Regeneron Pharmaceuticals PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Regeneron Pharmaceuticals Bundle

Unlock the strategic advantages Regeneron Pharmaceuticals holds by understanding the intricate web of political, economic, social, technological, legal, and environmental factors influencing its operations. Our comprehensive PESTLE analysis reveals how these external forces are shaping the biopharmaceutical landscape, offering you a critical edge in your own market strategy. Dive deep into actionable intelligence and download the full version now to gain a clearer vision of Regeneron's future.

Political factors

Government healthcare policies, especially in key markets like the U.S. and EU, wield substantial influence over pharmaceutical operations. Regeneron's financial performance is directly tied to drug pricing regulations, reimbursement frameworks, and evolving healthcare reforms.

For instance, the Inflation Reduction Act in the U.S. has introduced measures to negotiate Medicare drug prices, potentially impacting future revenue streams for Regeneron's blockbuster drugs. In 2024, the Centers for Medicare & Medicaid Services (CMS) announced its initial list of ten drugs subject to negotiation, highlighting the increasing government scrutiny on drug costs.

The speed and stringency of regulatory approvals from agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) significantly influence Regeneron's ability to bring new treatments to market. For instance, the FDA's review timelines for novel drugs can vary, impacting the pace of pipeline advancement. Stricter requirements or unexpected delays in the approval process for Regeneron's promising drug candidates, such as those in oncology or immunology, can directly affect its revenue projections and market competitiveness.

Beyond initial approvals, the regulatory environment also encompasses ongoing post-market surveillance and potential labeling changes. These ongoing regulatory obligations require continuous investment and can introduce unforeseen challenges. For example, any adverse event reporting or post-marketing studies mandated by regulatory bodies can influence a drug's commercial viability and Regeneron's operational focus.

Robust intellectual property (IP) protection is crucial for Regeneron, a company heavily reliant on its innovations. Strong patent laws safeguard the significant investments made in research and development, ensuring a period of market exclusivity for new therapies. For instance, in 2023, Regeneron's revenue was heavily influenced by its patented products, underscoring the financial importance of IP.

International Trade Relations and Market Access

Regeneron's global reach means international trade relations are critical. Changes in trade agreements, tariffs, and overall geopolitical stability directly impact its ability to access markets and manage its supply chain effectively. For instance, the USMCA (United States-Mexico-Canada Agreement), which replaced NAFTA, continues to shape North American trade dynamics for pharmaceutical companies, influencing sourcing and distribution networks.

Disruptions or shifts in trade policies can significantly alter the cost of raw materials, manufacturing processes, and the logistics of distributing its innovative medicines worldwide. Regeneron's extensive international collaborations and global manufacturing footprint make it particularly sensitive to these evolving trade landscapes. In 2023, the pharmaceutical industry continued to navigate complex trade environments, with ongoing discussions around intellectual property rights and market access in key regions like China and India.

- Trade Agreements: The continued implementation and potential renegotiation of trade pacts like the USMCA and EU trade deals directly influence Regeneron's operational costs and market entry strategies.

- Tariffs: Imposition or removal of tariffs on imported raw materials or finished pharmaceutical products can impact Regeneron's cost of goods sold and pricing strategies in various international markets.

- Geopolitical Stability: Political instability in key regions can disrupt supply chains, hinder market access, and affect the company's ability to conduct clinical trials or secure regulatory approvals.

- Market Access Barriers: Protectionist policies or complex regulatory hurdles in certain countries can limit Regeneron's ability to bring its therapies to patients, impacting revenue potential.

Lobbying and Political Contributions

Regeneron Pharmaceuticals actively participates in lobbying to shape policies impacting the biopharmaceutical sector, particularly concerning drug pricing and research and development incentives. In 2023, the pharmaceutical and health products industry spent approximately $365 million on federal lobbying efforts in the United States, according to OpenSecrets.org. Regeneron's own political contributions, while not always publicly itemized to the dollar for specific legislative pushes, align with broader industry advocacy for favorable regulatory environments and intellectual property protections.

The company's engagement aims to influence legislation that affects drug approval processes, reimbursement rates, and competition from biosimilars. This advocacy is crucial for maintaining market access and profitability in a highly regulated industry. For instance, debates surrounding the Inflation Reduction Act's drug price negotiation provisions directly impact pharmaceutical companies like Regeneron, making lobbying a key strategic component.

Transparency regarding political contributions and lobbying activities is a growing concern for stakeholders. While Regeneron adheres to disclosure requirements, the increasing scrutiny on these practices means that the company must carefully manage its political engagement to avoid reputational damage.

