ACS Solutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACS Solutions Bundle

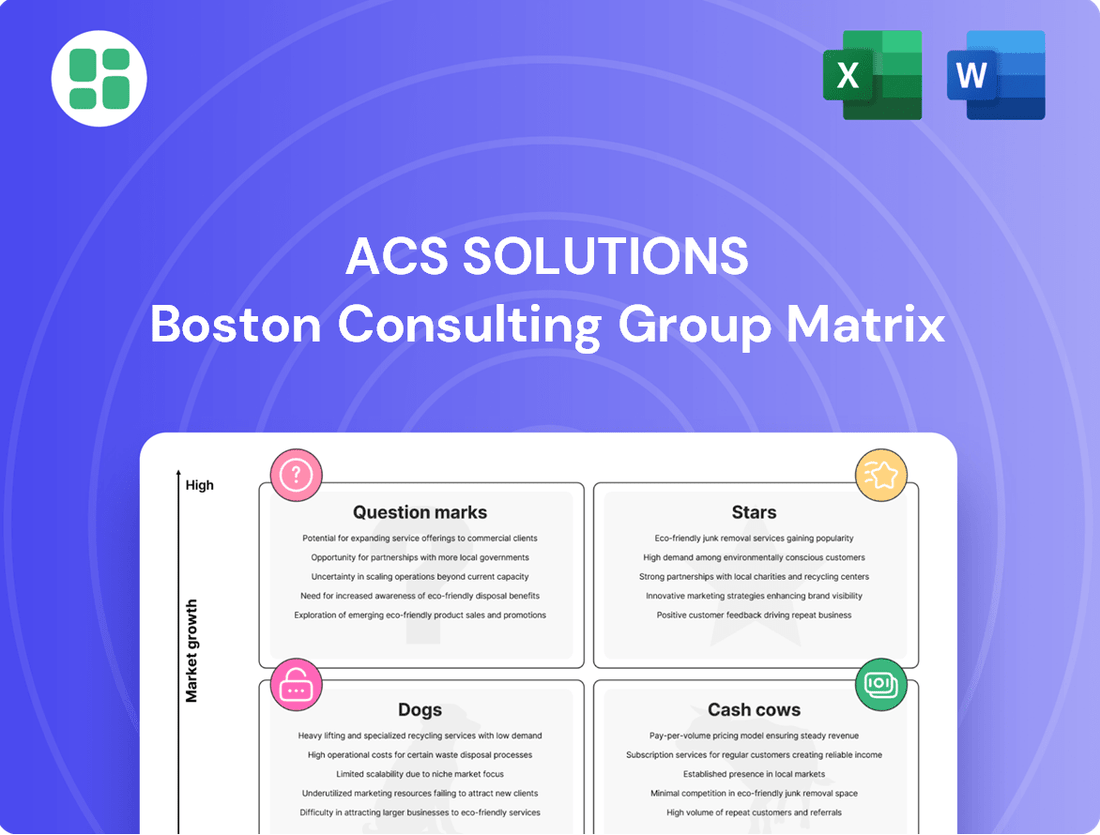

Unlock the strategic potential of your product portfolio with the ACS Solutions BCG Matrix. This powerful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a clear visual representation of their market position and growth prospects. Don't miss out on critical insights that can drive your business forward.

Ready to transform your strategic planning? Purchase the full ACS Solutions BCG Matrix for a comprehensive analysis, including detailed quadrant breakdowns, actionable recommendations, and data-driven insights to optimize your investments and product development. Gain the competitive edge you need to succeed.

Stars

Advanced AI and Generative AI solutions are a prime example of a Stars category, exhibiting high market growth and increasing adoption across numerous industries. For a global IT provider like ACS Solutions, this segment represents a significant opportunity.

The demand for AI-driven transformation, particularly in automating customer service and performing intricate data analysis, points towards substantial future market expansion. For instance, the global AI market was projected to reach $136.77 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 37.3% from 2023 to 2030, according to Grand View Research. This rapid evolution underscores the potential.

By making substantial investments in these advanced AI and Generative AI areas, ACS Solutions can position itself to capture a leading market share and generate considerable future revenue streams. This strategic focus is crucial for long-term growth and competitive advantage in the evolving technological landscape.

