ACNB Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACNB Bank Bundle

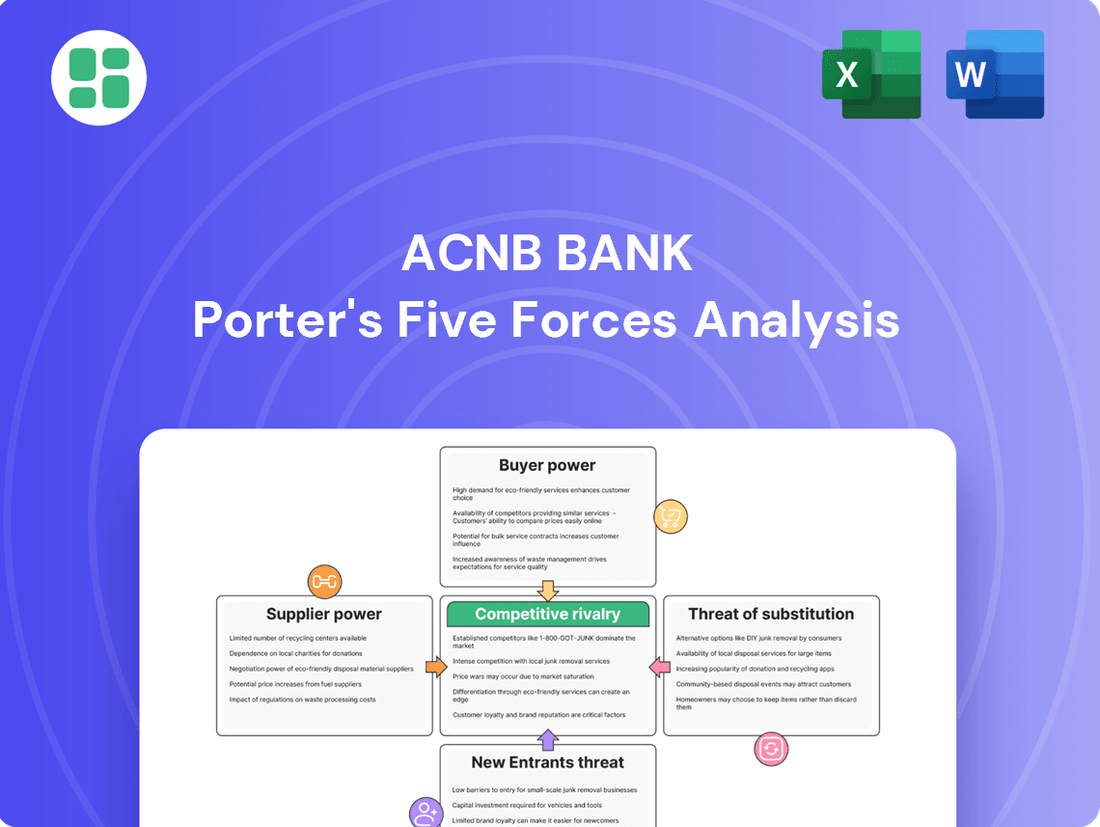

Our Porter's Five Forces analysis for ACNB Bank reveals the intricate competitive landscape, highlighting how buyer power and the threat of new entrants significantly shape its market. Understanding these forces is crucial for navigating the banking sector's evolving dynamics.

The complete report unveils the real forces shaping ACNB Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of core banking software vendors for ACNB Bank is substantial. These technology providers hold significant sway because banks face high switching costs, stemming from the intricate integration of new systems and the complex process of migrating vast amounts of data. For instance, a study in 2024 indicated that the average cost for a mid-sized bank to switch core banking systems can range from tens of millions to over a hundred million dollars, underscoring the financial commitment involved.

Payment processing networks and credit bureaus hold significant sway over banks like ACNB Bank. Access to these services is non-negotiable for daily operations, from processing transactions to evaluating borrower creditworthiness. Without them, a bank simply cannot function effectively in today's financial landscape.

