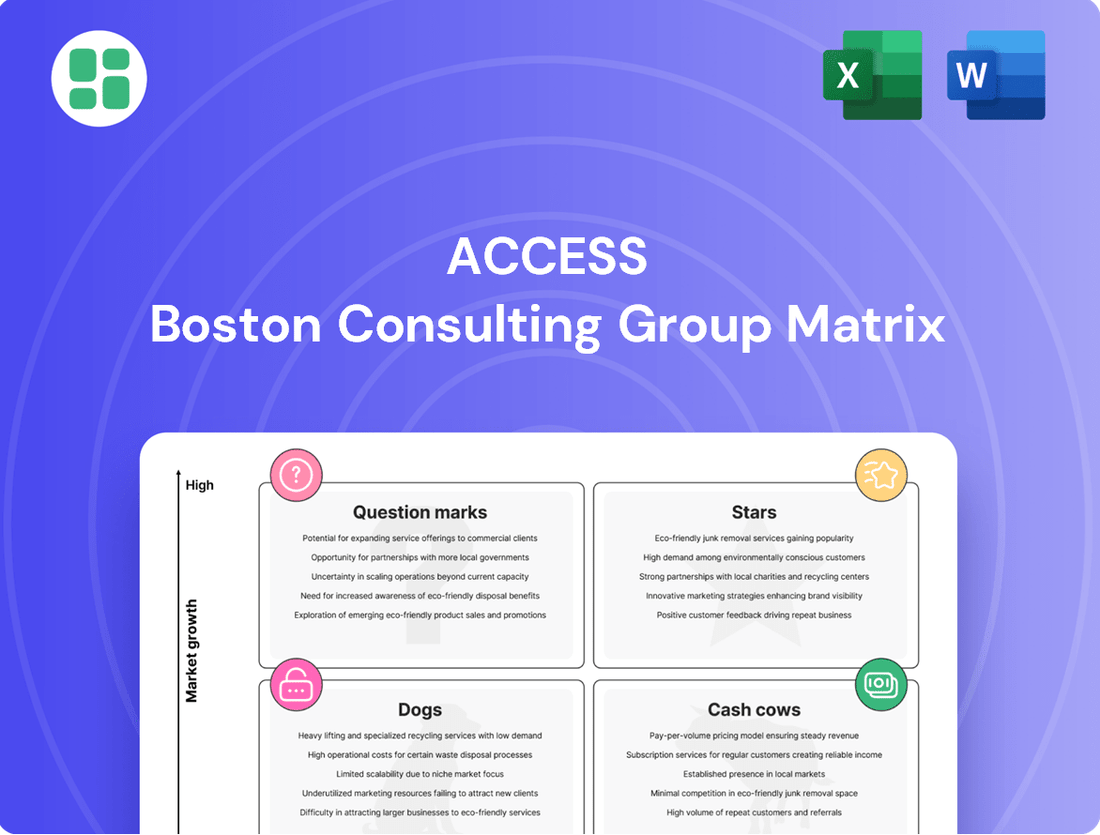

ACCESS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACCESS Bundle

Unlock the strategic potential of your product portfolio with the ACCESS BCG Matrix. This powerful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a clear visual of market share and growth potential.

Understand which products are driving growth and which are stagnating, enabling informed decisions about resource allocation and future investments. This preview offers a glimpse into the actionable insights you'll gain.

Purchase the full BCG Matrix report to receive a comprehensive breakdown of each product's position, coupled with data-driven recommendations for optimizing your business strategy and achieving market leadership.

Stars

ACCESS CO., LTD.'s automotive infotainment and connectivity platforms operate in a dynamic, high-growth sector. The connected car market is projected to reach substantial valuations by 2032, with an impressive compound annual growth rate of 13.1% from 2025 to 2032. This growth is fueled by consumer desire for richer in-car experiences and the integration of technologies like ADAS and OTA updates.

Given the rapid evolution and increasing demand for these advanced automotive solutions, ACCESS's embedded and content/app service platforms are prime candidates for the Stars quadrant of the BCG matrix. Continued strategic investment is crucial to solidify and expand their market leadership in this competitive and expanding landscape.

