Action Construction Equipment Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Action Construction Equipment Bundle

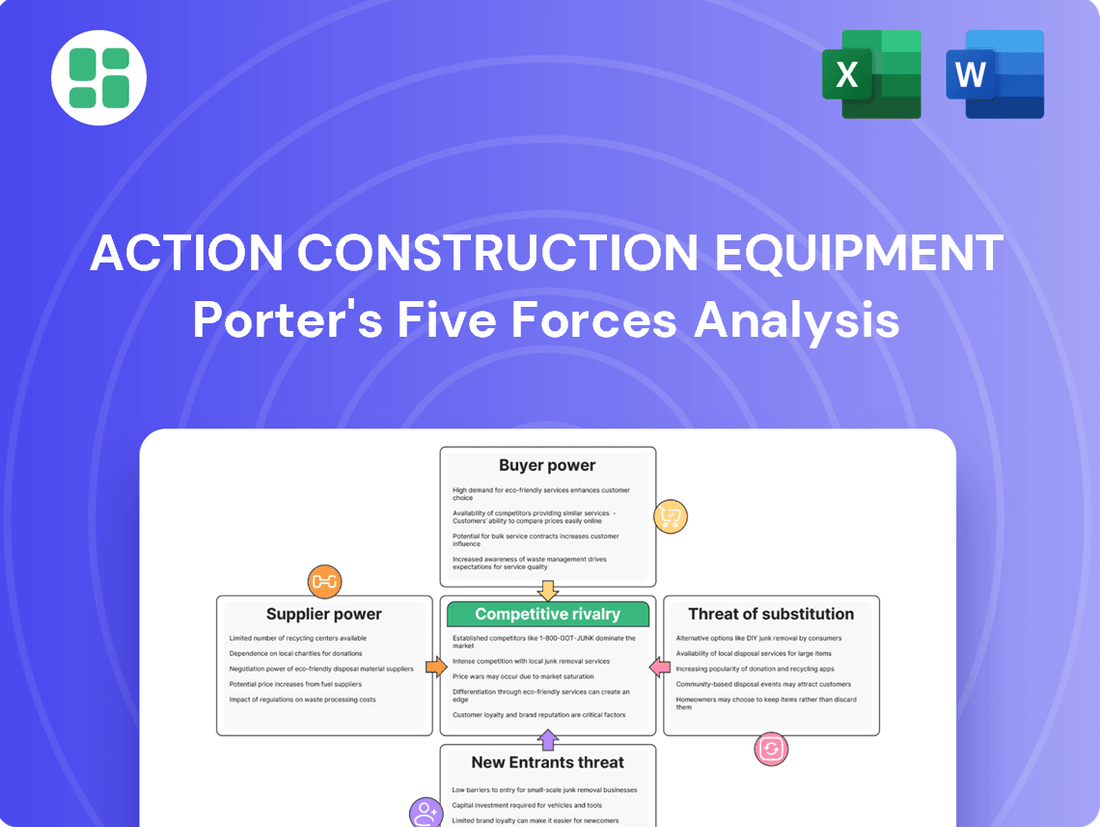

Understanding the competitive landscape for Action Construction Equipment is crucial for navigating its market. Our analysis reveals the intricate interplay of buyer power, supplier leverage, and the threat of new entrants, all of which significantly shape the industry's profitability.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Action Construction Equipment’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The construction and material handling equipment sector, including companies like Action Construction Equipment (ACE), depends heavily on specialized parts. Think hydraulic systems, engines, and high-strength steel. When only a few companies can provide these essential components, or if they hold unique technological advantages, their influence over manufacturers grows significantly.

This concentration of suppliers can directly impact ACE's bottom line. If these key component providers are few in number, they can dictate higher prices for their parts. For instance, in 2024, global supply chain disruptions for certain advanced electronic components used in heavy machinery led to an average price increase of 8-12% for affected manufacturers, illustrating the direct cost pressure from concentrated suppliers.

Furthermore, ACE might face potential disruptions if these critical suppliers experience production issues or decide to prioritize other clients. This reliance on a small pool of specialized providers creates a vulnerability in ACE's supply chain, potentially delaying production and impacting its ability to meet market demand.

