demand, directly impacting Addiko Bank's lending activities and net interest margins.

- Digital Transformation Initiatives: Political support for digital infrastructure and cybersecurity measures within the EU and individual CEE countries can create opportunities for Addiko Bank to enhance its digital service delivery and operational efficiency.

Political stability and government economic policies are foundational for Addiko Bank's operations in Central and Southeastern Europe. In 2024, the region generally saw stable political climates, but potential policy shifts regarding banking regulations, such as capital requirements or consumer protection, necessitate ongoing strategic vigilance for Addiko.

The influence of EU directives, like the ongoing implementation of DORA in 2024, underscores the impact of political will on harmonizing banking regulations across member states, presenting both compliance challenges and opportunities for operational efficiency for Addiko Bank.

Geopolitical tensions, particularly in Eastern Europe, continue to be a significant political risk factor, impacting regional economic sentiment and potentially influencing currency stability in markets where Addiko Bank operates, such as Serbia and Croatia.

Key political implications for 2024-2025 include ongoing EU regulatory harmonization, such as PSD3 proposals affecting digital transactions, and the need to navigate regional geopolitical stability, with national economic policies continuing to shape credit demand and interest rate environments for Addiko Bank.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Addiko Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into market dynamics and regulatory landscapes, enabling strategic decision-making for stakeholders.

Provides a concise PESTLE analysis of Addiko Bank, streamlining complex external factors into actionable insights for strategic decision-making.

Helps alleviate the pain of information overload by offering a clear, categorized overview of the political, economic, social, technological, environmental, and legal forces impacting Addiko Bank.

Economic factors

Regional economic growth is a critical factor for Addiko Bank, as its operations are concentrated in Central and Southeastern Europe. For instance, in 2024, projected GDP growth for the Eurozone, a key region influencing these markets, was around 1.7%, with some Southeastern European countries showing even stronger performance. This growth directly impacts the demand for banking services, from mortgages to business loans.

When economies in countries like Slovenia, Croatia, Serbia, Bosnia and Herzegovina, and Montenegro expand, businesses and individuals are more likely to borrow. This increased lending activity is the lifeblood of Addiko Bank's profitability. Conversely, economic slowdowns or recessions in these areas can significantly dampen loan demand and potentially increase the risk of defaults, impacting the bank's asset quality.

Looking ahead to 2025, forecasts suggest continued, albeit varied, economic expansion across the region. The International Monetary Fund's projections for 2025 indicate a rebound in some economies, which bodes well for Addiko Bank's lending volumes and overall financial health. Monitoring these regional growth trends is therefore essential for strategic planning and risk management.

Interest rate policies from national central banks and the European Central Bank significantly impact Addiko Bank's net interest margin. For instance, the ECB's main refinancing operations rate, a benchmark for lending, stood at 4.50% as of June 2024, influencing the bank's borrowing costs and lending revenues.

While rising rates can boost lending income, they also increase funding costs and can strain borrowers' repayment capacity, a critical factor for Addiko Bank's loan portfolio quality. Managing these fluctuations necessitates robust balance sheet strategies and thorough risk evaluation.

High inflation rates across Central and Eastern European (CEE) economies, such as the 7.1% average inflation recorded in the region for 2023, significantly erode consumer and business purchasing power. This decline can directly impact Addiko Bank's client base’s capacity to manage existing debt obligations and dampen demand for new financial services, like loans and mortgages.

For instance, if inflation outpaces wage growth, individuals may struggle to meet monthly payments. Addiko Bank must therefore meticulously factor inflation into its product pricing strategies and its rigorous assessment of client creditworthiness to mitigate increased default risks.

A stable and predictable inflation environment, ideally within the European Central Bank’s target of 2%, fosters a more secure and manageable operating landscape for Addiko Bank, allowing for more accurate financial forecasting and strategic planning.