The cybersecurity market is booming, with projections indicating it will reach $345.4 billion by 2026, up from $170.9 billion in 2022. This growth is fueled by increasing cyberattacks and stricter data protection laws.

ACS Solutions' focus on specialized areas like AI-powered threat detection positions it strongly within this expanding sector. These advanced services are particularly sought after as businesses seek to move beyond reactive security measures.

By concentrating on these high-demand, innovative cybersecurity solutions, ACS Solutions is well-placed to gain substantial market share and solidify its reputation as a leader in the field.

Niche digital transformation platforms, particularly those focused on Industry 4.0 integration and advanced IoT, represent significant growth avenues. These specialized solutions cater to high-demand sectors, allowing companies like ACS Solutions to capture substantial market share within these focused segments. For example, the global Industry 4.0 market was valued at approximately $80 billion in 2023 and is projected to reach over $200 billion by 2028, showcasing the immense potential.

Cloud Migration & Optimization for Emerging Technologies (e.g., Quantum Computing readiness)

Cloud computing is experiencing robust expansion, with industry analysts forecasting continued substantial investment through 2025. For instance, the global cloud computing market was valued at approximately $610 billion in 2023 and is projected to reach over $1.3 trillion by 2028, demonstrating a compound annual growth rate of around 16.4%.

Services that specifically enable the migration and optimization of workloads for emerging technologies, such as quantum computing and advanced AI, represent a particularly high-growth, high-value segment within this market. These specialized services cater to the unique infrastructure and processing demands of these cutting-edge fields.

ACS Solutions is well-positioned to capture leadership in this niche by providing sophisticated, forward-looking cloud solutions. This includes developing expertise in hybrid cloud architectures and specialized cloud platforms that can accommodate the complex computational needs of quantum computing, a field expected to see significant enterprise adoption in the coming years.

- High Growth Potential: Cloud migration for emerging tech, like quantum computing, is a rapidly expanding area.

- Specialized Demand: These technologies require unique cloud infrastructure and optimization strategies.

- ACS Solutions Opportunity: The company can lead by offering advanced, future-ready cloud services.

- Market Trajectory: The overall cloud market is projected for strong growth, with specialized segments outperforming.

Strategic Data Analytics for Predictive Insights

Strategic data analytics, especially those providing predictive insights, are crucial for businesses aiming for a competitive edge. Companies are actively seeking solutions that go beyond simple reporting, focusing on advanced analytics and machine learning to extract actionable intelligence from their data.

This focus on predictive capabilities positions ACS Solutions to capture a significant share in a rapidly expanding market. The demand for real-time data processing and AI-driven insights is a key driver for growth in this segment.

- Market Growth: The global big data and business analytics market was projected to reach $274.3 billion in 2022 and is expected to grow to $655.8 billion by 2029, demonstrating a compound annual growth rate (CAGR) of 13.1%. (Source: Fortune Business Insights, 2023)

- Predictive Analytics Adoption: By 2024, it's estimated that 75% of enterprises will have moved from descriptive to predictive or prescriptive analytics. (Source: Gartner, 2023)

- Investment Focus: Venture capital funding in AI and data analytics companies saw substantial investment throughout 2023, indicating strong investor confidence in the sector's future.

- Competitive Advantage: Companies leveraging advanced analytics are reporting significant improvements in operational efficiency and customer satisfaction.

Stars in the BCG Matrix represent products or services with high market share in a rapidly growing industry. For ACS Solutions, this signifies areas where significant investment can yield substantial future returns and market leadership.

These are the growth engines of the business, demanding continued investment to maintain their leading position and capitalize on market expansion. The focus is on innovation and scaling to meet increasing demand.

By excelling in these Star categories, ACS Solutions can build a strong competitive advantage and secure a dominant presence in key future markets.

