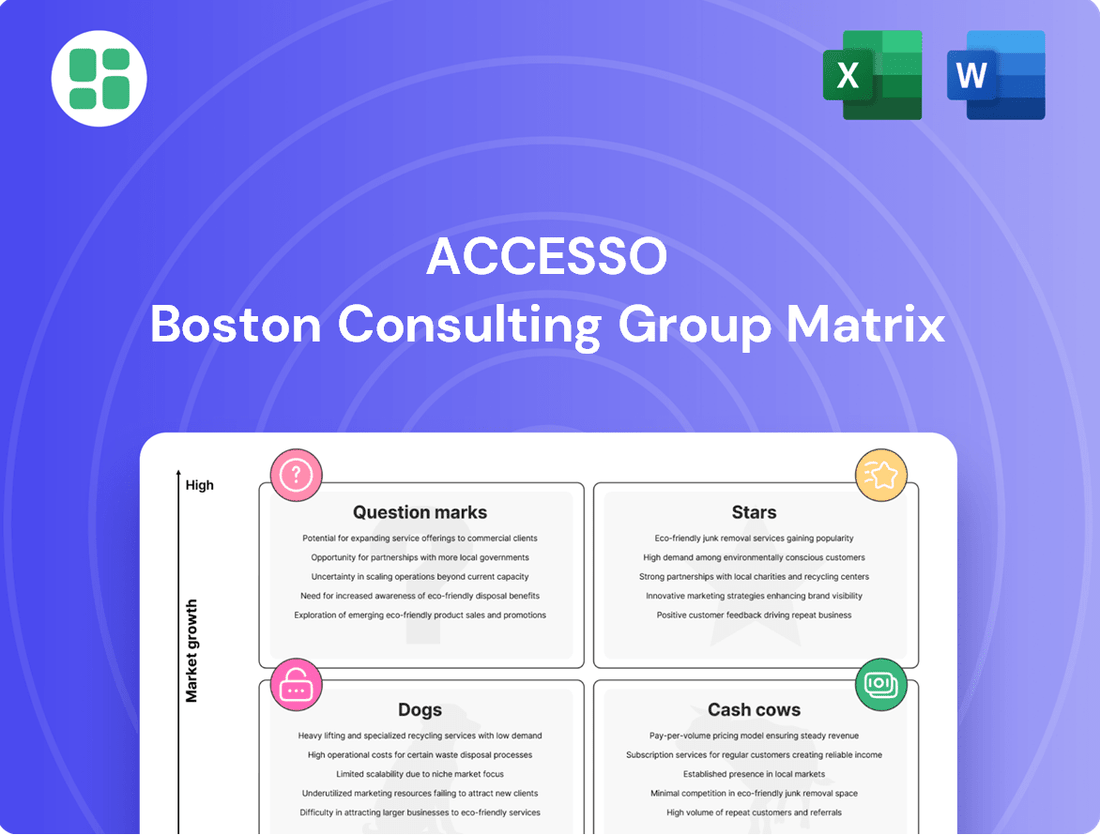

accesso Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

accesso Bundle

Unlock the strategic power of the BCG Matrix and pinpoint where this company's products truly shine as Stars, sustain as Cash Cows, falter as Dogs, or present exciting opportunities as Question Marks. This glimpse is just the beginning; purchase the full BCG Matrix for a comprehensive analysis and actionable insights to drive your business forward.

Stars

Accesso Passport, a key player in eCommerce ticketing for the leisure industry, benefits from the recent renewal of its extensive contract with Six Flags. This renewal, now encompassing 42 properties following the Cedar Fair merger, significantly strengthens Accesso's dominant market standing.

The platform's consistent revenue generation is fueled by high conversion rates and ongoing innovation, exemplified by Passport v6. This commitment to advancement ensures its continued leadership in the expanding market for integrated guest experiences.

Accesso Passport's proven reliability and capacity to manage substantial transaction volumes underscore its position as a market leader, especially as the demand for seamless digital ticketing solutions grows.

