Strategy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Strategy Bundle

Unlock the critical external factors shaping Strategy's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements create both opportunities and threats. This expertly crafted report provides the actionable intelligence you need to refine your own strategic planning and gain a competitive edge. Download the full version now and make informed decisions with confidence.

Political factors

Governments globally are pushing hard on digital transformation, pouring billions into modernizing public services. For instance, the US federal government's FY2025 budget proposal includes significant funding for IT modernization and cybersecurity, aiming to enhance citizen services through digital platforms. This trend creates a fertile ground for solutions like Questica Budget, as public sector organizations actively seek advanced financial management tools to align with these modernization efforts and improve efficiency.

Governments worldwide are increasingly emphasizing transparency and accountability in how public funds are managed. This push is fueled by citizens demanding clearer insights into spending and by new laws requiring more open financial practices. For instance, in 2024, many countries saw legislative updates aimed at making budget information more accessible, often through online portals.

Tools like Questica Budget are instrumental in meeting these demands. By offering features that ensure clear reporting and maintain robust audit trails, these platforms help governments demonstrate fiscal responsibility. This directly addresses the growing public expectation for oversight, fostering greater trust in public financial management. In 2025, we anticipate further integration of blockchain technology to enhance auditability and transparency in government accounting.

Government procurement policies for cloud services are a significant political factor. Frameworks like the UK's G-Cloud initiative, for example, are crucial for vendors looking to engage with the public sector. These policies often dictate stringent security and compliance standards, directly impacting how software companies like Questica Budget must structure their offerings and sales approaches to meet government acquisition rules.

Government Investment in AI and IT Research and Development

Governments worldwide are significantly increasing their investment in Artificial Intelligence (AI) and Information Technology (IT) research and development. For instance, the U.S. government has committed over $1 billion to AI research initiatives in 2024 alone, with a substantial portion earmarked for applications within executive agencies and public financial management. This trend highlights a strategic push to harness advanced technologies for enhanced governmental decision-making and more robust risk management capabilities.

This increased government spending directly impacts the landscape for platforms like Questica Budget. By integrating advanced AI and data analytics features, Questica can better align with and capitalize on these public sector investments. Such integration would empower government financial management systems with predictive analytics for budgeting, fraud detection, and optimized resource allocation.

- Increased Government AI/IT R&D Budgets: Global governments are prioritizing AI and IT, with significant funding directed towards public sector applications.

- Strategic Government Focus: The emphasis is on leveraging technology for improved decision-making and risk management within public financial management.

- Questica Budget Alignment: The platform can enhance its offerings by incorporating AI and data analytics to meet these evolving government needs.

- Data-Driven Public Finance: These investments aim to create more efficient, transparent, and secure public financial systems.

Political Stability and Policy Continuity

Political stability and a clear, consistent policy direction are foundational for public sector entities to confidently invest in and implement large-scale technology solutions like those offered by Questica Budget. Sudden shifts in government or abrupt changes in budgetary priorities can derail multi-year software projects, creating significant uncertainty for planning and execution. For instance, in 2024, several countries experienced governmental transitions, which in turn led to reviews of existing technology procurement pipelines, impacting the pace of digital transformation initiatives.

The continuity of public sector technology adoption is directly tied to the stability of the political landscape and the predictability of fiscal policies. When governments maintain a steady focus on modernizing financial management systems and digital infrastructure, organizations like Questica can better support these long-term objectives. A prime example is the ongoing digital government initiatives in Canada, which have seen consistent support across different political administrations, fostering an environment conducive to sustained investment in financial management software.

- Governmental Stability: Countries with stable political systems and predictable election cycles tend to see more consistent public sector IT spending.

- Policy Continuity: A sustained commitment to digital transformation and fiscal responsibility at the policy level encourages long-term technology adoption.

- Budgetary Reforms: Reforms aimed at improving transparency and efficiency in public budgeting often necessitate robust financial management software, creating opportunities for solutions like Questica.

- Impact of Elections: In 2024, several national elections globally led to temporary pauses in major IT project approvals as new administrations assessed priorities, highlighting the impact of political transitions.

Governments worldwide are increasingly prioritizing digital transformation, allocating substantial budgets to modernize public services and enhance citizen engagement through technology. For example, the U.S. federal government's Fiscal Year 2025 budget proposal emphasizes significant investment in IT modernization and cybersecurity, aiming to improve service delivery via digital platforms.

