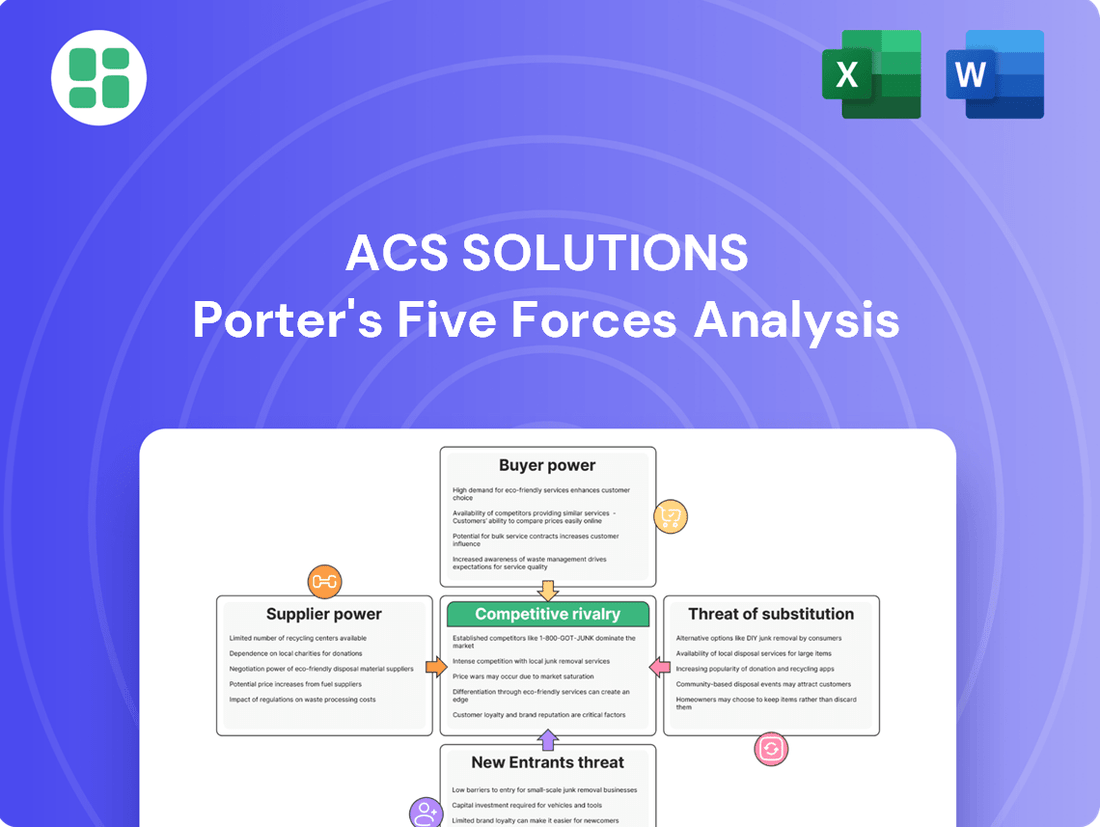

ACS Solutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACS Solutions Bundle

ACS Solutions operates within a dynamic market, significantly influenced by the bargaining power of buyers and the intensity of rivalry. Understanding these forces is crucial for any stakeholder looking to navigate its competitive landscape effectively. This brief overview only hints at the deeper insights available.

The complete report reveals the real forces shaping ACS Solutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The intense competition for specialized IT talent, especially in fields like artificial intelligence, cybersecurity, and cloud computing, significantly amplifies supplier bargaining power. This demand outstrips supply, allowing skilled IT professionals and specialized recruitment firms to dictate higher wages and more favorable contract terms, directly increasing ACS Solutions' operational expenses.

In 2024, the global shortage of cybersecurity professionals was estimated to be around 4 million people, highlighting the critical nature of this talent scarcity. Similarly, demand for AI and machine learning engineers continues to surge, with LinkedIn reporting a 74% increase in AI-related job postings in early 2024 compared to the previous year.

This limited availability of qualified IT personnel means that ACS Solutions faces substantial challenges in attracting and retaining the expertise needed to deliver its advanced solutions. The ability to secure and keep these in-demand professionals is paramount for maintaining service quality and competitive advantage.

