Hong Kong and China Gas Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hong Kong and China Gas Bundle

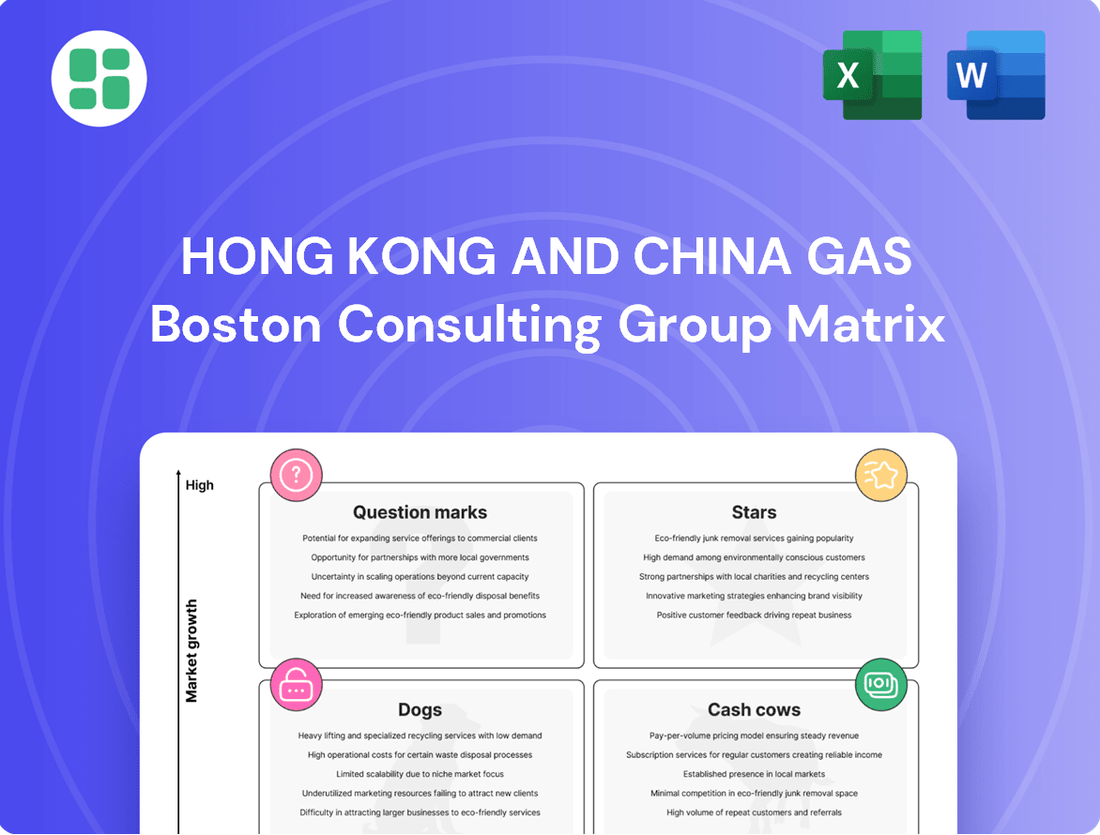

Curious about Hong Kong and China Gas's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. But to truly unlock their competitive advantage and make informed investment decisions, you need the full picture.

Dive deeper into the Hong Kong and China Gas BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Towngas's renewable energy ventures, primarily managed by Towngas Smart Energy, experienced a remarkable fivefold increase in net profit during 2024. This substantial growth underscores the segment's strong performance and its position as a high-potential area for the company.

The company boasts an impressive portfolio of over 1,000 renewable energy projects spread across 24 provincial-level regions in mainland China. With a connected photovoltaic capacity of 2.3 GW, Towngas Smart Energy has secured a notable market presence in the burgeoning renewable energy sector.

China's commitment to its 'dual carbon' targets is a significant tailwind for Towngas's green energy strategy. This focus on sustainability is expected to fuel continued expansion and solidify the renewable energy business as a primary growth engine for the company moving forward.

Green methanol production is a star performer for Towngas within the BCG matrix. The company's Inner Mongolia facility is boosting its capacity, and new plants are being built with Foran Energy Group. This strategic move taps into the booming demand for sustainable maritime fuels, with a notable surge expected from methanol-powered ships by 2025.

