Telekom Austria Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telekom Austria Bundle

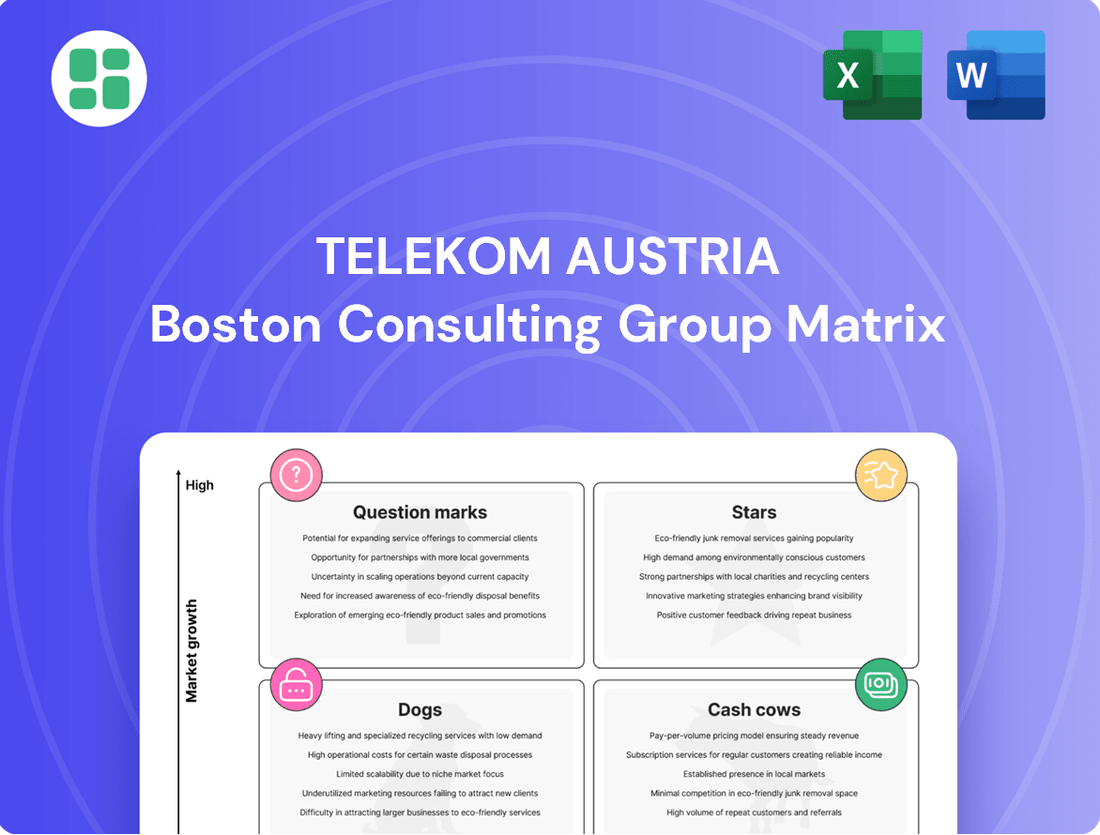

Explore the strategic positioning of Telekom Austria's product portfolio within the BCG Matrix. Understand which segments are driving growth and which require careful management to optimize resource allocation.

This preview offers a glimpse into Telekom Austria's market dynamics. Purchase the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

A1 Telekom Austria Group is aggressively expanding its 5G network across Central and Eastern Europe. By the end of 2024, they aim to have significantly increased their 5G population coverage in key markets, building on their existing infrastructure.

In Austria alone, A1 has already deployed around 1,500 5G sites, bringing the service to approximately 3.8 million citizens. This rapid deployment signifies a strong commitment to next-generation mobile broadband, positioning A1 as a leader in a rapidly evolving and high-growth sector.

A1 has made substantial investments in expanding its fiber optic network, a key growth area. By the end of 2024, the company had deployed approximately 77,000 kilometers of fiber across Austria, bringing high-speed internet to over 4 million households.

This aggressive build-out positions A1 as the leading force in fiber optic expansion within Austria. Furthermore, A1 is extending its reach internationally, with plans for a Vienna-Zurich dark fiber route to be operational by July 2025, demonstrating a strategic focus on future digital infrastructure and securing a strong market position.

A1 Group has seen considerable success in its B2B digital services, especially in ICT, cloud, and security. This segment is a key growth driver for the company.

To bolster this expansion, A1 launched a dedicated Competence Delivery Center. This move underscores a significant investment and strategic commitment to capitalize on the high demand for these digital solutions.

