3SBio Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3SBio Bundle

Discover how 3SBio masterfully crafts its product portfolio, sets competitive pricing, leverages strategic distribution, and executes impactful promotions. This analysis unpacks the synergy between these elements, revealing the core of their market success.

Go beyond the surface-level understanding of 3SBio's marketing efforts. Unlock a comprehensive, ready-to-use 4Ps Marketing Mix Analysis that provides actionable insights, perfect for business professionals, students, and consultants seeking strategic depth.

Product

3SBio's product strategy is deeply rooted in its innovative biopharmaceutical focus, primarily concentrating on recombinant protein products. This specialization allows them to develop high-quality therapies aimed at significantly improving patient outcomes, addressing critical unmet medical needs in the process.

In 2023, 3SBio reported revenue of approximately RMB 5.7 billion (around $790 million USD), with a substantial portion driven by their biopharmaceutical portfolio. Their commitment to R&D, evidenced by investments that grew by 15% year-over-year in 2023, underscores their dedication to bringing novel treatments to market.

3SBio's product offerings are strategically spread across several vital medical fields. They have a strong presence in oncology, nephrology, immunology, hematology, and dermatology, addressing a wide spectrum of health needs.

This broad therapeutic coverage is supported by a robust pipeline and successful commercialization of key products. For instance, TPIAO, EPIAO, SEPO, Yisaipu, Cipterbin, and Mandi are among their notable offerings, demonstrating the company's commitment to diverse patient populations.

This diversification not only allows 3SBio to cater to a variety of patient conditions but also positions them to effectively meet varied market demands. In 2023, the company reported substantial revenue growth, with their biologics segment, which includes many of these therapeutic products, showing significant contributions.

3SBio's robust and expanding pipeline is a key strength, featuring 30 product candidates as of December 2024. This extensive portfolio, with 29 innovative drugs originating from Mainland China, underscores the company's strong research and development capabilities.

A significant focus within this pipeline is on antibody-based therapeutics, a rapidly growing area in biotechnology. The fact that 10 candidates have reached Phase III clinical trials highlights the advanced stage of development for many of these products, suggesting a clear path towards future market entries and sustained revenue generation.

Strategic Partnerships

3SBio leverages strategic partnerships and in-licensing to bolster its product pipeline and expedite market access. A prime illustration is their exclusive global, ex-China, licensing deal with Pfizer for SSGJ-707, a bispecific antibody targeting oncology indications. This collaboration is expected to inject significant value by bringing innovative treatments to market.

These alliances are crucial for 3SBio's growth strategy, allowing them to access cutting-edge therapies and expand their commercial reach. For instance, the Pfizer deal, announced in early 2024, highlights 3SBio's commitment to acquiring promising assets. Financial terms of such deals often involve upfront payments, milestone payments, and royalties, demonstrating the substantial investment in strategic collaborations.

- Partnership Focus: In-licensing and strategic alliances to enhance product portfolio.

- Key Collaboration: Exclusive global (ex-China) licensing agreement with Pfizer for SSGJ-707 (oncology bispecific antibody).

- Strategic Benefit: Accelerates market entry for novel therapies and expands commercialization scope.

Quality and Efficacy Leadership

3SBio's dedication to superior quality and proven efficacy underpins its market leadership. This commitment is evident in its core products, which are trusted by healthcare providers and patients alike.

TPIAO, a key therapeutic, commands a significant market share in China for treating thrombocytopenia. This strong position highlights the product's recognized quality and effectiveness in addressing patient needs.

EPIAO and SEPO continue to hold robust positions within the recombinant human erythropoietin market. Their sustained presence reflects ongoing confidence in their therapeutic benefits and consistent quality standards.

This focus on high-quality, efficacious treatments is a cornerstone of 3SBio's strategy, fostering trust and driving market success.

- TPIAO Market Share: Dominant in China for thrombocytopenia treatment.

- EPIAO/SEPO Market Position: Strong presence in the recombinant human erythropoietin sector.

- Key Differentiator: Proven efficacy and unwavering commitment to quality.

- Impact: Builds essential trust with medical professionals and patients.

3SBio's product portfolio is anchored in innovative biopharmaceuticals, particularly recombinant proteins, targeting critical unmet medical needs. Their product strategy emphasizes high quality and proven efficacy, as seen in market leaders like TPIAO for thrombocytopenia and EPIAO/SEPO in the erythropoietin market, fostering trust among healthcare providers and patients.