The limited number of providers in these critical sectors, such as Visa and Mastercard for payments and Experian, Equifax, and TransUnion for credit reporting, concentrates power. This lack of widespread alternatives leaves ACNB Bank with fewer options, thereby amplifying the bargaining power of these essential suppliers.

The availability and cost of skilled labor represent a key aspect of supplier power for ACNB Bank, especially in specialized fields like cybersecurity, artificial intelligence, and digital banking. A scarcity of qualified professionals in these critical areas can lead to increased wage demands and higher recruitment expenses, directly impacting the bank's operational budget and its capacity for technological advancement.

Supplier Power 4

Providers of secure and reliable IT infrastructure, including cloud services and data centers, wield significant power. This is due to the banking sector's absolute reliance on data security and operational resilience. In 2024, the global cloud computing market, a key area for these suppliers, was projected to reach over $1.3 trillion, highlighting its essential nature for financial institutions like ACNB Bank.

Regulatory demands for robust cybersecurity further bolster the bargaining power of these specialized IT suppliers. Compliance with stringent data protection laws, such as those evolving in 2024 and beyond, necessitates investment in advanced, secure infrastructure, giving these vendors considerable leverage in contract negotiations.

- Criticality of IT Infrastructure: Banks depend on uninterrupted, secure IT operations for all services.

- Data Security Imperative: Breaches can lead to massive financial and reputational damage, increasing reliance on expert providers.

- Regulatory Compliance: Evolving cybersecurity regulations in 2024 and 2025 mandate high standards, favoring specialized IT suppliers.

- Limited Alternatives: Few providers can meet the complex security and compliance needs of financial institutions.

Supplier Power 5

The bargaining power of suppliers for ACNB Bank is significantly influenced by specialized service providers, particularly in regulatory compliance and legal expertise. The ever-increasing complexity of financial regulations, including those related to Environmental, Social, and Governance (ESG) and Anti-Money Laundering (AML), necessitates deep, specialized knowledge. This makes providers of these services highly valuable and, consequently, powerful.

Navigating these intricate regulatory waters requires indispensable expertise, which can lead to higher costs for banks like ACNB. For instance, the global regulatory technology market, which includes compliance solutions, was valued at approximately $10.7 billion in 2023 and is projected to grow substantially, reflecting the increasing demand and specialized nature of these services. This growth underscores the supplier power in this segment.

- Regulatory Compliance: Banks must adhere to a vast and changing set of rules, making compliance service providers essential.

- Legal Expertise: Specialized legal counsel is critical for interpreting and implementing complex financial legislation.

- ESG and AML Focus: New regulations in areas like ESG and AML demand niche knowledge, strengthening supplier leverage.

- Market Growth: The expanding regtech market indicates a high demand for these specialized services, translating to supplier power.

The bargaining power of core banking software vendors for ACNB Bank remains high due to significant switching costs and the critical nature of these systems. In 2024, the average cost for a mid-sized bank to change its core banking system was estimated to be in the tens to over one hundred million dollars, highlighting the substantial financial commitment and vendor leverage.

Payment networks and credit bureaus possess considerable power as essential operational partners for ACNB Bank. Their services are indispensable for transaction processing and credit assessment, with limited viable alternatives. The concentration of providers in these sectors, such as Visa and Mastercard for payments, further amplifies their influence.

Providers of specialized IT infrastructure, including cloud services and data centers, wield significant power due to the banking sector's absolute dependence on data security and operational continuity. The global cloud computing market, a vital component for such suppliers, was projected to exceed $1.3 trillion in 2024, underscoring its essential nature and the leverage held by providers.

| Supplier Category | Key Factors Influencing Power | Example Providers | Impact on ACNB Bank |

|---|---|---|---|

| Core Banking Software | High switching costs, system integration complexity | Fiserv, FIS, Jack Henry & Associates | Limited negotiation flexibility, significant investment required for changes |

| Payment Networks | Essential for transactions, limited alternatives | Visa, Mastercard | Fee structures and service terms are largely dictated by providers |

| Credit Bureaus | Critical for risk assessment, concentrated market | Experian, Equifax, TransUnion | Dependence on data access and pricing set by bureaus |

| Specialized IT Infrastructure | Data security, operational resilience, regulatory compliance | Amazon Web Services (AWS), Microsoft Azure, Google Cloud | Higher costs for secure, compliant cloud solutions |

| Regulatory Compliance & Legal Services | Complex and evolving regulations (ESG, AML) | Specialized law firms, RegTech providers | Increased spending on expertise to ensure compliance |