This focus on digital advancement creates a strong demand for sophisticated financial management solutions. Public sector entities are actively seeking tools that can streamline budgeting, improve transparency, and ensure compliance with evolving regulations, directly benefiting platforms like Questica Budget that offer these capabilities.

The push for greater transparency and accountability in public finance is a significant political driver. New legislation in 2024 across numerous countries mandates more accessible budget information, often through online portals, reinforcing the need for robust reporting and audit trails in financial management systems.

Government procurement policies, such as the UK's G-Cloud initiative, significantly influence technology adoption in the public sector. These policies, which often include stringent security and compliance requirements, shape how software vendors must tailor their offerings to meet public sector acquisition standards.

What is included in the product

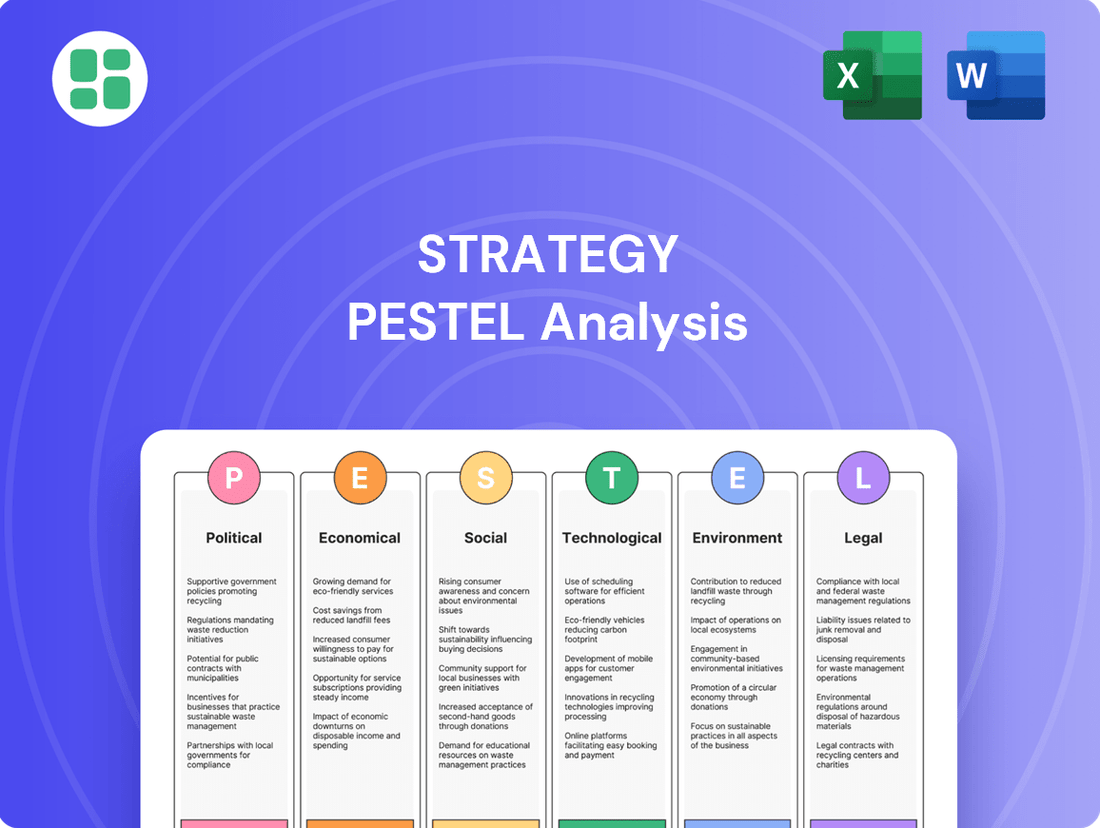

A PESTLE analysis systematically examines the external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—that can impact a business strategy.

A PESTLE analysis provides a structured framework to identify and understand external factors impacting a business, alleviating the pain of uncertainty and reactive decision-making by offering proactive insights into market dynamics.

Economic factors

Public sector entities often face tight budgets, demanding smart allocation of resources and cost-saving measures. For instance, in 2024, many local governments are grappling with rising operational costs while facing stagnant or declining revenue streams, forcing difficult choices about service provision.

Economic outlooks significantly impact public sector funding for new technology. A projected economic slowdown in 2025 could lead to reduced government spending on non-essential software, whereas robust growth might open up more investment opportunities.