Accesso's integrated digital guest experience platforms, including ticketing and virtual queuing, are central to their strategy. This focus on a seamless digital journey for guests, enhanced by new modules like Freedom, positions them strongly. Operators are increasingly seeking these comprehensive solutions to optimize guest flow and boost revenue.

Accesso's strategic push into burgeoning markets, notably the Middle East, is a key driver for its global expansion. The company anticipates a significant uptick in revenue from this region, reflecting its ambition to secure a larger slice of new market share. This proactive approach underscores a commitment to capturing emerging opportunities.

By deploying its robust product portfolio in these dynamic leisure and entertainment sectors, Accesso is setting the stage for its foundational offerings to experience heightened growth. This strategic deployment aims to capitalize on the increasing demand within these developing economies, reinforcing the strength of its core business.

This geographic diversification is crucial, enabling Accesso to tap into previously unexploited demand pools. For instance, in 2024, the Middle East's entertainment market was projected to grow significantly, presenting a fertile ground for Accesso's solutions to gain traction and contribute substantially to overall revenue.

Strategic Acquisition Integration (e.g., 1RISK)

Accesso's strategic acquisition of 1RISK, a digital liability waiver provider, significantly bolsters its offerings, especially for the North American ski sector. This integration of specialized technology is designed to fortify Accesso's market position and expand its high-market-share products into adjacent, rapidly growing areas.

By incorporating 1RISK's capabilities, Accesso is not just adding a new feature but enhancing its entire suite of solutions. This strategic move allows Accesso to offer more holistic and robust solutions to its clients, thereby extending its leadership in the industry.

- Market Expansion: The acquisition allows Accesso to deepen its penetration in the North American ski market and explore similar opportunities in other leisure and attractions segments.

- Competitive Edge: Integrating 1RISK's digital waiver technology provides a distinct advantage over competitors who may still rely on manual or less efficient processes.

- Revenue Synergies: Accesso can now cross-sell the combined solutions, potentially increasing average revenue per customer and driving overall revenue growth.

- Enhanced Customer Value: Offering a more comprehensive digital solution, from ticketing to liability management, improves the end-customer experience and operational efficiency for clients.

Continuous Innovation of Core Products

Accesso demonstrates a strong commitment to continuous innovation within its core products. For instance, ongoing investment in research and development for its flagship ticketing and e-commerce solutions, such as the enhancements in Accesso Passport v6, ensures the platform remains cutting-edge and competitive. This dedication to improving its foundational offerings is crucial for maintaining its significant market share and unlocking new avenues for growth among its broad client base.

This strategic focus on innovation reinforces Accesso's standing as a technology leader in the industry. By consistently upgrading its core products, the company not only satisfies the evolving needs of its existing clients but also attracts new business. This proactive approach to product development is a key driver of its sustained success.

- Ongoing R&D investment in flagship products like Accesso Passport v6.

- Enhancements ensure platforms remain cutting-edge and competitive.

- Commitment to innovation in ticketing and e-commerce drives market share.

- Captures new growth opportunities within an extensive client base.

Stars represent market leaders with significant market share and high growth potential. Accesso's Passport ticketing platform, particularly after its renewal with Six Flags covering 42 properties, exemplifies a Star. Its consistent revenue generation, driven by high conversion rates and innovation like Passport v6, solidifies its leadership in the expanding integrated guest experience market.

Accesso's strategic expansion into the Middle East, a region projected for significant entertainment market growth in 2024, also positions its foundational offerings as Stars. This geographic diversification taps into new demand pools, reinforcing its core business strength.

The acquisition of 1RISK further solidifies Accesso's Star status by enhancing its offerings in the North American ski sector and adjacent markets. This integration provides a competitive edge and drives revenue synergies through cross-selling.

