Action Construction Equipment PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Action Construction Equipment Bundle

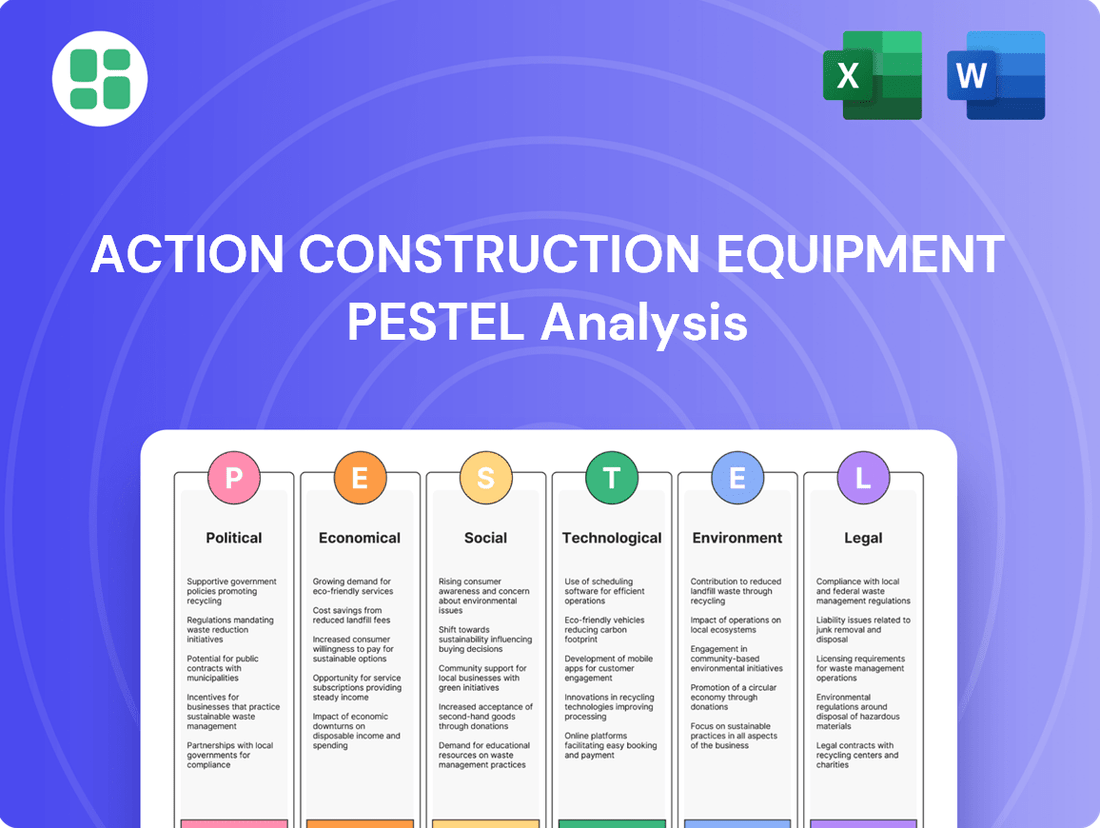

Unlock the full potential of Action Construction Equipment by understanding the intricate web of external forces at play. Our comprehensive PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors shaping the company's landscape. Gain a critical edge in your strategic planning and investment decisions.

Ready to make informed choices about Action Construction Equipment? Our PESTLE analysis provides the actionable intelligence you need to navigate market complexities and identify emerging opportunities. Don't miss out on crucial insights that can drive your business forward.

Equip yourself with unparalleled market foresight. Download the complete PESTLE analysis for Action Construction Equipment today and gain a strategic advantage that sets you apart. Your path to smarter business decisions starts here.

Political factors

The Indian government's commitment to infrastructure development is a major driver for construction equipment demand. For the fiscal year 2024-25, a significant ₹11.11 lakh crore has been allocated for capital expenditure, directly boosting the sector.

Key government programs like the National Infrastructure Pipeline (NIP), PM Gati Shakti, Bharatmala Pariyojana, and the Smart Cities Mission are spearheading massive projects in roads, railways, and urban infrastructure. These initiatives create a sustained need for construction machinery.

This sustained governmental focus on building out the nation's infrastructure provides a robust and predictable environment for the construction equipment industry to thrive.

The 'Make in India' initiative is a significant political driver for Action Construction Equipment (ACE), as it actively promotes domestic manufacturing and aims to decrease dependence on imported components, especially from nations like China. This policy directly benefits Indian manufacturers by fostering self-reliance and encouraging the production of robust, locally-made construction machinery.