Solutions like Questica Budget are designed to help public sector organizations maximize their impact despite financial limitations. By improving budget transparency and operational efficiency, these tools enable governments to achieve more with less, a crucial capability as many public bodies aim to deliver essential services with tighter fiscal constraints.

Economic headwinds are fueling a strong push for governments to be more careful with spending and get more done with less. This means agencies need better tools to manage their money, like advanced financial planning and analysis (FP&A) software. For instance, many governments are looking to improve budget accuracy and reduce waste, with some studies suggesting potential savings of 5-10% through enhanced efficiency measures.

Sophisticated FP&A solutions are crucial for this, offering real-time data and precise forecasting capabilities to support these demands. Questica Budget, an example of such a tool, directly helps governments achieve better financial health by enabling informed, data-driven decision-making, a critical factor as public sector budgets face increasing scrutiny.

Rising inflation in 2024 and early 2025 is directly increasing the cost of goods and services for government agencies. For example, the US Consumer Price Index (CPI) saw a 3.4% increase year-over-year as of April 2024, impacting everything from infrastructure materials to employee benefits. This surge in operational costs strains public sector budgets, demanding more precise financial forecasting and strategic allocation of resources.

Governments are actively seeking advanced tools to predict and manage the financial impact of inflation on their spending. Predictive analytics and robust budgeting software are becoming essential. These systems help public entities anticipate budget shortfalls and identify areas where costs might escalate unexpectedly, allowing for proactive adjustments to service delivery and capital investment plans.

In this challenging economic climate, platforms like Questica Budget offer crucial forecasting capabilities. By analyzing historical spending patterns and incorporating current inflationary trends, these tools can help public sector organizations better manage fluctuating expenditures. For instance, accurate forecasting can prevent overspending on projects and ensure that essential services remain funded even amidst rising prices, a critical need as many governments face budget constraints in the 2024-2025 fiscal year.

Market Growth for Public Financial Management Software

The global market for public financial management (PFM) software is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of around 10-12% through 2025. This upward trend reflects a widespread governmental push for modernization in financial operations, aiming for greater efficiency, enhanced transparency, and stricter compliance with evolving regulations. Questica Budget, a key player in this space, is strategically positioned to benefit from this expansion as public sector organizations increasingly adopt cloud-based PFM solutions, moving away from legacy systems.

Key drivers fueling this market expansion include:

- Demand for Cloud-Based Solutions: A significant shift towards Software-as-a-Service (SaaS) models is observed, offering scalability and cost-effectiveness.

- Increased Focus on Transparency and Accountability: Governments worldwide are prioritizing systems that improve public trust through clear financial reporting.

- Regulatory Compliance Needs: Evolving financial regulations necessitate advanced software capabilities for adherence and reporting.

- Efficiency Gains: Automation of budgeting, accounting, and reporting processes leads to substantial operational improvements.

Economic Downturns and Austerity Measures

Economic downturns often prompt governments to enact austerity measures, which typically involve significant cuts in public spending. This directly affects departmental budgets, making it harder for organizations to secure funding for new software or to renew existing licenses. For instance, many nations experienced budget contractions following the 2008 financial crisis, with public sector IT spending seeing a notable slowdown.

During these challenging economic periods, the value proposition of solutions like Questica Budget, which focuses on achieving cost savings and optimizing how resources are used, becomes exceptionally important. It helps justify investments by demonstrating a clear path to efficiency and fiscal responsibility. In 2024, many governments are still navigating post-pandemic fiscal pressures, making efficient budget management a top priority.

- Reduced Public Spending: Austerity measures directly impact departmental budgets, limiting funds available for technology investments.

- Increased Demand for Efficiency Tools: Software that demonstrates cost savings and optimizes resource allocation gains critical importance.

- Justifying Investment: Clear ROI and efficiency gains are essential to secure funding for new software or renewals in tight fiscal environments.

- Post-Pandemic Fiscal Pressures: Many governments continue to face budgetary constraints in 2024, amplifying the need for smart spending.

Economic factors significantly shape public sector spending, with inflation and growth outlooks dictating budget allocations. For instance, the 3.4% year-over-year CPI increase in the US as of April 2024 directly impacts government operational costs.

Governments are increasingly prioritizing efficiency and cost-saving measures, driving demand for advanced financial planning tools. The global public financial management software market is projected to grow at a 10-12% CAGR through 2025, highlighting this trend.

