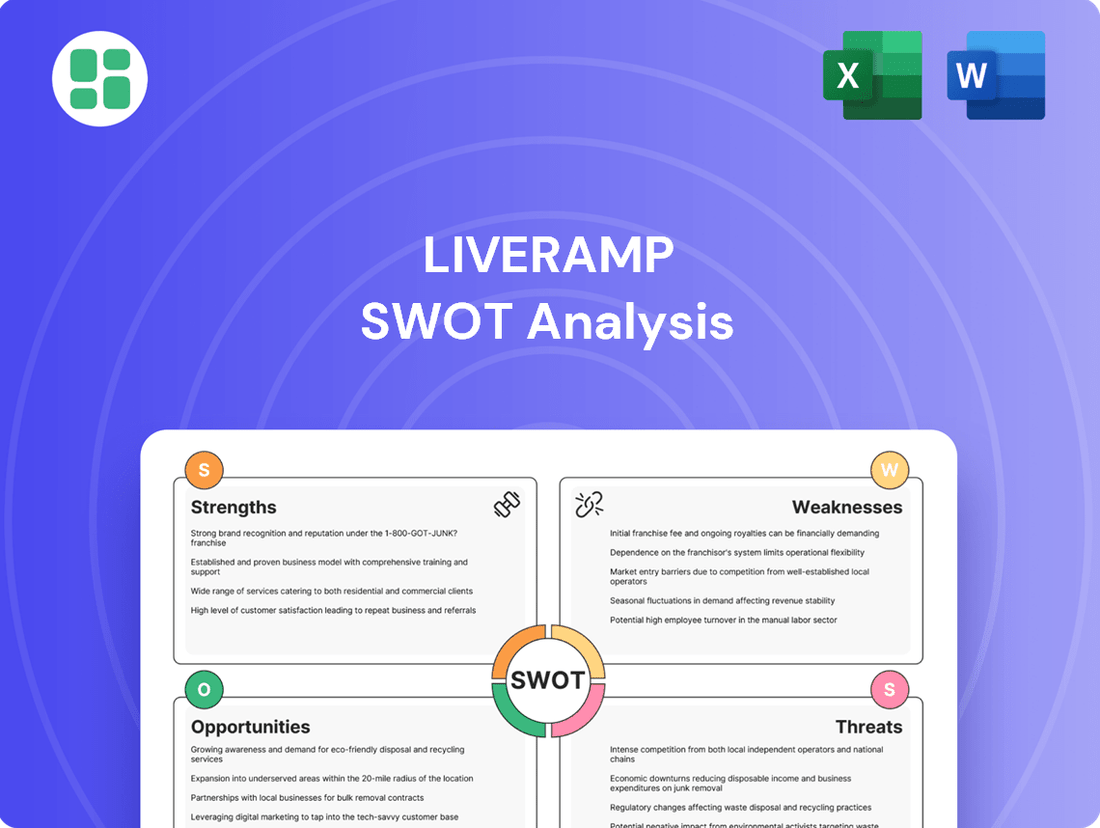

LiveRamp SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

LiveRamp Bundle

LiveRamp's strengths lie in its data connectivity and privacy-centric solutions, but it faces challenges with market competition and evolving regulations. Discover the full picture behind the company’s market position with our complete SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

LiveRamp stands out as a premier data collaboration platform, enabling businesses worldwide to securely connect, manage, and leverage their customer data. This leadership is underscored by its adoption by forward-thinking companies and its consistent recognition, including being named a Leader in the IDC MarketScape for Worldwide Data Clean Room Technology for Advertising and Marketing Use Cases in 2025.

LiveRamp's core strength lies in its pioneering identity resolution capabilities, exemplified by its RampID and Safe Haven solutions. These offerings are crucial for businesses aiming to create a unified customer view, a foundational element for effective marketing and customer engagement. This focus on building a single, reliable customer profile is a significant advantage in today's fragmented digital landscape.

A key differentiator for LiveRamp is its unwavering commitment to privacy-safe data collaboration. In an era of heightened data privacy regulations and growing consumer awareness, this approach is not just a feature but a necessity. LiveRamp's ability to facilitate data sharing and utilization while adhering to strict privacy standards positions it as a trusted partner for companies navigating these complex waters.

This dedication to privacy empowers LiveRamp's customers to meet stringent compliance requirements, such as GDPR and CCPA, with greater confidence. By providing solutions that inherently respect privacy, LiveRamp helps its clients avoid potential penalties and build stronger, more trusting relationships with their customers. This trust is invaluable in the current data-driven economy.

LiveRamp's strength lies in its vast global partner ecosystem, which includes over 650 to 1,000 key players like major publishers, retailers, platforms, and data providers. This extensive network allows for seamless data activation across a multitude of marketing and advertising channels, offering unparalleled reach and flexibility.

The interoperability of LiveRamp's platform with leading cloud providers such as AWS, Azure, Google Cloud, Databricks, and Snowflake is a significant advantage. This integration ensures robust connectivity and facilitates efficient data collaboration, further solidifying its position in the market.

