TÜV Rheinland AG Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TÜV Rheinland AG Bundle

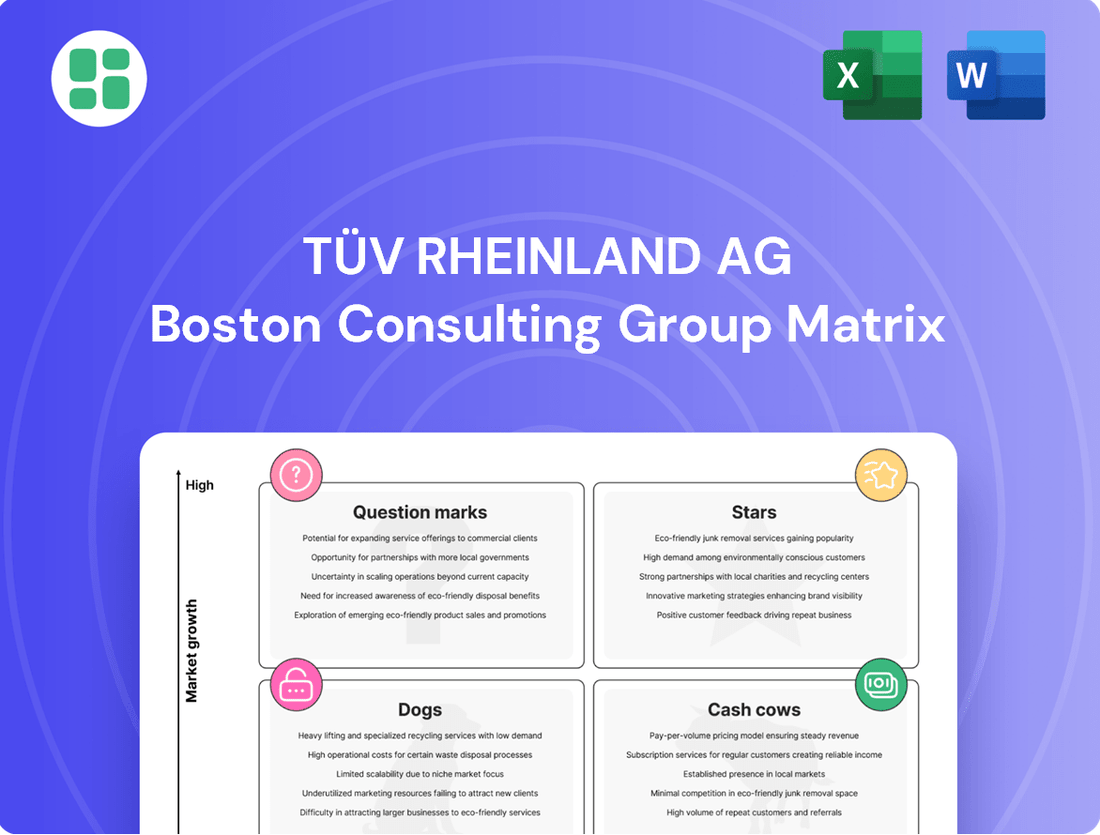

Curious about TÜV Rheinland AG's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio's potential, highlighting key areas of growth and stability. Understand where their current offerings fit within the market landscape.

Unlock the full strategic potential of TÜV Rheinland AG by purchasing the complete BCG Matrix. Gain detailed insights into each quadrant, empowering you to make informed decisions about resource allocation and future investments.

Don't miss out on a comprehensive understanding of TÜV Rheinland AG's market dynamics. The full BCG Matrix provides actionable strategies and data-driven recommendations to drive your business forward.

Stars

TÜV Rheinland's Sustainability Services (ESG) are a star in its portfolio, showing robust financial performance and significant growth. In 2024, these services generated approximately €650 million in revenue, marking a substantial contribution to the company's overall financial health.

This impressive revenue figure is complemented by double-digit growth rates, underscoring the high demand and TÜV Rheinland's strong market position within the burgeoning ESG sector. The company's strategic focus and investments in areas like photovoltaics and hydrogen further solidify its leadership in this critical and expanding market.

TÜV Rheinland is a frontrunner in certifying green hydrogen and renewable energy, a market surging due to global decarbonization mandates. Their early certifications for green hydrogen and ammonia projects highlight their leadership and significant market penetration in this rapidly expanding field. This expertise covers the full spectrum of the hydrogen lifecycle, from production to application, solidifying their strategic position.

