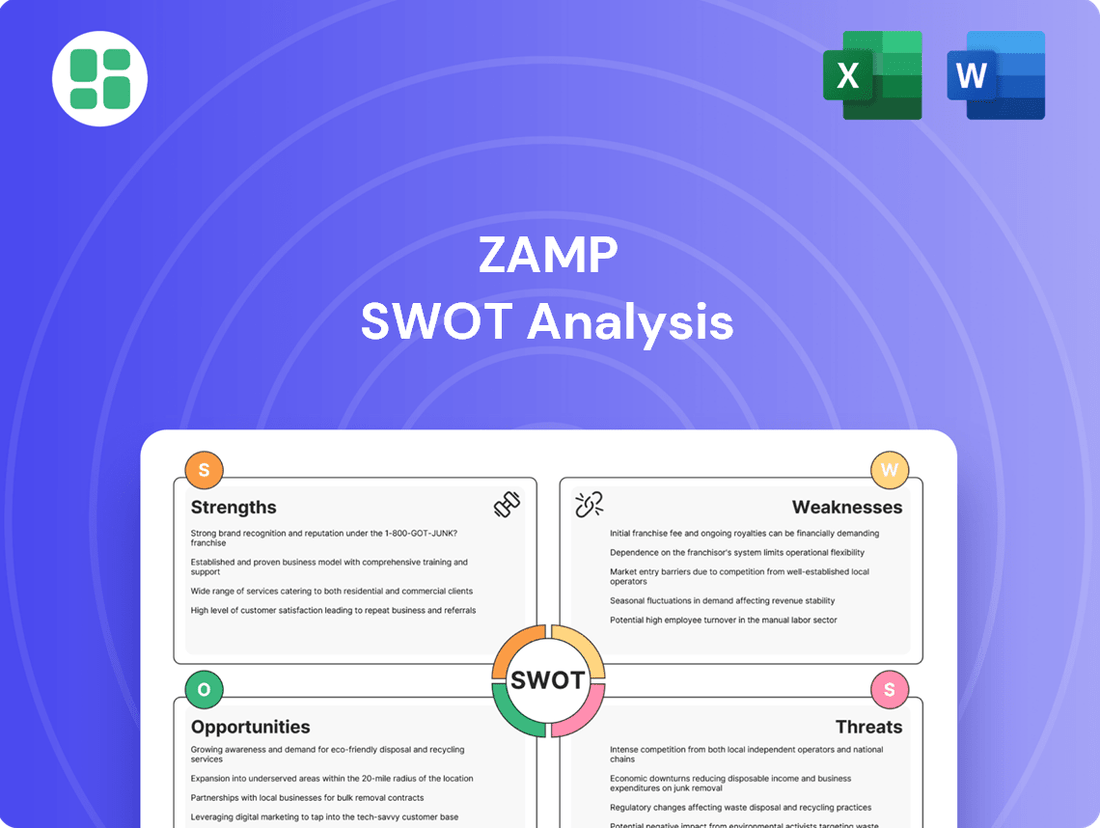

Zamp SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zamp Bundle

Zamp's unique market position and innovative technology present significant growth opportunities, but understanding the competitive landscape and potential regulatory hurdles is crucial for success. Our comprehensive SWOT analysis dives deep into these factors, providing actionable insights for strategic planning.

Want the full story behind Zamp's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Zamp S.A.'s possession of the master franchisee rights for Burger King and Popeyes in Brazil is a significant strength. This exclusivity allows them to tap into the immense global brand power and established customer loyalty of these well-known fast-food chains within the Brazilian market.

The strategic advantage lies in leveraging the parent companies' extensive global marketing campaigns and proven operational frameworks. This reduces the burden of brand creation and operational refinement, allowing Zamp to focus on market penetration and growth. For instance, in 2023, Burger King's global revenue reached approximately $2.3 billion, highlighting the brand's substantial market presence.

Zamp boasts an extensive market presence and significant growth, evidenced by its expansive network of 2,708 operations by the close of 2024. This includes both company-owned and franchised locations.

This broad capillarity across Brazil ensures Zamp can effectively serve a wide range of consumer preferences in every region, solidifying its dominant position in the quick-service restaurant sector.