The Indian construction equipment sector, including players like Action Construction Equipment (ACE), experienced significant headwinds in 2024-25. Escalating raw material costs, especially for steel and rubber, coupled with ongoing global supply chain snags, particularly from key manufacturing hubs like China and South Korea, directly impacted production expenses. This situation inherently strengthens the bargaining power of suppliers, as manufacturers face limited alternatives to mitigate these rising input costs without compromising profitability.

The upcoming Construction Equipment Vehicle Stage 5 (CEV-V) emission norms, effective January 2025, are significantly reshaping the demand landscape. Manufacturers are now actively seeking advanced, fuel-efficient, and environmentally friendly technologies, with a particular focus on electric and hybrid powertrains. This shift directly benefits suppliers who can offer these sophisticated, compliant solutions.

Suppliers possessing the capability to deliver these cutting-edge, regulatory-compliant technologies are positioned to wield considerable bargaining power. Action Construction Equipment, like other manufacturers, will find it necessary to integrate these innovations to maintain market competitiveness and adhere to stringent environmental mandates. This reliance on a smaller pool of specialized, high-tech suppliers amplifies their leverage.

Switching Costs for Manufacturers

For Action Construction Equipment (ACE), altering major component suppliers in the heavy machinery sector carries significant switching costs. These expenses encompass redesigning machinery, retooling production lines, obtaining new product certifications, and verifying that new parts meet stringent quality and performance benchmarks. For instance, a shift in hydraulic system suppliers could necessitate months of testing and validation, potentially delaying product launches and incurring substantial engineering costs.

These high switching costs inherently bolster the bargaining power of ACE's current, long-standing suppliers. When it is costly and time-consuming for ACE to find and integrate a new supplier, existing suppliers can leverage this situation to negotiate more favorable terms, potentially leading to higher component prices or less favorable payment schedules. This dynamic limits ACE's flexibility in sourcing and can impact overall cost structures.

The impact of these switching costs is evident in the capital expenditure required for supplier integration. In 2024, the average cost for recalibrating manufacturing equipment for a new component in the construction machinery industry was estimated to be between $50,000 and $250,000 per production line, not including the extensive R&D and testing phases.

- High Re-tooling Expenses: Manufacturers face significant costs in adapting production lines for new components.

- Product Certification Delays: Re-certifying heavy machinery after component changes can add months to market readiness.

- Supplier Leverage: Established suppliers benefit from ACE's high costs associated with finding and onboarding replacements.

- Impact on ACE's Flexibility: Switching costs reduce ACE's ability to quickly adapt to market price changes or seek alternative, potentially cheaper, suppliers.

Supplier's Ability to Forward Integrate

The potential for suppliers to integrate forward into manufacturing construction equipment themselves significantly bolsters their bargaining power. If a supplier can start producing the final product, they gain leverage over existing manufacturers. This threat compels companies like Action Construction Equipment to carefully manage their relationships with critical component providers, potentially leading to more favorable terms for those suppliers.

While this forward integration threat is less pronounced for highly specialized components, it remains a consideration. The substantial capital investment required for construction equipment manufacturing generally acts as a deterrent, limiting the practical ability of many suppliers to undertake such a venture. However, for suppliers of more commoditized or easily manufactured parts, this remains a more tangible possibility.

- Supplier Capability: Suppliers who can readily adapt their production processes to assemble final construction equipment gain considerable leverage.

- Market Entry Barriers: High capital requirements for manufacturing construction equipment typically limit the number of suppliers capable of forward integration.

- Strategic Implications: Manufacturers must remain vigilant about supplier capabilities to avoid unfavorable supply agreements driven by potential competition.

- Industry Trends: While not prevalent, any shift towards modular component design could potentially lower the barriers to forward integration for some suppliers.

The bargaining power of suppliers for Action Construction Equipment (ACE) is significant, particularly for specialized components like advanced hydraulic systems and engines. In 2024, global supply chain issues for critical electronic components in heavy machinery led to an average 8-12% price increase for manufacturers, highlighting supplier leverage.

High switching costs for ACE, including re-tooling and re-certification, make it difficult to change suppliers, strengthening the position of existing providers. For example, recalibrating manufacturing equipment for a new component in 2024 averaged $50,000 to $250,000 per production line.

The push for CEV-V emission norms by January 2025 also benefits suppliers offering compliant technologies, as ACE must integrate these to remain competitive, further amplifying supplier influence.

