MTU Aero Engines PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MTU Aero Engines Bundle

Navigate the complex global landscape impacting MTU Aero Engines with our expert-crafted PESTEL Analysis. Understand the political, economic, social, technological, environmental, and legal forces that shape its strategic decisions and future growth. Gain a competitive edge by leveraging these critical insights to refine your own market approach. Download the full version now for actionable intelligence.

Political factors

Heightened geopolitical tensions and a strong emphasis on national security are leading to substantial increases in defense budgets worldwide. This surge directly benefits MTU Aero Engines, especially through its military engine division. Programs like the Eurofighter's EJ200 engine are set to see continued demand, providing a reliable revenue source and opening doors for upgrades and new contract opportunities.

Germany's commitment to defense is particularly noteworthy. The country aims to more than double its defense spending by 2029, aligning with NATO's target of 3.5% of GDP. This significant investment translates into a more robust market for MTU's military engine solutions, supporting long-term growth prospects.

Changes in international trade policies, particularly the imposition of tariffs, directly affect MTU Aero Engines' global supply chain and overall cost of operations. The aerospace sector's intricate network of international suppliers means that trade barriers can disrupt production and increase expenses. For instance, a potential tariff increase in early 2025 could complicate the industry's recovery efforts, impacting MTU's import costs and its ability to offer competitive pricing on its engines and services.

Government regulations are a significant political factor for MTU Aero Engines. Strict aviation safety standards, like those mandated by the European Union Aviation Safety Agency (EASA) and the U.S. Federal Aviation Administration (FAA), dictate engine design, testing, and maintenance. Similarly, evolving emissions regulations, such as those aiming for a 20% reduction in CO2 emissions by 2035 under the ACARE Flightpath 2050 initiative, directly impact MTU's research and development priorities for cleaner propulsion systems.

Government support plays a crucial role in fostering innovation within the aerospace sector. For instance, Germany's Federal Ministry for Economic Affairs and Climate Action (BMWK) provides funding for advanced aerospace research, including projects focused on sustainable aviation technologies. MTU Aero Engines actively participates in these initiatives, leveraging public funding to advance its development of next-generation engines, including those powered by hydrogen fuel cells, a key area of investment for the company's future growth.

Geopolitical Stability and Conflicts

Global geopolitical instability, including ongoing conflicts, presents a mixed bag for MTU Aero Engines. Increased defense spending, a direct consequence of heightened global tensions, can significantly boost demand for MTU's military engine segment. For instance, in 2023, global military spending reached an estimated $2.4 trillion, a 9% increase in real terms from 2022, according to the Stockholm International Peace Research Institute (SIPRI). This trend suggests a stronger market for defense-related aerospace components and services.

However, broader geopolitical instability also poses challenges. Disruptions to commercial air travel and global supply chains can indirectly impact MTU's commercial engine business. Airlines facing reduced passenger traffic and profitability due to instability may scale back on new aircraft orders and maintenance services. Supply chain disruptions, a persistent issue amplified by global shocks, can also affect production timelines and costs for MTU's engines and spare parts.

- Increased defense budgets worldwide, reaching $2.4 trillion in 2023, directly benefit MTU's military segment.

- Geopolitical instability can lead to reduced airline profitability, potentially impacting commercial engine maintenance and new orders.

- Persistent supply chain disruptions, exacerbated by global events, continue to be a significant operational challenge for MTU.

Export Control and Sanctions

Strict export control regulations and international sanctions regimes significantly impact the aerospace industry, particularly for companies like MTU Aero Engines that operate globally. These frameworks govern the sale and transfer of sensitive aerospace technology, including advanced engine components and systems. For instance, the Wassenaar Arrangement, a multilateral export control regime, sets guidelines for conventional arms and dual-use goods and technologies. Failure to comply can lead to severe penalties and restrict market access.

MTU, as a key supplier for both commercial aviation and defense sectors, must meticulously navigate these complex legal landscapes. In 2023, the global aerospace market faced ongoing geopolitical tensions, with countries implementing targeted sanctions that could affect supply chains and customer relationships. MTU's adherence to these regulations is paramount for maintaining its international business operations and avoiding significant financial repercussions or reputational damage.

- Export Controls: MTU must comply with regulations like ITAR (International Traffic in Arms Regulations) in the US and similar frameworks in Europe, which restrict the export of defense-related technologies.

- Sanctions Regimes: International sanctions, such as those imposed by the EU and US on specific countries or entities, can directly impact MTU's ability to supply engines or services to certain markets.