| Category | Market Growth | ACS Solutions' Position | Key Opportunity |

|---|---|---|---|

| Advanced AI & Generative AI | High (Global AI market: $136.77B in 2022, 37.3% CAGR projected 2023-2030) | Significant opportunity for market share capture | Automating customer service, intricate data analysis |

| Specialized Cybersecurity | High (Global market: $170.9B in 2022, projected $345.4B by 2026) | Strong position with AI-powered threat detection | Moving beyond reactive security measures |

| Niche Digital Transformation (Industry 4.0, IoT) | High (Industry 4.0 market: ~$80B in 2023, projected >$200B by 2028) | Capture substantial market share in focused segments | Catering to high-demand sectors |

| Cloud Computing for Emerging Tech | High (Global market: ~$610B in 2023, projected >$1.3T by 2028, 16.4% CAGR) | Well-positioned for leadership in specialized cloud solutions | Hybrid cloud architectures, quantum computing infrastructure |

| Strategic Data Analytics (Predictive) | High (Big Data & Business Analytics market: $274.3B in 2022, projected $655.8B by 2029, 13.1% CAGR) | Capture significant share with AI-driven insights | Real-time data processing, actionable intelligence |

What is included in the product

ACS Solutions BCG Matrix analyzes product portfolios, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

ACS Solutions' BCG Matrix provides a clear, visual overview, instantly relieving the pain of complex strategic analysis.

Cash Cows

Traditional IT staffing services, despite slower growth in established regions like the US and UK, represent a robust global market exceeding hundreds of billions in annual revenue. ACS Solutions' established presence in this sector, leveraging deep client relationships and optimized operations, likely secures a significant market share, making these services a reliable source of consistent cash flow with minimal additional investment.

Managed IT services, focusing on IT infrastructure and network management, are often found in mature markets with slower growth. However, these services are highly profitable due to their recurring revenue streams and loyal customer relationships. ACS Solutions can capitalize on its existing resources to deliver these efficiently, needing little additional investment to produce consistent cash flow.

In 2024, the global managed IT services market was valued at approximately $270 billion, with projections indicating steady growth. Businesses are increasingly outsourcing IT functions to reduce costs and improve efficiency, making these services a reliable source of income for providers like ACS Solutions.

Many large enterprises continue to depend on older IT systems that necessitate consistent upkeep, support, and phased upgrades. This represents a mature, albeit slow-growing, market segment with predictable demand, offering a stable revenue stream.

ACS Solutions leverages its extensive IT consulting expertise to deliver these critical services efficiently, achieving robust profit margins. This positions legacy system modernization and maintenance as a significant cash cow, generating reliable cash flow for the company.

For instance, the global IT maintenance and support market was valued at approximately $350 billion in 2023 and is projected to grow at a CAGR of around 3.5% through 2028. ACS Solutions' ability to deliver these services cost-effectively allows them to capture a healthy portion of this stable market.

Standard Enterprise Resource Planning (ERP) Implementations

Standard Enterprise Resource Planning (ERP) implementations represent a mature market segment for ACS Solutions. While growth in this foundational area is modest, ACS Solutions leverages its established expertise to secure a significant market share. This translates into consistent and predictable revenue streams, often bolstered by ongoing support and maintenance contracts.

The stability of standard ERP implementations is a key characteristic. These services benefit from the ongoing needs of businesses to maintain and optimize their core operational systems. ACS Solutions' strong reputation in this space fosters repeat business, reducing the need for extensive client acquisition efforts and lowering marketing expenditures.

- Mature Market: The global ERP market, particularly for standard implementations, is well-established with many existing providers.

- Predictable Revenue: ACS Solutions benefits from recurring revenue through support and maintenance agreements for its implemented ERP systems.

- High Market Share: Deep expertise allows ACS Solutions to capture a substantial portion of the market for foundational ERP services.

- Cost Efficiency: Once a reputation is built, repeat business and lower marketing costs contribute to profitability in this segment.

Basic Cloud Infrastructure Services (IaaS & PaaS)

Basic Cloud Infrastructure Services (IaaS & PaaS) represent a mature market segment where ACS Solutions can leverage its established market share. While the growth rate for these foundational services might be slower compared to advanced cloud solutions, they are crucial for many enterprises seeking dependable and stable cloud operations.

ACS Solutions can position itself as a reliable provider for clients needing consistent management of their IaaS and PaaS environments. This stability translates into predictable revenue streams, minimizing the need for aggressive marketing or promotional spending, which is characteristic of a Cash Cow in the BCG Matrix.

- Market Maturity: The IaaS and PaaS market, while still growing, is largely dominated by established players, indicating a mature phase.

- ACS Solutions' Role: ACS Solutions can capture significant market share by offering stable and reliable infrastructure management to existing enterprise clients.

- Revenue Generation: These services are expected to generate consistent, strong cash flow with relatively low investment requirements for ACS Solutions.

