accesso Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

accesso Bundle

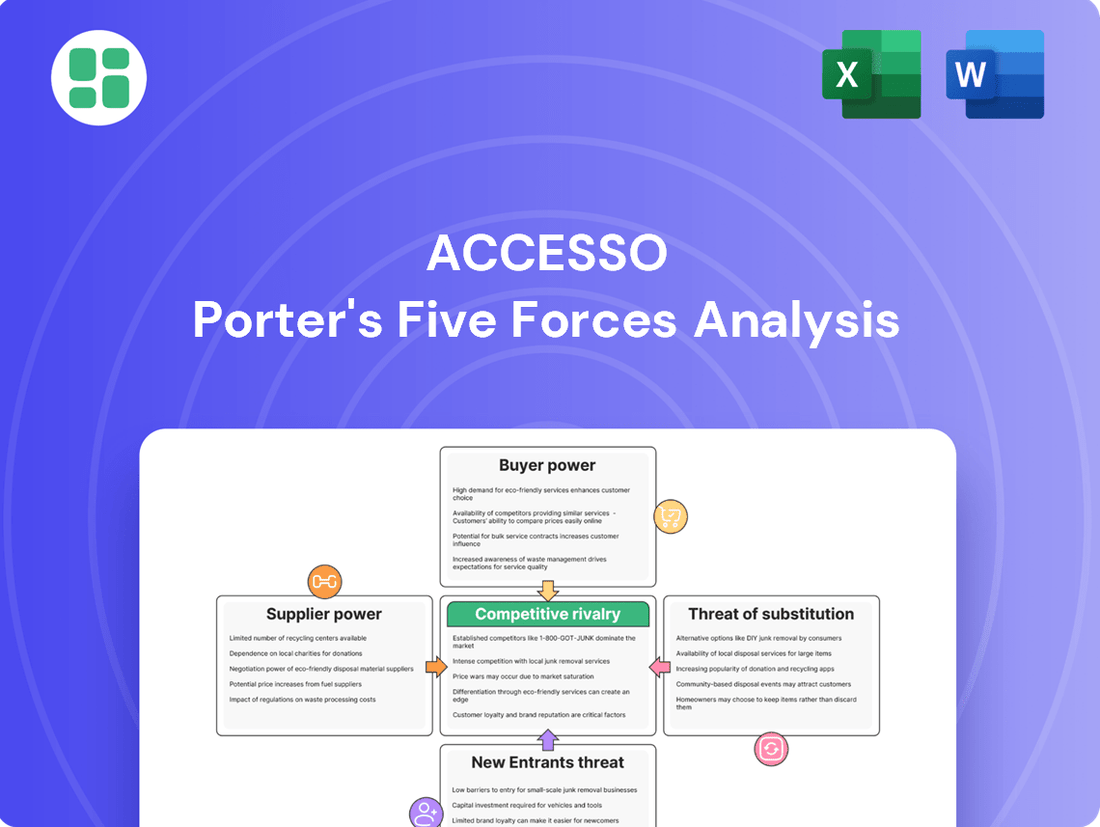

accesso operates in a dynamic market, facing pressures from rivals and the constant threat of new entrants. Understanding the bargaining power of buyers and suppliers is crucial for navigating this landscape. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore accesso’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Accesso's reliance on specialized software and hardware components significantly influences supplier bargaining power. If these components are proprietary and essential for Accesso's core ticketing, queuing, and point-of-sale systems, suppliers can exert considerable influence. This is particularly true if switching to an alternative supplier involves substantial integration costs and technical challenges, effectively locking Accesso in.

For instance, in 2024, the semiconductor industry, a key provider of hardware, continued to face supply chain complexities. Companies relying on advanced chips for their specialized equipment might experience higher component costs due to limited production capacity and high demand, thereby increasing the bargaining power of chip manufacturers.

Cloud infrastructure providers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, wield considerable bargaining power over technology companies like accesso. This is largely due to their market dominance; for instance, AWS held an estimated 31% of the cloud infrastructure market in the first quarter of 2024, with Azure at 24% and Google Cloud at 11%.

The sheer scale of these providers allows for significant economies of scale, making it difficult for smaller or niche providers to compete on price or service offerings. For accesso, deeply integrating its platforms with a specific cloud provider’s ecosystem can lead to substantial switching costs, further solidifying the provider's leverage. These costs can include data migration expenses, re-architecting applications, and retraining staff.

