Taiwan Cooperative Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Taiwan Cooperative Financial Bundle

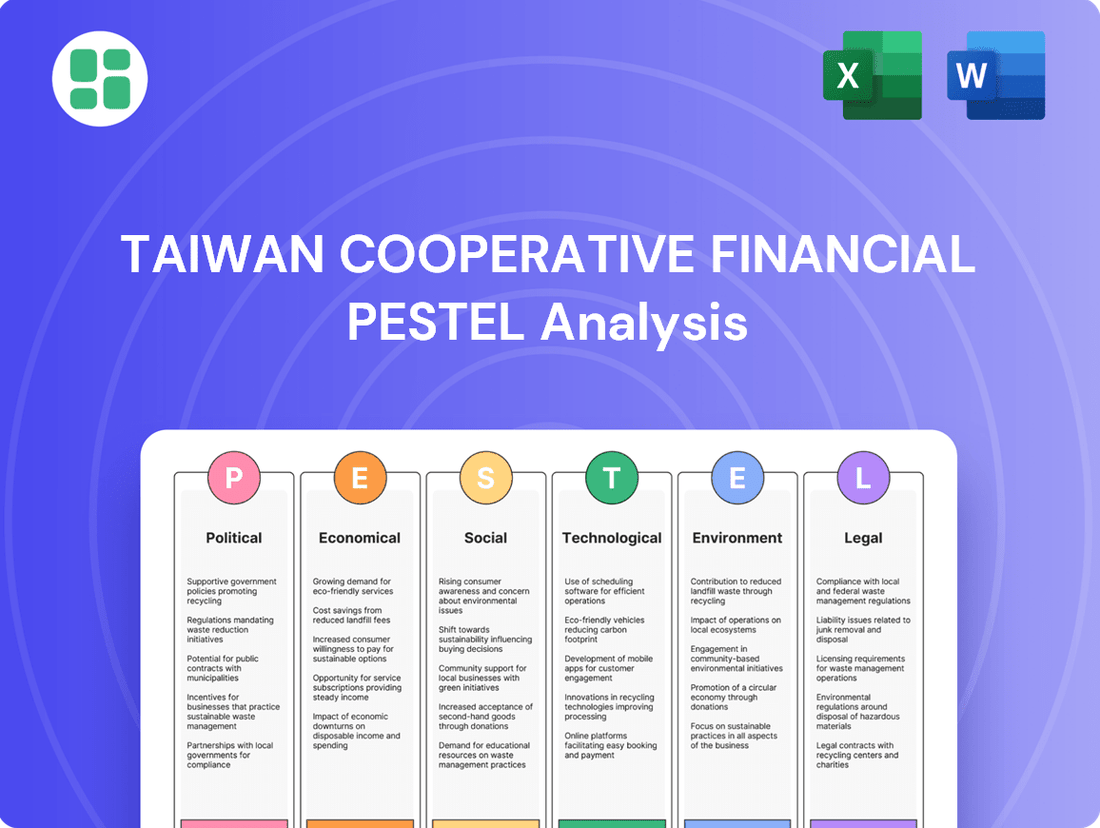

Unlock the critical external factors shaping Taiwan Cooperative Financial's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and technological advancements are creating both opportunities and challenges for this key player.

Gain a strategic advantage by delving into the social, technological, legal, and environmental forces impacting Taiwan Cooperative Financial. This in-depth analysis is your roadmap to informed decision-making and robust market positioning.

Don't miss out on actionable intelligence. Purchase the full PESTLE analysis of Taiwan Cooperative Financial today and equip yourself with the insights needed to navigate the evolving landscape and secure your competitive edge.

Political factors

Geopolitical stability, especially concerning cross-strait relations with mainland China, remains a paramount concern for Taiwan Cooperative Financial Holding. These tensions directly affect investor sentiment and capital flows, as seen in market volatility following any significant cross-strait developments. For instance, heightened military exercises by China in 2022 led to temporary dips in Taiwan's stock market, impacting the financial sector's performance.

The stability of Taiwan's government and its commitment to consistent financial policies are paramount for Taiwan Cooperative Financial. For instance, in 2023, Taiwan maintained a relatively stable political environment, which is essential for investor confidence and long-term financial planning within the banking sector.

Shifts in monetary policy, such as interest rate adjustments by the Central Bank of the Republic of China (Taiwan), directly influence lending margins and the cost of capital for financial institutions. Similarly, changes to capital adequacy ratios, overseen by the Financial Supervisory Commission (FSC), can impact a bank's lending capacity and overall risk profile.

The FSC's proactive approach to financial market development and regulation, including its efforts to bolster cybersecurity and consumer protection in 2024, directly shapes the operational environment for banks like Taiwan Cooperative Financial, fostering both stability and opportunities for growth.