Hong Kong and China Gas (Towngas) is strategically positioning itself in the burgeoning Sustainable Aviation Fuel (SAF) market with its new plant in Malaysia. This facility, slated for a Q3 2025 launch, will boast an annual production capacity of 300,000 tonnes, directly addressing the escalating global demand for greener aviation solutions driven by decarbonization mandates.

This significant investment places Towngas as a pioneering entity in Southeast Asia's SAF landscape. The company's early entry is a calculated move to capture market share in a sector projected for substantial growth, fueled by regulatory pressures and airline commitments to reduce their carbon footprint.

Hydrogen Energy Applications in Hong Kong

Towngas is making significant strides in hydrogen energy applications within Hong Kong, a move that aligns with its strategic growth initiatives. The company is focused on producing green hydrogen from biogas generated at landfills, a sustainable approach to energy generation. This initiative is crucial for Hong Kong's transition to cleaner energy sources.

These hydrogen projects are slated to begin production in 2025, marking a pivotal moment for Towngas's role in the burgeoning hydrogen market. The company's early engagement positions it to capture a substantial market share, especially given the supportive government policies driving the hydrogen economy in Hong Kong. This forward-thinking strategy is designed to capitalize on future energy demands.

The integration of hydrogen into existing gas networks for sectors like transportation and construction sites is a key aspect of Towngas's strategy. By doing so, they are creating diverse revenue streams and expanding the utility of hydrogen. This multi-faceted approach underscores their commitment to innovation.

Key developments include:

- Green Hydrogen Production: Utilizing biogas from landfills for hydrogen generation, aiming for pilot production in 2025.

- Network Integration: Incorporating hydrogen into existing gas networks for transportation and construction applications.

- Strategic Partnerships: Collaborating with Veolia and Chi Shing Group to bolster market entry and expansion.

- Market Leadership: Aiming to be a frontrunner in Hong Kong's hydrogen economy, driven by favorable government policies and growing demand.

Smart Energy Ecosystem Platform & Services

Towngas Smart Energy's development of a 'Smart Energy Ecosystem Platform' represents a significant growth opportunity. This platform provides integrated energy solutions, focusing on energy efficiency, carbon management, and green power trading. It caters to 20 diverse industries, actively supporting the creation of zero-carbon industrial parks and low-carbon factories across China.

The platform's expansion is driven by China's escalating demand for sophisticated energy management solutions. By leveraging digitalization, this segment is experiencing rapid growth as businesses increasingly prioritize effective Environmental, Social, and Governance (ESG) management and aim to optimize their energy consumption. For instance, in 2023, China's renewable energy capacity saw a substantial increase, with solar and wind power leading the charge, underscoring the market's readiness for such integrated solutions.

- Platform Focus: Integrated energy solutions, energy efficiency, carbon management, green power trading.

- Market Reach: Serves 20 industries, facilitating zero-carbon industrial parks and low-carbon factories.

- Growth Drivers: Surging demand for energy management in China, digitalization, and ESG implementation.

- Industry Trend: Businesses are actively seeking to optimize energy consumption and improve environmental performance.

Towngas's green methanol and sustainable aviation fuel (SAF) initiatives are clear stars in its BCG matrix. The company is significantly expanding its green methanol capacity in Inner Mongolia and is set to launch a 300,000-tonne annual capacity SAF plant in Malaysia in Q3 2025. These ventures capitalize on the growing global demand for cleaner fuels, driven by environmental regulations and industry commitments.

The company's strategic focus on hydrogen energy in Hong Kong, with pilot production anticipated in 2025, also positions it as a star. This includes producing green hydrogen from landfill biogas and integrating it into existing gas networks for transportation and construction. These efforts are bolstered by supportive government policies and strategic partnerships.

| Business Segment | Market Growth | Relative Market Share | BCG Classification |

|---|---|---|---|

| Green Methanol | High | High | Star |

| Sustainable Aviation Fuel (SAF) | High | High | Star |

| Hydrogen Energy (Hong Kong) | High | High | Star |

What is included in the product

The Hong Kong and China Gas BCG Matrix analyzes its diverse energy businesses, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions, identifying units for investment, divestment, or harvesting based on market growth and share.