What is included in the product

Tailored exclusively for ACNB Bank, this analysis dissects the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its strategic positioning.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces model, allowing ACNB Bank to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

Customers of ACNB Bank possess significant bargaining power, particularly for standard banking services like checking and savings accounts. The low costs associated with switching financial institutions empower customers to easily move their funds, which in turn pressures ACNB Bank to offer competitive rates and services.

ACNB Bank faces significant buyer power due to the highly competitive landscape in South Central Pennsylvania and Maryland. Customers have numerous options, including other community banks, regional players, large national institutions, and credit unions, giving them considerable leverage to shop for the best deals.

This abundance of choice allows customers to readily compare and switch providers based on interest rates, fee structures, and service quality. For instance, in 2024, the average interest rate on savings accounts across various financial institutions in the region hovered around 1.5% to 2.5%, with some online banks offering even higher yields, directly pressuring ACNB Bank to remain competitive.

Customers wield significant bargaining power due to readily available information and robust price comparison tools. Digital platforms and online reviews empower consumers to easily scrutinize interest rates, loan terms, and service fees across different financial institutions. This transparency compels ACNB Bank to maintain competitive offerings to attract and retain its customer base.

Buyer Power 4

While ACNB Bank operates as a community bank, its larger corporate clients and high-net-worth individuals, despite being fewer in number, can wield considerable bargaining power. This influence stems from the sheer volume of their deposits or the intricate nature of their financial requirements, enabling them to negotiate for customized services or more favorable interest rates.

For instance, in 2024, large commercial deposits can represent a significant portion of a community bank's funding base. A single large client shifting their substantial balances could impact ACNB Bank's liquidity and interest income. This necessitates a strategic approach to client relationship management, ensuring that the value provided aligns with the potential leverage these customers hold.

- High-Net-Worth Individuals: These clients often have complex financial needs, including wealth management, lending, and investment services, giving them leverage to seek competitive pricing and personalized attention.

- Corporate Clients: Businesses, especially those with substantial cash reserves or payroll services, can negotiate for better terms on loans, treasury management, and transaction fees due to the significant business volume they bring.

- Deposit Concentration: A concentration of deposits among a few large clients means that ACNB Bank is susceptible to the demands of these key customers, who could move their funds if dissatisfied with service or rates.

- Switching Costs: While switching banks can involve some effort, for large clients, the potential savings or improved services from a competitor can outweigh these costs, increasing their bargaining power.

Buyer Power 5

ACNB Bank faces significant buyer power as customers increasingly demand personalized and digital-first banking. This shift empowers them to switch to competitors offering superior digital experiences. For instance, by the end of 2023, over 70% of banking customers in the US reported using mobile banking apps, highlighting the critical need for robust digital platforms.

Banks that do not adapt by integrating seamless mobile applications, AI-driven insights, and comprehensive financial services risk losing valuable customers. This is particularly true as fintech companies continue to innovate, offering specialized and user-friendly alternatives. ACNB Bank must prioritize enhancing its digital offerings to retain and attract customers in this evolving landscape.

- Customer Expectations: A growing demand for personalized and digital-first banking experiences grants customers considerable leverage.

- Digital Adoption: By late 2023, over 70% of US banking customers utilized mobile banking apps, underscoring the importance of digital channels.

- Competitive Pressure: Banks lagging in mobile app integration, AI insights, and unified financial services face losing customers to tech-savvy rivals.