Suppliers who can provide advanced, environmentally compliant technologies for construction equipment, such as hybrid or electric powertrains, are in a strong position. ACE's need to adopt these innovations to meet upcoming regulations, like CEV-V norms effective January 2025, grants these specialized suppliers considerable bargaining power.

| Factor | Impact on ACE | Example/Data (2024-25) |

|---|---|---|

| Supplier Concentration | Limited alternatives increase supplier leverage. | Price increases of 8-12% for advanced electronic components due to supply chain issues. |

| Switching Costs | High costs for ACE to change suppliers. | $50,000 - $250,000 per production line for equipment recalibration. |

| Technological Dependency | Need for compliant, advanced components. | Demand for hybrid/electric powertrains driven by CEV-V norms (Jan 2025). |

| Forward Integration Threat | Potential for suppliers to enter ACE's market. | Generally low due to high capital investment in equipment manufacturing. |

What is included in the product

This analysis meticulously examines the competitive forces impacting Action Construction Equipment, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Action Construction Equipment's Porter's Five Forces Analysis provides a clear, one-sheet summary of all five forces, perfect for quick decision-making and understanding competitive pressures.

Customers Bargaining Power

The bargaining power of customers in the construction equipment sector is significantly influenced by large-scale infrastructure projects, particularly those driven by government demand. In India, a substantial portion of demand originates from these projects, encompassing roads, railways, and urban development initiatives.

The Union Budget 2025-26, for instance, underscores this by allocating approximately Rs 12 trillion towards infrastructure development, positioning the government as a dominant customer. This substantial commitment translates into large-volume orders, granting major infrastructure developers and government agencies considerable leverage due to the sheer scale of their procurement needs.

Action Construction Equipment (ACE) caters to a broad range of customers, from large infrastructure and government projects to agricultural and industrial sectors. For instance, in 2024, the infrastructure sector continued to be a significant driver for construction equipment demand in India, with government spending on roads and railways showing robust growth.

However, the bargaining power of customers can shift based on their price sensitivity. Smaller contractors, often facing tighter financial conditions and payment delays, are more likely to push for lower prices. This price sensitivity is amplified when financing options are constrained, increasing their leverage over suppliers like ACE.

The burgeoning rental equipment market in India, projected to grow significantly in the coming years, offers a compelling alternative for customers, especially small and medium-sized contractors, to outright equipment purchase. This accessibility to rental options directly impacts the bargaining power of customers.

The inherent flexibility and cost-effectiveness associated with renting equipment significantly lower the switching costs for customers. This ease of transition between different equipment providers, whether manufacturers or rental fleet operators, amplifies their collective bargaining power against companies like Action Construction Equipment (ACE).

ACE faces a dual competitive landscape; it must not only contend with other equipment manufacturers but also with a growing number of rental fleet operators who provide similar equipment access. In 2023, the Indian construction equipment rental market was estimated to be worth over USD 3 billion, highlighting the substantial presence of this alternative.

Standardization vs. Customization of Products

The bargaining power of customers in the construction equipment sector is significantly influenced by the degree of product standardization versus customization. For standardized offerings, such as many pick-and-carry cranes where Action Construction Equipment (ACE) has a strong market presence, customers can often find comparable alternatives from competitors. This availability of choices means customers retain a notable degree of power to negotiate prices and terms. For instance, in 2023, the Indian construction equipment market saw increased competition, with several domestic and international players vying for market share in the crane segment, potentially giving buyers more leverage.

- Standardization: In standardized segments, customers can switch between brands more easily, increasing their bargaining power.

- Customization: For highly specialized or bespoke machinery, ACE can command greater pricing power due to limited alternatives for the customer.

Conversely, when ACE provides highly customized solutions or specialized machinery designed for unique project requirements, the bargaining power shifts more towards the company. In such scenarios, the customer's alternatives are often limited, making them more reliant on ACE's specific expertise and product capabilities. This allows ACE to negotiate more favorable terms, as the cost and time associated with finding an alternative supplier for specialized equipment can be substantial.

Information Availability and Industry Consolidation Among Buyers

Customers in the construction and infrastructure sectors are increasingly informed, with readily available data on equipment performance, pricing, and service options from multiple vendors. This heightened awareness empowers them to negotiate more effectively. For instance, major infrastructure projects often involve large, consolidated buyers who can leverage their purchasing volume to secure better terms, directly impacting manufacturers like Action Construction Equipment (ACE).

