3SBio Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3SBio Bundle

3SBio faces moderate bargaining power from buyers due to the specialized nature of its biopharmaceutical products, but intense competition from existing players and potential new entrants significantly shapes its market dynamics. Understanding these forces is crucial for strategic planning.

Ready to move beyond the basics? Get a full strategic breakdown of 3SBio’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The biopharmaceutical sector, including companies like 3SBio, depends on a narrow group of suppliers for highly specialized raw materials, reagents, and equipment. This scarcity directly translates into substantial bargaining power for these suppliers.

For 3SBio, the cost of switching suppliers is often considerable. This is due to stringent regulatory hurdles and the extensive validation processes required for any new material or vendor, making it difficult and time-consuming to change sourcing partners.

In the biopharmaceutical industry, switching suppliers is a significant undertaking. It involves rigorous validation processes and obtaining necessary regulatory approvals, which can take considerable time and resources. This complexity inherently raises the switching costs for companies like 3SBio.

These high switching costs effectively strengthen the bargaining power of 3SBio's current suppliers. This is particularly true for suppliers providing critical raw materials, specialized equipment, or proprietary technologies essential for 3SBio's drug development and manufacturing processes. For instance, if a key active pharmaceutical ingredient (API) supplier has unique manufacturing capabilities that are difficult to replicate, 3SBio faces substantial hurdles and costs to find and qualify an alternative, giving that supplier considerable leverage.

Suppliers possessing patents on critical components or manufacturing techniques can wield substantial bargaining power over companies like 3SBio. This intellectual property exclusivity restricts alternative sourcing, potentially driving up costs for 3SBio. For instance, in the biopharmaceutical sector, patent protection on novel drug delivery systems or unique cell culture media can significantly enhance a supplier's leverage.

Potential for Forward Integration by Suppliers

While not a frequent occurrence, the possibility of specialized suppliers integrating forward into manufacturing or even drug development poses an implicit threat to 3SBio. This means some suppliers could potentially become direct competitors, leveraging their existing expertise and resources. This capability inherently strengthens their bargaining position, compelling 3SBio to cultivate robust and mutually beneficial supplier relationships to mitigate this risk.

- Supplier Forward Integration Threat: Specialized suppliers may integrate forward into manufacturing or drug development, directly competing with 3SBio.

- Increased Bargaining Power: This potential competition enhances supplier leverage, influencing pricing and terms.

- Relationship Management: 3SBio must maintain strong supplier relationships to counter this threat.

Quality and Regulatory Compliance Requirements

The biopharmaceutical industry, including companies like 3SBio, operates under exceptionally stringent quality and regulatory compliance mandates. Suppliers of critical components, such as active pharmaceutical ingredients (APIs) and specialized cell culture media, must meet rigorous standards set by bodies like the FDA and EMA. This necessity for adherence significantly increases the complexity and cost associated with supplier operations, limiting the pool of qualified providers.

3SBio's reliance on these specialized suppliers for high-quality, compliant materials directly translates into increased supplier bargaining power. The inability of a supplier to meet these exacting requirements can halt production, making 3SBio's dependence on their consistent adherence a significant factor. For instance, in 2024, the global biopharmaceutical contract manufacturing market was valued at approximately USD 20 billion, with a substantial portion dedicated to ensuring regulatory compliance and quality control, underscoring the significant investment required by suppliers.

- High Compliance Costs: Suppliers face substantial expenses for R&D, validation, and maintaining Good Manufacturing Practices (GMP), which are passed on to buyers.

- Limited Qualified Suppliers: The specialized nature of biopharmaceutical components means fewer suppliers can meet the required quality and regulatory benchmarks.

- Production Interruption Risk: Any lapse in a supplier's compliance can lead to costly production delays for 3SBio.

- Supplier Dependence: 3SBio's need for uninterrupted supply of compliant materials strengthens the negotiating position of its key suppliers.

