Tubos Reunidos Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tubos Reunidos Bundle

Tubos Reunidos faces intense competition, with moderate threats from new entrants and substitute products in the steel pipe industry. Buyer power is significant due to the commoditized nature of many products, while supplier power is somewhat limited by the availability of raw materials.

The complete report reveals the real forces shaping Tubos Reunidos’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Tubos Reunidos' reliance on essential raw materials such as steel billets and specialized alloys means its bargaining power is significantly influenced by its supplier base. If the market for these critical inputs is dominated by a few key players, those suppliers gain considerable leverage, potentially driving up costs for Tubos Reunidos. For instance, in 2023, global steel prices saw fluctuations, with benchmark prices for hot-rolled coil averaging around $600-$700 per metric ton, demonstrating the impact of supplier market dynamics.

The degree of differentiation in the raw materials also plays a crucial role. When Tubos Reunidos requires highly specific or specialized steel grades for its high-performance seamless tubes, the suppliers capable of producing these niche materials possess enhanced bargaining power. This is because the availability of substitutes for such specialized inputs is limited, making Tubos Reunidos more dependent on these select suppliers.

Switching suppliers for critical raw materials or specialized equipment presents significant hurdles for Tubos Reunidos. These costs can include substantial investments in re-tooling production lines, navigating complex re-certification processes for new materials, and the potential for considerable disruption to ongoing manufacturing operations. For instance, if a new steel supplier requires extensive validation, the downtime alone could be financially damaging.

These high switching costs inherently grant suppliers greater leverage over Tubos Reunidos. It limits the company's ability to readily change suppliers, even if more favorable terms are offered elsewhere. This is especially pronounced when dealing with suppliers of highly specialized steel grades or unique manufacturing components that are not easily sourced from alternative providers.

The threat of forward integration by suppliers is a significant concern for Tubos Reunidos. Large, integrated steel producers, who supply key raw materials, could decide to enter the seamless tube manufacturing market themselves. This would directly impact Tubos Reunidos by potentially limiting access to essential materials or increasing the cost of acquiring them due to heightened competition.

For instance, if a major steel conglomerate with substantial production capacity were to establish its own seamless tube division, it could divert a considerable portion of its output to its internal operations. This scenario would not only reduce the overall supply available to independent manufacturers like Tubos Reunidos but also intensify the competitive landscape, potentially driving down prices and margins.

However, this threat is generally less pronounced for highly specialized tube manufacturers that require unique alloys or intricate production processes. These specialized suppliers may not have the broad capabilities or the strategic incentive to integrate forward into the complex world of seamless tube production, offering a degree of insulation to niche players within the industry.

Importance of Supplier's Input to Tubos Reunidos's Product

The quality and consistent availability of raw materials are absolutely crucial for Tubos Reunidos's ability to produce its high-performance seamless steel tubes. These tubes are often used in very demanding sectors, such as the energy and petrochemical industries, where even minor variations in material quality can have significant consequences for performance and safety.

This direct link between supplier input and product integrity means that Tubos Reunidos has a considerable reliance on its suppliers. Reputable suppliers who can guarantee consistent, high-quality materials therefore hold substantial bargaining power. This is especially true when specialized alloys or specific material properties are required, limiting the pool of available suppliers.

- Criticality of Raw Materials: Tubos Reunidos's seamless steel tubes are vital components in industries like oil and gas exploration, where material failure is not an option.

- Supplier Dependence: The company relies on a select group of suppliers for specialized steel grades, giving these suppliers leverage in price negotiations.

- Quality Assurance Needs: Maintaining the stringent quality standards demanded by clients necessitates close collaboration and trust with raw material providers.

Availability of Substitute Inputs

The availability of substitute inputs for seamless steel tubes is quite limited. While steel is the core material, finding alternative raw materials or manufacturing processes that can replicate the high performance of seamless steel tubes for critical applications is difficult. This scarcity of viable substitutes for traditional steel inputs significantly bolsters the bargaining power of suppliers in this sector.

Steel billet prices, influenced by global supply dynamics, can be volatile. For instance, in early 2024, global steel production remained robust, contributing to price fluctuations. However, the absolute necessity for high-quality inputs in specialized tubular solutions means that any potential substitutes would need to meet stringent performance criteria, which few can currently achieve.

- Limited Substitutability: The specialized nature of seamless steel tube production restricts viable alternative raw materials.