However, accesso can mitigate this supplier power through strategic adoption of multi-cloud strategies or by building its infrastructure with portability in mind, enabling easier migration of workloads between providers. This flexibility reduces dependence on any single vendor and enhances accesso's negotiating position.

The availability of highly skilled talent, particularly in areas like software engineering, data science, and cybersecurity, is a critical factor for accesso. These specialists are the backbone of innovation and ensuring smooth service delivery for their clients.

When demand for these specialized skills outstrips supply, employees gain considerable bargaining power. This can directly influence accesso's recruitment expenses and retention strategies, ultimately affecting operational costs.

For instance, in 2024, the average salary for a senior software engineer in the tech sector saw an increase, reflecting the ongoing demand for experienced professionals. Accesso's success in attracting and keeping these top performers is therefore essential for maintaining its competitive advantage and developing cutting-edge solutions in the ticketing and event management technology space.

Data and Analytics Tools Providers

Accesso's reliance on specialized data analytics and business intelligence tools means providers of these essential components can hold significant sway. If these tools offer unique algorithms or proprietary datasets that are difficult to replicate, their bargaining power increases. For instance, a 2024 report indicated that companies heavily dependent on AI-driven analytics saw up to a 15% increase in operational efficiency, highlighting the value of specialized analytics. The cost and complexity of integrating alternative solutions also play a crucial role in determining supplier leverage.

The bargaining power of data and analytics tool providers for Accesso is shaped by several factors:

- Uniqueness of Offering: Proprietary algorithms and exclusive data sets give suppliers an edge.

- Integration Costs: High switching costs for integrating new analytics platforms strengthen supplier positions.

- Value Addition: The direct impact of the analytics tools on Accesso's product value proposition influences supplier power.

- Market Concentration: A limited number of providers for specific, critical analytics functionalities can amplify their bargaining strength.

Payment Processing Services

For accesso, which specializes in ticketing and point-of-sale solutions, strong partnerships with payment processing services are crucial. The bargaining power these financial service providers wield is influenced by factors like the sheer volume of transactions processed, industry-standard fee arrangements, and the evolving landscape of financial regulations. A significant portion of accesso's operational costs, directly impacting its profitability, hinges on its capacity to secure advantageous terms with these essential suppliers.

The bargaining power of payment processors is generally moderate to high for companies like accesso. This is due to the essential nature of their services and the concentration of major players in the market. For instance, in 2024, the global payment processing market was valued at over $60 billion, with a few dominant firms controlling a substantial share. This market structure can limit accesso's leverage, especially if transaction volumes are not substantial enough to warrant significant discounts.

- Transaction Volume: Larger transaction volumes typically grant businesses more negotiating power with payment processors.

- Industry Fees: Standardized interchange fees and processor markups can create a baseline cost that is difficult to significantly reduce.

- Regulatory Environment: Compliance with financial regulations (e.g., PCI DSS) can add complexity and potentially increase costs, influencing supplier power.

- Competition: While the market has key players, the availability of alternative processing solutions can offer some degree of leverage for accesso.

The bargaining power of suppliers for Accesso is a significant factor influencing its operational costs and strategic flexibility. This power is amplified when suppliers offer unique, proprietary components or services that are critical to Accesso's core business functions, such as ticketing and event management software. High switching costs, market concentration among suppliers, and the essential nature of their offerings all contribute to their leverage.

In 2024, the semiconductor industry, vital for Accesso's hardware needs, continued to experience supply chain challenges. This environment allowed chip manufacturers to maintain strong pricing power due to limited capacity and robust demand, directly impacting Accesso's component acquisition costs.

Similarly, major cloud providers like AWS, which held approximately 31% of the cloud market in Q1 2024, exert considerable influence. Accesso's deep integration with these platforms creates substantial switching costs, reinforcing the providers' strong bargaining position.

| Supplier Type | Key Influence Factors | Impact on Accesso |

|---|---|---|

| Semiconductor Manufacturers | Supply chain complexity, limited capacity, high demand | Increased hardware component costs |

| Cloud Infrastructure Providers | Market dominance, economies of scale, high switching costs | Potential for higher service fees, reduced negotiation flexibility |

| Payment Processors | Market concentration, transaction volume, regulatory compliance | Pressure on transaction fees, need for advantageous terms |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to accesso's position in the ticketing and event technology industry.

