Solutions 30 Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Solutions 30 Bundle

Solutions 30 operates in a dynamic market where the threat of new entrants is moderate, as significant capital and specialized expertise are required for entry. However, the intense rivalry among existing players, including established competitors and emerging service providers, presents a substantial challenge.

The bargaining power of buyers, primarily large telecommunications and energy companies, is considerable due to the standardized nature of many services and the availability of alternative suppliers. This necessitates competitive pricing and high service quality to retain clients.

The threat of substitutes is relatively low, as direct replacements for field service operations are limited. Nevertheless, technological advancements and evolving customer preferences could introduce indirect substitutes in the future.

Ready to move beyond the basics? Get a full strategic breakdown of Solutions 30’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Supplier concentration significantly impacts Solutions 30's bargaining power. If a few key suppliers dominate the market for specialized digital equipment or crucial software, they can dictate terms, potentially driving up costs for Solutions 30. For instance, if the market for advanced fiber optic installation tools is controlled by only two or three manufacturers, those suppliers gain considerable leverage.

Solutions 30 faces varying supplier bargaining power depending on the nature of the supplies. For specialized, high-tech components or proprietary software, the cost and complexity of switching suppliers can be substantial. This might involve significant investment in retraining technicians or re-certifying existing equipment, thereby increasing the leverage of these specialized suppliers.

Conversely, for more commoditized supplies such as vehicles or basic tools, Solutions 30 likely experiences lower switching costs. This means they can more readily change suppliers for these items, which in turn reduces the bargaining power of suppliers in these categories. In 2024, Solutions 30's operational efficiency is closely tied to managing these differing supplier dynamics.

Suppliers of highly specialized or proprietary technology, such as unique fiber optic installation equipment or specific smart meter components, wield significant bargaining power. For instance, in 2024, companies offering advanced diagnostic tools for fiber networks, with limited competition, could command higher prices, directly affecting Solutions 30's procurement costs.

When these critical inputs are not easily sourced from alternative providers, Solutions 30's dependence on these select suppliers increases substantially. This reliance can impact the company's cost of goods sold and its ability to adapt operations swiftly, especially if supply chain disruptions occur for these unique components.

Threat of Forward Integration by Suppliers

Suppliers of specialized technology or components could potentially integrate forward, offering installation and maintenance services directly to end-customers. This would transform them from mere suppliers into direct competitors for Solutions 30.

While broad-based equipment suppliers are less likely to pursue this, niche technology providers, particularly those with unique or proprietary solutions, might find this strategy appealing. This is especially true in areas requiring specialized deployment expertise, thereby significantly enhancing their bargaining power.

- Forward Integration Threat: Suppliers might offer installation and maintenance, becoming direct competitors.

- Niche Provider Focus: Specialized technology suppliers are more likely to consider this.

- Increased Bargaining Power: Successful forward integration by suppliers would boost their leverage.

Importance of Solutions 30 to Suppliers

The bargaining power of suppliers for Solutions 30 is influenced by how crucial Solutions 30 is to their revenue streams. If Solutions 30 constitutes a substantial part of a supplier's sales, that supplier's leverage diminishes as they become more reliant on maintaining the relationship with Solutions 30.

Conversely, if Solutions 30 is a minor client among many for a large technology provider, its individual significance to the supplier is minimal, thereby increasing the supplier's bargaining power. For instance, in 2023, Solutions 30's cost of revenue was €2.02 billion, indicating significant purchasing volume, but the diversity of its supplier base would be key to determining individual supplier leverage.

- Supplier Dependence: If Solutions 30 represents a large percentage of a supplier's annual turnover, the supplier has less power to dictate terms.

- Client Diversification: If Solutions 30 is a small client for a supplier, that supplier's bargaining power is amplified.

- Input Specialization: The uniqueness or specificity of the goods or services supplied also plays a role; highly specialized inputs grant suppliers more power.