- Market Access: Compliance with these regulations is critical for securing new contracts and maintaining partnerships, as non-compliance can result in denied export licenses or blacklisting.

- Risk Mitigation: MTU invests in robust compliance programs to identify and mitigate risks associated with export controls and sanctions, ensuring operational continuity and legal adherence.

Heightened geopolitical tensions continue to drive increased defense spending globally, directly benefiting MTU Aero Engines' military engine division. Germany's commitment to defense, aiming to more than double spending by 2029 to meet NATO's 3.5% GDP target, signifies a robust market for MTU's military solutions.

However, international trade policies, including potential tariffs in early 2025, pose challenges to MTU's global supply chain and cost structure. Strict export control regulations and sanctions regimes, such as those governed by the Wassenaar Arrangement, necessitate meticulous compliance to maintain market access and avoid penalties.

Government support, like funding from Germany's BMWK for sustainable aviation technologies, is crucial for MTU's R&D, particularly in areas like hydrogen fuel cells. Adherence to evolving aviation safety and emissions standards, such as EASA and FAA mandates and the ACARE Flightpath 2050 initiative, shapes MTU's product development priorities.

What is included in the product

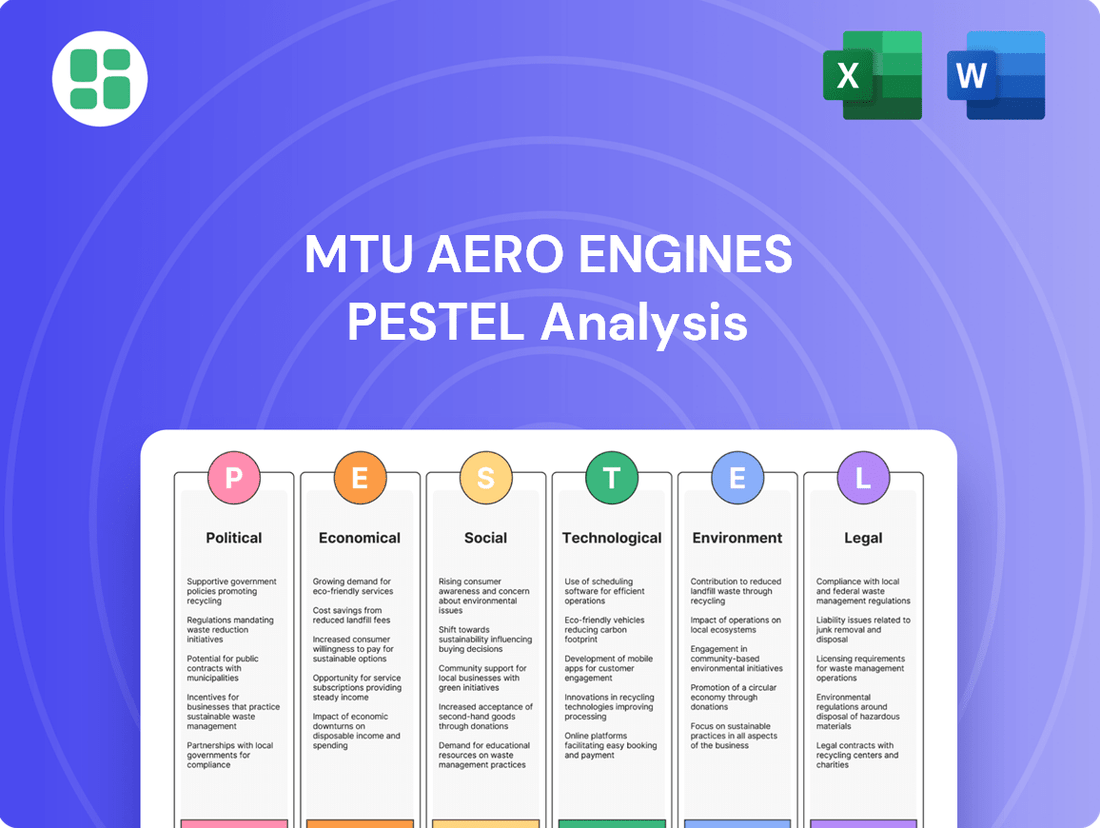

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing MTU Aero Engines across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and forward-looking perspectives to inform strategic decision-making and identify opportunities within the aerospace industry.