- Profitability: The established nature of these offerings allows ACS Solutions to operate efficiently, maximizing profitability from its client base.

ACS Solutions' legacy IT staffing and managed IT services are prime examples of Cash Cows. These mature markets, while experiencing slower growth, provide consistent, high-margin revenue streams with minimal need for further investment, thanks to established client bases and optimized operations.

The global managed IT services market, valued at approximately $270 billion in 2024, and the IT maintenance and support market, around $350 billion in 2023, underscore the stability and profitability of these offerings. ACS Solutions' ability to efficiently deliver these services, often to enterprises reliant on older systems, ensures predictable cash flow.

Standard ERP implementations and basic cloud infrastructure services also function as Cash Cows. ACS Solutions leverages its deep expertise and existing market share to generate reliable revenue from these foundational, albeit slower-growing, segments, benefiting from recurring support contracts and efficient operations.

| Service Category | Market Status | ACS Solutions' Position | Cash Flow Generation |

| IT Staffing | Mature | High Market Share | Consistent & Strong |

| Managed IT Services | Mature | Established Client Base | Predictable & High Margin |

| Legacy System Support | Mature | Deep Expertise | Stable & Reliable |

| Standard ERP Implementations | Mature | Strong Reputation | Recurring Revenue |

| Basic Cloud Infrastructure | Mature | Significant Market Share | Consistent & Low Investment |

What You’re Viewing Is Included

ACS Solutions BCG Matrix

The preview of the ACS Solutions BCG Matrix you are currently viewing is the identical, fully formatted document you will receive immediately upon purchase. This means no watermarks, no altered content, and no hidden surprises; you’ll get the complete strategic analysis ready for immediate application.

Rest assured, the ACS Solutions BCG Matrix file displayed here is the exact final version that will be delivered to you after completing your purchase. It has been meticulously prepared with professional formatting and insightful market analysis, ensuring you receive a high-quality, actionable tool without any modifications.

What you see is precisely the ACS Solutions BCG Matrix document you will download once your purchase is confirmed. This preview offers a transparent look at the complete, uncompromised report, allowing you to confidently acquire a ready-to-use strategic planning asset.

Dogs

Basic web design and generic development are highly commoditized. The market is flooded with small providers, making it easy for new businesses to enter. This intense competition drives down prices and squeezes profit margins, with many small agencies reporting profit margins in the single digits.

If ACS Solutions offers these services without a unique selling proposition, it would likely have a small piece of a market that isn't growing much. These types of projects can tie up valuable resources that could be better used in more profitable areas, offering little in the way of substantial returns.

Generic IT support and helpdesk services fall into the 'Cash Cow' category of the BCG Matrix for ACS Solutions. This segment represents a low-growth, highly competitive market where differentiation is minimal. In 2024, the global IT outsourcing market, which includes helpdesk services, was valued at approximately $380 billion, indicating its substantial size but also its mature stage.

Without specialized skills or advanced automation, ACS Solutions would struggle to achieve significant market share or high profit margins in this undifferentiated space. The intense competition often drives down prices, making it challenging to generate substantial returns. For instance, many companies opt for offshore providers who can offer services at a fraction of the cost, further pressuring margins for domestic providers.

These services can easily become cash traps if not managed efficiently or if they are not strategically linked to higher-value offerings within ACS Solutions' portfolio. The risk is that resources are consumed by a low-margin business that doesn't contribute to future growth or innovation. If ACS Solutions continues to offer these services, focusing on operational efficiency and potentially bundling them with more specialized managed services would be crucial to avoid them becoming a drain on resources.

Outdated software solutions, specifically those developed by ACS Solutions that are not central to their core business, represent a challenge. These might be older proprietary tools that haven't kept pace with technological advancements or evolving customer needs.

Products in this category likely hold a small market share within a shrinking market. For instance, if a non-core software solution from ACS Solutions was last updated in 2018 and the market for such solutions has seen a 15% decline annually since then, it would fit here. The company might be spending significant resources on maintaining these legacy systems, diverting funds that could be invested in growth areas.

Strategically, ACS Solutions would need to evaluate the cost-benefit of continuing to support these outdated offerings. Options such as divestiture, where another company might acquire and revitalize the technology, or a complete discontinuation of the product line are often considered to free up capital and resources for more promising ventures.