The bargaining power of suppliers for Solutions 30 is significantly shaped by the concentration of suppliers for critical inputs. When a few suppliers control essential components like specialized fiber optic installation tools or advanced diagnostic software, they can exert considerable influence over pricing and terms. This dynamic was evident in 2024, where reliance on niche technology providers for unique smart meter components could lead to increased procurement costs for Solutions 30.

Solutions 30's ability to switch suppliers is a key factor in mitigating supplier power. For commoditized items such as vehicles or standard tools, lower switching costs allow for greater flexibility and reduced supplier leverage. However, for highly specialized inputs, the cost and complexity of changing providers, including retraining staff and re-certifying equipment, can be substantial, amplifying the bargaining power of these specialized suppliers.

The strategic importance of Solutions 30 to its suppliers also plays a crucial role. If Solutions 30 represents a significant portion of a supplier's revenue, the supplier is more incentivized to maintain a favorable relationship, thereby reducing their bargaining power. Conversely, if Solutions 30 is a minor client for a large supplier, the supplier's leverage increases due to their reduced dependence on Solutions 30.

| Factor | Impact on Solutions 30 | 2024 Relevance |

|---|---|---|

| Supplier Concentration (Specialized Inputs) | Higher bargaining power for suppliers | Increased costs for advanced fiber optic tools |

| Switching Costs (Commoditized Inputs) | Lower bargaining power for suppliers | Flexibility in sourcing vehicles and basic tools |

| Solutions 30's Revenue Share for Supplier | Lower supplier bargaining power | Depends on supplier client diversification |

| Supplier Forward Integration Potential | Threat of direct competition | Higher for niche technology providers |

