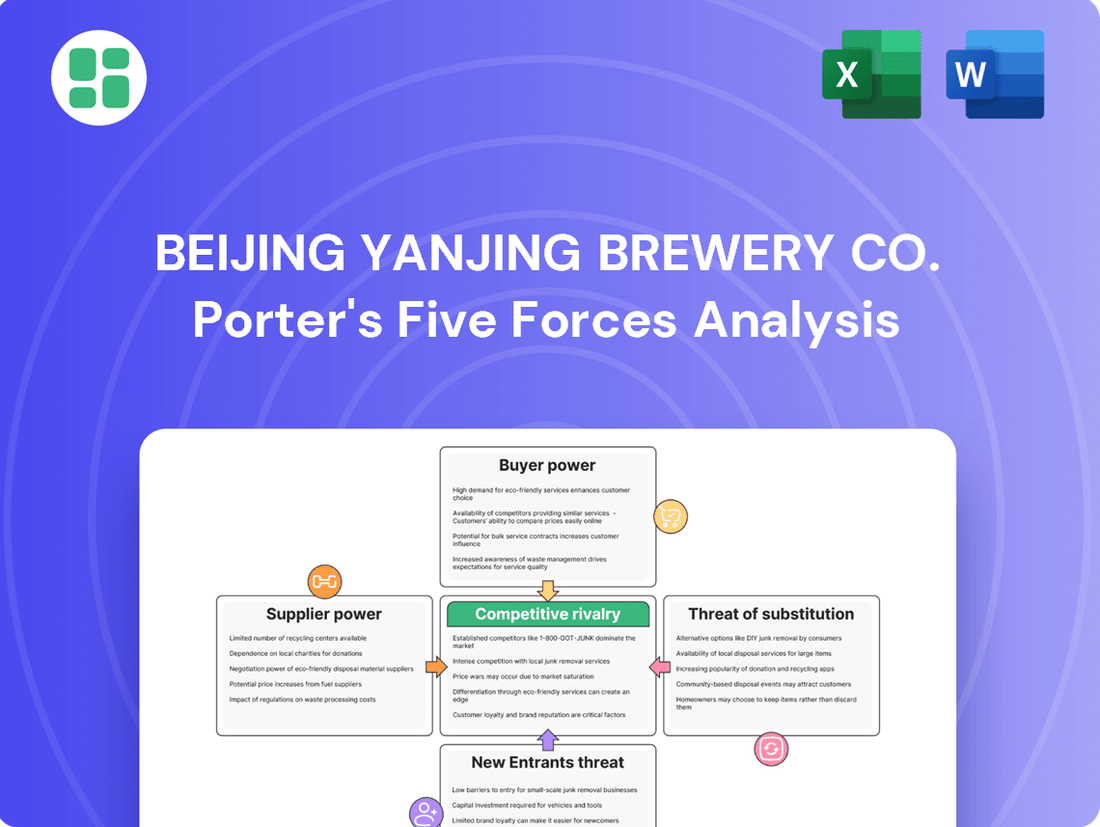

Beijing Yanjing Brewery Co. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing Yanjing Brewery Co. Bundle

Beijing Yanjing Brewery Co. likely faces moderate buyer power due to brand loyalty but also intense competition from domestic and international rivals. The threat of new entrants might be tempered by capital requirements and established distribution networks, yet the allure of China's vast beer market remains significant.

The complete report reveals the real forces shaping Beijing Yanjing Brewery Co.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The price and availability of essential brewing components like barley, hops, and malt directly influence Yanjing Brewery's production expenses. In 2024, a favorable trend emerged with raw material costs, including imported barley and packaging necessities such as glass bottles and corrugated paper, entering a downward cycle.

This cost reduction is anticipated to persist into 2025, offering a significant advantage to Yanjing Brewery by lowering its overall input expenditures.