- Critical Application Demands: High-performance requirements for sectors like oil and gas, and aerospace necessitate specific steel grades.

- Supplier Power: The scarcity of effective substitutes enhances the leverage of traditional steel billet suppliers.

- Price Volatility vs. Quality: While steel prices can fluctuate, the unwavering need for quality inputs maintains supplier strength.

Tubos Reunidos' bargaining power with suppliers is constrained by the critical nature of its raw materials, primarily steel billets and specialized alloys. The limited availability of substitutes for these high-performance inputs, coupled with the significant costs and operational disruptions associated with switching suppliers, grants considerable leverage to existing providers. This dynamic is further amplified when suppliers possess a strong market position or the potential for forward integration.

The dependence on specialized steel grades for demanding applications, such as those in the energy sector, means Tubos Reunidos must rely on a select group of suppliers. For instance, in 2023, the global average price for steel billets ranged from $400 to $550 per metric ton, subject to market conditions and the specific grade. This reliance on specific material properties and the associated quality assurance needs solidify supplier influence.

| Factor | Impact on Tubos Reunidos | Supporting Data/Example (2023-2024) |

|---|---|---|

| Criticality of Raw Materials | High dependence on steel billets and alloys for high-performance tubes. | Steel billet prices in 2023 averaged $400-$550/ton, highlighting input cost significance. |

| Supplier Concentration | Limited number of suppliers for specialized grades enhances their leverage. | Niche alloy suppliers can command premiums due to lack of alternatives. |

| Switching Costs | High costs for re-tooling, re-certification, and operational disruption. | Potential for significant downtime and investment deters easy supplier changes. |

| Threat of Forward Integration | Large steel producers could enter tube manufacturing, reducing supply. | Major steel conglomerates have the capacity to integrate vertically. |

What is included in the product

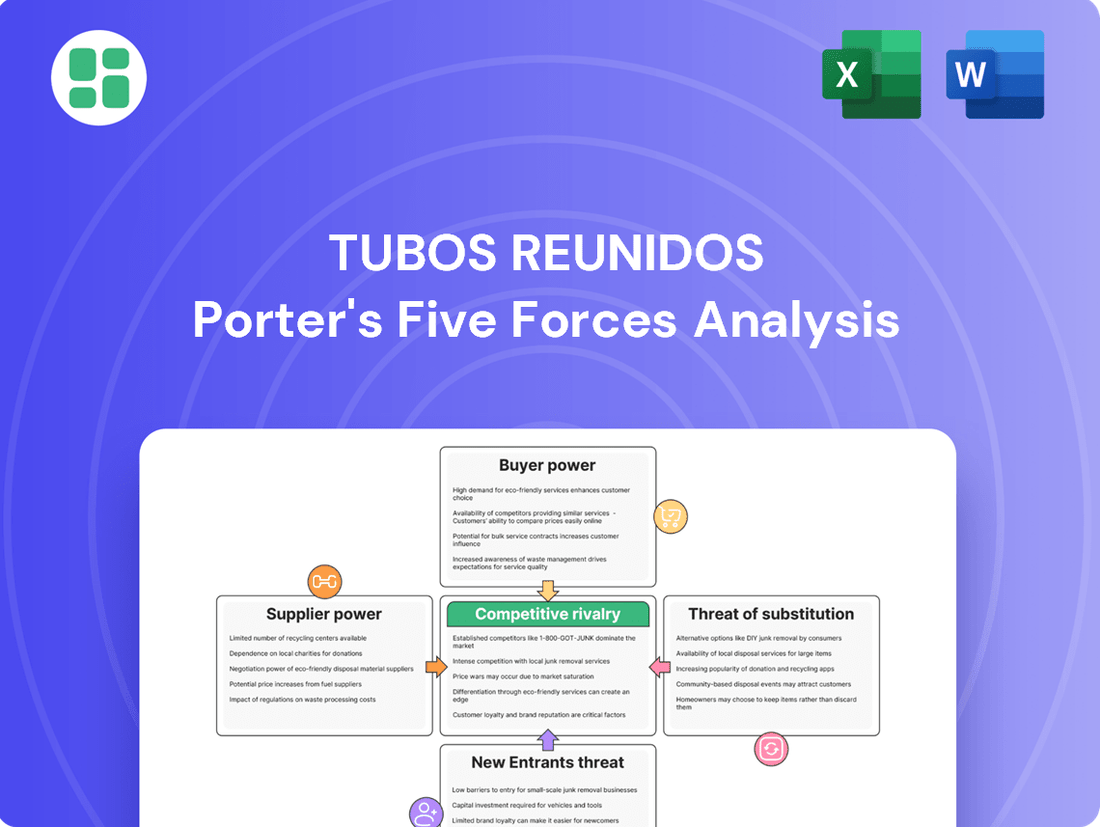

This analysis dissects the competitive forces impacting Tubos Reunidos, evaluating supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the steel pipe industry.