A concise MTU Aero Engines PESTLE analysis summary, presented in a visually segmented format by PESTEL categories, offers a quick and easy way to identify and address external challenges, thereby relieving the pain point of navigating complex market dynamics.

Economic factors

The global economic climate is a significant driver for MTU Aero Engines, directly influencing demand for both new engines and maintenance, repair, and overhaul (MRO) services. A robust global economy generally translates to higher passenger and cargo volumes, which in turn bolsters airline profitability and their willingness to invest in fleet modernization and engine upkeep.

MTU Aero Engines' performance in the first quarter of 2025, which saw strong results and a positive outlook for the full year, benefited from a favorable market. This positive environment was characterized by robust demand for spare parts and favorable trends within the military aerospace sector, underscoring the link between economic health and MTU's revenue streams.

Inflationary pressures and volatile raw material costs directly impact MTU Aero Engines' production expenses and overall profitability. The aerospace sector, including engine manufacturers, has grappled with escalating fuel prices and other operational expenditures, which can significantly compress profit margins for both airlines and original equipment manufacturers.

For instance, the price of key aerospace metals like titanium and nickel experienced fluctuations throughout 2023 and into early 2024, directly affecting MTU's input costs. While supply chain disruptions that plagued earlier years showed some signs of easing in 2024, with reported improvements in component lead times, the underlying cost pressures from these materials remain a significant factor.

MTU Aero Engines, as a global player, faces significant risks and opportunities from fluctuating exchange rates, especially between the Euro and the US Dollar. These currency movements directly impact its international revenues and the profitability of its overseas operations.

For instance, MTU's financial outlook for 2025 is built on an assumed exchange rate of 1.10 US dollars per Euro. A stronger US Dollar relative to the Euro, meaning the rate goes above 1.10, would generally boost MTU's reported revenues and earnings when translated back into Euros.

Conversely, a weaker US Dollar below the 1.10 mark would have the opposite effect, potentially reducing the Euro-denominated value of its US dollar earnings. This makes managing currency exposure a critical aspect of MTU's financial strategy.

Supply Chain Disruptions and Resilience

Ongoing supply chain inefficiencies and parts shortages continue to challenge the aerospace sector, impacting production schedules and delivery commitments. These persistent disruptions, coupled with labor issues, directly affect MTU Aero Engines' ability to maintain optimal operational efficiency and meet market demand for its engine services and components.

The aerospace and defense industry experienced a notable surge in labor disruptions, with a 33% increase observed in 2024. This trend exacerbates existing challenges, potentially delaying new aircraft deliveries and extending maintenance, repair, and overhaul (MRO) turnaround times, which are critical for MTU's service business.

- Supply Chain Inefficiencies: Persistent global supply chain bottlenecks continue to affect the availability of critical components.

- Parts Shortages: Limited access to specialized aerospace parts directly impacts manufacturing and MRO timelines.

- Labor Disruptions: A 33% rise in labor disruptions within aerospace and defense in 2024 highlights workforce instability as a key concern.

- Impact on Deliveries: These combined factors can lead to delays in new aircraft deliveries and slower MRO turnaround times, affecting MTU's revenue streams.

Interest Rates and Access to Capital

Fluctuations in interest rates directly impact MTU Aero Engines and its airline clientele by altering borrowing costs. This, in turn, shapes investment decisions and the pace of fleet upgrades. For instance, a sustained period of elevated interest rates, as seen in early 2024 with the US Federal Reserve maintaining its benchmark rate above 5%, can significantly increase the expense of financing new aircraft and engine acquisitions. This makes it more challenging for airlines to commit to large capital expenditures, potentially leading to a slowdown in new engine orders for MTU.

The broader aerospace industry is also grappling with financing accessibility. A significant concern for nearly half of aerospace companies surveyed in 2025 indicated that securing adequate financing is becoming a growing challenge. This suggests that even as demand for air travel recovers, potential financial constraints could limit the industry's ability to invest in new technologies and fleet expansion, which directly affects engine manufacturers like MTU.

- Interest Rate Impact: Higher interest rates, such as those maintained by central banks in 2024, increase the cost of capital for airlines, potentially delaying aircraft orders.

- Financing Concerns: In 2025, almost 50% of aerospace firms reported difficulties accessing finance, highlighting a critical bottleneck for industry growth and investment.

- Fleet Modernization: Increased borrowing costs can slow down airlines' plans to modernize their fleets, impacting demand for new, fuel-efficient engines from manufacturers like MTU.