Taiwan's Financial Supervisory Commission (FSC) actively shapes the operating landscape for financial institutions. In 2024, the FSC continued its focus on strengthening capital adequacy, with banks generally maintaining robust ratios well above regulatory minimums, for instance, the average capital adequacy ratio for Taiwanese banks stood at approximately 13.5% as of Q1 2024, providing a solid buffer against potential shocks. Furthermore, the FSC's commitment to combating financial crime is evident in its ongoing enhancements to Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) frameworks, requiring continuous vigilance and investment in compliance systems.

Consumer protection remains a key priority for the FSC, leading to updated regulations concerning fair lending practices, data privacy, and transparent fee structures. For Taiwan Cooperative Financial Holding, adherence to these evolving rules, including those related to digital finance and cybersecurity, is critical. Failure to comply can result in significant penalties and reputational damage, underscoring the importance of proactive regulatory engagement.

International Trade Agreements and Relations

Taiwan's economic health is significantly tied to its international trade agreements and diplomatic relationships. These pacts directly influence cross-border financial flows and investment, impacting demand for Taiwan Cooperative Financial's international banking and trade finance services. For instance, Taiwan's participation in agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) could open new avenues, while ongoing trade tensions, such as those involving major partners like the United States and China, introduce volatility.

The export-oriented nature of Taiwan's economy means that shifts in global trade policies can create substantial uncertainty. For example, changes in US tariff policies, as seen in recent years, can directly affect the competitiveness of Taiwanese exports, thereby influencing the volume of trade finance required.

- Taiwan's export value reached approximately USD 432.5 billion in 2023, highlighting its reliance on international trade.

- The island's trade surplus with the United States stood at around USD 28.7 billion in 2023, indicating the significance of this bilateral relationship.

- Taiwan continues to pursue accession to the CPTPP, a move that could reshape its trade landscape and financial service demands.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Enforcement

Taiwan's commitment to combating financial crime is evident in its stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) enforcement, aligning with global best practices. This regulatory environment mandates that financial institutions, including Taiwan Cooperative Financial, maintain rigorous compliance programs to detect and prevent illicit financial activities.

Recent legislative updates, such as amendments to the Money Laundering Control Act effective July 2024, have expanded the scope of obligated entities and intensified enforcement measures. These changes underscore the need for ongoing investment in compliance technology, data analytics, and employee training to meet evolving regulatory expectations.

The implications of non-compliance are substantial, potentially leading to significant financial penalties and severe reputational damage for financial institutions. For instance, in 2023, global financial institutions faced an estimated $10 billion in AML-related fines, highlighting the critical importance of robust compliance frameworks.

- Regulatory Alignment: Taiwan's AML/CTF framework adheres to Financial Action Task Force (FATF) recommendations, ensuring international compatibility.

- Legislative Enhancements: July 2024 amendments broaden definitions and strengthen penalties for AML/CTF violations.

- Compliance Investment: Financial institutions must allocate resources to technology, training, and internal controls.

- Risk Mitigation: Proactive compliance is crucial to avoid substantial fines and protect institutional reputation.

Political stability in Taiwan is crucial for financial institutions like Taiwan Cooperative Financial. The government's approach to cross-strait relations, exemplified by the ongoing dialogue and occasional tensions with mainland China, directly influences investor confidence and economic stability. For instance, Taiwan's Presidential election in January 2024, which resulted in a continuation of the ruling party, generally provided a sense of policy continuity, which is favorable for the financial sector.

Government policies on financial regulation and market development, guided by bodies like the Financial Supervisory Commission (FSC), significantly shape the operating environment. The FSC's focus on digital transformation and consumer protection, as seen in its 2024 initiatives, creates both compliance challenges and opportunities for innovation in financial services.

Taiwan's international trade policies and diplomatic engagements also play a vital role. Agreements and trade disputes can impact cross-border capital flows and the demand for financial services. Taiwan's continued efforts to join trade blocs like the CPTPP, alongside its significant trade surplus with the US in 2023 (around $28.7 billion), underscore the importance of these external political and economic relationships.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Taiwan Cooperative Financial across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, highlighting both emerging threats and opportunities within the Taiwanese financial sector.

A concise PESTLE analysis of Taiwan Cooperative Financial's external environment, presented in an easily digestible format, helps alleviate the pain of information overload during strategic planning.

This analysis offers a clear, summarized view of political, economic, social, technological, environmental, and legal factors impacting Taiwan Cooperative Financial, serving as a pain point reliever by simplifying complex external risks for efficient decision-making.

Economic factors

Taiwan's economic expansion is a key driver for its financial services sector. Strong GDP growth typically means more opportunities for banks and other financial institutions to offer loans, attract deposits, and provide wealth management services.

Looking ahead, Taiwan's real GDP growth is anticipated to be robust, with forecasts for 2025 hovering around 3.1% to 3.26%. This positive outlook is largely fueled by the booming demand for artificial intelligence (AI) related products and continued strength in the island's export markets.