The Hong Kong and China Gas BCG Matrix offers a clear, visual roadmap, simplifying complex portfolio decisions for executives.

This tool provides a concise, actionable overview, alleviating the pain of indecision in strategic resource allocation.

Cash Cows

Hong Kong and China Gas's (Towngas) core city-gas business in Hong Kong is a prime example of a cash cow. This segment serves a mature market with consistent demand from residential, commercial, and industrial users.

While residential gas consumption saw some impact from cross-border travel in 2024, the industrial and commercial sectors demonstrated resilience, with consumption growth contributing to stable overall gas sales volumes. This stability ensures a predictable and substantial cash flow for the company.

The Hong Kong city-gas operation boasts a high market share in a low-growth environment, a hallmark of a cash cow. It reliably generates significant profits and cash, which can be reinvested into other business segments or distributed to shareholders.

The established city-gas distribution networks in major, mature cities across mainland China are a prime example of a cash cow for Towngas. This segment experienced a 5% growth in sales volume during 2024, fueled by ongoing urbanization and the adoption of new technologies.

Successful cost pass-through strategies further bolstered profitability. With a significant footprint of 191 city-gas projects and serving 17.64 million customers, this business consistently holds a strong market position, generating substantial and reliable profits.

Towngas's water supply operations, especially those with significant concessions in stable regions, function as classic cash cows. These ventures benefit from long-term contracts and cater to essential needs in mature markets, guaranteeing consistent revenue streams.

While growth might be modest, the inherent stability and essential nature of water utilities solidify these investments as reliable cash generators for the company. For instance, in 2024, the company continued to leverage its expertise in water treatment and distribution, contributing to a predictable revenue base.

Waste Management Operations

Hong Kong and China Gas's waste management operations are solid cash cows. These ventures consistently generate revenue, especially through secured long-term contracts. They operate in essential, mature service sectors with stable demand and predictable cash flows, reflecting their high market share in specific regions and low growth potential.

- Stable Revenue Contribution: The waste management segment consistently contributes to the company's overall revenue, bolstered by long-term contracts that ensure predictable income streams.

- Mature Market Position: Operating in established and essential service sectors, these businesses benefit from steady demand, making them reliable generators of consistent cash flow.

- Low Investment Needs: Due to their mature nature and high market share in certain areas, these operations require minimal new capital investment to maintain their profitability, characteristic of a cash cow.

Traditional Gas Appliance Sales and Services (Hong Kong)

The sales and maintenance of traditional gas appliances in Hong Kong function as a stable, albeit slow-growing, source of income for Towngas.

Given Hong Kong's mature market and Towngas's extensive customer base, the company enjoys a dominant market share in this segment, which includes essential household items and their upkeep. This business line generates reliable earnings and underpins the company's primary gas utility operations, necessitating minimal marketing expenditure.

- Market Share: Towngas holds a significant majority of the market for traditional gas appliances in Hong Kong.

- Revenue Stability: This segment provides a consistent revenue stream, contributing to the company's overall financial stability.

- Low Growth, High Share: While growth is modest, the high market share ensures predictable cash flow.

The established city-gas distribution networks in mainland China, particularly in mature urban areas, represent significant cash cows for Towngas. These operations benefit from consistent demand driven by ongoing urbanization and a strong market position, with sales volume growing by 5% in 2024. The company's extensive network, serving 17.64 million customers across 191 projects, ensures reliable and substantial profit generation.

Towngas's water supply operations, especially those secured by long-term concessions in stable regions, also function as cash cows. These ventures cater to essential needs in mature markets, providing predictable revenue streams. The company's continued focus on water treatment and distribution in 2024 solidified this segment's role as a dependable cash generator.

Waste management services, supported by secured long-term contracts, are another key cash cow for Towngas. Operating in essential, mature sectors with stable demand, these businesses maintain a high market share in specific regions, yielding predictable cash flows with minimal need for new capital investment.