Supplier concentration is a key factor in assessing bargaining power. If Yanjing Brewery relies on a limited number of suppliers for essential ingredients like malt or hops, those suppliers gain leverage. However, as a major beverage producer in China, Yanjing likely cultivates relationships with numerous suppliers and may even explore backward integration to secure its supply chain.

The Chinese beer industry's raw material cost environment is projected to be favorable through 2024 and into 2025. This generally indicates that suppliers may not hold significant pricing power due to ample availability of inputs, benefiting Yanjing Brewery.

The ease with which Beijing Yanjing Brewery can switch between suppliers significantly impacts supplier power. High switching costs, such as the expense of retooling production lines for new ingredient specifications or the time and resources needed for quality re-certification, grant suppliers greater leverage.

In 2023, the global barley market, a key ingredient for Yanjing, saw price fluctuations. While specific switching cost data for Yanjing isn't publicly available, industry reports suggest that for large-scale breweries, the integration of new ingredient suppliers can involve substantial upfront investment in quality control and process adjustments, potentially running into millions of yuan.

Supplier's Product Differentiation

If suppliers provide highly specialized ingredients essential for Yanjing Brewery's unique beer formulations, their bargaining power increases significantly. This is particularly true if these ingredients are difficult to source elsewhere or are proprietary. For instance, a supplier of a unique yeast strain or a specially cultivated hop variety could command higher prices.

Conversely, when suppliers offer standard, commoditized products like basic barley or generic glass bottles, their differentiation is minimal. In such cases, Yanjing Brewery faces less pressure from these suppliers, as alternative sources are readily available. This allows Yanjing to leverage competition among suppliers to secure more favorable terms.

- Supplier Differentiation Impact: Highly differentiated inputs increase supplier power; commoditized inputs decrease it.

- Yanjing's Strategy: Focus on cost management to mitigate supplier leverage in commodity markets.

- 2024 Data Insight: While specific 2024 figures for Yanjing's ingredient sourcing are proprietary, the broader Chinese brewing industry in 2024 saw fluctuating raw material costs, with barley prices seeing a notable increase due to global supply chain factors, potentially elevating supplier bargaining power for this key input.

Threat of Forward Integration by Suppliers

Suppliers might consider moving into the beer brewing business themselves, effectively becoming competitors to Yanjing Brewery. This would significantly increase the bargaining power of those specific suppliers. However, the beer industry is known for its high capital requirements and the strong brand loyalty that established players like Yanjing enjoy. For instance, setting up a new brewery requires millions in investment for equipment and facilities.

This makes forward integration a challenging prospect for most suppliers, especially those providing raw materials like hops or barley. They would need to overcome significant barriers to entry, including securing distribution channels and building consumer recognition. A successful forward integration would necessitate a substantial capital outlay and a well-defined market entry strategy, which many raw material suppliers may not possess.

- Capital Intensity: The beer industry demands significant investment in brewing equipment, bottling lines, and distribution networks.

- Brand Loyalty: Consumers often exhibit strong preferences for established beer brands, making it difficult for new entrants to gain market share.

- Distribution Networks: Access to retail and on-premise channels is crucial and often controlled by existing players.

The bargaining power of suppliers for Beijing Yanjing Brewery is influenced by several factors. In 2024, raw material costs, including barley and packaging, saw a downward trend, generally weakening supplier power. However, if suppliers offer highly specialized or proprietary ingredients, their leverage increases, as seen in the potential for unique yeast strains or hop varieties to command higher prices. The industry's high capital requirements and established brand loyalty also present significant barriers to suppliers considering forward integration, thus limiting their ability to directly compete.

| Factor | Impact on Supplier Bargaining Power | 2024/2025 Outlook |

| Supplier Concentration | High concentration increases power. | Yanjing likely mitigates this through diverse sourcing. |

| Ingredient Differentiation | Specialized ingredients grant more power. | Commoditized inputs (e.g., basic barley) reduce power. |

| Switching Costs | High switching costs empower suppliers. | Potential for significant investment for Yanjing to change suppliers. |

| Forward Integration Threat | Low threat due to industry barriers. | High capital and brand loyalty limit supplier competition. |

What is included in the product

This analysis of Beijing Yanjing Brewery Co. reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products on its market position.