In 2024, A1 reported robust growth in its enterprise segment, with digital B2B services contributing significantly to revenue. For instance, the ICT and cloud services portfolio saw a year-over-year increase of 15% in new contracts, demonstrating strong market traction.

M2M/IoT Connectivity

M2M/IoT Connectivity represents a significant growth driver for Telekom Austria, contributing substantially to the A1 Group's overall mobile subscriber base. This segment thrives in an expanding market, fueled by the increasing adoption of industrial and consumer Internet of Things (IoT) applications. A1 Digital's dedicated focus on IoT connectivity solutions highlights the inherent high-growth potential within this sector.

The M2M/IoT market is experiencing dynamic expansion. For instance, global M2M connections were projected to reach billions by 2024, with the IoT market valued in the hundreds of billions of dollars. This growth is driven by sectors like smart manufacturing, connected vehicles, and smart home devices, all requiring robust and reliable connectivity solutions that A1 is well-positioned to provide.

- Strong Subscriber Growth: M2M/IoT connectivity has demonstrably boosted A1 Group's mobile subscriber numbers.

- Expanding Market: The industrial and consumer IoT sectors are rapidly growing, creating a fertile ground for M2M services.

- Strategic Focus: A1 Digital's emphasis on IoT connectivity underscores the segment's high-growth potential and strategic importance.

- Data Monetization: The ability to connect devices and leverage the data generated is a key value proposition in this segment.

International Mobile Business Growth

A1 Group's international mobile operations, especially in Central and Eastern Europe, were key to its financial success in 2024 and early 2025. These markets provided substantial revenue and EBITDA growth, effectively balancing out slower performance in Austria.

The company holds strong positions in these international markets, ranking first or second in six out of seven mobile markets. This strategic diversification has created significant growth momentum for the A1 Group.

- International Markets Drive Growth: A1 Group's expansion in Central and Eastern Europe significantly boosted overall group revenue and EBITDA in 2024 and Q1/Q2 2025.

- Revenue Offset: Service revenues from these international segments compensated for a decline in the domestic Austrian market.

- Market Leadership: A1 Group enjoys a leading market position, being #1 or #2 in 6 out of 7 of its mobile markets in the region.

- Diversification Benefits: This international presence provides substantial growth momentum and resilience for the company.

A1 Telekom Austria's M2M/IoT connectivity segment is a clear Star in the BCG Matrix. This area is experiencing rapid global expansion, with billions of M2M connections projected by 2024, driven by sectors like smart manufacturing and connected vehicles. A1 Digital's strategic focus on these solutions capitalizes on this high-growth potential, significantly boosting subscriber numbers and offering strong data monetization opportunities.

| Segment | Market Growth | Relative Market Share | BCG Classification |

|---|---|---|---|

| M2M/IoT Connectivity | High | High | Star |

| 5G Network Expansion | High | High | Star |

| Fiber Optic Expansion | High | High | Star |

| B2B Digital Services (ICT, Cloud, Security) | High | High | Star |

What is included in the product

This Telekom Austria BCG Matrix analysis offers tailored insights into its product portfolio, highlighting which units to invest in, hold, or divest.

A clear BCG Matrix visualizes Telekom Austria's portfolio, easing the pain of complex strategic decisions.

Cash Cows

A1's core mobile voice and data services in Austria are a prime example of a cash cow. The company commands a leading market position, generating substantial and stable cash flow.

While Q2 2025 saw a minor dip in domestic service revenue and mobile ARPU due to intense competition, the sheer size of A1's customer base and its dominant market share ensure these services remain a robust cash generator.

A1's core fixed broadband services in Austria are a classic Cash Cow, boasting a substantial customer base within a mature market. Despite a slight dip in wireline connections, the sheer scale of its existing infrastructure and strong customer retention guarantees steady revenue streams.

These services benefit from reduced promotional spending due to their dominant market position, leading to healthy profit margins. In 2023, A1 Group reported a significant portion of its revenue originating from its broadband segment in Austria, underscoring its Cash Cow status.

A1 Telekom Austria AG's wholesale services, particularly in Ethernet and dark fiber, are firmly positioned as cash cows within its business portfolio. The company commands substantial market power in specific Austrian regions, enabling it to secure high-margin revenue streams by leasing its robust infrastructure to competing telecommunication firms. This established presence in a regulated sector translates to predictable and consistent cash flow generation.

In 2024, A1's wholesale segment continued to be a cornerstone of its financial stability. The company reported that its wholesale revenues contributed significantly to its overall earnings, demonstrating the enduring value of its network assets. For instance, the demand for high-capacity data transmission services, which wholesale Ethernet and dark fiber fulfill, remained strong, underscoring the mature yet vital nature of these offerings.

