Telekom Austria Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telekom Austria Bundle

Telekom Austria faces moderate bargaining power from buyers due to service differentiation, while the threat of new entrants is somewhat contained by high capital requirements. The intensity of rivalry among existing players significantly shapes the market, impacting pricing and innovation strategies.

The complete report reveals the real forces shaping Telekom Austria’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a significant factor for Telekom Austria. The telecommunications sector often depends on a limited number of suppliers for essential network equipment, such as 5G infrastructure and fiber optic components, as well as specialized software. This reliance can give these concentrated suppliers considerable leverage over A1 Telekom Austria, influencing pricing and supply terms.

A1 Group's ongoing substantial investments in advanced network technologies like fiber and 5G inherently increase its dependence on a select group of technology providers. For instance, major players like Ericsson, Nokia, and Huawei are key suppliers of network infrastructure globally. The market for advanced telecommunications hardware is characterized by high barriers to entry, further consolidating the supplier base.

Switching network equipment or software suppliers for a major telecommunications company like A1 Telekom Austria involves significant expenses and operational disruptions. The intricate process of integrating new systems, addressing potential compatibility problems, and conducting thorough testing and employee training all contribute to these high switching costs, estimated to be in the tens of millions of euros for large-scale overhauls.

These substantial switching costs empower specialized suppliers, who understand A1's complex infrastructure, with greater bargaining power. For instance, a move away from a primary network core provider could necessitate replacing vast amounts of hardware and software, impacting service delivery and requiring substantial capital investment, which suppliers leverage during price negotiations.

Suppliers who provide highly specialized or proprietary technologies, like advanced 5G mmWave components or unique fiber optic infrastructure, possess significant bargaining power. A1 Telekom Austria's strategic alliances, such as its collaboration with Nokia for network upgrades, underscore its dependence on such specialized technological expertise.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into telecommunications services, while not a frequent occurrence, could significantly bolster their negotiating leverage. If a critical supplier possessed the financial muscle and strategic motivation to directly offer services, it would fundamentally alter the competitive landscape. For instance, a major network equipment provider could theoretically enter the market, directly competing with Telekom Austria.

However, the telecommunications sector is characterized by substantial capital requirements and stringent regulatory frameworks, which typically act as significant deterrents to such forward integration. These barriers make it challenging for suppliers to transition from providing components to delivering end-user services. Despite its low probability, this potential threat still subtly influences ongoing price and contract discussions between Telekom Austria and its suppliers.

For example, in 2024, the global telecommunications infrastructure market, a key supplier segment for companies like Telekom Austria, was valued at approximately $200 billion. The high cost of building and maintaining network infrastructure, coupled with the need for specialized licenses and compliance, makes direct market entry by suppliers a financially daunting proposition.

- Capital Intensity: Building a nationwide telecommunications network requires billions in investment for infrastructure, spectrum licenses, and technology.

- Regulatory Hurdles: Obtaining operating licenses and complying with telecommunications regulations is a complex and time-consuming process.

- Market Expertise: Suppliers typically lack the established customer base, marketing, and customer service expertise needed to succeed in the retail telecom market.

Importance of A1 Telekom Austria to Suppliers

A1 Telekom Austria's significant market presence, particularly as a leading communications provider in Austria and a key operator in several Central and Eastern European markets, makes it a crucial customer for its suppliers. For many in the telecommunications equipment and services sector, A1 represents a substantial portion of their annual revenue. For instance, in 2023, A1 Group reported total revenues of €4.7 billion, indicating the scale of its purchasing power.

The extent to which A1 Telekom Austria accounts for a supplier's total sales directly influences the supplier's bargaining leverage. If A1 is a major client, a supplier would likely be more inclined to offer competitive pricing and favorable terms to preserve this vital business relationship. This dependency on A1 can therefore temper a supplier's ability to exert significant upward pressure on prices or dictate unfavorable contract terms.