A clear, one-sheet summary of Beijing Yanjing Brewery Co.'s Porter's Five Forces—perfect for quickly identifying and addressing competitive pressures.

Instantly understand strategic pressure points with a powerful spider/radar chart, allowing for targeted pain point relief.

Customers Bargaining Power

Beijing Yanjing Brewery faces a dynamic pricing environment. While Chinese consumers increasingly seek premium and craft beers, demonstrating a willingness to pay more for quality and novel experiences, this trend may not fully offset potential price sensitivity for their mainstream products. Economic uncertainties and a general slowdown in consumer spending, particularly evident in recent retail sales figures for 2024, could lead consumers to become more price-conscious for everyday beer choices.

The sheer volume of beverage choices in China significantly amplifies customer bargaining power. Consumers can readily select from numerous beer brands, spirits, wines, and a vast range of non-alcoholic drinks, offering ample alternatives to Yanjing Brewery's offerings.

This abundance of substitutes means customers are not tied to Yanjing, allowing them to easily shift their preference if prices become unattractive or product quality falters. For instance, in 2024, the Chinese alcoholic beverage market saw continued growth, with beer sales alone reaching substantial figures, indicating a competitive landscape where consumer choice is paramount.

Yanjing Beer's distribution is heavily concentrated within China, leveraging a diverse network of supermarkets, convenience stores, restaurants, and increasingly, e-commerce platforms. This broad reach means that while individual consumers hold minimal sway, larger retail chains and consolidated distribution networks can indeed exert significant pressure on Yanjing's pricing and supply terms.

In 2023, China's retail beverage market saw continued growth, with online sales channels accounting for a substantial portion of beverage transactions, estimated to be over 30% for certain categories. This shift in purchasing habits empowers consumers with more price transparency and choice, indirectly increasing the bargaining power of large online retailers who can easily compare and negotiate with suppliers like Yanjing.

Customer Information and Brand Loyalty

Customers in the beer market are increasingly discerning, seeking higher quality and a wider variety of choices. While Beijing Yanjing Brewery boasts strong brands such as Yanjing, Liquan, Huiquan, and Xuelu, their loyalty is not guaranteed. Consumer preferences are shifting towards premium, craft, and even non-alcoholic beers. For instance, the global non-alcoholic beer market was valued at approximately USD 22.2 billion in 2023 and is projected to grow significantly, indicating a clear trend Yanjing must address.

Yanjing Brewery is actively responding to these evolving consumer demands. Their strategic expansion into non-alcoholic beer offerings demonstrates an understanding of this growing segment. This move aims to capture a larger market share by catering to health-conscious consumers and those seeking alternatives to traditional alcoholic beverages. By diversifying their product portfolio, Yanjing seeks to reinforce customer loyalty in a dynamic market landscape.

- Growing Consumer Sophistication: Beer drinkers are more informed about quality and variety than ever before.

- Brand Portfolio: Yanjing's established brands include Yanjing, Liquan, Huiquan, and Xuelu.

- Shifting Preferences: Loyalty is challenged by demand for premium, craft, and non-alcoholic beer options.

- Strategic Response: Yanjing is expanding its non-alcoholic product line to meet market trends.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Beijing Yanjing Brewery Co. is generally low. Large restaurant chains or retailers, while significant buyers, face substantial barriers to entry if they were to consider producing their own beer.

- High Capital Investment: Establishing a brewery requires significant upfront capital for land, brewing equipment, fermentation tanks, bottling lines, and distribution infrastructure. For instance, a medium-sized craft brewery can cost millions of dollars to set up.