The concentration of key technology vendors significantly influences the bargaining power of suppliers for ACS Solutions. Companies relying on specialized software platforms, cloud infrastructure from giants like AWS, Azure, or GCP, and specific hardware often face a limited number of providers. For instance, in 2024, the cloud computing market saw AWS, Microsoft Azure, and Google Cloud holding a combined market share exceeding 65%, illustrating this concentration.

When a few dominant vendors control the essential tools and technologies that ACS Solutions integrates into its service offerings, their pricing power and negotiation terms can directly impact ACS Solutions' operational expenses. This dependence means that if these critical suppliers increase their prices or alter their service agreements, ACS Solutions may have fewer viable alternatives, potentially affecting its ability to deliver competitive pricing and maintain service quality.

When ACS Solutions deeply integrates specific vendor technologies into its client solutions, like a particular cloud platform or specialized software, the effort and expense for a client to switch to a different provider can be significant. This integration often involves custom development, data migration, and extensive testing. For instance, if a client’s core operations are built on a vendor's ecosystem, moving to a competitor could mean rebuilding substantial parts of their IT infrastructure.

Proprietary Technology and Intellectual Property

Suppliers possessing proprietary technology or intellectual property crucial for ACS Solutions' services wield significant bargaining power. This is evident when suppliers control unique algorithms or patented software that ACS Solutions relies on for its core operations. For instance, if a key component of ACS Solutions' data analytics platform is built on a patented AI model only available from one supplier, that supplier can dictate terms.

This reliance on specialized, protected technology allows these suppliers to command higher prices or impose restrictive licensing agreements. In 2024, companies in the IT services sector that depend on specialized software components often saw price increases of 5-10% from their key technology providers due to such dependencies. This directly impacts ACS Solutions' cost structure and profitability.

- Proprietary Advantage: Suppliers with unique, protected technologies hold a strong negotiating position.

- Cost Implications: Reliance on such suppliers can lead to increased licensing fees or component costs for ACS Solutions.

- Market Data: In 2024, IT service providers experienced average price hikes of 5-10% from specialized technology suppliers.

- Strategic Dependence: ACS Solutions' need for these specific technologies limits its ability to switch suppliers easily.

Impact of Supplier's Financial Stability

The financial stability of ACS Solutions' key suppliers directly impacts their bargaining power. A supplier with strong financial health, perhaps demonstrated by a healthy debt-to-equity ratio or consistent profitability, might have less incentive to offer favorable pricing or flexible terms. Conversely, a supplier experiencing financial distress could become more accommodating on price to secure business, but this also introduces a significant risk of supply chain disruption or compromised quality, potentially hindering ACS Solutions' operational efficiency and client service delivery.

For instance, if a critical component supplier for ACS Solutions' technology offerings faced significant financial headwinds in late 2023 or early 2024, it could lead to price increases to shore up their own balance sheet or, worse, a reduction in their capacity to meet ACS Solutions' demand. This scenario would force ACS Solutions to potentially absorb higher costs or seek alternative, possibly less ideal, suppliers, directly impacting their margins and project timelines.

- Supplier Financial Health: Robust financial standing can translate to stronger supplier bargaining power, potentially leading to less favorable pricing for ACS Solutions.

- Risk of Financial Distress: A financially unstable supplier presents a dual risk: potential for price concessions coupled with a significant threat to supply continuity and quality.

- Impact on ACS Solutions: Supplier financial issues can indirectly affect ACS Solutions' ability to maintain competitive pricing, ensure timely project completion, and uphold service quality for its clients.

The bargaining power of suppliers for ACS Solutions is significantly influenced by the concentration of key technology vendors. In 2024, the top three cloud providers—AWS, Microsoft Azure, and Google Cloud—accounted for over 65% of the market. This dominance allows these providers to exert considerable pricing power and dictate terms, potentially increasing ACS Solutions' operational expenses due to limited alternatives for essential infrastructure.