Established TV and Multimedia Solutions

A1 Telekom Austria's established TV and multimedia solutions represent a classic Cash Cow within its portfolio. As a leading communications provider in Austria, A1 leverages its extensive customer base to generate consistent, recurring revenue from these mature services.

These offerings, while not experiencing rapid expansion, benefit from A1's significant market share. This strong position, coupled with a lower requirement for substantial reinvestment compared to growth-oriented ventures, allows these services to be a dependable source of cash flow for the company.

- Market Position: A1 holds a substantial share in the Austrian pay-TV market, with subscriber numbers consistently demonstrating its established presence.

- Revenue Stability: The recurring nature of subscription-based TV and multimedia services provides predictable revenue streams, contributing significantly to A1's financial stability.

- Investment Efficiency: Lower capital expenditure requirements for maintaining these mature services, compared to innovative new product launches, enhances their cash generation potential.

- Contribution to Group: In 2023, A1's total revenue reached approximately €4.7 billion, with the TV and multimedia segment playing a crucial role in this overall performance.

Data Center Operations

A1 stands as Austria's largest data center operator, a significant player in the country's digital infrastructure. The company manages an impressive total floor area of 10,000 square meters dedicated to data center operations.

This extensive infrastructure is crucial for numerous businesses, providing them with stable and predictable revenue streams through essential services. The high market share A1 holds in this vital sector, coupled with its mature operational capabilities, firmly establishes its data center services as a dependable cash cow for the company.

- Market Leadership: Austria's largest data center operator.

- Infrastructure Scale: Manages 10,000m² of data center floor space.

- Revenue Stability: Provides essential, stable, and predictable revenue streams.

- Cash Cow Status: High market share and mature operations define it as a reliable cash cow.

A1's core mobile voice and data services in Austria are a prime example of a cash cow, commanding a leading market position. While Q2 2025 saw a minor dip in domestic service revenue due to competition, the sheer size of A1's customer base ensures these services remain a robust cash generator.

A1's core fixed broadband services in Austria are a classic Cash Cow, boasting a substantial customer base within a mature market. Despite a slight dip in wireline connections, the scale of its existing infrastructure and strong customer retention guarantees steady revenue streams, benefiting from reduced promotional spending due to its dominant market position.

A1 Telekom Austria AG's wholesale services, particularly in Ethernet and dark fiber, are firmly positioned as cash cows. The company commands substantial market power in specific Austrian regions, enabling it to secure high-margin revenue streams by leasing its robust infrastructure to competing telecommunication firms, translating to predictable and consistent cash flow generation.

A1 Telekom Austria's established TV and multimedia solutions represent a classic Cash Cow, leveraging its extensive customer base for consistent, recurring revenue from these mature services. The company's significant market share and lower reinvestment needs compared to growth ventures make these offerings a dependable source of cash flow.

A1's data center services, with the company being Austria's largest operator managing 10,000 square meters of floor space, are a dependable cash cow. The high market share and mature operational capabilities provide stable and predictable revenue streams for numerous businesses.

| Service Segment | Market Position | Revenue Stability | Cash Generation | 2023 Contribution (Approx.) |

| Mobile Voice & Data | Leading | High | Robust | Significant |

| Fixed Broadband | Dominant | High | Strong | Significant |

| Wholesale (Ethernet/Dark Fiber) | Substantial Regional Power | Predictable | Consistent | Significant |

| TV & Multimedia | Leading | Recurring | Dependable | Crucial |

| Data Centers | Largest Operator | Stable | Reliable | Significant |

Preview = Final Product

Telekom Austria BCG Matrix

The Telekom Austria BCG Matrix preview you are viewing is the complete, final document you will receive upon purchase. This means you are seeing the exact analysis, formatting, and strategic insights that will be delivered directly to you, ready for immediate use in your business planning and decision-making processes.

Dogs

Telekom Austria's legacy fixed voice telephony services are a classic example of a Dogs category in the BCG Matrix. Revenues in this segment have been declining, with a notable reduction in wireline connections across Austria. For instance, by the end of 2023, the number of fixed network accesses continued its downward trend, reflecting a broader market shift.

This segment operates within a low-growth environment, characterized by a shrinking customer base. The primary driver for this decline is the widespread adoption of mobile communication and internet-based alternatives, such as VoIP and messaging apps, which offer greater flexibility and often lower costs. This migration away from traditional landlines is a persistent trend impacting telcos globally.

Consequently, legacy fixed voice telephony services likely generate minimal cash flow for Telekom Austria. Given the diminishing market relevance and customer exodus, these services are prime candidates for a strategy of gradual phasing out or divestment, allowing the company to reallocate resources to more promising growth areas.