Key areas of focus for Regeneron's lobbying efforts include:

- Advocacy for robust intellectual property rights to protect innovation.

- Influencing policies related to Medicare and Medicaid drug pricing.

- Promoting legislation that supports biopharmaceutical research and development funding.

- Engaging with policymakers on issues of market access and regulatory pathways.

Government healthcare policies significantly shape Regeneron's operational landscape, particularly concerning drug pricing and reimbursement. The Inflation Reduction Act, for instance, empowers Medicare to negotiate prices for certain high-cost drugs, a move that began impacting drug costs in 2024, with the first negotiated prices expected in 2026. This policy directly influences Regeneron's revenue potential for its key therapies.

Regulatory approvals from agencies like the FDA and EMA are critical for market access and revenue generation. The time taken for these approvals directly impacts the commercialization timeline for new treatments. For example, any delays in the approval of Regeneron's pipeline candidates could shift projected earnings and market competitiveness.

Intellectual property protection remains paramount, safeguarding Regeneron's substantial R&D investments and ensuring market exclusivity. The strength and duration of patents directly correlate with the company's ability to recoup development costs and generate profits from its innovative medicines.

Regeneron's global operations are sensitive to international trade dynamics and geopolitical stability. Trade agreements and tariffs can influence supply chain costs and market access, while political instability can disrupt operations and regulatory pathways. The company's extensive international presence means it must continually adapt to these evolving global conditions.

What is included in the product

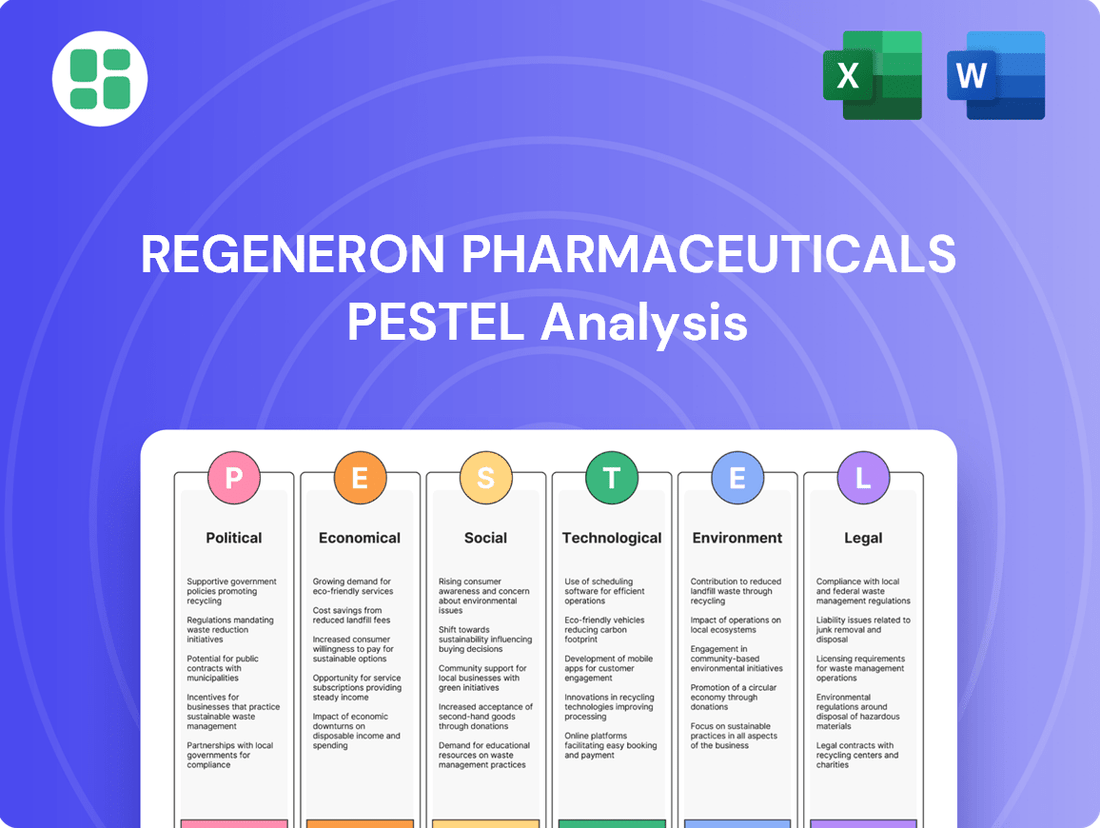

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting Regeneron Pharmaceuticals, detailing how Political, Economic, Social, Technological, Environmental, and Legal factors present both challenges and strategic opportunities.