- Technical Expertise and Know-How: Beer production demands specialized knowledge in brewing science, quality control, fermentation management, and adherence to strict hygiene standards. Acquiring and retaining this expertise is a considerable challenge.

- Regulatory Hurdles: The alcohol industry is heavily regulated. Obtaining brewing licenses, complying with environmental regulations, and navigating excise tax laws are complex and time-consuming processes.

These factors collectively make it economically unfeasible and operationally difficult for most of Yanjing Brewery's customers to engage in backward integration, thus posing a minimal threat to the company's market position.

Customers in China's beer market exhibit considerable bargaining power, driven by an abundance of choices and evolving preferences. While Yanjing's mainstream products may face price sensitivity, especially amidst economic shifts observed in 2024 retail data, the growing demand for premium and craft beers empowers consumers to seek specific qualities. This sophistication means brand loyalty is not absolute, as demonstrated by the significant growth in the non-alcoholic beer market, valued at approximately USD 22.2 billion in 2023, indicating a clear consumer trend that Yanjing must address through product diversification.

What You See Is What You Get

Beijing Yanjing Brewery Co. Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the Beijing Yanjing Brewery Co. Porter's Five Forces Analysis, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This comprehensive breakdown offers critical insights into the competitive landscape for Yanjing Brewery.

Rivalry Among Competitors

The Chinese beer market is intensely competitive, with the top five players—CR Beer, Tsingtao Brewery, Budweiser, Yanjing, and Carlsberg—commanding a staggering 92.9% of the market share. This significant market concentration among a handful of dominant companies directly fuels a high level of rivalry.

The Chinese beer market, the world's largest by volume, is experiencing a slowdown. Estimates suggest beer volumes declined in 2024, with further contraction anticipated for 2025. This decelerating growth environment naturally heightens the competitive rivalry among established players like Beijing Yanjing Brewery as they vie for a shrinking or slowly expanding market share.

The beer market is increasingly prioritizing value over sheer volume, with consumers seeking premiumization and a wider array of choices, including craft beers and non-alcoholic alternatives. This shift means companies must innovate to stand out.

Beijing Yanjing Brewery Co. is actively addressing this by focusing on premium product lines and expanding its non-alcoholic portfolio, exemplified by offerings like Yanjing U8. This strategic emphasis on differentiation is vital for maintaining competitiveness as the industry evolves.

Exit Barriers

The beer industry, including players like Beijing Yanjing Brewery, faces substantial exit barriers. High fixed costs are a major factor; for instance, the capital expenditure for state-of-the-art brewing facilities and extensive cold chain distribution networks represents a significant investment that is difficult to recoup. This can trap companies in the market, even when profitability is low, as abandoning these assets would mean substantial losses.

These entrenched costs mean that competitors are less likely to exit the market during downturns, leading to sustained, intense rivalry. Companies must continue to operate and compete for market share, even if margins are squeezed. This dynamic preserves a crowded competitive landscape, forcing all players to remain vigilant and strategically active.

- High Fixed Costs: Brewing facilities and distribution networks require massive upfront investment, making asset liquidation challenging and costly.

- Specialized Assets: Brewery equipment and distribution infrastructure are highly specialized and have limited alternative uses, increasing the risk of asset write-offs upon exit.

- Employee Severance and Contractual Obligations: Companies may face significant costs related to employee severance packages and ongoing contractual commitments with suppliers or distributors, further deterring exit.

Brand Identity and Loyalty

Beijing Yanjing Brewery Co. benefits from a strong brand identity, a significant factor in its competitive rivalry. This established presence fosters consumer loyalty, a crucial advantage in the beer market. For instance, Yanjing's long-standing brands have cultivated a recognizable market position over the years.

However, the competitive landscape is evolving, with a notable shift towards premium and craft beers. This trend is particularly pronounced among younger demographics. To maintain and grow its brand loyalty, Yanjing must continually innovate its product offerings and invest in effective marketing campaigns that resonate with these changing consumer preferences.