Instantly visualize the competitive landscape for Tubos Reunidos, highlighting key pressures from suppliers, buyers, new entrants, substitutes, and rivals to inform strategic adjustments.

Customers Bargaining Power

Tubos Reunidos operates in sectors like energy and petrochemicals, which are characterized by large, discerning buyers. These major clients, often involved in substantial projects, wield significant influence due to their considerable purchase volumes.

When a few key customers represent a large chunk of Tubos Reunidos's revenue, their ability to negotiate favorable terms, including lower prices and preferential conditions, increases dramatically. For instance, if 30% of Tubos Reunidos's 2024 sales were derived from its top five clients, these clients would possess considerable leverage.

For customers needing seamless steel tubes in critical sectors like oil and gas or aerospace, the costs associated with switching suppliers can be substantial. These costs often include rigorous qualification processes, potential redesigns of components, and the risk of operational downtime during the transition. For instance, a new supplier might need extensive testing and certification, which can take months and significant investment.

However, if Tubos Reunidos's offerings are not uniquely differentiated, or if competitors can readily match their quality standards and certifications, customers face lower barriers to switching. This situation directly enhances customer bargaining power. In 2023, the global seamless steel pipe market was valued at approximately $35.5 billion, indicating a competitive landscape where product differentiation is key to retaining customers.

Customers in the energy and petrochemical sectors are highly sensitive to price because they often face intense competition themselves. This means they are constantly looking for ways to reduce their operational costs. Even though they need reliable, high-performance seamless pipes, they will actively seek out the most economical suppliers.

This price sensitivity directly impacts Tubos Reunidos, as customers will engage in strong price negotiations. For instance, in 2024, the global seamless pipe market experienced fluctuations in demand, particularly from the oil and gas sector, which can amplify customer bargaining power when supply outstrips demand.

Threat of Backward Integration by Customers

The bargaining power of customers, particularly large industrial clients with significant manufacturing expertise, poses a potential threat to Tubos Reunidos through backward integration. These customers could explore producing their own seamless steel tubes, especially for more standardized product lines.

While the substantial capital investment required for such an endeavor acts as a deterrent, the mere possibility of backward integration can influence Tubos Reunidos’ pricing and service strategies. This leverage is more pronounced for customers seeking high volumes of common tube specifications rather than highly specialized or custom-engineered products.

For instance, a major automotive manufacturer or a large oil and gas exploration company might possess the technical know-how and financial resources to consider in-house tube production. This strategic option pressures Tubos Reunidos to maintain competitive pricing and offer favorable terms to secure long-term contracts and prevent customer attrition.

- Customer Leverage: Large customers with manufacturing capabilities can exert pressure on suppliers like Tubos Reunidos by considering backward integration.

- Capital Intensity as a Barrier: The significant investment required for seamless steel tube production is a major hurdle for most customers contemplating backward integration.

- Product Specificity Matters: The threat of backward integration is more significant for standard, high-volume steel tube products than for specialized or custom-manufactured ones.

- Impact on Terms: The potential for customers to integrate backward compels Tubos Reunidos to offer attractive pricing and contract terms to retain their business.

Product Differentiation and Importance to Customer

Tubos Reunidos's specialization in high-performance seamless steel tubes for critical sectors like oil and gas, and energy, means its products are not easily substituted. This inherent product differentiation significantly limits the bargaining power of customers, as these specialized tubes are crucial for operational integrity and performance.

The importance of these tubes to customer operations, particularly in demanding environments, further solidifies Tubos Reunidos's position. When a failure can lead to catastrophic consequences or substantial downtime, customers are less inclined to switch suppliers based solely on price.

