Wingstop Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wingstop Bundle

Wingstop's menu is a fascinating case study for the BCG Matrix, with its popular bone-in wings likely acting as Cash Cows, generating consistent revenue. Meanwhile, newer flavor innovations or boneless options might be positioned as Question Marks, requiring further investment to determine their market potential.

This preview offers a glimpse into Wingstop's strategic product portfolio. To truly understand how these elements interact and to unlock actionable insights for growth, dive into the full BCG Matrix report.

Get the complete BCG Matrix to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Wingstop.

Stars

Wingstop's aggressive global unit expansion firmly places it in the Star category of the BCG Matrix. In 2024, the company achieved a significant milestone by opening 349 net new restaurants, signaling robust growth. This momentum is expected to continue, with projections for 2025 indicating an impressive 16-17% unit growth.

The brand's ambitious target of exceeding 10,000 global units highlights its participation in a high-growth market and its success in capturing an increasing share of the fast-casual dining segment. This expansion is largely fueled by existing franchisees, a testament to their confidence and the brand's proven success.

Wingstop's digital sales are a clear Star, with digital channels making up a commanding 72% of system-wide sales in Q1 2025. This impressive figure builds on a strong performance in Q4 2024, where digital sales also exceeded 70%. This dominance highlights a high-growth area for the company.

The continued investment in proprietary technology, such as the MyWingstop app and AI-powered kitchen systems, further solidifies the digital platform's Star status. These investments are strategically aimed at boosting customer engagement and streamlining operations, ensuring sustained growth in this vital sales channel.

Wingstop's international market penetration is a key component of its growth strategy, showcasing a rapid expansion into new territories. The company's performance in established international markets like the UK and Canada demonstrates strong potential in these high-growth regions, with increasing market share being a significant indicator of success.

Looking ahead to 2025, Wingstop has ambitious plans to enter two to four additional international markets. This aggressive expansion underscores the company's belief in its global franchise model and its commitment to leveraging international opportunities as a primary driver for future revenue and brand recognition.

Achievement of $3 Million AUV Target

Wingstop's ambitious goal to elevate its Average Unit Volume (AUV) from $2.1 million in 2024 to $3 million signifies a strategic push for accelerated growth. This target is a key component of its "Star" positioning within a BCG Matrix framework, indicating high market share and high growth potential.

Achieving this $3 million AUV target involves significant investment in areas like technology, which enhances operational efficiency and the customer experience, and robust brand-building initiatives to drive traffic. These efforts are designed to capitalize on Wingstop's existing strong unit economics, transforming them into a more potent driver of overall company expansion and profitability.

- 2024 AUV Baseline: Wingstop's AUV stood at $2.1 million in 2024.

- Growth Target: The company aims to reach a $3 million AUV.

- Strategic Drivers: Investments in technology and brand awareness are central to this growth.

- Market Position: This objective reinforces Wingstop's status as a market leader with strong growth prospects.

Crispy Chicken Tenders Relaunch

Wingstop's relaunch of its crispy chicken tenders, amplified by strategic partnerships such as with the NBA, clearly positions this offering as a star in its BCG Matrix. This focus highlights a high-growth trajectory for the product line.

The strategic emphasis on tenders signals Wingstop's ambition to broaden its appeal beyond core wings. This diversification aims to attract new customer demographics and expand market share within the fiercely competitive chicken restaurant sector.

- Growth Driver: The crispy chicken tenders are identified as a star due to their significant growth potential and increasing popularity.

- Market Expansion: Wingstop's investment in tenders reflects a strategy to capture a larger share of the broader chicken market.

- Partnership Impact: Collaborations like the one with the NBA are instrumental in driving awareness and demand for the tenders.

Wingstop's global unit expansion, with 349 net new restaurants opened in 2024 and projected 16-17% unit growth in 2025, firmly places its overall brand in the Star category. This aggressive growth strategy is supported by a high-growth market presence and increasing market share, with existing franchisees driving much of this expansion.