By supporting companies like ACE, the 'Make in India' program is designed to bolster the nation's manufacturing capabilities and enhance its standing in the global arena. For instance, in the fiscal year 2023-24, India's manufacturing sector saw robust growth, with initiatives like 'Make in India' playing a crucial role in attracting investment and boosting production volumes, which in turn can translate to increased demand for ACE's product lines.

The Indian government is pushing for stricter environmental and safety regulations, with the upcoming Bharat Stage V (CEV-V) emission and safety standards set to be implemented from January 2025. This move positions India as the third nation globally to adopt such advanced norms.

These regulatory upgrades are crucial for ensuring environmental compliance and are expected to boost the export potential of Indian construction equipment by aligning them with international standards.

Furthermore, new legislation is under consideration to establish unambiguous technical benchmarks and address existing operational inefficiencies within the construction equipment sector.

Public-Private Partnerships (PPPs)

The Indian government is strongly encouraging Public-Private Partnerships (PPPs) to harness private sector capital and expertise for significant infrastructure development. This focus on PPPs is vital for funding major projects and speeding up progress in areas such as transportation networks and industrial hubs. For instance, the National Infrastructure Pipeline (NIP) for 2020-2025 projected investments of ₹111 lakh crore (approximately $1.4 trillion), with a substantial portion expected to come through PPPs, directly boosting demand for construction equipment.

PPPs are instrumental in driving the development of critical infrastructure like airports, ports, and highways, creating a consistent flow of projects. This collaborative approach not only accelerates project execution but also ensures the availability of a steady project pipeline, which is a direct benefit for manufacturers like Action Construction Equipment. The success of PPPs in India is evidenced by the increasing number of projects awarded under this model, with the Ministry of Finance reporting a significant uptick in PPP project approvals in recent fiscal years.

- Government Push for PPPs: The Indian government's commitment to PPPs aims to bridge infrastructure funding gaps and leverage private sector efficiency.

- Infrastructure Focus: Key sectors benefiting from PPPs include roads, railways, airports, ports, and logistics, all major consumers of construction machinery.

- Project Pipeline Growth: PPPs are projected to contribute significantly to the ₹111 lakh crore National Infrastructure Pipeline (2020-2025), ensuring sustained project activity.

- Economic Impact: Increased PPP-driven infrastructure projects translate into higher demand for construction equipment, supporting growth for companies like Action Construction Equipment.

Policy Stability and Economic Growth Vision

India's ambitious goal to achieve developed economy status by 2047, with a strong emphasis on infrastructure, translates into a stable policy environment for construction equipment manufacturers like Action Construction Equipment (ACE). This long-term vision underpins consistent budgetary support for infrastructure projects, ensuring sustained demand for essential machinery.

The government's commitment to infrastructure spending, projected to remain robust through 2025 and beyond, provides ACE with the confidence to make strategic capital investments. This policy stability allows for more accurate forecasting of equipment needs and facilitates long-term business planning.

- Infrastructure Push: India aims for developed nation status by 2047, driving significant infrastructure investment.

- Budgetary Support: Expect continued, steady growth in government allocations for infrastructure projects through 2025.

- Demand Certainty: This focus ensures a predictable and sustainable demand for construction equipment.

- Investment Confidence: Policy stability allows companies like ACE to plan and execute long-term growth strategies with reduced uncertainty.

Government policies heavily influence the construction equipment market in India. The nation's commitment to infrastructure development, with a significant capital expenditure allocation of ₹11.11 lakh crore for FY 2024-25, directly fuels demand for machinery.

Initiatives like 'Make in India' bolster domestic manufacturing, reducing reliance on imports and benefiting local players like Action Construction Equipment (ACE). Furthermore, upcoming stringent emission standards (Bharat Stage V) from January 2025 are pushing for technological upgrades and enhancing export potential.

The strong emphasis on Public-Private Partnerships (PPPs) for infrastructure projects, such as those under the National Infrastructure Pipeline (2020-2025) valued at ₹111 lakh crore, ensures a consistent project pipeline and sustained demand for construction equipment.

India's long-term vision to achieve developed economy status by 2047 reinforces a stable policy environment with consistent budgetary support for infrastructure, providing ACE with the confidence for strategic capital investments and long-term planning.

| Policy/Initiative | Impact on Construction Equipment | Key Data/Timeline |

|---|---|---|

| Infrastructure Capital Expenditure | Directly drives demand for machinery | ₹11.11 lakh crore allocated for FY 2024-25 |

| 'Make in India' | Promotes domestic manufacturing, reduces import dependence | Aims to boost local production capabilities |

| Environmental/Safety Standards (BS-V) | Drives technological upgrades, improves export potential | Implementation from January 2025 |

| Public-Private Partnerships (PPPs) | Ensures sustained project pipeline and demand | Part of ₹111 lakh crore National Infrastructure Pipeline (2020-2025) |

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing Action Construction Equipment across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities within the industry and its operating regions.