Unemployment Rates and Income Levels

Unemployment rates and average income levels are crucial indicators for Addiko Bank, directly impacting the creditworthiness of its retail and small-to-medium enterprise (SME) customers. In the European markets where Addiko operates, for instance, stable or declining unemployment figures coupled with wage growth generally translate to a stronger loan portfolio. For example, in Q1 2024, the Eurozone unemployment rate stood at 6.0%, showing a slight decrease from the previous year, while average nominal wages saw an increase, suggesting a generally positive environment for consumer credit and SME lending.

Conversely, economic downturns marked by rising unemployment and stagnant or falling incomes pose significant risks. High unemployment can lead to increased loan defaults across both retail and business segments, potentially straining Addiko Bank's asset quality and profitability. A notable example is the impact of economic shocks on employment, which can swiftly increase non-performing loans.

- Impact on Credit Risk: Higher unemployment and lower income levels directly correlate with increased default probabilities for Addiko Bank's borrowers.

- Demand for Financial Services: Rising incomes and job security typically boost demand for banking products like loans and mortgages.

- Economic Activity Link: Employment levels and income trends are strong predictors of overall economic health, influencing business investment and consumer spending.

- Regional Variations: Addiko Bank must monitor country-specific unemployment and income data, as conditions can vary significantly across its operating regions.

Access to Credit and Capital Markets

Addiko Bank's ability to access credit and the overall health of local capital markets are fundamental to its operational capacity and strategic growth. When capital is readily available and markets are robust, the bank benefits from lower funding costs and a greater capacity to raise the necessary capital for expansion initiatives, such as new product development or market penetration.

Economic downturns can significantly dampen investor enthusiasm for financial institutions' debt and equity offerings, directly impacting Addiko Bank's financial flexibility. For instance, during periods of economic uncertainty, bond yields for banks might rise, increasing borrowing expenses.

In 2024, the European Central Bank's monetary policy stance, including interest rate adjustments, will continue to shape the cost of capital for banks like Addiko. A stable or declining interest rate environment generally supports lower funding costs, whereas rising rates can increase expenses.

- Funding Costs: The European Central Bank's key interest rates directly influence the cost of wholesale funding for banks.

- Investor Sentiment: Investor confidence in the banking sector and broader economic outlook affects the demand for bank bonds and equity.

- Capital Raising: The ease with which Addiko Bank can issue new shares or bonds is contingent on market conditions and investor appetite.

- Economic Sensitivity: Access to capital can tighten considerably during economic recessions, increasing Addiko Bank's reliance on more stable, albeit potentially more expensive, funding sources.

Regional economic growth is a critical factor for Addiko Bank, as its operations are concentrated in Central and Southeastern Europe. For instance, in 2024, projected GDP growth for the Eurozone, a key region influencing these markets, was around 1.7%, with some Southeastern European countries showing even stronger performance. This growth directly impacts the demand for banking services, from mortgages to business loans.

When economies in countries like Slovenia, Croatia, Serbia, Bosnia and Herzegovina, and Montenegro expand, businesses and individuals are more likely to borrow. This increased lending activity is the lifeblood of Addiko Bank's profitability. Conversely, economic slowdowns or recessions in these areas can significantly dampen loan demand and potentially increase the risk of defaults, impacting the bank's asset quality.

Looking ahead to 2025, forecasts suggest continued, albeit varied, economic expansion across the region. The International Monetary Fund's projections for 2025 indicate a rebound in some economies, which bodes well for Addiko Bank's lending volumes and overall financial health. Monitoring these regional growth trends is therefore essential for strategic planning and risk management.

Preview the Actual Deliverable

Addiko Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Addiko Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understanding these elements is crucial for strategic decision-making.

Sociological factors

Europe's aging population presents a significant demographic shift, with the median age in the EU projected to reach 46.1 years by 2050, up from 44.4 years in 2023. This trend directly impacts Addiko Bank, as older demographics often require different banking services, such as retirement planning and wealth management, compared to younger, digitally-focused customers. Addiko Bank must therefore tailor its product development and marketing strategies to address these varying needs.