While the construction equipment market can appear fragmented, the presence of large, influential buyers or consortiums significantly shifts the bargaining power towards customers. These major players can dictate terms due to their substantial order volumes. In 2024, the global construction equipment market saw continued demand, with large-scale projects in emerging economies driving significant purchasing power for major contractors.

- Informed Buyers: Access to detailed product specifications, independent reviews, and competitive pricing online allows customers to make well-researched purchasing decisions.

- Consolidated Purchasing Power: Large construction firms and government-backed infrastructure projects can aggregate their demand, creating substantial bargaining leverage.

- Demand for Transparency: Buyers expect clear pricing structures, comprehensive after-sales support, and transparent service agreements.

The bargaining power of customers for Action Construction Equipment (ACE) is moderate, influenced by government infrastructure spending and the availability of rental alternatives. While large projects and informed buyers can negotiate effectively, the demand for specialized equipment can limit customer leverage.

| Factor | Impact on ACE | Data Point (2024/2025 Projection) |

|---|---|---|

| Government Infrastructure Spending | Increases customer power due to large order volumes. | Union Budget 2025-26 infrastructure allocation: ~Rs 12 trillion. |

| Rental Market Growth | Empowers customers with alternatives, reducing switching costs. | Indian construction equipment rental market estimated over USD 3 billion (2023). |

| Product Standardization | Enhances customer power through readily available alternatives. | Increased competition in India's crane segment (2023). |

| Product Customization | Reduces customer power by limiting alternatives. | ACE's strength in specialized cranes offers pricing advantage. |

| Customer Information & Consolidation | Increases customer negotiation leverage. | Large contractors leverage purchasing volume for better terms. |

Preview the Actual Deliverable

Action Construction Equipment Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Action Construction Equipment Porter's Five Forces Analysis you see here details the industry's competitive landscape, including supplier power, buyer power, threat of new entrants, threat of substitutes, and competitive rivalry. This professionally formatted report is ready for your immediate strategic use.

Rivalry Among Competitors

The Indian construction equipment market is quite concentrated, with the top ten companies holding more than 70% of the market. This means there's a lot of competition between well-established companies. Action Construction Equipment (ACE), for instance, is a leader in cranes, especially pick-and-carry and fixed tower cranes, where it has a significant market share of 60-65%.

ACE operates in an environment where both strong Indian companies and major international players are present. This high concentration of major players intensifies rivalry, forcing companies like ACE to constantly innovate and compete on price, quality, and service to maintain their market position.

Action Construction Equipment (ACE) navigates a dynamic competitive arena, featuring both established Indian manufacturers and significant international players with a presence in India. This includes companies that import and distribute equipment, adding another layer of competition. For instance, in 2023, the Indian construction equipment market saw robust growth, with key segments like backhoe loaders being particularly competitive.

Prominent rivals such as JCB India, a strong contender in backhoe loaders, Escorts Kubota India, and global giants like Volvo Construction Equipment, Hitachi Construction Machinery, Caterpillar, and Komatsu all vie for market share. Other notable competitors include Sany Heavy Industry India, Tata Hitachi, BEML, Hyundai Construction Equipment, and Mahindra Construction Equipment, creating a multifaceted competitive environment where rivalry intensity can differ significantly depending on the specific product category.

The Indian construction equipment (CE) industry saw a modest 3% growth in 2024-25, with sales reaching 140,191 units. This represents the slowest annual growth in recent times, indicating a more measured pace for established players.

Despite this current slowdown, the future outlook for the CE market is quite promising. Projections show a robust expansion, with an anticipated Compound Annual Growth Rate (CAGR) of 8.33% from 2025 to 2030. This growth is expected to propel the market from USD 8.55 billion to USD 12.76 billion.

This significant anticipated growth, fueled by substantial infrastructure investments, naturally encourages existing companies to compete more fiercely for market share. Such a dynamic environment intensifies rivalry as firms aim to capture a larger portion of the expanding pie.

Product Differentiation and Innovation as a Competitive Edge

Competitive rivalry in the construction equipment sector is intensifying, with companies like Action Construction Equipment (ACE) heavily investing in product differentiation and innovation. This focus is driven by the need to meet evolving environmental regulations, such as the CEV Stage V emission norms, and to capture market share through superior offerings. ACE's strategic moves, including the development of India's first fully electric mobile crane and the introduction of new high-capacity cranes, underscore the critical role of technological advancement and an expanded product portfolio in this competitive landscape.