Unspecialized General IT Consulting

Unspecialized General IT Consulting represents a segment within ACS Solutions' portfolio that offers broad IT services without a defined niche. This area is characterized by intense competition and limited growth potential, making it challenging to gain a significant market advantage.

In 2024, the global IT consulting market was valued at approximately $300 billion, but general IT consulting often faces price pressures and commoditization. Without unique offerings, companies in this space may struggle to achieve profitability, with margins often hovering around 5-10%.

- Market Saturation: The general IT consulting sector is crowded with numerous providers, leading to intense competition and reduced pricing power.

- Low Growth Prospects: Without specialization, these services cater to a broad but often mature market, limiting opportunities for substantial expansion.

- Profitability Challenges: Companies offering generic IT solutions often find it difficult to differentiate, leading to thin profit margins that may barely cover operational costs.

- Resource Strain: A lack of specialized focus can lead to inefficient allocation of human capital, as skilled professionals are spread across diverse, non-distinctive projects.

On-Premise Only Solutions (without cloud integration)

Solutions that are strictly on-premise, without any cloud integration, are facing a rapidly shrinking market. As businesses increasingly adopt cloud-based models for scalability and flexibility, these legacy on-premise offerings are becoming less attractive. For ACS Solutions, any significant services tied exclusively to non-cloud, on-premise deployments without a clear modernization strategy would likely fall into a declining market segment with limited future growth potential.

The trend away from purely on-premise solutions is stark. For instance, a 2024 report by Gartner indicated that worldwide end-user spending on public cloud services is projected to reach $679 billion in 2024, an increase of 20.4% from 2023. This highlights the significant shift in IT investment priorities, leaving purely on-premise solutions with a diminishing share of the market.

- Declining Market Share: Purely on-premise solutions are seeing a consistent decline in market demand as cloud adoption accelerates.

- Limited Future Potential: Without cloud integration or a modernization roadmap, these offerings face obsolescence and low future growth prospects.

- Customer Preference Shift: Businesses are prioritizing cloud-native or hybrid solutions, making standalone on-premise systems less appealing to new clients.

- Investment Risk: Companies heavily reliant on solely on-premise solutions may face higher maintenance costs and a lack of innovation compared to cloud-enabled alternatives.

Dogs in the BCG Matrix represent products or services with low market share in a low-growth industry. For ACS Solutions, this could include legacy software offerings that haven't been updated or are no longer aligned with current market demands. These offerings often consume resources without generating significant returns, hindering overall business growth.

These are typically products that have a small slice of a market that isn't expanding. Think of outdated proprietary software ACS Solutions might still support, where the overall demand for such solutions has shrunk considerably. For example, if a specific on-premise software solution, last updated in 2017, has seen its market shrink by 20% annually, it would fit this category.

The strategic approach for Dogs usually involves either a significant revitalization effort, a divestiture, or complete discontinuation. Continuing to invest in these areas without a clear path to market relevance can be a drain on capital and talent that could be better allocated to Stars or Question Marks with higher growth potential.

In 2024, the market for specialized, non-cloud integrated legacy software continued its decline, with many businesses actively migrating away from such systems. This trend means that any ACS Solutions offerings falling into the Dog category are likely to see further erosion of their already small market share and profitability.

Question Marks

Emerging AI-driven staffing platforms are transforming recruitment by leveraging automation to identify top talent and enhance candidate experiences. This sector represents a high-growth opportunity for ACS Solutions, characterized by its innovative nature and nascent market penetration. For instance, the global AI in recruitment market was valued at approximately $1.5 billion in 2023 and is projected to reach over $5 billion by 2028, indicating substantial room for growth.

ACS Solutions' investment in these AI platforms places them in a position of potential Stars. While current market share may be low, the rapid adoption of AI in HR functions, with companies like Unilever reporting a 70% reduction in time-to-hire using AI tools, suggests strong future demand. However, capturing this market share requires significant capital investment to outpace competitors and establish a dominant presence.

Blockchain-based supply chain solutions represent a promising, albeit nascent, sector with significant growth potential. While adoption is still in its early stages, the inherent capabilities of blockchain to enhance transparency and efficiency are driving interest. Companies like IBM and Maersk, through their TradeLens platform, are already making strides in this area, demonstrating the technology's viability.