Suppliers in the biopharmaceutical sector, especially those providing specialized raw materials or patented components, hold significant bargaining power over companies like 3SBio. This power is amplified by high switching costs, driven by rigorous validation and regulatory approval processes, which can take extensive time and resources. For example, in 2024, the complexity of qualifying new suppliers for active pharmaceutical ingredients (APIs) can add 6-18 months to a product's development timeline, a substantial hurdle for any biopharma firm.

| Factor | Impact on 3SBio | Supplier Leverage |

|---|---|---|

| Specialized Inputs | Reliance on unique materials | High |

| Switching Costs | Regulatory hurdles, validation time | High |

| Supplier Patents | Exclusivity on critical components | High |

| Compliance Demands | Strict quality and regulatory standards | High |

What is included in the product

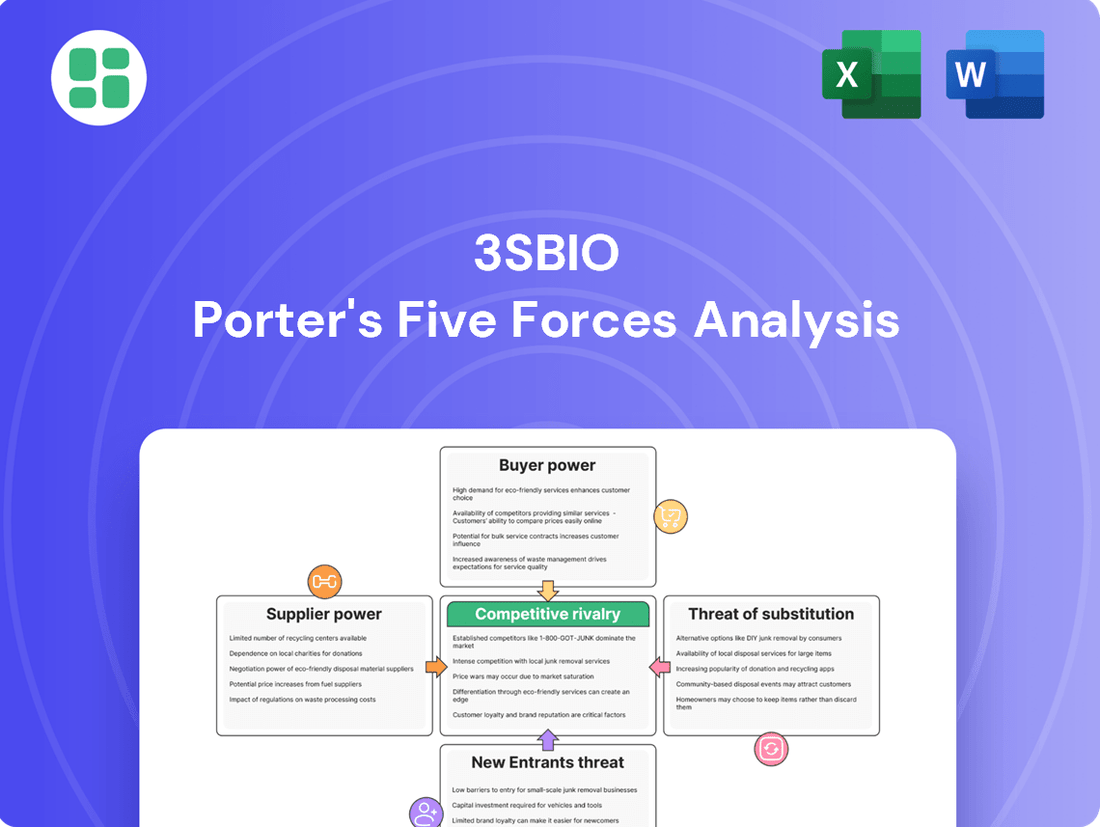

This analysis uncovers the competitive intensity, buyer and supplier power, threat of substitutes, and barriers to entry impacting 3SBio's strategic positioning and profitability.