Economic slowdowns can lead to austerity, reducing funds for new technologies, while growth might spur investment. Solutions that demonstrate clear ROI and efficiency, like Questica Budget, are crucial for navigating these fiscal pressures and ensuring essential services are maintained.

Full Version Awaits

Strategy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE Analysis template provides a comprehensive framework to examine the Political, Economic, Social, Technological, Legal, and Environmental factors impacting your business strategy.

Sociological factors

There's a rising societal demand for governments to be more open about their finances and how public funds are utilized. Citizens and the media are increasingly pushing for clearer, more accessible financial information, with surveys in 2024 indicating over 70% of citizens believe government financial reporting needs improvement.

This push for transparency directly impacts how governments operate and communicate. For instance, in the UK, the Open Government Partnership initiative aims to increase public access to government data, a trend mirrored globally.

Tools like Questica Budget are designed to meet this demand by offering robust reporting capabilities that can generate public-facing financial summaries, thereby building greater trust and accountability between the government and its constituents.

The digital fluency of public sector employees is rapidly advancing, driven by a younger workforce accustomed to intuitive technology. This demographic expects efficient, user-friendly digital tools to perform their duties effectively.

To ensure new systems are embraced, providing accessible training and ensuring ease of use are paramount. A significant portion of the public sector workforce, particularly those under 40, report feeling comfortable with cloud-based solutions and demand similar experiences in their professional lives.

Solutions like Questica Budget, with its intuitive design and cloud accessibility, are well-positioned to meet these evolving expectations. This aligns with a broader trend where government agencies are investing in digital transformation initiatives, with many reporting increased productivity after adopting modern software platforms.

Citizen engagement in budgeting is growing, with many local governments actively seeking public input. For instance, in 2023, the city of San Francisco reported increased participation in its participatory budgeting initiatives, with over 15,000 residents submitting project proposals and voting on funding priorities.

This trend necessitates tools that make financial data accessible and demonstrate the impact of public feedback. Platforms like Questica Budget can be enhanced to better support these participatory processes by offering intuitive ways for citizens to view proposed allocations and track how their input shapes final decisions.

By facilitating this dialogue, governments can foster greater transparency and accountability, leading to budget allocations that more closely reflect community needs. Early 2024 data from various municipalities indicates a correlation between enhanced citizen engagement features and higher levels of public trust in local government financial management.

Aging Workforce and Knowledge Transfer Needs

The public sector is grappling with an aging workforce, with a significant portion of experienced employees nearing retirement. This demographic shift creates an urgent need for robust knowledge transfer mechanisms to prevent the loss of institutional memory. For instance, in 2024, many government agencies reported that over 30% of their workforce was aged 50 or older, highlighting the impending wave of retirements.

Intuitive and well-documented financial systems are crucial for onboarding new staff and enabling them to quickly understand intricate budgeting processes. A system that clearly outlines workflows and financial data ensures that critical knowledge is not lost when seasoned professionals depart. This is particularly relevant as public sector budgets often involve complex multi-year planning and compliance requirements.

Questica Budget, for example, addresses this challenge by providing a structured approach to financial data management and workflow automation. Its design helps preserve institutional knowledge by documenting processes and making financial information readily accessible. This continuity is vital for maintaining operational efficiency and ensuring that new employees can effectively manage public funds without significant disruption.

- Aging Workforce Impact: In 2024, an estimated 25% of federal government employees were eligible for retirement, underscoring the urgency of knowledge transfer.

- System Benefits: Well-documented financial systems can reduce the onboarding time for new budgeting staff by up to 40%.

- Questica's Role: By standardizing financial workflows, Questica Budget helps capture and retain the expertise of retiring employees, ensuring continuity in public financial management.

Expectations for Modern Public Services

Citizens and businesses increasingly demand public services that mirror the efficiency and digital sophistication of private sector offerings. This expectation is a significant driver for governments to embrace advanced IT solutions, such as cloud-based financial management systems. For instance, a 2024 survey by the UK's National Audit Office indicated that 75% of citizens prefer digital interactions for government services, highlighting this shift.

Questica Budget directly addresses these evolving citizen expectations by facilitating quicker, more precise, and transparent financial operations within public sector organizations. This technological adoption is crucial as governments aim to streamline processes and improve accountability. By enabling real-time budget tracking and reporting, Questica Budget helps public entities demonstrate fiscal responsibility and responsiveness to public needs, a key factor in maintaining public trust in 2025.