What is included in the product

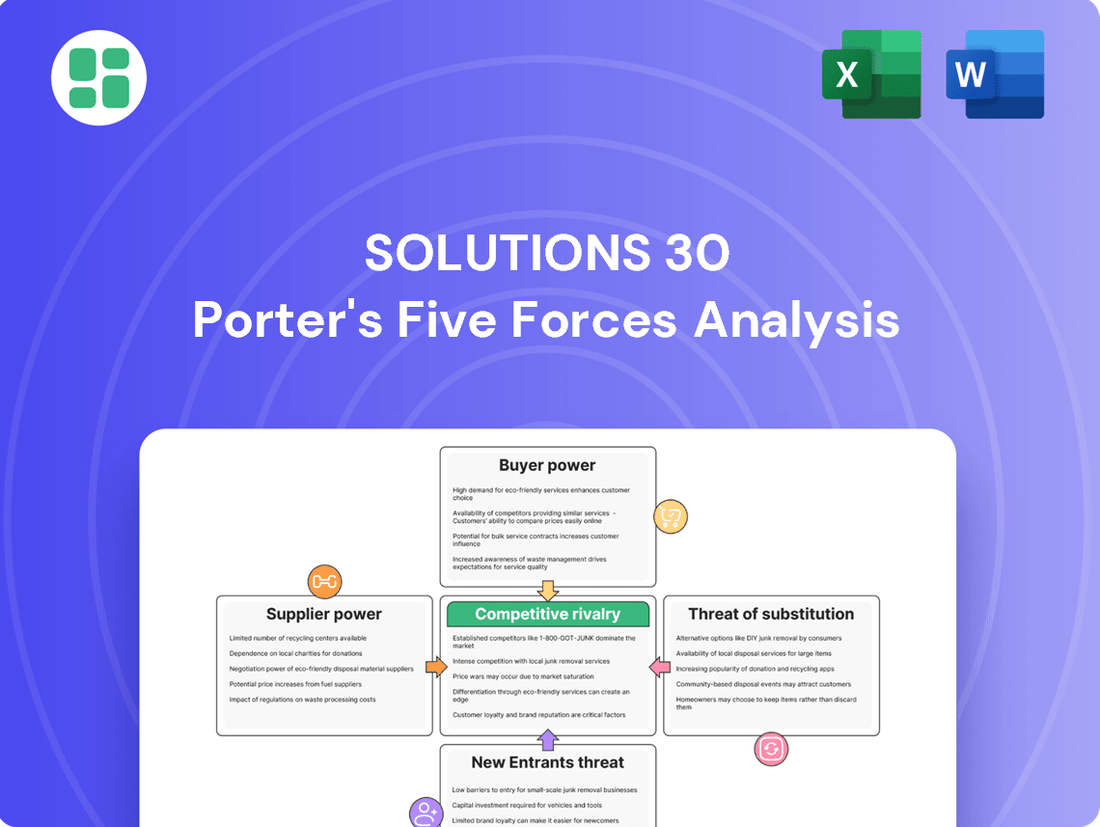

This analysis delves into the competitive forces impacting Solutions 30, examining the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitute products or services.

Effortlessly identify competitive threats and opportunities with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Solutions 30's customer base includes both large corporations like telecom operators and energy companies, as well as individual consumers. For the corporate segment, particularly those placing large volume orders or operating across multiple countries, their significant demand grants them considerable leverage.

This concentration of high-volume clients means Solutions 30 must carefully manage relationships and pricing to retain these key accounts. For instance, a single major telecom contract could represent a substantial portion of revenue, making the client's demands on pricing and service levels highly impactful.

For Solutions 30's large business clients, the effort to switch from an established provider is substantial. This often includes significant administrative tasks, potential disruptions to ongoing services, and the need to retrain staff on new systems, all contributing to moderate to high switching costs. Once a contract is secured, these costs tend to diminish the bargaining power of these clients.

Conversely, individual customers typically face much lower barriers to switching. For instance, if a customer is unhappy with their internet or energy provider, the process of changing can often be completed with minimal hassle and cost, thereby increasing their leverage and bargaining power against Solutions 30.

Customers in mature markets, like telecommunications in France and Spain, can be quite sensitive to price. This means they might push Solutions 30 to lower its service fees, impacting the company's profitability.

However, when it comes to crucial projects like deploying and maintaining essential infrastructure, customers often prioritize reliability and the company's technical skill over just the lowest price. For instance, in 2024, a significant portion of Solutions 30's revenue came from these critical infrastructure projects, where the cost of failure due to poor service is far greater than the savings from a cheaper provider.

Threat of Backward Integration by Customers

The bargaining power of customers, particularly large telecom and utility companies, poses a significant threat to Solutions 30. These major clients have the capacity to develop or expand their own internal teams for installation and maintenance, thereby decreasing their dependence on third-party service providers.

This potential for backward integration directly impacts Solutions 30 by creating downward pressure on pricing, especially for standardized maintenance tasks or specific project scopes where in-house capabilities are feasible. For instance, in 2024, several European telecom operators explored increasing their direct workforce for fiber optic installations to gain more control over quality and costs.

- Customer Integration Threat: Large clients like telecom and utility firms can bring installation and maintenance services in-house.

- Pricing Pressure: This capability allows customers to negotiate lower prices with Solutions 30.

- Market Dynamics: In 2024, major European telecom players showed increased interest in expanding their internal technical teams.

Information Availability and Service Differentiation

Customers now have unprecedented access to information about service providers and their pricing, significantly increasing their ability to compare options. This transparency can put pressure on companies like Solutions 30 to maintain competitive pricing.

Solutions 30 counters this by emphasizing its unique value proposition. Its multi-technical expertise allows it to handle a broader range of services, while its rapid response times and extensive European network offer convenience and reliability that go beyond simple price comparisons.

- Information Access: Customers can easily research and compare service providers, including pricing and reviews.

- Solutions 30 Differentiation: Multi-technical expertise, rapid response, and a wide European network offer distinct advantages.

- Reducing Bargaining Power: Unique service offerings and reliability can lessen customer focus on price alone.