Identify and quantify competitive pressures with a visual breakdown of each force—making complex market dynamics immediately actionable.

Customers Bargaining Power

Accesso's extensive product ecosystem, encompassing ticketing, virtual queuing, and guest experience solutions, becomes deeply integrated into venue operations. This integration means that switching providers involves substantial costs related to implementation, staff re-training, and data migration, as well as the inherent risk of operational disruption.

For instance, a major theme park using Accesso's full suite might face millions in costs and months of planning to transition to a new system, significantly diminishing their ability to negotiate better terms as a customer.

Accesso's customer base is remarkably varied, encompassing everything from major global theme park operators to smaller, regional zoos and museums. This diversity across different leisure and entertainment sectors means that no single customer segment holds significant sway over accesso's pricing or terms. In 2024, this broad reach across 500+ clients globally highlights a significant diffusion of purchasing power.

The sheer number of clients, spread across numerous industries, prevents any single customer or even a small group from dictating terms. This fragmentation is a key factor in limiting the collective bargaining power that customers might otherwise exert. For instance, while a large international client might represent a substantial revenue stream, they are still one among many, diminishing their ability to unilaterally influence accesso's operations.

For leisure and entertainment venues, smooth ticketing and managing visitor crowds are absolutely crucial for making money and ensuring guests have a good time. Accesso's tools aren't just nice-to-haves; they're fundamental to making these operations work well.

This dependence on Accesso's reliable services and new features means that these venues can’t easily push back on prices or terms. For instance, if a major venue experiences ticketing system failures, it can directly impact ticket sales and reputation, highlighting their reliance on a stable provider like Accesso.

Customer's Ability to Demand Customization

Customers' ability to demand customization can significantly influence accesso's profitability. While accesso's platform is robust, large or highly specialized clients may require bespoke features or unique system integrations. If accesso's revenue is heavily concentrated among a few of these demanding clients, their leverage to negotiate tailored solutions could escalate, potentially increasing development expenses or compressing profit margins. This dynamic is somewhat mitigated by the inherent flexibility and configurability built into the accesso platform.

In 2024, the trend towards hyper-personalization across industries means that customers increasingly expect solutions that precisely match their workflows. For accesso, this translates to a potential increase in requests for custom development. For instance, a major ticketing client might require integration with a specific CRM system not natively supported, or a unique reporting module. Such demands, if concentrated among a few key accounts, could shift the balance of power.

- Customization Demands: Larger clients may require unique integrations or features, increasing their bargaining power.

- Revenue Concentration Risk: Reliance on a few large clients demanding customization can impact margins.

- Platform Configurability: accesso's inherent flexibility helps to balance customer customization demands.

- Industry Trends: The growing demand for personalized solutions amplifies the potential for customer influence.

Price Sensitivity vs. Value Proposition

Customers in the leisure and entertainment sector, especially smaller venues or those with tighter budgets, often exhibit significant price sensitivity. For instance, a study by Statista in early 2024 indicated that over 60% of consumers consider price a primary factor when choosing entertainment options.

However, accesso's value proposition transcends simple cost savings. The company provides operational efficiencies, boosts guest satisfaction, and unlocks greater revenue through features like dynamic pricing and targeted upsells. This integrated approach aims to deliver a strong return on investment, making the initial and ongoing fees justifiable.

- Price Sensitivity: While price is a key consideration, especially for smaller operators, it's balanced against the tangible benefits offered.

- Value Proposition: accesso offers operational efficiencies, improved guest experience, and revenue enhancement, justifying its cost.

- ROI Focus: Customers evaluate the investment against the potential for increased revenue and reduced operational friction.

- Competitive Landscape: In 2024, the market for ticketing and access control solutions saw continued demand for integrated platforms that demonstrably improve profitability.

The bargaining power of customers for Accesso is generally low due to high switching costs and the essential nature of their services. Accesso's integrated solutions, covering ticketing, virtual queuing, and guest experience, create significant operational dependencies for venues. This means that even large clients face substantial financial and logistical hurdles when considering a change, limiting their ability to negotiate aggressively. In 2024, Accesso's broad client base of over 500 venues globally further dilutes individual customer influence.