Effortlessly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Pinpoint potential disruptions and opportunities across the competitive landscape, enabling proactive strategic adjustments.

Customers Bargaining Power

3SBio's significant customer base, including major hospitals, government health programs, and large pharmacy networks, wields considerable influence. These entities, by purchasing in bulk, can negotiate for reduced pricing and more favorable contract conditions.

For instance, in 2024, the average price reduction negotiated by large hospital groups for pharmaceuticals often ranged from 5% to 15% based on volume commitments, directly impacting 3SBio's revenue margins for these sales.

This bargaining power necessitates that 3SBio carefully manage its pricing strategies and product differentiation to maintain profitability when dealing with these key accounts.

Customers, particularly government payers and insurance companies, exhibit strong price sensitivity. This is driven by healthcare budget limitations and national reimbursement policies, which directly impact 3SBio's pricing strategies. In 2024, for instance, many national health systems continued to implement stringent cost-control measures, leading to increased pressure on pharmaceutical companies to lower prices, especially for biologics facing emerging biosimilar competition.

The growing availability of generic drugs and biosimilars significantly bolsters customer bargaining power. Even if these alternatives don't directly match 3SBio's patented biologics, they present more affordable treatment options, forcing 3SBio to consider pricing and value propositions more carefully. This competitive landscape empowers customers by giving them choices and leverage in their purchasing decisions.

Customer Information and Awareness

While patients often rely on their doctors, increased access to treatment information, particularly for common ailments, is boosting customer awareness. This growing knowledge empowers patients to request specific therapies or seek out more budget-friendly options, directly influencing demand.

For instance, in 2024, online health information platforms saw continued robust engagement, with many users actively comparing treatment efficacy and cost. This trend suggests that patients are becoming more proactive in their healthcare decisions, shifting some of the traditional power dynamic towards them.

- Increased Online Health Information: In 2024, a significant percentage of consumers reported using online resources to research medical conditions and treatment options before consulting a physician.

- Demand for Cost-Effective Alternatives: Growing awareness of drug pricing and insurance coverage is leading patients to inquire more frequently about generic or biosimilar options.

- Patient Empowerment in Treatment Choices: Patients are increasingly comfortable discussing and negotiating treatment plans with their healthcare providers, armed with readily available comparative data.

Regulatory Influence on Access and Pricing

Government and regulatory bodies exert significant influence over drug pricing and market access, especially in China where 3SBio is a key player. National drug lists and procurement tenders are primary mechanisms for this control. For instance, inclusion on China's National Reimbursement Drug List (NRDL) is vital for widespread patient access and commercial success, but often necessitates substantial price reductions through competitive bidding processes. This dynamic directly amplifies the bargaining power of customers, which include government health insurance providers and large hospital networks.

The pricing of pharmaceuticals is frequently determined through tenders, where government entities or large healthcare providers solicit bids from manufacturers. 3SBio, like its peers, must navigate these tender processes, which can lead to considerable price concessions. For example, in 2023, many innovative drugs saw price reductions of over 50% when included in centralized procurement programs in China, a trend that continued into early 2024. This environment forces companies to balance market penetration with profitability, as customer power in these negotiations is substantial.

- Regulatory Influence: Government bodies in China dictate which drugs are reimbursed and at what price, directly impacting 3SBio's revenue potential.

- Procurement Tenders: Participation in national and provincial tenders is essential for market access but often involves aggressive price negotiations.

- Price Reductions: Reports from 2023 and early 2024 indicate significant price cuts, sometimes exceeding 50%, for drugs entering centralized procurement, highlighting customer leverage.

- Market Access Dependence: Inclusion on national drug lists is critical, but this access is frequently contingent on accepting lower prices, thereby strengthening the bargaining power of the purchasing entities.