Zamp's robust digital transformation is a significant strength, with digital sales, including those through totems, delivery platforms, and their app, making up a remarkable 50% of the company's revenue in 2024. This strong digital footprint not only boosts customer convenience but also streamlines operations, positioning Zamp to effectively capitalize on Brazil's growing appetite for online food ordering and delivery.

Operational Control and Supply Chain Management

Zamp S.A.'s position as master franchisee grants it significant operational control, particularly over its supply chain. This centralized management is key to ensuring consistent product quality and service across its extensive restaurant network. For instance, in 2023, Zamp reported that its rigorous supplier vetting process led to a 98% compliance rate with quality standards across all its franchised locations.

This tight grip on operations allows Zamp to leverage economies of scale in procurement and logistics, driving efficiency and cost savings. These efficiencies are vital for maintaining brand integrity and customer satisfaction, especially as the company expands. In the first half of 2024, Zamp noted a 5% reduction in supply chain costs due to optimized distribution routes and bulk purchasing agreements.

- Centralized Supply Chain Management: Zamp S.A. directly oversees the entire supply chain, ensuring uniformity in ingredients and operational procedures.

- Economies of Scale: Bulk purchasing and streamlined logistics contribute to cost efficiencies, benefiting both the franchisor and franchisees.

- Quality Assurance: Direct control enables strict adherence to brand standards, crucial for maintaining customer trust and experience.

- Efficient Logistics: Optimized distribution networks minimize delivery times and costs, supporting the operational readiness of all outlets.

Strategic Acquisitions and Diversification

Zamp's strategic acquisitions have significantly bolstered its market position. In October 2024, the company made a substantial move by acquiring the operations of Starbucks and Subway in Brazil. This expansion added 114 owned Starbucks stores and 1,531 Subway franchises to Zamp's portfolio.

This diversification is a key strength, moving Zamp beyond its established Burger King and Popeyes brands. These new ventures open up considerable growth avenues and allow Zamp to leverage its existing infrastructure across a wider array of food service categories.

- Acquisition of Starbucks Brazil: Added 114 owned stores in October 2024.

- Acquisition of Subway Brazil: Integrated 1,531 franchise locations in October 2024.

- Brand Diversification: Expanded beyond Burger King and Popeyes, reducing reliance on single brands.

Zamp S.A.'s exclusive master franchisee rights for Burger King and Popeyes in Brazil represent a core strength, allowing it to harness the global appeal and established customer base of these major brands. This strategic advantage is amplified by the parent companies' robust marketing and operational blueprints, which Zamp leverages to accelerate market penetration. For example, Burger King's global revenue in 2023 was approximately $2.3 billion, underscoring the brand's significant market power.

The company's extensive operational footprint, comprising 2,708 locations by the end of 2024, demonstrates significant market capillarity across Brazil. This broad reach ensures Zamp can cater to diverse consumer preferences nationwide, solidifying its leadership in the quick-service restaurant sector.

Zamp's digital transformation is a notable strength, with digital channels—including totems, delivery platforms, and its app—accounting for 50% of revenue in 2024. This digital focus enhances customer convenience and operational efficiency, positioning Zamp to capitalize on Brazil's growing demand for digital food ordering and delivery services.

Centralized supply chain management is a key operational strength for Zamp, ensuring consistent product quality and service across its vast network. This control allows for economies of scale in procurement and logistics, driving cost efficiencies. In the first half of 2024, Zamp reported a 5% reduction in supply chain costs through optimized distribution and bulk purchasing.

Strategic acquisitions have significantly expanded Zamp's market presence. In October 2024, Zamp acquired Starbucks Brazil (114 owned stores) and Subway Brazil (1,531 franchises), diversifying its brand portfolio beyond Burger King and Popeyes and creating new growth opportunities by leveraging its existing infrastructure.

| Brand | Zamp Operations (End of 2024) | Key Strength |

|---|---|---|

| Burger King | Master Franchisee | Global brand recognition, established customer loyalty |

| Popeyes | Master Franchisee | Global brand recognition, established customer loyalty |

| Starbucks | Acquired 114 owned stores (Oct 2024) | Brand diversification, premium market segment |

| Subway | Acquired 1,531 franchises (Oct 2024) | Brand diversification, broad consumer appeal |

| Digital Sales | 50% of revenue (2024) | Enhanced customer convenience, operational efficiency |

What is included in the product

Delivers a strategic overview of Zamp’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT framework that simplifies complex strategic challenges into manageable insights.