The global IoT market is booming, expected to hit $1520.12 billion by 2029, growing at a 24.7% CAGR. ACCESS's IoT Gateway solutions are perfectly positioned to leverage this growth, especially within industrial IoT (IIoT), a sector hungry for robust device management and data analytics.

Securing substantial contracts in key IIoT sectors, like manufacturing or logistics, would solidify ACCESS's gateway offerings as Stars in the BCG matrix. This strategic focus allows them to capture market share in high-growth industrial segments.

Advanced embedded operating systems for next-generation devices represent a potential star for ACCESS within the BCG matrix. The embedded software market is projected to grow at a substantial 9.6% CAGR from 2025 to 2034, fueled by the burgeoning demand in IoT and autonomous vehicle sectors.

ACCESS's proprietary or highly optimized OS solutions, if gaining significant traction in these high-growth device categories, would position them as stars. Success hinges on continuous innovation and securing key design wins on emerging hardware platforms to maintain a competitive edge.

Chromium Blink-based HTML5 Browser for Emerging Platforms

A Chromium Blink-based HTML5 browser targeting emerging platforms, such as advanced automotive infotainment systems or specialized IoT devices, could be a Star in the BCG matrix. These platforms often require highly optimized and performant browsing capabilities to support evolving web standards and user experiences. Capturing significant market share in these high-growth, nascent segments would be key to its classification as a Star.

For instance, consider the automotive sector, where in-car connectivity and infotainment systems are rapidly advancing. By 2024, the global automotive infotainment market was projected to reach hundreds of billions of dollars, with a significant portion relying on web technologies. A browser tailored for these environments, offering seamless integration and robust HTML5 support, could quickly establish dominance.

Key factors for success would include:

- Performance Optimization: Ensuring the browser runs efficiently on resource-constrained or specialized hardware.

- Feature Set Tailoring: Developing features specifically for the target emerging platform's use cases.

- Strategic Partnerships: Collaborating with hardware manufacturers and platform providers to ensure deep integration and early adoption.

- Market Penetration: Securing a substantial share of the browser market within these new, rapidly expanding segments.

Digital Transformation Solutions for Specific Niche Industries

ACCESS BCG Matrix identifies digital transformation solutions tailored for niche industries experiencing accelerated digitalization. These bespoke software solutions are designed to capture significant market share within these expanding verticals.

For instance, in 2024, the global healthtech market was projected to reach $660 billion, with a significant portion driven by digital transformation. ACCESS could develop specialized AI-powered diagnostic tools or telemedicine platforms for this sector.

Similarly, the sustainable agriculture technology market is rapidly growing, expected to exceed $40 billion by 2027. ACCESS might create IoT-based farm management systems or precision agriculture software for this niche.

- Healthtech: AI diagnostics, telemedicine platforms.

- Sustainable Agriculture: IoT farm management, precision agriculture software.

- Fintech: Blockchain-based compliance solutions, AI fraud detection.

Stars represent high-growth, high-market-share offerings. For ACCESS, their automotive infotainment platforms, leveraging the connected car market's projected growth, are prime examples. Similarly, their IoT Gateway solutions, positioned within the booming global IoT market, are strong contenders.

Advanced embedded operating systems and specialized Chromium Blink-based browsers for emerging platforms like automotive infotainment also fit the Star criteria. These segments demand optimized performance and broad adoption, areas where ACCESS can excel.

Digital transformation solutions for rapidly growing niche industries, such as healthtech and sustainable agriculture, also hold Star potential. Success here depends on capturing significant market share within these expanding verticals.

| Offering | Market Growth | Market Share Potential | BCG Classification |

|---|---|---|---|

| Automotive Infotainment Platforms | High (Connected Car Market CAGR 13.1% from 2025-2032) | High (with strategic investment) | Star |

| IoT Gateway Solutions | Very High (Global IoT Market CAGR 24.7% to 2029) | High (in key IIoT sectors) | Star |

| Advanced Embedded OS | High (Embedded Software Market CAGR 9.6% from 2025-2034) | High (with key design wins) | Star |

| Chromium Blink Browser (Emerging Platforms) | High (Automotive Infotainment Market in hundreds of billions by 2024) | High (in new, expanding segments) | Star |

| Niche Digital Transformation Solutions | High (e.g., Healthtech market to reach $660 billion in 2024) | High (within expanding verticals) | Star |

What is included in the product

Strategic guidance on investing, holding, or divesting business units based on market growth and share.