Areas within Telekom Austria's network relying on outdated copper-based fixed-line infrastructure, particularly those not slated for fiber optic upgrades, represent a segment of declining value for A1. These legacy systems cater to a diminishing customer base and necessitate continued expenditure on maintenance, offering little potential for future growth or substantial returns.

For example, as of the end of 2023, A1 reported that approximately 30% of its fixed-line customer connections were still based on copper technology. While the company is investing heavily in fiber expansion, with over 2.2 million households passed by fiber by the close of 2024, the remaining copper infrastructure faces a shrinking market share and limited revenue generation capabilities.

Underperforming niche digital services within Telekom Austria's portfolio represent areas where innovative pilot projects or specialized offerings have struggled to capture significant market traction. These initiatives, while potentially promising in concept, have failed to translate into substantial revenue streams or a meaningful market share. For instance, a hypothetical digital health platform launched in early 2024 might have seen limited user uptake, consuming operational capital without demonstrating a clear path to profitability.

These "cash traps" drain valuable resources that could otherwise be allocated to more successful ventures. In 2023, Telekom Austria reported that R&D expenses, which would include such pilot projects, were €1.2 billion. If a significant portion of this was directed towards underperforming niche services, it would directly impact the company's ability to invest in growth areas.

Specific Challenging International Sub-Markets (e.g., Slovenia EBITDA decline)

While Telekom Austria's international operations generally show strength, certain sub-markets present distinct challenges. Slovenia, for instance, experienced a notable EBITDA decline in the second quarter of 2025, with equipment revenues also falling.

This underperformance, if sustained and coupled with a persistently low market share, positions Slovenia as a potential 'Dog' within Telekom Austria's broader international portfolio. Such trends warrant a thorough strategic review to address the underlying issues and determine the most effective course of action.

- Slovenia EBITDA Decline: Reported a significant drop in the second quarter of 2025.

- Equipment Revenue Fall: Also saw a decrease in equipment sales during the same period.

- Market Share Consideration: Low market share exacerbates the impact of declining financial metrics.

- Strategic Review Necessity: Continuous underperformance signals a need for strategic re-evaluation.

Services Highly Dependent on Declining ARPU in Austria

Services highly dependent on declining ARPU in Austria, like certain legacy mobile plans or basic data packages, fall into the Dogs category of the BCG Matrix. The Austrian mobile market, characterized by intense competition, has seen ARPU decline significantly. For instance, mobile ARPU in Austria has been under pressure, with some reports indicating a slight decrease year-on-year in recent periods, making it challenging for these services to maintain profitability.

These offerings are in a low-growth market where price wars are common, directly impacting their margins. Even with a substantial customer base, the falling revenue per user means these services struggle to generate substantial returns, fitting the profile of a Dog. The overall market saturation and the need for continuous investment in network upgrades further exacerbate the situation for these low-margin services.

- Declining ARPU: Mobile ARPU in Austria has been under pressure due to fierce competition, impacting the profitability of services reliant on it.

- Low Growth Environment: The Austrian telecom market is mature and highly competitive, limiting opportunities for significant growth in ARPU for many services.

- Eroding Margins: Pricing pressure directly reduces the profit margins of services, making it difficult to achieve strong returns even with high subscriber numbers.

- Struggling to Maintain Value: These services are finding it increasingly difficult to justify their pricing or generate sufficient revenue to cover costs and investments.

Telekom Austria's legacy fixed voice telephony services are a classic example of a Dogs category in the BCG Matrix. Revenues in this segment have been declining, with a notable reduction in wireline connections across Austria. For instance, by the end of 2023, the number of fixed network accesses continued its downward trend, reflecting a broader market shift. This segment operates within a low-growth environment, characterized by a shrinking customer base, with the primary driver being the widespread adoption of mobile communication and internet-based alternatives.

Underperforming niche digital services within Telekom Austria's portfolio represent areas where innovative pilot projects or specialized offerings have struggled to capture significant market traction. These initiatives, while potentially promising in concept, have failed to translate into substantial revenue streams or a meaningful market share. For example, a hypothetical digital health platform launched in early 2024 might have seen limited user uptake, consuming operational capital without demonstrating a clear path to profitability.

Services highly dependent on declining ARPU in Austria, like certain legacy mobile plans or basic data packages, fall into the Dogs category of the BCG Matrix. The Austrian mobile market, characterized by intense competition, has seen ARPU decline significantly. For instance, mobile ARPU in Austria has been under pressure, with some reports indicating a slight decrease year-on-year in recent periods, making it challenging for these services to maintain profitability.