3SBio faces significant customer bargaining power from its large institutional buyers like hospitals and government health programs. These entities, by purchasing in bulk, can negotiate for reduced pricing and more favorable contract terms. For instance, in 2024, major hospital groups often secured pharmaceutical price reductions ranging from 5% to 15% based on volume commitments, directly affecting 3SBio's revenue margins.

| Customer Segment | Bargaining Power Drivers | Impact on 3SBio (2024 Estimates) |

|---|---|---|

| Major Hospitals & Pharmacy Networks | Bulk purchasing, volume commitments | Negotiated price reductions (5-15%), favorable contract terms |

| Government Health Programs | Price sensitivity, budget limitations, national reimbursement policies | Increased pressure for lower prices, especially for biologics |

| Patients (increasingly informed) | Access to health information, demand for cost-effective alternatives | Demand for generics/biosimilars, negotiation with providers |

What You See Is What You Get

3SBio Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape of 3SBio through a rigorous Porter's Five Forces analysis, covering the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors.

Rivalry Among Competitors

The biopharmaceutical sector, particularly in China, is booming with growth fueled by rising healthcare needs and strong government backing for new discoveries. This robust expansion, however, also draws a crowd of competitors, making the fight for market dominance fierce, especially in fast-developing treatment areas.

3SBio competes in crowded therapeutic markets such as oncology, nephrology, and immunology, facing a multitude of both domestic Chinese and international pharmaceutical companies. This crowded landscape intensifies rivalry, as numerous players vie for market share and patient access.

The biopharmaceutical industry, including the segments where 3SBio operates, is defined by substantial research and development (R&D) expenditure. Companies are continually investing heavily to discover and bring to market novel treatments, creating a dynamic environment where innovation is paramount and the threat of new, disruptive therapies is ever-present.

In 2024, the global biopharmaceutical R&D spending was projected to exceed $250 billion, highlighting the significant capital commitment required to remain competitive. This intense focus on R&D means that companies like 3SBio must constantly innovate to differentiate their product pipelines and maintain a competitive edge against rivals who are also investing heavily in new drug development.

3SBio's flagship product, TPIAO, boasts a strong market position and unique attributes, showcasing effective product differentiation. However, the broader biopharmaceutical sector is characterized by relentless innovation as companies strive to distinguish their offerings.

The biopharmaceutical industry is facing a significant patent cliff for numerous biologics, a trend that is expected to accelerate competition. In 2023, the global biopharmaceutical market size was valued at approximately $1.5 trillion, with a significant portion of revenue tied to blockbuster drugs facing or nearing patent expiration.

The increasing prevalence of biosimilars intensifies this rivalry, compelling companies like 3SBio to continuously invest in research and development. This ensures a pipeline of novel products and maintains a competitive edge against lower-cost alternatives, thereby safeguarding market share and profitability.

Strategic Partnerships and Global Expansion

Chinese biopharmaceutical companies, including 3SBio, are actively pursuing strategic partnerships and global expansion to enhance their competitive standing. This proactive approach is evident in 3SBio's licensing agreement with Pfizer, a significant move that underscores the growing importance of international collaboration in the industry. Such alliances not only provide access to new markets and technologies but also intensify rivalry by raising the bar for innovation and operational efficiency.

The competitive landscape is increasingly shaped by these cross-border ventures and strategic alliances. For instance, in 2024, numerous Chinese biotech firms announced collaborations with Western pharmaceutical giants, aiming to leverage global R&D capabilities and distribution networks. This trend suggests that companies failing to engage in such partnerships may find themselves at a disadvantage.

- Increased Collaboration: 3SBio's partnership with Pfizer exemplifies the trend of Chinese biotechs seeking global alliances.

- Market Access: These partnerships are crucial for gaining access to international markets and distribution channels.

- Innovation Drive: Global expansion and collaboration spur innovation, intensifying competition among all players.

- Competitive Pressure: Companies not participating in global expansion face growing pressure from more interconnected rivals.

