ACNB Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACNB Bank Bundle

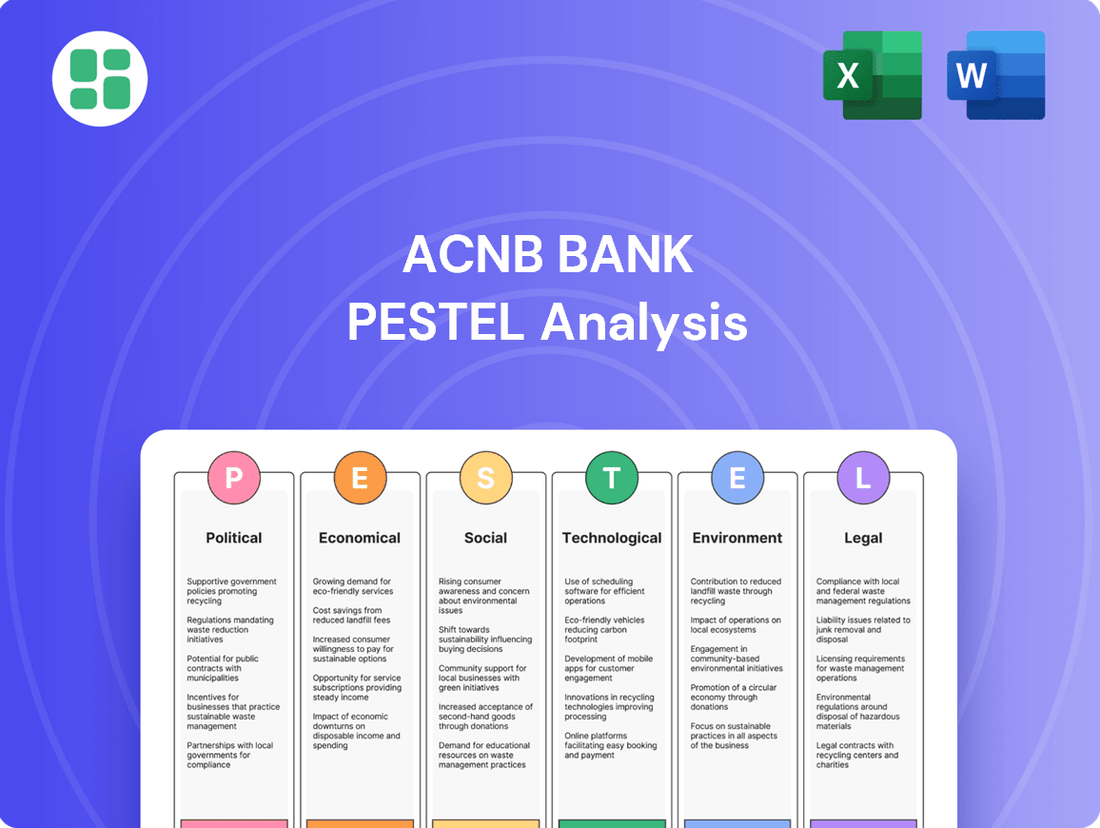

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping ACNB Bank's trajectory. Our meticulously researched PESTLE analysis provides the strategic foresight you need to navigate this dynamic landscape. Gain a competitive advantage and make informed decisions by downloading the full, actionable report today.

Political factors

The stability and direction of government policies, especially those concerning financial institutions, significantly influence ACNB Bank's operations. For instance, the Federal Reserve's monetary policy decisions, like interest rate adjustments throughout 2024 and into 2025, directly affect lending margins and the bank's overall profitability. Political shifts can lead to new compliance requirements, impacting operational efficiency and strategic planning.

The Federal Reserve's monetary policy decisions, particularly concerning interest rates, directly impact ACNB Bank. For instance, the Fed's decision in mid-2024 to maintain its benchmark interest rate in the 5.25%-5.50% range, following a series of hikes throughout 2023, created a higher cost of funds for banks like ACNB.

These shifts in monetary policy significantly influence ACNB Bank's profitability. Higher interest rates can increase the cost of deposits and borrowing, potentially squeezing net interest margins if loan yields don't rise commensurately. Conversely, a stable or declining rate environment might boost loan demand but compress margins.

By closely monitoring the Federal Reserve's forward guidance and economic projections, ACNB Bank can better anticipate future lending conditions and investment opportunities. For example, if the Fed signals a prolonged period of higher rates, ACNB might adjust its lending strategies and focus on variable-rate loans to protect its net interest income.

Federal and state fiscal policies, encompassing taxation and government spending, directly influence the economic landscape where ACNB Bank operates. For instance, changes in federal tax rates or state-level budget allocations can significantly alter disposable income for individuals and investment capital for businesses, thereby impacting loan demand and overall banking activity.

Increased government spending, particularly on infrastructure projects or social programs within ACNB's service regions, can inject capital into local economies, potentially leading to higher consumer spending and business expansion, which in turn can boost demand for ACNB's lending products.