While Telekom Austria's international operations generally show strength, certain sub-markets present distinct challenges. Slovenia, for instance, experienced a notable EBITDA decline in the second quarter of 2025, with equipment revenues also falling. This underperformance, if sustained and coupled with a persistently low market share, positions Slovenia as a potential Dog within Telekom Austria's broader international portfolio.

Question Marks

A1's new fixed-line broadband offering in Serbia, launched in early 2025 after acquiring Conexio Metro, positions it as a fully convergent provider. This venture enters a growing market but currently has a minimal market share due to its nascent stage.

Significant capital investment is anticipated to elevate this segment from a Question Mark to a Star within the BCG matrix. For context, Serbia's broadband market saw a 5% year-on-year growth in fixed broadband subscriptions in 2023, reaching over 2.8 million connections.

A1 Digital is venturing into advanced IoT applications like Industry 4.0 and smart city initiatives. These sectors offer substantial growth prospects, though A1's current market penetration is minimal due to the early stage of market development and the considerable investment needed for widespread adoption.

The potential of 5G technology within Industrial IoT (IIoT) underscores this emerging, yet unproven, growth avenue. For instance, by 2024, the global IIoT market was projected to reach over $214 billion, indicating the significant scale of this nascent opportunity.

A1 is a key player in pioneering future mobile communication, exemplified by its collaboration with Nokia on pre-6G video streaming trials within Austria. This forward-thinking initiative places A1 at the forefront of technological advancement.

This venture into pre-6G technology represents a significant investment in a nascent market with immense, albeit uncertain, future growth potential. The development phase is still in its infancy, meaning there is no established market share yet.

New Digital Payment Solutions

Telekom Austria's strategic focus on new digital payment solutions positions it within a rapidly expanding market, aligning with its goal to foster smart business ecosystems. This initiative suggests a Stars or Question Marks category within the BCG Matrix, depending on market share and growth potential. The digital payments market globally is projected to reach over $2.5 trillion by 2027, highlighting the significant growth opportunity.

While Telekom Austria is investing in this high-growth area, its current market share in digital payments is likely nascent compared to dominant global and regional players. For example, in 2024, companies like Adyen and Stripe continue to hold substantial market shares in various digital payment segments. These new solutions necessitate substantial investment in marketing and user acquisition to achieve critical mass and compete effectively.

- High Market Growth: The global digital payments market is experiencing robust expansion, driven by increasing smartphone penetration and e-commerce.

- Investment Focus: Telekom Austria is actively developing and promoting digital payment solutions as part of its broader smart business strategy.

- Market Share Challenge: Gaining significant market share in digital payments requires overcoming established competitors with existing user bases and infrastructure.

- Adoption Hurdles: Success hinges on driving user adoption through effective marketing, seamless integration, and compelling value propositions.

Expansion into New Digital Services beyond Core Connectivity

A1 Telekom Austria is actively pursuing expansion into new digital services beyond its core connectivity offerings, a strategic move aligning with the 'Question Marks' category in the BCG Matrix. This involves a significant focus on B2B digital services and other digital solutions, aiming to tap into high-growth markets such as digital transformation and IT consulting.

These ventures, while promising, are in their nascent stages of market penetration. A1 is investing heavily to build market share and achieve widespread adoption for these newer digital offerings, acknowledging the inherent risks and the need for substantial capital commitment.

- B2B Digital Services: Targeting areas like cloud solutions, cybersecurity, and IoT platforms.

- Early Stage Investment: Significant R&D and marketing expenditure is allocated to these new digital ventures.

- Market Penetration Goal: Focus on establishing a strong foothold and customer base in these competitive digital landscapes.

- High Growth Potential: The strategy anticipates substantial future revenue streams as these services mature.

Telekom Austria's ventures into new digital services, such as B2B digital solutions and advanced IoT applications, are classified as Question Marks in the BCG Matrix. These initiatives are characterized by high market growth potential but currently hold a low market share due to their early stage of development and the significant investments required for expansion.

The company is actively investing in these areas to build market presence and achieve widespread adoption, recognizing the competitive landscape and the need for substantial capital commitment to transform these into Stars.

For instance, the global IIoT market was projected to exceed $214 billion by 2024, illustrating the substantial growth prospects for A1's IoT ventures, despite their current minimal market penetration.

Similarly, the digital payments market, a key focus for Telekom Austria, is expected to reach over $2.5 trillion by 2027, highlighting the significant, albeit challenging, opportunity for growth.

BCG Matrix Data Sources

Our Telekom Austria BCG Matrix leverages comprehensive data from financial reports, market share analyses, and industry growth projections. This ensures a robust understanding of each business unit's performance and market position.