Tubos Reunidos's commitment to innovation, such as its O-Next® low-emission tubes, enhances this differentiation. This focus on premium, technologically advanced offerings creates a stronger value proposition, making customers more reliant on Tubos Reunidos's unique capabilities and thereby reducing their ability to negotiate lower prices or demand less favorable terms.

- Specialized Product Range: Tubos Reunidos focuses on high-performance seamless steel tubes, essential for critical applications in industries like energy and automotive.

- Reduced Substitutability: The technical specifications and reliability required for these applications make generic alternatives less viable, diminishing customer power.

- Importance to Operations: The critical nature of these tubes means that product failure can have severe consequences, increasing customer dependence on quality and reliability.

- Innovation and Premium Offerings: Products like O-Next® represent a commitment to advanced solutions, further differentiating Tubos Reunidos and lessening customer leverage.

The bargaining power of customers for Tubos Reunidos is moderate, influenced by factors like customer concentration and switching costs. Large clients in sectors such as energy and petrochemicals, often representing significant portions of revenue, can negotiate favorable terms. For example, if Tubos Reunidos's top five clients accounted for 30% of its 2024 sales, their leverage would be substantial.

Switching costs for customers requiring specialized seamless steel tubes in critical industries are often high, involving extensive qualification and potential operational disruptions. However, if Tubos Reunidos’ products are not uniquely differentiated, or if competitors offer comparable quality, customers can switch more easily. The competitive global seamless steel pipe market, valued at approximately $35.5 billion in 2023, underscores the importance of this differentiation.

Customers, particularly those in price-sensitive sectors like oil and gas, actively seek cost reductions. This price sensitivity fuels strong negotiations, especially during market conditions where supply exceeds demand, as seen with fluctuating demand in the oil and gas sector during 2024.

The threat of backward integration, where large customers might produce their own tubes, is a factor, especially for standardized products. While capital investment is a deterrent, this possibility pressures Tubos Reunidos to offer competitive pricing and terms to retain business, particularly from high-volume buyers.

What You See Is What You Get

Tubos Reunidos Porter's Five Forces Analysis

This preview showcases the complete Tubos Reunidos Porter's Five Forces Analysis, offering a detailed examination of industry competition and profitability factors. You are looking at the actual document; once your purchase is complete, you’ll gain instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The seamless steel tube market is quite crowded, with a mix of big global companies and smaller, local ones. This means Tubos Reunidos faces stiff competition from various fronts.

Major players like Tubacex, Nippon Steel, Vallourec, and Tenaris are significant competitors, often having extensive global reach and diverse product portfolios. Their scale and market presence create a challenging environment.

Beyond these giants, numerous regional manufacturers also compete, particularly in specific geographic markets. This diversity in competitor type and scale intensifies the rivalry for Tubos Reunidos.

The seamless pipe market is experiencing growth, with projections indicating the cold drawn seamless steel pipes market will reach $16.05 billion by 2025. Similarly, the stainless steel seamless pipes market is anticipated to expand from $3.88 billion in 2025 to $5.15 billion by 2030.

However, this growth doesn't eliminate competitive pressures. Periods of oversupply and fluctuating demand can significantly intensify rivalry among players.

Economic slowdowns in crucial sectors that consume these pipes, coupled with increased exports from regions like China, create a challenging landscape. These factors can compress profit margins for companies like Tubos Reunidos.

Tubos Reunidos emphasizes premium, high-performance, and low-emission seamless steel tubes. While this specialization can reduce direct price competition for its specific offerings, the broader seamless tube market exhibits a range of differentiation. For more commoditized seamless tubes, price remains a significant driver of rivalry, intensifying competition among manufacturers.

However, in segments requiring specialized solutions, stringent quality standards, and specific certifications, customers face higher switching costs. This is because re-qualifying suppliers and ensuring consistent performance for critical applications can be time-consuming and expensive, thereby mitigating intense price-based rivalry for Tubos Reunidos' specialized products.

Exit Barriers

The seamless steel tube industry, including players like Tubos Reunidos, faces significant exit barriers due to its capital-intensive nature. Companies invest heavily in specialized manufacturing plants and machinery, creating substantial sunk costs. For instance, the construction and equipping of a modern seamless tube mill can easily run into hundreds of millions of dollars, making it extremely difficult to recoup these investments if a company decides to exit the market.