A concise PESTLE analysis of Regeneron Pharmaceuticals, presented in an easily digestible format, serves as a crucial pain point reliever by providing a clear overview of external factors influencing the company's strategic decisions.

This analysis, segmented by PESTEL categories, allows for quick interpretation, alleviating the pain of sifting through extensive data and enabling faster, more informed strategic planning.

Economic factors

Global economic health significantly influences healthcare spending. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a stable rate that supports consistent healthcare investment. This generally translates to more robust sales for companies like Regeneron, as governments, insurers, and individuals have more disposable income for medical treatments.

However, economic slowdowns present challenges. If global growth falters, as seen in potential regional recessions, governments might reduce healthcare budgets. Insurers could also tighten reimbursement policies, and individuals might delay or forgo treatments, all of which could pressure Regeneron's revenue streams and necessitate a closer look at drug pricing strategies.

Regeneron's revenue is significantly influenced by drug reimbursement policies. In 2024, approximately 46.5% of Regeneron's net product sales were to government payers, including Medicare and Medicaid, highlighting the critical role of these programs in patient access and company revenue.

Changes in payer coverage and formulary placement directly impact Regeneron's sales volume and the net prices realized for its innovative therapies. For instance, shifts in Medicare Part D coverage rules or private insurer formulary decisions can alter patient out-of-pocket costs, affecting prescription uptake.

The evolving landscape of payer negotiations and the increasing focus on value-based pricing models present ongoing challenges and opportunities for Regeneron. Navigating these complex dynamics is crucial for maintaining market access and ensuring the long-term commercial success of its product portfolio.

Regeneron's commitment to research and development is the engine of its growth, requiring significant and consistent financial backing. In 2023, the company reported $3.3 billion in R&D expenses, a testament to its focus on innovation.

The capacity to fund these crucial, long-term investments is directly tied to broader economic conditions, particularly interest rates and the overall health of capital markets. When interest rates are favorable and capital is accessible, Regeneron can more readily secure the funding needed for its high-risk, high-reward scientific endeavors.

A strong financial standing, evidenced by robust revenue streams and healthy cash flow, empowers Regeneron to maintain its R&D momentum. This financial resilience is paramount for sustaining a pipeline of novel therapies and staying competitive in the fast-evolving biopharmaceutical landscape.

Inflation and Cost Pressures

Inflationary pressures directly impact Regeneron's operational expenses, potentially increasing the cost of essential raw materials, complex manufacturing processes, and skilled labor. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase in 2024, impacting various sectors, including pharmaceuticals.

Effectively managing these escalating operational costs is paramount for Regeneron to safeguard its profit margins. The company's strategic decisions regarding pricing and cost containment will be key indicators of its financial resilience in this environment.

- Rising Input Costs: Increased inflation can lead to higher prices for active pharmaceutical ingredients (APIs), specialized chemicals, and packaging materials, directly affecting Regeneron's cost of goods sold.

- Labor Expenses: Wage inflation, particularly for highly skilled scientists and manufacturing personnel, adds to Regeneron's overhead, requiring careful workforce management and compensation strategies.

- Supply Chain Volatility: Broader inflationary trends often coincide with supply chain disruptions, further complicating procurement and potentially driving up logistics and inventory carrying costs for Regeneron.

Currency Exchange Rate Fluctuations

Regeneron's status as a global pharmaceutical company means its international sales and revenues are significantly influenced by currency exchange rate fluctuations. When the U.S. dollar strengthens, for example, it can reduce the reported value of revenues earned in foreign currencies when those amounts are converted back into dollars. This can directly impact Regeneron's overall financial performance and reported earnings.

For instance, in the first quarter of 2024, Regeneron reported that unfavorable foreign currency movements had a modest negative impact on its reported net sales. While specific percentages can vary quarterly, this highlights the ongoing sensitivity of its financial results to global currency markets.

- Global Operations Sensitivity: Regeneron's diverse international markets expose it to the risk of currency depreciation affecting its reported earnings.

- U.S. Dollar Strength Impact: A strong USD can make Regeneron's products more expensive for international buyers, potentially dampening sales volume or forcing price adjustments.

- Q1 2024 Performance: Unfavorable currency fluctuations were noted to have a slight negative effect on Regeneron's reported net sales in early 2024, underscoring the ongoing financial impact.