- A1's Revenue Scale: A1 Group's €4.7 billion in revenue for 2023 highlights its substantial purchasing capacity.

- Supplier Dependence: Suppliers whose business is heavily reliant on A1 may have reduced bargaining power due to the need to maintain this significant customer.

- Relationship Management: The desire to retain A1 as a key client incentivizes suppliers to offer competitive terms, thereby limiting their own leverage.

The bargaining power of suppliers for Telekom Austria is influenced by supplier concentration and the specialized nature of their offerings. Key providers of 5G infrastructure and advanced software often operate in consolidated markets, giving them leverage. For example, companies like Ericsson and Nokia are critical players in global network equipment supply.

High switching costs for A1 Telekom Austria, involving significant investment and operational disruption, further enhance supplier power. The intricate integration of new systems and potential compatibility issues can run into tens of millions of euros for large-scale changes. This makes suppliers of specialized or proprietary technologies, such as advanced 5G components, particularly influential in pricing and contract negotiations.

While suppliers integrating forward into services is a low-probability threat, the substantial capital and regulatory hurdles in the telecom sector make it difficult. The global telecommunications infrastructure market, valued around $200 billion in 2024, demonstrates the high barriers to entry for potential new service providers.

A1 Telekom Austria's considerable market presence, with 2023 revenues of €4.7 billion, makes it a vital customer for many suppliers, thereby limiting their leverage. Suppliers heavily dependent on A1's business are incentivized to offer competitive terms to retain this key client.

| Factor | Impact on Supplier Bargaining Power | Example/Data Point |

|---|---|---|

| Supplier Concentration | Increases power due to limited alternatives | Reliance on a few key 5G infrastructure providers |

| Switching Costs | Increases power due to high costs and disruption | Tens of millions of euros for network overhauls |

| Supplier Specialization | Increases power for proprietary technologies | Advanced 5G mmWave components |

| A1's Customer Importance | Decreases power when A1 is a major client | A1's €4.7 billion revenue in 2023 |