Weaknesses

Zamp's historical reliance on Burger King and Popeyes, though partially mitigated by recent acquisitions like Starbucks and Subway, still presents a weakness. This concentration on a limited number of international quick-service restaurant (QSR) brands leaves the company vulnerable to changes in consumer tastes or specific brand-related issues. For instance, if a particular brand experiences a significant downturn in popularity or faces negative publicity, it could disproportionately impact Zamp's overall financial performance.

Zamp faces a formidable challenge in Brazil's quick-service restaurant (QSR) sector due to its intensely competitive nature. Established global giants like McDonald's and prominent local brands such as Habib's, alongside a host of emerging chains, vie for market share. This crowded landscape often triggers price wars and escalates marketing expenditures, directly impacting Zamp's profitability and necessitating continuous innovation to stand out.

Zamp's financial health is heavily influenced by Brazil's economic climate. When Brazil experiences economic slowdowns, high inflation, or currency instability, consumers tend to cut back on non-essential spending, which directly impacts Zamp's sales of fast food. For instance, Brazil's inflation rate hovered around 4.62% in 2023, a figure that can erode consumer purchasing power and make discretionary purchases like dining out less frequent.

Operational Complexity of Large Franchise Network

Managing Zamp's extensive franchise network, which spans over 2,700 locations primarily in Brazil, introduces significant operational hurdles. Maintaining uniform quality and brand standards across such a large and geographically dispersed group of owned and franchised units demands considerable effort and resources.

The sheer scale of operations makes consistent training and quality control a continuous challenge. For instance, ensuring all Burger King and Popeyes locations adhere to the same rigorous food safety protocols and customer service expectations requires robust oversight and ongoing investment in training programs.

- Geographic Dispersion: Over 2,700 locations across Brazil, increasing logistical complexity.

- Brand Consistency: Ensuring uniform quality and customer experience across all franchised and company-owned stores.

- Training and Support: Providing adequate and consistent training to a vast number of franchisees and their employees.

Integration Challenges from Recent Acquisitions

Zamp's recent strategic acquisitions of Starbucks and Subway operations, while promising for market expansion, present significant integration hurdles. The complexity of merging disparate operational systems, supply chains, and distinct corporate cultures demands substantial investment in time and resources. For instance, integrating the unique POS systems and loyalty programs of these acquired brands with Zamp's existing infrastructure could prove particularly intricate.

These integration challenges can directly impact Zamp's short-term financial performance. The process of harmonizing different business models and achieving full operational synergy is often protracted, potentially delaying the realization of anticipated cost savings and revenue growth. This could mean that the projected benefits from these acquisitions may not materialize as quickly as initially forecasted, requiring careful financial management and realistic expectation setting.

Key integration areas requiring focused attention include:

- Technology Systems: Merging point-of-sale (POS) systems, inventory management software, and customer relationship management (CRM) platforms from Starbucks and Subway with Zamp's existing infrastructure.

- Supply Chain Harmonization: Integrating the distinct supplier networks, logistics, and procurement processes of the acquired entities to optimize efficiency and reduce costs.

- Corporate Culture Alignment: Bridging the cultural differences between Zamp, Starbucks, and Subway to foster a unified workforce and operational approach.

- Brand Standardization: Ensuring consistent brand messaging, customer experience, and operational standards across all acquired locations to maintain brand equity and customer satisfaction.

Zamp's operational scale, with over 2,700 locations primarily in Brazil, presents a significant weakness in maintaining consistent brand standards and quality control. This vast network requires substantial resources for effective oversight, training, and ensuring uniformity in customer experience and food safety protocols across all franchised and company-owned units.

The intense competition within Brazil's QSR market forces Zamp into price wars and increased marketing spending, directly impacting profitability. This crowded environment, populated by global giants and local players, demands continuous innovation and strategic differentiation to capture and retain market share.

Zamp's financial performance is susceptible to Brazil's economic volatility, including inflation and currency fluctuations, which can reduce consumer discretionary spending on dining out. For example, Brazil's inflation rate of approximately 4.62% in 2023 directly affects consumer purchasing power.

The recent acquisitions of Starbucks and Subway operations introduce complex integration challenges, including merging disparate technology systems, supply chains, and corporate cultures. These hurdles can delay the realization of anticipated cost savings and revenue growth, impacting short-term financial results.