Conversely, shifts in tax policy, such as adjustments to corporate tax rates or personal income tax brackets, can affect the financial behavior of ACNB's clients. For example, a reduction in corporate taxes might free up capital for businesses, encouraging investment and potentially leading to increased borrowing, while changes in personal income taxes can influence consumer spending patterns and savings rates.

Budget deficits at the federal or state level can also indirectly impact ACNB Bank. Persistent deficits might lead to higher interest rates as governments borrow more, potentially increasing the cost of funds for banks and affecting their net interest margins. As of Q1 2024, the US federal deficit was projected to be around $1.9 trillion for fiscal year 2024, a figure that influences the broader economic environment.

Trade Policies and International Relations

While ACNB Bank primarily serves a local community, shifts in global trade policies and international relations can still ripple through its customer base. For instance, changes in tariffs or trade agreements impacting industries prevalent in ACNB's operating regions, such as manufacturing or agriculture, could affect the financial health of local businesses. This, in turn, influences their borrowing capacity and the overall performance of loans held by the bank.

The broader economic impact of international trade disputes or disruptions in global supply chains, which were evident throughout 2024 with ongoing geopolitical tensions affecting shipping costs and commodity prices, can indirectly influence the economic stability of the communities ACNB Bank serves. For example, a significant slowdown in a key export market for a local industry could reduce demand for that industry's products, impacting revenue and potentially increasing the need for financial support from the bank.

- Impact on Local Businesses: Disruptions in global supply chains, such as those seen with extended shipping delays and increased freight costs in late 2024, can raise operating expenses for local businesses reliant on imported materials or exporting finished goods, potentially affecting their profitability and loan repayment ability.

- Regional Economic Sensitivity: The bank's regional economy might be particularly sensitive to trade policies affecting key local industries. For example, changes in agricultural trade agreements could directly impact the financial well-being of farmers in ACNB's service area, influencing their demand for agricultural loans and lines of credit.

- International Relations and Investment: Evolving international relations can influence foreign direct investment into the United States, which could indirectly benefit local economies and create new banking opportunities for ACNB if businesses within its footprint attract such investment.

Political Stability and Local Governance

Political stability in ACNB Bank's primary service areas of South Central Pennsylvania and Maryland is a significant driver of economic growth. Local government initiatives and consistent leadership directly influence the region's attractiveness for new businesses and residents, thereby expanding ACNB's potential customer base. A stable political landscape also creates a more predictable operating environment, reducing uncertainty for financial institutions.

For instance, in Pennsylvania, the state government's focus on economic development through initiatives like the Redevelopment Assistance Capital Program (RACP) aims to foster job creation and investment in targeted areas. Similarly, Maryland's economic development strategies often emphasize support for small businesses and community revitalization projects. These efforts, when effectively implemented by local governance, contribute to a healthier regional economy, which directly benefits banks like ACNB by increasing deposit growth and loan demand.

ACNB Bank's operational success is therefore closely tied to the effectiveness and stability of local governance in counties such as Adams, Franklin, and York in Pennsylvania, and Frederick in Maryland. Positive trends in local employment and business formation, often influenced by political stability, translate into a stronger financial ecosystem for the bank. For example, continued investment in infrastructure and workforce development programs at the local level can spur economic activity, leading to a more robust market for banking services.

Key political factors influencing ACNB Bank include:

- Local Government Effectiveness: Stable and proactive local governments in Pennsylvania and Maryland are crucial for attracting and retaining businesses, which directly impacts ACNB's market penetration and growth potential.

- Economic Development Policies: State and local policies that support business expansion, job creation, and community investment create a favorable environment for ACNB's lending and deposit-gathering activities.

- Regulatory Environment: Changes in banking regulations at both state and federal levels, influenced by political decisions, can affect ACNB's operational costs and strategic planning.

- Infrastructure Investment: Government-backed infrastructure projects can stimulate local economies, leading to increased economic activity and demand for financial services.

Political stability and effective local governance in Pennsylvania and Maryland are crucial for ACNB Bank's growth, influencing business attraction and economic vitality. Proactive economic development policies at state and local levels, such as Pennsylvania's Redevelopment Assistance Capital Program, directly foster job creation and investment, thereby boosting demand for ACNB's financial services.

The bank's performance is intrinsically linked to the stability of local governments in key counties like Adams, Franklin, and York in Pennsylvania, and Frederick in Maryland. Positive economic indicators stemming from stable political environments, including increased business formation and employment, create a stronger market for ACNB's lending and deposit services.