The bargaining power of Solutions 30's customers, particularly large corporate clients in sectors like telecom and energy, is a significant factor. These clients can exert pressure through volume purchasing, potential backward integration, and price sensitivity, especially in mature markets. For example, in 2024, several major European telecom operators explored expanding their in-house technical teams for fiber optic installations, aiming for greater control and cost efficiency. This trend directly impacts Solutions 30 by potentially reducing demand for its services and driving down pricing for standardized tasks.

| Customer Segment | Bargaining Power Factors | Impact on Solutions 30 | 2024 Trend Example |

|---|---|---|---|

| Large Corporate (Telecom, Energy) | High volume orders, potential for backward integration, switching costs | Downward pricing pressure, need for strong relationship management | Exploration of in-house installation teams by telecom firms |

| Individual Consumers | Low switching costs, high price sensitivity, access to information | Limited impact due to lower order volume, but requires competitive pricing | Increased comparison shopping for connectivity services |

Same Document Delivered

Solutions 30 Porter's Five Forces Analysis

This preview showcases the comprehensive Solutions 30 Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, providing actionable insights into the industry's dynamics. You're looking at the actual document, so you can be confident that what you preview is precisely what you'll be able to download and utilize without any alterations or missing sections.

Rivalry Among Competitors

The proximity services market, particularly in telecommunications and energy, is quite crowded. Solutions 30 contends with a mix of large engineering and construction giants, alongside many smaller, specialized field service providers. This creates a fragmented but intensely competitive environment.

Key competitors for Solutions 30 include well-established names like CIRCET, Eiffage, Vinci, SNEF, and SPIE. These companies operate across similar service areas, intensifying the rivalry for contracts and market share in the proximity services sector.

While certain areas like fiber optics and electric vehicle charging infrastructure are booming in Europe, mature telecommunications markets often exhibit slower growth. This dynamic intensifies competition as companies vie for a limited pool of existing contracts.

Solutions 30's strategic decision to focus on improving profit margins rather than solely chasing revenue growth in these mature telecom markets is a direct response to this heightened competitive environment. For instance, in 2023, the company reported a notable improvement in its operational profitability, a testament to this strategic pivot amidst challenging market conditions.

Solutions 30 stands out by offering a wide array of technical skills and a significant European presence, positioning itself as a crucial ally for technology rollouts. This broad service offering and established network can create a sticky customer base.

For major clients, the effort and cost involved in switching from an established, integrated service provider can be substantial, acting as a deterrent to rivals. However, without continuous innovation and clear value propositions, even these core services risk becoming undifferentiated commodities, intensifying price-based competition.

Exit Barriers

Exit barriers in the telecom and energy installation sector, where Solutions 30 operates, can be moderate. These arise from the need for specialized tools and a highly trained workforce, making it difficult for companies to simply walk away. Long-term contracts further anchor competitors, often compelling them to stay in the market even when facing challenging economic conditions, thereby sustaining intense rivalry.

Solutions 30's substantial investment in assets and its operational presence across numerous European countries amplify these exit barriers. The company's extensive network of technicians and specialized equipment represents a significant commitment that is not easily divested. This immobility can lead to prolonged periods of high competition as firms are hesitant to incur losses associated with exiting the market.

For instance, in 2023, Solutions 30 reported a workforce of approximately 13,000 employees, underscoring the human capital investment that contributes to exit barriers. The company’s diversified geographic footprint, spanning countries like France, Germany, and Italy, means that exiting one market may not necessarily be a complete withdrawal, but rather a complex, phased process.

- Specialized Equipment: High upfront costs for installation and maintenance tools.

- Trained Personnel: Significant investment in training and retaining a skilled technical workforce.

- Long-Term Contracts: Commitments to clients that necessitate continued service provision.

- Geographic Presence: Operational scale across multiple countries makes complete withdrawal challenging.

Strategic Objectives of Competitors

Competitors in the field services sector often pursue divergent strategic goals. Some may prioritize aggressive market share acquisition, even at the expense of short-term profitability, while others focus intensely on maximizing margins within niche segments. This variety in objectives directly shapes how they engage with rivals.