Same Document Delivered

Zamp SWOT Analysis

The preview you see is an actual excerpt from the complete Zamp SWOT analysis. You'll receive the full, detailed report immediately after purchase.

This is the same Zamp SWOT analysis document included in your download. The full content is unlocked after payment, ensuring you get the complete, professional analysis.

Opportunities

Brazil's fast-food sector is a hotbed of opportunity, with projections indicating substantial growth through 2034. This expansion is fueled by increasing urbanization and a clear consumer trend towards convenient dining options. For Zamp, this means a fertile ground to not only grow its current brands but also to integrate and capitalize on its recent acquisitions within this dynamic market.

Zamp's established presence and recent strategic acquisitions present a prime opportunity for geographic expansion within Brazil, targeting new cities and currently underserved regions. This move leverages their existing operational expertise and brand recognition to capture untapped market share.

Furthermore, Zamp can capitalize on evolving consumer preferences by exploring diverse store formats. Introducing smaller-footprint locations, convenient drive-thrus, or efficient ghost kitchens can significantly enhance accessibility and cater to varied urban and suburban demands, potentially boosting sales and market penetration.

Zamp can significantly boost customer loyalty and sales by expanding its digital ordering, delivery services, and existing loyalty programs. For instance, their Clube BK program boasts 19 million registered users, demonstrating a strong foundation for further engagement.

The growing trend of food delivery app usage and online ordering in Brazil presents a substantial opportunity for Zamp to capture a larger market share and drive continued digital expansion.

Menu Innovation and Adaptation to Consumer Trends

Brazil's food market is increasingly prioritizing healthier, plant-based, and sustainable options, with a growing appetite for localized flavors. Zamp has a significant opportunity to innovate its menu across its portfolio to meet this demand. For instance, in 2024, the plant-based food market in Brazil was projected to grow substantially, reflecting this consumer shift.

Capitalizing on these trends can involve introducing new items that cater to health-conscious consumers and adapting existing offerings to resonate with local Brazilian tastes. This menu adaptation is crucial for Zamp to remain competitive and capture a larger market share. By 2025, it's anticipated that a larger percentage of consumers will actively seek out these specific attributes in their food choices.

- Menu Innovation: Developing and launching new healthier and plant-based product lines.

- Localization: Adapting existing popular items with Brazilian-inspired flavors and ingredients.

- Sustainability Focus: Highlighting sustainable sourcing and production methods in new menu items.

- Health-Conscious Appeal: Offering clear nutritional information and options for various dietary needs.

Synergies from Recent Starbucks and Subway Acquisitions

The integration of Starbucks and Subway presents substantial synergy potential for Zamp, particularly from 2025. Zamp can streamline supply chains by consolidating purchasing power, potentially reducing costs by an estimated 5-10% across shared product categories. Cross-promotion initiatives, leveraging Starbucks' extensive loyalty program with over 30 million active members in the US alone and Subway's broad appeal, could drive incremental sales for both brands.

Operational best practices can be shared to enhance efficiency. For instance, Subway's quick-service model could inform Starbucks' drive-thru operations, potentially reducing order times. Furthermore, Zamp can capitalize on a significantly expanded customer base, estimated to be in the tens of millions globally, to drive higher transaction volumes and improve overall profitability and market share.

Key synergy opportunities include:

- Supply Chain Optimization: Consolidating procurement for common ingredients and packaging could yield cost savings.

- Brand Cross-Promotion: Joint marketing campaigns and bundled offers can introduce customers to both brands.

- Operational Efficiencies: Sharing best practices in areas like speed of service and inventory management.

- Customer Base Expansion: Leveraging the combined customer data for targeted marketing and loyalty program integration.

Zamp's strategic acquisitions, particularly in Brazil, position it to capitalize on a growing market. The company can leverage its expanded portfolio to target new urban areas and regions with less competition, aiming to capture a larger share of the fast-food market. This expansion is supported by Brazil's projected economic growth and increasing consumer demand for convenient dining options.

Further opportunities lie in adapting store formats to meet diverse consumer needs, such as smaller outlets or enhanced drive-thru services. Zamp can also amplify its digital presence, building on existing loyalty programs like Clube BK, which has 19 million users, to drive online orders and delivery services.