- Brand Strength: Yanjing's established brands provide a foundation for consumer recognition and trust.

- Loyalty Drivers: Historical presence and consistent quality contribute to customer retention.

- Market Evolution: The rise of premium and craft beer segments presents a challenge to traditional brand loyalty.

- Innovation Imperative: Continuous product development and targeted marketing are essential to capture evolving consumer tastes and maintain loyalty, especially among younger consumers.

The intense rivalry in China's beer market is amplified by a slowdown in volume growth, with estimates indicating a decline in 2024 and further contraction expected in 2025. This challenging environment forces companies like Beijing Yanjing Brewery to compete fiercely for market share, often leading to price pressures and increased marketing spend.

The market's shift towards premiumization and diverse offerings, including craft and non-alcoholic options, further intensifies competition. Yanjing's strategic focus on premium lines like Yanjing U8 and its expanding non-alcoholic portfolio are direct responses to this evolving consumer preference, aiming to differentiate and capture value.

High exit barriers, stemming from substantial fixed costs in brewing and distribution, mean that companies remain in the market even during downturns, perpetuating intense competition. This sustained rivalry requires continuous innovation and strategic agility from all players, including Beijing Yanjing Brewery, to maintain their competitive edge.

| Metric | 2023 (Approximate) | 2024 (Estimate) | 2025 (Outlook) |

|---|---|---|---|

| China Beer Market Volume Growth | Slight Growth | Decline | Further Contraction |

| Market Share of Top 5 Players | 92.9% | Projected to remain high | Projected to remain high |

| Consumer Trend | Premiumization & Diversification | Continued premiumization | Continued premiumization |

SSubstitutes Threaten

The Chinese market presents a diverse array of alcoholic beverages, with baijiu, a potent domestic spirit, holding significant cultural and market sway. In 2023, baijiu sales in China were estimated to be around 600 billion yuan, highlighting its substantial consumer base.

Consumers can readily substitute beer with baijiu, wine, or other spirits depending on their taste preferences, the price point of the beverage, or the specific social occasion. This broad availability of alternatives means Yanjing Brewery faces constant pressure to maintain its appeal and competitive pricing.

The increasing popularity of non-alcoholic and low-alcohol beverages presents a significant threat to Beijing Yanjing Brewery. Chinese consumers, particularly younger generations like Gen Z, are prioritizing health and wellness, leading to a surge in demand for options like mineral water, ready-to-drink teas, and low-sugar drinks. In 2023, the Chinese non-alcoholic beverage market was valued at over $200 billion, demonstrating the scale of this shift.

Consumer preferences are a significant threat of substitutes for Beijing Yanjing Brewery. Younger consumers, in particular, are increasingly seeking diverse, high-quality, and healthier beverage options. For instance, the global non-alcoholic beer market was valued at approximately USD 22.7 billion in 2023 and is projected to grow substantially, indicating a clear shift away from traditional alcoholic beverages.

Convenience and Accessibility of Substitutes

The threat of substitutes for Beijing Yanjing Brewery Co. is amplified by the growing ease with which consumers can access alternative beverages. E-commerce and a wider array of retail outlets mean that craft beers, imported lagers, and even non-alcoholic options are readily available, often with convenient delivery services. This broad accessibility means consumers can switch brands or beverage types with minimal friction.

Yanjing's strategy of diversifying its product portfolio, which includes soft drinks, serves as a partial buffer against this threat. By offering a range of beverages beyond traditional beer, the company can capture consumer spending across different categories, reducing the direct impact of substitute beverages on its core beer business. For example, in 2024, the Chinese beverage market saw continued growth in non-alcoholic options, highlighting the importance of such diversification.

- Increased E-commerce Penetration: Online sales channels for beverages in China grew significantly, making it easier for consumers to discover and purchase a wide variety of substitute drinks.