- Hedging Strategies: Pharmaceutical companies like Regeneron often employ financial instruments to hedge against currency risks, aiming to mitigate the volatility of international revenue streams.

Global economic health directly impacts healthcare spending, with the IMF projecting 3.2% global growth in 2024, supporting consistent healthcare investment. However, economic downturns can lead to reduced healthcare budgets and tighter reimbursement policies, potentially pressuring Regeneron's revenue. Approximately 46.5% of Regeneron's 2023 net product sales were to government payers, highlighting their critical role.

What You See Is What You Get

Regeneron Pharmaceuticals PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Regeneron Pharmaceuticals delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions. You'll gain a clear understanding of the external forces shaping the biopharmaceutical landscape.

Sociological factors

The world's population is getting older, with projections indicating that by 2050, nearly 17% of the global population will be over 65. This demographic shift, coupled with an increasing prevalence of chronic conditions like cardiovascular diseases and various eye disorders, directly fuels demand for Regeneron's specialized treatments. For instance, age-related macular degeneration (AMD), a key focus for Regeneron, affects millions globally, with its incidence expected to rise significantly with an aging populace.

Growing public awareness about health conditions and the increasing influence of patient advocacy groups are significantly shaping the pharmaceutical landscape. These groups actively lobby for specific treatments and can sway public opinion about companies like Regeneron. For instance, the growing patient-led movement advocating for access to advanced therapies for rare genetic diseases directly impacts market demand and R&D priorities.

Regeneron's proactive engagement with these advocacy organizations, coupled with its focus on ensuring patient access to its innovative treatments, is crucial for building trust and market acceptance. By demonstrating a commitment to patient education and support programs, Regeneron can foster a positive brand image, which is increasingly important in a market where patient voices are amplified.

Societal shifts towards more sedentary lifestyles and processed food consumption are contributing to a rise in metabolic and inflammatory diseases, areas Regeneron actively researches. For instance, global obesity rates continue to climb, with the World Health Organization reporting in 2024 that over 1 billion people are now classified as obese, a significant driver for conditions like diabetes and cardiovascular disease that Regeneron targets.

These evolving lifestyle trends directly influence the market demand for Regeneron's therapeutic areas. As awareness grows around the impact of diet and exercise on chronic illness, there's an increasing patient and physician interest in innovative treatments for conditions like non-alcoholic steatohepatitis (NASH) and autoimmune disorders, aligning with Regeneron's R&D pipeline and commercial strategies.

Public Perception and Trust in Biotechnology

Public trust is a significant factor for biotechnology firms like Regeneron, particularly as innovative treatments such as gene therapies become more prevalent. A recent survey in late 2024 indicated that while public enthusiasm for medical advancements is high, concerns about the long-term safety and ethical implications of gene editing technologies remain. Regeneron's proactive approach to communicating its research findings and engaging with patient advocacy groups directly impacts how these new therapies are received.

Regeneron's dedication to maintaining high ethical standards and transparency throughout its drug development process is paramount. This commitment fosters greater public acceptance, which in turn encourages patient participation in clinical trials and willingness to utilize novel treatments. For instance, Regeneron's ongoing efforts to clearly explain the benefits and risks associated with its gene therapy candidates, like those for rare genetic diseases, are vital for building confidence.

The perception of pharmaceutical companies, including Regeneron, is often shaped by media coverage and public discourse surrounding drug pricing and accessibility. In 2024, discussions around the affordability of advanced therapies continued, highlighting the need for companies to demonstrate value beyond the scientific innovation. Regeneron's strategies for ensuring patient access to its life-changing medicines are therefore closely scrutinized and influence overall public trust.

- Public Opinion on Gene Therapies: A 2024 Pew Research Center study found that 65% of Americans are optimistic about gene therapies, but 40% express concerns about potential unintended consequences.

- Transparency Initiatives: Regeneron's commitment to publishing clinical trial data on platforms like ClinicalTrials.gov aims to enhance transparency and build trust with the scientific community and the public.

- Ethical Frameworks: The company adheres to established ethical guidelines for genetic research, which are crucial for maintaining public confidence in its innovative approaches to medicine.

Healthcare Accessibility and Equity

Societal demands for equitable healthcare access and affordable medicines are intensifying, placing considerable pressure on pharmaceutical giants like Regeneron. This trend is driven by a growing awareness of health disparities and the rising cost of innovative treatments.