Solutions 30's strategic emphasis on enhancing profitability and expanding its footprint in key growth markets, such as Germany, and its increasing focus on the energy services sector, demonstrates a clear understanding of these competitive pressures. For instance, in 2023, Solutions 30 reported revenue growth of 7.3% to €925.4 million, signaling its commitment to expansion.

These strategic choices are often a direct reaction to the competitive landscape. Companies aiming for high profitability might avoid price wars, whereas those seeking market share might engage in more aggressive pricing strategies. Solutions 30's approach suggests a strategy of targeted growth and operational efficiency.

Key competitor objectives can include:

- Market Share Growth: Aggressively acquiring new customers and expanding service territories.

- Profitability Enhancement: Focusing on high-margin services and cost optimization.

- Technological Specialization: Developing expertise in specific advanced technologies or service areas.

- Geographic Expansion: Entering new national or regional markets to diversify revenue streams.

The competitive rivalry within Solutions 30's proximity services market is intense, driven by a fragmented landscape of large engineering firms and specialized field service providers. This dynamic forces companies like Solutions 30 to differentiate through a broad service offering and established European presence to retain clients amidst potential price-based competition.

Solutions 30 faces significant competition from established players such as CIRCET, Eiffage, Vinci, SNEF, and SPIE, all vying for contracts in similar service areas. The company's strategic focus on improving profit margins, evidenced by its 2023 operational profitability gains, reflects the pressure to maintain competitiveness in mature telecom markets.

Exit barriers, including specialized equipment and trained personnel, keep rivals engaged even in challenging conditions, sustaining rivalry. Solutions 30's 2023 workforce of approximately 13,000 employees highlights the human capital investment contributing to these barriers.

Competitors pursue varied objectives, from aggressive market share growth to profitability enhancement, influencing their engagement strategies. Solutions 30's 2023 revenue growth of 7.3% to €925.4 million indicates its strategy of targeted expansion and operational efficiency in response to this competitive landscape.

| Key Competitor | Primary Service Areas | 2023 Revenue Indication (if available) |

|---|---|---|

| CIRCET | Telecom infrastructure, Energy | N/A (Private Company) |

| Eiffage | Construction, Concessions, Energy | €21.7 billion (Group Revenue) |

| Vinci | Concessions, Construction, Energy | €69.5 billion (Group Revenue) |

| SNEF | Industrial, Energy, Telecom | N/A (Private Company) |

| SPIE | Energy, Buildings, Networks | €8.1 billion (Group Revenue) |

SSubstitutes Threaten

Large telecommunication and utility companies often possess the in-house expertise and personnel to manage installation, maintenance, and customer support directly. This internal capability acts as a significant substitute for outsourcing these essential services to providers like Solutions 30, particularly for their core, recurring operational needs.

General IT service providers and consulting firms present a moderate threat of substitution. While they can offer support for digital equipment and some maintenance, their capabilities often don't extend to the specialized on-site deployment and infrastructure work that Solutions 30 excels at.

For instance, while a general IT consultant might help troubleshoot a faulty server, they are unlikely to have the trained technicians and logistical networks to install and maintain fiber optic networks across multiple locations, a core offering for Solutions 30. This specialization limits the direct substitutability of their services.

For individual customers, particularly with straightforward digital equipment setup or common troubleshooting needs, the threat of substitutes is significant. Many individuals can turn to readily available online tutorials, forums, or even informal help from tech-savvy friends and family instead of engaging professional services.

The continuous improvement in the user-friendliness of technology further empowers this trend. For instance, many smart home devices and consumer electronics in 2024 offer intuitive setup wizards that minimize or eliminate the need for professional installation, thereby reducing reliance on external support.

Technological Advancements Reducing Need for Physical Intervention

Future technological advancements, like sophisticated remote diagnostics and self-healing network capabilities, pose a significant threat by potentially reducing the reliance on Solutions 30's core physical intervention services. This evolution could lead to a gradual decline in demand for on-site repair and maintenance as more issues are resolved remotely.