These high fixed costs and the specialized nature of assets mean that even when market conditions are unfavorable and profitability is low, companies are often compelled to continue operations. This strategy aims to at least cover ongoing fixed expenses rather than abandoning the assets altogether. This dynamic can lead to prolonged periods of intense competition as firms fight to maintain market share and cover their operational burdens.

- High Capital Investment: The seamless steel tube sector demands substantial upfront capital for advanced manufacturing facilities.

- Specialized Assets: Machinery and plants are highly specific to seamless tube production, limiting resale value or alternative use.

- Operational Continuity: Companies often continue production to cover fixed costs, even during downturns, intensifying rivalry.

Strategic Commitments and Aggressiveness of Competitors

Competitors in the seamless steel tube market demonstrate significant strategic commitments, often involving substantial investments in capacity expansions and the adoption of new technologies, such as developing low-emission products to meet evolving environmental standards. These actions highlight a proactive approach to maintaining market share and anticipating future demand shifts.

Mergers and acquisitions are also prevalent, signaling a drive for consolidation and enhanced competitive positioning. For example, the European Commission's initiation of an anti-dumping investigation in May 2024 concerning seamless pipes originating from China underscores the aggressive nature of international competition and the presence of significant trade barriers and challenges that players must navigate.

- Capacity Expansions: Competitors are investing in increasing their production capabilities to meet growing demand, particularly in sectors like energy and infrastructure.

- Technological Advancements: Focus on developing and implementing advanced manufacturing processes and products, such as those with reduced environmental impact, to gain a competitive edge.

- Mergers and Acquisitions: Strategic consolidation through M&A activities aims to achieve economies of scale, broaden product portfolios, and strengthen market presence.

- Aggressive Trade Practices: The threat of anti-dumping measures, as seen with the May 2024 investigation into Chinese seamless pipes, indicates intense price competition and protectionist responses in global markets.

The competitive rivalry within the seamless steel tube market is intense, driven by a mix of large global players and numerous regional manufacturers. This crowded landscape, coupled with periods of oversupply and fluctuating demand, pressures profit margins for companies like Tubos Reunidos.

While Tubos Reunidos focuses on specialized, high-performance tubes, reducing direct price competition for its niche products, the broader market sees price as a key differentiator for more commoditized offerings. This means that even with specialization, the overall rivalry remains a significant factor.

| Competitor Type | Market Presence | Key Strategies |

|---|---|---|

| Global Giants (e.g., Tubacex, Tenaris) | Extensive global reach, diverse portfolios | Capacity expansion, technological advancement, M&A |

| Regional Manufacturers | Specific geographic focus | Price competition, localized service |

| New Entrants/Exporters (e.g., China) | Growing export volume, potential price pressure | Cost-effective production, aggressive trade practices |

SSubstitutes Threaten

The primary substitute for seamless steel tubes is welded steel tubes. While generally less expensive to produce, welded tubes may not match the structural integrity or performance of seamless tubes, especially in demanding high-pressure and high-temperature environments.

For critical sectors like energy and petrochemicals, the superior reliability and safety of seamless tubes often justify their higher cost. For instance, in 2024, the global market for seamless steel pipes was valued at approximately $35 billion, with a significant portion driven by these high-stakes industries where failure is not an option.

While welded pipes can substitute for seamless pipes in some uses, the threat is limited. For demanding applications in sectors like energy and petrochemicals, seamless steel pipes are irreplaceable due to their superior strength and integrity under high pressure. In 2023, the global seamless pipe market was valued at approximately $35 billion, underscoring its critical role where substitutes simply cannot perform.

The willingness of buyers to switch to substitutes for seamless steel tubes, like welded tubes or alternative materials, hinges on application demands, regulatory compliance, and a thorough cost-benefit assessment. For instance, in critical sectors such as oil and gas exploration, the high stakes of equipment failure make buyers hesitant to adopt substitutes, keeping the propensity to substitute low.

Relative Price and Quality of Substitutes

The threat of substitutes for Tubos Reunidos's seamless steel tubes is influenced by the relative price and quality of alternatives, such as welded pipes. While welded pipes can be more economical, often presenting a lower initial cost, they generally fall short in terms of quality and performance, especially in demanding applications.

For instance, welded pipes might not offer the same level of integrity or corrosion resistance as seamless tubes, making them less suitable for critical sectors like oil and gas, or high-pressure industrial processes. Tubos Reunidos strategically targets these premium markets where the superior quality and reliability of seamless tubes justify their higher price point.