Regeneron's commitment to broadening access to its medicines through patient assistance programs is crucial for maintaining its social license to operate and ensuring long-term sustainability. For instance, in 2023, Regeneron's patient assistance programs helped thousands of eligible patients access its therapies, demonstrating a tangible impact on healthcare equity.

- Increased Scrutiny on Drug Pricing: Public and governmental pressure to lower prescription drug costs continues to mount, influencing market access and reimbursement strategies.

- Patient Advocacy and Demand for Access: Strong patient advocacy groups are pushing for greater affordability and accessibility of life-saving treatments.

- Focus on Health Equity: A growing societal emphasis on reducing health disparities means companies are evaluated on their efforts to serve underserved populations.

Societal trends toward aging populations and increased chronic disease prevalence directly boost demand for Regeneron's treatments, particularly for conditions like age-related macular degeneration. Furthermore, growing public awareness and the influence of patient advocacy groups are shaping market priorities and R&D focus for the company.

Evolving lifestyle choices, such as more sedentary habits, contribute to a rise in metabolic and inflammatory diseases, aligning with Regeneron's research areas. Public trust in innovative therapies, especially gene therapies, remains a critical factor, with ongoing discussions about safety and ethical considerations influencing patient acceptance.

Societal pressure for equitable healthcare access and affordable medicines intensifies, pushing companies like Regeneron to demonstrate value beyond scientific breakthroughs. Regeneron's patient assistance programs and transparency in clinical data are key to fostering public confidence and ensuring long-term market viability.

| Sociological Factor | Impact on Regeneron | Relevant Data (2024/2025) |

|---|---|---|

| Aging Population & Chronic Diseases | Increased demand for treatments | By 2050, nearly 17% of global population over 65. Millions affected by AMD. |

| Patient Advocacy & Public Awareness | Influences R&D and market access | Patient-led movements for rare disease therapies. |

| Lifestyle Trends (Sedentary, Diet) | Drives demand for metabolic/inflammatory disease treatments | Over 1 billion people classified as obese globally (WHO, 2024). |

| Public Trust in Gene Therapies | Affects adoption of novel treatments | 65% optimistic about gene therapies, 40% concerned about unintended consequences (Pew Research, 2024). |

| Healthcare Access & Affordability Demands | Pressures pricing and reimbursement strategies | Continued scrutiny on drug pricing; patient assistance programs vital. |

Technological factors

Regeneron's proprietary VelociSuite technologies are a cornerstone of its competitive advantage, powering the discovery of fully human antibodies and bispecific antibodies. This advanced platform allows for rapid and efficient identification of therapeutic candidates, a key differentiator in the biopharmaceutical industry.

The company's commitment to continuous innovation within these platforms is crucial for sustaining a diverse and robust pipeline of potential new medicines. For instance, advancements in VelociGene and VelocImmune have been instrumental in developing treatments for a range of diseases, contributing to Regeneron's strong market position.

The field of genetic medicine is accelerating, with technologies like CRISPR gene editing and sophisticated cell therapies rapidly advancing. Regeneron is actively participating in this evolution, recognizing its critical role in developing future treatments and maintaining a competitive edge.

Regeneron's commitment to these innovative areas is evident through its strategic investments and partnerships. For instance, in 2023, Regeneron continued to expand its pipeline of gene-editing programs, targeting rare genetic diseases. These efforts are crucial for unlocking new therapeutic possibilities and ensuring the company remains at the forefront of medical innovation.

Regeneron is actively integrating AI and machine learning into its research and development pipeline, a trend that is revolutionizing drug discovery. This technological shift is accelerating the identification of potential drug targets and optimizing clinical trial designs. For instance, by leveraging vast genetic datasets, such as those from collaborations, Regeneron aims to pinpoint novel therapeutic avenues more efficiently.

Innovation in Biomanufacturing Processes

Technological advancements are significantly reshaping biomanufacturing, enabling more efficient and cost-effective production of complex biologic drugs. These innovations are critical for companies like Regeneron to scale their operations and meet the growing global demand for their therapies.

Regeneron's strategic investments in manufacturing capacity, including its large-scale facilities, are designed to leverage these technological leaps. For instance, their collaboration with Fujifilm Diosynth Biotechnologies, announced in 2021, aims to expand biologics manufacturing capabilities, bolstering supply chain resilience.

The company's focus on advanced bioprocessing technologies allows for higher yields and faster production cycles. This technological edge is vital for bringing innovative treatments to market quickly and affordably.