What is included in the product

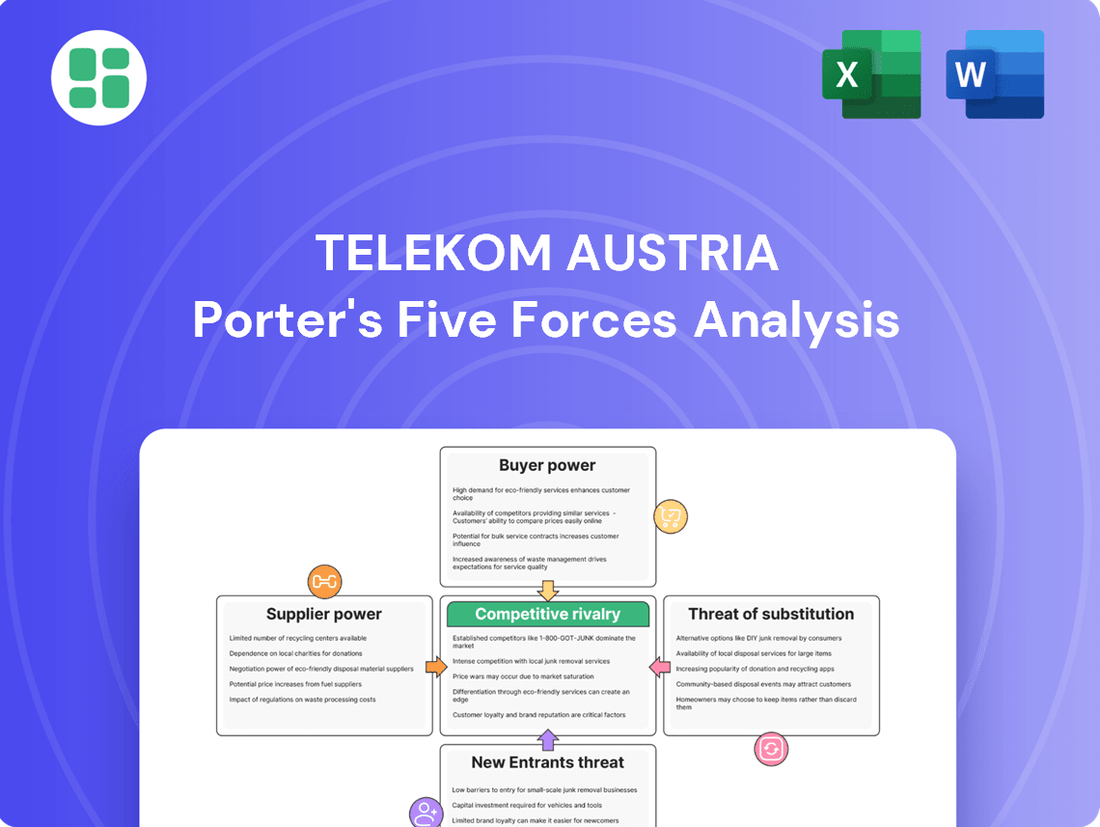

This analysis unpacks the competitive forces impacting Telekom Austria, revealing the intensity of rivalry, the power of buyers and suppliers, and the threat of new entrants and substitutes.

Effortlessly assess Telekom Austria's competitive landscape with a visual analysis of all five forces, enabling rapid identification of strategic vulnerabilities and opportunities.

Customers Bargaining Power

Telekom Austria's customers, especially individuals, are very aware of prices for mobile and internet services. They actively look for the best offers available.

This price sensitivity is amplified by the fiercely competitive nature of the telecommunications sector. In 2024, for instance, numerous providers were running aggressive promotional campaigns, often featuring discounted plans and bundled services, making it easy for consumers to switch providers for a better deal.

The bargaining power of customers for Telekom Austria is significantly influenced by the availability of substitutes and alternatives. The Austrian market features several established mobile network operators (MNOs) alongside numerous mobile virtual network operators (MVNOs), offering a wide array of plans and services. This competitive landscape, coupled with the rise of over-the-top (OTT) communication services like WhatsApp and Zoom, gives consumers considerable leverage to seek better pricing and terms.

In 2024, the Austrian telecommunications market saw continued high penetration rates, with mobile subscriptions exceeding population, indicating a saturated market where customer retention is paramount. For instance, A1 Telekom Austria, a major player, reported in its 2024 financial statements that customer churn remains a key metric. The ease with which customers can switch providers, often facilitated by simplified porting processes and attractive introductory offers from competitors, directly translates to increased customer bargaining power, forcing incumbents to remain competitive on price and service quality.

For many telecommunications services, especially mobile plans, customers face minimal costs when switching providers. This ease of transition, often facilitated by number portability, significantly boosts their bargaining power. In 2024, the competitive landscape in Austria's telecom sector means providers are keen to attract new customers, further incentivizing them to offer attractive deals to those willing to switch.

Customer Information and Transparency

Customers now have unprecedented access to information about pricing, service quality, and promotions from various telecommunications providers. Online comparison tools and extensive advertising campaigns empower consumers to make well-informed choices, directly influencing A1 Telekom Austria's strategy.

This heightened transparency significantly boosts the bargaining power of customers. They can easily identify better deals and superior service offerings elsewhere, compelling A1 Telekom Austria to maintain competitive pricing and service standards to retain its customer base.

- In 2024, Austria saw a significant increase in broadband penetration, reaching over 90%, with consumers actively comparing speeds and prices.

- Online comparison portals in Austria are widely used, with many customers reporting that they switch providers based on price differences of as little as €5 per month.

- Customer reviews and social media feedback play a crucial role in shaping purchasing decisions, putting pressure on providers like A1 Telekom Austria to ensure high service quality.