The ACCESS BCG Matrix provides a clear, visual overview of your portfolio, instantly relieving the pain of strategic uncertainty.

Cash Cows

ACCESS's NetFront Browser, especially its WebKit-based HTML5 version and Browser SDKs for platforms such as HbbTV and UK Freeview Play, is a prime example of a Cash Cow. These are mature technologies serving stable consumer electronics markets where ACCESS holds a significant market share.

The company likely experiences consistent cash flow from these established deployments, primarily due to existing licensing agreements. These mature products require minimal investment for ongoing maintenance, further solidifying their Cash Cow status within the ACCESS portfolio.

Foundational embedded software components for legacy systems represent ACCESS's cash cows. These are the core operating system elements and deeply integrated software found in long-life consumer electronics and industrial control systems. Think of the reliable software running essential functions in older but still operational machinery or established consumer devices.

The market for these legacy components experiences low growth, but ACCESS holds a dominant position. This allows for stable, predictable revenue streams with minimal need for significant new development investment. In 2023, ACCESS reported continued stability in its embedded software segment, contributing a significant portion to its overall revenue despite the mature nature of these markets.

The strategy here is to maximize profit harvesting from these established offerings. ACCESS focuses on maintaining these existing customer relationships and ensuring the continued reliability of the software, rather than pursuing aggressive expansion. This approach ensures consistent income generation, underpinning the company's financial stability.

ACCESS's digital publishing solutions for traditional media conversion are prime examples of Cash Cows within the BCG matrix. These offerings cater to established media companies that have already invested in digital transformation, where ACCESS has secured a dominant market position. The steady revenue stream from these loyal clients, requiring minimal new sales efforts, highlights their Cash Cow status.

Mature Network OS for Fixed-Function Devices

Mature network operating systems for fixed-function devices represent a potential cash cow for ACCESS. These offerings, often found in established network infrastructure, benefit from high market penetration and stable, recurring licensing revenue. The limited need for substantial research and development further solidifies their profitability.

The market for these specific network components is characterized by low growth, but ACCESS's entrenched position ensures consistent earnings. For instance, in 2024, the global market for network infrastructure software, which includes these mature OS segments, was projected to reach approximately $65 billion, with steady, albeit slow, annual growth.

- Stable Revenue Streams: Recurring licensing fees from established network OS deployments provide predictable cash flow.

- Low R&D Investment: Mature products require minimal ongoing development, boosting profit margins.

- Dominant Market Share: ACCESS's strong position in these segments allows for sustained profitability despite low market growth.

- High Profitability: The combination of stable revenue and low costs makes these offerings highly lucrative.

Legacy Mobile Software Licensing for Stable Platforms

Legacy mobile software licensing for stable platforms, such as older operating systems or devices with a substantial existing user base, can indeed be considered cash cows for a company like ACCESS. These offerings have likely moved beyond their rapid growth stages but continue to provide a steady stream of income. Think of them as reliable workhorses that, while not exciting, consistently contribute to the bottom line. Their value lies in their established presence and the ongoing need for support and maintenance from users who haven't yet migrated to newer technologies.

These types of products typically require minimal new investment because the core development is complete. Revenue generation often comes from:

- Maintenance and Support Contracts: Providing ongoing technical assistance and updates to existing licensees.

- Long-Term Licensing Agreements: Securing revenue from businesses or users committed to these stable platforms.

- Niche Market Dominance: Holding a strong position in segments where newer solutions are not yet adopted or suitable.