A PESTLE analysis for Action Construction Equipment offers a structured framework to identify and mitigate external threats and opportunities, thereby reducing uncertainty and improving strategic decision-making.

Economic factors

The Indian construction sector is booming, with projections indicating it will reach a staggering USD 1.21 trillion by 2025 and is expected to hit USD 2.13 trillion by 2030. This impressive growth trajectory, boasting a compound annual growth rate of 12.1% between 2025 and 2030, underscores a dynamic and expanding market.

Within this broader growth, the construction equipment market is also set for a substantial upswing, forecast to move from $10 billion to $11 billion in the 2025-26 period. This expansion is directly fueled by ongoing and significant investments in infrastructure development across the nation.

These robust market conditions create a fertile ground and a vast opportunity for companies like Action Construction Equipment (ACE) to capitalize on the increasing demand for construction machinery and services.

The Union Budget for 2024-25 has earmarked a historic ₹11.11 lakh crore (around US$133 billion) for capital expenditure in infrastructure. This significant allocation, representing 3.4% of India's GDP, directly fuels demand for construction and material handling equipment.

This robust investment underscores the government's dedication to upgrading public infrastructure, logistics networks, and utility services. For companies like Action Construction Equipment, this translates into a more favorable market environment with heightened opportunities for sales and growth.

Action Construction Equipment (ACE) operates in an environment where raw material costs and supply chain stability are critical. The construction sector, in general, experienced a modest 2-4% escalation in greenfield construction costs during 2024, a slowdown from earlier periods. However, this doesn't negate the ongoing risks associated with global supply chains, especially those involving major manufacturing hubs like China and South Korea.

These potential disruptions and cost increases directly affect manufacturers like ACE, squeezing profit margins. Efficient supply chain management is therefore paramount for ACE to navigate these challenges and maintain competitive pricing for its equipment.

Financial Performance of ACE

Action Construction Equipment (ACE) demonstrated robust financial health, with its net profit soaring by 16.08% to ₹97.72 crore in the first quarter of FY2025-26. The company's trailing twelve months (TTM) earnings for 2025 reached $64.8 million USD, underscoring its strong profitability. This financial strength positions ACE favorably for strategic investments and product line expansion.

Key financial highlights for ACE include:

- Net Profit Growth: 16.08% increase in Q1 FY2025-26.

- TTM Earnings (2025): $64.8 million USD reported.

- Profitability: Indicates a healthy and growing financial standing.

- Investment Capacity: Enables investment in new technologies and product development.

Domestic Sales and Export Growth

In FY2024-25, Action Construction Equipment (ACE) saw a modest 2.7% increase in domestic sales, influenced by election-related disruptions and evolving regulatory landscapes. However, export growth surged to 10%, demonstrating a strong international appetite for Indian-manufactured construction machinery.

- Domestic sales growth: 2.7% in FY2024-25.

- Export growth: 10% in FY2024-25.

- Export destination: 88% to non-SAARC countries.

- Key driver: Increasing global demand for Indian equipment.

This substantial export performance, with the vast majority of shipments directed towards non-SAARC nations, underscores the growing global recognition of Indian-made equipment. It also presents a vital and expanding avenue for ACE's overall growth, diversifying revenue streams beyond the domestic market.

India's robust economic growth, projected to reach USD 1.21 trillion by 2025 and USD 2.13 trillion by 2030, significantly bolsters the construction equipment sector. The Union Budget 2024-25's record ₹11.11 lakh crore allocation for infrastructure development directly translates into increased demand for construction machinery.

Despite a modest 2-4% rise in construction costs in 2024, global supply chain vulnerabilities remain a concern for manufacturers like Action Construction Equipment (ACE). ACE's financial performance is strong, with Q1 FY2025-26 net profit up 16.08% to ₹97.72 crore and TTM earnings at $64.8 million USD for 2025.