- Product Diversification Benefits: Yanjing's expansion into non-beer categories like soft drinks in 2023 aimed to hedge against market shifts and capture a broader consumer base.

- Consumer Preference Shifts: Growing consumer interest in health and wellness continues to drive demand for lower-alcohol or non-alcoholic alternatives, posing a direct substitute threat to traditional beer products.

Innovation in Substitute Products

The beverage industry's relentless innovation poses a significant threat of substitution for Beijing Yanjing Brewery. New functional drinks, premium specialty coffees, and a growing array of non-alcoholic alternatives are increasingly capturing consumer attention and diverting market share that might otherwise be allocated to beer.

For instance, the global functional beverage market was valued at approximately USD 125 billion in 2023 and is projected to grow substantially. This rapid evolution necessitates continuous product development and marketing efforts from Yanjing to maintain its competitive edge against these diversifying beverage options.

- Emergence of Functional Beverages: Drinks offering health benefits beyond basic hydration are gaining traction.

- Growth of Specialty Coffees and Teas: Premium non-alcoholic options provide sophisticated alternatives.

- Rise of Craft Non-Alcoholic Options: Sophisticated mocktails and non-alcoholic beers mimic traditional alcoholic beverages.

- Increased Consumer Health Consciousness: A shift towards healthier lifestyles favors drinks with lower alcohol content or perceived health benefits.

The threat of substitutes for Beijing Yanjing Brewery is substantial, driven by a wide range of alternative beverages and evolving consumer preferences. The Chinese market offers everything from potent baijiu, which saw sales around 600 billion yuan in 2023, to a rapidly growing non-alcoholic sector. This broad spectrum of choices means consumers can easily switch based on taste, occasion, or health considerations.

The increasing popularity of non-alcoholic and low-alcohol options, particularly among younger demographics, presents a direct challenge. The global non-alcoholic beer market, valued at approximately USD 22.7 billion in 2023, is a prime example of this shift. Furthermore, the rise of functional beverages, a market valued at around USD 125 billion in 2023, indicates consumers are seeking more than just refreshment, diverting attention from traditional beer.

Convenient access through e-commerce and diverse retail channels further empowers consumers to explore substitutes like craft beers, imported lagers, and sophisticated non-alcoholic alternatives. Yanjing's diversification into soft drinks in 2023 is a strategic move to mitigate this threat by capturing spending across broader beverage categories.

| Substitute Category | 2023 Market Value (Approx.) | Key Trend Impacting Yanjing |

|---|---|---|

| Baijiu | 600 billion yuan (China) | Cultural significance and established consumer base |

| Non-alcoholic Beer | USD 22.7 billion (Global) | Growing health consciousness, particularly among youth |

| Functional Beverages | USD 125 billion (Global) | Demand for health benefits beyond basic hydration |

| Soft Drinks & Teas | > USD 200 billion (China - Non-alcoholic) | Broad appeal and Yanjing's diversification efforts |

Entrants Threaten

Entering the beer brewing industry, particularly to challenge established giants like Beijing Yanjing Brewery, demands significant upfront capital. Think massive investments in state-of-the-art brewing equipment, efficient bottling lines, and a robust distribution infrastructure to reach consumers across China.

These considerable capital requirements act as a formidable barrier. For example, setting up a modern brewery with an annual capacity of, say, 500,000 hectoliters could easily cost tens of millions of US dollars, making it a daunting prospect for smaller, less-resourced companies looking to enter the market.

Existing giants like Beijing Yanjing Brewery leverage significant economies of scale, meaning they can produce beer much more cheaply per unit. In 2023, Yanjing's massive production capacity allowed it to spread fixed costs over millions of hectoliters, a feat new entrants would find incredibly difficult to replicate quickly. This cost advantage makes it tough for newcomers to compete on price against established players.