Preview Before You Purchase

accesso Porter's Five Forces Analysis

This preview showcases the complete accesso Porter's Five Forces Analysis, offering a detailed examination of competitive and market forces. The document you see here is precisely the same professionally formatted and ready-to-use analysis that you will receive immediately after purchase, ensuring no surprises or hidden elements. You're looking at the actual document, ready for your strategic planning the moment you buy.

Rivalry Among Competitors

The market for leisure, entertainment, and cultural technology is quite fragmented, with many specialized companies alongside larger, more general software providers. This means accesso faces competition not just from direct rivals but also from broader enterprise software firms that might offer overlapping solutions.

For instance, while accesso is a significant player, numerous smaller firms excel in specific niches like advanced ticketing systems or sophisticated queue management. In 2024, the global market for event ticketing software alone was estimated to be worth billions, showcasing the depth of specialized competition accesso navigates.

This diverse competitive landscape means accesso must continually innovate and differentiate its offerings. The presence of both niche specialists and large enterprise players intensifies rivalry, particularly for clients seeking comprehensive solutions or highly specific functionalities.

Accesso differentiates itself by offering a comprehensive, integrated suite of solutions covering ticketing, point-of-sale, virtual queuing, and overall guest experience. This end-to-end approach sets it apart from competitors who might specialize in only one or two of these areas. For instance, while some rivals might offer robust ticketing, they may lack Accesso's seamless integration with virtual queuing technology, a crucial element for modern venue operations.

This broad offering significantly reduces direct competition for clients who prefer a single vendor to manage multiple operational needs. By providing a unified platform, Accesso simplifies procurement and management for its clients, making it a more attractive option than piecing together solutions from various providers. This integrated strategy is a key factor in its competitive positioning.

Competitive rivalry in the ticketing and access control sector, including companies like accesso, is intensely fueled by a relentless pursuit of innovation and the swift introduction of new features. This drive is essential to satisfy ever-changing customer expectations, with a strong emphasis on contactless solutions, seamless mobile integration, and sophisticated analytical capabilities. For instance, the demand for personalized guest experiences and real-time data insights has become a critical differentiator.

Companies that demonstrate agility in adopting emerging technological trends and delivering advanced functionalities, such as predictive analytics for managing crowd flow or tools for highly personalized guest engagement, are positioned to secure a significant competitive edge. This dynamic environment underscores the necessity for continuous research and development investment, as seen with accesso's ongoing commitment to enhancing its product suite to remain at the forefront of the industry.

Global Reach and Local Presence

Accesso's global operational footprint means it contends with a dual threat: large, established international technology firms and agile, localized competitors. This dynamic creates a complex competitive landscape where broad market penetration must be balanced against the need for granular market understanding.

While global players benefit from economies of scale and a wider client base, local competitors often possess an intrinsic advantage through their deep familiarity with specific regional market intricacies, regulatory frameworks, and entrenched client relationships. This can translate into more tailored solutions and stronger customer loyalty in those areas.

The intensity of this rivalry isn't uniform; it fluctuates considerably depending on the specific geographic markets Accesso operates within. For instance, competition might be fiercer in mature markets with established players compared to emerging markets where the landscape is still developing.

- Global Competitors: Accesso faces competition from large, multinational ticketing and technology providers with extensive resources and established global client networks.

- Local Competitors: Strong regional players often hold an advantage due to their nuanced understanding of local market demands, regulations, and existing business relationships.

- Market-Specific Rivalry: The intensity of competition varies significantly across different geographic regions, influenced by the maturity of the market and the presence of dominant local players.

- Balancing Reach and Relevance: Accesso must continually balance the benefits of its global scale against the necessity of adapting to and excelling within diverse local market conditions.

Switching Costs as a Barrier to Rivalry

The significant switching costs associated with integrating enterprise-level software, as previously noted in relation to customer bargaining power, also serve as a formidable barrier to intense competitive rivalry. This is because once a venue has committed to and implemented accesso's technology, the inherent disruption and substantial re-investment required to switch to a competitor’s offering makes it difficult for rivals to lure away these clients, even with aggressive pricing strategies.

These high switching costs create customer stickiness, effectively locking in existing clients and reducing the incentive for competitors to engage in price wars or aggressive customer acquisition tactics. For instance, in 2024, the average cost for a mid-sized business to migrate its core operational software was estimated to be upwards of $100,000, encompassing data migration, system integration, and employee retraining.

- High Integration Costs: The complex integration of accesso's software with existing venue systems (ticketing, CRM, POS) represents a substantial upfront investment for clients, making a change costly.