The pursuit of innovation is a key battleground for ACE and its competitors. By developing advanced technologies, particularly in electric and hybrid models, companies aim to differentiate themselves and appeal to a growing segment of environmentally conscious customers. This strategic imperative is reflected in the significant R&D expenditures across the industry, as firms strive to lead in areas like emission reduction and operational efficiency.

- Product Innovation: ACE's development of India's first fully electric mobile crane highlights a significant leap in product differentiation.

- Technology Adoption: Meeting stricter CEV Stage V emission norms necessitates investment in advanced technologies like electric and hybrid powertrains.

- Product Range Expansion: The introduction of new high-capacity cranes by ACE broadens its market appeal and competitive offering.

- R&D Investment: Companies are channeling resources into research and development to stay ahead in technological advancements and regulatory compliance.

Government Policies and Localization Efforts

Government policies are significantly shaping the competitive landscape for construction equipment manufacturers. Initiatives such as the Make in India campaign and the Production-Linked Incentive (PLI) scheme are actively encouraging domestic production and the use of locally sourced components. This focus on localization naturally intensifies competition among Indian players as they strive to capitalize on these incentives and meet growing domestic demand.

The government's strategic intent to bolster the domestic construction equipment (CE) sector is further underscored by plans for new legislation. This proposed bill aims to reduce the industry's reliance on imports, especially from China, a move that could fundamentally alter the competitive dynamics. By favoring local manufacturers, these policies create a more level playing field and potentially drive innovation within the Indian CE market.

- Government Support for Domestic Manufacturing: Programs like Make in India and PLI schemes are designed to boost local production and component sourcing.

- Intensified Local Competition: These initiatives encourage greater competition among Indian construction equipment manufacturers.

- Reduced Import Dependence: New legislation is anticipated to decrease reliance on foreign-made equipment, particularly from China.

- Reshaped Competitive Dynamics: Policy changes are expected to favor domestic players, potentially leading to a more consolidated and competitive local market.

Competitive rivalry in the Indian construction equipment market is fierce, driven by a concentrated industry structure and the presence of both strong domestic and international players. Companies like Action Construction Equipment (ACE) face intense competition, necessitating continuous innovation and strategic differentiation. The market's growth trajectory, though experiencing a slowdown in 2024-25 with 3% growth, is projected to expand significantly, fueling further competitive pressures.

| Competitor | Key Product Segments | Market Presence in India |

|---|---|---|

| JCB India | Backhoe Loaders, Excavators | Strong domestic manufacturing, significant market share |

| Escorts Kubota India | Tractors, Construction Equipment | Joint venture, expanding product portfolio |

| Volvo Construction Equipment | Heavy machinery, excavators, loaders | Global leader, premium offerings |

| Hitachi Construction Machinery | Excavators, mining equipment | Global presence, advanced technology |

| Caterpillar | Earthmoving equipment, engines | Extensive dealer network, wide product range |

| Komatsu | Excavators, dozers, mining equipment | Global player, focus on technology |

| Sany Heavy Industry India | Cranes, excavators, concrete machinery | Rapidly growing Chinese manufacturer |

| Tata Hitachi | Excavators, backhoe loaders | Joint venture, strong brand recognition |

SSubstitutes Threaten

In India, traditional labor-intensive construction methods remain a significant substitute for heavy machinery, particularly for smaller projects and in rural settings. Despite the rise of mechanization, the readily available and cost-effective manual labor force in certain segments can lessen the immediate demand for advanced construction equipment, even though this often comes with lower efficiency and longer project completion times.

The burgeoning rental market for construction and material handling equipment presents a compelling alternative to outright ownership. This trend is particularly pronounced among smaller contractors who can bypass substantial upfront capital outlays, ongoing maintenance expenses, and the inevitable depreciation associated with owning machinery.

This flexibility is a key driver, enabling businesses to adjust their fleet size according to fluctuating project demands without the burden of long-term commitments. For instance, the global construction equipment rental market was valued at approximately USD 115 billion in 2023 and is projected to grow significantly, indicating a strong preference for rental solutions over purchase for many operations.

This shift directly influences the sales of new equipment for manufacturers like Action Construction Equipment, as customers may choose to rent for specific projects rather than invest in purchasing assets that might sit idle between jobs. The convenience and cost-effectiveness of rentals can therefore act as a significant substitute, potentially dampening demand for new equipment sales.