Established brands such as Yanjing, Liquan, Huiquan, and Xuelu have cultivated significant brand loyalty, making it difficult for newcomers to gain traction. For instance, Yanjing Brewery’s market share in China, while facing competition, remained substantial, indicating the power of its established brand presence.

New entrants must overcome the hurdle of securing widespread and efficient distribution networks. Incumbent brewers often control key distribution channels, requiring substantial investment and strategic partnerships for new players to achieve comparable reach across China's vast market.

Regulatory Hurdles and Government Policy

The Chinese government maintains a tight grip on its beverage market, creating significant barriers for new entrants. Stringent regulations, including import quotas and complex licensing requirements, often favor established domestic players like Beijing Yanjing Brewery. For instance, in 2024, the average tariff on imported alcoholic beverages remained substantial, deterring many international brands from entering the competitive landscape.

Furthermore, evolving government policies, particularly concerning environmental sustainability, are poised to increase compliance costs for any new brewery. As of early 2025, anticipated stricter waste management and emissions standards will necessitate considerable investment in new technologies, making market entry more capital-intensive. These regulatory and policy-driven challenges significantly dampen the threat of new entrants in the Chinese beer market.

- Stringent Import Tariffs: In 2024, import tariffs on beer in China averaged around 15-20%, a significant hurdle for foreign breweries.

- Distribution Restrictions: Navigating China's complex distribution networks often requires extensive local partnerships and government approvals, which are difficult for new companies to secure.

- Environmental Compliance Costs: Upcoming environmental regulations, expected to be fully implemented by late 2025, will likely add 5-10% to initial operational costs for new breweries.

Access to Raw Materials and Technology

New breweries entering the market face hurdles in securing consistent, high-quality raw materials like malted barley and hops, even with current favorable costs. For instance, in 2024, the global hop market experienced price volatility due to climate impacts on crop yields in key regions, making stable sourcing a challenge.

Access to sophisticated brewing technology and specialized expertise also acts as a significant barrier to entry. Smaller, emerging breweries may struggle to afford the capital investment required for state-of-the-art equipment, which is crucial for consistent quality and efficient production, unlike established players like Beijing Yanjing Brewery.

- Raw Material Volatility: Fluctuations in agricultural commodity prices, influenced by weather and global demand, can impact new entrants' cost structures.

- Technological Investment: High upfront costs for advanced brewing equipment and automation present a barrier for smaller startups.

- Expertise Gap: Acquiring skilled brewmasters and technical staff can be difficult and expensive for new companies.

The threat of new entrants in Beijing Yanjing Brewery's market is significantly mitigated by substantial capital requirements, estimated to be in the tens of millions of US dollars for a moderately sized brewery. Established players benefit from massive economies of scale, as demonstrated by Yanjing's 2023 production capacity, which allows for lower per-unit costs that newcomers cannot easily match. Furthermore, strong brand loyalty, as evidenced by Yanjing's significant market share, and control over distribution channels present considerable obstacles for new companies aiming to gain a foothold.

| Barrier Type | Description | Estimated Impact on New Entrants (2024-2025) |

|---|---|---|

| Capital Requirements | Investment in brewing equipment, bottling, and distribution infrastructure. | High (Tens of millions USD for moderate capacity) |

| Economies of Scale | Cost advantages due to large-scale production. | Significant; Yanjing's 2023 capacity offers substantial cost savings. |

| Brand Loyalty | Consumer preference for established brands. | High; Yanjing's market share indicates strong consumer trust. |

| Distribution Networks | Access to efficient channels to reach consumers. | Challenging; requires extensive partnerships and investment. |

| Regulatory Hurdles | Government licensing, import quotas, and environmental compliance. | Moderate to High; tariffs averaged 15-20% in 2024, and future environmental costs are projected to add 5-10%. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Beijing Yanjing Brewery Co. leverages data from the company's annual reports, industry-specific market research reports, and government economic indicators to provide a comprehensive view of its competitive landscape.