Key aspects of innovation in Regeneron's biomanufacturing include:

- Continuous manufacturing processes, which can improve efficiency and reduce waste compared to traditional batch methods.

- Single-use technologies, offering flexibility and reducing the risk of cross-contamination, speeding up process development.

- Data analytics and automation, enhancing process control, quality assurance, and overall operational performance.

- Cell line development, improving the productivity and robustness of the biological systems used to produce medicines.

Digital Health and Personalized Medicine Trends

The increasing adoption of digital health tools, such as wearable devices and remote patient monitoring, is generating vast amounts of real-world data. This data is crucial for understanding drug efficacy and patient adherence outside of clinical trials. For instance, by mid-2025, it's projected that over 70% of healthcare providers will be utilizing some form of digital health platform for patient management.

Personalized medicine, driven by advancements in genomics and AI, is transforming drug development by enabling more precise patient stratification. Regeneron's focus on antibody-based therapies aligns well with this trend, allowing for the development of treatments tailored to specific genetic profiles. In 2024, the global personalized medicine market was valued at approximately $50 billion, with significant growth anticipated in the coming years.

Regeneron's strategic imperative involves integrating these technological advancements to refine its R&D pipeline and commercialization efforts. This includes leveraging real-world data analytics for better clinical trial design and patient selection, as well as exploring digital platforms for enhanced patient engagement and treatment monitoring. The company's investment in data science capabilities is key to capitalizing on these evolving healthcare dynamics.

- Digital Health Adoption: Over 70% of healthcare providers expected to use digital health platforms by mid-2025.

- Personalized Medicine Market: Valued at around $50 billion in 2024, with strong growth projections.

- Data-Driven R&D: Real-world data analytics are becoming essential for optimizing clinical trials and patient targeting.

- Regeneron's Strategy: Integration of digital health and personalized medicine approaches to enhance drug development and outcomes.

Regeneron's proprietary VelociSuite technologies, including VelociGene and VelocImmune, are central to its drug discovery, enabling the rapid identification of fully human antibodies. The company actively integrates AI and machine learning into its R&D, accelerating target identification and clinical trial design, exemplified by its 2023 expansion of gene-editing programs.

Technological advancements in biomanufacturing are enhancing efficiency and scalability, with Regeneron leveraging these through collaborations like the one with Fujifilm Diosynth Biotechnologies. Innovations such as continuous manufacturing and single-use technologies are key to their production strategy, aiming for higher yields and faster market entry.

The rise of digital health is generating vast real-world data, with over 70% of healthcare providers projected to use digital platforms by mid-2025, impacting patient monitoring and drug efficacy understanding. Personalized medicine, a $50 billion market in 2024, is also a significant driver, aligning with Regeneron's antibody-based therapies for tailored treatments.

| Technology Area | Regeneron's Application/Focus | Market Trend/Impact |

|---|---|---|

| VelociSuite Platforms | Antibody discovery, bispecific antibodies | Enables rapid identification of therapeutic candidates |

| AI & Machine Learning | Drug target identification, clinical trial optimization | Accelerates R&D, improves efficiency |

| Biomanufacturing | Continuous manufacturing, single-use tech | Enhances production efficiency, scalability |

| Digital Health | Real-world data, patient monitoring | Improves understanding of drug efficacy and adherence |

| Personalized Medicine | Genomics, AI-driven patient stratification | Facilitates tailored treatments, growing market |

Legal factors

Regeneron Pharmaceuticals places immense importance on safeguarding its vast patent portfolio, which is crucial for maintaining market exclusivity for its innovative therapies.

Legal battles, including patent infringement claims and the emergence of biosimilar competitors, directly threaten the revenue generated by Regeneron's top-selling medications. For instance, ongoing disputes surrounding patents for key drugs like Eylea highlight the financial stakes involved.

Recent settlements in intellectual property disputes underscore the necessity of strong legal strategies and proactive defense of its innovations. These legal actions are critical to protecting Regeneron's competitive edge and profitability in the pharmaceutical landscape.

Regeneron Pharmaceuticals operates under a strict global regulatory environment, necessitating compliance with agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) for drug approvals and market access. For instance, in 2023, the FDA approved two new indications for Regeneron's Dupixent, highlighting the ongoing need for regulatory navigation. Failure to adhere to these rigorous standards, which cover clinical trial conduct, manufacturing quality, and post-market safety monitoring, can result in substantial fines or the forced withdrawal of products from key markets.

Pharmaceutical companies, including Regeneron, are constantly exposed to product liability risks stemming from allegations of adverse drug reactions or inadequate efficacy. These lawsuits can lead to substantial financial penalties and reputational damage.