Furthermore, suppliers possessing proprietary technology or intellectual property crucial for ACS Solutions' core operations also hold substantial bargaining power. For instance, if a vital component of ACS Solutions' data analytics platform relies on a patented AI model available from only one source, that supplier can command higher prices or impose restrictive licensing agreements. In 2024, IT service providers experienced average price hikes of 5-10% from such specialized technology suppliers, directly impacting ACS Solutions' cost structure.

| Factor | Description | Impact on ACS Solutions | 2024 Data Point |

| Vendor Concentration | Limited number of dominant providers for essential technologies (e.g., cloud infrastructure). | Increased pricing power for vendors, potentially raising ACS Solutions' costs. | AWS, Azure, GCP held >65% cloud market share. |

| Proprietary Technology | Suppliers control unique algorithms, patented software, or essential components. | Higher licensing fees, restrictive terms, and limited switching options for ACS Solutions. | IT service providers saw 5-10% price hikes from specialized tech suppliers. |

What is included in the product

Analyzes the competitive intensity and profitability potential for ACS Solutions by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Effortlessly identify and address competitive threats with a visual breakdown of each force, enabling proactive strategy adjustments.

Customers Bargaining Power

ACS Solutions' diverse customer base, spanning government, healthcare, finance, and technology, significantly dilutes the bargaining power of any single customer segment. This broad market reach means that even large enterprise clients, while possessing some leverage due to project scale, do not hold disproportionate sway over ACS Solutions. For instance, in 2024, ACS Solutions reported that no single industry vertical accounted for more than 25% of its total revenue, underscoring this diversification.

Clients looking to switch from an established IT and business solutions provider like ACS Solutions often face considerable expenses. These costs can include data migration, retraining staff on new systems, and potential disruptions to ongoing business operations. For instance, a study by IBM in 2024 indicated that the average cost of migrating enterprise-level data can range from $100,000 to over $1 million, depending on the volume and complexity.

The deep integration of ACS's services into a client's existing infrastructure and core business processes creates substantial switching barriers. This entanglement means that simply changing providers isn't a straightforward task; it requires a significant overhaul of how the client's business functions. This complexity inherently reduces the bargaining power of customers, as the effort and cost involved in moving away are substantial.

ACS Solutions delivers vital services such as cybersecurity, data analytics, and digital transformation. These offerings are frequently indispensable to a client's core operations and their ability to compete effectively. For instance, in 2024, the global cybersecurity market was projected to reach over $230 billion, highlighting the critical nature of these services for businesses.

The essential nature of ACS Solutions' services significantly reduces a customer's leverage in price or term negotiations. A client's reluctance to risk operational disruption or compromise their competitive edge by demanding unfavorable terms limits their bargaining power. This criticality means clients are often willing to pay a premium for reliable, high-quality services that ensure business continuity.

Demand for Specialized Solutions

Customers are increasingly looking for IT and business solutions that are not one-size-fits-all but rather are specifically designed for their particular industry or operational needs. This trend toward specialization means that businesses are less likely to switch providers based solely on price if a competitor cannot offer the same level of tailored expertise.

ACS Solutions' capacity to deliver these highly specialized and customized services directly impacts the bargaining power of its customers. When clients require unique solutions, their ability to negotiate aggressively on price diminishes because the value proposition shifts from a commodity to a critical, niche capability. This reliance on ACS's specialized knowledge reduces price sensitivity.

- Specialized Demand: Global IT spending was projected to reach $5 trillion in 2024, with a growing segment dedicated to specialized cloud and AI solutions.

- Reduced Price Sensitivity: Companies requiring bespoke software or complex integration services are typically willing to pay a premium for reliable and expert delivery, as the cost of failure or a poor fit is significantly higher.

- Increased Reliance: For businesses that depend on ACS's unique skill sets for their core operations or competitive advantage, their bargaining power is inherently lower.

Customer Sophistication and Information Asymmetry

While many enterprise clients are indeed sophisticated, the intricate and rapidly changing landscape of IT and digital transformation services can still lead to information asymmetry. ACS Solutions, leveraging its deep expertise, can effectively shape project scope and articulate value, thereby mitigating direct customer leverage.

This dynamic is particularly relevant as businesses increasingly rely on specialized digital solutions. For instance, in 2024, the global IT services market was projected to reach over $1.3 trillion, highlighting the sheer volume and complexity involved, where specialized knowledge becomes a key differentiator.