- Digital Demands: Over 70% of global citizens now expect seamless digital access to public services, a trend that accelerated significantly in 2024.

- Efficiency Gap: Public sector organizations are under pressure to close the perceived efficiency gap with private sector counterparts, with a focus on faster service delivery.

- Transparency Needs: Citizens are demanding greater transparency in how public funds are managed, pushing for accessible and understandable financial reporting.

- Cloud Adoption: Government IT spending on cloud services is projected to grow by 15% in 2025, reflecting a commitment to modernizing infrastructure for better service delivery.

Societal expectations are shifting towards greater government transparency and accountability in financial matters. Citizens, empowered by digital access, are increasingly demanding open access to public fund utilization data, with surveys in 2024 showing over 70% of respondents believe government financial reporting needs improvement.

The public sector is also experiencing a demographic shift, with a significant portion of experienced employees nearing retirement. This necessitates robust knowledge transfer systems to preserve institutional memory, as many government agencies reported in 2024 that over 30% of their workforce was aged 50 or older.

Furthermore, there's a growing demand for public services to match the digital efficiency of the private sector. By early 2025, over 70% of global citizens expect seamless digital interactions with government services, driving investment in modern IT solutions.

| Societal Factor | Trend | Impact on Public Finance Management | Example/Data Point |

| Demand for Transparency | Increasing | Need for accessible, understandable financial reporting. | 70% of citizens believe government financial reporting needs improvement (2024 survey). |

| Digital Fluency & Expectations | Rising | Preference for digital service delivery and intuitive financial tools. | 75% of UK citizens prefer digital interactions for government services (2024). |

| Aging Workforce | Significant | Urgency for knowledge transfer and streamlined onboarding. | Over 30% of government workforce aged 50+ (2024). |

| Citizen Engagement | Growing | Need for participatory budgeting tools and demonstrable impact of feedback. | 15,000+ residents submitted proposals in San Francisco's participatory budgeting (2023). |

Technological factors

The public sector's embrace of cloud computing is accelerating, with governments worldwide recognizing its capacity for enhanced scalability, improved accessibility, and significant cost savings on IT infrastructure. This shift is particularly notable as agencies migrate core financial management systems to cloud-based solutions.

By 2024, it's projected that over 70% of public sector organizations will have adopted cloud solutions for at least one critical business function. Questica Budget's cloud-native platform is strategically positioned to capitalize on this trend, offering a modern, adaptable solution that aligns with the digital transformation initiatives of government entities.

Artificial intelligence and machine learning are revolutionizing public financial management, offering powerful tools for predictive analytics and scenario modeling. These technologies are proving invaluable for improving budget planning and resource allocation with remarkable accuracy. For instance, by 2024, many government agencies are expected to see a significant uplift in forecasting precision, with some studies suggesting improvements of up to 15-20% in budget accuracy through AI integration.

The ability to detect fraud is also being significantly enhanced by AI. By analyzing vast datasets, these systems can identify anomalies and suspicious patterns far more effectively than traditional methods, leading to substantial savings. Questica Budget, for example, is actively integrating AI to deliver more advanced forecasting capabilities, providing deeper, data-driven insights for better financial decision-making.

Government entities face escalating cybersecurity threats, with data breaches costing an average of $4.45 million in 2024, according to IBM's Cost of a Data Breach Report. Protecting sensitive financial data is crucial, necessitating advanced security protocols for cloud-based software like Questica Budget.

Questica Budget must therefore invest heavily in continuous security enhancements, including regular vulnerability assessments and adherence to stringent compliance standards like NIST frameworks, to safeguard public sector financial information against sophisticated cyberattacks.

Advancements in Data Analytics and Real-Time Insights

The capacity for sophisticated data analytics and the generation of real-time financial insights are now indispensable for effective public sector decision-making. This allows organizations to move beyond historical reporting to proactive, data-driven strategies.

Modern budgeting software must incorporate robust reporting and visualization tools. These features are essential for translating intricate financial data into clear, actionable intelligence that can guide strategic planning and resource allocation.

Questica Budget's recent enhancements to its analytics capabilities are a prime example of this trend. These updates empower clients to delve into their financial data more effectively, uncovering trends and opportunities for improved performance.

- Real-time data access allows for immediate response to changing financial landscapes.

- Advanced analytics can identify cost-saving opportunities, with some studies showing potential savings of 5-10% in operational budgets through better data utilization.