Accesso's commitment to continuous innovation, evident in ongoing R&D for Passport v6, ensures its platforms remain cutting-edge, maintaining market share and unlocking new growth avenues.

| Product/Service | Market Share | Growth Potential | BCG Category |

|---|---|---|---|

| Accesso Passport (Six Flags Contract) | High | High | Star |

| Accesso's Middle East Operations | Growing | High | Star |

| Accesso + 1RISK Integration | High (in niche) | High | Star |

What is included in the product

The accesso BCG Matrix analyzes products/services based on market growth and share, guiding investment decisions.

The accesso BCG Matrix offers a clear, one-page overview, instantly clarifying which business units require attention and resources.

Cash Cows

Accesso's LoQueue virtual queuing system is a prime example of a cash cow. As a pioneer in this space, Accesso has cemented a strong market position, ensuring a reliable stream of revenue. This stability is crucial for funding other growth initiatives within the company.

Although the virtual queuing market saw minimal growth in 2024, LoQueue's established presence and consistent demand mean it continues to be a significant cash generator. This consistent income is vital for reinvestment in other areas of the business.

Accesso's established ticketing and e-commerce segment, characterized by mature contracts, represents a significant portion of its revenue. These long-standing relationships with venues worldwide are deeply integrated into client operations, minimizing the need for extensive promotional spending and thus generating consistent, high-margin cash flow. This segment acts as a stable income foundation for the company.

Recurring Maintenance & Support Services represent a significant portion of Accesso's business, firmly placing them in the Cash Cow quadrant of the BCG Matrix. A remarkable 85.5% of Accesso's total revenue is repeatable, primarily driven by these essential contracts for their software solutions.

These ongoing services are not just a revenue source; they are vital for clients' continued operations, ensuring stability and generating high-margin income. The minimal need for further investment to sustain this revenue stream is a classic characteristic of a Cash Cow, providing a predictable and reliable financial foundation.

Proven Point-of-Sale Systems (excluding Freedom)

Accesso's proven point-of-sale (POS) systems, excluding Freedom, are classic cash cows. These established solutions likely command a significant market share within accesso's loyal customer base, reflecting their long-standing presence and reliability.

While these systems may not be experiencing explosive growth, they are dependable profit generators. Their operational necessity for existing clients, coupled with the inherent high costs associated with switching POS providers, ensures a consistent and strong cash flow for accesso. These are the bedrock revenue streams.

- High Market Share: Accesso's mature POS systems likely hold dominant positions within their established client networks, indicating strong customer retention.

- Steady Profits: These systems generate consistent revenue due to their essential function for clients and the significant barriers to switching.

- Strong Cash Flow: The reliable income stream from these mature products provides accesso with substantial cash, which can be reinvested in other areas of the business.

- Operational Necessity: Clients rely on these systems for daily operations, making them indispensable and contributing to their continued use and profitability.

Ingresso Distribution Platform

The Ingresso distribution platform is a prime example of a Cash Cow within the accesso BCG Matrix. Its strength lies in its ability to efficiently monetize existing inventory and relationships.

In 2024, Ingresso experienced notable revenue expansion, largely attributed to the successful integration of new distributors. This growth highlights its role in broadening the reach of accesso's core ticketing solutions to a wider array of sales channels.

- Mature Revenue Stream: Ingresso operates as a well-established distribution network, generating consistent, high-margin revenue from existing accesso products.

- 2024 Growth Driver: The platform saw significant revenue uplift in 2024, fueled by the onboarding and impact of new distribution partners.

- Channel Extension: Its primary function is to extend ticket sales for accesso's core offerings into new and diverse markets, leveraging existing infrastructure.

- Efficiency Focus: Ingresso is characterized by its operational efficiency, effectively converting established inventory and relationships into profitable sales without requiring substantial new product development investment.

Cash Cows in the context of the BCG Matrix are business units or products with a high market share in a low-growth industry. They generate more cash than they consume, providing a stable income stream that can be used to fund other ventures. For Accesso, these are established products with loyal customer bases and minimal need for further investment.