A healthy economy translates directly into increased spending by both businesses and individuals. This heightened economic activity generally benefits the financial sector, as it leads to greater demand for financial products and services.

The Central Bank of the Republic of China (Taiwan) wields considerable influence over the financial landscape through its interest rate policies. These decisions directly affect the net interest margins of banks, which is the difference between the interest income generated by banks and the amount of interest they pay out to their depositors. For consumers and businesses, these policies dictate the cost of borrowing, impacting everything from mortgage payments to business expansion loans.

Looking ahead to 2025, inflation in Taiwan is projected to moderate, with estimates suggesting a slight easing to around 1.9%. Despite this anticipated slowdown in price increases, the central bank is expected to maintain its policy discount rate. This stability in the benchmark rate suggests a cautious approach, ensuring that lending and deposit rates remain relatively consistent, thereby influencing credit availability and savings incentives.

Fluctuations in the New Taiwan Dollar (NTD) can significantly impact Taiwan Cooperative Financial's financial health. For instance, if the NTD weakens against major currencies, the value of its foreign currency-denominated assets, like overseas investments, would decrease when translated back into NTD. Conversely, a stronger NTD would make its foreign liabilities cheaper to repay.

A stable exchange rate environment is generally beneficial for Taiwan Cooperative Financial. It simplifies cross-border transactions for its diverse client base, which includes businesses engaged in international trade and individuals with overseas financial interests. For example, in early 2024, the NTD experienced some volatility, trading around 31-32 NTD to the US dollar, highlighting the importance of managing this risk.

The stability of the NTD also plays a crucial role in attracting foreign investment into Taiwan, which in turn can boost economic activity and create opportunities for financial institutions like Taiwan Cooperative Financial. When the exchange rate is predictable, businesses and investors are more confident in making long-term commitments, leading to increased demand for financial services.

Consumer Spending and Household Debt Levels

Consumer spending is a key driver for financial institutions, directly influencing the demand for retail banking products like personal loans, mortgages, and credit cards. In 2025, Taiwan anticipates moderate growth in private consumption, bolstered by anticipated wage increases and strong corporate profits. However, this positive outlook could be tempered by increased volatility in the stock market, potentially impacting household wealth and spending confidence.

Household debt levels also play a crucial role. As of late 2024, Taiwan's household debt to GDP ratio remained a significant factor, influencing borrowing capacity and the appetite for new credit.

- Consumer Spending Outlook: Moderate growth projected for 2025, driven by wage adjustments and corporate profitability.

- Potential Headwinds: Heightened stock market volatility could dampen consumer spending.

- Impact on Banking: Directly affects demand for personal loans, mortgages, and credit cards.

- Household Debt: Remains a significant consideration for consumer borrowing capacity.

Global Economic Volatility and Trade Dynamics

Taiwan's economy, heavily reliant on exports, faces significant headwinds from global economic volatility. A projected slowdown in major economies, such as a potential 2.1% GDP growth for the US in 2024 according to IMF forecasts, could dampen demand for Taiwanese goods. This directly impacts sectors requiring trade finance and corporate lending, creating uncertainty for financial institutions.

Trade dynamics are further complicated by geopolitical tensions, notably the ongoing US-China trade friction. Tariffs and trade barriers can disrupt supply chains and reduce export volumes, affecting Taiwanese businesses. For instance, the World Trade Organization (WTO) has noted persistent trade restrictions globally, impacting the flow of goods and services.

The financial sector, including Taiwan Cooperative Financial, must build resilience against these external shocks. A diversified lending portfolio and robust risk management strategies are crucial. The potential for a global economic downturn, as highlighted by various economic indicators in late 2023 and early 2024, necessitates proactive measures to mitigate the impact on financial stability.

- Global Growth Concerns: Projections for global GDP growth in 2024, while varied, generally indicate a moderation compared to previous years, impacting export demand.

- Trade Policy Uncertainty: Evolving trade policies between major economic blocs, particularly the US and China, create an unpredictable environment for international trade.

- Financial Sector Exposure: Taiwan's banks are exposed to fluctuations in global trade volumes and the financial health of export-oriented corporations.

- Geopolitical Risk Premium: Increased geopolitical tensions can lead to higher borrowing costs and reduced investment appetite, affecting the broader financial landscape.

Taiwan's economic trajectory in 2025 is projected to be strong, with real GDP growth anticipated between 3.1% and 3.26%. This expansion is significantly bolstered by robust demand for AI-related products and sustained export performance. A healthy economy directly translates to increased business and consumer spending, creating more opportunities for financial institutions like Taiwan Cooperative Financial to offer a wider range of products and services.

The Central Bank of the Republic of China (Taiwan) plays a pivotal role through its interest rate policies, influencing banks' net interest margins and the cost of borrowing for consumers and businesses. For 2025, inflation is expected to moderate to around 1.9%, with the central bank likely maintaining its policy discount rate. This stability in rates suggests a consistent environment for lending and savings, impacting credit availability.