Key political influences on ACNB Bank include the effectiveness of local governments in fostering business environments, state and local economic development strategies, and the ever-evolving banking regulatory landscape shaped by political decisions. Government-backed infrastructure investments also play a vital role in stimulating regional economies, enhancing the demand for banking products.

| Political Factor | Impact on ACNB Bank | Supporting Data/Example (2024-2025 Focus) |

|---|---|---|

| Local Government Effectiveness | Attracts businesses, influences market growth | Pennsylvania's focus on revitalizing downtown areas in counties like York aims to boost local economies, potentially increasing ACNB's customer base. |

| Economic Development Policies | Drives loan demand and deposit growth | Maryland's continued support for small business grants and loans in 2024-2025 can lead to increased borrowing from local entrepreneurs served by ACNB. |

| Regulatory Environment | Affects operational costs and strategy | Ongoing discussions and potential adjustments to Community Reinvestment Act (CRA) regulations in 2024 could influence ACNB's lending priorities and compliance efforts. |

| Infrastructure Investment | Stimulates regional economic activity | Federal and state investments in infrastructure projects within ACNB's service regions in 2024 are expected to create jobs and spur local business expansion, benefiting the bank. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting ACNB Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, by clearly identifying external factors impacting ACNB Bank and offering actionable insights to mitigate risks.

Economic factors

Changes in the Federal Reserve's benchmark interest rates significantly impact ACNB Bank. For instance, the Fed's aggressive rate hikes throughout 2022 and 2023, with the federal funds rate reaching a range of 5.25% to 5.50%, boosted net interest income on ACNB's variable-rate assets. However, this also led to a slowdown in new loan origination as borrowing became more expensive.

Looking ahead to 2024 and 2025, market expectations suggest a potential stabilization or even a slight decrease in rates. If rates fall, ACNB could see improved loan demand, but its net interest margin might face pressure as the cost of deposits potentially rises faster than asset yields. Effectively managing this interest rate risk, as demonstrated by the bank's focus on asset-liability management, remains a core strategic priority for sustained profitability.

Inflation significantly impacts ACNB Bank by affecting consumer spending power and business operating costs. For instance, the US inflation rate hovered around 3.4% in early 2024, a noticeable decrease from the 2023 peaks but still a factor for pricing and investment strategies.

Conversely, deflation, though less common recently, poses risks of reduced economic activity and increased loan defaults, which would directly affect ACNB Bank's loan portfolio and overall financial health.

Managing inflationary pressures is crucial for ACNB Bank when setting interest rates on loans and deposits, as well as when making investment decisions to preserve asset value and ensure profitability in a fluctuating economic environment.

The economic health of South Central Pennsylvania and Maryland directly impacts ACNB Bank. A strong regional GDP, a key indicator of economic vitality, typically translates to more jobs, higher consumer spending, and increased business activity. This environment naturally boosts demand for banking products such as loans and deposit accounts, supporting the bank's core operations.

For instance, the Bureau of Economic Analysis reported that Pennsylvania's real GDP grew by 2.1% in the first quarter of 2024, while Maryland saw a 1.8% increase over the same period. These positive growth rates suggest a favorable climate for ACNB Bank, as they generally correlate with increased borrowing and saving by individuals and businesses in its service areas.

Conversely, a slowdown in regional GDP growth or a contraction can present challenges. Reduced economic output often leads to lower consumer confidence and business investment, which can dampen demand for loans and potentially increase the risk of loan defaults for the bank.

Unemployment Rates and Income Levels

Low unemployment rates and rising income levels directly bolster the financial health of ACNB Bank's customer base. For instance, as of May 2024, the U.S. unemployment rate stood at a remarkably low 4.0%, indicating a robust labor market. This trend generally translates to more stable incomes for individuals and households within ACNB's service areas.

Higher employment levels mean more disposable income, which in turn reduces the risk of loan defaults for ACNB Bank. It also increases the capacity for customers to save and invest, potentially leading to greater deposit growth and demand for the bank's financial products. This economic environment is generally favorable for banking institutions.

Conversely, an uptick in unemployment can present challenges. Should unemployment rates rise, we might see a negative impact on loan performance as individuals struggle to meet repayment obligations. Additionally, deposit growth could slow as consumers become more cautious with their spending and saving habits.

- U.S. Unemployment Rate: 4.0% (May 2024)

- Impact on Loan Defaults: Lower unemployment generally reduces loan default risk.

- Impact on Savings/Investments: Higher incomes from employment boost savings and investment capacity.

- Economic Sensitivity: Rising unemployment can negatively affect loan performance and deposit growth.

Consumer Spending and Savings Behavior

Consumer spending and savings habits are critical indicators for ACNB Bank's financial health. In 2024, consumer spending has shown resilience, with retail sales increasing by an estimated 3.1% year-over-year through May, according to the National Retail Federation. This trend suggests a potential for higher loan demand as individuals and households finance purchases.

Conversely, savings behavior also plays a vital role. The personal savings rate in the U.S. hovered around 3.9% in early 2024, a slight decrease from the elevated levels seen during the pandemic but still indicating a notable portion of income being set aside. This provides ACNB Bank with a stable deposit base, crucial for its lending activities.

- Consumer Spending Trend: Retail sales growth points to increased demand for credit products.

- Savings Rate Impact: A stable savings rate supports ACNB Bank's deposit funding.

- Strategic Implications: Understanding these shifts allows ACNB to refine loan products and savings account incentives.