The brand's digital sales are a clear Star, consistently exceeding 70% of system-wide sales in late 2024 and Q1 2025. This dominance is bolstered by ongoing investments in proprietary technology like the MyWingstop app, enhancing customer engagement and operational efficiency.

| Growth Area | 2024 Data | 2025 Projection | BCG Category |

|---|---|---|---|

| Global Unit Expansion | 349 net new restaurants | 16-17% unit growth | Star |

| Digital Sales Share | >70% (Q4 2024) | 72% (Q1 2025) | Star |

| Average Unit Volume (AUV) | $2.1 million | Aiming for $3 million | Star |

What is included in the product

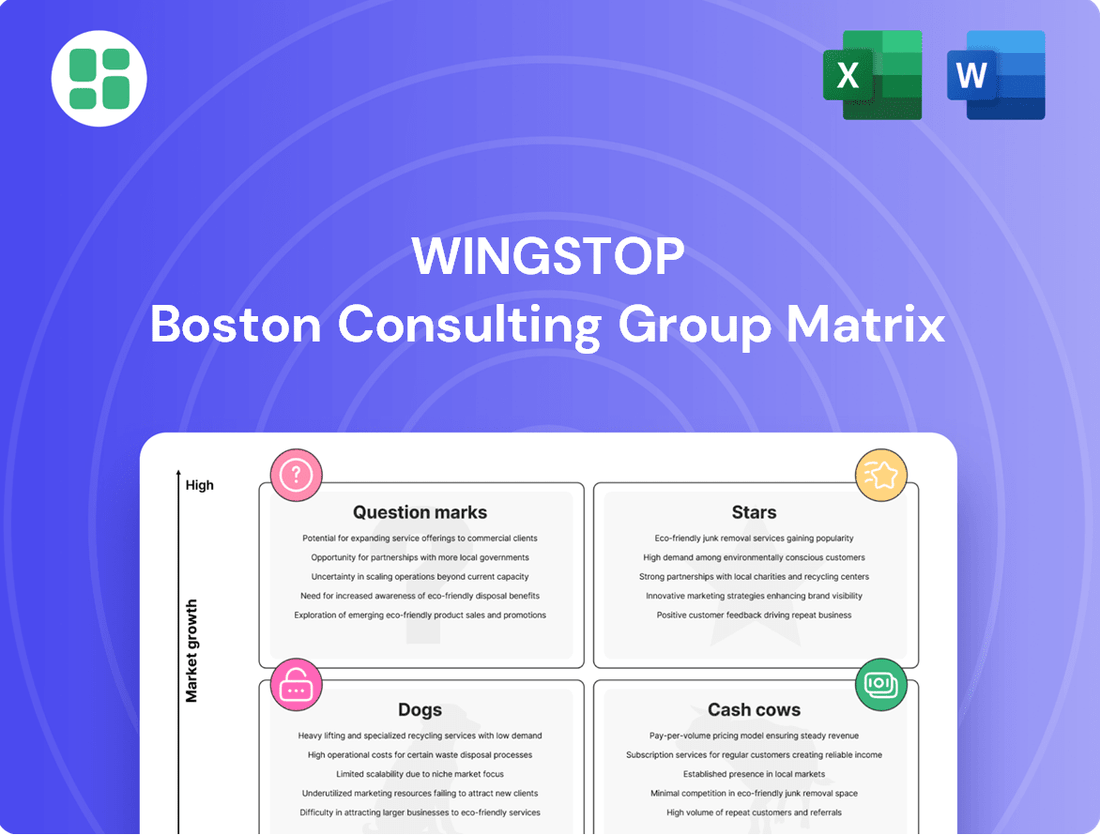

Wingstop's BCG Matrix analyzes its menu items, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment and resource allocation.

A Wingstop BCG Matrix overview clarifies which units are Stars, Cash Cows, Question Marks, or Dogs, easing strategic decision-making.

Cash Cows

Wingstop's core domestic classic and boneless wings are undoubtedly its Cash Cows. These foundational products hold a commanding market share within the U.S. fast-casual dining sector, a market that, while mature, continues to exhibit consistent demand for these popular items.

These offerings are the bedrock of Wingstop's revenue generation, consistently bringing in substantial and stable income. This reliable financial performance provides the company with the necessary capital to invest in new markets, product innovation, and other strategic growth ventures, all while ensuring robust profitability.

Wingstop's predominantly franchised model, with 98% of its locations operating under franchise agreements, positions its royalty and franchise fee revenue as a significant Cash Cow. This structure generates substantial and predictable income for the corporate entity.

The company's asset-light strategy, driven by franchising, facilitates rapid growth with limited capital outlay. This approach ensures a consistent and reliable cash flow, a hallmark of a strong Cash Cow.

In 2023, Wingstop's system-wide sales reached $4.5 billion, with franchise royalties and fees forming a core component of its corporate revenue. This highlights the financial strength derived from its franchised locations.

Wingstop's extensive network of established domestic restaurants, boasting average unit volumes of $2.1 million in 2024, clearly positions them as a Cash Cow within the BCG Matrix. These mature locations are the bedrock of the company's financial stability, consistently generating high sales volumes. They represent a reliable and significant contributor to Wingstop's overall system-wide sales, offering a dependable revenue stream.