Consumer spending is a vital component, with moderate growth anticipated in 2025, supported by wage increases and strong corporate profits. However, potential stock market volatility could temper consumer confidence and spending. Household debt levels, a significant factor as of late 2024, also influence borrowing capacity and the demand for credit products.

Global economic volatility and geopolitical tensions, particularly US-China trade friction, pose headwinds to Taiwan's export-driven economy. Forecasts for global GDP growth in 2024 suggest a moderation, potentially impacting demand for Taiwanese goods and creating uncertainty for financial institutions exposed to international trade. Navigating these external shocks requires robust risk management and portfolio diversification.

| Economic Indicator | 2024 Projection | 2025 Projection | Key Drivers/Impacts |

|---|---|---|---|

| Real GDP Growth | ~3.0% - 3.5% | ~3.1% - 3.26% | AI demand, export strength, global economic health |

| Inflation Rate | ~2.0% - 2.5% | ~1.9% | Supply chain stability, energy prices, domestic demand |

| Policy Discount Rate | ~1.875% | ~1.875% (expected stability) | Central bank's monetary policy stance, inflation outlook |

| Exchange Rate (NTD/USD) | ~31.0 - 32.5 | ~31.5 - 33.0 (potential volatility) | US monetary policy, trade balances, capital flows |

| Household Debt to GDP Ratio | ~45% - 47% | ~46% - 48% (slight increase) | Consumer borrowing, housing market, economic confidence |

Preview Before You Purchase

Taiwan Cooperative Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Taiwan Cooperative Financial PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the institution.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of the external forces shaping Taiwan Cooperative Financial's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights to understand and navigate the dynamic operating environment of Taiwan Cooperative Financial.

Sociological factors

Taiwan's demographic landscape is undergoing a profound transformation, characterized by a rapidly aging population and a persistently low birth rate. By 2024, projections indicate that individuals aged 65 and over will constitute a significant portion of the populace, a trend that is expected to accelerate. This demographic shift directly influences the financial services sector.

The aging demographic necessitates a strategic pivot for financial institutions like Taiwan Cooperative Financial. There is a growing demand for specialized products and services focused on retirement planning, wealth management, and financial solutions for elder care. This presents an opportunity to develop and market new offerings tailored to the needs of an older clientele, moving beyond traditional banking services.

Financial institutions must proactively adapt their business models and product portfolios to effectively serve an expanding senior demographic. This includes enhancing digital accessibility for older users and potentially partnering with elder care service providers. For example, by 2025, it's anticipated that a substantial percentage of new financial product uptake will be from individuals aged 55 and above, highlighting the urgency of this adaptation.

Taiwan's financial literacy is on the rise, with a growing comfort in managing personal finances. This, coupled with a remarkable 94% smartphone penetration rate as of early 2024, means consumers are increasingly seeking digital avenues for banking and investment.

This digital savviness directly impacts how financial institutions operate. Banks are compelled to invest heavily in user-friendly mobile apps and online platforms, as customers expect seamless digital experiences. The trend towards mobile-first finance and embedded finance solutions is accelerating, driven by this high digital adoption.

Taiwanese consumers increasingly demand financial services that are both convenient and tailored to their individual needs. This shift is evident in the growing adoption of digital banking solutions, with mobile banking transactions in Taiwan projected to reach 70% of all banking transactions by the end of 2024. Taiwan Cooperative Financial Holding must therefore prioritize investments in customer relationship management (CRM) systems and advanced data analytics to deliver personalized product offerings and seamless omnichannel experiences.

The expectation for personalization extends to product development and service delivery. For instance, the rise of fintech startups offering niche, customized financial products highlights this trend. By leveraging data insights, Taiwan Cooperative Financial Holding can anticipate customer needs, offering proactive solutions and building stronger, more loyal customer relationships in the competitive Taiwanese financial landscape.

Social Responsibility and Ethical Banking Practices

Taiwanese society increasingly expects financial institutions to demonstrate strong social responsibility and ethical conduct. This translates to a demand for transparency in operations, fair treatment of customers, and active participation in community development. For Taiwan Cooperative Financial Holding, aligning with these values is paramount for maintaining a positive public perception and fostering customer loyalty.

Recent surveys indicate a significant portion of Taiwanese consumers consider a bank's social impact when making financial decisions. For instance, a 2024 poll revealed that over 60% of respondents are more likely to choose a bank that actively supports local charities and environmental initiatives. This highlights the direct link between corporate social responsibility (CSR) and customer engagement.

Taiwan Cooperative Financial Holding's commitment to social inclusion and customer welfare is a key differentiator. The company's ongoing investments in financial literacy programs, reaching an estimated 50,000 individuals annually, underscore this dedication. Furthermore, their focus on accessible banking services for underserved populations directly addresses societal expectations for equitable financial access.

- Growing Consumer Demand: A 2024 survey found 60% of Taiwanese consumers favor banks with strong social impact initiatives.