ACE experienced a 2.7% domestic sales increase in FY2024-25, while exports surged by 10%, with 88% going to non-SAARC countries, highlighting global demand for Indian equipment.

| Economic Factor | Data Point | Impact on ACE |

|---|---|---|

| Indian Construction Market Growth | Projected to reach USD 1.21 trillion by 2025 | Increased demand for ACE's equipment |

| Union Budget 2024-25 Infrastructure Spend | ₹11.11 lakh crore (3.4% of GDP) | Directly fuels demand for construction machinery |

| Greenfield Construction Cost Escalation (2024) | 2-4% | Potential impact on profit margins if not managed |

| ACE Q1 FY2025-26 Net Profit Growth | 16.08% | Indicates strong financial health and investment capacity |

| ACE TTM Earnings (2025) | $64.8 million USD | Demonstrates robust profitability |

| ACE Domestic Sales Growth (FY2024-25) | 2.7% | Stable domestic market performance |

| ACE Export Growth (FY2024-25) | 10% | Significant international market expansion |

What You See Is What You Get

Action Construction Equipment PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Action Construction Equipment PESTLE analysis delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Action Construction Equipment's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed PESTLE analysis provides a robust framework for understanding the opportunities and threats facing Action Construction Equipment.

Sociological factors

India's urbanization is accelerating, with projections indicating that by 2030, around 600 million people will reside in urban areas. This significant demographic shift fuels an immense demand for both residential and commercial construction, directly benefiting companies like Action Construction Equipment (ACE).

Government initiatives, such as the Pradhan Mantri Awas Yojana, are actively pushing for the construction of millions of new homes. This policy-driven demand translates into a substantial and sustained need for construction machinery and equipment, creating a favorable market environment for ACE.

The construction industry grapples with a persistent shortage of skilled labor, a critical issue impacting project timelines and quality. This demand for expertise is amplified by the increasing complexity of modern construction techniques and the adoption of advanced machinery. For Action Construction Equipment (ACE), a robustly trained workforce is essential not only for its own manufacturing efficiency but also for ensuring its clients can effectively operate its sophisticated equipment.

Addressing these skill gaps is paramount. In 2024, reports indicated that over 70% of construction firms faced challenges finding workers with the necessary skills. ACE's commitment to supporting workforce development, including providing training programs for operators of its machinery, directly addresses this societal need and strengthens its market position by enabling customers to maximize the value of their investments.

Consumers increasingly prioritize sustainability, driving demand for eco-friendly construction materials and practices. This is reflected in a growing market for green building certifications, with the U.S. Green Building Council reporting over 100,000 LEED-certified projects globally as of early 2024.

There's a significant shift towards smart building technologies, integrating automation and IoT for enhanced efficiency and user experience. In 2024, the global smart buildings market was valued at an estimated $80 billion, with projections indicating continued robust growth driven by these evolving consumer preferences.

Project developers and end-users are now actively seeking construction equipment that offers higher energy efficiency and advanced technological features. This demand pushes manufacturers like ACE to invest in research and development for innovative, next-generation machinery that aligns with these forward-looking market expectations.

Emphasis on Safety and Quality of Life

As urban development accelerates, there's a marked societal shift towards prioritizing safety and enhancing the overall quality of life within cities. This translates into stricter adherence to construction safety regulations and a demand for infrastructure that supports better urban living, such as improved public transportation and well-planned residential areas. Action Construction Equipment (ACE) directly addresses this by supplying machinery known for its reliability and adherence to quality standards, which are crucial for building safe and functional urban environments.

This societal focus is reflected in increasing government spending on infrastructure. For instance, India's National Infrastructure Pipeline aims to invest ₹111 lakh crore (approximately $1.4 trillion) between 2020 and 2025, with a significant portion dedicated to roads, railways, and urban development projects that inherently require high safety and quality benchmarks. ACE's product portfolio, including cranes and excavators, plays a direct role in enabling these projects to meet these elevated standards.

- Increased demand for durable construction equipment to meet stringent safety regulations in urban projects.

- Growing investment in public infrastructure, such as transit systems and urban renewal, directly benefits manufacturers of reliable machinery.

- Societal pressure for improved urban living standards drives the need for construction that is both efficient and safe.

- ACE's brand reputation for quality and safety positions it favorably to capitalize on these evolving societal expectations.

Growth of Rental Market

The construction equipment rental market in India is booming, providing a financially accessible route for contractors, particularly small and medium-sized enterprises (SMEs), to utilize cutting-edge machinery. This growth means more businesses can afford advanced equipment, potentially broadening the customer base for companies like ACE, even if it means a shift from direct sales to rental partnerships.

Key drivers for this rental market expansion include:

- Cost Efficiency: Renting eliminates the significant upfront capital expenditure and ongoing maintenance costs associated with owning heavy machinery.

- Access to Technology: It allows smaller players to access the latest, most efficient equipment, improving project quality and timelines.

- Market Growth: The Indian rental market was projected to grow at a compound annual growth rate (CAGR) of around 10% to 12% between 2023 and 2028, indicating strong demand.

- Flexibility: Contractors can rent equipment based on specific project needs, offering greater operational flexibility.