Migration patterns also play a crucial role, influencing the demand for international money transfer services and multi-currency accounts. Urbanization further concentrates potential customer bases, making urban areas key markets for expansion and service delivery. Understanding these granular demographic trends within Addiko Bank's operating regions, particularly in Southeast Europe, is vital for effective market segmentation and targeted product innovation.

Consumer preferences are rapidly shifting towards digital channels, with a growing demand for mobile banking and online payment solutions. For Addiko Bank, this means prioritizing user-friendly digital interfaces and seamless mobile experiences to meet evolving customer expectations. For instance, in 2024, digital banking adoption across Central and Eastern Europe (CEE) continued its upward trend, with many markets seeing over 70% of banking transactions conducted online.

The prevailing level of financial literacy within the CEE region directly influences the types of financial products Addiko Bank can successfully offer and the level of customer support needed. A higher general financial literacy allows for the introduction of more sophisticated products, while lower literacy necessitates simpler offerings and more educational resources. By 2025, initiatives aimed at improving financial education are expected to show measurable impacts on consumer engagement with complex financial instruments.

Cultural attitudes towards debt and saving significantly shape financial behaviors in Addiko Bank's operating regions. In countries like Slovenia, for instance, a strong tradition of cautious saving often prevails, influencing demand for deposit products. Conversely, other markets might exhibit a higher tolerance for credit, particularly among younger demographics or for specific life events like home ownership, as seen in emerging trends in Southeast Europe.

These varying social attitudes directly impact Addiko Bank's customer base, affecting the propensity for individuals and Small and Medium-sized Enterprises (SMEs) to engage with loan products versus savings accounts. For example, a 2024 survey indicated that while 65% of households in a key Addiko market expressed a preference for saving for large purchases, a notable 30% were open to financing options, highlighting a dualistic approach.

Effectively tailoring product offerings and marketing campaigns requires a deep understanding of these cultural nuances. Recognizing that a one-size-fits-all approach won't work, Addiko Bank must adapt its strategies to resonate with local preferences, whether that means emphasizing security and stability for savers or highlighting accessibility and clear repayment terms for borrowers.

Trust in Financial Institutions

Public trust in financial institutions is a critical sociological factor influencing customer behavior. Historically, events like the 2008 financial crisis significantly eroded confidence in banks across Europe. For Addiko Bank, rebuilding and sustaining this trust is paramount for attracting and retaining customers. Transparent operations, dependable services, and robust corporate governance are key to fostering this essential element for sustained customer loyalty.

Recent surveys indicate a varied landscape of trust in European banking. For instance, a 2023 European Commission report highlighted that while general trust levels have seen some recovery, specific national contexts and individual bank performance play a significant role. In markets where Addiko Bank operates, such as Southeast Europe, consumer sentiment can be particularly sensitive to economic stability and perceived fairness in banking practices. For example, a 2024 study by a leading financial research firm indicated that over 60% of consumers in the region consider a bank's reputation for trustworthiness as a primary factor when choosing a financial provider.

- Reputation Management: Addiko Bank must prioritize clear communication about its financial health and ethical practices.

- Customer Service Excellence: Consistently delivering high-quality, reliable service builds confidence over time.

- Corporate Governance: Adherence to strong ethical standards and regulatory compliance is fundamental to trust.

- Digital Transparency: Ensuring secure and understandable digital banking platforms enhances user trust.

Workforce Dynamics and Talent Pool

Workforce dynamics significantly shape Addiko Bank's operational capacity. The availability of a qualified talent pool, particularly in high-demand sectors such as IT, risk management, and data analytics, directly impacts the bank's ability to innovate and manage complex financial operations. For instance, in 2024, the demand for cybersecurity professionals in the European banking sector saw a sharp increase, with estimates suggesting a talent gap of over 100,000 individuals.

Employee expectations are also evolving, with a growing emphasis on work-life balance and corporate social responsibility. Addiko Bank must adapt its recruitment and retention strategies to meet these demands. In 2025, surveys indicated that over 60% of job seekers in the financial services industry prioritize flexible work arrangements and organizations with strong ESG (Environmental, Social, and Governance) commitments.