Regulatory Environment and Market Access

China's regulatory environment is a dynamic force impacting competitive rivalry. While reforms in 2024 have accelerated drug approvals, securing market access, particularly inclusion in the National Reimbursement Drug List (NRDL), remains a significant hurdle for companies like 3SBio. This process is crucial for commercial success, as NRDL inclusion dramatically expands patient access and sales potential. Companies must therefore strategize to align their innovative pipelines with evolving regulatory priorities and demonstrate clear value to gain reimbursement.

Navigating these regulatory complexities directly influences competitive intensity. Companies that effectively manage the drug approval and reimbursement pathways can gain a substantial advantage, potentially limiting the market penetration of slower-moving competitors. For instance, in 2023, the average time for innovative drug approval in China saw a notable reduction, yet the NRDL negotiation process can still be lengthy and demanding, requiring substantial price concessions. This creates a competitive tension between rapid innovation and the ability to translate that innovation into widespread market access and profitability.

- Accelerated Approvals: China's regulatory reforms continue to streamline the drug approval process, with a focus on innovative therapies.

- Market Access Challenges: Inclusion in the NRDL remains a critical but challenging step for commercial success, impacting competitive positioning.

- Strategic Imperative: Companies must balance R&D investment with the ability to navigate market access, influencing their competitive strategies.

- Value Demonstration: Successful negotiation for NRDL inclusion requires demonstrating significant clinical and economic value, a key differentiator.

The competitive rivalry within the biopharmaceutical sector, particularly for companies like 3SBio operating in China, is exceptionally intense. This is driven by a crowded market with numerous domestic and international players vying for dominance in key therapeutic areas. The constant need for substantial R&D investment, exceeding $250 billion globally in 2024, means that innovation is not just a strategy but a necessity for survival and differentiation.

The threat of biosimilars, exacerbated by an accelerating patent cliff for many established biologics, further fuels this rivalry. Companies must continuously develop novel products to counter lower-cost alternatives and maintain their market share. Strategic partnerships, such as 3SBio's collaboration with Pfizer, are becoming crucial for accessing global markets and enhancing competitive capabilities, a trend mirrored by many Chinese biotech firms in 2024.

Navigating China's evolving regulatory landscape, including the critical National Reimbursement Drug List (NRDL) inclusion, presents another layer of competitive challenge. While drug approvals have accelerated, securing reimbursement remains a significant hurdle. Companies that can effectively demonstrate value and manage these pathways gain a distinct advantage over rivals. For instance, the average time for innovative drug approval in China saw reductions in 2023, but NRDL negotiations still demand strategic maneuvering and price concessions, intensifying the competitive pressure.

| Factor | Description | Impact on 3SBio |

| Market Crowding | Numerous domestic and international firms compete in 3SBio's therapeutic areas. | High pressure to differentiate and gain market share. |

| R&D Intensity | Global R&D spending projected over $250 billion in 2024. | Requires continuous, significant investment to stay competitive. |

| Patent Expirations & Biosimilars | Increasing patent cliffs and growth of biosimilars. | Drives need for new product pipelines and threatens existing revenue streams. |

| Strategic Alliances | Growing trend of partnerships for market access and innovation. | Opportunity for 3SBio to expand, but also intensifies competition from allied firms. |

| Regulatory Environment | Accelerated approvals but challenging NRDL inclusion process. | Success hinges on navigating regulations and demonstrating value for market access. |

SSubstitutes Threaten

The most significant threat of substitutes for 3SBio originates from biosimilars and generics. Once patents on innovative biologic drugs expire, these lower-cost alternatives enter the market, offering comparable therapeutic benefits. For instance, the global biosimilar market is projected to reach approximately $68 billion by 2025, indicating a substantial competitive pressure.

This reality compels 3SBio to prioritize ongoing innovation and product differentiation. By developing novel therapies or enhancing existing ones, the company aims to justify its premium pricing strategies and safeguard its market share against the erosion caused by more affordable substitutes.