Economic factors significantly shape ACNB Bank's operating environment. Fluctuations in interest rates, as seen with the Federal Reserve's policy adjustments, directly influence net interest income and loan demand. For instance, the federal funds rate range of 5.25%-5.50% in late 2023 and early 2024 provided a boost to variable-rate assets but also increased borrowing costs.

Inflationary pressures, with the US inflation rate around 3.4% in early 2024, impact consumer spending power and the bank's pricing strategies for loans and deposits. Conversely, regional economic health, reflected in GDP growth rates like Pennsylvania's 2.1% and Maryland's 1.8% in Q1 2024, drives demand for banking services.

A low unemployment rate, such as the U.S. figure of 4.0% in May 2024, supports ACNB Bank by reducing loan default risk and increasing customer savings capacity. Consumer spending trends, with retail sales up an estimated 3.1% year-over-year through May 2024, signal potential for higher loan origination.

| Economic Factor | Key Data Point (2024/2025 Projections/Actuals) | Impact on ACNB Bank |

| Federal Funds Rate | 5.25%-5.50% (late 2023-early 2024) | Boosted net interest income on variable assets; increased borrowing costs. |

| US Inflation Rate | ~3.4% (early 2024) | Affects consumer spending power and bank's pricing strategies. |

| Pennsylvania Real GDP Growth | 2.1% (Q1 2024) | Indicates favorable regional economic climate, driving loan and deposit demand. |

| Maryland Real GDP Growth | 1.8% (Q1 2024) | Supports positive outlook for banking services in the region. |

| US Unemployment Rate | 4.0% (May 2024) | Low rate reduces loan default risk and enhances savings potential. |

| US Retail Sales Growth | +3.1% YoY (through May 2024) | Suggests increased demand for credit products. |

Full Version Awaits

ACNB Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for ACNB Bank offers a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the institution. Gain immediate access to actionable insights upon completing your purchase.

Sociological factors

Demographic shifts in ACNB Bank's operating regions, South Central Pennsylvania and Maryland, are significantly reshaping its customer landscape. For instance, the median age in these areas, mirroring national trends, continues to tick upwards, suggesting a growing need for retirement planning and estate management services. Conversely, areas experiencing population influx, particularly among younger demographics, present opportunities for increased demand in first-time homebuyer mortgages and student loan refinancing.

Societal expectations are rapidly evolving, with consumers increasingly prioritizing convenience and digital accessibility in all aspects of their lives, including banking. A 2024 survey indicated that over 70% of banking customers prefer using mobile apps for daily transactions. This shift necessitates that institutions like ACNB Bank adapt by enhancing their digital platforms to offer seamless online account opening, mobile deposit, and intuitive digital payment solutions.

Furthermore, there's a growing demand for personalized financial advice, moving beyond generic product offerings. Customers, particularly younger demographics, seek tailored guidance on investments, savings, and debt management. ACNB Bank can leverage its community roots by integrating personalized digital tools with accessible human interaction, offering financial planning services that resonate with individual needs and aspirations, thereby fostering deeper customer loyalty.

The general level of financial literacy in ACNB Bank's operating regions directly influences customer demand for specific banking products and their capacity for sound financial management. A community with higher financial literacy is likely to engage more with complex investment products and digital banking solutions, while lower literacy may necessitate a focus on basic savings and lending services.

ACNB Bank has an opportunity to enhance financial literacy through workshops and educational outreach. For instance, initiatives like those seen in the broader banking sector in 2024, which often partner with local schools or community centers, can cultivate more informed customers. This improved understanding can foster greater trust and encourage deeper utilization of ACNB's offerings, potentially boosting customer loyalty and transaction volumes.

Workforce Dynamics and Labor Market

The labor market is a critical consideration for ACNB Bank. The characteristics of the local workforce, such as available skill sets and prevailing wage expectations, directly impact the bank's ability to recruit and retain qualified employees. For instance, a shortage of experienced financial analysts in the regions ACNB Bank operates could necessitate higher compensation or investment in training programs.

Shifting work trends, particularly the increasing acceptance of remote and hybrid work models, also influence staffing strategies. ACNB Bank must adapt its operational and recruitment approaches to remain competitive in attracting top talent. This might involve offering flexible work arrangements or investing in technology to support a distributed workforce.

- Skill Availability: ACNB Bank needs to assess the local availability of specialized financial skills, such as data analytics and cybersecurity expertise.

- Wage Expectations: Understanding current wage benchmarks for banking professionals in its operating areas is crucial for competitive compensation.

- Remote Work Trends: The bank must consider how evolving remote work preferences affect its ability to attract and retain talent, potentially impacting office space needs and IT infrastructure.

- Labor Force Participation: Changes in overall labor force participation rates can influence the pool of available candidates for various roles within ACNB Bank.

Community Engagement and Trust

ACNB Bank, as a community-focused institution, thrives on its deep connections and the trust it cultivates within its operating regions. Societal expectations are increasingly emphasizing corporate social responsibility, local economic investment, and unwavering ethical conduct, all of which directly shape customer perceptions and foster loyalty. For instance, in 2023, ACNB Bank reported significant community involvement, including over 1,000 volunteer hours contributed by employees and substantial financial support for local non-profits, demonstrating a tangible commitment to its community's well-being.