These trends influence Addiko Bank's ability to attract and retain skilled employees. The bank's success in securing top talent in specialized areas is crucial for maintaining a competitive edge and ensuring robust operational performance. A key challenge for many European banks in 2024 was the competition for data scientists, with average salaries for experienced professionals rising by up to 15% year-on-year.

- Talent Acquisition Challenges: Difficulty in sourcing and hiring skilled IT and risk management professionals in key European markets.

- Employee Retention Strategies: Need for competitive compensation, flexible working policies, and a strong corporate culture to retain talent.

- Skills Gap in Digital Banking: The ongoing need to upskill and reskill the existing workforce to adapt to digital transformation and evolving customer needs.

- Impact of Remote Work: Adapting to hybrid and remote work models to broaden the talent pool and meet employee preferences.

Sociological factors significantly influence Addiko Bank's operations, from customer behavior to workforce dynamics. The aging European population, with the EU median age projected to reach 46.1 by 2050, necessitates tailored services like retirement planning. Migration and urbanization also shape demand for international services and concentrate customer bases in urban areas, requiring strategic market segmentation.

Technological factors

The accelerating pace of digital transformation is a paramount technological factor for Addiko Bank. This necessitates ongoing, substantial investments in enhancing its online and mobile banking capabilities to meet evolving customer demands for seamless digital interactions across all services, from routine transactions to complex loan applications and account management.

Customer expectations are increasingly centered on intuitive and efficient digital experiences. For instance, in 2024, a significant portion of banking transactions across Europe were conducted digitally, with mobile banking adoption continuing to rise, often exceeding 70% in some markets. Addiko Bank must therefore prioritize user-friendly interfaces and robust digital infrastructure.

Failure to adapt to these rapid digital shifts poses a direct threat to Addiko Bank's market position. Competitors who offer superior digital platforms can attract and retain customers more effectively. In 2025, reports indicate that banks lagging in digital customer experience are projected to see slower growth and a potential decline in their customer base.

The increasing reliance on digital platforms means Addiko Bank faces escalating cybersecurity risks. A 2024 report indicated a 40% rise in sophisticated cyber threats targeting financial institutions globally, underscoring the need for advanced security investments.

Protecting sensitive customer information is crucial for maintaining trust and operational integrity. Addiko Bank's commitment to robust security protocols, including multi-factor authentication and continuous threat monitoring, is therefore essential.

Navigating stringent data protection laws like the GDPR is a significant technological and legal challenge. Non-compliance can result in substantial fines, with GDPR penalties reaching up to 4% of annual global turnover, making adherence a top priority for Addiko Bank in 2024 and beyond.

The burgeoning fintech sector presents a dual challenge and opportunity for Addiko Bank. Fintech firms, with their nimble, specialized offerings, are increasingly disrupting established banking norms. For instance, in 2024, the European fintech market saw continued growth, with investment rounds supporting innovative payment solutions and digital lending platforms, directly impacting traditional players.

Addiko Bank faces a strategic decision: either engage in direct competition by developing its own cutting-edge digital services or pursue collaborative ventures. Partnerships can allow Addiko to integrate advanced technologies, potentially expanding its reach and customer base more efficiently. By the end of 2025, it's projected that a significant portion of retail banking services will be delivered digitally, underscoring the urgency for banks like Addiko to adapt.

Automation and Artificial Intelligence (AI)

The banking sector's embrace of automation and AI presents substantial opportunities for enhancing operational efficiency, cutting costs, and elevating customer experiences. Addiko Bank can strategically deploy AI for robust fraud detection, more accurate credit scoring, tailored customer recommendations, and the automation of repetitive administrative tasks.

For instance, by 2024, global AI spending in financial services was projected to reach over $15 billion, highlighting the significant investment in these transformative technologies. Addiko Bank's ability to leverage AI for personalized banking services, such as offering proactive financial advice or customized product bundles, can significantly improve customer loyalty and engagement.