In 2023, the pharmaceutical industry continued to see significant settlements in product liability cases, with some major companies facing multi-billion dollar judgments. Regeneron's commitment to stringent quality control and transparent communication about its products is crucial for navigating this legal landscape.

To mitigate these risks, Regeneron invests heavily in post-market surveillance and pharmacovigilance programs. Adherence to evolving regulatory guidelines from bodies like the FDA and EMA is paramount in minimizing litigation exposure and associated costs, which can impact profitability and investor confidence.

Anti-Trust and Competition Laws

Regeneron, as a prominent biotechnology firm, navigates a landscape shaped by anti-trust and competition laws aimed at fostering fair market practices and preventing monopolies. These regulations are particularly relevant given the company's significant market share in certain therapeutic areas.

The scrutiny of drug pricing and market dominance by regulatory bodies, such as the Federal Trade Commission (FTC) in the United States, poses a continuous risk. For instance, in early 2024, ongoing discussions and potential legislative actions regarding pharmaceutical pricing in the US could impact Regeneron's strategies.

- Regulatory Oversight: Regeneron faces potential investigations into its market practices and pricing strategies.

- Merger and Acquisition Scrutiny: Any future acquisitions by Regeneron would be subject to anti-trust review to ensure they do not unduly reduce competition.

- Pricing Transparency Demands: Increased calls for drug pricing transparency could lead to greater regulatory oversight and potential challenges to pricing models.

- Global Competition Landscape: International competition authorities also monitor Regeneron's activities to ensure compliance with local competition laws.

Data Privacy and Cybersecurity Regulations

Regeneron Pharmaceuticals must navigate a complex web of data privacy and cybersecurity regulations. Strict adherence to laws like HIPAA in the US and GDPR in Europe is crucial for handling sensitive patient data and proprietary research. Failure to comply can lead to significant financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. Maintaining robust cybersecurity is not just a legal requirement but also essential for preventing breaches that could compromise patient confidentiality and intellectual property, thereby safeguarding Regeneron's reputation and market trust.

The legal landscape for data handling is continually evolving, requiring ongoing investment in compliance and security infrastructure. In 2024, the focus on data protection is intensifying globally, with new regulations and stricter enforcement anticipated. For a company like Regeneron, which relies heavily on clinical trial data and R&D insights, this means:

- Maintaining up-to-date data privacy policies and procedures aligned with evolving international standards.

- Implementing advanced cybersecurity measures, including encryption, access controls, and regular vulnerability assessments.

- Ensuring all third-party vendors handling sensitive data also meet stringent privacy and security requirements.

- Proactively addressing potential legal challenges related to data breaches or non-compliance, which could impact operational continuity and financial performance.

Regeneron's legal and regulatory environment is a critical factor, demanding strict adherence to global pharmaceutical regulations, including those from the FDA and EMA, as seen with the 2023 approvals for Dupixent.

The company actively defends its intellectual property, as evidenced by ongoing patent disputes for key drugs like Eylea, which directly impact revenue streams and market exclusivity.

Navigating product liability risks and evolving data privacy laws, such as GDPR with potential fines up to 4% of global revenue, requires substantial investment in compliance and robust cybersecurity measures to protect patient data and IP.

Antitrust and competition laws also shape Regeneron's operations, particularly concerning drug pricing and market dominance, with ongoing discussions in 2024 potentially influencing future strategies.

Environmental factors

Regeneron's operational footprint, encompassing energy use, water consumption, and waste output, faces growing environmental oversight. In 2023, the company reported reducing its greenhouse gas emissions intensity by 28% compared to a 2019 baseline, demonstrating a commitment to operational sustainability.

Adopting sustainable methods throughout its manufacturing facilities and supply network is vital for minimizing ecological harm and meeting evolving regulatory demands. Regeneron's focus on renewable energy sources for its Tarrytown, NY campus, for instance, highlights its proactive approach to environmental stewardship.

The complex processes involved in pharmaceutical manufacturing, like those at Regeneron, inherently create hazardous waste streams. Adherence to stringent environmental regulations concerning the disposal of these materials and the control of pollution is paramount. Failure to comply can lead to significant financial penalties, legal entanglements, and severe damage to the company's public image.

Regeneron's commitment to sustainability includes actively pursuing initiatives to minimize plastic waste and reduce the use of hazardous substances throughout its operations. For instance, in 2023, many pharmaceutical companies reported investing millions in advanced waste treatment technologies to meet evolving environmental standards.