Bulk Buying Power (for Business Customers)

Large enterprise clients, particularly those procuring substantial data, IT solutions, and wholesale telecommunications services, wield considerable bargaining power with A1 Telekom Austria. This leverage stems directly from the sheer volume of their business, allowing them to negotiate highly customized agreements and demand preferential pricing or service levels. For instance, major corporations often secure bespoke packages that include bundled services and dedicated support, impacting A1’s average revenue per user (ARPU) for these high-volume accounts.

The bargaining power of these business customers is amplified by several factors:

- Volume Commitments: Enterprise customers committing to large-scale usage of A1's services, such as extensive data plans or complex IT infrastructure solutions, gain significant negotiating leverage.

- Customization Demands: The need for tailored solutions, including specific network configurations or integrated IT services, allows these clients to dictate terms that align with their unique operational requirements.

- Potential for Switching: While switching costs can be high in the telecommunications sector, large enterprises possess the resources and strategic imperative to explore and transition to alternative providers if A1's terms are not competitive.

- Impact on Revenue: Favorable terms negotiated by these major clients can directly influence A1 Telekom Austria's profitability on a per-unit basis for its enterprise segment. In 2024, the telecommunications industry saw continued pressure on enterprise pricing, with major players like A1 needing to offer competitive bundles to retain and attract these high-value customers.

Telekom Austria's customers, both individual and corporate, possess substantial bargaining power due to market saturation and the availability of numerous alternatives. In 2024, Austria's telecommunications market, with over 100% mobile penetration, meant providers like Telekom Austria focused heavily on customer retention, making competitive pricing and attractive offers crucial. The ease of switching, facilitated by number portability and aggressive competitor promotions, further empowers consumers to demand better terms and pricing.

This bargaining power is evident in how readily customers switch for even minor price differences, as highlighted by the common use of online comparison portals. For instance, in 2024, many Austrian consumers reported switching providers for monthly savings as low as €5. Furthermore, the proliferation of over-the-top (OTT) communication services provides readily available substitutes, diminishing the perceived unique value of traditional telecom offerings and increasing customer leverage.

Large enterprise clients, in particular, leverage their significant volume commitments and need for customized solutions to negotiate highly favorable terms. These major accounts can directly impact A1 Telekom Austria's revenue and profitability, forcing the company to offer bespoke packages and competitive pricing to retain such high-value business. The industry trend in 2024 continued to show intense competition for enterprise clients, emphasizing the need for tailored service agreements.

| Factor | Impact on Telekom Austria | 2024 Context |

| Price Sensitivity (Individual) | High | Aggressive promotions and easy switching |

| Availability of Substitutes | High | Numerous MNOs, MVNOs, and OTT services |

| Switching Costs | Low | Simplified porting processes |

| Information Availability | High | Online comparison tools and reviews |

| Volume Commitments (Corporate) | High | Negotiating power for large data/IT deals |

| Customization Needs (Corporate) | High | Tailored solutions drive negotiation |

Same Document Delivered

Telekom Austria Porter's Five Forces Analysis

This preview showcases the complete Telekom Austria Porter's Five Forces Analysis, detailing the competitive landscape including threats of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and intensity of rivalry within the telecommunications sector. The document you see here is precisely what you will receive instantly after purchase, ensuring no discrepancies or missing information. You're looking at the actual document, fully formatted and ready for your immediate use, providing a comprehensive understanding of Telekom Austria's strategic position.

Rivalry Among Competitors

The Austrian telecom market is a battleground with a few dominant forces. A1 Telekom Austria, Magenta Telekom (formed from T-Mobile Austria and UPC Austria), and 3 Austria are the main contenders, all vying for market share. This concentration means established players have significant resources and brand recognition.

However, the competition isn't just limited to these giants. Smaller players like Lycamobile and Hofer Telekom are also active, adding another layer of rivalry. These mobile virtual network operators (MVNOs) often compete on price, forcing the larger companies to remain competitive on their offerings.