The sales and maintenance of traditional gas appliances in Hong Kong also act as a stable income source. Despite modest growth prospects in this mature market, Towngas's dominant share ensures consistent earnings and predictable cash flow with limited marketing expenditure.

| Business Segment | Market Position | Growth Potential | Cash Flow Generation | Key Driver |

| Hong Kong City Gas | High Market Share (Mature) | Low | Stable & Substantial | Consistent Demand |

| Mainland China City Gas | Strong Market Position | Moderate (5% sales growth in 2024) | Substantial & Reliable | Urbanization, New Tech |

| Water Supply Operations | Dominant in Concessions | Low to Moderate | Consistent & Predictable | Essential Service, Contracts |

| Waste Management | High in Specific Regions | Low | Consistent & Predictable | Long-term Contracts |

| Gas Appliance Sales (HK) | Dominant Market Share | Low | Stable & Reliable | Established Customer Base |

Full Transparency, Always

Hong Kong and China Gas BCG Matrix

The Hong Kong and China Gas BCG Matrix preview you are viewing is the complete, final document you will receive upon purchase, offering an unwatermarked and fully formatted strategic analysis. This means the detailed breakdown of their business units, categorized by market share and growth rate, is precisely what you'll download for immediate application in your own strategic planning. You can confidently use this preview as an accurate representation of the professional-grade report you'll acquire, ready for presentation or further internal discussion without any need for revisions or additional content.

Dogs

Some legacy telecommunications ventures within Towngas's portfolio, particularly those struggling in highly competitive or saturated markets, would likely be classified as Dogs in the BCG Matrix. These investments would exhibit both low market growth and a low relative market share, failing to generate substantial returns and potentially becoming cash drains.

For instance, if a specific legacy telecommunications project, like a fiber optic expansion in a region already dominated by established players, failed to capture even 5% market share by the end of 2023, it would fit this category. Such ventures would require careful consideration for divestiture or a significant strategic overhaul to avoid continued underperformance.

Smaller, older gas production sites within Hong Kong and China Gas’s portfolio, especially those relying on outdated technology or situated in resource-depleted regions, would likely be classified as Dogs in a BCG Matrix analysis. These facilities typically exhibit a low market share and minimal growth prospects, often due to elevated operating expenses or declining output, which limits their profitability.

Such assets could represent a drain on capital, as they may not generate substantial profits while still requiring investment for maintenance or compliance. For instance, if a facility’s production cost per unit significantly exceeds market prices, its continued operation becomes questionable, potentially impacting overall financial performance.

Minor, non-strategic investment holdings in niche sectors that have not yielded expected returns and face stiff competition are likely dogs for Hong Kong and China Gas. These could be small, diversified investments that Towngas made but which have not achieved critical mass or competitive advantage, resulting in low market share and minimal growth prospects. For example, if Towngas had a small stake in a specialized renewable energy component manufacturer in mainland China that faced intense competition from larger, more established players, this would fit the description of a dog. By the end of 2023, Towngas’s overall investment portfolio showed a slight increase in value, but specific niche holdings continued to underperform, contributing minimally to overall group profitability.

Localized Gas Projects in Shrinking Industrial/Rural Areas

Localized gas distribution projects in areas like the declining industrial zones of northern China or certain rural regions of Hong Kong, characterized by shrinking populations and minimal new development, would likely be categorized as 'dogs' in the BCG Matrix. These ventures typically demonstrate very low, if any, gas sales volume growth and a limited, often stagnant, customer base. For instance, in 2023, some older industrial parks in provinces like Liaoning saw a decline in manufacturing output, directly impacting gas consumption.

These 'dog' projects are characterized by their inefficiency and potential to become cash traps. Their low market share in a slow-growing or declining market means they require significant investment to maintain operations without generating substantial returns.

- Low Growth Market: Industrial areas with significant factory closures or rural areas experiencing depopulation offer minimal expansion opportunities for gas distribution.

- Limited Customer Base: A shrinking population directly translates to fewer residential and commercial customers, capping sales potential.

- Inefficient Operations: Maintaining infrastructure in sparsely populated or declining industrial zones can lead to high per-customer operating costs.

- Cash Trap Potential: Projects requiring ongoing capital for maintenance without commensurate revenue growth can drain company resources.