Customers hold significant sway over ACNB Bank, especially for common services, due to low switching costs and a competitive market. In 2024, the average savings account rates, often around 1.5% to 2.5%, illustrate how easily customers can find better deals elsewhere. This forces ACNB Bank to remain competitive on pricing and service to keep its customer base.

| Customer Segment | Bargaining Power Factors | Impact on ACNB Bank |

|---|---|---|

| General Depositors | Low switching costs, readily available rate information | Pressure on deposit rates and fees |

| High-Net-Worth Individuals | Complex needs, potential for large balances | Negotiation for customized services and preferential rates |

| Corporate Clients | Significant transaction volume, treasury needs | Leverage for loan terms, treasury management pricing |

| Digital-Savvy Customers | Demand for seamless digital experience | Need for investment in mobile apps and online services |

Preview Before You Purchase

ACNB Bank Porter's Five Forces Analysis

This preview showcases the complete ACNB Bank Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you see here is precisely what you'll receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning. This professionally formatted analysis is designed for immediate use, providing actionable insights into ACNB Bank's competitive landscape.

Rivalry Among Competitors

ACNB Bank faces intense competition in South Central Pennsylvania and Maryland, with a crowded landscape featuring numerous local community banks, as well as larger regional and national players. This sheer volume of competitors directly fuels a heightened rivalry for both customer deposits and loan opportunities, making market share acquisition a constant challenge.

Competitive rivalry within the banking sector, including for ACNB Bank, is often intense. Traditional banking products like checking accounts and loans offer limited differentiation, forcing many institutions to compete primarily on price, such as interest rates on deposits and loans, and the fees they charge.

While ACNB Bank highlights its community-centric approach, many other banks provide similar core personal and business banking solutions. This similarity means that customer loyalty can be swayed by factors like convenience, digital offerings, and promotional rates, intensifying the battle for market share.

In 2023, the average interest rate for a new 30-year fixed-rate mortgage in the US hovered around 6.8%, a key area where banks compete. Similarly, competition for business loans often centers on offering competitive annual percentage rates (APRs) and flexible terms to attract and retain commercial clients.

ACNB Bank faces intense competition from other financial institutions, many of which employ aggressive pricing strategies. This often translates into rivals offering highly competitive loan rates or attractive high-yield deposit accounts to draw in and keep customers. For instance, in 2024, the average interest rate on a 30-year fixed-rate mortgage hovered around 6.5% to 7.5% nationally, creating pressure on banks like ACNB to match or beat these offers.

Such price-based competition directly impacts ACNB Bank's profitability by potentially squeezing its net interest margins. When a bank must offer higher rates on deposits to attract funds and lower rates on loans to secure business, the spread between what it earns and what it pays out narrows. This dynamic is particularly challenging in a market where customers are highly sensitive to even minor rate differences, making customer retention a constant battle.

Competitive Rivalry 4

ACNB Bank operates in a landscape where the competition for customer deposits and new loans is intense, particularly in established banking regions. This rivalry is a constant force, pushing banks to innovate and differentiate themselves to secure their position.

Banks are actively engaged in a multi-faceted competition. Strategies include robust marketing campaigns to attract new customers, careful planning of branch networks—whether through expansion or optimization—and a strong push into digital channels to reach a wider audience. The goal is to capture a greater share of the financial activity within their operating territories.

- Deposit Gathering: Banks compete aggressively on interest rates and service offerings to attract and retain customer deposits.

- Loan Origination: Competition is fierce in originating various loan types, from mortgages to commercial loans, often involving competitive pricing and flexible terms.

- Digital Presence: Investment in user-friendly mobile apps and online banking platforms is crucial for attracting and serving customers in the modern financial environment.

- Market Share: In 2023, the U.S. banking industry saw continued consolidation and intense competition, with regional banks like ACNB Bank striving to maintain or grow their market share against larger national institutions and credit unions.

Competitive Rivalry 5

The competitive rivalry within the banking sector, particularly for institutions like ACNB Bank, is intensifying. This escalation is driven by the growing demand for robust digital banking solutions and the strategic importance of a well-distributed branch network. Competitors are actively enhancing their digital offerings, focusing on mobile-first strategies, AI-driven customer support, and integrated online platforms to capture market share.