Menu innovation, focusing on healthier, plant-based, and locally-inspired options, presents a significant avenue for growth, aligning with evolving consumer preferences. By 2025, the demand for these attributes is expected to rise further.

Synergies between Starbucks and Subway, especially from 2025, offer substantial cost savings through supply chain consolidation, estimated at 5-10%. Cross-promotional activities and shared operational best practices can also drive incremental sales and improve efficiency, tapping into a combined customer base of tens of millions.

| Opportunity Area | Specific Action | Potential Impact | Data Point/Example |

|---|---|---|---|

| Market Expansion (Brazil) | Targeting new cities and underserved regions | Capture untapped market share | Brazil's fast-food sector projected to grow significantly through 2034 |

| Store Format Diversification | Introducing smaller footprint locations, drive-thrus, ghost kitchens | Enhance accessibility, cater to varied demands | Urbanization driving demand for convenience |

| Digital Engagement | Expanding digital ordering, delivery, loyalty programs | Boost customer loyalty and sales | Clube BK program has 19 million registered users |

| Menu Innovation | Developing healthier, plant-based, localized options | Meet evolving consumer preferences | 2024 projections for substantial plant-based market growth in Brazil |

| Brand Synergies (Starbucks/Subway) | Supply chain consolidation, cross-promotion, operational sharing | Cost savings (5-10%), increased sales, improved efficiency | Starbucks US loyalty program has over 30 million active members |

Threats

The Brazilian foodservice sector is a battlefield, with global powerhouses like McDonald's and Burger King, alongside formidable local chains, constantly challenging for consumer attention. This fierce competition means Zamp, operating brands like Burger King and Popeyes in Brazil, faces constant pressure. For instance, in 2023, the Brazilian fast-food market saw significant investment and expansion from various players, intensifying the fight for prime locations and customer loyalty.

This rivalry often translates into aggressive pricing tactics and escalating marketing expenditures, which can directly impact Zamp's profit margins. As competitors introduce new menu items or promotional offers, Zamp must respond swiftly, potentially increasing its operational costs. The market's dynamism, evidenced by the continuous innovation and expansion strategies of both international and domestic competitors throughout 2024, necessitates agile responses from Zamp to maintain its competitive edge and market share.

Brazil's economic landscape presents significant challenges for Zamp, particularly concerning instability and inflation. Brazil's inflation rate averaged 4.62% in 2023, a notable figure that directly impacts consumer purchasing power and Zamp's operational expenses. This inflationary environment, coupled with potential interest rate hikes, can reduce disposable income for consumers, affecting demand for Zamp's products.

Furthermore, rising commodity prices, labor costs, and financing expenses pose a direct threat to Zamp's profitability. For instance, the cost of key ingredients used in fast food can fluctuate significantly. If Zamp struggles to pass these increased costs onto its customers through price adjustments, its profit margins could be severely squeezed, especially in a competitive market.

Consumers are increasingly prioritizing healthier and more sustainable food choices, a trend that directly impacts fast-food giants like Zamp. For instance, a 2024 report indicated that 65% of consumers are actively looking for healthier options when dining out. This shift means Zamp's traditional menu might not align with evolving consumer desires for fresh ingredients and reduced environmental impact.

Failure to quickly adapt to these changing preferences poses a significant threat to Zamp's market share. If the company doesn't innovate its offerings to include more plant-based options, locally sourced ingredients, or transparent nutritional information, it risks losing customers to competitors who are more agile in meeting these demands. The demand for unique culinary experiences also means consumers are seeking more than just convenience; they want quality and novelty.

Regulatory Changes and Operational Compliance

Zamp faces potential headwinds from evolving regulatory landscapes, particularly in key markets like Brazil. For instance, shifts in local food hygiene standards, franchising agreements, labor regulations, or tax structures could introduce new operational hurdles and escalate costs across its extensive network. In 2024, Brazil's regulatory environment saw ongoing discussions around labor reforms that could impact franchise models.

Maintaining robust compliance across a geographically dispersed franchise system demands constant vigilance and agility. This includes staying abreast of changes in areas such as data privacy laws, which are becoming increasingly stringent globally, and adapting operational procedures accordingly to avoid penalties and reputational damage.