- Financial Literacy Focus: Taiwan Cooperative Financial Holding's programs aim to reach 50,000 individuals yearly, enhancing financial inclusion.

- Ethical Operations: Transparency and fair lending practices are crucial for maintaining public trust and customer commitment.

- Community Investment: Active support for local communities and environmental causes positively influences brand perception.

Talent Attraction and Retention in the Financial Sector

Taiwan's financial sector faces a fierce battle for skilled professionals, especially in rapidly growing areas like fintech, cybersecurity, and data analytics. This demand is driving up salary expectations and the need for attractive benefits packages.

To secure and keep the best employees, financial institutions must offer more than just a paycheck. This includes robust career advancement paths, continuous learning opportunities, and a workplace culture that fosters innovation and employee well-being.

- Talent Demand: A 2024 survey indicated that over 60% of Taiwanese financial firms reported difficulty in finding qualified candidates for specialized tech roles.

- Compensation Trends: Average salaries for cybersecurity analysts in Taiwan saw an estimated 8-10% increase in 2024 compared to the previous year.

- Employee Expectations: Data from early 2025 suggests that professional development opportunities are now a top priority for over 70% of job seekers in the financial industry.

- Cultural Impact: Companies with strong employee engagement programs reported a 15% lower turnover rate in the financial sector during 2024.

Taiwanese society increasingly expects financial institutions to demonstrate strong social responsibility and ethical conduct, influencing customer loyalty and brand perception. A 2024 poll showed over 60% of respondents favor banks actively supporting local charities and environmental initiatives, directly linking corporate social responsibility (CSR) to customer engagement. Taiwan Cooperative Financial Holding's commitment to financial literacy programs, aiming to reach 50,000 individuals annually, and their focus on accessible banking for underserved populations, directly address societal expectations for equitable financial access and social inclusion.

| Sociological Factor | 2024/2025 Data/Trend | Impact on Taiwan Cooperative Financial |

|---|---|---|

| Consumer Demand for CSR | 60% of Taiwanese consumers prefer banks with strong social impact initiatives (2024 survey). | Enhances brand reputation and customer loyalty if aligned. |

| Financial Literacy & Inclusion | Taiwan Cooperative Financial Holding targets 50,000 individuals annually with financial literacy programs. | Builds trust and expands customer base through improved financial well-being. |

| Ethical Conduct Expectations | Transparency and fair practices are crucial for maintaining public trust. | Requires robust compliance and ethical governance to prevent reputational damage. |

| Community Investment | Active support for local communities and environmental causes positively influences brand perception. | Offers opportunities for positive PR and deeper community ties. |

Technological factors

Taiwan's financial sector is experiencing a significant digital overhaul, with fintech integration accelerating. By early 2024, a substantial portion of Taiwanese financial institutions were actively adopting AI, big data analytics, and Robotic Process Automation (RPA) to streamline operations and enhance customer experiences. Furthermore, blockchain technology adoption was notably increasing, with over 30% of surveyed financial firms in Taiwan reporting active exploration or implementation in 2024.

Taiwan Cooperative Financial Holding needs to prioritize ongoing investment in its digital infrastructure and the seamless integration of emerging fintech solutions. This proactive approach is crucial for maintaining a competitive edge in a rapidly evolving market where digital-native competitors and innovative startups are gaining traction. The focus should be on enhancing digital channels to meet evolving customer expectations for convenience and personalized services.

Taiwan's financial sector, like global counterparts, grapples with escalating cybersecurity and data privacy threats due to rapid digitalization. Institutions must fortify defenses against sophisticated attacks aiming to compromise sensitive customer information.

The Financial Supervisory Commission (FSC) has explicitly flagged cybersecurity management as a crucial examination area for 2025, underscoring its importance in safeguarding financial stability and consumer confidence.

Failure to maintain robust cybersecurity frameworks and comply with stringent data protection regulations, such as Taiwan's Personal Data Protection Act, can lead to severe financial penalties and irreparable damage to institutional reputation.

Taiwan's financial sector is rapidly integrating artificial intelligence (AI) and big data analytics, revolutionizing everything from customer interactions and personalized financial advice to sophisticated risk assessment and fraud prevention. This technological shift is not just about efficiency; it's about creating a more responsive and secure financial ecosystem.

The Financial Supervisory Commission (FSC) has actively supported this evolution by releasing guidelines for AI applications in finance. This proactive regulatory stance, as seen in their 2024 initiatives, aims to foster innovation while ensuring the stability and sustainability of the financial industry, providing a clear roadmap for AI adoption.

Cloud Computing and Infrastructure Modernization

Taiwanese financial institutions are increasingly adopting cloud computing, recognizing its benefits in scalability, cost savings, and operational flexibility. This shift is crucial for modernizing their IT infrastructure, enabling the delivery of new digital services and enhancing overall efficiency. For example, in 2024, the global financial services cloud market was projected to reach over $100 billion, highlighting the significant investment in this area.