Outdated or Unscalable Waste-to-Energy Projects

Certain older or less efficient waste-to-energy projects within Hong Kong and China Gas's portfolio might be categorized as Dogs. These are typically facilities that struggle with scalability or have become economically unviable. For instance, projects facing increased operational costs due to evolving environmental regulations or the advent of more advanced, cost-effective technologies could fall into this category.

These underperforming assets might be characterized by their inability to generate significant profits, often operating at a loss or with minimal returns. Without a clear strategy or investment to improve their efficiency, market share, or adapt to new technological landscapes, they represent a drag on the company's overall performance. In 2024, for example, older incinerator designs might be particularly vulnerable if they cannot meet stricter emission standards without substantial retrofitting costs.

- Economic Viability: Projects with high operating costs and low energy output efficiency, potentially generating less than 100 kWh per tonne of waste processed, could be dogs.

- Regulatory Compliance: Facilities failing to meet updated emission standards, such as those requiring particulate matter below 5 mg/Nm³, may incur significant compliance costs, impacting profitability.

- Technological Obsolescence: Older combustion technologies that are less efficient than modern gasification or advanced incineration methods could be candidates for divestment.

- Market Share and Growth: Projects with stagnant or declining waste processing volumes and no clear growth prospects in their local markets would be classified as dogs.

Certain legacy telecommunications ventures within Towngas's portfolio, particularly those struggling in highly competitive or saturated markets, would likely be classified as Dogs in the BCG Matrix. These investments exhibit both low market growth and a low relative market share, failing to generate substantial returns and potentially becoming cash drains.

Smaller, older gas production sites within Hong Kong and China Gas’s portfolio, especially those relying on outdated technology or situated in resource-depleted regions, would likely be classified as Dogs. These facilities typically exhibit a low market share and minimal growth prospects, often due to elevated operating expenses or declining output.

Localized gas distribution projects in areas like declining industrial zones or certain rural regions, characterized by shrinking populations and minimal new development, would likely be categorized as Dogs. These ventures demonstrate very low gas sales volume growth and a limited customer base, potentially becoming inefficient cash traps.

| Asset Type | Market Growth | Relative Market Share | Profitability Trend | 2023/2024 Outlook |

|---|---|---|---|---|

| Legacy Telecom Projects | Low | Low | Declining | Continued underperformance, potential divestment |

| Older Gas Production Sites | Low | Low | Stagnant/Loss-making | High operating costs, risk of closure |

| Rural/Declining Area Gas Distribution | Very Low/Negative | Low | Minimal/Negative | Limited customer growth, high maintenance costs |

Question Marks

Towngas's early-stage investments in carbon capture, utilization, and storage (CCUS) represent question marks in the BCG matrix. The CCUS sector is experiencing rapid growth, fueled by global decarbonization efforts, with projections indicating a significant market expansion in the coming years. For instance, the global CCUS market was valued at approximately USD 3.5 billion in 2023 and is anticipated to reach over USD 10 billion by 2030, demonstrating substantial growth potential.

While the overall market shows promise, Towngas's current market share in this nascent CCUS field is minimal. These initiatives demand considerable capital for development and scaling, presenting a high-risk, high-reward scenario. The uncertainty surrounding technological maturity and market adoption means that while returns could be substantial, the path to profitability is not yet clearly defined.

New ventures into broader smart city infrastructure, like IoT platforms for urban management or intelligent transport systems, beyond Towngas's core energy business, represent potential question marks. These are high-growth sectors, but Towngas would likely enter with a small market share, requiring significant investment to compete effectively.

Hong Kong and China Gas (Towngas) venturing into new international utility markets, such as Southeast Asia, would be classified as question marks in the BCG Matrix. These regions often present high growth opportunities due to increasing demand for energy services. For instance, the Association of Southeast Asian Nations (ASEAN) region is projected to see significant economic growth, driving utility demand.

However, Towngas's presence in these nascent markets would likely be characterized by a low market share and strong competition from established local and international players. Significant capital investment would be necessary to build infrastructure and gain traction, mirroring the typical challenges of question mark businesses aiming for market leadership.

Advanced Battery Storage Solutions for Grid Integration

Investments in advanced battery storage solutions for grid integration are a question mark for Hong Kong and China Gas. While the global energy storage market is projected to reach $540 billion by 2030, with significant growth driven by renewable energy integration, Towngas's current position in this specialized, capital-intensive segment might be nascent. Securing a competitive edge requires substantial R&D and deployment capital, making it a high-risk, high-reward area.