TÜV Rheinland is making significant strides in AI safety, a critical area given AI's rapid advancement. Their commitment is evident through investments in specialized laboratories, such as the TÜV AI.Lab, aimed at developing robust testing methodologies for AI systems, particularly in safety-critical sectors like autonomous vehicles.

This strategic focus places TÜV Rheinland at the forefront of a burgeoning market where trust and reliability are non-negotiable. By establishing early expertise and capturing market share, they are positioning themselves as a leader in ensuring the safe and responsible deployment of AI technologies.

Cybersecurity Services

Cybersecurity Services, as a component of TÜV Rheinland AG's BCG Matrix, are positioned as a strong contender in a rapidly expanding market. The increasing reliance on digital technologies across all sectors fuels a significant demand for robust cybersecurity testing and certification. TÜV Rheinland has actively bolstered its offerings in this domain, leveraging strategic acquisitions and consistent investment to stay ahead of evolving threats.

The company's commitment to providing comprehensive protocols and adherence to compliance frameworks is particularly evident in its work within the automotive industry. This sector is experiencing substantial growth in cybersecurity needs, making it a prime area for TÜV Rheinland to capture considerable market share. Their expertise ensures that connected vehicles and their underlying systems meet stringent security standards.

- Market Growth: The global cybersecurity market was projected to reach approximately $214.1 billion in 2023 and is expected to grow significantly, with some forecasts suggesting a compound annual growth rate of over 13% in the coming years.

- Automotive Focus: The automotive cybersecurity market alone is anticipated to reach tens of billions of dollars by the late 2020s, driven by the increasing connectivity and autonomous features in vehicles.

- TÜV Rheinland's Investment: While specific figures vary, TÜV Rheinland has consistently invested in expanding its cybersecurity capabilities, including talent acquisition and the development of new testing methodologies.

- Strategic Acquisitions: The company has made strategic acquisitions to enhance its cybersecurity portfolio, integrating specialized expertise and expanding its service reach within critical industries like automotive.

Smart Home and IoT Device Certification

TÜV Rheinland is actively expanding its certification services for critical smart home protocols, including Thread, Matter, and Zigbee. This strategic move directly caters to the rapidly increasing demand for interconnected and interoperable Internet of Things (IoT) devices, placing the company within a high-growth consumer electronics sector where seamless device compatibility and unwavering reliability are paramount. Their commitment to offering thorough testing services across the entire product development journey, from initial design phases through to market introduction, solidifies their significant market presence in this dynamic and ever-evolving technological landscape.

The global smart home market is projected for substantial growth, with forecasts indicating a compound annual growth rate (CAGR) of over 10% in the coming years. For instance, the smart home market was valued at approximately $100 billion in 2023 and is expected to reach over $200 billion by 2028, according to various industry analyses. This expansion highlights the critical need for robust certification to ensure consumer trust and product performance.

- Market Growth: The smart home sector is experiencing rapid expansion, driven by consumer demand for convenience and connectivity.

- Interoperability Focus: Certification for protocols like Matter is crucial for ensuring that devices from different manufacturers can communicate effectively.

- Consumer Electronics Dominance: TÜV Rheinland's expansion aligns with its strength in the broader consumer electronics testing and certification domain.

- Lifecycle Support: Providing testing from design to launch offers a comprehensive solution for manufacturers navigating complex certification requirements.

TÜV Rheinland's Sustainability Services (ESG) are a star in its portfolio, showing robust financial performance and significant growth. In 2024, these services generated approximately €650 million in revenue, marking a substantial contribution to the company's overall financial health.

This impressive revenue figure is complemented by double-digit growth rates, underscoring the high demand and TÜV Rheinland's strong market position within the burgeoning ESG sector. The company's strategic focus and investments in areas like photovoltaics and hydrogen further solidify its leadership in this critical and expanding market.

TÜV Rheinland is a frontrunner in certifying green hydrogen and renewable energy, a market surging due to global decarbonization mandates. Their early certifications for green hydrogen and ammonia projects highlight their leadership and significant market penetration in this rapidly expanding field. This expertise covers the full spectrum of the hydrogen lifecycle, from production to application, solidifying their strategic position.

TÜV Rheinland is making significant strides in AI safety, a critical area given AI's rapid advancement. Their commitment is evident through investments in specialized laboratories, such as the TÜV AI.Lab, aimed at developing robust testing methodologies for AI systems, particularly in safety-critical sectors like autonomous vehicles.