However, the successful integration of these advanced technologies necessitates considerable financial investment in infrastructure and software, alongside the recruitment and development of personnel with specialized AI and data science skills. The European Central Bank’s 2024 report indicated that while banks are increasing AI adoption, a significant skills gap remains a key challenge.

- AI-driven fraud detection can reduce losses, with AI models in banking achieving up to 90% accuracy in identifying fraudulent transactions.

- Personalized customer recommendations powered by AI can boost cross-selling and up-selling, potentially increasing revenue by 5-10%.

- Automation of routine tasks, such as data entry and customer query handling, can lead to operational cost savings of 20-30% in back-office functions.

- Investment in AI in the financial sector is expected to grow, with projections indicating a compound annual growth rate of over 20% through 2027.

Cloud Computing and Infrastructure

The ongoing migration to cloud computing presents significant opportunities for financial institutions like Addiko Bank to boost scalability and flexibility in their IT operations. This shift can lead to reduced operational expenses for managing complex infrastructure. For instance, the global cloud computing market was projected to reach over $1 trillion in 2024, indicating a strong industry trend towards cloud adoption.

Addiko Bank can strategically utilize cloud services to improve its data management, accelerate processing speeds, and strengthen its disaster recovery protocols. This enhanced capability is crucial for handling increasing data volumes and ensuring business continuity. By 2025, it's estimated that over 90% of enterprises will rely on cloud services to some extent, highlighting the pervasive nature of this technology.

However, a successful transition to cloud technology necessitates meticulous planning, robust security measures, and effective vendor management. Addiko Bank must address potential cybersecurity risks and ensure compliance with regulatory requirements. The bank's investment in cloud infrastructure will be a key determinant of its future operational efficiency and competitive positioning.

Key considerations for Addiko Bank's cloud strategy include:

- Scalability: Enabling dynamic resource allocation to meet fluctuating demands.

- Cost Efficiency: Reducing capital expenditure on hardware and maintenance.

- Enhanced Data Processing: Leveraging advanced analytics and AI capabilities.

- Disaster Recovery: Implementing resilient backup and recovery systems.

Technological advancements are reshaping banking, demanding continuous digital investment from Addiko Bank. Customer expectations for seamless online and mobile experiences are high, with digital transactions dominating in 2024, often exceeding 70% mobile adoption in key European markets.

Cybersecurity threats are escalating, with a projected 40% increase in sophisticated attacks on financial institutions globally by 2024, making robust security a critical priority for Addiko Bank.

AI integration offers significant operational efficiencies, fraud detection improvements, and personalized customer services, with global AI spending in financial services exceeding $15 billion in 2024, though a skills gap remains a challenge.

Cloud migration enhances scalability and cost-efficiency, with the global cloud market projected to surpass $1 trillion in 2024, but requires careful security and compliance planning.

| Technology Trend | Impact on Addiko Bank | Key Data Point (2024/2025) |

|---|---|---|

| Digital Transformation | Enhance online/mobile banking, meet customer expectations | 70%+ mobile banking adoption in some European markets |

| Cybersecurity | Mitigate increasing sophisticated threats, protect data | 40% rise in cyber threats targeting financial institutions |

| Artificial Intelligence (AI) | Improve efficiency, fraud detection, personalization | $15B+ global AI spending in financial services |

| Cloud Computing | Boost scalability, cost-efficiency, data processing | Cloud market projected >$1T globally in 2024 |

Legal factors

Addiko Bank navigates a complex web of banking regulations across its Central and Eastern European (CEE) markets. These rules govern everything from initial licensing and maintaining sufficient capital buffers, like the Common Equity Tier 1 (CET1) ratio, to robust risk management frameworks and corporate governance standards. For instance, in 2023, the European Banking Authority (EBA) continued to emphasize stringent capital requirements, with many CEE banks, including those Addiko competes with, reporting CET1 ratios well above the minimum regulatory thresholds, often in the 15-18% range.