- Training and Familiarity: Staff become proficient with accesso's platform, and retraining on a new system incurs additional time and expense, further deterring switches.

- Data Migration Challenges: Moving large volumes of historical customer and sales data to a new platform is often complex, time-consuming, and carries a risk of data loss or corruption.

- Operational Disruption: The transition period itself can lead to operational inefficiencies and potential revenue loss, which venues aim to avoid by sticking with a proven system.

Competitive rivalry in the leisure, entertainment, and cultural technology sector is intense due to a fragmented market with both specialized niche players and broad enterprise software providers. Accesso faces competition from companies offering advanced ticketing, virtual queuing, and point-of-sale systems. The global event ticketing software market alone was valued in the billions in 2024, highlighting the depth of competition.

Accesso differentiates itself by offering an integrated, end-to-end suite of solutions, reducing direct competition for clients seeking a single vendor. This comprehensive approach, combining ticketing with virtual queuing and other guest experience technologies, sets it apart from more specialized rivals.

The drive for innovation, particularly in contactless solutions and mobile integration, fuels rivalry. Companies that quickly adopt new technologies, like predictive analytics for crowd management, gain a significant edge. Accesso’s commitment to enhancing its product suite reflects this need for continuous development.

Accesso contends with both large global technology firms and agile local competitors, each with distinct advantages. While global players leverage economies of scale, local competitors benefit from deep market understanding and established relationships, making competition vary significantly by region.

SSubstitutes Threaten

Even with the rise of digital platforms, some smaller or less tech-savvy venues still use manual ticketing, paper maps, and physical lines. These traditional methods act as a basic substitute for accesso's digital offerings. For instance, a small community theater might opt for cash-only ticket sales at the door, bypassing the need for accesso's online ticketing system.

Large entertainment groups and venue chains with substantial IT budgets may opt to build their own custom ticketing, point-of-sale (POS), and guest management systems. This approach, while requiring significant upfront investment and ongoing operational costs, offers unparalleled customization and direct control over the technology stack. For instance, in 2024, major theme park operators often invest tens of millions of dollars annually into their internal technology infrastructure, which can include bespoke software solutions that directly compete with third-party providers like accesso.

Venues might consider using off-the-shelf business software like generic Customer Relationship Management (CRM) systems or basic e-commerce platforms as substitutes for specialized ticketing and venue management solutions. These alternatives, while potentially cheaper initially, often lack the deep integration and industry-specific functionalities that accesso offers, leading to operational inefficiencies. For instance, a generic CRM might not handle the complex seating charts, dynamic pricing, or real-time capacity management crucial for large entertainment venues.

Alternative Guest Engagement Methods

The threat of substitutes for accesso's guest engagement solutions lies in less technologically advanced or non-digital methods. These can include traditional methods like relying solely on in-person staff interactions for information and assistance, or using static signage and printed materials within venues. While these approaches can be cost-effective in the short term, they typically lack the personalization, real-time data capture, and scalability that accesso's platforms provide.

For instance, venues might opt for basic website FAQs or email support instead of integrated mobile apps for ticketing and information. This bypasses the richer, data-driven insights and direct communication channels that accesso offers, potentially leading to a less dynamic and responsive guest experience. The perceived cost savings of these simpler alternatives are often offset by missed opportunities for enhanced loyalty and revenue generation.

Consider the market for event ticketing and management. While accesso offers sophisticated digital solutions, a venue could theoretically revert to entirely paper-based ticketing or manual entry systems. Such substitutes forgo the convenience of online purchases, digital wallets, and the wealth of customer data that modern platforms collect. In 2023, the global event ticketing market was valued at approximately $45 billion, with a significant portion driven by digital platforms that offer superior guest engagement.

- Reliance on Staff: Basic venues might depend entirely on front-line staff for guest inquiries and information dissemination, a substitute for digital self-service portals.

- Static Information Displays: Using printed maps, brochures, and signage instead of interactive digital displays or mobile app information.

- Basic Websites: Offering only fundamental website information rather than integrated booking, personalized recommendations, or real-time updates.

- Manual Processes: Employing paper-based ticketing or manual check-in procedures as an alternative to digital solutions.