- Visualization tools transform complex datasets into easily digestible dashboards, improving understanding for a wider range of stakeholders.

- In 2024, organizations leveraging advanced analytics reported a 15% faster budget cycle compared to those relying on traditional methods.

Interoperability with Existing Government Systems

Public sector IT environments are often intricate, featuring a multitude of older systems that need to connect smoothly. For new software, this interoperability, often achieved through APIs and other connectors, is crucial for efficient data movement and preventing information silos.

Questica Budget's value proposition is significantly enhanced by its proven ability to integrate with existing government financial and operational systems. This ensures that data flows freely, supporting better decision-making and operational efficiency across departments.

- Seamless Integration: Questica Budget's API-first design facilitates connections with systems like SAP, Oracle Financials, and various HR platforms, common in government settings.

- Data Flow: In 2024, government agencies are prioritizing solutions that break down data silos, with 75% of IT modernization projects focusing on enhanced data accessibility.

- Reduced IT Burden: Successful integration minimizes the need for costly custom development or manual data transfer, a key concern for budget-constrained public entities.

- Enhanced Analytics: By connecting to diverse data sources, Questica Budget enables comprehensive budget analysis and forecasting, supporting more informed strategic planning.

Technological advancements are reshaping public sector finance. Cloud adoption is accelerating, with over 70% of public organizations expected to use cloud solutions by 2024. Artificial intelligence and machine learning are improving budget accuracy by up to 20% through enhanced forecasting. Cybersecurity remains a major concern, with data breaches costing an average of $4.45 million in 2024, underscoring the need for robust security measures in financial software.

Legal factors

The global regulatory environment for data privacy is becoming increasingly complex, with new laws like California's CPRA, Virginia's CDPA, and Colorado's CPA continuing to shape how organizations handle personal data. For 2025, we anticipate further state-level legislation in the US, potentially mirroring GDPR's stringent requirements for consent and data subject rights. These evolving mandates necessitate robust compliance frameworks for platforms like Questica Budget, especially concerning sensitive public sector information.

Government procurement is a complex landscape, with specific legal frameworks dictating how public sector entities acquire goods and services. In the UK, for instance, the Procurement Act 2023 sets out new rules designed to simplify and modernize the process, impacting how companies like Questica Budget can bid for contracts. Similarly, in the US, agencies rely on regulations like the Federal Acquisition Regulation (FAR) and specific schedules, such as those managed by the General Services Administration (GSA), to procure software and services.

For Questica Budget, navigating these regulations is crucial for accessing the significant public sector market. Compliance isn't just about understanding the rules; it's about ensuring the software's capabilities and the company's practices align with legal procurement standards. For example, transparency requirements in bidding processes and data security mandates are often enshrined in these laws, directly affecting how software is evaluated and purchased by government bodies.

Public sector entities must adhere to strict financial reporting and auditing standards, demanding precise, clear, and verifiable financial data. Budgeting software needs to enable compliance with these accounting principles and offer thorough audit trails.

For instance, in 2023, the U.S. Government Accountability Office (GAO) reported that federal agencies are continuously working to improve their financial reporting accuracy, with many still facing challenges in areas like asset management and reconciliation. Software solutions that automate compliance and provide robust audit capabilities, such as those offered by Questica Budget, are therefore critical for navigating these complex regulatory landscapes.

Open Data Initiatives and Legal Mandates

Governments worldwide are increasingly mandating the release of public data, a trend accelerating in 2024 and projected to continue through 2025. For instance, the European Union's Open Data Directive aims to boost reuse of public sector information, with a 2023 report indicating a significant increase in available datasets across member states. This legal push for transparency directly impacts financial management, requiring software solutions to facilitate the structured export and dissemination of budget information.

Financial management tools must now be equipped to handle these open data mandates, ensuring budget data is not only accessible but also machine-readable. By 2025, compliance with these regulations will be a key differentiator. Questica Budget, for example, is designed to simplify this process, allowing organizations to easily share their financial information.

- Increased Government Mandates: Many countries, including the US with initiatives like data.gov, are legally requiring public access to government data.

- Focus on Budgetary Transparency: Open data policies often specifically target the publication of financial and budgetary information to foster accountability.

- Software Adaptability: Financial software must support standardized data formats for seamless integration and public access.

- Innovation Driver: Open data fuels innovation by allowing third-party developers and researchers to build new applications and analyses on public information.