Advances in construction techniques, like pre-fabricated and modular building, alongside new materials such as advanced concrete and specialized steel, can influence the demand for specific heavy machinery. For instance, the growing adoption of modular construction, which saw significant investment and project scaling in 2024, can reduce the on-site labor and equipment needs compared to traditional builds.

Multi-Functional and Compact Equipment

The rise of multi-functional and compact equipment presents a significant threat of substitutes for Action Construction Equipment. As urban development and smaller project sites become more prevalent, there's a growing demand for machinery that can handle diverse tasks, reducing the need for multiple specialized units. This trend directly impacts the market for single-purpose equipment, potentially diverting customer interest towards these more adaptable solutions.

These versatile machines offer compelling advantages, including cost savings and enhanced operational efficiency, making them an attractive alternative for contractors. For instance, a single compact loader with various attachments can replace a skid steer, a mini-excavator, and a forklift on certain job sites.

- Growing Market Share: The compact construction equipment market is projected to reach USD 45.2 billion by 2028, indicating strong customer adoption of these multi-functional alternatives.

- Versatility as a Key Driver: Features like quick-attach systems and interchangeable tools allow a single machine to perform tasks such as digging, lifting, grading, and demolition, directly substituting the need for separate, specialized equipment.

- Cost-Effectiveness: Acquiring and maintaining one multi-functional unit is often more economical than managing a fleet of single-purpose machines, a key consideration for budget-conscious buyers.

- Urbanization Impact: Increased construction in space-constrained urban environments favors smaller, more maneuverable, and versatile equipment, further solidifying the threat of substitution.

Digitalization and Automation in Construction Processes

While digitalization and AI in construction are still emerging in markets like India, with adoption hindered by contractor reluctance and initial costs, the long-term potential is significant. These advanced technologies could fundamentally alter project execution, offering a substitute for current methods.

The increasing integration of AI, IoT, and automation promises to streamline construction processes, potentially reducing the need for traditional heavy machinery. This evolution poses a future threat to incumbent equipment manufacturers who must adapt to these new, technology-driven approaches to remain competitive.

- Emerging Technologies: Digitalization, AI, IoT, and automation are transforming construction, offering new methods of project execution.

- Market Adoption: In India, adoption is currently limited by contractor resistance and high implementation costs, but the long-term trend is clear.

- Threat to Traditional Equipment: These technologies can optimize processes and reduce reliance on conventional heavy machinery, acting as a substitute.

- Manufacturer Imperative: Construction equipment manufacturers must innovate to keep pace with these advancements or risk becoming obsolete.

The rental market for construction equipment offers a significant substitute for outright purchase, particularly for smaller contractors who can avoid large upfront costs and maintenance burdens. This flexibility allows businesses to align their equipment needs with project demands, a trend supported by the global rental market's valuation of approximately USD 115 billion in 2023.

Advances in construction techniques, such as pre-fabricated and modular building, alongside new materials, can reduce the need for traditional heavy machinery. For instance, the increasing adoption of modular construction in 2024 has shown a trend towards lower on-site equipment requirements compared to conventional builds.

Multi-functional and compact equipment also pose a threat by substituting the need for multiple specialized units. The compact construction equipment market is projected to reach USD 45.2 billion by 2028, highlighting customer preference for versatile machinery that can perform various tasks, thereby reducing the demand for single-purpose equipment.

Emerging technologies like AI and automation in construction are poised to streamline processes, potentially decreasing reliance on conventional heavy machinery. While adoption in markets like India is currently limited by cost and contractor resistance, these advancements represent a future substitute for current construction methods.

Entrants Threaten

The construction and material handling equipment manufacturing sector is characterized by exceptionally high capital expenditure. Establishing state-of-the-art manufacturing facilities, acquiring advanced machinery, and investing in continuous research and development demand significant financial outlay. For instance, setting up a new production line for complex machinery can easily run into tens of millions of dollars.

These substantial financial prerequisites act as a formidable barrier to entry for aspiring companies. Potential new entrants must secure vast amounts of capital to even begin operations, let alone achieve economies of scale necessary to compete with established players like Action Construction Equipment (ACE). This financial hurdle effectively deters many smaller or less-funded businesses from entering the market.

The implementation of stringent regulatory standards, such as the CEV Stage V emission norms effective January 2025, necessitates substantial investment in research and development for compliance. This forces manufacturers to adapt their product designs, creating a significant barrier for new entrants who must meet these complex and costly requirements from the outset.