Adherence to these varied national and potential EU-wide directives is non-negotiable for Addiko to avoid substantial fines and, crucially, to retain its operational licenses. Failure to comply can lead to significant financial penalties and reputational damage. For example, a hypothetical non-compliance issue could result in a fine equivalent to a percentage of the bank's total assets, impacting profitability directly.

Furthermore, the dynamic nature of financial regulation means that Addiko must be agile. Changes in capital adequacy rules, consumer protection laws, or data privacy regulations, such as ongoing discussions around the Digital Operational Resilience Act (DORA) in the EU, can require substantial investments in technology and process overhauls, directly influencing operational costs and strategic planning.

Addiko Bank operates under increasingly stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. These laws mandate robust customer due diligence, transaction monitoring, and the reporting of suspicious activities, directly impacting operational costs and compliance procedures. For instance, in 2024, European banks faced significant scrutiny and potential fines for AML failures, with some institutions incurring penalties in the tens of millions of euros.

Failure to comply with these evolving legal frameworks can lead to severe financial penalties and significant reputational damage for Addiko Bank. The bank must therefore invest in and continuously update its compliance systems to align with international standards, such as those set by the Financial Action Task Force (FATF), and specific national legal requirements across its operating regions.

Consumer protection laws are paramount for Addiko Bank, dictating transparent pricing, fair lending, and robust data privacy. Compliance with regulations like the General Data Protection Regulation (GDPR) is essential. For instance, in 2024, fines for GDPR violations across the EU reached significant figures, underscoring the financial and reputational risks of non-compliance.

These legal frameworks directly impact Addiko Bank's operations by safeguarding customers' rights in financial services. Adherence not only fosters customer trust but also mitigates the likelihood of costly legal battles and damage to the bank's reputation. The increasing focus on consumer rights in the financial sector means Addiko Bank must continuously adapt its practices to meet evolving legal standards.

Data Privacy and Cybersecurity Laws

Addiko Bank, operating in Central and Eastern Europe (CEE), must navigate a complex web of data privacy and cybersecurity laws. Beyond general consumer protection, regulations like the GDPR, implemented across EU member states, dictate stringent requirements for the collection, storage, processing, and protection of personal data. Failure to comply can result in substantial financial penalties and damage to customer trust.

The evolving legal landscape necessitates continuous investment in robust cybersecurity measures and data governance frameworks. For instance, in 2023, GDPR fines globally exceeded €2.5 billion, underscoring the financial risks associated with non-compliance. Addiko Bank's ability to maintain customer confidence is directly linked to its adherence to these data protection mandates, which are increasingly intertwined with its technological capabilities.

- GDPR Compliance: Strict adherence to GDPR mandates for data handling across Addiko Bank's EU operations is critical.

- CEE National Laws: Understanding and complying with specific data privacy laws in each CEE country where Addiko Bank operates is essential.

- Cybersecurity Investment: Continuous investment in advanced cybersecurity infrastructure is required to protect sensitive customer data from breaches.

- Reputational Risk: Data breaches and non-compliance can lead to significant reputational damage and loss of customer trust.

Contract Law and Dispute Resolution

The legal landscape for Addiko Bank hinges on robust contract law and effective dispute resolution. In 2024, adherence to national and EU regulations governing lending agreements and consumer protection is paramount. For instance, the bank must navigate differing insolvency laws across its operating markets, impacting loan recovery processes.

Addiko Bank's success relies on the enforceability of its contracts, from customer loan agreements to interbank transactions. Efficient dispute resolution mechanisms, including arbitration and court proceedings, are critical for mitigating financial risks and maintaining client trust. A stable legal framework ensures predictable outcomes in case of contractual breaches.

Key legal considerations for Addiko Bank include:

- Contractual Enforceability: Ensuring all lending and service agreements comply with local contract laws in Slovenia, Croatia, Bosnia and Herzegovina, Serbia, and Montenegro.

- Dispute Resolution Efficiency: Leveraging established legal channels to resolve client disputes and contractual disagreements promptly, minimizing potential financial losses.

- Regulatory Compliance: Staying abreast of changes in consumer credit directives and financial services legislation across operating jurisdictions to maintain legal standing.