Economic growth directly fuels demand for air travel and cargo, benefiting MTU Aero Engines through increased engine sales and MRO services. MTU's Q1 2025 performance, marked by strong demand in spare parts and military aerospace, highlights this correlation.

Inflationary pressures and fluctuating raw material costs, such as for titanium and nickel in 2023-2024, directly impact MTU's production expenses. Despite some easing of supply chain issues in 2024, these input cost pressures persist.

Exchange rate volatility, particularly between the Euro and US Dollar, significantly affects MTU's international revenues; the company's 2025 outlook assumes a 1.10 USD/EUR rate.

Rising interest rates, exemplified by the US Federal Reserve's rates above 5% in early 2024, increase financing costs for airlines, potentially delaying new aircraft and engine orders. Furthermore, nearly 50% of aerospace companies faced financing challenges in 2025.

Preview the Actual Deliverable

MTU Aero Engines PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing a comprehensive PESTLE analysis for MTU Aero Engines. This includes an in-depth examination of Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic landscape. You will gain immediate access to this professionally structured report upon completing your purchase.

Sociological factors

Public awareness of climate change and aviation's environmental footprint is growing, directly impacting consumer choices and increasing regulatory scrutiny. This heightened concern puts pressure on the industry to demonstrate tangible sustainability progress.

Despite a strong rebound in air travel demand, the sector faces persistent questions about its environmental responsibility. For example, the International Air Transport Association (IATA) has set targets for net-zero carbon emissions by 2050, reflecting this industry-wide challenge.

MTU Aero Engines is proactively tackling these issues by investing heavily in research and development for technologies that reduce emissions. Their focus on advancements like geared turbofan engines and exploring the potential of sustainable aviation fuels (SAFs) shows a commitment to addressing these environmental concerns head-on.

The aerospace sector, including companies like MTU Aero Engines, grapples with ongoing shortages of skilled labor, affecting both manufacturing and maintenance, repair, and overhaul (MRO) activities. This talent deficit is a significant hurdle for operational continuity and expansion.

Job openings within the aerospace industry saw a further increase of 9% in 2024, highlighting the growing demand for qualified personnel. Consequently, retaining existing employees has become a paramount concern for industry executives, underscoring the critical need for effective human capital management strategies.

For MTU Aero Engines, which employs more than 13,000 individuals worldwide, proactively addressing these labor availability and skills gap challenges is essential. Strategic workforce planning and development are crucial to maintaining operational efficiency and supporting future growth objectives.

The core of MTU Aero Engines' commercial sector relies heavily on global consumer desire for air travel. This demand has rebounded robustly following the pandemic, with projections indicating a significant upswing.

Global air passenger traffic is anticipated to expand by almost 12% in 2025, a clear indicator of increasing travel frequency. This sustained growth in both passenger and cargo movement directly fuels the need for new aircraft engines, replacement parts, and essential maintenance services, benefiting MTU.

Workforce Diversity and Inclusion Initiatives

Societal expectations are increasingly pushing companies to prioritize diversity and inclusion within their workforces, recognizing it as crucial for attracting and retaining top talent. MTU Aero Engines, with its global team representing over 80 nationalities, demonstrates a tangible commitment to fostering a diverse environment. This focus on diversity and inclusion isn't just about social responsibility; it's a strategic lever that can significantly boost innovation and overall employee satisfaction.

Companies that actively promote diversity often see tangible benefits. For instance, a 2023 McKinsey report highlighted that companies in the top quartile for ethnic and cultural diversity on executive teams were 39% more likely to outperform on profitability compared to those in the bottom quartile. Similarly, for gender diversity, top-quartile companies were 25% more likely to have above-average profitability. This suggests a strong correlation between diverse leadership and financial success.

- Talent Attraction: Diverse and inclusive workplaces are more appealing to a broader talent pool, crucial in specialized fields like aerospace engineering.

- Innovation Boost: Varied perspectives from a diverse workforce can lead to more creative problem-solving and product development.

- Employee Engagement: Inclusive environments foster a sense of belonging, leading to higher employee morale and retention rates.

- Reputational Enhancement: A strong commitment to diversity and inclusion positively impacts a company's public image and brand value.

Social Responsibility and Ethical Business Practices

Societal expectations for companies to act responsibly and ethically are growing significantly. This includes a strong focus on upholding human rights and actively combating corruption. MTU Aero Engines, by participating in the UN Global Compact, publicly commits to these fundamental principles. This integration is evident across its corporate governance structures, its approach to managing its supply chain, and its overarching business strategy.