This strategic focus places TÜV Rheinland at the forefront of a burgeoning market where trust and reliability are non-negotiable. By establishing early expertise and capturing market share, they are positioning themselves as a leader in ensuring the safe and responsible deployment of AI technologies.

Cybersecurity Services, as a component of TÜV Rheinland AG's BCG Matrix, are positioned as a strong contender in a rapidly expanding market. The increasing reliance on digital technologies across all sectors fuels a significant demand for robust cybersecurity testing and certification. TÜV Rheinland has actively bolstered its offerings in this domain, leveraging strategic acquisitions and consistent investment to stay ahead of evolving threats.

The company's commitment to providing comprehensive protocols and adherence to compliance frameworks is particularly evident in its work within the automotive industry. This sector is experiencing substantial growth in cybersecurity needs, making it a prime area for TÜV Rheinland to capture considerable market share. Their expertise ensures that connected vehicles and their underlying systems meet stringent security standards.

| Service Area | 2024 Revenue (Est.) | Growth Outlook | Key Market Drivers | TÜV Rheinland's Position |

| Sustainability Services (ESG) | €650 million | Double-digit | Decarbonization mandates, renewable energy transition | Market leader, early certifications |

| AI Safety | N/A (Emerging) | High | AI adoption, safety-critical applications | Investing in specialized labs, developing methodologies |

| Cybersecurity | N/A (Integrated) | High | Digitalization, evolving threats, automotive connectivity | Strengthening offerings, strategic acquisitions |

| Smart Home Protocols | N/A (Integrated) | High (CAGR >10%) | IoT growth, demand for interoperability | Expanding certification for Thread, Matter, Zigbee |

What is included in the product

This BCG Matrix overview for TÜV Rheinland AG offers strategic insights into their product portfolio, guiding investment and divestment decisions.

A clear BCG Matrix visualizes TÜV Rheinland's portfolio, easing strategic decisions and resource allocation.

Cash Cows

TÜV Rheinland's traditional vehicle inspection and homologation services, akin to the German 'TÜV' inspections, represent a mature market with consistent, legally mandated demand. This core business benefits from a significant and established market share in Germany and numerous other international locations, ensuring a steady revenue stream.

These essential services, characterized by low growth but high predictability, generate substantial and reliable cash flow. The mandatory nature of these inspections means they require minimal marketing investment, solidifying their position as classic cash cows within TÜV Rheinland's portfolio.

Industrial Plant and Equipment Inspections are a classic Cash Cow for TÜV Rheinland AG. These services are fundamental, deeply embedded in global safety regulations, and consistently in demand by industrial clients worldwide. The company's extensive history and established market position ensure a reliable, high-margin income from this mature sector.

In 2024, TÜV Rheinland continues to leverage its decades of expertise in this area, benefiting from ongoing industrial activity and stringent safety standards. While the market for these inspections is not experiencing rapid expansion, its essential nature and regulatory backing provide a stable and predictable revenue stream, contributing significantly to the company's overall profitability.

TÜV Rheinland's Management System Certification services, including ISO 9001 and ISO 14001, represent a stable cash cow. These certifications are essential for businesses seeking to enhance credibility and operational efficiency, ensuring consistent demand.

In 2023, TÜV Rheinland reported a significant portion of its revenue stemming from its broad portfolio of certification and inspection services, with management system certifications being a core component. The global market for management system certifications is mature, with steady growth projections around 3-5% annually through 2027, indicating a predictable revenue stream for TÜV Rheinland.

Standard Product Safety Testing and Certification

Standard Product Safety Testing and Certification represents a mature business segment for TÜV Rheinland AG, acting as a solid Cash Cow. This essential service ensures a vast array of consumer and industrial products, from electronics to toys, meet stringent safety and regulatory standards worldwide. TÜV Rheinland’s established global presence and reputation for reliability have secured it a significant market share in this steady, albeit not rapidly expanding, industry.

The demand for product safety testing remains consistent, driven by ongoing regulatory updates and consumer expectations for safe goods. In 2024, the global product testing, inspection, and certification (TIC) market, which includes safety testing, was valued at approximately $220 billion, with a projected compound annual growth rate of around 5% through 2030. This indicates a stable and predictable revenue stream for TÜV Rheinland’s offerings in this area.

- Market Maturity: The product safety testing sector is well-established, offering consistent demand.