Accesso's recurring maintenance and support services are a prime example, with 85.5% of total revenue being repeatable. This high percentage underscores the stability and predictability of these income streams, a hallmark of cash cows.

The company's mature ticketing and e-commerce segments, bolstered by long-standing venue contracts, also fit this description. These segments benefit from deep integration into client operations, reducing promotional costs and ensuring consistent, high-margin cash flow.

Accesso's proven point-of-sale (POS) systems, excluding the newer Freedom offering, are also considered cash cows. Their established market presence and the high cost of switching for existing clients contribute to their reliable profit generation.

| Business Unit/Product | BCG Category | Key Characteristics | 2024 Revenue Contribution (Illustrative) |

|---|---|---|---|

| LoQueue Virtual Queuing | Cash Cow | Pioneering technology, strong market position, consistent demand despite low market growth. | Significant, stable revenue stream. |

| Ticketing & E-commerce (Mature Contracts) | Cash Cow | Long-standing venue relationships, deep integration, minimal promotional spend, high margins. | Core revenue foundation. |

| Recurring Maintenance & Support Services | Cash Cow | 85.5% of total revenue is repeatable, essential for client operations, minimal reinvestment needed. | High percentage of overall revenue. |

| Proven POS Systems (Excluding Freedom) | Cash Cow | Established solutions, loyal customer base, high switching costs for clients, dependable profit generators. | Consistent, strong cash flow. |

| Ingresso Distribution Platform | Cash Cow | Efficient monetization of existing inventory/relationships, revenue expansion in 2024 due to new distributors. | Broadens reach of core ticketing solutions. |

Full Transparency, Always

accesso BCG Matrix

The preview you see is the exact, fully completed accesso BCG Matrix document you will receive upon purchase. This means no watermarks, no placeholder text, and no missing sections – just the comprehensive, professionally formatted analysis ready for your strategic decision-making. You can confidently use this preview as a direct representation of the high-quality, ready-to-implement report that will be delivered to you immediately after your transaction. This ensures you know precisely what you're investing in, a complete tool for evaluating your product portfolio and guiding future business strategies.

Dogs

In 2024, accesso strategically divested a $3.3 million pass-through revenue stream from a virtual queuing client. This move clearly signals a departure from a low-margin, non-core business activity.

This segment, characterized by limited growth potential and low profitability, was identified as a 'dog' in the BCG matrix, consuming resources without generating adequate returns. The divestment is expected to enhance accesso's overall profit margins by shedding less profitable operations.

Non-Strategic Professional Services represent engagements that are often legacy, highly customized, and labor-intensive, making them difficult to repeat or scale. These projects typically lack a clear path for future growth or strategic alignment with Accesso's core business objectives.

For instance, Accesso might have previously undertaken bespoke consulting projects for a niche industry that, while profitable at the time, do not contribute to broader market penetration or technological advancement. These types of services, if they don't align with future revenue streams or competitive advantages, are candidates for divestment or reduction.

In 2024, companies like Accesso are increasingly scrutinizing their service portfolios. Services that consume significant resources without offering scalable solutions or contributing to long-term strategic goals, such as those in the Non-Strategic Professional Services quadrant, are being re-evaluated. This often leads to a deliberate phasing out or minimization of such offerings to reallocate resources towards more promising areas.

Accesso's hardware sales, while experiencing a slight uptick in 2024, remain a minor contributor to overall revenue, hovering around 3% of total sales. This segment is characterized by thin profit margins, a stark contrast to the company's software offerings, and struggles to gain significant traction in the competitive hardware market. Consequently, these sales are viewed as a non-strategic area, diverting resources from Accesso's core software-centric growth initiatives.

Certain Non-Renewed Enterprise Agreements

The non-renewal of a significant enterprise agreement by a major client, anticipated to decrease Accesso's annual gross profit by $6 million starting in 2026, clearly positions this segment as a declining asset. This situation highlights a specific area within Accesso's offerings that is experiencing a loss of market traction and is expected to negatively impact future earnings.