- Information Asymmetry: The technical depth and rapid innovation in IT services can create a knowledge gap between providers like ACS Solutions and their clients, even sophisticated ones.

- ACS Solutions' Advantage: The company's specialized knowledge allows it to define service parameters and demonstrate value, which can reduce the customers' ability to dictate terms.

- Market Context (2024): The substantial size of the global IT services market underscores the complexity and the potential for information imbalances to influence bargaining power.

The bargaining power of customers for ACS Solutions is generally moderate, influenced by factors like switching costs, service essentiality, and the company's specialized offerings. While large clients may have some leverage due to project scale, ACS's diversified revenue streams, with no single industry exceeding 25% of revenue in 2024, limit any single customer's disproportionate influence.

High switching costs, often exceeding $100,000 to over $1 million for enterprise data migration in 2024, and the deep integration of ACS's vital services like cybersecurity and data analytics, create significant barriers. These essential, often specialized, solutions reduce customer price sensitivity, as businesses prioritize operational continuity and competitive advantage over minor cost savings.

ACS Solutions' ability to provide tailored expertise further diminishes customer bargaining power. The complexity of the global IT services market, projected over $1.3 trillion in 2024, and the inherent information asymmetry in specialized digital transformation, allow ACS to effectively articulate value and shape service parameters, reducing clients' leverage.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2024) |

|---|---|---|

| Customer Diversification | Lowers individual customer leverage | No single industry vertical > 25% of revenue |

| Switching Costs | Increases customer dependency | Enterprise data migration costs: $100K - $1M+ |

| Service Essentiality | Reduces customer price negotiation | Global cybersecurity market: > $230 billion |

| Specialized Offerings | Diminishes customer price sensitivity | Global IT services market: > $1.3 trillion |

What You See Is What You Get

ACS Solutions Porter's Five Forces Analysis

This preview showcases the complete ACS Solutions Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. You're looking at the actual document, ensuring that what you see is precisely what you'll receive immediately after purchase, fully formatted and ready for your strategic planning. This comprehensive analysis will equip you with the insights needed to understand and navigate the competitive landscape effectively.

Rivalry Among Competitors

The IT and business solutions sector, which includes staffing and consulting, is incredibly fragmented. This means there are a vast number of companies, from massive global firms to smaller, specialized ones, all vying for business. For instance, in 2024, the global IT services market was projected to reach over $1.5 trillion, with a significant portion attributed to staffing and consulting segments, highlighting the sheer volume of participants.

This intense competition naturally leads to price pressures. Companies like ACS Solutions must constantly innovate and refine their service offerings to stand out. Failing to differentiate can result in a race to the bottom on pricing, impacting profitability. The need for continuous investment in new technologies and talent development is therefore paramount to maintain a competitive edge in this crowded landscape.

The IT and digital transformation sector thrives on constant innovation, with advancements in AI, cloud computing, and cybersecurity reshaping the landscape at an unprecedented pace. This necessitates significant and ongoing investment in research and development, as well as a continuous focus on acquiring and retaining top talent, for companies like ACS Solutions to maintain their competitive edge.

In 2024, the global IT services market was valued at approximately $1.3 trillion, with a substantial portion dedicated to digital transformation initiatives. Competitors are aggressively launching new solutions, forcing ACS Solutions to allocate considerable resources to R&D to keep pace with emerging technologies and client demands.

While certain IT services can become interchangeable, ACS Solutions carves out its competitive edge by concentrating on specialized domains such as digital transformation and robust cybersecurity. This focus allows them to offer distinct value propositions compared to more generalized IT providers.

However, this differentiation is not a solitary pursuit. Competitors are also actively developing their own unique selling points, creating an ongoing struggle for market dominance. This battle is often won through demonstrated expertise and the ability to deliver highly tailored, niche solutions that precisely meet client needs.

Market Growth Rate and Attractiveness

The IT consulting, digital transformation, and cybersecurity sectors are booming, drawing in new players and heating up competition among established companies. This rapid expansion offers fertile ground for growth, but it also means firms are aggressively battling for market share.