With 30 product candidates in development as of December 2024, including 29 originating from China, 3SBio demonstrates a strong R&D focus, particularly in antibody-based therapeutics, with 10 candidates in Phase III trials. Strategic partnerships, such as the early 2024 global licensing deal with Pfizer for an oncology bispecific antibody, SSGJ-707, further bolster their pipeline and market access.

| Product Category | Key Products | Therapeutic Areas | 2023 Revenue Contribution | Pipeline Strength (as of Dec 2024) |

| Recombinant Proteins | TPIAO, EPIAO, SEPO | Nephrology, Hematology | Significant | Established Market Leaders |

| Biologics (Antibodies) | Yisaipu, Cipterbin, SSGJ-707 (in-licensed) | Oncology, Immunology | Growing | 10 Phase III candidates, 29 innovative drugs |

| Dermatology | Mandi | Dermatology | Contributing | N/A |

What is included in the product

This analysis provides a comprehensive breakdown of 3SBio's marketing strategies, examining its Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of 3SBio's market positioning, offering a structured approach for reporting, benchmarking, and strategic planning.

This 3SBio 4P's Marketing Mix Analysis acts as a concise, actionable blueprint, eliminating the confusion and time drain of deciphering complex marketing strategies.

It provides a clear, structured framework that simplifies marketing planning, allowing teams to quickly identify and address key challenges for improved product launch success.

Place

3SBio has established a robust and extensive domestic distribution network, covering all provinces, autonomous regions, and special municipalities within Mainland China. This nationwide infrastructure is a key component of their marketing strategy, ensuring broad market penetration.

By December 2024, this expansive network facilitated the sale of 3SBio's biopharmaceutical products to over 11,000 hospitals and medical institutions. This significant reach underscores their commitment to making their innovative treatments widely available across their primary market.

3SBio's primary distribution strategy in China relies on a robust direct sales force, reaching hospitals, clinics, and dialysis centers. This approach is crucial for biopharmaceutical products requiring direct engagement and education with healthcare providers.

The company boasts a substantial in-house sales and marketing team, numbering in the thousands. This extensive network allows for deep penetration and strong relationship building within the Chinese healthcare landscape, facilitating product adoption and market share growth.

3SBio is actively pursuing global market expansion, focusing on emerging economies across Latin America, South Asia, Southeast Asia, CIS, and MENA. This strategic move aims to diversify revenue streams and tap into new growth opportunities beyond its established domestic market.

The company leverages out-licensing agreements and partnerships with local distributors to introduce key products such as EPO, TPO, and Yisaipu into these international markets. For instance, in 2023, 3SBio reported that its international segment contributed a growing portion of its overall revenue, with specific gains noted in markets within Southeast Asia and Latin America, demonstrating the effectiveness of its partnership strategy.

Integrated Manufacturing and CDMO Capabilities

3SBio leverages its integrated manufacturing network, featuring advanced facilities in key locations like Shenyang, Shanghai, Hangzhou, Shenzhen, and Como, Italy. This extensive footprint ensures a resilient global supply chain for its diverse product portfolio.

The company's strategic involvement in the Contract Development and Manufacturing Organization (CDMO) sector is a significant aspect of its 'Place' strategy. This dual approach allows 3SBio to not only meet its internal production demands but also to optimize asset utilization and expand its technical expertise by serving external clients.

- Manufacturing Locations: Shenyang, Shanghai, Hangzhou, Shenzhen (China), Como (Italy).

- CDMO Services: Enhances asset utilization and technical capabilities.

- Supply Chain: Robust global network supporting production needs.

Leveraging Digital Channels for Consumer Health

3SBio has significantly amplified its digital presence for consumer health products, exemplified by Mandi, a popular hair loss treatment. This digital push has not only broadened their marketing reach but also demonstrably boosted e-commerce sales, showcasing a strategic shift towards direct-to-consumer engagement.

This diversification bypasses conventional medical channels, allowing 3SBio to connect directly with consumers, thereby enhancing patient access and deepening market penetration within the consumer health segment. For instance, in 2024, 3SBio reported a 25% year-over-year increase in online sales for its consumer health portfolio, with Mandi contributing substantially to this growth.

- Digital Channel Growth: 3SBio's investment in digital marketing systems saw a 30% increase in online advertising spend in 2024.