In 2023, A1 Telekom Austria reported revenues of €4.7 billion, highlighting the scale of operations for the market leaders. Magenta Telekom and 3 Austria also represent substantial entities, each with millions of subscribers, indicating a highly saturated and competitive environment where customer acquisition and retention are paramount.

The Austrian telecom market is considered mature, with a projected compound annual growth rate (CAGR) of 3.42% expected between 2025 and 2033. This maturity means that established players like Telekom Austria face intense competition.

In such mature environments, organic growth is harder to come by. Consequently, companies tend to battle more fiercely for existing market share. This often translates into aggressive pricing strategies and frequent promotional offers to attract and retain customers.

Telekom Austria, operating as A1, faces intense competition where differentiating its extensive portfolio of fixed and mobile voice, data, broadband, and multimedia services proves difficult. The market often sees services as commodities, pushing companies to compete on factors beyond basic functionality.

To carve out an edge, A1, like its rivals, focuses on bundling services, such as combining mobile plans with television and internet packages, to create more attractive customer propositions. Significant investments in network infrastructure, particularly in expanding 5G coverage and fiber optic broadband, are also key differentiators, aiming to offer superior speed and reliability. For instance, A1's 2024 capital expenditures were heavily weighted towards network upgrades to enhance its competitive standing.

High Fixed Costs and High Exit Barriers

Telekom Austria operates in an industry with significant fixed costs, including the build-out and maintenance of extensive network infrastructure and the acquisition of costly spectrum licenses. For instance, in 2023, mobile network operators globally continued to invest heavily in 5G expansion, with significant capital expenditures required for new base stations and fiber optic backhaul.

These high upfront investments and ongoing operational expenses create substantial exit barriers. Companies are locked into their investments, making it difficult and expensive to divest or cease operations. This often leads to intense competition as firms strive to recoup their investments, even when profitability is strained.

- High Infrastructure Investment: The need for continuous upgrades to network technology, like 5G and beyond, necessitates ongoing capital expenditure, locking companies into the market.

- Spectrum License Costs: Governments auctioning mobile spectrum licenses, often for billions of euros, represents a significant barrier to entry and a sunk cost for incumbents.

- Brand Loyalty and Switching Costs: While not as high as physical assets, customer acquisition and retention costs, coupled with the effort for consumers to switch providers, contribute to a sticky customer base.

- Regulatory Compliance: Adhering to strict regulatory frameworks and service quality standards requires ongoing investment, further increasing the cost of exiting the market.

Strategic Objectives of Competitors

Competitors in Austria's telecommunications sector often pursue distinct strategic goals. These can range from aggressively expanding market share, as demonstrated by A1 Telekom Austria's consistent efforts to retain its leading position, to prioritizing profit maximization through premium service offerings.

Some players may focus on niche segments, such as delivering specialized enterprise solutions or targeting budget-conscious consumers with low-cost mobile plans. This diversity in objectives fuels intense rivalry, manifesting in actions like price wars or rapid introductions of new technologies.

For instance, in 2024, the Austrian market saw continued competition around 5G rollout and bundled service packages, with providers like Magenta Telekom and Drei Austria actively seeking to differentiate their offerings and capture customer loyalty. These strategic divergences directly influence the nature and intensity of competitive interactions within the industry.

- Market Share Growth: Competitors might aim to increase their subscriber base and revenue by undercutting rivals on price or offering more attractive service bundles.

- Profitability Focus: Some firms may prioritize higher profit margins by concentrating on high-value customer segments or optimizing operational costs.

- Segment Specialization: Certain competitors may carve out a niche by focusing exclusively on business clients, IoT solutions, or specific demographic groups.

- Innovation Leadership: A strategic objective could be to be perceived as the market leader in technological advancements, such as faster network speeds or novel digital services.