- Global Trust: TÜV Rheinland is a recognized leader, benefiting from high brand equity.

- Steady Growth: The market experiences predictable growth, ensuring a reliable income for the company.

- Regulatory Driven: Ongoing compliance requirements fuel consistent business for safety certification services.

Occupational Health and Safety Services

Occupational Health and Safety Services within TÜV Rheinland AG's BCG Matrix are firmly positioned as Cash Cows. This segment benefits from consistent demand as workplace risk assessments, safety training, and health surveillance are not only legally mandated but also essential for business operations across diverse industries.

TÜV Rheinland’s established presence in this mature market ensures reliable revenue streams. The predictable nature of client needs, coupled with relatively low market dynamism, allows for efficient resource allocation and stable profitability. For instance, in 2024, the global occupational health and safety market was valued at approximately USD 55 billion, with a projected compound annual growth rate (CAGR) of around 6% through 2030, indicating a stable yet growing demand that TÜV Rheinland is well-positioned to capture.

- Stable Revenue Generation: The services provided are recurring and often contract-based, ensuring a predictable income flow.

- Low Market Growth, High Market Share: TÜV Rheinland leverages its strong brand and expertise to maintain a significant share in a mature, slow-growing market.

- Profitability Focus: The emphasis here is on maximizing profits through efficient operations and cost management, rather than aggressive expansion.

- Investment Strategy: Minimal investment is required, primarily for maintenance and incremental improvements, to sustain its cash-generating capabilities.

TÜV Rheinland's core inspection and certification services, such as vehicle inspections and industrial plant safety, are classic Cash Cows. These businesses operate in mature markets with consistent, legally mandated demand and high market share, generating substantial and reliable cash flow with minimal marketing investment.

In 2023, TÜV Rheinland's revenue was significantly driven by these established segments. The global product testing, inspection, and certification (TIC) market, a key area for TÜV Rheinland, was valued at approximately $220 billion in 2024, with steady growth projected.

These services benefit from a strong brand reputation and established global presence, ensuring predictable income streams. The focus for these Cash Cows is on efficient operations and maximizing profitability rather than aggressive expansion.

| Business Segment | BCG Category | Key Characteristics | 2024 Market Insight |

| Vehicle Inspection & Homologation | Cash Cow | Legally mandated, consistent demand, high market share | Mature market with steady revenue |

| Industrial Plant & Equipment Inspections | Cash Cow | Essential for safety, global regulatory backing, established demand | Stable income from ongoing industrial activity |

| Management System Certification | Cash Cow | Credibility enhancement, operational efficiency, consistent demand | Global market growth ~3-5% annually through 2027 |

| Product Safety Testing & Certification | Cash Cow | Regulatory driven, consumer safety focus, high brand equity | Global TIC market ~ $220 billion in 2024, ~5% CAGR |

| Occupational Health & Safety Services | Cash Cow | Workplace safety, risk assessment, legally mandated | Global market ~ USD 55 billion, ~6% CAGR through 2030 |

Delivered as Shown

TÜV Rheinland AG BCG Matrix

The TÜV Rheinland AG BCG Matrix preview you are viewing is the identical, comprehensive document you will receive immediately after your purchase. This means no watermarks, no altered content, and no demo versions – just the fully formatted, professionally analyzed BCG Matrix report, ready for your strategic decision-making.

Dogs

Highly commoditized basic training programs offered by TÜV Rheinland likely face significant competition from a multitude of smaller, local training providers and a growing number of online educational platforms. These services often exhibit low product differentiation, which can translate into a low market share and limited growth potential, ultimately resulting in thin profit margins. For instance, in 2024, the global online learning market was valued at approximately $300 billion, with a substantial portion attributed to basic skills development, highlighting the intensely competitive landscape for such offerings.

Niche or outdated industrial compliance checks, especially in sectors with declining regulatory needs or traditional industries, fall into the Dogs category of the BCG Matrix. These services likely hold a small market share due to shrinking demand and limited growth potential, making them potential cash drains.

Audits of legacy IT systems that lack a digital transformation lens, such as cloud migration, cybersecurity enhancements, or AI integration, likely fall into the low-growth, low-market share quadrant of the BCG matrix. As businesses increasingly prioritize modernization, the demand for standalone audits of purely outdated systems diminishes, making these offerings less competitive for TÜV Rheinland. For instance, a 2024 survey indicated that over 60% of enterprises are actively pursuing cloud adoption, signaling a reduced market for traditional legacy system assessments.