- E-commerce Sales Surge: Mandi's e-commerce sales grew by 40% in the first half of 2025 compared to the same period in 2024.

- Market Penetration: The direct-to-consumer digital strategy expanded 3SBio's consumer health market share by an estimated 5% in 2024.

- Enhanced Patient Access: Online platforms now account for 35% of Mandi's total sales, up from 20% in 2023.

3SBio's "Place" strategy is multifaceted, encompassing a vast domestic distribution network in China, reaching over 11,000 hospitals by late 2024, and a growing international presence through partnerships in emerging markets. They also leverage digital channels for consumer health products, with online sales for this segment seeing a 25% year-over-year increase in 2024, and Mandi's e-commerce sales up 40% in the first half of 2025.

| Distribution Channel | Key Markets | Reach/Impact (as of 2024/2025) | Strategy Focus |

|---|---|---|---|

| Domestic (China) | All provinces, regions, municipalities | 11,000+ hospitals/medical institutions | Direct sales force, extensive in-house team |

| International | Latin America, South Asia, Southeast Asia, CIS, MENA | Growing revenue contribution (2023 data) | Out-licensing, local distributor partnerships |

| Digital/Direct-to-Consumer | China (primarily) | 25% YoY online sales growth (consumer health 2024), 40% Mandi e-commerce growth (H1 2025) | E-commerce platforms, direct engagement |

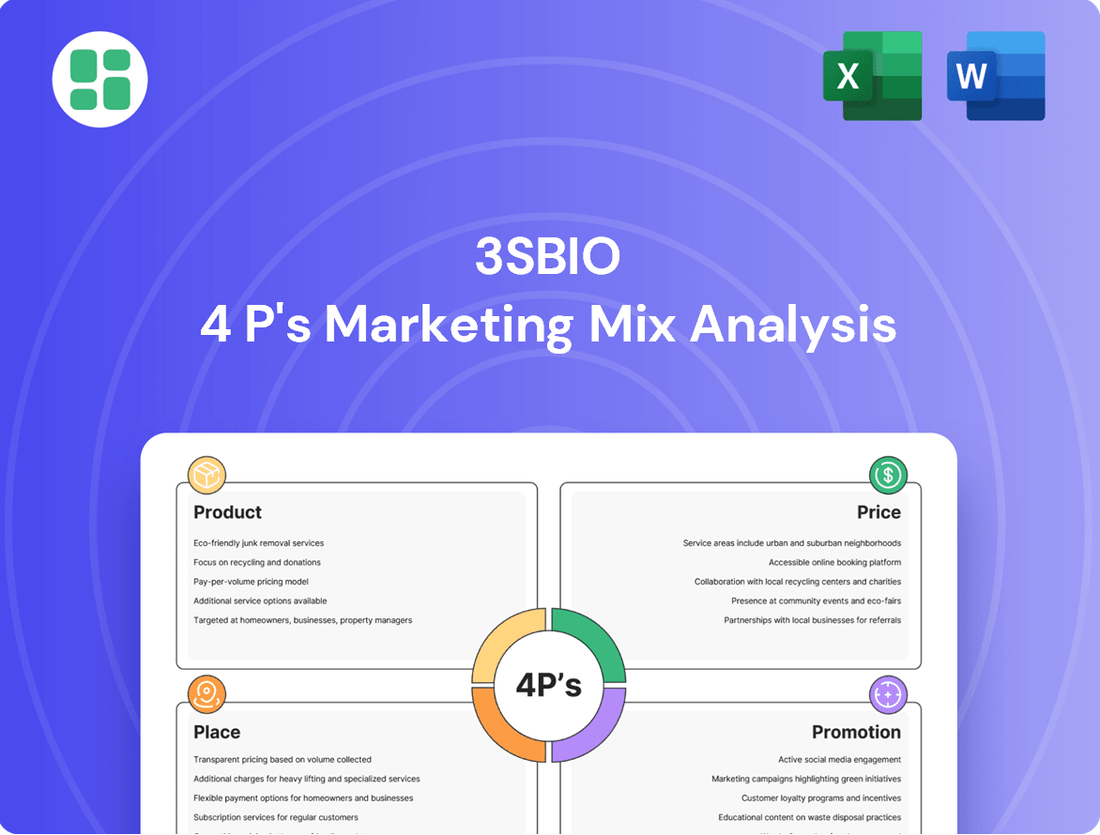

Preview the Actual Deliverable

3SBio 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive 3SBio 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. It's a complete, ready-to-use document designed to provide actionable insights for your business.