Societal expectations are increasingly focused on safety and improved urban living, driving demand for high-quality construction. This translates into a need for reliable equipment that meets stringent safety standards, benefiting manufacturers like ACE. The growing investment in public infrastructure, such as urban renewal and transit systems, further fuels this demand for dependable machinery.

The construction equipment rental market in India is experiencing significant growth, projected at a 10-12% CAGR from 2023-2028. This trend offers greater accessibility to advanced machinery for smaller businesses, potentially expanding ACE's customer reach. This accessibility is driven by cost efficiency, access to new technology, and operational flexibility.

Societal pressure for enhanced urban living standards is pushing for construction that is both efficient and safe. ACE's reputation for quality and safety positions it well to meet these evolving expectations. The company's commitment to supporting workforce development also addresses critical skill gaps within the industry, ensuring clients can effectively operate their equipment.

Technological factors

The Indian construction equipment sector is seeing a significant uptake of advanced technologies like telematics, AI, and IoT. This integration allows for remote equipment monitoring, proactive maintenance scheduling, and improved fuel efficiency, ultimately lowering operating expenses for users.

For Action Construction Equipment (ACE), this technological shift presents a clear opportunity to integrate these smart features into their machinery, offering clients more efficient and data-driven operational solutions. For instance, telematics can provide real-time performance data, enabling better fleet management and predictive maintenance, which is crucial in the demanding construction environment.

The construction industry is witnessing a significant pivot towards electrification and hybrid technology in equipment. This move is largely propelled by a dual focus on achieving sustainability targets and mitigating the impact of escalating fuel prices. For instance, by early 2024, several major manufacturers announced substantial investments in R&D for battery-electric and hybrid models, aiming for a significant portion of their fleets to be emissions-free by 2030.

Manufacturers are actively redesigning equipment to incorporate eco-friendly materials, more efficient powertrains, and components that can be easily recycled. This commitment to greener design is not just about compliance; it's about future-proofing operations. For Action Construction Equipment (ACE), this presents a strategic opening to expand its offerings with innovative, environmentally conscious machinery, thereby resonating with both international environmental mandates and India's own push for sustainable development.

The construction industry is seeing a significant surge in automation and robotics. By 2024, it's estimated that the global construction robotics market will reach $1.5 billion, with projections indicating substantial growth through 2025 and beyond. This shift is driven by the increasing adoption of remote-controlled and semi-autonomous machinery, which is fundamentally changing how construction projects are managed.

These advanced technologies are directly contributing to improved safety, enhanced efficiency, and greater visibility on job sites. As automation technology continues to mature, it directly translates to reduced downtime and lower operational costs for construction firms. Action Construction Equipment (ACE) has a clear opportunity to capitalize on this trend by integrating more sophisticated automation features into its product lines, such as loaders and cranes, to align with evolving market demands.

Building Information Modeling (BIM) and Digitalization

Building Information Modeling (BIM) and the broader trend of digitalization are fundamentally reshaping the construction industry, enhancing design accuracy, fostering seamless collaboration, and boosting overall operational efficiency. This digital transformation is particularly evident in public sector projects, where the adoption of integrated digital platforms is becoming increasingly standard, driving a need for greater transparency and data management.

Action Construction Equipment (ACE) stands to gain significantly by aligning its offerings with these evolving digital landscapes. Ensuring its equipment is compatible with these advanced digital construction ecosystems and proactively providing customers with valuable data-driven insights from their machinery will be crucial for maintaining a competitive edge. For instance, the global construction BIM market was valued at approximately $7.5 billion in 2023 and is projected to reach over $25 billion by 2030, indicating a substantial shift towards digital integration.

- Increased Project Efficiency: BIM adoption can reduce project costs by up to 10% and shorten project timelines by 7% through improved coordination and clash detection.

- Enhanced Collaboration: Digital platforms facilitate real-time information sharing among stakeholders, from architects to equipment operators.

- Data-Driven Operations: ACE can leverage telematics and IoT sensors on its equipment to provide predictive maintenance and performance analytics to clients.

- Growing Market Demand: The increasing prevalence of BIM mandates in government projects signals a growing demand for digitally integrated construction solutions.

Innovation in Materials and Design

The construction industry is witnessing a significant push towards sustainable materials and innovative designs, emphasizing lighter components and energy-efficient solutions. This evolution directly impacts equipment manufacturing, with companies like Action Construction Equipment (ACE) exploring ways to minimize the environmental impact of their machinery.

This focus on innovation extends to materials science and engineering. For instance, the development of advanced composites and recycled materials offers the potential for lighter, stronger, and more durable construction equipment. ACE's strategic alignment with these material and design trends can lead to improved fuel efficiency and reduced operational emissions. By 2024, the global market for sustainable construction materials was projected to reach over $300 billion, highlighting the significant economic driver behind these technological shifts.