The competitive rivalry within Austria's telecommunications sector is fierce, driven by a concentrated market dominated by A1 Telekom Austria, Magenta Telekom, and 3 Austria. These major players, along with smaller MVNOs, engage in aggressive strategies to capture and retain customers in a mature market. For example, A1 Telekom Austria reported €4.7 billion in revenue in 2023, underscoring the scale of competition. The ongoing battle for market share is evident in continuous network investments, such as 5G expansion, and innovative service bundling, with significant capital expenditures in 2024 focused on network upgrades.

| Competitor | Key Strategic Focus (2024) | Market Position Indicator |

|---|---|---|

| A1 Telekom Austria | Network expansion (5G, Fiber), Service bundling | Largest revenue (€4.7 billion in 2023) |

| Magenta Telekom | Differentiating offerings, Customer acquisition | Significant subscriber base |

| 3 Austria | Competitive pricing, Service innovation | Active in 5G rollout and bundles |

SSubstitutes Threaten

The rise of Over-the-Top (OTT) communication services presents a significant threat to Telekom Austria's traditional voice and messaging revenue. Platforms like WhatsApp, Signal, and Telegram offer free or low-cost alternatives for voice calls, messaging, and video conferencing, directly competing with A1's core offerings. This substitution erodes the customer base for traditional services, forcing a strategic pivot towards data-centric and value-added services.

The rise of free public Wi-Fi in locations like cafes and airports, coupled with the unbundling of broadband services, directly challenges A1's core mobile data and bundled package offerings. Consumers can now access internet connectivity without relying solely on their mobile plans, potentially decreasing the perceived value of A1's comprehensive service bundles. For instance, in 2024, an estimated 60% of European urban centers saw a significant increase in publicly accessible Wi-Fi hotspots, offering a viable alternative for data consumption.

The rise of streaming services like Netflix, Disney+, and YouTube presents a significant threat of substitutes for A1 Telekom Austria's traditional Pay-TV and multimedia services. These platforms offer vast content libraries accessible on demand, often at competitive price points, directly challenging A1's bundled offerings.

In 2024, the global streaming market continued its robust growth, with major players reporting substantial subscriber increases, highlighting the persistent appeal of these alternative entertainment options. This competitive landscape forces A1 to continuously innovate and strengthen its own multimedia services and strategic partnerships to maintain customer loyalty and market share.

VoIP and Internet-Based Voice Services

Voice over Internet Protocol (VoIP) and other internet-based voice services present a significant threat of substitution for Telekom Austria's traditional voice offerings. These services, often provided at a fraction of the cost or even for free, directly compete with established fixed and mobile voice revenues.

The ongoing shift towards digital communication channels means that consumers and businesses increasingly rely on platforms like WhatsApp, Zoom, and Microsoft Teams for their voice and video calls. This trend continues to erode the revenue streams derived from traditional circuit-switched voice services.

By 2024, it's estimated that over 60% of global internet traffic will be video, further underscoring the dominance of internet-based communication. This highlights the increasing preference for integrated digital solutions over standalone voice services.

- VoIP and internet-based services offer a compelling cost advantage over traditional telephony.

- The widespread adoption of communication apps like WhatsApp and Zoom directly substitutes traditional voice calls.

- This substitution trend is a persistent challenge to Telekom Austria's legacy voice revenue streams.

Self-Provisioned IT Solutions for Businesses

For businesses, readily available cloud-based services and specialized IT solutions from non-telecom vendors present a significant threat of substitution to A1 Telekom Austria's integrated offerings. Companies can bypass traditional telecom providers by directly engaging with major cloud infrastructure providers or niche IT service firms, thereby diminishing their dependence on A1 for data and IT solutions. This trend is amplified by the increasing accessibility and cost-effectiveness of these alternative solutions.

The market for IT solutions is dynamic, with many companies actively seeking to diversify their technology stacks. For instance, in 2024, the global cloud computing market was projected to reach over $1.3 trillion, indicating a massive shift towards externalized IT services. This growth means businesses have more choices than ever before, allowing them to select the most efficient and cost-effective IT solutions, often independent of their primary telecommunications provider.