Direct-to-Consumer Ticketing Platforms

Direct-to-consumer ticketing platforms like Eventbrite and Ticketmaster, while not direct competitors to accesso's core venue management solutions, represent a tangential threat. These platforms can reduce a venue's perceived need for sophisticated in-house ticketing infrastructure by offering a seemingly simpler, end-user focused solution. In 2023, the global event ticketing market was valued at over $50 billion, highlighting the scale of this sector.

However, accesso differentiates itself by providing a comprehensive operational management suite for venues, extending far beyond simple ticket sales. This includes areas like CRM, marketing automation, and on-site operations, which direct-to-consumer platforms typically do not address. While a platform might handle ticket processing, it doesn't solve the venue's broader operational challenges.

- Tangential Threat: Direct-to-consumer platforms can be seen as substitutes for a venue's ticketing function.

- Market Size: The global event ticketing market exceeded $50 billion in 2023.

- Accesso's Value Proposition: Accesso offers integrated venue management, not just ticket sales.

- Differentiation: Accesso's solutions encompass CRM, marketing, and on-site operations, which consumer platforms lack.

The threat of substitutes for accesso's offerings primarily stems from simpler, less integrated, or even manual alternatives. These can range from basic website FAQs and email support to entirely paper-based ticketing and manual entry systems, bypassing the richer data and convenience of digital platforms. In 2023, the global event ticketing market, valued at over $50 billion, showcased the significant shift towards digital solutions, yet these lower-tech substitutes still exist.

Major entertainment groups with substantial IT budgets may also develop their own custom systems, a significant substitute for third-party providers. For example, in 2024, large theme park operators often allocate tens of millions of dollars to internal technology infrastructure, creating bespoke software that directly competes with solutions like those offered by accesso.

| Substitute Type | Description | Example Scenario |

|---|---|---|

| Manual/Low-Tech | Paper tickets, cash-only sales, printed maps, in-person assistance. | A small community theater using cash at the door for tickets. |

| Off-the-Shelf Software | Generic CRMs, basic e-commerce platforms. | Using a standard CRM instead of specialized ticketing software for complex seating. |

| In-House Development | Custom-built ticketing and management systems. | A major theme park operator investing millions in proprietary software. |

| Direct-to-Consumer Platforms | Eventbrite, Ticketmaster (for ticketing function). | Venues relying on external platforms for ticket sales, reducing perceived need for internal systems. |

Entrants Threaten

The significant capital required for research and development presents a substantial barrier to entry. Developing a full technology suite for the leisure and entertainment industry, covering everything from ticketing to guest experience, demands considerable upfront investment in software creation and ongoing innovation. For instance, in 2024, major tech companies in adjacent sectors reported R&D spending in the billions, indicating the scale of investment needed to even approach parity with established players.

The need for specialized industry expertise acts as a significant barrier to entry for potential competitors. Success in this niche market, particularly for companies like accesso, requires a deep understanding of the unique operational complexities, visitor flow dynamics, and stringent regulatory requirements specific to theme parks, zoos, museums, and sporting events.

New entrants would face considerable challenges in acquiring this specialized knowledge and developing tailored solutions without substantial time and financial investment. For instance, a new player would need to navigate the intricate ticketing systems for events like the 2024 Paris Olympics or understand the seasonal demand patterns of major amusement parks, which took established players years to master.

Accesso's established client relationships and strong reputation act as a significant deterrent to new entrants. Over years of operation, the company has cultivated trust and proven reliability with a diverse global clientele. Newcomers would need to invest heavily in building similar credibility and demonstrating their ability to integrate seamlessly with existing venue systems, a considerable challenge against incumbents with proven track records.

Economies of Scale and Network Effects

Economies of scale present a significant barrier for potential new entrants into the ticketing and event management industry, where accesso operates. By serving a vast network of venues, accesso achieves lower per-unit costs in critical areas like software development, customer support, and the maintenance of its technological infrastructure. For instance, in 2024, major players in the ticketing software space often reported significant R&D investments, with companies like Live Nation Entertainment (which owns Ticketmaster) allocating substantial capital towards platform enhancements, a cost burden new, smaller entrants would struggle to match.

Network effects further solidify accesso's competitive position. As more venues utilize accesso's platforms, the aggregated data becomes more valuable, enabling richer industry insights and the refinement of best practices. This creates a virtuous cycle where increased adoption leads to improved service offerings, making it harder for newcomers to compete. A hypothetical new entrant would face the challenge of building a comparable data set and demonstrating equivalent analytical capabilities without an established user base.