Signature Sides and Dips

Signature sides and dips, like their seasoned fries and popular ranch and bleu cheese, are Wingstop's cash cows. These consistently high-demand items are mature products, meaning they don't need heavy marketing spend. They contribute significantly to the average check size and offer robust profit margins, making them a stable revenue generator for the company.

- High Demand: These sides are frequently ordered, driving repeat business.

- Profitability: They boast strong profit margins due to their mature product status.

- Transaction Size: Their inclusion boosts the overall value of each customer order.

- Low Investment: Minimal promotional efforts are required to maintain their popularity.

Proprietary Supply Chain Management

Wingstop's proprietary supply chain management, particularly its strategic move to lessen dependence on the unpredictable spot market for bone-in chicken wings, is a textbook Cash Cow strategy. This focus on stabilizing the largest component of their product cost directly boosts the efficiency and profitability of their core business.

By ensuring more predictable food costs, Wingstop strengthens the consistent cash flow generated from its primary sales drivers. This stability allows for greater reinvestment in other areas of the business or shareholder returns.

- Predictable Food Costs: Wingstop's efforts to secure more stable pricing for bone-in chicken wings, their primary ingredient, directly contribute to consistent profit margins.

- Enhanced Profitability: Reducing volatility in a key cost center allows the company to better forecast and maintain profitability on its core wing sales.

- Consistent Cash Flow: The stabilization of food costs underpins the reliable generation of cash from their established customer base, a hallmark of a Cash Cow.

Wingstop's core domestic classic and boneless wings are its Cash Cows, holding a dominant market share in a mature but consistently demanded sector. These products are the primary revenue generators, providing stable income that fuels growth and ensures profitability.

The company's franchised model, with 98% of locations franchised, makes royalty and franchise fee revenue a significant Cash Cow, generating substantial and predictable income for the corporate entity. This asset-light strategy allows for rapid expansion with minimal capital investment, ensuring consistent cash flow.

Wingstop's established domestic restaurants are clear Cash Cows, with average unit volumes reaching $2.1 million in 2024. These mature locations provide financial stability and a dependable revenue stream, contributing significantly to system-wide sales.

Signature sides and dips, such as seasoned fries and popular sauces, are also Cash Cows due to their consistent high demand and robust profit margins. These mature products require minimal marketing spend and increase the average transaction size.

| Product Category | Market Position | Growth Rate | Cash Flow Generation |

|---|---|---|---|

| Classic & Boneless Wings (Domestic) | High Market Share | Low | High & Stable |

| Franchise Royalties & Fees | Dominant Revenue Stream | Low | High & Predictable |

| Established Domestic Restaurants | Mature Market Leaders | Low | High & Consistent |

| Signature Sides & Dips | Consistent High Demand | Low | High & Profitable |

What You’re Viewing Is Included

Wingstop BCG Matrix

The Wingstop BCG Matrix you are currently previewing is the identical, fully completed document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no incomplete sections; you'll get the comprehensive strategic analysis ready for immediate application.

Rest assured, the BCG Matrix for Wingstop that you see here is the exact final product that will be delivered to you upon purchase. This professionally crafted report is designed for clarity and actionable insights, ensuring you receive a complete, ready-to-use strategic tool without any modifications or missing components.

Dogs

While Wingstop's overall performance is robust, some individual franchised locations might be struggling. These units, characterized by significantly lower average unit volumes compared to the system average, could be classified as Dogs in the BCG matrix. For instance, if a location consistently reports sales that are 30% below the system-wide average of $1.8 million in 2024, it warrants attention.

These underperforming sites often face challenges within their specific micro-markets, such as intense local competition or unfavorable demographics, limiting their growth potential. Such locations can strain franchisee resources and dilute overall brand profitability, necessitating a strategic review of their operational viability or potential exit strategies.

Discontinued or failed menu innovations at Wingstop, such as past limited-time offers that didn't gain traction, would fall into the Dogs category of the BCG Matrix. These items represent investments that didn't yield the expected returns, consuming resources without significant market penetration. For instance, if a new flavor profile or a side dish experiment in 2023-2024 didn't meet sales targets, it would be a prime example of a Dog.

Inefficient legacy marketing initiatives, such as older, less effective campaigns, would fall into the Dogs category for Wingstop. These are strategies that are no longer providing a strong return on investment. For instance, a local co-op advertising program that previously drove traffic but now shows diminishing returns would be a prime example.