For instance, the global IT services market was projected to reach over $1.3 trillion in 2024, a substantial increase that naturally attracts more competitors. This intense rivalry means companies like ACS Solutions must constantly innovate and differentiate themselves to stand out.

- Market Expansion Fuels Rivalry: The significant growth in IT consulting, digital transformation, and cybersecurity creates an attractive environment for new entrants.

- Aggressive Competition for Share: Rapid market expansion leads to intensified competition as existing firms and new players vie for a larger portion of the increasing demand.

- Innovation as a Differentiator: Companies must focus on unique offerings and service quality to gain a competitive edge in this dynamic and growing market.

- Attracting New Entrants: The high growth rates signal profitability, which in turn encourages new companies to enter the market, further intensifying competitive pressures.

Acquisition and Consolidation Activity

The IT and staffing sectors have experienced significant merger and acquisition (M&A) activity. For instance, in 2023, global M&A volume in technology reached approximately $3.5 trillion, indicating a strong trend towards consolidation. This drive for expansion and market share often results in larger, more powerful competitors emerging, intensifying the competitive landscape for companies like ACS Solutions.

This consolidation trend means that ACS Solutions may face rivals with broader service offerings and greater financial resources. For example, a major IT services firm acquiring a specialized staffing agency could instantly bolster its capabilities in a niche area, directly challenging ACS Solutions’ existing market position. Such strategic moves are designed to enhance competitive advantage and streamline operations.

- Increased Rivalry: Consolidation leads to fewer, but larger, competitors.

- Capability Expansion: Acquirers gain new technologies and talent.

- Market Share Gains: Mergers create dominant players.

- Reduced Competition: Smaller firms may be absorbed or struggle to compete.

The IT and business solutions sector, including staffing and consulting, is intensely competitive due to its fragmented nature. With a projected global IT services market exceeding $1.3 trillion in 2024, numerous companies, from global giants to niche specialists, are vying for market share. This high volume of participants drives aggressive pricing and a constant need for innovation, forcing firms like ACS Solutions to differentiate through specialized offerings such as digital transformation and cybersecurity to maintain profitability and relevance.

| Factor | Description | Impact on ACS Solutions |

|---|---|---|

| Fragmentation | Numerous companies of varying sizes compete. | Intense price pressure and need for differentiation. |

| Innovation Pace | Rapid technological advancements (AI, cloud). | Requires continuous R&D investment and talent acquisition. |

| Market Growth | High demand in digital transformation and cybersecurity. | Attracts new entrants, intensifying competition for market share. |

| Consolidation | Mergers and acquisitions create larger competitors. | ACS Solutions faces rivals with broader capabilities and resources. |

SSubstitutes Threaten

Large enterprises might opt to build or enhance their in-house IT departments, bringing in their own specialists for cloud migration, data analytics, or cybersecurity. This directly competes with ACS Solutions' external consulting and staffing offerings.

For instance, a significant trend in 2024 has been the increased investment by companies in their internal digital transformation teams. Many Fortune 500 companies are expanding their IT workforces, aiming to reduce reliance on external vendors for core technology functions.

This internal development of capabilities acts as a potent substitute, as clients can achieve similar outcomes by controlling their IT resources directly, potentially at a lower long-term cost or with greater data security and control.

The rise of off-the-shelf software and SaaS solutions presents a significant threat of substitution for ACS Solutions. Clients can increasingly find pre-built applications that address many common business needs, bypassing the requirement for custom development. For instance, the global SaaS market was projected to reach over $200 billion in 2024, indicating a vast array of readily available alternatives.

These readily available options, often with subscription-based pricing, can be more cost-effective and quicker to implement than bespoke solutions. The continuous innovation in SaaS platforms means they are becoming more sophisticated, capable of handling complex tasks that were once the domain of IT consultancies like ACS Solutions, thereby diminishing the perceived value of custom integration services.

The increasing sophistication of automation and AI tools presents a significant threat of substitutes for ACS Solutions' traditional IT services. These technologies can perform tasks previously requiring human intervention, such as routine IT support, data processing, and even basic software coding, directly impacting demand for these human-led services.