The decision between seamless and substitute pipes often hinges on a cost-benefit analysis where long-term performance and safety are prioritized. For example, in the energy sector, the cost of failure for a pipe due to lower quality can far exceed the initial savings from using a cheaper substitute.

Key considerations for customers include:

- Corrosion Resistance: Seamless tubes generally exhibit superior resistance to corrosion, a critical factor in many industrial environments.

- Pressure Handling: The manufacturing process for seamless tubes ensures a uniform wall thickness, enabling them to withstand higher pressures than most welded alternatives.

- Material Integrity: The absence of a weld seam in seamless tubes eliminates a potential weak point, enhancing overall structural integrity and reliability.

- Application-Specific Needs: For applications demanding the highest levels of safety and performance, such as in aerospace or critical infrastructure, the quality premium of seamless tubes is often non-negotiable.

Innovation in Substitute Materials

Ongoing innovation in materials science presents a significant threat to seamless steel tubes. New substitutes with improved properties could emerge, directly challenging the market position of steel. For instance, advancements in advanced composites or specialized plastics, particularly those offering enhanced temperature and pressure resistance, could become viable alternatives. This threat intensifies if these new materials can match steel's performance benchmarks while simultaneously offering a lower cost of production or demonstrable environmental advantages.

The potential for cost-competitiveness is a key driver for substitute adoption. As of early 2024, the global average price for steel coil hovered around $700-$800 per metric ton, a figure that can fluctuate significantly based on raw material costs and geopolitical factors. If innovative composite materials can achieve comparable structural integrity and durability at a price point below this range, their adoption rate would likely accelerate, especially in sectors sensitive to material expenses.

- Emerging Materials: Advanced composites and specialized plastics are key areas of innovation that could yield viable substitutes.

- Performance Parity: The threat escalates if these substitutes can match or exceed the temperature and pressure resistance of seamless steel tubes.

- Cost and Environmental Factors: Lower production costs and environmental benefits associated with new materials can significantly accelerate their market penetration.

- Market Vulnerability: Sectors prioritizing cost-efficiency and sustainability may be the first to adopt these alternative materials, impacting demand for steel tubes.

The threat of substitutes for seamless steel tubes, primarily welded steel tubes and emerging materials, is moderated by the critical performance demands of key industries. While welded tubes offer a lower initial cost, their limitations in structural integrity and pressure handling make them unsuitable for high-stakes applications in sectors like energy and petrochemicals.

The global seamless pipe market, valued at approximately $35 billion in 2023, highlights the essential role of these tubes where reliability is paramount. For instance, the oil and gas sector, a major consumer, prioritizes the superior strength and safety of seamless pipes, limiting the propensity for substitution despite potential cost savings from alternatives.

Innovations in advanced composites and specialized plastics pose a growing, albeit currently contained, threat. If these materials can achieve performance parity with seamless steel tubes, particularly in temperature and pressure resistance, and offer cost advantages, their adoption could accelerate, especially in cost-sensitive market segments.

| Substitute Type | Key Advantages | Key Disadvantages | Industry Relevance |

|---|---|---|---|

| Welded Steel Tubes | Lower production cost | Lower structural integrity, limited pressure handling | General construction, lower-pressure applications |

| Advanced Composites | Potential for high strength-to-weight ratio, corrosion resistance | Higher initial cost, unproven long-term performance in extreme conditions, manufacturing complexity | Aerospace, niche industrial applications (emerging) |

| Specialized Plastics | Corrosion resistance, lower weight | Lower temperature and pressure limits, material degradation concerns | Chemical processing, low-pressure fluid transport (specific uses) |

Entrants Threaten

The seamless steel tube manufacturing industry demands significant capital investment, with costs for specialized machinery, foundries, and advanced production facilities running into hundreds of millions of dollars. For instance, establishing a new, state-of-the-art seamless tube mill in 2024 could easily require upwards of $300 million to $500 million. This substantial financial barrier makes it incredibly difficult for new players to enter the market and compete effectively with established companies that have already amortized their initial investments.

Established players like Tubos Reunidos leverage significant economies of scale in their manufacturing processes, raw material sourcing, and distribution networks. For instance, in 2024, the global steel pipe market, a key area for Tubos Reunidos, saw major producers operating at high capacity utilization rates to spread fixed costs, thereby lowering per-unit production expenses.