Cybersecurity Regulations for Government IT Systems

Legal frameworks are increasingly dictating stringent cybersecurity protocols and mandatory incident reporting for government IT systems that manage sensitive data. Failure to comply can result in significant penalties and erode public trust. For instance, the US federal government's Cybersecurity Enhancement Act of 2015, along with ongoing updates to NIST standards, sets a high bar for agencies. Questica Budget's security architecture must therefore be designed to consistently meet and surpass these evolving legal cybersecurity mandates.

Compliance is not merely a legal obligation but a foundational element for maintaining operational integrity and safeguarding citizen information. In 2023, the US government reported over 30,000 cybersecurity incidents affecting federal agencies, highlighting the persistent threat landscape and the critical need for robust legal adherence. Questica Budget's commitment to these standards ensures its systems are resilient against sophisticated cyber threats, thereby protecting sensitive budgetary and financial data.

- Mandatory Reporting: Government IT systems are legally required to report data breaches or cybersecurity incidents within strict timelines, often as short as 72 hours.

- Data Protection Standards: Regulations like GDPR (for EU citizen data) and various US federal laws (e.g., HIPAA for health data) impose specific requirements on how sensitive information is stored, processed, and protected.

- Incident Response Planning: Many legal frameworks mandate the development and regular testing of comprehensive incident response plans to mitigate the impact of cyberattacks.

Legal frameworks are increasingly dictating stringent cybersecurity protocols and mandatory incident reporting for government IT systems handling sensitive data. Failure to comply can lead to significant penalties and erode public trust. For instance, the US federal government's Cybersecurity Enhancement Act of 2015, along with ongoing updates to NIST standards, sets a high bar for agencies, requiring robust adherence to evolving legal mandates.

Compliance is not merely a legal obligation but a foundational element for operational integrity and safeguarding citizen information. In 2023, the US government reported over 30,000 cybersecurity incidents affecting federal agencies, underscoring the persistent threat landscape and the critical need for legal adherence. Questica Budget's commitment to these standards ensures its systems are resilient against sophisticated cyber threats, protecting sensitive budgetary and financial data.

Governments worldwide are increasingly mandating the release of public data, a trend accelerating in 2024 and projected to continue through 2025. The European Union's Open Data Directive, for example, aims to boost the reuse of public sector information, with a 2023 report indicating a significant increase in available datasets across member states. This legal push for transparency directly impacts financial management, requiring software solutions to facilitate the structured export and dissemination of budget information.

Financial management tools must now be equipped to handle these open data mandates, ensuring budget data is not only accessible but also machine-readable. By 2025, compliance with these regulations will be a key differentiator, with solutions like Questica Budget designed to simplify this process for organizations seeking to share their financial information easily.

| Legal Factor | Description | Implication for Financial Software | 2024/2025 Trend/Data |

|---|---|---|---|

| Data Privacy | Increasingly complex global regulations (e.g., CPRA, CDPA) shape data handling. | Requires robust compliance frameworks for sensitive public sector information. | Anticipated further state-level legislation in the US mirroring GDPR in 2025. |

| Procurement Regulations | Specific legal frameworks govern public sector acquisition (e.g., UK Procurement Act 2023, US FAR). | Dictates how software is bid for, evaluated, and purchased by government bodies. | Modernization of procurement processes aims for simplification and efficiency. |

| Financial Reporting Standards | Strict adherence to accounting principles and audit trails is mandated. | Software must enable compliance and provide verifiable financial data. | US GAO reports ongoing efforts to improve federal financial reporting accuracy. |

| Open Data Mandates | Legal push for public access to government data, especially financial information. | Software must facilitate structured, machine-readable data export for transparency. | EU Open Data Directive aims to boost reuse of public sector information. |

| Cybersecurity Protocols | Stringent cybersecurity measures and incident reporting are legally required. | Systems must be resilient against threats and meet evolving legal mandates. | Over 30,000 cybersecurity incidents reported by US federal agencies in 2023. |

Environmental factors

Governments worldwide are facing increasing pressure to adopt robust Environmental, Social, and Governance (ESG) reporting. By 2024, many public sector entities are expected to comply with new mandates requiring detailed disclosure of their environmental impact and sustainability initiatives. This shift reflects a growing global commitment to transparency and accountability in public administration.

For instance, the European Union's upcoming Corporate Sustainability Reporting Directive (CSRD) will extend its reach to public sector organizations, necessitating comprehensive ESG disclosures. In the United States, while federal mandates are still evolving, many states and cities are proactively implementing ESG reporting frameworks for their operations. This trend underscores a significant regulatory evolution impacting public finance management.