ACCESS's established embedded software components for legacy systems are definitive cash cows. These are the foundational elements powering long-life consumer electronics and industrial control systems, generating stable, predictable revenue with minimal new investment. In 2023, ACCESS saw its embedded software segment continue to provide a significant, stable revenue contribution.

These mature offerings benefit from low market growth but ACCESS's dominant position ensures consistent earnings. For example, the global market for network infrastructure software, encompassing these mature OS segments, was projected to reach approximately $65 billion in 2024, exhibiting steady, albeit slow, annual growth.

| Product Category | Market Position | Revenue Driver | Investment Needs | Profitability |

|---|---|---|---|---|

| Legacy Embedded OS | Dominant | Maintenance & Licensing | Low | High |

| Digital Publishing Solutions | Dominant | Recurring Fees | Low | High |

| Network OS (Fixed-Function) | High Penetration | Recurring Licensing | Low R&D | High |

Full Transparency, Always

ACCESS BCG Matrix

The ACCESS BCG Matrix preview you are viewing is the identical, fully polished document you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally formatted strategic analysis ready for immediate application in your business planning. You're getting exactly what you see, ensuring a seamless transition from preview to actionable insight for your strategic decision-making.

Dogs

Obsolete mobile browser versions for discontinued devices, such as older versions of Internet Explorer Mobile on devices like the Nokia Lumia 900, would likely be classified as a Dog in the BCG Matrix. These technologies have minimal current market share and operate within a shrinking market segment, as newer, more capable devices and browsers dominate.

For instance, as of late 2023, the market share for mobile browsers on devices manufactured before 2015 is negligible, with most users having migrated to newer smartphones. Companies supporting these legacy browser versions would be allocating resources to a product with very low revenue potential and a declining user base, making it an inefficient use of capital.

Niche network solutions with limited adoption often represent products or services designed for very specific, often outdated, network architectures or specialized use cases that never achieved widespread market acceptance. These offerings typically reside in the "Question Mark" quadrant of the BCG matrix, characterized by low market share in a slow-growing or declining market segment.

For instance, a proprietary network operating system developed in the early 2000s for a specific type of industrial control system might fall into this category. While it served its intended niche, the broader market shifted towards more standardized and scalable solutions. In 2024, such a product would likely have negligible revenue, perhaps in the low millions globally, and a market share that is a fraction of a percent, if even measurable.

The challenge with these "Dogs" is that their low revenue generation and minimal growth prospects make significant investment in their revival or expansion highly questionable. The cost to adapt them to current market demands or to scale their infrastructure would likely outweigh any potential return, making them candidates for divestment or discontinuation.

Digital publishing tools for niche, outdated formats, like specialized e-book readers for legacy file types or platforms supporting defunct digital magazine standards, fall into the Dogs quadrant of the BCG Matrix. These tools often possess a very small market share within a shrinking user base.

For instance, consider platforms built around formats like the now largely obsolete LIT ebook format. While some users might still exist, the overall market for such content and the tools to create or consume it have significantly diminished. This leads to negligible revenue generation, making continued investment questionable.

In 2024, the market for many such legacy digital formats is extremely limited, with user adoption for newer, more versatile standards like EPUB or PDF being overwhelmingly dominant. The cost of maintaining and updating these specialized tools often exceeds the minimal revenue they generate, presenting a clear case for divestment or discontinuation.

Legacy Embedded Software for Phased-Out Hardware

Legacy embedded software for phased-out hardware falls into the Dogs category of the BCG Matrix. These are products with a low market share in a low-growth or declining market. Think of software designed for older industrial control systems or legacy automotive infotainment units that are no longer in production.

These offerings typically require significant maintenance and support without generating substantial revenue. For instance, a 2024 report indicated that companies spend an average of 15-20% of their IT budget on maintaining legacy systems, a cost that often outweighs the returns from these "dog" products.

- Low Market Share: These software solutions have minimal adoption in current markets.

- Declining Market Growth: The hardware they support is obsolete, leading to a shrinking customer base.

- High Support Costs: Maintaining and updating legacy software can be resource-intensive.