New entrants would face substantial hurdles in matching these cost efficiencies. Without the established volume and infrastructure, a new competitor would likely incur higher per-unit costs for production and procurement, making it difficult to compete on price with incumbent firms like Tubos Reunidos, which benefits from years of optimized operations.

Tubos Reunidos benefits from an extensive global sales network and deep-seated relationships with major oil companies, engineering firms, and distributors across more than 100 nations. This established infrastructure presents a significant hurdle for potential new entrants aiming to replicate its reach and credibility in a sector where trust and a track record of performance are paramount.

Proprietary Technology and Experience

Tubos Reunidos' century-plus of experience, dating back over 120 years, and its dedication to product and process innovation create a substantial hurdle for newcomers. This includes mastery of specialized alloys and advanced manufacturing methods crucial for high-performance tubes.

The development of proprietary technology and the deep well of accumulated expertise represent significant barriers to entry, particularly in specialized markets demanding high-performance tubular solutions. For instance, their advanced welding techniques and material science knowledge are not easily replicated.

In 2023, Tubos Reunidos reported a significant portion of its revenue derived from specialized, high-value products, underscoring the importance of its technological edge. This focus on niche, technologically demanding segments makes it difficult for new players to compete effectively without substantial upfront investment in R&D and specialized equipment.

- Proprietary Technology: Tubos Reunidos possesses unique manufacturing processes and specialized alloy formulations.

- Extensive Experience: Over 120 years in the industry provides invaluable operational knowledge and market understanding.

- High Barriers to Entry: These factors create significant challenges for new entrants in specialized, high-performance tube markets.

Government Policy and Regulations

Government policy and regulations present substantial barriers to entry for new players in the steel pipe manufacturing sector, particularly for companies like Tubos Reunidos. Stringent environmental standards, rigorous safety protocols, and mandatory quality certifications, especially for critical applications in the oil and gas industry, require significant upfront investment and ongoing compliance. For instance, adherence to ISO 37000 series standards for anti-bribery management systems or specific API (American Petroleum Institute) certifications can be costly and time-consuming to obtain, deterring new entrants who may lack the resources for such compliance.

Trade policies also play a crucial role in shaping the competitive landscape. The imposition of tariffs on imported steel, such as the potential for renewed Section 232 tariffs by the U.S. in 2025, directly increases the cost of raw materials for pipe manufacturers. This can make it economically unviable for new companies to compete, especially if they rely on imported steel. Such protectionist measures can also lead to retaliatory tariffs from other countries, further complicating international market access and increasing operational risks for any new entrant aiming for global reach.

- Regulatory Hurdles: New entrants must invest heavily in meeting strict environmental, safety, and quality certifications, such as those required by the oil and gas sector.

- Trade Policy Impact: Tariffs on steel imports, like potential U.S. Section 232 tariffs in 2025, raise raw material costs and can restrict market access for newcomers.

- Compliance Costs: Obtaining and maintaining certifications like ISO standards or API specifications represents a significant financial and operational challenge for new market participants.

The threat of new entrants in the seamless steel tube market is significantly low due to substantial capital requirements and established economies of scale. New companies would need hundreds of millions of dollars to build production facilities, as evidenced by the estimated $300 million to $500 million cost for a new mill in 2024. Furthermore, existing players like Tubos Reunidos benefit from lower per-unit costs due to high production volumes and optimized supply chains, making it difficult for newcomers to compete on price.

Established companies also possess strong competitive advantages through proprietary technology, extensive experience, and robust global distribution networks. Tubos Reunidos' over 120 years of expertise and its focus on high-value, specialized products in 2023 highlight the difficulty for new entrants to match this technological edge and market penetration. This creates a high barrier to entry, particularly in niche segments requiring advanced manufacturing capabilities.

Government regulations and trade policies further deter new entrants. Compliance with stringent environmental and safety standards, along with obtaining critical certifications like API, incurs significant costs. Potential trade actions, such as U.S. Section 232 tariffs on steel in 2025, can also inflate raw material costs and complicate market access for new players, reinforcing the dominance of established firms.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Tubos Reunidos is built upon a foundation of publicly available financial reports, industry-specific market research, and regulatory filings. We also incorporate insights from reputable financial news outlets and analyst reports to provide a comprehensive view of the competitive landscape.