ACE's product development can capitalize on these advancements by integrating:

- Lighter, high-strength alloys and composites to reduce machine weight and improve fuel economy.

- Modular design principles for easier maintenance, repair, and component upgrades, extending equipment lifespan.

- Energy-efficient component integration such as advanced hydraulics and electric powertrains in new equipment models.

Technological advancements are rapidly transforming the construction equipment sector, with a strong emphasis on digitalization, automation, and sustainability. By 2024, the global construction robotics market was projected to reach $1.5 billion, underscoring the growing adoption of automated machinery. This trend directly enhances safety, boosts efficiency, and provides better job site visibility, leading to reduced downtime and operational costs for construction firms.

Action Construction Equipment (ACE) can leverage these technological shifts by integrating advanced automation features into its product lines, aligning with evolving market demands for more efficient and data-driven solutions. The integration of telematics and IoT, for example, enables remote monitoring and predictive maintenance, which are critical for optimizing performance in demanding construction environments.

Furthermore, the industry is increasingly embracing electrification and hybrid technologies, driven by sustainability goals and rising fuel costs. By early 2024, significant R&D investments were announced for battery-electric and hybrid models, with targets for emissions-free fleets by 2030. ACE's strategic alignment with these trends, including the use of advanced composites and energy-efficient powertrains, positions it to offer innovative, environmentally conscious machinery.

The widespread adoption of Building Information Modeling (BIM) and digitalization is also reshaping construction, improving design accuracy and collaboration. The global BIM market, valued around $7.5 billion in 2023, is expected to exceed $25 billion by 2030, highlighting a significant shift towards digital integration in construction projects.

| Technology Trend | Impact on Construction Equipment | ACE Opportunity | Market Data (2024/2025 Projections) |

| Automation & Robotics | Enhanced safety, efficiency, reduced downtime | Integrate advanced automation in loaders, cranes | Global construction robotics market projected to reach $1.5 billion by 2024 |

| Electrification & Hybridization | Reduced emissions, lower fuel costs, sustainability | Develop battery-electric and hybrid equipment | Target of emissions-free fleets by 2030 |

| Digitalization & BIM | Improved design accuracy, collaboration, data insights | Ensure equipment compatibility with digital ecosystems, provide data analytics | Global BIM market projected to exceed $25 billion by 2030 |

Legal factors

India's adoption of Bharat Stage V (CEV-V) emission norms for non-road diesel engines, effective January 2025, directly affects wheeled construction equipment. This regulatory shift mandates improved engine technology and enhanced safety features, leading to an estimated 12-15% increase in equipment costs.

This move is significant as it brings India's standards in line with international benchmarks. For manufacturers like Action Construction Equipment (ACE), compliance is crucial not only for domestic sales but also for tapping into export markets where these advanced emission standards are already prevalent.

ACE must proactively ensure its entire product portfolio adheres to these stricter CEV-V regulations. Failure to do so could result in market access limitations and a competitive disadvantage against compliant rivals.

The Ministry of Heavy Industry's Machinery and Electrical Equipment Safety (Omnibus Technical Regulation) Order, 2024, now extended to September 1, 2026, imposes rigorous safety requirements for all machinery manufactured or imported into India. This regulation necessitates Bureau of Indian Standards (BIS) approval and adherence to newly established safety standards for all equipment.

Action Construction Equipment (ACE) must proactively ensure its entire product line complies with these enhanced safety regulations to avoid potential market access issues or penalties. This includes verifying that all imported components and domestically produced machinery meet the BIS certification and updated safety specifications before market entry.

Government initiatives such as the Energy Conservation Building Code (ECBC) and the Indian Green Building Council's (IGBC) Green Home rating system are increasingly shaping the construction landscape. These regulations and voluntary standards promote energy efficiency and sustainable materials, directly influencing the types of projects undertaken and the equipment required. For instance, the ECBC 2017 mandates specific thermal performance standards for buildings, driving demand for equipment that facilitates precise construction and insulation installation.

Incentives like tax rebates and expedited approval processes for projects achieving certifications like GRIHA (Green Rating for Integrated Habitat Assessment) or LEED India are further stimulating the adoption of green building practices. These financial and administrative benefits encourage developers to invest in sustainable construction, creating a growing market segment for specialized equipment. ACE's robust machinery can play a crucial role in efficiently executing these green projects, from material handling to structural assembly.