Beyond traditional drugs, alternative treatment modalities like gene therapies and cell therapies present a significant threat to established biopharmaceutical treatments. These advanced approaches, while still developing, offer novel mechanisms of action and the potential for more effective long-term outcomes.

For instance, the market for cell and gene therapies is experiencing rapid growth, with projections indicating substantial expansion in the coming years. By 2024, the global cell and gene therapy market was valued at approximately $12.5 billion, with forecasts suggesting it could reach over $30 billion by 2028, demonstrating a clear and accelerating shift in treatment paradigms.

Furthermore, sophisticated medical devices, such as implantable sensors or advanced diagnostic tools, can also act as substitutes by offering alternative ways to manage or even cure conditions previously addressed solely by pharmaceuticals. This diversification of treatment options means companies must continuously innovate to remain competitive.

In certain markets, particularly in regions like China, traditional medicines and lifestyle interventions pose a threat of substitution, especially for less severe or chronic health conditions. These alternatives can sway patient decisions away from conventional biopharmaceuticals, impacting market demand for specific treatments.

While these traditional approaches are generally not direct competitors to complex biopharmaceutical products for serious illnesses, their availability and patient acceptance can indirectly reduce the market share for certain biopharma offerings. For instance, in 2023, the global traditional medicine market was valued at approximately $150 billion, demonstrating a significant consumer base for these alternatives.

Patient and Physician Willingness to Switch

Patient and physician willingness to switch to alternative treatments is a significant factor in assessing the threat of substitutes for 3SBio's products. This willingness is shaped by several key elements, including how well a substitute is perceived to work, its safety record, how easy it is to use, and its overall cost. For instance, if a competitor launches a biosimilar with comparable efficacy and a lower price point, it could sway both patient and physician adoption.

To counter this, 3SBio must actively engage in educating both healthcare professionals and patients. Highlighting the unique value proposition and the specific benefits of 3SBio's innovative therapies is paramount. This educational push can help solidify loyalty and reduce the appeal of alternatives. In 2024, the global biosimil market was valued at approximately $25 billion, demonstrating a growing acceptance of alternatives, making robust education even more critical for 3SBio.

- Perceived Efficacy: How well a substitute performs compared to 3SBio's offerings.

- Safety Profiles: The comparative risk and side effect profiles of alternative treatments.

- Convenience of Use: Factors like administration method and dosing frequency.

- Cost-Effectiveness: The overall financial burden of the substitute versus 3SBio's therapies.

Innovation in Small Molecules

While 3SBio concentrates on biopharmaceuticals, the evolving landscape of small molecule drugs presents a potential substitute threat. Innovations in small molecule therapies, offering enhanced effectiveness, reduced side effects, or more convenient administration, could challenge biologics in specific treatment categories. For instance, by mid-2024, the global small molecule drug market was projected to reach over $1.4 trillion, indicating substantial ongoing research and development in this area, with new oral medications frequently gaining regulatory approval.

These advancements can directly impact 3SBio's market share if small molecule alternatives become more appealing to patients and healthcare providers. The accessibility and cost-effectiveness of small molecule drugs often make them a compelling alternative, particularly in therapeutic areas where the benefits of biologics are not overwhelmingly superior. The continued investment in small molecule research, evidenced by the significant number of clinical trials initiated annually, suggests this competitive pressure will persist.

- Small Molecule Market Growth: The global small molecule drug market is a significant and growing segment, indicating substantial competitive investment.

- Therapeutic Area Overlap: Advancements in small molecules can directly substitute for biologics in certain disease areas, impacting 3SBio's potential market.

- Innovation Drivers: Factors like improved efficacy, fewer side effects, and easier administration for small molecules drive their competitive appeal.

- R&D Investment: High levels of research and development in small molecule therapies signal ongoing and future competitive threats.