Active engagement in community initiatives not only bolsters the bank's reputation but also solidifies its market position. This can translate into tangible benefits, such as increased customer acquisition and retention. A recent survey of ACNB Bank customers indicated that a strong majority cited the bank's community involvement as a key factor in their decision to bank with them, highlighting the direct correlation between social engagement and customer trust.

Furthermore, the bank's commitment to ethical practices and transparency is paramount. In the financial sector, particularly for community banks, maintaining a reputation for integrity is non-negotiable. This focus on trust and ethical operations directly impacts ACNB Bank's ability to attract and retain both customers and talent, reinforcing its role as a valued community partner.

- Reputation Enhancement: Active participation in local events and charitable giving strengthens ACNB Bank's image.

- Customer Loyalty: Societal emphasis on ethical practices and local investment directly influences customer retention.

- Market Position: Strong community ties and a trustworthy reputation provide a competitive advantage.

- Volunteerism Impact: In 2023, ACNB Bank employees dedicated over 1,000 hours to community service, underscoring their commitment.

Societal values are increasingly emphasizing convenience and digital accessibility, with a 2024 survey showing over 70% of banking customers prefer mobile apps for daily transactions. This necessitates ACNB Bank enhancing its digital platforms for seamless online services. Additionally, there's a growing demand for personalized financial advice, especially from younger demographics seeking tailored guidance on investments and savings, which ACNB can address through integrated digital tools and human interaction.

Technological factors

The widespread adoption of smartphones, with global mobile penetration reaching approximately 6.9 billion unique users in early 2024, has cemented digital and mobile banking as a necessity, not a luxury. ACNB Bank faces the imperative to consistently enhance its digital offerings, ensuring intuitive and secure online and mobile interfaces. This investment is crucial for meeting customer demands for seamless account management and payment processing, especially when competing against the robust digital ecosystems of larger banks and agile fintech disruptors.

ACNB Bank faces significant technological challenges due to its increasing reliance on digital channels, making it a prime target for cyberattacks and data breaches. In 2024, the financial sector globally experienced a surge in sophisticated cyber threats, with reports indicating a 20% increase in ransomware attacks targeting financial institutions compared to the previous year. This necessitates ACNB Bank to invest heavily in advanced cybersecurity measures and adhere to evolving data protection regulations, such as those influenced by the ongoing discussions around the potential expansion of GDPR-like principles in various jurisdictions.

To maintain customer trust and ensure operational resilience, ACNB Bank must implement robust cybersecurity protocols. This includes continuous monitoring of systems, regular security audits, and employee training on best practices for data protection. The bank’s commitment to safeguarding sensitive customer information is paramount, especially as digital transactions continue to grow, projected to increase by another 15% in the US banking sector by the end of 2025.

Fintech innovation is rapidly reshaping the financial services sector, with new companies offering specialized services in payments, lending, and wealth management. This creates a dynamic competitive environment for traditional banks like ACNB. For instance, the global fintech market was valued at approximately $2.4 trillion in 2023 and is projected to grow significantly, highlighting the scale of this disruption.

ACNB Bank can strategically engage with this trend by forming partnerships with fintech firms to integrate cutting-edge solutions, thereby enhancing customer experience and expanding service capabilities. Alternatively, investing in its own digital transformation and developing proprietary fintech offerings can solidify its competitive position. The bank's ability to adapt and embrace these technological advancements will be crucial for its continued success in the evolving financial landscape.

Artificial Intelligence and Data Analytics

Artificial intelligence and data analytics are transforming the banking sector, offering ACNB Bank significant opportunities. These technologies enable a deeper understanding of customer behavior, allowing for the personalization of financial products and services. For instance, by analyzing transaction data, ACNB can identify customer needs and offer tailored loan or investment options, potentially increasing customer retention and revenue. In 2024, many banks reported using AI to improve fraud detection, with some seeing a reduction in fraudulent transactions by up to 20%.

Furthermore, AI and data analytics are crucial for enhancing risk assessment and operational efficiency. ACNB can leverage these tools to more accurately predict loan defaults, optimize marketing campaigns based on data-driven insights, and automate routine tasks. This leads to cost savings and improved decision-making. By mid-2025, it's projected that AI in banking will contribute to significant cost reductions, with some estimates suggesting savings of billions of dollars globally through process automation and improved risk management.

The implementation of these advanced technologies can lead to a more streamlined and responsive banking experience for customers. ACNB can utilize AI-powered chatbots for instant customer support, analyze customer feedback at scale, and proactively address potential issues. This focus on a tailored customer experience is becoming a key differentiator in the competitive financial landscape. The adoption of AI in customer service is expected to grow substantially, with a significant percentage of customer inquiries handled by AI by 2025.

- Enhanced Customer Insights: AI and data analytics allow ACNB Bank to analyze vast amounts of customer data to understand preferences and behaviors, leading to personalized product offerings.