This dedication to social responsibility and ethical conduct directly impacts MTU's standing. It plays a crucial role in building and maintaining a positive corporate reputation, which in turn fosters greater trust among its diverse stakeholders. For instance, in 2023, MTU reported a strong adherence to its compliance guidelines, with a minimal number of reported ethical breaches, underscoring its commitment to these practices.

- Commitment to Human Rights: MTU actively integrates human rights considerations into its operational framework, aligning with international standards.

- Anti-Corruption Stance: The company maintains a zero-tolerance policy towards corruption, enforced through robust compliance programs and training.

- UN Global Compact Participation: MTU's involvement signifies a dedication to ten universally accepted principles covering human rights, labor, environment, and anti-corruption.

- Stakeholder Trust: Demonstrating strong ethical practices enhances MTU's brand image and strengthens relationships with investors, customers, and employees.

Societal expectations are increasingly pushing companies to prioritize diversity and inclusion, recognizing its importance for attracting and retaining top talent. MTU Aero Engines, with its global team representing over 80 nationalities, demonstrates a tangible commitment to fostering a diverse environment, which can boost innovation and employee satisfaction.

Companies with greater diversity often show better financial performance. For example, a 2023 McKinsey report indicated that companies in the top quartile for ethnic and cultural diversity on executive teams were 39% more likely to outperform on profitability. This highlights how diverse perspectives can translate into stronger business outcomes.

Societal pressure also demands corporate responsibility and ethical conduct, including upholding human rights and combating corruption. MTU Aero Engines' participation in the UN Global Compact underscores its commitment to these principles across its operations and supply chain, reinforcing stakeholder trust.

The aerospace sector, including MTU Aero Engines, faces ongoing challenges with skilled labor shortages, impacting both manufacturing and maintenance. Job openings in aerospace saw a 9% increase in 2024, emphasizing the critical need for effective human capital management and talent retention strategies.

Technological factors

MTU Aero Engines is heavily invested in pushing the boundaries of engine efficiency, a key technological driver. Their focus is on developing propulsion systems that significantly reduce fuel consumption, directly impacting operational costs for airlines. This commitment is evident in their ongoing research into advanced materials and aerodynamic designs that promise substantial performance gains.

The company is also a leader in exploring and integrating alternative fuels, particularly Sustainable Aviation Fuels (SAFs) and hydrogen fuel cell technology. By 2025, the aviation industry aims to increase SAF usage, with targets set by bodies like IATA. MTU's work on projects such as the Flying Fuel Cell initiative, aiming for hydrogen-electric propulsion, positions them to capitalize on this shift towards decarbonization.

These technological advancements are not just about innovation; they are crucial for MTU to meet the increasingly stringent environmental regulations and carbon emission reduction goals being implemented globally. For instance, the European Union's 'Fit for 55' package includes measures that will necessitate greater adoption of cleaner aviation technologies by 2030, a timeline MTU is actively preparing for.

MTU Aero Engines is heavily invested in digitalization and Industry 4.0, recognizing their critical role in boosting manufacturing efficiency and product quality. The company's commitment to advanced processes, including automation and smart factory concepts, directly contributes to its operational excellence, evidenced by reduced throughput times in its Maintenance, Repair, and Overhaul (MRO) services.

This technological integration is not just about production; MTU anticipates an even deeper reliance on digital tools for sophisticated inventory management and robust supplier compliance oversight. For instance, in 2023, MTU reported a significant increase in its digital transformation initiatives, aiming to streamline its complex supply chain and enhance predictive maintenance capabilities, which are key components of Industry 4.0.

Innovation in materials science, particularly with advanced composites and additive manufacturing, is a significant technological driver for MTU Aero Engines. These advancements allow for the creation of lighter, stronger, and more fuel-efficient engine components, directly impacting MTU's competitive edge. For instance, MTU's investment in 3D printing for turbine blades aims to reduce weight and improve performance, a key aspect of their future engine development strategy.

Acoustic and Emissions Reduction Technologies

Beyond CO2, the aerospace industry faces a dual challenge: reducing noise pollution and tackling non-CO2 emissions like NOx and contrails. MTU Aero Engines is actively investing in research and development for technologies that address these critical environmental concerns, aiming to make air travel both cleaner and quieter. This focus aligns directly with ambitious global sustainability targets.

The European Aviation Environmental Report 2025 underscores the growing regulatory and societal pressure to mitigate the impact of non-CO2 emissions. MTU's technological advancements are therefore crucial for meeting these evolving standards.