The modernization of IT infrastructure is directly linked to the ability of financial firms to innovate and remain competitive. This includes upgrading legacy systems to support advanced analytics, AI-driven services, and robust cybersecurity measures. By embracing cloud solutions, institutions can achieve greater agility in responding to market changes and customer demands.

However, the expansion of cloud services also necessitates careful consideration of regulatory frameworks. Taiwan's Financial Supervisory Commission (FSC) continues to refine guidelines on cloud outsourcing to ensure data security and operational resilience. As of early 2025, regulatory bodies worldwide are emphasizing stricter oversight on third-party cloud providers within the financial sector.

Key technological factors driving this modernization include:

- Enhanced Scalability: Cloud platforms allow financial institutions to adjust computing resources dynamically based on demand, a significant improvement over traditional on-premises infrastructure.

- Cost Optimization: Shifting to cloud services can reduce capital expenditure on hardware and maintenance, leading to more predictable operational costs.

- Improved Agility and Innovation: Modernized infrastructure supports faster deployment of new applications and services, fostering innovation in areas like mobile banking and personalized financial advice.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are increasingly being investigated for a range of financial uses in Taiwan, from streamlining cross-border payments and trade finance to managing digital assets. This technological shift is already impacting the financial sector significantly.

The adoption rate is notable, with approximately 80% of Taiwanese banks actively employing blockchain for applications like the certification of letters of credit. This widespread integration highlights the perceived benefits in efficiency and security.

Looking ahead, the Financial Supervisory Commission (FSC) is actively considering the development of specific legal frameworks for cryptocurrencies, with potential legislation anticipated by mid-2025. This proactive regulatory approach aims to foster innovation while managing associated risks.

The ongoing exploration and implementation of blockchain technology present both opportunities and challenges for Taiwan's financial institutions, influencing operational models and customer service delivery.

Taiwan's financial sector is rapidly embracing technological advancements, with AI and big data analytics transforming customer service and risk management. By early 2024, a significant number of financial institutions were integrating these technologies to enhance efficiency and personalize offerings. The Financial Supervisory Commission (FSC) has supported this by releasing guidelines for AI applications, aiming to foster innovation responsibly.

Cloud computing adoption is also a key trend, with institutions like Taiwan Cooperative Financial Holding recognizing its benefits for scalability and cost savings. This modernization is vital for developing new digital services and maintaining competitiveness, though it requires careful adherence to evolving data security and privacy regulations, with the FSC refining cloud outsourcing guidelines as of early 2025.

Blockchain technology is gaining traction, with around 80% of Taiwanese banks utilizing it for applications like letter of credit certification, demonstrating a clear move towards greater efficiency and security. The FSC is actively considering specific legal frameworks for cryptocurrencies, with potential legislation anticipated by mid-2025 to manage innovation and associated risks.

| Technology | Adoption/Impact in Taiwan (2024/2025) | Key Benefits | Regulatory Focus |

|---|---|---|---|

| AI & Big Data Analytics | High adoption for customer service, risk assessment, fraud prevention. | Enhanced personalization, improved efficiency, better risk modeling. | FSC guidelines released for AI applications. |

| Cloud Computing | Increasing adoption for scalability, cost savings, and agility. | Reduced IT infrastructure costs, faster service deployment, operational flexibility. | FSC refining cloud outsourcing guidelines; global focus on third-party provider oversight. |

| Blockchain & DLT | ~80% of Taiwanese banks use for specific applications (e.g., letters of credit). | Streamlined transactions, enhanced security, improved transparency. | FSC considering cryptocurrency legal frameworks, potential legislation by mid-2025. |

Legal factors

Taiwan Cooperative Financial Holding operates under the watchful eye of the Financial Supervisory Commission (FSC), adhering to strict banking regulations. A key development is the full implementation of Basel III capital adequacy requirements, effective January 1, 2025, which mandates higher risk-weighted capital ratios for banks.

As a Domestic Systemically Important Bank (D-SIB), Taiwan Cooperative Bank, a crucial part of the holding company, faces even more rigorous capital buffer requirements. This designation means the bank must maintain a higher proportion of capital relative to its risk-weighted assets, currently set at an additional 0.5% CET1 capital buffer as of the latest FSC directives.

Furthermore, the FSC requires D-SIBs like Taiwan Cooperative Bank to undergo regular stress tests. These tests assess the bank's resilience under severe economic downturns, ensuring it can absorb potential losses and maintain financial stability, with the most recent stress test results indicating a robust capital position.

Taiwan's Personal Data Protection Act (PDPA) and related regulations strictly govern how financial institutions handle customer information. Compliance is paramount for avoiding penalties and fostering trust, particularly as the Financial Supervisory Commission (FSC) is intensifying its focus on data privacy in 2025. Failure to adhere can lead to significant fines and reputational damage.