Basic Environmental Testing in Saturated Local Markets

In saturated local markets for basic environmental testing, TÜV Rheinland faces challenges. The presence of many small labs offering routine services like water and air quality checks can limit market share and pricing power. This commoditization often leads to lower growth and profitability for such offerings within the company's portfolio.

For instance, in 2024, the global environmental testing market, while growing, saw intense competition in these foundational segments. Many smaller, regional players often operate with lower overhead, allowing them to undercut larger, established entities on price for standardized tests. This dynamic makes it difficult for a company like TÜV Rheinland to differentiate its basic services and command premium rates.

- Limited Differentiation: Basic environmental tests are often standardized, making it hard to stand out from competitors.

- Price Sensitivity: In saturated markets, customers frequently prioritize cost, impacting profitability.

- Low Growth Potential: Without innovation or specialization, these services typically experience modest growth.

Standardized Quality Control for Declining Manufacturing Sectors

Standardized quality control services for manufacturing sectors facing long-term decline or significant outsourcing to lower-cost regions could be categorized as a 'Dog' within TÜV Rheinland AG's BCG Matrix.

The market for these specialized services is contracting, directly impacting potential revenue streams. For example, in 2024, sectors like traditional textile manufacturing in developed economies continued to see production shifts, leading to a reduced demand for on-site quality inspections.

TÜV Rheinland's market share within these shrinking niches may be insufficient to justify significant investment, as growth opportunities are limited. Data from late 2023 indicated that while overall industrial inspection services remain robust, specific segments tied to declining manufacturing bases showed minimal year-over-year growth.

- Declining Market Share: Sectors experiencing persistent downturns often see reduced demand for quality control services.

- Limited Growth Prospects: Outsourcing trends and technological obsolescence in certain manufacturing areas restrict expansion potential.

- Resource Allocation: Investments in these 'Dog' segments may divert resources from more promising 'Star' or 'Question Mark' business units.

- Strategic Review: TÜV Rheinland might consider divesting or minimizing its presence in these specific, low-growth quality control niches.

TÜV Rheinland's 'Dogs' represent services with low market share and low growth potential, often commoditized or in declining industries. These offerings, such as basic training programs or audits of legacy IT systems, face intense competition and limited demand. For example, the global online learning market, valued around $300 billion in 2024, highlights the competitive nature of even basic skill development. Similarly, with over 60% of enterprises actively pursuing cloud adoption in 2024, demand for purely legacy system assessments is shrinking.

| Service Category | Market Share | Growth Potential | Key Challenges |

| Basic Training Programs | Low | Low | High competition, low differentiation, price sensitivity |

| Legacy IT System Audits | Low | Low | Declining demand due to digital transformation trends |

| Niche Industrial Compliance | Low | Low | Shrinking regulatory needs, declining industries |

| Basic Environmental Testing | Low | Low | Saturated markets, price-sensitive customers |

Question Marks

TÜV Rheinland is actively investing in blockchain technology to revolutionize certification and enhance supply chain traceability, aiming to build greater transparency and trust. This sector represents a significant growth opportunity, though TÜV Rheinland's current market presence is modest due to the nascent stage of blockchain adoption.

The company anticipates substantial investment will be necessary to develop and scale these blockchain-based solutions. While the return on these investments remains uncertain, the potential for high future rewards in this burgeoning market is considerable. For instance, the global blockchain market size was valued at approximately USD 12.16 billion in 2023 and is projected to grow significantly in the coming years, indicating the substantial potential TÜV Rheinland is targeting.

Certification for AI ethics and bias mitigation is becoming increasingly important, especially with new regulations like the EU AI Act coming into play. This area represents a rapidly growing, new market where TÜV Rheinland is actively developing its capabilities and setting industry standards.

While TÜV Rheinland's current market share in this specific niche is likely small, being an early entrant offers a significant opportunity to become a future leader in AI assurance. The demand for trustworthy AI systems is escalating, creating a fertile ground for such specialized certification services.

The market for certifying advanced driver-assistance systems (ADAS) and autonomous driving capabilities beyond Level 2 is a dynamic and rapidly expanding field. As of 2024, regulatory frameworks are still solidifying globally, creating both opportunities and challenges for certification bodies like TÜV Rheinland. This sector demands substantial investment in cutting-edge testing facilities and highly specialized engineering talent.