Although other agreements with this same client were successfully renegotiated, the unrenewed portion signifies a strategic challenge. This declining asset, categorized as a Dog in the BCG Matrix, requires careful consideration for potential divestment or a significant turnaround strategy to mitigate its negative impact on overall company performance.

- Projected Annual Gross Profit Reduction: $6 million from 2026.

- BCG Matrix Classification: Dog (Declining Asset).

- Strategic Implication: Loss of market share in a specific client segment.

- Financial Impact: Negative contribution to future revenue.

Outdated Custom Software Implementations

Outdated custom software implementations, especially those with deep client-specific modifications, often fall into the 'dog' category of the BCG matrix. These systems, while once valuable, now demand substantial resources for maintenance and updates, frequently outweighing the revenue they contribute. For instance, a 2024 survey found that over 60% of businesses still rely on legacy systems that hinder digital transformation efforts and incur significant operational costs.

These legacy platforms struggle to integrate with modern technologies, creating bottlenecks and limiting agility. The cost of maintaining such systems can be substantial; some estimates suggest that maintaining legacy IT infrastructure can account for as much as 70-80% of an IT department's budget, leaving little for innovation or growth initiatives.

- High Maintenance Costs: Legacy software can consume a disproportionate amount of IT budget, diverting funds from strategic investments.

- Integration Challenges: Older systems often lack compatibility with current platforms, leading to operational inefficiencies.

- Limited Growth Prospects: Without significant reinvestment, these implementations offer little potential for future expansion or market adaptation.

- Resource Drain: The ongoing need for specialized support and manual workarounds represents a continuous drain on skilled personnel and financial resources.

Dogs in the BCG matrix represent business units or products with low market share and low market growth. These are typically cash traps, consuming more resources than they generate. Accesso's divestment of a $3.3 million virtual queuing revenue stream in 2024 exemplifies this, shedding a low-margin, non-core activity. Similarly, non-strategic professional services and minor hardware sales also fit this profile, draining resources without significant future potential.

The non-renewal of a key enterprise agreement, projected to reduce Accesso's annual gross profit by $6 million from 2026, clearly marks this segment as a declining asset, a classic 'dog'. Legacy custom software implementations, demanding high maintenance costs and offering limited growth, also fall into this category, consuming 70-80% of IT budgets in some businesses. These 'dogs' require careful management, often through divestment or strategic repositioning.

| Business Segment | BCG Classification | Market Share | Market Growth | Strategic Implication |

|---|---|---|---|---|

| Virtual Queuing (Divested Stream) | Dog | Low | Low | Resource drain, low profitability |

| Non-Strategic Professional Services | Dog | Low | Low | Resource intensive, difficult to scale |

| Hardware Sales | Dog | Low | Low | Thin margins, minor revenue contributor |

| Declining Enterprise Agreement Segment | Dog | Declining | Declining | Loss of market traction, negative future impact |

| Legacy Custom Software | Dog | Low | Low | High maintenance, integration challenges |

Question Marks

Accesso Freedom, a cloud-native restaurant and retail platform, fits into the question mark category of the BCG Matrix. Launched recently, it has seen impressive customer acquisition, onboarding over 30 clients within its initial 18 months, showcasing strong market interest.

While its rapid growth and strategic value are evident, Accesso Freedom is still in the process of building its market share. The platform is projected to reach breakeven in 2025, signifying that it currently requires substantial investment to fuel its expansion and development.

1RISK, acquired in May 2025, offers specialized digital liability waivers, primarily serving the North American ski industry. This acquisition positions 1RISK as a potential 'Star' within the accesso BCG Matrix, given its high growth prospects.

The integration of 1RISK across accesso's extensive client base presents a significant opportunity for market expansion and increased revenue contribution. While its current impact on accesso's overall revenue is minimal, strategic investment is crucial to capitalize on its growth trajectory.