The threat of substitutes for 3SBio is multifaceted, encompassing biosimilars, generics, and emerging therapies. Biosimilars, in particular, represent a significant challenge as patent expirations allow lower-cost versions of biologic drugs to enter the market. For instance, the global biosimilar market was projected to reach around $68 billion by 2025, highlighting the competitive pressure from these alternatives.

Beyond biosimilars, advanced treatments like cell and gene therapies are gaining traction, offering novel approaches that could displace traditional biopharmaceuticals. The cell and gene therapy market was valued at approximately $12.5 billion in 2024 and is expected to grow substantially. Additionally, sophisticated medical devices and even traditional medicines can serve as substitutes, depending on the specific therapeutic area and patient needs. The global traditional medicine market, valued at around $150 billion in 2023, indicates a significant consumer base for non-biopharmaceutical options.

| Substitute Type | Market Size/Projection | Key Impact on 3SBio |

|---|---|---|

| Biosimilars & Generics | Global biosimilar market projected ~$68B by 2025 | Erodes market share and pricing power of biologics |

| Cell & Gene Therapies | Global market ~$12.5B (2024), projected >$30B by 2028 | Offers novel treatment paradigms, potentially displacing existing biologics |

| Traditional Medicines | Global market ~$150B (2023) | Can influence patient choice for less severe conditions, indirectly impacting biopharma market share |

Entrants Threaten

Developing novel biopharmaceutical products demands immense capital, often running into hundreds of millions, even billions, of dollars. This is largely due to the protracted and intricate process of preclinical research and extensive, multi-phase clinical trials, which are essential for regulatory approval. For instance, the average cost to bring a new drug to market in 2023 was estimated to be over $2.7 billion, a figure that continues to climb.

These substantial upfront investments create a formidable barrier to entry for aspiring companies. Potential new entrants must secure significant funding and possess a long-term financial runway to withstand the years of development without revenue. This high financial threshold effectively deters many smaller or less capitalized firms from entering the biopharmaceutical arena, thus protecting established players.

The biopharmaceutical sector, including companies like 3SBio, faces a significant threat from new entrants due to stringent regulatory approval processes. Agencies such as China's NMPA, the US FDA, and Europe's EMA impose complex and lengthy requirements for drug development and market authorization.

Successfully navigating these regulatory pathways demands substantial investment in research, clinical trials, and specialized expertise, creating a formidable barrier for potential new competitors. For instance, the average cost to bring a new drug to market in the US was estimated to be over $2 billion in recent years, a figure that discourages many startups.

Established companies like 3SBio possess robust patent portfolios, shielding their innovative products and manufacturing processes. This intellectual property acts as a significant barrier, making it challenging for newcomers to enter the market without infringing on existing rights. For instance, in 2024, the biopharmaceutical sector saw continued heavy investment in R&D, with companies like 3SBio likely to have expanded their patent protections on novel biologics and therapeutic platforms.

New entrants face a stark choice: invest heavily in developing entirely unique technologies, a costly and time-consuming endeavor, or risk protracted and expensive legal disputes over patent infringement. This legal and financial hurdle significantly deters potential competitors, reinforcing the market position of established players like 3SBio.

Need for Established Manufacturing and Distribution Networks

The biopharmaceutical industry, including companies like 3SBio, faces a significant barrier to entry due to the immense capital required for establishing robust manufacturing capabilities. Building and scaling up facilities that meet stringent Good Manufacturing Practices (GMP) demands substantial investment, often in the hundreds of millions of dollars. For instance, the construction of a new biologics manufacturing plant can easily exceed $200 million, a figure that deters many potential new entrants.

Beyond manufacturing, creating effective sales and distribution networks presents another formidable challenge. Reaching diverse healthcare providers, from major hospital systems to smaller clinics across various geographical regions, necessitates extensive logistical infrastructure and established relationships. Companies that have spent years building these networks, like 3SBio, possess a competitive advantage that is difficult and costly for newcomers to replicate quickly.