Climate change presents significant risks to Regeneron's operations, from supply chain disruptions caused by extreme weather to potential increases in climate-sensitive diseases impacting research and development. For instance, the increasing frequency of severe weather events globally, such as those experienced in 2024, can directly affect the transportation and availability of raw materials crucial for pharmaceutical manufacturing.

Regeneron actively monitors and evaluates these climate-related risks as part of its broader environmental sustainability strategy. The company's commitment to mitigating these impacts is demonstrated through initiatives aimed at reducing its carbon footprint and enhancing operational resilience against environmental shifts, ensuring business continuity.

Ethical Sourcing and Resource Management

Regeneron's focus on ethical sourcing and resource management is becoming increasingly critical. The company's commitment to responsible procurement of raw materials and minimizing its environmental footprint directly addresses growing global concerns about sustainability. This aligns with increasing stakeholder expectations for environmentally conscious business practices.

For instance, in 2023, Regeneron continued its efforts to reduce waste generation across its operations, with a target of a 15% reduction in non-hazardous waste by 2025 compared to a 2020 baseline. Their water conservation initiatives aim to decrease water intensity by 10% by 2027. These efforts demonstrate a tangible commitment to managing their resource use more efficiently.

- Ethical Sourcing: Ensuring raw materials are acquired without negative social or environmental impacts.

- Resource Footprint Reduction: Implementing strategies to minimize energy, water, and waste consumption.

- Stakeholder Expectations: Meeting the growing demand from investors, customers, and employees for sustainable operations.

- Operational Efficiency: Driving cost savings and improving long-term resilience through responsible resource management.

Energy Consumption and Greenhouse Gas Emissions

Regeneron Pharmaceuticals is actively pursuing environmental sustainability by focusing on reducing its greenhouse gas (GHG) emissions and increasing its reliance on renewable energy. This commitment aligns with broader global efforts to combat climate change. The company has established specific targets to shrink its carbon footprint.

Key initiatives include transitioning to renewable electricity sources. For instance, in 2023, Regeneron reported that approximately 50% of its global electricity consumption was sourced from renewable energy. Their goal is to reach 100% renewable electricity by 2030, demonstrating a clear strategy for decarbonization.

- GHG Emission Reduction: Regeneron aims to reduce its absolute Scope 1 and Scope 2 GHG emissions by 50% by 2030, compared to a 2019 baseline.

- Renewable Electricity: The company is working towards sourcing 100% of its global electricity from renewable sources by 2030.

- Energy Efficiency: Investments in energy-efficient technologies and practices across its facilities are ongoing to lower overall energy consumption.

- Supply Chain Engagement: Regeneron is also engaging with its suppliers to encourage emission reductions within its value chain.

Regeneron's environmental strategy focuses on reducing its carbon footprint and resource consumption, driven by regulatory pressures and stakeholder expectations. The company reported a 28% reduction in greenhouse gas emissions intensity by 2023 compared to a 2019 baseline, showcasing progress in operational sustainability.

Climate change poses risks to Regeneron's supply chain and R&D, prompting proactive risk assessment and mitigation efforts. Initiatives like transitioning to renewable energy, with 50% of global electricity sourced renewably in 2023, underscore their commitment to reducing environmental impact.

The pharmaceutical industry's waste generation, particularly hazardous materials, necessitates strict adherence to environmental regulations. Regeneron's efforts to minimize waste, including a target of 15% reduction in non-hazardous waste by 2025, reflect a dedication to responsible resource management.

| Environmental Focus Area | 2023 Status/Target | 2024/2025 Outlook |

|---|---|---|

| Greenhouse Gas (GHG) Emissions Intensity Reduction | 28% reduction vs. 2019 baseline (reported 2023) | Continued reduction efforts towards 50% absolute Scope 1 & 2 GHG reduction by 2030 |

| Renewable Electricity Sourcing | 50% of global electricity consumption (reported 2023) | Targeting 100% renewable electricity by 2030 |

| Non-Hazardous Waste Reduction | Ongoing initiatives | Target of 15% reduction vs. 2020 baseline by 2025 |

| Water Conservation | Ongoing initiatives | Target to decrease water intensity by 10% by 2027 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Regeneron Pharmaceuticals is built on a robust foundation of data sourced from leading health organizations, regulatory bodies like the FDA and EMA, and comprehensive market research reports. We incorporate economic indicators from global financial institutions and track technological advancements through industry journals and patent filings.