- Noise Reduction: MTU is developing advanced engine designs and acoustic liners to significantly decrease aircraft noise footprint.

- NOx Reduction: Research into lean-burn combustion technologies and advanced combustor designs aims to lower nitrogen oxide emissions.

- Contrail Mitigation: Efforts are underway to understand and reduce the formation of contrails, which contribute to climate warming.

- Efficiency Gains: Innovations in aerodynamics and engine component efficiency indirectly reduce overall emissions.

Unmanned Aerial Vehicle (UAV) and Future Air Mobility Developments

The rapid advancement of Unmanned Aerial Vehicles (UAVs) and future air mobility concepts, such as electric vertical take-off and landing (eVTOL) aircraft, signifies a significant shift in the aerospace landscape. These emerging sectors offer substantial new market opportunities, but also introduce novel technological hurdles for established players like MTU Aero Engines. For instance, the global urban air mobility market is projected to reach USD 33.86 billion by 2030, highlighting the scale of this unfolding opportunity.

While MTU's primary focus remains on traditional aircraft engines, its deep-seated expertise in propulsion systems provides a strong foundation for potential diversification into these nascent segments. The company's ongoing exploration of revolutionary propulsion concepts, moving beyond conventional engine designs, directly addresses the technological demands of eVTOLs and other advanced air mobility solutions. This strategic pivot could leverage MTU's engineering prowess to capture a share of this rapidly growing market.

- Market Growth: The global UAM market is expected to experience significant expansion, with projections indicating substantial growth by the end of the decade.

- Technological Adaptation: MTU's propulsion expertise is a key asset for developing engines suitable for lighter, more efficient eVTOL aircraft.

- Innovation Focus: MTU's commitment to exploring revolutionary engine concepts positions it to address the unique power requirements of future air mobility.

MTU Aero Engines is at the forefront of developing next-generation propulsion systems, focusing on enhanced fuel efficiency and reduced emissions. Their investment in areas like advanced materials and additive manufacturing, such as 3D printing for turbine blades, directly translates to lighter and more performant engine components. This technological push is crucial for meeting stringent environmental regulations, including the EU's 'Fit for 55' package, which aims for significant emission reductions by 2030.

Legal factors

MTU Aero Engines operates within a highly regulated environment, where stringent aviation safety regulations are non-negotiable. Agencies such as the European Union Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA) set the bar for engine design, production, and maintenance. Compliance ensures MTU's engines are certified as airworthy, a fundamental requirement for any operator.

These regulations directly impact MTU's research and development, manufacturing quality control, and the meticulous processes involved in Maintenance, Repair, and Overhaul (MRO) services. For instance, EASA's Part 21 and Part 145 regulations dictate the standards for design organization approval and maintenance organization approval, respectively, requiring robust safety management systems. The financial implications are significant, with ongoing investments needed to meet evolving safety standards and maintain certifications, crucial for market access and customer trust.

Environmental protection laws are tightening, with specific CO2 emission targets and noise regulations directly influencing MTU Aero Engines' product design and operational strategies. For instance, the EU's Fit for 55 package aims for a 55% net reduction in greenhouse gas emissions by 2030 compared to 1990 levels, impacting the aviation sector significantly.

The EU Emissions Trading System (ETS) and the RefuelEU Aviation Regulation, which mandates increased use of Sustainable Aviation Fuels (SAF), are driving MTU's investment in cleaner technologies and sustainable aviation solutions. RefuelEU Aviation sets a progressive blending mandate for SAF, starting at 2% in 2025 and rising to 6% by 2030, pushing the industry towards lower-emission operations.

These evolving regulations are increasing costs for airlines, creating a strong incentive for them to reduce emissions and seek out more fuel-efficient engines and SAF-compatible technologies, which MTU is positioned to provide.

Protecting intellectual property rights (IPR) is paramount for MTU Aero Engines, especially considering their substantial R&D investments in advanced engine technologies. Patents and trade secrets are vital for safeguarding their competitive edge and ensuring revenue from unique designs and manufacturing methods.

MTU's market leadership is directly tied to its innovative technologies and specialized components. In 2023, MTU reported R&D expenses of €480 million, underscoring their commitment to maintaining a technological advantage through robust intellectual property.

International Sanctions and Trade Compliance

MTU Aero Engines, as a global player in the aerospace industry, navigates a complex web of international sanctions and trade compliance regulations. These laws dictate permissible business activities, including where MTU can operate and with whom it can engage. For instance, the ongoing geopolitical tensions in Eastern Europe have led to extensive sanctions regimes, impacting supply chains and market access for many global manufacturers.