For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to grow substantially, indicating a rising capability and adoption of AI-driven solutions that can replace human IT functions. This trend means clients might opt for AI-powered platforms instead of engaging ACS Solutions for certain operational needs.

Generic Business Consulting Firms

Broader management consulting firms present a significant threat of substitution for ACS Solutions, particularly in areas touching upon digital transformation. These generalist firms, while perhaps lacking ACS's deep technical IT specialization, can offer high-level strategic guidance that overlaps with clients' needs for business process improvement and technology adoption. For instance, a large consulting firm might advise on organizational restructuring or market entry strategies that necessitate IT integration, positioning themselves as a viable alternative for strategic IT consulting needs.

The market for consulting services is vast, with global management consulting revenue projected to reach over $300 billion in 2024. This broad market means that many firms, even those not exclusively focused on IT, can compete for projects where technology is a component of a larger business strategy. This competitive landscape means clients can often find alternative solutions for their strategic planning and implementation needs.

- Broad Scope: General management consulting firms can address strategic IT needs as part of wider business transformation projects.

- Market Size: The global management consulting market's substantial size, exceeding $300 billion in 2024, indicates numerous potential substitutes.

- Accessibility: Clients can often engage these firms for strategic advice, viewing them as substitutes even without deep IT expertise.

Freelance Platforms and Gig Economy

The rise of freelance platforms and the gig economy presents a significant threat of substitutes for traditional IT staffing and consulting firms. Clients can now directly engage with a vast pool of skilled IT professionals on platforms like Upwork, Fiverr, and Toptal, often at competitive rates. This bypasses the need for intermediaries like ACS Solutions for many project-based requirements, offering greater flexibility and potentially reduced overheads for businesses.

For instance, the global freelance platform market was valued at approximately $3.7 billion in 2023 and is projected to grow substantially in the coming years. This growth indicates a clear shift in how businesses source IT talent.

- Direct Access to Talent: Clients can directly vet and hire IT professionals for specific tasks, reducing reliance on consulting firms.

- Cost Efficiency: Freelancers often offer lower rates compared to traditional consulting engagements, especially for short-term or specialized projects.

- Flexibility and Agility: Businesses can scale their IT workforce up or down quickly by engaging freelancers as needed, adapting to changing project demands.

- Global Talent Pool: Freelance platforms provide access to a diverse, worldwide talent base, enabling companies to find niche skills that might be unavailable locally.

The threat of substitutes for ACS Solutions is multifaceted, encompassing both technological advancements and alternative service delivery models. Companies can increasingly leverage off-the-shelf software and Software-as-a-Service (SaaS) platforms to meet their IT needs, bypassing the necessity for custom development or extensive consulting. For example, the global SaaS market was projected to exceed $200 billion in 2024, highlighting the widespread availability of pre-built solutions.

Furthermore, the growing sophistication of automation and artificial intelligence (AI) tools allows businesses to perform tasks that were previously handled by IT consultancies. The AI market, valued at approximately $200 billion in 2023, is rapidly expanding, offering AI-powered alternatives for routine IT support and data processing.

Clients are also increasingly building in-house IT capabilities or utilizing freelance platforms to source talent directly, reducing their reliance on external firms like ACS Solutions. The global freelance platform market, valued at around $3.7 billion in 2023, demonstrates a significant shift towards more agile and cost-effective talent acquisition strategies.

Entrants Threaten

The threat of new entrants into the IT consulting space, particularly for firms offering comprehensive services like ACS Solutions, is tempered by high initial capital requirements. Establishing robust cloud infrastructure, advanced cybersecurity tools, and the necessary platforms for digital transformation projects demands substantial financial outlay.

Furthermore, the cost of acquiring and retaining highly skilled IT professionals presents a significant barrier. In 2024, the demand for specialized talent in areas like AI, cloud architecture, and data analytics continues to drive up compensation packages, making it challenging for new, smaller firms to compete for top talent against established players.

Success in the IT and business solutions sector, particularly for companies like ACS Solutions, hinges on trust and a proven history. Newcomers struggle to build the credibility and secure the confidence of major enterprise clients, especially in critical areas like government and healthcare where reliability is paramount.