- Improved Risk Management: Predictive analytics can help ACNB Bank identify and mitigate risks, such as loan defaults, with greater accuracy, potentially reducing losses.

- Operational Efficiency Gains: Automation of tasks through AI can streamline operations, reduce costs, and free up human resources for more strategic activities.

- Personalized Customer Experience: By understanding individual customer needs, ACNB can deliver tailored financial advice and services, boosting satisfaction and loyalty.

Cloud Computing and Infrastructure

Cloud computing offers ACNB Bank significant advantages, including enhanced scalability to handle fluctuating customer demand and cost efficiencies by reducing on-premises hardware investment. For instance, the global cloud computing market was projected to reach over $1 trillion in 2024, highlighting the widespread adoption and potential for savings. This shift supports digital transformation by enabling faster innovation and improved data analytics capabilities.

Migrating to cloud-based infrastructure can bolster ACNB Bank's system reliability and speed up the rollout of new digital services, a critical factor in staying competitive. By leveraging cloud platforms, banks can achieve greater agility, allowing for quicker responses to market changes and customer needs. However, this transition necessitates a robust strategy for managing data security and adhering to stringent financial regulations, such as those concerning data privacy and residency.

Key technological factors related to cloud adoption for ACNB Bank include:

- Scalability: Ability to adjust computing resources up or down based on business needs, a crucial advantage in the dynamic banking sector.

- Cost Efficiency: Potential to reduce capital expenditure on IT infrastructure and shift to a more predictable operational expense model.

- Digital Transformation: Facilitates the adoption of new technologies and services, enhancing customer experience and operational processes.

- Security and Compliance: Requires rigorous implementation of security protocols and adherence to financial industry regulations, such as GDPR or CCPA, to protect sensitive customer data.

ACNB Bank must prioritize continuous investment in cybersecurity to counter the escalating threat landscape, with global financial institutions reporting a 20% rise in ransomware attacks in 2024. The bank’s digital channels, essential for customer engagement, are prime targets, necessitating robust defenses and adherence to evolving data protection mandates.

Fintech innovation, with the global market valued at $2.4 trillion in 2023, presents both a challenge and an opportunity, pushing ACNB Bank to either partner with or develop its own advanced digital solutions. AI and data analytics are key, offering enhanced customer insights and operational efficiencies, with AI in banking projected to yield significant cost reductions by mid-2025.

Cloud computing offers ACNB Bank scalability and cost efficiencies, supporting digital transformation and faster service delivery, though stringent security and regulatory compliance remain critical. By mid-2025, AI adoption in customer service is expected to handle a substantial portion of inquiries, highlighting the shift towards automated, personalized banking experiences.

Legal factors

ACNB Bank navigates a stringent regulatory environment, adhering to federal mandates from the FDIC and Federal Reserve, alongside state-specific laws in Pennsylvania and Maryland. This complex web ensures financial stability and consumer protection, but also demands significant resources for ongoing compliance.

Key compliance areas include the Bank Secrecy Act and anti-money laundering (AML) statutes, critical for preventing illicit financial activities. Failure to meet these stringent requirements, including capital adequacy ratios which stood at 12.5% for ACNB Bank's common equity tier 1 capital ratio as of Q1 2024, can result in substantial penalties and damage to the bank's reputation.

Consumer protection laws significantly shape ACNB Bank's operations. Regulations like the Truth in Lending Act (TILA) mandate clear disclosure of loan terms, ensuring customers understand costs and risks. The Real Estate Settlement Procedures Act (RESPA) promotes transparency in real estate transactions, preventing kickbacks and protecting borrowers. In 2024, continued emphasis on these acts ensures fair treatment and builds consumer trust.

Data privacy and security are paramount for ACNB Bank, especially with the escalating volume of digital transactions and sensitive customer data. Regulations like the Gramm-Leach-Bliley Act (GLBA) and various state-specific privacy laws, such as California's Consumer Privacy Act (CCPA), impose stringent requirements. Failure to comply can result in significant fines; for instance, the CCPA allows for statutory damages of $100 to $750 per violation, which can quickly escalate.

ACNB Bank must maintain robust data encryption, implement stringent access controls, and develop comprehensive incident response plans. This proactive approach is essential not only for safeguarding customer information against breaches, which saw a 72% increase in reported incidents in 2024 according to some industry analyses, but also for adhering to these complex data privacy mandates and maintaining customer trust.

Employment and Labor Laws

ACNB Bank, like all employers, navigates a complex web of federal and state employment and labor laws. These regulations cover critical areas such as minimum wage, overtime pay, equal employment opportunities, and workplace safety. For instance, the Fair Labor Standards Act (FLSA) sets the baseline for these protections nationwide.

Recent shifts in labor legislation present ongoing challenges and opportunities. In 2024, discussions around federal minimum wage increases continue, with some states and cities already implementing higher rates. For example, states like California and New York have minimum wages significantly above the federal $7.25 per hour, impacting payroll costs for businesses operating in those regions. ACNB Bank must remain agile in adapting its compensation structures and HR policies to comply with these evolving requirements, potentially affecting operational expenses and talent acquisition strategies.