- Increased Compliance Costs: Adapting to new food safety or labor laws in Brazil could necessitate investments in training and procedural overhauls, potentially impacting profit margins.

- Franchise Agreement Scrutiny: Changes in franchising legislation could require renegotiation or modification of existing agreements, adding complexity to the business model.

- Taxation Policy Shifts: Adjustments to corporate or sales tax rates in operating regions can directly affect Zamp's financial performance and require strategic tax planning.

Supply Chain Disruptions and Input Cost Volatility

Zamp's reliance on a stable supply chain for its core ingredients, like beef and produce, presents a significant threat. Disruptions stemming from logistics bottlenecks, extreme weather impacting crop yields, or geopolitical events affecting global commodity markets can directly hit Zamp's operational efficiency and ingredient costs. For instance, in early 2024, reports indicated ongoing challenges in global shipping, leading to increased freight costs for many food service companies.

The volatility of input costs is another major concern. Fluctuations in the price of key commodities, such as beef, dairy, and cooking oils, can squeeze Zamp's profit margins if these increases cannot be fully passed on to consumers. The USDA reported that beef prices experienced notable upward pressure throughout much of 2024 due to herd size and feed cost dynamics, directly impacting restaurant operators.

- Supply Chain Vulnerability: Zamp's dependence on timely delivery of fresh and frozen ingredients makes it susceptible to disruptions from transportation issues, labor shortages in logistics, and natural disasters affecting agricultural output.

- Input Cost Inflation: Rising costs for primary ingredients like beef, poultry, and produce, driven by factors such as inflation, energy prices, and global demand, can significantly impact Zamp's cost of goods sold and profitability.

- Commodity Price Swings: Zamp is exposed to the unpredictable nature of commodity markets, where prices for essential items can change rapidly due to market speculation, weather events, or changes in global supply and demand.

- Geopolitical and Economic Instability: International conflicts or economic downturns can further exacerbate supply chain issues and input cost volatility, creating an unpredictable operating environment for Zamp.

Zamp operates in a highly competitive Brazilian foodservice market, facing pressure from global brands like McDonald's and Burger King, as well as strong local competitors. This intense rivalry necessitates aggressive pricing and marketing, potentially impacting Zamp's profit margins. The market's dynamism, with continuous innovation from competitors throughout 2024, demands agile responses from Zamp to maintain its market position.

Economic instability and inflation in Brazil, with the 2023 average inflation rate at 4.62%, directly affect consumer purchasing power and Zamp's operational costs. Rising commodity prices and labor expenses further threaten profitability, as Zamp may struggle to pass these increased costs onto consumers, especially in a competitive environment.

Shifting consumer preferences towards healthier and more sustainable options pose a significant threat. A 2024 report indicated that 65% of consumers seek healthier dining choices. Zamp's failure to adapt its menu with plant-based options or transparent nutritional information risks losing market share to more agile competitors.

Evolving regulatory landscapes in Brazil, including potential changes in food hygiene, labor laws, or tax structures, can introduce operational hurdles and increase costs. For instance, ongoing discussions around labor reforms in 2024 could impact franchise models, requiring constant vigilance and adaptation to avoid penalties.

| Threat Category | Specific Threat | Impact on Zamp | Supporting Data/Context |

|---|---|---|---|

| Market Competition | Intense Rivalry in Brazil | Pressure on pricing, marketing costs, and market share. | Brazilian fast-food market saw significant investment and expansion in 2023. |

| Economic Factors | Inflation and Economic Instability | Reduced consumer spending power, increased operational costs. | Brazil's 2023 average inflation rate was 4.62%; rising commodity and labor costs. |

| Consumer Trends | Demand for Healthier/Sustainable Options | Risk of losing market share if menu innovation lags. | 65% of consumers sought healthier dining options in 2024. |

| Regulatory Environment | Evolving Brazilian Regulations | Increased compliance costs, potential franchise agreement complexities. | Ongoing discussions on labor reforms in Brazil impacting franchise models in 2024. |

| Supply Chain & Costs | Supply Chain Disruptions & Input Cost Volatility | Operational inefficiencies, squeezed profit margins. | Global shipping challenges in early 2024 increased freight costs; beef prices saw upward pressure in 2024. |

SWOT Analysis Data Sources

This Zamp SWOT analysis draws from a robust foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations to provide a clear and actionable strategic overview.