ACS Solutions provides a wide array of intricate services, demanding significant expertise in areas like cloud architecture, cybersecurity, and digital transformation. New companies entering this space would face a substantial hurdle in building or acquiring this specialized knowledge, effectively raising the barrier to entry.

Regulatory Compliance and Industry Certifications

The threat of new entrants is significantly influenced by regulatory compliance and the need for industry certifications. Operating in highly regulated sectors such as healthcare, finance, and government requires new companies to adhere to strict rules like HIPAA, GDPR, or FedRAMP. Successfully navigating these complex legal and compliance frameworks represents a substantial barrier, increasing both the cost and time required for market entry.

For instance, achieving FedRAMP authorization, a key requirement for cloud service providers working with the U.S. federal government, can take 12-18 months and cost upwards of $100,000 to $200,000, depending on the complexity and existing security posture. This substantial investment and time commitment deter many potential new entrants, especially smaller firms or startups.

- High Capital Requirements: Meeting extensive compliance mandates often necessitates significant upfront investment in technology, personnel, and legal counsel.

- Time-to-Market Delays: The lengthy process of obtaining necessary certifications can significantly delay a new entrant's ability to generate revenue.

- Ongoing Compliance Costs: Beyond initial entry, maintaining compliance requires continuous monitoring, auditing, and updates, adding to operational expenses.

- Reputational Risk: Non-compliance can lead to severe penalties and reputational damage, making the stakes for new entrants exceptionally high.

Economies of Scale and Scope

Established companies like ACS Solutions often leverage significant economies of scale, meaning their per-unit costs decrease as production volume increases. For instance, in 2024, major cloud service providers, a key area for ACS Solutions, continued to see cost efficiencies as their data center capacity expanded, allowing them to offer competitive pricing. This scale advantage makes it difficult for newcomers to match pricing structures.

Furthermore, economies of scope allow ACS Solutions to offer a wider range of integrated services, creating bundled solutions that are more attractive and cost-effective for clients. A new entrant might specialize in one area, but ACS's ability to cross-sell cybersecurity, cloud migration, and managed IT services provides a more comprehensive value proposition. This breadth of offering is a substantial barrier.

- Economies of Scale: Reduced per-unit costs due to high production volumes, seen in sectors like cloud infrastructure.

- Economies of Scope: Cost savings achieved by offering a variety of related products or services, like bundled IT solutions.

- New Entrant Disadvantage: Lack of established scale and scope makes it challenging to compete on price and service breadth.

- 2024 Trend: Continued consolidation in IT services amplified scale advantages for leading players.

The threat of new entrants for comprehensive IT solutions providers like ACS Solutions is significantly mitigated by high capital investment needs, the necessity for specialized talent, and the critical importance of established client trust. In 2024, the competitive landscape further solidified, with established players benefiting from economies of scale and scope, making it challenging for newcomers to match pricing and service breadth.

Regulatory compliance, particularly in sectors like government and healthcare, adds substantial time and financial burdens, with certifications like FedRAMP costing upwards of $100,000-$200,000 and taking 12-18 months. This rigorous environment, coupled with the need for deep expertise across multiple IT domains, creates a formidable barrier to entry.

| Barrier Type | Description | 2024 Impact |

| Capital Requirements | Investment in infrastructure, tools, and talent. | High, especially for advanced cybersecurity and cloud platforms. |

| Talent Acquisition | Cost and competition for skilled IT professionals. | Intensified in 2024 due to demand for AI, cloud, and data analytics experts. |

| Client Trust & Reputation | Building credibility with enterprise clients. | Difficult for new entrants; established track records are paramount. |

| Regulatory Compliance | Adherence to industry-specific rules (e.g., HIPAA, GDPR, FedRAMP). | Significant cost ($100k-$200k+) and time (12-18 months) for certifications like FedRAMP. |

| Economies of Scale & Scope | Cost efficiencies from high volume and bundled services. | Advantage for established firms; 2024 consolidation amplified this. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ACS Solutions leverages a robust combination of publicly available company filings, industry-specific market research reports, and expert analyst commentary. This ensures a comprehensive understanding of competitive dynamics.