Geopolitical shifts frequently introduce new sanctions or modify existing ones, directly influencing MTU's ability to conduct business. These changes can necessitate adjustments to market strategies and supply chain management, as seen with the impact of sanctions on certain export controls and technology transfers. Staying abreast of these evolving regulations is paramount.

Compliance with these international rules is not merely a legal obligation but a critical factor in safeguarding MTU's reputation and operational continuity. Failure to comply can result in severe penalties, including fines and restrictions on future business dealings, underscoring the importance of robust internal compliance frameworks.

- Sanctions Impact: In 2023, the global aerospace sector faced ongoing disruptions due to various international sanctions, particularly those related to conflicts and export controls, requiring companies like MTU to meticulously vet all business partners and transactions.

- Regulatory Landscape: The U.S. Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Entity List, impacting companies' ability to export U.S.-origin technology, a key consideration for MTU's global supply chain.

- Compliance Costs: Industry estimates suggest that compliance with international trade regulations can represent a significant operational cost, often ranging from 1% to 5% of a company's revenue, depending on the complexity of its global operations.

- Reputational Risk: A single compliance breach can lead to substantial reputational damage, affecting investor confidence and customer relationships, as demonstrated by past instances of companies facing public scrutiny for trade violations.

Product Liability and Warranty Laws

MTU Aero Engines, as a manufacturer and service provider of critical aircraft engine components, operates under rigorous product liability and warranty laws. These regulations are designed to protect consumers and ensure the safety and reliability of aviation products.

Any defects or failures in MTU's engines or components can expose the company to substantial legal claims, leading to significant financial liabilities and considerable reputational damage. The cost of recalls, repairs, and potential lawsuits can be immense.

A prime example of this impact is seen in MTU's involvement with the Geared Turbofan (GTF) fleet management plan. This plan was initiated due to a manufacturing problem, underscoring the profound financial and operational consequences that can arise from such issues. In 2023, MTU's provisions for warranty and maintenance services related to the GTF program were substantial, reflecting the ongoing commitment to addressing these challenges.

- Stringent Regulations: Aviation manufacturers like MTU are bound by strict product liability and warranty laws globally.

- Financial Exposure: Defects can result in costly legal battles, compensation payouts, and extensive repair programs.

- Reputational Risk: Product failures can severely damage customer trust and brand image in the safety-critical aviation sector.

- GTF Program Impact: The ongoing management of issues within the GTF fleet highlights the significant financial commitments MTU makes to uphold product integrity and customer satisfaction.

MTU Aero Engines operates under a strict legal framework governing aviation safety, with agencies like EASA and the FAA mandating rigorous standards for engine design, production, and maintenance. These regulations directly influence R&D, quality control, and MRO processes, requiring substantial ongoing investment to maintain certifications and market access, as seen in their €480 million R&D expenditure in 2023.

Environmental laws, including the EU's Fit for 55 and the RefuelEU Aviation Regulation (mandating 2% SAF blending in 2025), are pushing MTU towards cleaner technologies and sustainable aviation solutions, impacting product design and strategy to meet emission reduction targets.

Protecting intellectual property is critical for MTU's competitive edge, with patents and trade secrets safeguarding their advanced engine technologies, a crucial element given their significant R&D investments.

Navigating international sanctions and trade compliance is paramount for MTU, as geopolitical shifts can impact supply chains and market access, necessitating robust internal compliance frameworks to avoid severe penalties and reputational damage.

Environmental factors

The aerospace sector is under significant pressure to adopt Sustainable Aviation Fuels (SAFs) to curb its environmental impact. This drive is fueled by global climate goals and increasing regulatory mandates.

The European Union's ReFuelEU Aviation initiative is a prime example, requiring airlines to blend SAFs, beginning with a 2% mandate in 2025 and escalating to 70% by 2050. This regulatory push directly influences engine manufacturers like MTU Aero Engines.

MTU is proactively developing engine technologies that can efficiently utilize SAFs and is also investigating other novel fuel sources to meet these evolving industry requirements. This strategic focus ensures their engines remain competitive and compliant in a decarbonizing aviation landscape.