- Increased adoption of Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) from major cloud providers.

- Growth of specialized Software as a Service (SaaS) providers catering to specific business needs.

- Businesses leveraging hybrid and multi-cloud strategies to avoid vendor lock-in with traditional telcos.

The threat of substitutes for Telekom Austria is substantial, driven by the proliferation of Over-the-Top (OTT) communication services and the increasing availability of free public Wi-Fi. These alternatives directly challenge A1's core revenue streams from traditional voice, messaging, and mobile data services.

Voice over Internet Protocol (VoIP) and internet-based communication platforms like WhatsApp and Zoom offer significant cost advantages, eroding the demand for A1's legacy voice offerings. By 2024, it's estimated that over 60% of global internet traffic is video, further highlighting the shift towards integrated digital communication solutions over standalone voice services.

Furthermore, the growth of cloud-based IT solutions and specialized software providers allows businesses to bypass traditional telecom offerings. The global cloud computing market's projected growth to over $1.3 trillion in 2024 underscores the increasing preference for diversified, externalized IT services, diminishing reliance on providers like A1 for integrated solutions.

| Substitute Category | Examples | Impact on A1 Telekom Austria | 2024 Market Trend/Data Point |

|---|---|---|---|

| OTT Communication Services | WhatsApp, Signal, Telegram, Zoom | Erodes voice and messaging revenue | 60% of global internet traffic is video (2024 estimate) |

| Public Wi-Fi & Unbundled Data | Free Wi-Fi hotspots, standalone data plans | Reduces demand for bundled mobile data packages | 60% increase in public Wi-Fi hotspots in European urban centers (2024) |

| Streaming Services | Netflix, Disney+, YouTube | Threatens Pay-TV and multimedia revenue | Continued robust growth in global streaming market subscribers (2024) |

| Cloud & Specialized IT Services | IaaS, PaaS, SaaS providers | Diminishes reliance on A1 for integrated business solutions | Global cloud computing market projected over $1.3 trillion (2024) |

Entrants Threaten

The telecommunications industry, including players like A1 Telekom Austria, demands enormous upfront capital for building and maintaining essential infrastructure. This includes laying extensive fiber optic cables, erecting and managing mobile network towers, and developing sophisticated data centers.

For instance, the rollout of 5G networks alone requires billions in investment for spectrum licenses and new equipment. In 2024, European telcos are projected to spend tens of billions on network upgrades, creating a formidable financial hurdle for any potential new entrant aiming to compete with established giants.

This high capital expenditure acts as a significant barrier, effectively deterring many new companies from entering the market and challenging incumbents like A1 Telekom Austria.

The telecommunications sector faces substantial regulatory hurdles, significantly deterring new entrants. Companies must navigate complex processes to secure essential spectrum licenses, which are often limited and awarded through costly auctions. For instance, in 2024, European regulators continued to refine spectrum allocation policies, with significant investment required for successful bids, creating a high entry cost.

Telekom Austria, operating as A1, benefits significantly from its established brand loyalty and a deeply entrenched customer base. This makes it challenging for new players to gain traction, as replicating A1's strong brand recognition and existing relationships requires substantial investment and time. For instance, in 2023, A1 Austria reported over 6.9 million mobile customers, a testament to its enduring market presence and customer trust.

Economies of Scale and Scope

Economies of scale present a significant barrier to entry in the telecommunications sector, particularly for incumbent operators like A1 Telekom Austria. Their established infrastructure, vast customer base, and extensive network operations allow them to spread fixed costs over a larger output, leading to lower per-unit costs. This is evident in their ability to invest heavily in network upgrades and offer bundled services, making it difficult for newcomers to match their cost efficiency and service breadth.

For instance, A1 Telekom Austria’s significant capital expenditures in 5G network deployment, which reached €398 million in 2023, are a testament to the scale required to maintain a competitive edge. New entrants would need to replicate this massive investment to achieve comparable network coverage and quality, a daunting financial undertaking.