- Limited Future Potential: There's little to no opportunity for growth or expansion.

Unsuccessful IoT Pilot Projects without Commercial Scale

Unsuccessful IoT pilot projects that didn't reach commercial scale represent the Dogs in the ACCESS BCG Matrix. These are initiatives where the technology or solution showed promise in a limited trial but couldn't gain traction for broader deployment or monetization. For instance, a smart agriculture sensor network pilot might have demonstrated improved crop yields in a specific field but faced insurmountable challenges in cost, connectivity, or farmer adoption for widespread use.

These failed ventures, despite their initial investment and potential, are characterized by low market share and a lack of a clear, viable path to profitability. The Internet of Things market itself is experiencing robust growth, with projections indicating it will reach over $1.5 trillion by 2025, but this overall success doesn't negate the reality of individual project failures. Companies must be prepared to identify and divest from these underperforming IoT components.

- Example: A smart city lighting pilot using advanced connectivity for real-time energy management might have failed due to high infrastructure upgrade costs and a lack of interoperability with existing city systems.

- Financial Implication: Companies with such projects should consider divestment to reallocate capital towards more promising IoT ventures, especially as the global IoT market continues its upward trajectory.

- Market Reality: Many IoT pilots struggle to scale due to issues like data security concerns, the complexity of integration, and the need for specialized technical expertise, leading to a high failure rate for early-stage deployments.

Products or services classified as Dogs in the BCG Matrix are characterized by low market share within a low-growth or declining market. These offerings typically generate minimal revenue and have little to no future potential for expansion. Companies often find that continuing to invest in Dogs is an inefficient use of resources, as the costs associated with their maintenance or revival are unlikely to be recouped.

In 2024, many legacy technologies and niche software solutions fit this description. For instance, specialized software for outdated industrial equipment or digital tools supporting obsolete file formats often fall into the Dog category. These products require ongoing support, but their user base and market demand are shrinking, making them prime candidates for divestment or discontinuation to free up capital for more promising ventures.

The strategic approach for Dogs usually involves minimizing investment and exploring options like selling off the business unit, licensing the technology, or simply phasing out the product. This allows businesses to focus their efforts and capital on products with higher growth potential, such as Stars or Question Marks that show promise.

Consider the example of specialized software for older manufacturing equipment. While it might still have a small, dedicated user base, the overall market for such equipment is declining rapidly. In 2024, companies supporting these legacy systems might find that the cost of compliance with new regulations or the effort to maintain compatibility with newer systems far outweighs the revenue generated. This is a classic scenario where divestment or discontinuation becomes the most logical strategic move.

| BCG Category | Market Share | Market Growth | Revenue Potential | Strategic Recommendation |

|---|---|---|---|---|

| Dogs | Low | Low/Declining | Low | Divest, Discontinue, or Harvest |

Question Marks

ACCESS's move into AI-powered software for automotive and IoT fits the Question Mark category. This is because the AI and ML space is experiencing rapid growth, but ACCESS would likely start with a small slice of the market in these emerging, competitive areas.

Developing these advanced capabilities and building a strong market presence will demand substantial investment. For instance, the global AI in automotive market was valued at approximately $2.4 billion in 2023 and is projected to reach over $15 billion by 2030, highlighting the significant growth potential but also the intense competition ACCESS would face.

Success here hinges on effectively channeling resources to innovate and capture market share, with the ultimate goal of transforming these ventures into future Stars within the ACCESS portfolio.

Developing new 5G-enabled network operating systems is a classic question mark scenario within the ACCESS BCG Matrix. This area offers significant growth potential as 5G adoption accelerates, with global 5G connections projected to reach over 2 billion by 2025, according to industry reports. However, ACCESS's market share in this emerging space is expected to be minimal at the outset.

Significant investment in research and development, alongside crucial strategic partnerships, will be essential for ACCESS to build a competitive foothold. The success of these new operating systems hinges on market acceptance and the evolving competitive landscape, meaning they could either develop into Stars or languish as Dogs.