Noise pollution from aircraft engines is a major environmental issue, driving stricter regulations, particularly near airports and populated zones. MTU Aero Engines actively invests in noise reduction technologies, making it a critical consideration in both the development of new engines and the modernization of older ones. For instance, their GTF Advantage engine, designed for efficiency, also incorporates advanced acoustic treatments to meet evolving noise standards.

Global and regional carbon emission reduction targets are significantly shaping MTU Aero Engines' strategic direction. The European Union's commitment to climate neutrality by 2050 and the International Civil Aviation Organization's (ICAO) goal of net-zero carbon emissions by the same year are key drivers. These ambitious targets necessitate a fundamental shift in how aviation operates.

MTU is actively responding to these environmental pressures by focusing on reducing its Scope 1 and 2 emissions. This involves internal operational improvements and, crucially, the development of advanced technologies aimed at achieving climate-neutral flying. The company recognizes the substantial environmental footprint of the aviation sector.

In 2023, aviation was responsible for an estimated 2.5% of global CO2 emissions. This statistic underscores the urgency and importance of initiatives like those MTU is pursuing to decarbonize air travel and meet increasingly stringent regulatory and societal expectations for environmental responsibility.

Resource Scarcity and Waste Management

MTU Aero Engines, like many in the aerospace sector, depends heavily on specialized raw materials and intricate manufacturing. This reliance underscores the critical need for robust resource management and effective waste reduction. The company's commitment to sustainability is evident in its efforts to conserve resources and integrate green energy into its operations, reflecting broader industry trends toward more environmentally conscious production.

Growing global awareness of resource depletion and the environmental toll of industrial waste compels companies like MTU to actively pursue sustainable production methods. Embracing circular economy principles is becoming a strategic imperative, aiming to minimize waste and maximize the value extracted from materials throughout their lifecycle.

- Resource Intensity: The aerospace industry's manufacturing processes, particularly for engine components, often require rare earth metals and high-performance alloys, making efficient material utilization paramount.

- Waste Reduction Targets: MTU has set ambitious targets for reducing production waste, aiming to achieve significant reductions in landfill waste by 2025, aligning with global sustainability goals.

- Circular Economy Initiatives: The company is exploring and implementing circular economy models, focusing on remanufacturing, repair, and recycling of engine parts to extend their lifespan and reduce the demand for virgin materials.

- Green Energy Adoption: MTU is increasing its use of renewable energy sources for its manufacturing facilities, with a goal to significantly increase the proportion of green electricity consumed in its European operations by 2025.

Climate Change Impacts on Operations and Supply Chain

Climate change poses significant physical risks to MTU Aero Engines' operations. Extreme weather events, like severe storms or prolonged heatwaves, can directly impact manufacturing facilities and disrupt the flow of materials and finished goods through their supply chains. This means building more resilient infrastructure and logistics is crucial.

The aerospace and defense sector experienced a notable increase in supply chain disruptions in 2024, with extreme weather events ranking among the top five causes. This underscores the urgent need for MTU Aero Engines to implement robust risk management strategies to mitigate these climate-related vulnerabilities.

- Physical Disruptions: Increased frequency and intensity of extreme weather events impacting production sites and transportation routes.

- Supply Chain Resilience: Necessity for diversified sourcing and contingency planning to counter weather-related delays.

- Operational Logistics: Potential for extended downtime or increased costs due to climate-induced infrastructure damage or transportation disruptions.

- Risk Management Focus: Prioritizing adaptation measures to safeguard operations against the growing threat of climate change impacts.

The aviation industry's environmental footprint, with CO2 emissions at 2.5% globally in 2023, necessitates a significant shift towards Sustainable Aviation Fuels (SAFs). MTU Aero Engines is developing technologies to efficiently utilize SAFs, aligning with mandates like the EU's ReFuelEU Aviation, which requires a 2% SAF blend in 2025, rising to 70% by 2050.

Noise pollution is another key environmental concern, leading to stricter regulations. MTU is investing in noise reduction technologies for its engines, such as the GTF Advantage, to meet these evolving standards.

Global climate goals, like net-zero emissions by 2050 set by ICAO, are driving MTU's focus on reducing its operational emissions and developing climate-neutral flying technologies.

MTU is also addressing resource intensity and waste reduction in its manufacturing processes. The company aims to significantly reduce production waste by 2025 and is exploring circular economy models like remanufacturing and recycling, alongside increasing its use of renewable energy in operations.

PESTLE Analysis Data Sources

Our MTU Aero Engines PESTLE Analysis is built on a robust foundation of data from official government publications, leading aerospace industry associations, and reputable financial news outlets. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the sector.