Key considerations for this segment include:

- Market Growth Potential: The global battery energy storage market is expanding rapidly, with forecasts suggesting a compound annual growth rate (CAGR) of over 20% in the coming years, driven by decarbonization efforts and grid modernization.

- Capital Intensity: Developing and deploying advanced battery storage for grid-scale applications requires significant upfront investment in technology, infrastructure, and project development.

- Technological Evolution: The battery technology landscape is constantly evolving, with ongoing advancements in chemistries, efficiency, and cost reduction, necessitating continuous innovation and adaptation.

Digitalization of Customer Services and AI Integration for New Offerings

The aggressive digitalization of customer services and AI integration for new offerings represent a significant question mark for Towngas within the Hong Kong and China Gas BCG Matrix. This segment is experiencing rapid market growth, with the global AI in energy market projected to reach USD 4.9 billion by 2025, and smart home technology adoption continuing to climb.

While Towngas has a strong foundation in traditional energy distribution, its market share in these highly specialized, tech-driven niches is likely lower when compared to dedicated technology firms. This necessitates substantial investment in research and development, advanced AI capabilities, and targeted marketing campaigns to gain traction.

- High Market Growth: The digital transformation of customer interactions and the development of AI-powered energy solutions are key growth areas in the utility sector.

- Potential Low Market Share: Towngas may currently hold a smaller share in these innovative, tech-focused segments compared to specialized technology providers.

- Investment Requirement: Significant capital expenditure is needed for technology development, AI implementation, and marketing to establish a competitive presence.

- Strategic Importance: Successfully developing these new offerings could position Towngas as a future market leader in smart energy management and personalized home services.

Towngas's exploration into emerging technologies like hydrogen energy infrastructure and advanced renewable energy integration, such as offshore wind farm support, are prime examples of question marks. The global hydrogen market is projected to grow significantly, with some estimates suggesting it could reach over $1.4 trillion by 2050, highlighting substantial future potential. Similarly, the offshore wind sector is experiencing robust expansion, driven by climate goals and technological advancements.

However, Towngas's current market share in these specialized, capital-intensive areas is likely minimal. These ventures require substantial upfront investment in research, development, and infrastructure, presenting a high-risk profile with uncertain but potentially high returns. The rapid evolution of these technologies means significant ongoing investment is necessary to maintain competitiveness.

The company's strategic investments in digital utility platforms and smart grid technologies, aimed at enhancing operational efficiency and customer engagement, also fall into the question mark category. The global smart grid market is expected to grow substantially, with projections indicating it could reach over $100 billion by 2027, showcasing a strong growth trajectory.

Despite this market potential, Towngas's market share in these cutting-edge digital solutions may be limited, especially when compared to established tech firms. Successfully navigating this space demands significant investment in software development, data analytics, and cybersecurity to build a competitive advantage.

| Business Area | BCG Category | Market Growth | Relative Market Share | Investment Need | Key Considerations |

| Carbon Capture, Utilization, and Storage (CCUS) | Question Mark | High | Low | High | Technological maturity, regulatory support |

| Smart City Infrastructure (IoT, Intelligent Transport) | Question Mark | High | Low | High | Integration complexity, competition |

| New International Utility Markets (e.g., Southeast Asia) | Question Mark | High | Low | High | Regulatory environment, local competition |

| Advanced Battery Storage Solutions | Question Mark | High | Low | High | Technology evolution, cost reduction |

| Digitalization of Customer Services & AI Integration | Question Mark | High | Low | High | Cybersecurity, data analytics expertise |

| Hydrogen Energy Infrastructure | Question Mark | High | Low | High | Infrastructure development, safety standards |

| Advanced Renewable Energy Integration (e.g., Offshore Wind Support) | Question Mark | High | Low | High | Project financing, specialized equipment |

BCG Matrix Data Sources

Our Hong Kong and China Gas BCG Matrix is informed by publicly available financial statements, industry growth forecasts, and market research reports to accurately assess business unit performance and market dynamics.