Electric Vehicle (EV) Battery System Certification for New Technologies

Certifying emerging EV battery technologies like solid-state and advanced chemistries represents a significant growth avenue. This niche currently sees low market penetration for any single certification body, making it a prime area for market share acquisition. TÜV Rheinland's proactive development of new certification programs specifically for these next-generation EV battery systems underscores their strategic investment in this high-potential, evolving sector.

The success of TÜV Rheinland in this segment hinges on their agility in adapting to and validating novel battery innovations as they emerge. The global EV battery market was valued at approximately $60 billion in 2023 and is projected to grow substantially, with next-generation technologies expected to capture a significant portion of this market in the coming years. For instance, solid-state batteries, while still in development, are anticipated to move towards commercialization, creating a demand for their unique certification requirements.

- High-Growth Opportunity: Certification for next-generation EV batteries (solid-state, advanced chemistries) is a burgeoning market with limited established players.

- TÜV Rheinland's Investment: The company has launched new certification programs, signaling a commitment to this expanding technological frontier.

- Market Dynamics: The overall EV battery market is expanding rapidly, with new technologies poised to gain significant traction.

- Key Success Factor: Rapid adaptation and validation of innovative battery technologies are crucial for TÜV Rheinland to secure market leadership.

Circular Economy and Waste-to-Resource Certification

TÜV Rheinland's circular economy and waste-to-resource certification services, including product lifecycle assessments for recyclability and zero-waste-to-landfill verification, are experiencing robust growth. This expansion is fueled by increasing global demand for sustainable business practices and regulatory pressures. For instance, the global circular economy market was valued at an estimated $2.4 trillion in 2023 and is projected to reach over $4.7 trillion by 2030, indicating a significant opportunity.

While TÜV Rheinland is actively investing in and developing its capabilities in this nascent but complex sector, its market share is still in its formative stages. These specialized services demand deep technical expertise and a nuanced understanding of material flows and waste management processes. The market adoption is accelerating, with many companies actively seeking such certifications to enhance their environmental credentials and meet stakeholder expectations.

- Growth Driver: Increasing corporate sustainability commitments and regulatory mandates are propelling the demand for circular economy services.

- Market Position: TÜV Rheinland is strategically expanding its offerings, but its market share in this specialized area is still developing.

- Service Complexity: Waste-to-resource certification and lifecycle assessments require significant technical expertise, positioning them as high-value offerings.

- Future Potential: As market adoption of circular economy principles accelerates, these services are poised to become a substantial revenue stream.

The certification for AI ethics and bias mitigation is a rapidly developing area, particularly with new regulations like the EU AI Act becoming prominent. TÜV Rheinland is actively building expertise in this nascent market, aiming to set industry standards and become a leader in AI assurance.

While TÜV Rheinland's current market share in AI assurance is likely small, their early entry into this specialized niche presents a significant opportunity. The increasing demand for trustworthy and unbiased AI systems creates a fertile ground for these certification services, with the global AI market projected to reach hundreds of billions of dollars in the coming years.

The market for certifying advanced driver-assistance systems (ADAS) and autonomous driving capabilities beyond Level 2 is dynamic. As of 2024, regulatory frameworks are still evolving globally, presenting both opportunities and challenges. This sector requires substantial investment in advanced testing infrastructure and specialized engineering talent, with the ADAS market alone expected to grow significantly.

Certifying emerging EV battery technologies, such as solid-state and advanced chemistries, offers a substantial growth path. This niche currently has low market penetration for any single certification provider, making it an ideal area for market share expansion. TÜV Rheinland's development of specific certification programs for these next-generation EV batteries highlights their strategic focus on this high-potential, evolving sector.

| Business Area | Market Growth Potential | TÜV Rheinland's Position | Investment/Focus |

|---|---|---|---|

| AI Ethics & Bias Mitigation | Very High (New Market) | Emerging Player | Developing Capabilities, Standard Setting |

| ADAS & Autonomous Driving (Beyond L2) | High (Evolving Regulations) | Active Participant | Testing Infrastructure, Specialized Talent |

| Next-Gen EV Batteries | Very High (Technological Advancements) | Early Entrant, Expanding Offerings | New Certification Programs |

BCG Matrix Data Sources

Our TÜV Rheinland AG BCG Matrix leverages a robust blend of internal financial disclosures, comprehensive market research reports, and industry growth forecasts to accurately position business units.