Taiwan's Money Laundering Control Act (MLCA) and its related regulations place significant burdens on financial institutions to detect and report suspicious transactions, aiming to curb illicit financial flows. These laws are critical for maintaining the integrity of the financial system and preventing its exploitation for criminal purposes.

Recent updates to the MLCA, effective July 2024, have expanded the definition of predicate offenses and increased penalties for non-compliance, demanding greater investment in robust compliance programs and ongoing staff training. Financial institutions must adapt their internal controls to meet these heightened requirements, ensuring they can effectively identify and report potential money laundering or terrorist financing activities.

Consumer Protection Regulations

Taiwan's Financial Supervisory Commission (FSC) prioritizes safeguarding financial consumers, a trend expected to intensify through 2025. This includes stringent oversight of sales practices, mandating clear and comprehensive product disclosures, and establishing effective complaint handling procedures. For instance, in 2023, the FSC continued to refine regulations for digital financial services to enhance consumer protection in online transactions.

The FSC's commitment extends to vulnerable populations, such as the physically and mentally challenged. This focus directly influences how financial institutions in Taiwan design and market their products, ensuring accessibility and fairness. By 2024, financial firms are expected to demonstrate enhanced efforts in product suitability assessments and tailored communication strategies for these groups.

Key areas of consumer protection regulation impacting financial institutions include:

- Fair Sales Practices: Ensuring product suitability and preventing mis-selling.

- Transparent Disclosures: Providing clear, understandable information on product features, risks, and fees.

- Complaint Resolution: Establishing efficient and accessible mechanisms for addressing consumer grievances.

- Protection for Vulnerable Groups: Adapting product design and marketing for individuals with physical or mental challenges.

Green Finance and ESG Disclosure Regulations

Taiwan is ramping up its environmental, social, and governance (ESG) disclosure requirements. By 2025, the full adoption of IFRS S1 and S2 will mandate that companies integrate ESG information directly into their financial reporting, a significant shift towards greater transparency.

The Financial Supervisory Commission's (FSC) Green Finance Action Plan 3.0, and its subsequent updates, are actively pushing for sustainable finance practices. This includes making carbon inventory reporting and robust climate risk management a requirement for businesses operating in Taiwan.

- IFRS S1 and S2 Adoption: Full implementation by 2025, mandating ESG data integration in financial statements.

- FSC Green Finance Action Plan 3.0: Focuses on promoting sustainable finance and climate risk management.

- Carbon Inventory Requirements: Companies will need to report their carbon emissions.

- Climate Risk Management: Mandates for assessing and managing climate-related financial risks.

Taiwan's legal framework mandates strict adherence to capital adequacy ratios, with Basel III fully implemented by January 1, 2025, requiring higher risk-weighted capital. As a Domestic Systemically Important Bank (D-SIB), Taiwan Cooperative Bank must maintain an additional 0.5% CET1 capital buffer, subject to rigorous stress tests by the FSC to ensure financial resilience.

Data protection is paramount, with Taiwan's Personal Data Protection Act (PDPA) imposing strict rules on handling customer information, a focus area for the FSC in 2025, with non-compliance risking significant penalties.

The Money Laundering Control Act (MLCA) was updated in July 2024, expanding predicate offenses and increasing penalties, necessitating enhanced compliance programs and staff training to combat illicit financial activities.

Consumer protection remains a key FSC priority through 2025, emphasizing fair sales practices, transparent disclosures, and robust complaint resolution, with particular attention paid to vulnerable groups.

Environmental factors

Climate change presents significant physical risks, like extreme weather events impacting assets, and transition risks, such as policy changes affecting carbon-intensive industries, for financial institutions in Taiwan. For instance, in 2023, Taiwan experienced typhoons causing billions in damages, highlighting these physical vulnerabilities.

Taiwan's Financial Supervisory Commission (FSC) is actively driving green finance through its Green Finance Action Plan 3.0, launched in 2022 and updated in 2024. This plan mandates financial institutions to assess climate-related risks and encourages investment in sustainable sectors, aiming to channel NT$1 trillion into green and sustainable projects by 2025.

Taiwan Cooperative Financial Holding is aligning with these national directives by integrating sustainability into its core strategy. Their blueprint focuses on managing climate risks, expanding green financing, and supporting the transition to a low-carbon economy, reflecting a commitment to long-term resilience and responsible growth.

New environmental, social, and governance (ESG) reporting regulations are set to take effect in Taiwan from 2025. These rules mandate that publicly traded companies must disclose detailed ESG information, crucially including their Scope 1, 2, and 3 carbon emissions. This move towards greater transparency means Taiwan Cooperative Financial Holding, like its peers, will need to establish and maintain sophisticated data collection and reporting infrastructure to ensure compliance and satisfy growing stakeholder demands for environmental accountability.