The push towards net-zero energy buildings and reduced carbon footprints in construction, a trend gaining momentum through 2024 and projected to intensify into 2025, directly impacts equipment demand. Projects focusing on renewable energy integration and advanced building envelope technologies will require precise and efficient construction machinery. This regulatory environment positions ACE's offerings favorably for contractors engaged in high-performance, environmentally conscious building projects.

Proposed New Law for CE Industry

India is actively working on a new bill designed to bolster its construction equipment sector. The primary objective is to decrease reliance on imported, lower-cost machinery and instead encourage the development and adoption of advanced, domestically produced equipment. This legislative push is anticipated to establish robust technical standards and resolve existing operational inefficiencies, thereby enhancing the competitiveness of Indian manufacturers.

This evolving legal landscape is poised to benefit local players, including Action Construction Equipment (ACE). By creating a more structured and supportive domestic market, the bill aims to level the playing field and foster growth for indigenous companies.

- Reduced Import Dependency: The bill targets a significant reduction in the import of construction equipment, which stood at approximately $1.5 billion in FY23, aiming to redirect this spending towards domestic production.

- Technical Standards: Introduction of clear technical standards is expected to improve product quality and safety across the industry.

- Support for Local Manufacturers: The legislation is designed to create a more favorable environment for domestic companies like ACE, potentially boosting their market share.

- Industry Growth: The Indian construction equipment market is projected to grow at a CAGR of 12% from 2024 to 2029, and this bill could accelerate that growth by fostering innovation and local capacity.

Labor Laws and Workforce Safety

Labor laws and workforce safety are paramount for Action Construction Equipment (ACE). While specific 2024-2025 legislative updates aren't detailed here, adherence to general occupational safety regulations is crucial for ACE's manufacturing facilities. This ensures a safe working environment for employees involved in the production of heavy machinery.

Furthermore, these regulations extend to the end-users of ACE's equipment. Ensuring that the machinery is designed and manufactured with operator safety in mind is a legal and ethical imperative. Compliance with these standards directly impacts ACE's reputation as a responsible manufacturer.

- Worker Safety: Compliance with India's Factories Act, 1948, and its amendments, ensures safety protocols are followed in ACE's production units.

- Operator Safety: Adherence to product safety standards, often influenced by international benchmarks, is vital for the safe operation of ACE's construction equipment.

- Reputational Risk: Non-compliance can lead to fines, operational disruptions, and significant damage to ACE's brand image in the competitive construction equipment market.

The Indian government's focus on reducing import dependency for construction equipment, aiming to bolster domestic manufacturing, presents a significant legal advantage for companies like Action Construction Equipment (ACE). This legislative push, anticipated to solidify technical standards and streamline operations, directly supports local players. The market is projected for robust growth, with an estimated 12% CAGR from 2024 to 2029, a trajectory this bill is expected to accelerate by fostering innovation and local capacity.

Environmental factors

India's construction industry is increasingly prioritizing green building techniques, spurred by growing environmental awareness and corporate commitments to sustainability. This translates to a focus on reducing energy usage, minimizing waste generation, and efficiently managing resources from project inception to completion.

The Indian Green Building Council (IGBC) has been instrumental in promoting sustainable construction, with a significant number of projects achieving IGBC certification. For instance, by the end of 2023, over 1.5 billion square feet of real estate had achieved IGBC certification, highlighting the tangible shift towards eco-conscious development.

Action Construction Equipment (ACE) can leverage this trend by developing and promoting machinery designed for eco-friendly operations, such as fuel-efficient excavators or equipment that facilitates waste recycling on-site, thereby aligning with the sector's evolving environmental standards.

The construction industry is increasingly prioritizing sustainability, driving a significant demand for eco-friendly equipment. This includes a growing preference for hybrid and electric machinery, aiming to cut down on carbon emissions and reduce noise pollution at construction sites. For example, by the end of 2024, the global market for electric construction equipment was projected to reach over $10 billion, with significant growth expected through 2030.

Manufacturers are responding by focusing on energy-efficient designs, utilizing lighter materials to improve fuel economy, and incorporating recyclable components into their machinery. This shift reflects a broader industry commitment to environmental responsibility and operational efficiency.

Action Construction Equipment (ACE) has a clear opportunity to leverage this trend. By investing in and actively promoting its range of environmentally responsible machinery, ACE can secure a competitive edge, meeting evolving customer demands and contributing to a greener construction sector.

The introduction of stricter emission standards, such as the CEV Stage V norms effective from January 2025 in India, directly impacts construction equipment manufacturers like ACE. These regulations mandate a significant reduction in particulate matter and nitrogen oxides, compelling companies to invest in advanced engine technologies and emission control systems.