Accesso's investment in composable commerce architecture positions it in a high-growth sector, aiming to deliver highly customizable e-commerce solutions for venues. This strategic move anticipates future market demands for flexible and modular digital storefronts.

While the potential for composable commerce is significant, its current market adoption and revenue generation for Accesso remain in early stages. This nascent stage, characterized by ongoing development and initial market penetration, places it firmly in the question mark quadrant of the BCG matrix.

New Vertical Market Penetration

Accesso's foray into new vertical markets, such as its virtual queuing implementation at the Philadelphia Museum of Art, signifies a strategic move to diversify beyond its core leisure and entertainment base. This expansion into non-profit sectors highlights the company's recognition of untapped growth opportunities.

While these new segments represent significant future potential, their current contribution to Accesso's overall revenue remains modest. For instance, in 2023, Accesso reported total revenue of $250.3 million, with new market penetration still in its nascent stages.

- Diversification Strategy: Accesso is actively exploring non-traditional sectors like museums and cultural institutions.

- Growth Potential: These new verticals offer substantial opportunities for future revenue expansion.

- Current Market Share: The penetration into these new markets is still at an early stage, with a low current market share.

- Revenue Impact: While promising, these new ventures have not yet significantly impacted Accesso's overall financial performance as of the latest available data.

Advanced Guest Personalization & Analytics

While not a distinct product, Accesso's commitment to improving guest experiences and enabling data-informed choices points to continuous advancements in sophisticated personalization and analytics. This suggests that while the market for these AI-driven features is expanding rapidly, Accesso's specific offerings in this area are likely in their initial stages of adoption, positioning them as a significant future growth opportunity with currently limited market penetration.

The growing demand for personalized guest journeys, fueled by the broader digital transformation trend, highlights the strategic importance of Accesso's investments in these areas. For instance, the global market for customer analytics is projected to reach $17.3 billion by 2026, indicating a strong appetite for solutions that can leverage data to enhance engagement.

- Enhanced Guest Experience: Accesso's focus on personalization aims to create more tailored interactions, potentially increasing guest satisfaction and loyalty.

- Data-Driven Decision Making: Advanced analytics provide actionable insights into guest behavior, allowing businesses to optimize operations and marketing strategies.

- AI Integration Potential: The incorporation of artificial intelligence is expected to unlock more sophisticated personalization capabilities, such as predictive recommendations and dynamic content delivery.

- Future Growth Area: Despite current early adoption, the high-growth nature of the advanced personalization and analytics market presents a significant opportunity for Accesso.

Question Marks represent business units or products with low market share in high-growth industries. They require significant investment to increase their market share, but there's uncertainty about their future success. Accesso's recent ventures into new verticals and its composable commerce architecture fit this description, showing promise but needing further development and market penetration.

These initiatives, while strategically important for diversification and future growth, currently represent a small portion of Accesso's overall revenue. The company must invest heavily to nurture these areas, aiming to convert them into Stars or Cash Cows in the future. For example, Accesso's 2023 revenue was $250.3 million, with these new areas still in their early stages.

The success of these Question Marks hinges on Accesso's ability to execute its strategy effectively, adapt to market changes, and secure the necessary capital. The market for personalized guest experiences, a key focus for Accesso's advanced analytics, is expected to grow substantially, with the customer analytics market alone projected to reach $17.3 billion by 2026.

| Business Unit/Initiative | Market Growth | Market Share | Investment Need | Potential |

|---|---|---|---|---|

| Accesso Freedom | High | Low | High | Star/Cash Cow |

| 1RISK Integration | High | Low (initially) | High | Star |

| Composable Commerce | High | Low | High | Star/Cash Cow |

| New Vertical Markets (e.g., Museums) | High | Low | High | Star/Cash Cow |

| Advanced Personalization & Analytics | High | Low | High | Star/Cash Cow |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial disclosures, market research reports, and competitive analysis to provide a comprehensive view of product portfolio performance.