Key legal considerations for ACNB Bank include:

- Compliance with Wage and Hour Laws: Adhering to federal and state mandates on minimum wage, overtime, and record-keeping.

- Anti-Discrimination Regulations: Ensuring fair hiring, promotion, and treatment practices, aligned with laws like the Civil Rights Act of 1964.

- Workplace Safety Standards: Meeting Occupational Safety and Health Administration (OSHA) requirements to provide a secure working environment.

- Employee Benefits and Leave Policies: Staying current with legislation like the Family and Medical Leave Act (FMLA) and evolving healthcare mandates.

Contract Law and Litigation Risk

ACNB Bank’s operations are deeply intertwined with contract law, covering everything from customer loan agreements to vendor service contracts. Navigating these agreements requires strict adherence to legal frameworks to ensure smooth business functioning.

The risk of litigation, including potential class-action suits, is a significant concern. For instance, in 2024, the banking sector saw ongoing scrutiny regarding lending practices and consumer disclosures, highlighting the importance of meticulous contract drafting and enforcement.

Robust legal counsel and proactive risk management are therefore critical to mitigate potential disputes and financial repercussions. This includes staying abreast of evolving contract law interpretations and implementing strong internal compliance measures.

- Contractual Obligations: ACNB Bank manages thousands of contracts, each requiring careful legal review and compliance.

- Litigation Exposure: The banking industry faces persistent litigation risks, with class-action lawsuits remaining a significant threat in 2024-2025.

- Legal Defense Costs: Unforeseen litigation can lead to substantial legal fees, impacting profitability. For example, some regional banks faced significant legal expenses in 2024 related to past compliance issues.

- Regulatory Compliance: Adherence to contract law is intrinsically linked to regulatory compliance, with penalties for breaches potentially severe.

ACNB Bank operates within a highly regulated financial landscape, necessitating strict adherence to federal and state laws. Key legal factors include compliance with consumer protection statutes like the Truth in Lending Act, ensuring transparent loan terms. Data privacy laws, such as the Gramm-Leach-Bliley Act, also impose rigorous requirements on safeguarding customer information, with potential damages for violations reaching significant amounts.

The bank must also navigate employment law, including minimum wage and anti-discrimination statutes, as exemplified by ongoing discussions around federal minimum wage increases in 2024. Contract law governs all business agreements, and the risk of litigation, including class-action suits, remains a significant concern for financial institutions, with legal defense costs potentially impacting profitability.

| Legal Factor | Description | 2024/2025 Relevance |

|---|---|---|

| Consumer Protection | Ensuring fair and transparent lending and disclosure practices. | Continued emphasis on TILA and RESPA for customer trust and compliance. |

| Data Privacy | Protecting sensitive customer information. | Adherence to GLBA and state privacy laws, with potential for significant statutory damages ($100-$750 per violation for CCPA). |

| Employment Law | Compliance with wage, hour, and anti-discrimination regulations. | Adapting to evolving minimum wage laws and ensuring equal employment opportunities. |

| Contract Law & Litigation | Managing contractual obligations and mitigating legal risks. | Ongoing scrutiny of lending practices and potential for costly class-action lawsuits. |

Environmental factors

ACNB Bank, while not directly facing climate change impacts itself, can experience significant exposure through its loan portfolio. Extreme weather events, increasingly common due to climate change, pose physical risks to borrowers, particularly those in agriculture or coastal regions within ACNB's operational footprint. For instance, a severe drought in 2023 impacted U.S. agricultural output, with some regions experiencing yield reductions of 20-30%, potentially affecting loan repayment from farming clients.

These physical risks can manifest as property damage or business disruptions for ACNB's clients. Such events can directly impair a borrower's ability to repay loans, thereby impacting the bank's asset quality and overall financial health. For example, a major flood event in a key service area could lead to increased non-performing loans if businesses and individuals are unable to recover and meet their financial obligations.

ACNB Bank faces increasing pressure to integrate sustainability into its operations, driven by growing public and regulatory focus on environmental issues. This trend is reflected in the expanding green finance market, which saw global sustainable debt issuance reach an estimated $1.5 trillion in 2024, with projections for further growth in 2025.

The bank could see heightened demand for green financial products, such as loans for energy-efficient upgrades or renewable energy projects, aligning with a broader market shift. For instance, the U.S. residential solar market alone is expected to add over 300,000 new installations in 2025, indicating strong consumer interest in green solutions.

Furthermore, ACNB Bank will likely need to incorporate Environmental, Social, and Governance (ESG) criteria into its lending and investment decisions, a practice becoming standard across the financial industry. Many institutional investors are now prioritizing ESG factors, with over 70% of surveyed asset managers in a recent study indicating they integrate ESG into their investment processes.

Assessing and reducing its own operational carbon footprint will also be a key consideration, as many corporations aim for net-zero emissions by 2050. ACNB Bank's commitment to these initiatives will not only address regulatory expectations but also enhance its reputation and appeal to environmentally conscious customers and investors.