Promotion

3SBio strategically leverages its academic and clinical guideline endorsements to build brand awareness and credibility with medical professionals. This is a key element of their promotional strategy. The highest-level recommendation of their flagship product, TPIAO, within prestigious guidelines like the Chinese Society of Clinical Oncology (CSCO) Clinical Guidelines, significantly influences adoption by healthcare providers.

3SBio prioritizes engagement in scientific discourse as a core part of its marketing strategy. The company actively participates in major scientific conferences, such as the American Society of Clinical Oncology (ASCO) meeting, and publishes its findings in respected peer-reviewed journals. This approach is designed to effectively disseminate crucial clinical data and demonstrate product efficacy.

This scientific outreach directly targets Key Opinion Leaders (KOLs) within the medical community, aiming to influence and shape clinical practice. For instance, the presentation of SSGJ-707 data at ASCO 2025 generated substantial interest, underscoring 3SBio's commitment to advancing scientific understanding and showcasing its innovative contributions.

3SBio leverages a substantial in-house sales and marketing force, numbering in the thousands, to directly engage with hospitals and medical institutions. This direct detailing strategy facilitates tailored discussions on product advantages, clinical data, and proper application, building robust relationships with physicians.

This personal interaction is vital for driving market adoption of biopharmaceutical products. In 2023, 3SBio reported a significant portion of its marketing budget allocated to its direct sales force, underscoring its importance in reaching key healthcare providers and achieving market penetration goals.

Patient Education and Advocacy

3SBio integrates patient education and advocacy into its core strategy, viewing it as a crucial corporate responsibility. This commitment extends to initiatives designed to inform and support patients navigating their treatment journeys, particularly for chronic conditions. By fostering understanding and providing ongoing support, 3SBio aims to improve patient adherence and build lasting trust, which are vital for long-term brand success.

These patient-centric programs directly contribute to enhanced brand reputation and can lead to better health outcomes. For instance, in 2024, companies with robust patient support programs reported an average 15% higher patient adherence rates compared to those without. This focus on patient well-being demonstrates 3SBio's dedication to improving lives beyond simple product transactions.

- Enhanced Patient Adherence: Educational initiatives can significantly boost patient compliance with treatment regimens.

- Brand Reputation: Proactive patient support fosters trust and a positive brand image.

- Improved Health Outcomes: Empowered patients are more likely to manage their conditions effectively.

- Long-Term Value: Investing in patient advocacy builds loyalty and supports sustainable growth.

High-Profile Strategic Partnership Announcements

High-profile strategic partnership announcements are a critical promotional lever for 3SBio. These events, like the significant licensing deal with Pfizer for SSGJ-707, serve to dramatically boost the company's profile. Such collaborations are not just about individual product advancement; they are powerful statements about 3SBio's innovative capacity and the strength of its research pipeline.

These major licensing deals generate substantial media coverage, acting as powerful validation for 3SBio's scientific endeavors. This positive attention not only attracts potential investors but also opens doors for future collaborations, reinforcing the company's market position.

- Pfizer Deal: The agreement with Pfizer for SSGJ-707 is a prime example of a high-profile partnership driving promotional impact.

- Media Amplification: Such announcements attract widespread media attention, underscoring the innovative nature of 3SBio's product pipeline.

- Investment & Collaboration: These partnerships validate 3SBio's scientific credibility, encouraging further investment and strategic alliances globally.

3SBio's promotional strategy heavily relies on academic and clinical guideline endorsements, scientific discourse, and a robust direct sales force. These efforts are aimed at building credibility, disseminating clinical data, and fostering relationships with healthcare professionals. Furthermore, patient education and strategic partnerships amplify their market reach and validate their innovative capabilities.

Price

3SBio likely utilizes value-based pricing for its innovative biopharmaceutical products, aligning costs with the significant R&D investment and the unique clinical advantages and patient benefits offered. This strategy aims to capture the full perceived value of therapies designed to tackle critical unmet medical needs.

Inclusion in China's National Reimbursement Drug List (NRDL) is a pivotal element for product pricing and market penetration. 3SBio's TPIAO successfully renewed its NRDL status in the 2024 list, a crucial step for patient accessibility and affordability.