Established brand reputation and extensive distribution networks pose a significant barrier to new entrants in the construction equipment sector. Companies like Action Construction Equipment (ACE) have invested heavily over years, cultivating strong brand recognition and customer loyalty across India. ACE, for instance, boasts a presence in over 100 locations with 21 regional offices, a testament to its established infrastructure and reach.

Replicating such a comprehensive network and earning customer trust would be a monumental and costly undertaking for any new player. Incumbents benefit from economies of scale, which lower per-unit costs, and the advantage of providing consistent after-sales support, further solidifying their market position and deterring potential competitors.

Technological Complexity and R&D Intensity

The construction equipment sector is becoming increasingly tech-driven, with a focus on smart, connected, and eco-friendly machinery. New companies entering this market must commit substantial resources to research and development to create equipment that can compete on features like telematics, automation, and alternative power sources. For instance, the global construction equipment market saw significant investment in R&D, with major players allocating 3-5% of their revenue towards innovation in 2024, particularly in areas like electric powertrains and AI-driven diagnostics.

This high degree of technological sophistication and the rapid pace of innovation present a considerable hurdle for newcomers trying to establish a foothold. Developing advanced features and keeping pace with evolving industry standards, such as emissions regulations and connectivity protocols, requires deep technical expertise and continuous investment. The barrier to entry is further amplified by the need for robust after-sales support and service networks, which are critical for customer adoption and retention in this capital-intensive industry.

- High R&D Expenditure: New entrants face substantial upfront costs for developing advanced features and complying with evolving technological standards.

- Pace of Innovation: Rapid advancements in areas like automation and electrification require continuous investment to remain competitive.

- Technical Expertise: The need for specialized knowledge in areas like telematics and alternative fuels creates a significant knowledge gap for new players.

- Capital Intensity: Developing and manufacturing complex machinery demands significant financial resources, deterring many potential entrants.

Intense Competition and Government Support for Incumbents

The Indian construction equipment market, already a crowded space with established domestic and international giants, presents a significant barrier to new entrants. This intense competition is further amplified by government policies aimed at bolstering local manufacturers.

Initiatives like 'Make in India' and proposed legislation to boost domestic competitiveness provide substantial advantages to incumbent players. For instance, in 2023, the Indian construction equipment market was valued at approximately USD 5.1 billion, with domestic players holding a significant share.

- Dominant Market Share: A few key players, both Indian and foreign, control a substantial portion of the market, making it difficult for newcomers to gain traction.

- Government Support for Incumbents: Policies like 'Make in India' and potential new bills favor existing domestic manufacturers, offering them incentives and a more favorable operating environment.

- High Capital Requirements: Establishing manufacturing facilities, distribution networks, and brand recognition in this sector demands considerable upfront investment, deterring many potential new entrants.

The threat of new entrants for Action Construction Equipment (ACE) remains moderate due to significant barriers. High capital requirements, estimated in the tens of millions for new production lines, alongside substantial R&D investment for compliance with regulations like CEV Stage V emission norms effective January 2025, deter many. Furthermore, ACE's established brand reputation and extensive distribution network, covering over 100 locations with 21 regional offices in India, present a formidable challenge for newcomers aiming to replicate this reach and customer trust.

The increasing technological sophistication, demanding investment in areas like telematics and electrification, further elevates the entry barrier. In 2024, major players allocated 3-5% of revenue to R&D for innovations like electric powertrains. The Indian market's competitive landscape, valued at approximately USD 5.1 billion in 2023, is dominated by established players, and government initiatives like 'Make in India' also favor incumbents, making it challenging for new companies to gain market share.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Setting up manufacturing and R&D facilities requires tens of millions of dollars. | High; deters less-funded businesses. |

| Regulatory Compliance | Meeting standards like CEV Stage V emission norms (effective Jan 2025) demands significant R&D investment. | High; costly for newcomers to comply from the start. |

| Brand & Distribution | ACE's extensive network (100+ locations, 21 offices) and brand loyalty are hard to replicate. | High; requires massive investment and time to build trust and reach. |

| Technological Sophistication | Focus on telematics, automation, and electrification requires continuous R&D investment (3-5% of revenue in 2024). | High; necessitates deep technical expertise and ongoing capital outlay. |

Porter's Five Forces Analysis Data Sources

Our Action Construction Equipment Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, investor presentations, and industry-specific market research reports to capture competitive dynamics.