These combined advantages mean that new entrants would likely face higher operational costs and offer less sophisticated, data-driven solutions compared to accesso. This disparity in scale and network benefits creates a formidable hurdle, significantly deterring new companies from entering the market.

- Economies of Scale: Reduced per-unit costs in software development, support, and infrastructure due to accesso's large customer base.

- Network Effects: Increased value of aggregated data and industry best practices as more venues adopt accesso's platforms.

- Barrier to Entry: New entrants would struggle to match accesso's cost efficiencies and data-driven capabilities.

Regulatory and Compliance Hurdles

The threat of new entrants in the ticketing and payment processing sector is significantly dampened by substantial regulatory and compliance hurdles. Operating in these domains requires meticulous adherence to a complex web of rules. For instance, data privacy regulations like GDPR and CCPA demand robust data protection measures, while PCI compliance is non-negotiable for handling payment card information.

New players must allocate considerable resources to ensure their systems meet these rigorous standards, creating a high barrier to entry. In 2024, the ongoing evolution of data security mandates and the increasing stringency of financial regulations continue to elevate these compliance costs, making it challenging for aspiring companies to establish a foothold without significant upfront investment and expertise.

- Data Privacy Laws: Compliance with GDPR and CCPA requires substantial investment in secure data handling and user consent mechanisms.

- Payment Card Industry (PCI) Compliance: Meeting PCI DSS standards involves costly security audits and continuous monitoring.

- Local and International Regulations: Navigating diverse regulatory landscapes across different jurisdictions adds layers of complexity and expense.

- Increased Enforcement: Regulatory bodies are enhancing enforcement actions, making non-compliance a greater financial risk for new entrants.

The threat of new entrants is considerably low due to high capital requirements for R&D and technology development, as seen in the billions spent by major tech firms in 2024. Specialized industry expertise, crucial for understanding venue operations and regulations, takes years to acquire, posing another significant barrier. Established client relationships and strong reputations, built over time, also deter newcomers who would need to invest heavily in trust and integration capabilities.

Economies of scale, achieved by accesso through its large client network, lead to lower per-unit costs in development and support, a level difficult for new entrants to match, especially considering the substantial R&D investments by industry leaders like Ticketmaster in 2024. Furthermore, network effects, where more users increase data value and refine best practices, create a virtuous cycle that new players struggle to replicate. These combined factors result in higher operational costs and less sophisticated offerings for potential competitors, effectively limiting new market entry.

Regulatory and compliance hurdles, including data privacy laws like GDPR and CCPA, and PCI DSS compliance for payment processing, represent substantial barriers. New entrants must invest heavily in secure systems and expertise to meet these evolving standards, with increased enforcement in 2024 raising the financial risk of non-compliance. Navigating diverse local and international regulations further adds complexity and expense, making it challenging for new companies to establish a foothold.

| Barrier Type | Description | Impact on New Entrants | Relevant 2024 Data/Context |

|---|---|---|---|

| Capital Requirements | High investment needed for R&D, technology development, and infrastructure. | Deters companies lacking significant funding. | Major tech companies' R&D spending in billions in adjacent sectors. |

| Specialized Expertise | Deep understanding of leisure and entertainment industry operations, regulations, and visitor dynamics. | Requires extensive time and financial investment to acquire. | New entrants would need to master complex ticketing for events like the 2024 Paris Olympics. |

| Established Relationships | Proven track record and trust with a global clientele. | Newcomers must invest heavily to build similar credibility. | Incumbents have years of experience integrating with venue systems. |

| Economies of Scale | Lower per-unit costs due to large customer base in development, support, and infrastructure. | New entrants struggle to match cost efficiencies. | Live Nation Entertainment (Ticketmaster) R&D investments in platform enhancements. |

| Network Effects | Increased data value and refined best practices with more platform adoption. | New entrants lack established user base and comparable analytical capabilities. | Hypothetical challenge for new players to build comparable data sets. |

| Regulatory Compliance | Adherence to data privacy (GDPR, CCPA) and payment security (PCI DSS) standards. | Requires costly upfront investment in systems and expertise. | Evolving data security mandates and stringent financial regulations increase compliance costs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from industry-specific market research reports, financial statements of key players, and publicly available company disclosures to provide a comprehensive view of competitive dynamics.