In 2024, the banking industry saw continued investment in technology. For instance, many regional banks are upgrading their mobile apps to include advanced features like personalized financial insights and streamlined loan applications. This digital push directly challenges traditional banking models and forces established players to adapt or risk losing customers to more digitally agile competitors.

ACNB Bank faces this heightened rivalry as it navigates the evolving landscape. While its physical branch network remains a strength, the industry trend leans towards digital convenience. Competitors are not only investing in technology but also in marketing campaigns that highlight these digital advantages, further pressuring ACNB Bank to innovate its service delivery to maintain its competitive standing.

- Digital Transformation: Banks are prioritizing mobile banking apps, online account opening, and digital lending platforms.

- Customer Experience: AI-powered chatbots and personalized digital interfaces are becoming standard expectations.

- Branch Network Strategy: While digital is key, a strategic physical presence still matters for certain customer segments and services.

- Competitive Investment: Competitors are allocating significant capital to technology upgrades and digital marketing initiatives.

Competitive rivalry is a significant force for ACNB Bank, particularly in its core markets of South Central Pennsylvania and Maryland. The presence of numerous community banks, alongside larger regional and national institutions, creates a highly competitive environment for both deposits and loans.

Banks often differentiate on price, such as interest rates for mortgages and business loans, and customer fees. In 2024, national 30-year fixed mortgage rates have ranged between approximately 6.5% and 7.5%, a key area of competition that directly impacts ACNB Bank's ability to attract borrowers.

This intense competition, often driven by aggressive pricing strategies from rivals, can squeeze ACNB Bank's net interest margins. The battle for market share is further fueled by investments in digital banking, with competitors enhancing mobile apps and online platforms to attract a wider customer base.

The U.S. banking industry in 2023 continued to see strong competition, with regional banks like ACNB Bank needing to adapt to digital trends and maintain competitive offerings against both larger banks and credit unions.

| Metric | ACNB Bank (Approximate) | Industry Average (2023-2024) | Key Competitors |

| Net Interest Margin | Varies (e.g., ~2.8%-3.2%) | ~3.0%-3.5% | Community Banks, Regional Banks |

| 30-Year Fixed Mortgage Rate | Competitive (e.g., 6.6%-7.2%) | 6.5%-7.5% | National Banks, Credit Unions |

| Digital Banking Investment | Increasing | High | All Financial Institutions |

SSubstitutes Threaten

Fintech companies represent a substantial threat by providing specialized digital services for payments, lending, and investments. These companies often operate with lower overheads and leverage more adaptable technology, allowing them to be highly competitive. For instance, by mid-2024, the global fintech market was projected to reach over $3.5 trillion, demonstrating the scale of this disruptive force.

These agile fintech firms can effectively unbundle traditional banking offerings, attracting customers who prefer focused, efficient financial tools. This disaggregation means customers can pick and choose specific services, bypassing the need for a full-service bank for certain transactions.

Credit unions represent a significant threat of substitutes for ACNB Bank. These member-owned cooperatives often boast lower fees and more competitive interest rates on loans and savings accounts, directly appealing to cost-conscious consumers. In 2024, the credit union sector continued its robust growth, with assets growing by over 7% year-over-year, demonstrating their increasing market presence and appeal.

Their non-profit structure allows credit unions to reinvest profits back into member services, offering benefits like reduced charges and higher deposit yields. This member-centric model can foster strong customer loyalty, presenting a challenge for traditional banks like ACNB Bank to retain and attract customers who prioritize value and community focus.

The threat of substitutes for ACNB Bank is significant, particularly from the burgeoning peer-to-peer (P2P) lending platforms and direct online lenders. These alternatives bypass traditional banking infrastructure, offering borrowers faster approvals and more adaptable loan terms, which can be very attractive to those seeking to avoid the perceived complexities of conventional bank processes.

In 2023, the online lending market continued its robust growth, with fintech lenders originating billions in loans across various categories. For instance, some reports indicated that online lenders captured an increasing share of the small business loan market, with origination volumes potentially reaching over $100 billion annually, presenting a direct challenge to ACNB Bank's traditional lending business.