Cutting-edge digital publishing solutions, emphasizing interactive and personalized content, represent a high-growth market. These platforms leverage advanced technologies to deliver unique user experiences, driving engagement and potentially new revenue streams.

However, ACCESS likely holds a low market share in these innovative, rapidly evolving segments. Capturing significant user adoption in these areas demands substantial marketing and development investment, which may not align with ACCESS's current strategic focus or resource allocation.

Cloud-Native Embedded Solutions for Edge Computing

Cloud-native embedded solutions for edge computing are a burgeoning area, fueled by the explosion of the Internet of Things (IoT) and the increasing demand for localized data processing. This segment is characterized by rapid innovation and a growing need for specialized hardware and software that can operate efficiently at the network's edge. For ACCESS, this represents a significant opportunity, though likely starting from a modest market share.

This market is highly competitive, with established players and nimble startups vying for dominance. To carve out a niche, ACCESS needs to focus on developing unique, value-added solutions. Strategic investments in research and development are crucial to create differentiated offerings that meet the specific needs of edge deployments.

Securing early adopters is key to gaining traction and building a strong foundation. This involves demonstrating clear value propositions and offering robust, reliable solutions that can handle the complexities of edge environments. The global edge computing market size was valued at approximately USD 15.75 billion in 2023 and is projected to reach USD 115.2 billion by 2030, growing at a CAGR of 32.5% during the forecast period.

- Market Growth: The edge computing market is experiencing exponential growth, with projections indicating a substantial increase in value by 2030.

- Competitive Landscape: ACCESS operates in a crowded market, necessitating strategic differentiation.

- Investment Focus: Significant investment is required to develop specialized, cloud-native embedded solutions for edge applications.

- Customer Acquisition: Early adoption by key clients will be vital for establishing market presence and validating offerings.

New Security Solutions for Connected Devices

As the digital landscape continues to expand, the need for strong security for connected devices, including those in the Internet of Things (IoT) and embedded systems, is becoming increasingly critical. This sector is experiencing significant growth.

If ACCESS is introducing novel, sophisticated security solutions for these connected devices, it's probable they would enter the market with a relatively small share, even though the market itself is expanding quickly. This is typical for new entrants in high-growth areas.

Developing these advanced security offerings requires substantial investment in research and development (R&D) and focused efforts to gain market traction. The goal is to build a profitable position over time.

- Market Growth: The global IoT security market was valued at approximately $15.6 billion in 2023 and is projected to reach over $100 billion by 2030, indicating a compound annual growth rate (CAGR) of around 30%.

- R&D Investment: Companies in this space often allocate 15-25% of their revenue to R&D to stay ahead of evolving threats and develop cutting-edge solutions.

- Market Penetration Challenges: New entrants typically face challenges in building brand recognition and trust, which can impact initial market share despite technological advantages.

Question Marks represent business units with low market share in high-growth industries. ACCESS's ventures into AI for automotive and IoT, new 5G operating systems, cutting-edge digital publishing, cloud-native edge computing, and advanced IoT security solutions all fit this profile. These areas offer substantial future potential but require significant investment to gain traction against established or rapidly emerging competitors.

The challenge for ACCESS is to strategically invest resources to foster innovation and capture market share in these dynamic sectors. Success in these Question Marks is crucial, as they represent potential future Stars that can drive the company's long-term growth.

Failure to adequately invest or adapt to market shifts could see these ventures become Dogs, consuming resources without generating significant returns.

| Business Unit | Market Growth | Market Share | Investment Need | Potential Outcome |

|---|---|---|---|---|

| AI for Automotive/IoT | High | Low | High | Star or Dog |

| 5G Network OS | High | Low | High | Star or Dog |

| Digital Publishing Solutions | High | Low | High | Star or Dog |

| Cloud-Native Edge Computing | High (e.g., $15.75B in 2023, projected $115.2B by 2030) | Low | High | Star or Dog |

| IoT Security Solutions | High (e.g., $15.6B in 2023, projected >$100B by 2030) | Low | High | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from company financial statements, market research reports, and industry growth forecasts to provide strategic insights.