While ACNB Bank isn't a direct emitter, evolving environmental regulations can ripple through its business. For instance, stricter rules on industrial waste disposal or agricultural runoff could increase compliance costs for ACNB's clients in manufacturing and farming sectors. This, in turn, might impact their profitability and loan repayment capacity, a key consideration for the bank's risk assessment.

In 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Air Act and Clean Water Act, which can influence operational costs for businesses across various industries. For example, industries facing increased costs due to carbon pricing mechanisms or investments in greener technologies might see their financial leverage shift, potentially affecting their borrowing needs and creditworthiness with institutions like ACNB.

Resource Scarcity and Operational Costs

Concerns over resource scarcity, particularly water and energy, directly impact ACNB Bank's operational expenses and those of its clientele. For instance, the U.S. Energy Information Administration reported that average commercial electricity prices increased by approximately 4.5% in 2023 compared to 2022, a trend likely to continue impacting utility bills for ACNB's branches and customers alike.

These rising costs can affect the bank’s own bottom line through increased overhead for its physical locations. Furthermore, ACNB must consider how escalating resource costs might influence the financial health and loan repayment capacity of businesses in sectors heavily reliant on these resources, potentially affecting the bank's loan portfolio quality.

- Increased utility expenses: Higher energy and water costs directly add to ACNB's operating budget.

- Impact on borrowers: Industries facing resource cost pressures may struggle with debt servicing, affecting loan performance.

- Shift to sustainable practices: The bank may need to invest in energy-efficient technologies to mitigate rising operational costs.

Reputational Risk and Stakeholder Expectations

Societal expectations around environmental responsibility are increasingly shaping how financial institutions operate, presenting both risks and opportunities for ACNB Bank. Stakeholders, from individual customers to institutional investors, are paying closer attention to a company's environmental footprint. For instance, a 2024 survey indicated that over 60% of retail investors consider ESG (Environmental, Social, and Governance) factors when making investment decisions, a figure that has steadily climbed in recent years.

ACNB Bank's commitment to environmental stewardship can directly impact its reputation. A strong stance on sustainability can attract a socially responsible clientele, potentially leading to increased deposits and loan demand from environmentally conscious individuals and businesses. Conversely, a perceived lack of action on environmental issues could damage the bank's public image and deter these valuable customer segments.

The bank's approach to environmental factors can also influence its ability to attract and retain talent. A 2025 report highlighted that a significant majority of millennials and Gen Z employees prioritize working for companies with strong environmental commitments. This suggests that ACNB Bank's environmental policies could play a role in its human capital strategy.

- Reputational Impact: Stakeholder preference for environmentally responsible institutions is growing, influencing brand perception.

- Customer Attraction: Demonstrating environmental stewardship can attract a socially conscious customer base.

- Investor Sentiment: ESG considerations are increasingly vital for investors, impacting capital availability.

- Talent Acquisition: Environmental commitment is a key factor for younger generations seeking employment.

Environmental factors present both risks and opportunities for ACNB Bank, primarily through its loan portfolio and operational footprint. Increased frequency of extreme weather events, linked to climate change, can negatively impact borrowers' ability to repay loans, particularly in sectors like agriculture. For instance, the U.S. experienced several significant weather-related disasters in 2023 and early 2024, leading to substantial insured losses, which could translate to higher non-performing loans for banks with exposure to affected regions.

Growing societal and regulatory pressure for sustainability is driving demand for green financial products and requiring greater integration of ESG criteria into lending practices. The global green bond market, for example, was projected to exceed $1.6 trillion in issuance by the end of 2025, indicating a substantial market shift that ACNB could leverage. Furthermore, rising energy and water costs, evidenced by a projected 3-5% increase in average commercial electricity prices in the U.S. through 2025, directly affect operating expenses and necessitate investments in energy-efficient technologies.

| Environmental Factor | Impact on ACNB Bank | Data/Trend (2023-2025 Projection) |

|---|---|---|

| Climate Change & Extreme Weather | Increased risk of loan defaults due to borrower impact (e.g., property damage, reduced agricultural yields) | Significant insured losses from weather events in 2023-2024; projected continued volatility. |

| Sustainability & ESG Focus | Opportunity for green finance products; requirement for ESG integration in lending; reputational enhancement. | Global green bond issuance projected to exceed $1.6 trillion by end of 2025; >60% of retail investors consider ESG in 2024. |

| Resource Scarcity & Costs | Higher operational costs (utilities); potential impact on borrower profitability and loan repayment. | Projected 3-5% annual increase in U.S. commercial electricity prices through 2025. |

| Environmental Regulations | Potential increased compliance costs for clients, affecting loan repayment capacity. | Continued enforcement of EPA regulations impacting industrial and agricultural sectors in 2024-2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis for ACNB Bank is built on a robust foundation of data from reputable sources, including government economic reports, financial regulatory bodies, and industry-specific market research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the bank.