Very Low-Volume Niche Flavors

Very Low-Volume Niche Flavors within Wingstop's menu represent offerings that consistently show minimal sales. These flavors, while catering to specific tastes, do not contribute significantly to the company's overall revenue. For instance, if a flavor consistently accounts for less than 0.5% of total flavor sales and shows no upward trend, it might fall into this category.

These underperforming flavors can tie up resources and inventory without providing a substantial return. Wingstop's operational efficiency could be improved by evaluating these niche flavors.

- Low Sales Contribution: Flavors with consistently low sales volume, potentially less than 1% of total flavor sales.

- Stagnant Growth: Lack of any discernible increase in sales over multiple reporting periods.

- Operational Strain: These items can complicate inventory management and kitchen operations.

- Potential Menu Optimization: Consideration for removal to streamline offerings and focus on more popular choices.

Company-Owned Restaurants with Persistent Low AUV

Wingstop's business model heavily relies on franchising, but its company-owned locations offer valuable insights. Any company-owned restaurants that consistently lag behind the domestic average unit volume (AUV) and show a persistent lack of growth would be classified as dogs in a BCG matrix analysis.

These underperforming units, while few, can serve as crucial learning opportunities. They highlight potential pitfalls in site selection, market saturation, or operational execution that could hinder expansion efforts. For instance, if a company-owned store in a particular demographic consistently reports lower sales than franchised counterparts in similar areas, it signals a need for deeper investigation into the underlying causes.

- Underperforming Company-Owned Units: These restaurants, characterized by persistently low Average Unit Volumes (AUVs) compared to the domestic average, represent potential 'dogs' in Wingstop's portfolio.

- Diagnostic Value: Such locations provide critical data for refining site selection criteria and operational best practices, serving as cautionary examples for future development.

- Strategic Implications: Identifying and understanding the factors contributing to low performance in these few company-owned stores can inform decisions about market entry, store remodels, or even potential divestitures.

Underperforming franchised locations, with average unit volumes significantly below Wingstop's 2024 system average of $1.8 million, are considered Dogs. These sites often struggle due to intense local competition or unfavorable demographics, limiting their growth potential and potentially straining franchisee resources.

Failed menu items or discontinued limited-time offers that did not gain traction, such as a new flavor experiment in 2023-2024 that missed sales targets, also fall into the Dogs category. These represent investments that consumed resources without significant market penetration or return.

Ineffective legacy marketing campaigns, like older co-op advertising programs showing diminishing returns, are also classified as Dogs. Additionally, very low-volume niche flavors, consistently accounting for less than 0.5% of total flavor sales with no upward trend, can complicate inventory and operations without substantial revenue contribution.

Company-owned restaurants that consistently lag behind the domestic average unit volume (AUV) and show persistent lack of growth are also considered Dogs. These locations offer valuable insights into potential pitfalls in site selection or operational execution.

Question Marks

Wingstop's ambitious expansion into new international territories, such as potential new ventures in Western Europe, firmly places these nascent markets within the Question Mark quadrant of the BCG Matrix. These regions represent significant growth opportunities for the brand, reflecting the global appetite for its unique flavor profiles and casual dining experience.

The challenge lies in Wingstop's current low market share in these emerging markets. For instance, as of early 2024, while Wingstop has seen success in countries like the UK and Mexico, many other Western European nations are in the very early stages of brand penetration. This necessitates substantial capital investment and meticulous strategic planning to build brand awareness and capture market share.

The objective is to transform these Question Marks into Stars through focused marketing efforts, operational efficiency, and potentially strategic partnerships. Success in these markets could lead to significant revenue streams and further solidify Wingstop's global brand presence, mirroring its growth trajectory in established markets where it already holds a strong position.

Wingstop's chicken sandwich is a classic Question Mark in the BCG matrix. This category is experiencing rapid growth, with the overall chicken sandwich market projected to continue its upward trajectory. Wingstop's entry into this space, while promising, likely represents a smaller portion of their overall sales compared to their established wing products.

The sandwich requires significant investment to gain traction and market share within this competitive landscape. Wingstop's strategy here will involve increased marketing spend and potential product innovation to differentiate its offering.

Wingstop's full-scale adoption of AI-powered kitchen technology is a classic Question Mark. While the potential for boosting operational efficiency and speed is significant, aiming to elevate average unit volumes (AUVs) towards its $3 million target, the current system-wide penetration and demonstrably proven impact on AUV are still in nascent stages.