For instance, the increasing sophistication of AI-powered diagnostic tools, which are projected to see significant growth in the coming years, could automate many tasks currently performed by field technicians. By 2024, the global AI market was valued at hundreds of billions of dollars, with a substantial portion dedicated to automation and predictive maintenance solutions.

- Remote Diagnostics: Technologies allowing for the identification and troubleshooting of network issues without physical presence.

- Self-Healing Networks: Systems designed to automatically detect and rectify faults, minimizing the need for human intervention.

- Automation of Tasks: AI and robotics are increasingly capable of performing tasks previously requiring manual labor.

- Reduced On-Site Demand: A potential consequence is a decrease in the volume of physical service calls for certain types of problems.

Alternative Infrastructure Deployment Models

Alternative infrastructure deployment models pose a significant threat. For instance, advanced wireless technologies, such as 5G Fixed Wireless Access (FWA), are increasingly viable substitutes for traditional fiber optic deployments in certain areas. These wireless solutions can offer competitive speeds and reduce the need for extensive physical cabling and on-site installation services, directly impacting Solutions 30's core business model.

The market is seeing a growing adoption of these alternatives. In 2023, the global FWA market was valued at approximately $28.5 billion, with projections indicating substantial growth through 2030. This trend suggests that a portion of the demand Solutions 30 typically serves could be met by these substitute technologies, potentially limiting market share and revenue opportunities.

- Wireless Alternatives: Advanced wireless solutions like 5G FWA can bypass the need for extensive physical cabling.

- Reduced Reliance on On-Site Services: These alternatives can lessen the demand for the physical installation and maintenance services that form a core part of Solutions 30's operations.

- Market Impact: The growing FWA market, valued at nearly $28.5 billion in 2023, represents a tangible substitute for traditional fiber deployments.

The threat of substitutes for Solutions 30's services comes from various sources, ranging from in-house capabilities of large companies to advancements in technology and alternative deployment models. For individual consumers, readily available online tutorials and tech-savvy friends offer a low-cost alternative for basic setup and troubleshooting.

The increasing user-friendliness of technology in 2024, such as intuitive setup wizards for smart home devices, further reduces the need for professional installation. This trend is amplified by future technological advancements like sophisticated remote diagnostics and self-healing networks, which could automate tasks currently performed by field technicians.

For instance, the global AI market, valued in the hundreds of billions of dollars by 2024, is increasingly focused on automation and predictive maintenance, posing a direct challenge to on-site intervention services. Additionally, advanced wireless technologies like 5G Fixed Wireless Access (FWA) are becoming viable substitutes for fiber optic deployments, bypassing the need for extensive physical cabling and on-site installation.

The growing FWA market, estimated at $28.5 billion in 2023, highlights a tangible shift towards alternatives that can reduce demand for Solutions 30's core physical services.

| Substitute Category | Examples | Impact on Solutions 30 | Market Data Point |

|---|---|---|---|

| In-house Capabilities | Large telecom/utility companies performing their own installations and maintenance | Reduces outsourcing opportunities for core operational needs | N/A (Internal capability) |

| General IT Services | IT consultants for digital equipment support | Limited substitution for specialized infrastructure work | N/A (Broad service category) |

| DIY & Informal Support | Online tutorials, friends/family for consumer electronics | Significant for individual customers with simple needs | Increasingly relevant due to user-friendly tech |

| Advanced Technologies | Remote diagnostics, self-healing networks, AI-powered diagnostics | Potential reduction in demand for on-site physical intervention | Global AI market valued in hundreds of billions (2024); AI for automation growing |

| Alternative Deployment Models | 5G Fixed Wireless Access (FWA) | Bypasses need for fiber optic cabling and installation | FWA market valued at ~$28.5 billion (2023) |

Entrants Threaten

Entering the multi-technical field services market, particularly for large-scale projects like fiber optic network deployment or smart meter installations, demands significant upfront capital. Companies need to invest heavily in specialized equipment, a diverse fleet of vehicles, and the recruitment and training of a substantial, skilled workforce. For instance, a single fiber deployment project can necessitate millions in equipment alone.