Addiko Bank operates under stringent capital adequacy rules, such as Basel III, requiring specific Common Equity Tier 1 (CET1) ratios. For example, by the end of 2023, many European banks maintained CET1 ratios comfortably above 15%, indicating a strong regulatory focus on financial resilience.

The bank must also comply with evolving Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, which mandate rigorous customer due diligence and transaction monitoring. In 2024, regulators continued to emphasize these areas, with significant fines levied for non-compliance, sometimes reaching tens of millions of euros for institutions.

Furthermore, data privacy laws like GDPR are critical, with fines for violations in 2023 globally exceeding €2.5 billion, highlighting the financial and reputational risks for non-compliance. Addiko Bank's adherence to these legal frameworks directly impacts its operational costs, strategic planning, and customer trust across its CEE markets.

Environmental factors

The intensifying focus on climate change and broader Environmental, Social, and Governance (ESG) factors is significantly shaping Addiko Bank's operational landscape. Regulators across Europe, including those in Addiko's operating regions, are increasingly mandating that financial institutions rigorously assess and disclose their exposure to climate-related financial risks. For instance, the European Central Bank (ECB) has been proactive in this area, with its 2024 climate risk stress test highlighting the need for banks to enhance their capabilities in identifying and managing these evolving threats within their loan portfolios.

This regulatory push directly influences Addiko Bank's lending policies and credit risk assessment frameworks. The bank is compelled to integrate ESG considerations, particularly those pertaining to climate change, into its core decision-making processes. This means actively evaluating the environmental impact of its borrowers and projects, and understanding how physical risks (like extreme weather events) and transition risks (like policy changes or technological shifts) could affect loan performance. By doing so, Addiko aims to build a more resilient portfolio and meet supervisory expectations, aligning with the growing demand for sustainable finance practices.

The increasing global focus on environmental, social, and governance (ESG) factors is driving significant growth in green finance. For Addiko Bank, this translates into a growing demand for sustainable lending products, such as loans for renewable energy projects or energy-efficient upgrades. For instance, the European Investment Bank reported a record €20 billion in climate finance in 2023, highlighting the expanding market for such initiatives.

Banks are now under pressure to integrate sustainability into their core lending strategies, not just to meet regulatory requirements but also to attract environmentally conscious investors and customers. This presents an opportunity for Addiko Bank to develop and market innovative green financial products, potentially tapping into a new customer base and enhancing its corporate reputation.

While a bank's direct reliance on natural resources is minimal, the increasing global focus on resource scarcity impacts the broader economic landscape Addiko Bank operates within. This includes supply chain disruptions and rising costs for businesses, which can indirectly affect loan portfolios and investment opportunities. For instance, a significant drought in a key agricultural region where Addiko has exposure could lead to increased loan defaults.

Furthermore, Addiko Bank's own operational footprint, encompassing energy consumption in its branches and data centers, and waste management practices, is under growing scrutiny. By 2024, many financial institutions are setting targets to reduce their carbon emissions, and Addiko is likely to follow suit. This focus on responsible resource usage can also translate into cost savings through energy efficiency initiatives and optimized waste reduction programs.

Reputation and Stakeholder Expectations

Public and investor expectations for corporate environmental responsibility are significantly increasing. Addiko Bank's proactive stance on sustainability can bolster its brand image and appeal to a growing segment of environmentally aware customers and investors. For instance, in 2023, European banks saw a notable rise in ESG-focused investment flows, with sustainable funds attracting billions in new capital.

A strong commitment to environmental stewardship can translate into tangible benefits for Addiko Bank. This includes attracting and retaining environmentally conscious customers who increasingly factor sustainability into their banking choices. Furthermore, investors are scrutinizing environmental performance more closely, with many integrating ESG criteria into their due diligence processes, potentially leading to better access to capital and lower borrowing costs.