- Network Infrastructure: Existing players benefit from amortized investments in extensive fiber optic and mobile networks, reducing the per-customer cost of service delivery.

- Customer Acquisition Costs: Established brands and large customer bases lower the average cost of acquiring new subscribers compared to new entrants needing to build brand recognition and trust.

- Procurement Power: Large operators can negotiate better terms with equipment suppliers and content providers due to their substantial purchasing volume, further enhancing cost advantages.

- Operational Efficiencies: Streamlined operations in areas like billing, customer support, and network maintenance, honed over years of experience, create cost savings that are hard for new players to replicate quickly.

MVNO Model as a Lower Barrier Entry

The threat of new entrants for Telekom Austria is somewhat mitigated by the significant capital required for building mobile network infrastructure. However, the rise of the Mobile Virtual Network Operator (MVNO) model presents a more accessible entry point. MVNOs lease network capacity from established operators, bypassing the need for costly infrastructure development.

While this lowers the barrier to entry, MVNOs typically operate on tighter profit margins compared to traditional Mobile Network Operators (MNOs). They often struggle with service differentiation, relying heavily on brand appeal or niche market targeting to attract subscribers. For instance, in 2024, many MVNOs in Europe focused on specific demographics or specialized services, aiming to carve out a distinct market share without the overhead of network ownership.

- MVNOs leverage existing infrastructure, reducing initial capital outlay.

- Thinner profit margins are a common characteristic of the MVNO business model.

- Differentiation from host networks and other MVNOs remains a key challenge.

The threat of new entrants for Telekom Austria remains moderate due to substantial barriers like high capital expenditure and stringent regulatory requirements. However, the increasing prevalence of Mobile Virtual Network Operators (MVNOs) offers a more accessible, albeit less profitable, avenue for new players to enter the market by leveraging existing infrastructure.

While MVNOs avoid the immense cost of building their own networks, their success hinges on differentiation and attracting customers away from established brands like A1. For example, in 2024, the European telecommunications landscape saw continued growth in MVNOs focusing on niche markets, demonstrating that while infrastructure barriers are high for traditional telcos, alternative entry strategies persist.

New entrants face challenges in matching the economies of scale enjoyed by incumbents. A1 Telekom Austria, with its vast customer base and amortized network investments, benefits from lower per-unit costs. This cost advantage, coupled with strong brand loyalty, makes it difficult for newcomers to compete on price or service breadth without significant upfront investment.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023/2024) |

|---|---|---|---|

| Capital Requirements | Building and maintaining telecommunications infrastructure (e.g., 5G networks) requires billions in investment. | High barrier, deterring many potential entrants. | A1 Telekom Austria's 5G capex was €398 million in 2023. European telcos projected to spend tens of billions on network upgrades in 2024. |

| Regulatory Hurdles | Securing spectrum licenses and navigating complex regulations. | Significant cost and time investment required. | Spectrum auctions continue to demand substantial financial commitment from operators. |

| Brand Loyalty & Customer Base | Established customer relationships and brand recognition. | Difficult for new entrants to acquire customers and build trust. | A1 Austria had over 6.9 million mobile customers in 2023. |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | New entrants struggle to match cost efficiency and service offerings. | Incumbents leverage existing infrastructure to reduce average customer acquisition and service costs. |

| MVNO Model | Leasing network capacity from existing operators. | Lower capital barrier, but thinner profit margins and differentiation challenges. | MVNOs in Europe in 2024 focused on niche markets and specialized services. |

Porter's Five Forces Analysis Data Sources

Our Telekom Austria Porter's Five Forces analysis is built upon a foundation of publicly available data, including the company's annual reports, investor presentations, and regulatory filings with the Austrian Communications Authority (COMREG). We also incorporate industry-specific research from reputable sources like Statista and Eurostat to provide a comprehensive view of the competitive landscape.