For ACS Solutions, venturing into blockchain for supply chains would mean entering a market characterized by high growth but currently low market penetration. This positions such initiatives as potential question marks within a BCG matrix framework. Substantial investment in research and development, coupled with aggressive market adoption strategies, will be crucial for these solutions to transition into Stars.

Quantum computing advisory services represent a classic Question Mark within the BCG matrix for ACS Solutions. This is a field brimming with potential, poised for substantial long-term growth, but it's still in its very early stages of development. Think of it like investing in a promising tech startup before it's widely adopted.

ACS Solutions’ involvement here, offering guidance and early-stage development support, positions them in a segment where market share is currently minimal. The quantum computing market, while projected to reach tens of billions of dollars by the late 2020s, is still nascent, with many potential applications yet to be fully realized. Significant investment is needed to build the necessary expertise and secure early clients in this evolving landscape.

Hyper-automation & Robotic Process Automation (RPA) Implementations

Hyper-automation and Robotic Process Automation (RPA) represent significant growth avenues for ACS Solutions, aligning with the broader digital transformation trend. These areas are characterized by their potential to streamline intricate business operations, making them prime candidates for investment and development within the BCG matrix. The global RPA market, for instance, was projected to reach $10.1 billion in 2023 and is expected to grow significantly, with some forecasts suggesting it could exceed $30 billion by 2028, indicating a robust expansion trajectory.

For ACS Solutions, positioning hyper-automation and RPA as Question Marks suggests they are in a high-growth market but may not yet have established a dominant market share. This presents a strategic opportunity to increase investment in developing specialized expertise and refining their implementation methodologies. Achieving this scale is vital for them to move these offerings from the Question Mark quadrant to the Star quadrant, where they can capitalize on market growth and command a larger share.

- Market Growth: The global hyper-automation market is anticipated to expand from $1.3 trillion in 2023 to $2.6 trillion by 2027, at a compound annual growth rate of 19.5%.

- RPA Adoption: By the end of 2024, it's estimated that over 70% of large enterprises will have adopted RPA in some capacity, highlighting broad market acceptance.

- Investment Needs: Significant capital expenditure is required for talent acquisition, training in AI and machine learning integration, and building robust, scalable RPA platforms.

- Strategic Focus: ACS Solutions needs to focus on demonstrating clear ROI and building repeatable success stories to gain traction and market share in these competitive segments.

Sustainable Technology & Green IT Solutions

Sustainable Technology & Green IT Solutions would likely be classified as Question Marks within the ACS Solutions BCG Matrix. This is due to the significant global shift towards environmental consciousness, making these markets inherently high-growth.

For ACS Solutions, developing offerings in areas such as energy-efficient data centers or sustainable software development places them in a burgeoning market. However, realizing the full potential of these ventures requires substantial investment to establish a strong market presence and capture significant market share.

- Market Growth: The global green IT market was valued at approximately $23.5 billion in 2023 and is projected to reach over $60 billion by 2030, indicating robust growth.

- Investment Needs: Companies entering this space often face high upfront costs for research, development, and infrastructure to deliver truly sustainable solutions.

- Competitive Landscape: While growing, the sustainable technology sector is becoming increasingly competitive, demanding strategic investment to differentiate and gain traction.

- Potential for Stars: Successful navigation of these challenges could see these offerings transition into Stars, capitalizing on their high-growth market position.

Question Marks represent business areas with low market share in high-growth industries. For ACS Solutions, these are opportunities that require significant investment to develop and capture market share. Success here can lead to becoming Stars, but failure means they could become Dogs.

The key challenge for Question Marks is determining whether to invest heavily to grow them or divest if they don't show promise. This strategic decision-making is crucial for optimizing resource allocation and future portfolio balance.

Emerging technologies like quantum computing advisory and blockchain supply chain solutions exemplify Question Marks for ACS Solutions. These sectors are experiencing rapid expansion, but ACS Solutions' current market penetration is minimal, necessitating substantial capital and strategic focus.

AI-driven staffing platforms and hyper-automation/RPA are also positioned as Question Marks, reflecting their high-growth potential alongside the need for ACS Solutions to build greater market presence and expertise.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from annual reports, market share analysis, and industry growth rates to provide a clear strategic overview.