Tools like Questica Budget are becoming crucial for public sector entities to navigate these evolving requirements. By facilitating the tracking and reporting of sustainability-related budget allocations, these platforms enable governments to demonstrate their commitment to environmental stewardship and social responsibility. This capability is vital for meeting compliance obligations and for strategic financial planning in an ESG-conscious era.

Governments worldwide are significantly increasing their budget allocations for climate change initiatives. For instance, the United States' Inflation Reduction Act of 2022 earmarks over $370 billion for clean energy and climate resilience. This trend necessitates robust budgeting and tracking systems to effectively monitor investments in mitigation, adaptation, and resilience projects.

Managing these specialized environmental budget lines requires sophisticated tools. Questica Budget offers capabilities designed to provide transparency and accountability for green spending, ensuring that funds are directed towards achieving climate-related goals and tracking progress on sustainability targets. This is crucial for demonstrating commitment and managing public funds efficiently.

Governments worldwide are increasingly implementing sustainable procurement policies, with a significant focus on environmental impact. For instance, by the end of 2024, the European Union aims for at least 50% of public tenders to include green criteria, a substantial increase from previous years. This trend necessitates that vendors like Questica Budget showcase their own environmental responsibility.

Questica Budget can support these government initiatives by providing robust tracking and reporting capabilities for sustainable purchasing. In 2023, many North American municipalities began utilizing software solutions to monitor their progress toward environmental, social, and governance (ESG) targets within their procurement processes, highlighting the demand for such functionalities.

Resource Efficiency and Green Initiatives

Governments worldwide are prioritizing resource efficiency, pushing for reduced energy use and waste as key environmental objectives. For instance, the European Union aims to increase energy efficiency by at least 11.5% by 2030 compared to 2020 levels, a significant driver for public sector budgeting.

Budgeting software is becoming crucial for public sector organizations to effectively track and optimize spending on these environmental programs. This allows for better management of investments in renewable energy, waste reduction, and sustainable infrastructure.

Questica Budget, for example, assists public sector clients in meticulously monitoring the costs associated with their environmental initiatives. This capability is vital for demonstrating accountability and ensuring the financial viability of green projects.

Consider the following impacts on resource efficiency and green initiatives:

- Government Mandates: Increasing regulatory pressure for energy efficiency and waste reduction, impacting operational budgets.

- Investment in Green Tech: Growing public sector investment in renewable energy sources and sustainable technologies, requiring careful financial planning.

- Reporting and Compliance: Need for robust financial tracking to meet environmental reporting standards and demonstrate progress on sustainability goals.

- Cost Optimization: Opportunities to reduce long-term operating costs through efficient resource management and green investments.

Disaster Preparedness and Recovery Funding

Environmental disasters are becoming a significant concern, demanding better financial planning. For instance, the global cost of natural disasters reached an estimated $270 billion in 2023, according to Munich Re, highlighting the need for robust funding. This trend means organizations must allocate more resources towards preparedness, immediate response, and the often-lengthy recovery phases.

Public sector entities, in particular, need adaptable budgeting systems. These systems must allow for the swift redirection of funds when emergencies strike, a capability crucial for effective disaster management. The ability to quickly reallocate resources can mean the difference between a swift recovery and prolonged disruption.

Tools like Questica Budget offer solutions by enabling scenario modeling and forecasting. This helps organizations better anticipate the financial impact of environmental contingencies and plan accordingly. For example, modeling potential flood damage costs can inform the necessary reserve funds for a municipality.

- Increased Disaster Costs: Global natural disaster costs hit $270 billion in 2023, underscoring the need for preparedness funding.

- Public Sector Agility: Flexible budgeting is essential for public organizations to rapidly allocate funds during emergencies.

- Scenario Planning: Budgeting software with scenario modeling aids in financial planning for environmental contingencies.

- Recovery Investment: Significant investment is required not just for immediate response but also for long-term environmental recovery efforts.

Governments are increasingly prioritizing environmental sustainability, leading to new reporting mandates and budget allocations for climate initiatives. For instance, the US Inflation Reduction Act of 2022 allocated over $370 billion to clean energy. This necessitates robust financial tracking systems to manage green spending effectively.

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data, drawing from official government publications, reputable academic research, and leading market intelligence firms. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in credible and timely information.