Compliance with these evolving environmental regulations is not just a legal necessity but also a strategic imperative. ACE's ability to adapt and offer equipment that meets these stringent standards, for instance, by incorporating selective catalytic reduction (SCR) or diesel particulate filters (DPF), will be crucial for its market access and brand reputation. This transition also presents an opportunity to lead in sustainable construction practices.

Green Building Initiatives and Certifications

Government initiatives and organizations like the Indian Green Building Council (IGBC) and Green Rating for Integrated Habitat Assessment (GRIHA) are actively promoting green building certifications. These frameworks often mandate energy-efficient practices and the use of sustainable materials, directly influencing the construction sector. For instance, by 2023, over 1.5 billion square feet of real estate in India had achieved green building certifications, showcasing a significant market shift.

This growing emphasis on sustainability drives demand for construction equipment that can effectively support green building projects. Equipment capable of precise material handling, efficient waste management, and the use of eco-friendly construction techniques is becoming increasingly crucial. Action Construction Equipment (ACE) is well-positioned to cater to this specialized segment with its range of products designed for efficiency and advanced operational capabilities.

The push for green construction also impacts the types of projects undertaken, favoring those that require specialized equipment. ACE's product portfolio, including telehandlers and pick-and-carry cranes, aligns with the needs of these projects, offering solutions for:

- Efficient material placement for sustainable building components.

- On-site waste segregation and management systems.

- Reduced energy consumption during construction operations.

- Support for modular and prefabricated construction methods.

Waste Management and Resource Efficiency

The construction sector is prioritizing waste management and resource efficiency, with a growing emphasis on rainwater harvesting and the incorporation of recycled materials. For instance, plastic waste and steel slag are now being utilized in road construction, reflecting a significant shift towards sustainability. This trend is driven by both regulatory pressures and a desire to reduce the environmental footprint of infrastructure development.

Action Construction Equipment (ACE) can capitalize on this by developing machinery that enhances waste segregation and material recycling processes on-site. Equipment designed for efficient resource utilization, such as compactors that can process recycled aggregates or excavators with precise material handling capabilities, will be in high demand. The global construction waste management market was valued at approximately USD 150 billion in 2023 and is projected to grow, indicating a substantial opportunity for ACE to innovate.

- Increased demand for equipment facilitating on-site recycling and waste segregation.

- Potential for ACE to develop specialized machinery for processing recycled materials like plastic and steel slag.

- Growing market for sustainable construction practices presents a significant growth avenue for ACE.

- The global construction waste management market is expected to continue its upward trajectory, reaching an estimated USD 210 billion by 2028.

The construction industry's increasing focus on sustainability is driving demand for eco-friendly equipment, with a notable preference for hybrid and electric machinery to reduce emissions and noise. By the end of 2024, the global market for electric construction equipment was projected to exceed $10 billion, with substantial growth anticipated through 2030.

Stricter emission standards, such as India's CEV Stage V norms effective from January 2025, necessitate advanced engine technologies and emission control systems, compelling manufacturers like ACE to adapt. Compliance with these regulations is crucial for market access and brand reputation, presenting an opportunity for ACE to lead in sustainable practices.

The growing emphasis on green building certifications, with over 1.5 billion square feet of Indian real estate certified by IGBC by the end of 2023, directly influences equipment needs. ACE can capitalize on this by offering machinery that supports precise material handling and efficient waste management for green projects.

The construction sector is increasingly prioritizing waste management and resource efficiency, with initiatives like using plastic waste and steel slag in road construction gaining traction. The global construction waste management market, valued at approximately $150 billion in 2023 and projected to reach $210 billion by 2028, offers significant opportunities for ACE to innovate in machinery for on-site recycling.

| Trend | Impact on Construction Equipment | Opportunity for ACE |

|---|---|---|

| Green Building Practices | Increased demand for energy-efficient and low-emission machinery. | Develop and promote eco-friendly equipment lines. |

| Stricter Emission Norms (CEV Stage V from Jan 2025) | Mandatory adoption of advanced engine and emission control technologies. | Invest in SCR and DPF technologies; market compliance as a key differentiator. |

| Waste Management & Recycling | Growing need for equipment facilitating on-site segregation and processing of recycled materials. | Innovate machinery for processing recycled aggregates and other construction waste. |

| Electrification of Construction Equipment | Shift towards hybrid and electric machinery to reduce carbon footprint. | Explore and invest in electric and hybrid equipment offerings. |

PESTLE Analysis Data Sources

Our Action Construction Equipment PESTLE Analysis is built on a robust foundation of data from official government publications, leading industry associations, and reputable market research firms. We integrate insights from economic indicators, environmental policy updates, and technological advancements to provide a comprehensive overview.