4

The threat of substitutes for traditional banking services, including wealth management, is significant and growing. Investment apps and robo-advisors are increasingly capturing market share by offering automated, low-cost portfolio management. These digital platforms appeal to a broad range of investors, particularly younger demographics, who prioritize accessibility and affordability over personalized human advice.

These substitutes provide a compelling alternative for individuals seeking to grow their wealth. For instance, by mid-2024, the assets under management for leading robo-advisors had surpassed hundreds of billions of dollars, demonstrating their substantial impact. This trend suggests a shift in consumer preference towards digital-first financial solutions.

- Growing Adoption: Digital investment platforms continue to gain traction, attracting a substantial portion of new investment capital.

- Cost Advantage: Robo-advisors typically charge significantly lower fees than traditional human advisors, making them attractive to cost-conscious investors.

- Accessibility: These platforms offer easy access to investment tools and advice, often with lower minimum investment requirements.

- Technological Advancement: Continuous improvements in AI and user interface design further enhance the appeal and functionality of these digital substitutes.

5

The threat of substitutes for ACNB Bank is amplified by the rise of embedded finance. This means financial services are increasingly offered directly within non-financial platforms, like retail apps or e-commerce sites. For instance, buy-now-pay-later options integrated into online shopping carts act as direct substitutes for traditional credit products offered by banks.

This trend allows consumers to manage payments and even access credit without directly engaging with a bank's interface. By 2024, the global embedded finance market was projected to reach hundreds of billions of dollars, demonstrating a significant shift in how consumers access financial services. This integration reduces the need for customers to seek out traditional banking channels for everyday transactions and financing needs.

Key substitutes impacting traditional banking models include:

- Fintech Payment Solutions: Platforms like PayPal, Stripe, and Square offer seamless payment processing and alternative lending options, bypassing traditional bank infrastructure.

- Embedded Lending: Point-of-sale financing and buy-now-pay-later services integrated into e-commerce checkout processes directly compete with bank loans and credit cards.

- Digital Wallets: Services like Apple Pay and Google Pay, while often linked to bank accounts, provide a substitute for direct debit card or cash transactions.

The threat of substitutes for traditional banking services, including wealth management, is significant and growing. Investment apps and robo-advisors are increasingly capturing market share by offering automated, low-cost portfolio management. These digital platforms appeal to a broad range of investors, particularly younger demographics, who prioritize accessibility and affordability over personalized human advice.

These substitutes provide a compelling alternative for individuals seeking to grow their wealth. For instance, by mid-2024, the assets under management for leading robo-advisors had surpassed hundreds of billions of dollars, demonstrating their substantial impact. This trend suggests a shift in consumer preference towards digital-first financial solutions.

Key substitutes impacting traditional banking models include fintech payment solutions, embedded lending, and digital wallets. Platforms like PayPal and Stripe offer seamless payment processing, while buy-now-pay-later services integrated into e-commerce checkout processes directly compete with bank loans. Digital wallets provide an alternative to direct debit card or cash transactions.

| Substitute Type | Example Platforms | Key Advantage | Market Impact (Illustrative, mid-2024) |

| Fintech Payment Solutions | PayPal, Stripe, Square | Seamless transactions, alternative lending | Billions processed annually |

| Embedded Lending (BNPL) | Affirm, Klarna (integrated into retail) | Point-of-sale financing, faster approval | Significant growth in e-commerce |

| Robo-Advisors | Betterment, Wealthfront | Automated, low-cost portfolio management | Hundreds of billions in AUM |

| Digital Wallets | Apple Pay, Google Pay | Convenient, secure transactions | Widespread adoption in mobile payments |

Entrants Threaten

The threat of new entrants for ACNB Bank, like other established financial institutions, is significantly tempered by the high regulatory landscape. Obtaining a banking charter involves navigating a complex web of federal and state regulations, demanding substantial capital reserves and adherence to strict operational standards. For instance, in 2024, the average capital requirement for a new national bank charter remained in the tens of millions of dollars, a substantial hurdle for most aspiring players.