Taiwan's commitment to achieving net-zero emissions by 2050, legally enshrined in the Climate Change Response Act, is driving the establishment of a carbon pricing mechanism. This regulatory shift directly influences industries requiring capital, compelling financial institutions like Taiwan Cooperative Financial to rigorously assess the carbon intensity of their lending and investment portfolios.

The implementation of carbon pricing is expected to increase operational costs for carbon-intensive businesses, potentially affecting their creditworthiness and the viability of financed projects. For instance, sectors heavily reliant on fossil fuels may face higher expenses, necessitating a closer look at their transition plans when seeking loans or investments.

Sustainable Investment Trends and Green Products

The global and domestic appetite for sustainable investments is surging, with green bonds leading the charge. Taiwan's financial sector is actively channeling credit towards environmentally friendly projects, presenting a significant opportunity for financial institutions like Taiwan Cooperative Financial.

By developing and actively marketing a suite of green financial products and services, the company can tap into this expanding market. For instance, in 2023, the issuance of green bonds globally reached a record high, indicating strong investor demand for sustainable options.

- Growing Demand: Increased global and domestic investor interest in ESG (Environmental, Social, Governance) compliant investments.

- Green Financing: Taiwan's financial industry is actively increasing its provision of credit for green initiatives.

- Product Development: Opportunity for Taiwan Cooperative Financial to create and promote specialized green financial products and services.

- Market Opportunity: Capitalizing on the trend of sustainable finance can lead to new revenue streams and enhanced brand reputation.

Natural Disaster Preparedness and Operational Resilience

Taiwan's position in a seismically active zone and along typhoon paths presents a significant environmental challenge for financial institutions. The Taiwan Cooperative Bank, like others, must maintain robust operational resilience. This includes comprehensive business continuity plans and disaster recovery strategies to safeguard assets and ensure uninterrupted services for customers, especially following recent weather events.

The impact of natural disasters on Taiwan's economy and its financial sector is a persistent concern. For instance, Typhoon Haikui in August 2023 caused widespread disruptions, highlighting the need for proactive preparedness. Financial institutions are investing in infrastructure upgrades and diversified operational sites to mitigate these risks.

- Typhoon Frequency: Taiwan typically experiences 3-4 typhoons annually, with varying degrees of impact.

- Seismic Activity: Taiwan sits on the Pacific Ring of Fire, experiencing frequent seismic activity, including significant earthquakes.

- Economic Impact: Natural disasters can lead to supply chain disruptions, damage to property, and reduced consumer spending, affecting loan portfolios and investment returns.

- Regulatory Focus: Financial regulators are increasingly emphasizing stress testing and scenario analysis related to natural disaster impacts on financial institutions.

Taiwan's commitment to net-zero emissions by 2050, codified in the Climate Change Response Act, is driving the implementation of carbon pricing mechanisms. This regulatory shift directly impacts capital-intensive industries, compelling financial institutions like Taiwan Cooperative Financial to meticulously evaluate the carbon footprint of their lending and investment portfolios. Sectors heavily reliant on fossil fuels may face increased operational costs, influencing their creditworthiness and project viability.

The growing global and domestic demand for sustainable investments, particularly green bonds, presents a significant opportunity for Taiwan Cooperative Financial to expand its green financing offerings. By developing and promoting specialized green financial products, the company can tap into this expanding market, which saw record global green bond issuance in 2023, signaling strong investor appetite.

Taiwan's vulnerability to typhoons and seismic activity necessitates robust operational resilience for financial institutions. The Taiwan Cooperative Bank, like its peers, must maintain comprehensive business continuity and disaster recovery plans to safeguard assets and ensure service continuity, especially following events like Typhoon Haikui in August 2023, which caused significant disruptions.

| Environmental Factor | Impact on Taiwan Cooperative Financial | Relevant Data/Initiative |

| Climate Change & Extreme Weather | Physical risks to assets, operational disruptions, potential impact on loan portfolios. | Typhoon Haikui (Aug 2023) caused billions in damages; Taiwan experiences 3-4 typhoons annually. |

| Green Finance & Sustainability | Opportunity for new revenue streams, enhanced brand reputation, alignment with regulatory goals. | Green Finance Action Plan 3.0 (updated 2024) aims to channel NT$1 trillion into green projects by 2025. |

| Carbon Pricing & Emissions | Increased credit risk for carbon-intensive industries, need for portfolio carbon assessment. | Net-zero by 2050 target legally enshrined; carbon pricing mechanism under development. |

| ESG Reporting Requirements | Need for enhanced data collection and reporting infrastructure for compliance. | New ESG reporting regulations effective 2025, mandating disclosure of Scope 1, 2, and 3 emissions. |

PESTLE Analysis Data Sources

Our Taiwan Cooperative Financial PESTLE analysis is built upon a comprehensive review of official government publications, reports from financial regulatory bodies, and economic data from reputable institutions like the Central Bank of the Republic of China (Taiwan) and the Financial Supervisory Commission. We also incorporate insights from leading market research firms and industry associations to ensure a well-rounded perspective.