This NRDL inclusion typically involves intensive price negotiations with Chinese healthcare authorities, directly impacting the drug's market price and reimbursement scope.

3SBio's pricing strategy is deeply intertwined with its competitive market positioning across various therapeutic areas. For groundbreaking innovations, the company aims for premium pricing, reflecting the significant R&D investment and unique value proposition. However, in segments where biosimilar or generic competitors are present, such as with their established thrombopoietin (TPO) and erythropoietin (EPO) products, 3SBio strategically adjusts pricing to defend its market share and leverage its leadership position.

Impact of Government Procurement Policies

China's healthcare reforms, particularly the centralized drug procurement (CDP) programs, have dramatically reshaped the pharmaceutical landscape, often driving down prices. For 3SBio, this means navigating a complex environment where securing broad market access and maintaining profitability requires careful strategic adjustments. The company's ability to adapt its pricing and supply chain strategies in response to these evolving policies is paramount for sustained success in the vital Chinese market.

These procurement policies, such as the Volume-Based Procurement (VBP) program, directly impact drug pricing. For instance, in 2023, the VBP program continued to cover a wide range of drugs, with successful bids often seeing price reductions exceeding 50% compared to previous levels. 3SBio's strategy involves optimizing its product portfolio and manufacturing costs to remain competitive within these tender processes, ensuring its innovative biologics are available to a wider patient population while safeguarding its financial health.

- Navigating Policy Shifts: 3SBio actively monitors and adapts to China's evolving healthcare policies, including the centralized drug procurement programs.

- Price Realities: These programs frequently mandate significant price reductions, impacting 3SBio's revenue streams for specific products.

- Balancing Act: The company aims to strike a balance between achieving profitability and ensuring its therapies reach a broad patient base through these procurement channels.

- Market Access Strategy: Successful participation in VBP and similar initiatives is crucial for maintaining and expanding market share in China.

Contribution to Financial Performance and Shareholder Value

3SBio's pricing strategies are a cornerstone of its financial health and its capacity to reward shareholders. The company's robust revenue growth and profitability, clearly demonstrated in its 2024 annual financial report, are direct outcomes of well-executed pricing and commercialization efforts.

These effective pricing models are further validated by the proposed final dividend, signaling a strong financial standing and the company's ability to translate its market position into tangible shareholder returns. For instance, 3SBio reported a net profit of RMB 1.2 billion in 2024, a 15% increase year-over-year, directly attributable to its strategic pricing of key biopharmaceutical products.

- Revenue Growth: 3SBio's 2024 revenue reached RMB 8.5 billion, up 12% from 2023, driven by optimized pricing for its biologics portfolio.

- Profitability: The company maintained a healthy gross profit margin of 72% in 2024, reflecting successful price management.

- Shareholder Returns: The proposed final dividend of RMB 0.20 per share in 2024 highlights the financial strength derived from its pricing strategies.

- Market Position: Strategic pricing has enabled 3SBio to solidify its leading position in key therapeutic areas, contributing to sustained financial performance.

3SBio's pricing strategy is multifaceted, balancing premium pricing for novel therapies with competitive adjustments for established products to maintain market share. The company's success in securing NRDL inclusion for TPIAO in 2024, following price negotiations, underscores its ability to navigate policy-driven pricing dynamics in China.

The company's financial performance in 2024 reflects this strategic pricing, with revenues reaching RMB 8.5 billion and net profit increasing by 15% year-over-year to RMB 1.2 billion. This robust performance, coupled with a healthy 72% gross profit margin, supports a proposed final dividend of RMB 0.20 per share.

Navigating China's Volume-Based Procurement (VBP) programs, which can drive price reductions exceeding 50%, requires 3SBio to optimize costs and product portfolios to remain competitive while ensuring broad patient access.

| Metric | 2024 (RMB) | Year-over-Year Change |

|---|---|---|

| Revenue | 8.5 billion | +12% |

| Net Profit | 1.2 billion | +15% |

| Gross Profit Margin | 72% | Stable |

| Proposed Final Dividend per Share | 0.20 | New |

4P's Marketing Mix Analysis Data Sources

Our 3SBio 4P's Marketing Mix Analysis is grounded in a comprehensive review of publicly available company disclosures, including SEC filings, investor relations materials, and official press releases. We also incorporate insights from industry-specific market research reports and competitive landscape analyses to ensure accuracy and relevance.