The threat of new entrants for ACNB Bank is relatively low. Establishing a new bank demands substantial capital, with regulatory bodies often requiring significant initial capital reserves. For instance, in 2024, minimum capital requirements for new banks can range from millions to tens of millions of dollars, depending on the jurisdiction and the proposed scope of operations. This high barrier to entry, coupled with the costs of building physical infrastructure, developing robust IT systems, and marketing to attract customers, deters most potential competitors.

New entrants into the banking sector face significant hurdles, particularly in cultivating the customer trust and brand recognition essential for financial services. Established institutions like ACNB Bank leverage decades of operation and a proven track record of stability, making it challenging for newcomers to gain a foothold.

4

The threat of new entrants for ACNB Bank is relatively low. Existing banks like ACNB benefit from significant economies of scale in their operations, technology investments, and marketing efforts. This scale allows them to spread costs over a larger base, making it difficult for newcomers to match their pricing and service offerings. ACNB Bank's established infrastructure and loyal customer base further solidify this advantage, creating a substantial barrier to entry.

New financial technology companies, or fintechs, could pose a threat, but often lack the broad regulatory approval and trust of traditional banks. While they can offer innovative digital solutions, their ability to attract a significant market share against established players like ACNB Bank, which reported total assets of $3.4 billion as of December 31, 2023, remains a challenge.

- Economies of Scale: Incumbent banks leverage scale in operations, technology, and marketing to reduce per-unit costs.

- Capital Requirements: Establishing a bank requires substantial capital, a significant hurdle for new entrants.

- Regulatory Hurdles: Strict banking regulations necessitate extensive compliance, adding complexity and cost for new players.

- Brand Loyalty and Trust: Established institutions like ACNB Bank benefit from long-standing customer relationships and trust, which are difficult for new entrants to replicate quickly.

5

While setting up a traditional brick-and-mortar bank involves significant capital, regulatory hurdles, and established brand loyalty, the threat of new entrants is evolving. The rise of digital-only banks, often called neobanks, presents a more potent challenge. These entities leverage lower overhead costs associated with fewer physical branches and often utilize advanced technology to offer competitive rates and streamlined customer experiences.

Neobanks are particularly adept at attracting younger, tech-savvy demographics. For instance, in 2024, the global digital banking market continued its robust growth, with projections indicating a significant increase in customer adoption of these online-first financial services. This agility allows them to quickly adapt to market changes and customer preferences, potentially siphoning off profitable customer segments from incumbent institutions like ACNB Bank.

- Neobanks' lower operational costs compared to traditional banks can translate into more attractive pricing for consumers.

- Technological innovation is a key differentiator, enabling neobanks to offer user-friendly interfaces and novel financial products.

- Targeting specific market niches allows new digital entrants to gain traction without needing to serve the entire banking spectrum initially.

- Regulatory shifts, while still a barrier, are sometimes more accommodating to fintech startups, potentially lowering the entry threshold.

The threat of new entrants for ACNB Bank is generally low due to substantial regulatory barriers and significant capital requirements. For example, in 2024, establishing a new bank charter often necessitates millions of dollars in initial capital reserves, a significant deterrent for most aspiring competitors. Furthermore, the established brand loyalty and trust that ACNB Bank has cultivated over its operational history present a considerable challenge for newcomers seeking to attract customers.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Substantial initial capital reserves are mandated by regulators, often in the millions of dollars as of 2024. | High barrier, limiting the pool of potential entrants. |

| Regulatory Hurdles | Navigating complex federal and state banking regulations requires significant compliance expertise and resources. | Increases cost and time to market for new entrants. |

| Brand Loyalty & Trust | Established banks like ACNB benefit from long-standing customer relationships and a proven track record. | Difficult for new entrants to replicate, impacting customer acquisition. |

| Economies of Scale | Incumbents enjoy cost advantages in operations, technology, and marketing due to their size. | Makes it challenging for new entrants to compete on price and service. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ACNB Bank leverages data from ACNB's annual reports and SEC filings, alongside industry reports from organizations like the American Bankers Association and FDIC data, to provide a comprehensive view of the competitive landscape.