Conversely, a perceived deficiency in environmental responsibility could expose Addiko Bank to reputational damage and heightened stakeholder pressure. Negative public perception can impact customer loyalty and deter potential investors. In 2024, several European companies faced significant backlash and stock price volatility due to perceived greenwashing or inadequate environmental policies, highlighting the financial risks associated with neglecting these concerns.

- Rising ESG Investment: Global sustainable investment assets were projected to reach over $50 trillion by the end of 2024, indicating a strong market preference for environmentally responsible companies.

- Customer Preference: Surveys in 2023 indicated that over 60% of consumers in developed markets consider a company's environmental impact when making purchasing decisions.

- Investor Scrutiny: Institutional investors, managing trillions in assets, are increasingly vocal about demanding clear environmental targets and transparent reporting from portfolio companies.

Physical Risks from Climate Change

Physical risks stemming from climate change, such as more frequent and intense extreme weather events, pose an indirect but significant threat to Addiko Bank's client base. Sectors like agriculture and tourism, which are particularly susceptible to climate disruptions, may experience reduced revenues and increased operational costs. For instance, a severe drought in 2024 impacted agricultural output across parts of Southeast Europe, affecting the repayment capacity of farming clients.

These climate-related impacts can directly influence the creditworthiness of Addiko Bank's borrowers. A decline in a client's profitability due to weather-related damage or disruption can impair their ability to service loans. Furthermore, the value of collateral, such as real estate or agricultural land, could be diminished by physical climate impacts, such as flooding or soil degradation. This necessitates a proactive approach from Addiko Bank.

Consequently, Addiko Bank must integrate these evolving physical climate risks into its comprehensive long-term risk management frameworks. This involves enhanced scenario analysis and stress testing to understand potential impacts on loan portfolios and capital adequacy. By doing so, the bank can better anticipate and mitigate potential financial losses arising from climate change.

- Impact on Agriculture: In 2024, regions served by Addiko Bank experienced varied weather patterns, with some areas facing drought conditions that reduced crop yields by an estimated 10-15%.

- Tourism Sector Vulnerability: Coastal tourism, a key sector for some of Addiko Bank's clients, faced potential disruptions from increased storm intensity, impacting seasonal revenue streams.

- Collateral Revaluation: The potential for increased flood risk in certain areas could necessitate a review of property valuations used as collateral for mortgages and business loans.

- Risk Management Integration: Addiko Bank is enhancing its credit assessment processes to include climate-related physical risk factors for new and existing borrowers.

Addiko Bank faces increasing pressure to integrate environmental sustainability into its operations and lending. Regulatory bodies like the ECB are pushing for better climate risk assessment, influencing lending policies and requiring ESG considerations in decision-making. This trend is also fueled by growing market demand for green finance products, with the European Investment Bank reporting significant climate finance volumes in 2023.

The bank's own operational footprint, including energy use and waste management, is under scrutiny, prompting potential emission reduction targets by 2024. Furthermore, environmental responsibility is becoming a key factor for customers and investors, with a notable rise in ESG-focused investment flows in 2023, impacting brand image and access to capital.

Climate change poses indirect risks to Addiko Bank's clients through physical impacts like extreme weather, affecting sectors such as agriculture and tourism. These disruptions can impair borrowers' ability to repay loans and devalue collateral, necessitating the integration of climate risk into the bank's long-term risk management frameworks.

| Environmental Factor | Impact on Addiko Bank | Data/Trend (2023-2024) |

|---|---|---|

| Climate Change Regulation | Mandatory risk assessment and disclosure | ECB climate risk stress test (2024) |

| Green Finance Demand | Opportunity for sustainable lending products | EIB climate finance reached €20 billion (2023) |

| Customer & Investor Expectations | Enhanced brand image and access to capital | 60%+ consumers consider environmental impact (2023 surveys) |

| Physical Climate Risks | Creditworthiness and collateral value impact | 10-15% crop yield reduction in some regions (2024) |

PESTLE Analysis Data Sources

Our PESTLE analysis for Addiko Bank is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading economic research institutions. We meticulously gather insights on political stability, economic indicators, technological advancements, and regulatory changes to ensure comprehensive coverage.