These high capital requirements act as a formidable barrier for new entrants. Potential competitors must secure substantial funding to acquire the necessary assets and operational capacity, making it challenging to compete with established players who already possess these resources. This financial hurdle significantly limits the number of new companies that can realistically enter the market.

Solutions 30 benefits significantly from economies of scale, leveraging its extensive European network and high volume of service calls to optimize resource allocation and reduce per-unit costs. For instance, in 2023, the company reported a revenue of €1.06 billion, indicative of its substantial operational capacity.

New entrants face a considerable hurdle in replicating these cost efficiencies. Without a comparable scale of operations, they would require substantial initial investment to achieve the same level of market penetration and operational leverage, making it difficult to compete on price.

The threat of new entrants is significantly influenced by existing players' control over crucial distribution channels and established customer relationships. Solutions 30 has cultivated deep, long-term partnerships with major telecom and energy companies throughout Europe. For instance, in 2023, the company reported that its top 10 clients represented a substantial portion of its revenue, highlighting the stickiness of these relationships. New companies entering this market would face immense difficulty in replicating this level of access and trust, making it a formidable barrier.

Regulatory and Licensing Requirements

The threat of new entrants for Solutions 30 is significantly influenced by regulatory and licensing hurdles, particularly in its core European markets. Operating in sectors such as telecommunications, energy, and the rapidly expanding electric vehicle infrastructure necessitates adherence to a complex web of national and EU regulations. For instance, obtaining the necessary permits and licenses to deploy fiber optic networks or install charging stations can be a time-consuming and costly process, acting as a substantial barrier for newcomers.

These stringent requirements vary considerably across different countries, demanding specialized knowledge and resources to navigate effectively.

- High Capital Investment: Securing licenses often requires demonstrating financial stability and the capacity for significant upfront investment in infrastructure and compliance.

- Technical Expertise: New entrants must possess deep technical expertise to meet the rigorous standards set by regulatory bodies for installation and maintenance.

- Navigational Complexity: The fragmented regulatory landscape across Europe means that a new player must understand and comply with multiple sets of rules, increasing operational complexity and cost.

- Established Relationships: Existing players like Solutions 30 often benefit from established relationships with regulatory bodies and local authorities, which can expedite approval processes.

Skilled Labor and Expertise

The specialized nature of Solutions 30's services, particularly in telecommunications and energy network installation and maintenance, necessitates a highly trained and certified workforce of technicians. This requirement acts as a significant barrier to entry for potential new competitors.

Recruiting, training, and retaining a large and skilled labor force across multiple geographies presents a substantial challenge. For instance, as of the end of 2023, Solutions 30 employed over 15,000 people, many of whom are field technicians requiring specific certifications. Developing this level of human capital is a time-consuming and capital-intensive process that new entrants would struggle to replicate quickly.

- High Training Investment: New entrants must invest heavily in training programs to equip technicians with the necessary skills and certifications.

- Geographic Dispersion: Solutions 30's operational footprint across Europe and beyond means new players need to build a similar geographically diverse and skilled workforce.

- Retention Challenges: The demand for skilled technicians in these sectors means retaining talent is crucial, and new companies may face difficulties in attracting and keeping experienced personnel.

- Certification Hurdles: Obtaining and maintaining the required industry certifications for technicians can be a complex and costly undertaking for new market entrants.

The threat of new entrants for Solutions 30 is moderate, primarily due to the high capital investment required for specialized equipment and a skilled workforce, alongside established customer relationships and regulatory hurdles. While the demand for services like fiber optic deployment and smart meter installation is growing, the significant upfront costs and the need for extensive certifications and licenses present substantial barriers.

Porter's Five Forces Analysis Data Sources

Our Solutions 30 Porter's Five Forces analysis is built upon a foundation of publicly available company filings, including annual reports and investor presentations. We also leverage industry-specific market research reports and reputable financial news outlets to capture current competitive dynamics.