The investment required for such advanced technology, including AI-driven inventory management and predictive ordering, presents a substantial hurdle. As of early 2024, while many quick-service restaurants are exploring AI, widespread, fully integrated implementations remain uncommon, making Wingstop's ambitious rollout a high-risk, high-reward proposition.

Upcoming Customer Loyalty Program

Wingstop's planned customer loyalty program, slated for a 2026 launch, represents a Question Mark in the BCG Matrix. This initiative targets significant growth in customer retention and visit frequency, aiming to capitalize on Wingstop's vast digital customer data. However, its current lack of market share means its success hinges entirely on effective implementation and widespread customer engagement.

The program's potential is high, but its uncertain future places it in the Question Mark category. Wingstop reported strong digital growth, with digital channels accounting for approximately 70% of sales in Q1 2024, providing a solid foundation for a loyalty program. The key challenge will be converting this digital reach into measurable loyalty metrics.

- High Growth Potential: The program aims to boost customer lifetime value by increasing visit frequency and average check size.

- Uncertain Market Share: As a new initiative, it starts with zero market share within this specific program category.

- Execution Risk: Success is contingent on seamless integration with existing digital platforms and compelling offers that resonate with customers.

- Data Leverage: The program will utilize Wingstop's extensive digital customer database, built from millions of transactions, to personalize rewards and communications.

Exploration of Adjacent Product Categories

Wingstop's exploration into adjacent product categories, such as breakfast or alternative proteins, would likely place these new ventures in the Question Mark quadrant of the BCG Matrix.

These initiatives would represent new markets with potentially high growth, but Wingstop would start with minimal to no market share. For instance, entering the breakfast market would require significant investment in product development, supply chain adjustments, and marketing to compete with established players.

As of 2024, the quick-service restaurant industry continues to see innovation, with brands like McDonald's and Starbucks dominating breakfast sales, indicating a challenging entry point for newcomers.

Successful adoption would be crucial for these new product lines to transition out of the Question Mark phase.

- New Product Categories: Ventures into breakfast or other proteins are new market entries.

- Low Market Share: Initial market share in these adjacent categories would be negligible.

- High Market Growth: These segments offer potential for significant future growth.

- Investment Required: Substantial capital would be needed for development and market penetration.

Wingstop's international expansion, particularly into untapped Western European markets, positions these regions as Question Marks. While the brand has shown promise in places like the UK, its penetration in many other European countries is still minimal as of early 2024. This requires substantial investment to build brand recognition and gain a foothold.

The chicken sandwich offering is another Question Mark. The overall chicken sandwich market is growing rapidly, but Wingstop's share within this specific segment is likely small compared to its core wing products. Significant marketing and product innovation are needed to compete effectively.

The full integration of AI-powered kitchen technology is a Question Mark. While it promises to boost efficiency and potentially raise average unit volumes (AUVs) towards a $3 million target, its widespread adoption and proven impact are still in early stages. The substantial investment for such advanced systems presents a considerable challenge, as fully integrated AI remains uncommon in the QSR sector as of early 2024.

Wingstop's planned customer loyalty program, set to launch in 2026, is a Question Mark. It aims to leverage the brand's strong digital presence, which accounted for about 70% of sales in Q1 2024, to enhance customer retention. However, its success hinges on effective execution and customer adoption, as it currently has no established market share within this program category.

Exploring adjacent product categories, such as breakfast or alternative proteins, places these ventures in the Question Mark quadrant. These represent new markets with high growth potential but negligible initial market share. The breakfast market, for example, is dominated by established players, requiring significant investment in product development and marketing for Wingstop to gain traction, as seen in the competitive landscape of 2024.

| Initiative | BCG Quadrant | Market Growth | Market Share | Strategic Consideration |

| Western Europe Expansion | Question Mark | High | Low | Requires significant investment for brand building and market penetration. |

| Chicken Sandwich Offering | Question Mark | High | Low | Needs marketing and product differentiation to compete in a crowded market. |

| AI-Powered Kitchen Tech | Question Mark | Moderate to High | Nascent | Substantial capital investment with uncertain ROI; focus on operational efficiency. |

| Customer Loyalty Program | Question Mark | High (Customer Lifetime Value) | Zero (Program Specific) | Leverages digital data; success depends on engagement and integration. |

| Adjacent Product Categories (e.g., Breakfast) | Question Mark | High | Negligible | High entry barriers and investment required to challenge established players. |

BCG Matrix Data Sources

Our Wingstop BCG Matrix is constructed using comprehensive data, including internal sales figures, market share reports, and industry growth projections, to accurately position each product.