- Capital Intensity: Biopharmaceutical manufacturing requires significant upfront investment in specialized facilities and equipment, often running into hundreds of millions of dollars.

- Regulatory Hurdles: Adherence to Good Manufacturing Practices (GMP) and other regulatory standards is non-negotiable and adds to the cost and complexity of entry.

- Distribution Network Development: Establishing a widespread and efficient sales and distribution system to reach target markets is a time-consuming and expensive process.

- Expertise and Experience: New entrants often lack the specialized scientific, manufacturing, and commercial expertise that established players have cultivated over time.

Brand Loyalty and Physician Trust

Brand loyalty and physician trust are significant barriers for new entrants in the biopharmaceutical sector. Established companies like 3SBio have cultivated deep relationships with healthcare providers over many years, fostering a strong sense of reliability and confidence in their product lines. For instance, in 2024, the biopharmaceutical industry continued to see a high degree of physician preference for proven treatments, with many doctors citing long-term efficacy and safety data as primary decision-making factors.

New companies entering this space must invest heavily in demonstrating the superiority or unique advantages of their offerings to even begin chipping away at this ingrained loyalty. Building this credibility is a lengthy and costly process, often requiring extensive clinical trials and robust post-market surveillance to gain physician and patient acceptance. The challenge is compounded by the fact that patient adherence and physician prescription habits are deeply rooted, making a switch to a new, unproven therapy a considerable hurdle.

Consider the landscape in 2024: many blockbuster drugs maintained their market share due to strong physician endorsement, even as newer, potentially innovative therapies emerged. This highlights the enduring power of trust. New entrants often find themselves needing to offer a demonstrably better clinical profile or a significantly lower price point to gain traction, and even then, market penetration can be slow.

- Established Reputation: Companies like 3SBio benefit from decades of successful product performance and positive patient outcomes, creating a strong foundation of trust.

- Physician Preference: Healthcare professionals often favor treatments they are familiar with and have seen succeed in their practice, making it difficult for new entrants to displace established therapies.

- Patient Loyalty: Patients who have experienced positive results with existing medications are often reluctant to switch, even if newer alternatives become available.

- High Switching Costs: The effort and risk associated with changing treatment regimens create a significant barrier for new entrants aiming to capture market share.

The threat of new entrants in the biopharmaceutical sector, impacting companies like 3SBio, is significantly mitigated by extremely high capital requirements. Developing a single drug can cost billions, with estimated R&D expenditures for new drugs reaching over $2.7 billion in 2023. This immense financial burden, coupled with lengthy development timelines, deters most new players. Furthermore, navigating complex regulatory pathways, such as those mandated by the FDA or EMA, demands substantial investment in clinical trials and specialized expertise, creating a formidable barrier. Established companies also benefit from robust patent portfolios, which protect their innovations and require new entrants to either invest in novel technologies or face costly legal battles.

| Barrier Type | Description | Estimated Cost/Impact |

| Capital Intensity | Funding R&D, clinical trials, and manufacturing | >$2.7 billion per new drug (2023 estimate) |

| Regulatory Hurdles | Navigating complex approval processes (FDA, EMA, NMPA) | Significant investment in trials & expertise |

| Intellectual Property | Patent protection on novel products and processes | Requires unique technology development or risk of litigation |

| Manufacturing Scale-up | Building GMP-compliant facilities | >$200 million for a new biologics plant |

| Distribution & Sales Networks | Establishing market reach and physician relationships | Years of investment and relationship building |

| Brand Loyalty & Trust | Physician and patient preference for established therapies | Requires proven efficacy, safety data, and time to build credibility |

Porter's Five Forces Analysis Data Sources

Our 3SBio Porter's Five Forces analysis leverages data from annual reports, industry-specific market research, regulatory filings, and expert analyst reports to provide a comprehensive view of the competitive landscape.