Consistent Double-Digit Revenue Growth

LiveRamp has shown impressive financial health, achieving consistent double-digit revenue growth over several quarters in fiscal year 2025. This sustained expansion highlights the market's strong appetite for its identity resolution and data connectivity solutions.

The company's total revenue for fiscal year 2025 reached $746 million, marking a significant 13% increase year-over-year. A substantial portion of this growth is attributed to its recurring subscription revenue, underscoring the sticky nature of its platform and customer loyalty.

- Consistent Double-Digit Revenue Growth: LiveRamp has maintained this trend across multiple fiscal quarters in 2025.

- FY2025 Total Revenue: Reached $746 million, a 13% increase.

- Subscription Revenue Driver: A key contributor to the company's expanding top line.

Innovation in Cross-Media Measurement and AI

LiveRamp's strength lies in its commitment to innovation, particularly in cross-media measurement and the integration of artificial intelligence. The company is actively developing and launching solutions like Cross-Media Intelligence, designed to help marketers accurately track and enhance ad performance across diverse channels and devices.

Furthermore, LiveRamp is embedding AI into its core identity graph. This strategic move aims to sharpen audience targeting, boost the return on investment for personalized advertising efforts, and streamline internal operations. This focus on advanced technology positions LiveRamp to address evolving industry needs.

- Cross-Media Intelligence: A key new offering for comprehensive campaign measurement.

- AI Integration: Enhancing targeting precision and campaign ROI.

- Operational Efficiency: AI adoption promises to streamline internal processes.

- Future-Forward Approach: Demonstrates a proactive stance on technological advancements in the data and advertising space.

LiveRamp's core strengths are its robust identity resolution capabilities, exemplified by its RampID and Safe Haven solutions, which are critical for building unified customer views. The company's unwavering commitment to privacy-safe data collaboration is a significant advantage in today's regulatory environment, allowing clients to comply with regulations like GDPR and CCPA. Its extensive global partner ecosystem, boasting over 650 to 1,000 key players, enables seamless data activation across numerous channels.

Financially, LiveRamp demonstrated strong performance in fiscal year 2025, achieving $746 million in total revenue, a 13% increase year-over-year, driven by consistent double-digit revenue growth and a substantial contribution from recurring subscription revenue. The company is also heavily invested in innovation, particularly in cross-media measurement and AI integration, with offerings like Cross-Media Intelligence and AI-enhanced identity graphs to improve targeting and campaign ROI.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Identity Resolution | Pioneering capabilities with RampID and Safe Haven for unified customer views. | Crucial for effective marketing and customer engagement. |

| Privacy-Safe Data Collaboration | Facilitates data sharing while adhering to strict privacy standards. | Enables compliance with GDPR and CCPA, building customer trust. |

| Global Partner Ecosystem | Extensive network of over 650-1,000 key players. | Allows for seamless data activation across diverse marketing channels. |

| Financial Performance (FY2025) | Consistent double-digit revenue growth and strong top-line expansion. | Total revenue reached $746 million, a 13% increase year-over-year; recurring subscription revenue is a key driver. |

| Innovation (AI & Cross-Media) | Developing advanced solutions like Cross-Media Intelligence and AI-integrated identity graphs. | Aims to enhance ad performance tracking, audience targeting precision, and campaign ROI. |

What is included in the product

Delivers a strategic overview of LiveRamp’s internal strengths and weaknesses, alongside external opportunities and threats in the evolving data landscape.

Identifies key market opportunities and competitive threats, enabling proactive strategic adjustments for LiveRamp.

Weaknesses

LiveRamp has a history of GAAP operating losses, even with impressive revenue growth and expanding non-GAAP operating income. This divergence suggests that while the company's core operations are becoming more profitable on a non-GAAP basis, the reported GAAP earnings are still affected by certain costs or investments. For investors who prioritize traditional profitability metrics, these GAAP losses can be a point of concern, indicating potential inefficiencies or significant expenditures impacting the bottom line.

LiveRamp's customer base saw a reduction in fiscal year 2025, with direct subscription customers decreasing from 900 to 840. This indicates a strategic move to shed smaller, less profitable clients, a common tactic for margin improvement.

However, this concentration on larger clients introduces a risk. If mid-sized customers begin to leave at a faster rate than anticipated, it could negatively impact LiveRamp's projected revenue growth.

LiveRamp's significant reliance on the advertising and marketing sector presents a notable weakness. This industry is particularly sensitive to economic shifts, meaning a downturn in ad spending directly impacts LiveRamp's revenue streams. For instance, during periods of economic uncertainty, companies often reduce marketing budgets, which can lead to lower sales and increased churn for LiveRamp.

Intense Competitive Landscape

LiveRamp operates in a fiercely competitive arena. Companies like Hightouch and TransUnion's TruAudience offer comparable data connectivity and activation solutions, intensifying rivalry. This crowded market puts pressure on LiveRamp's pricing strategies and its ability to capture and maintain market share.

The data integration space is populated by numerous active players, many providing similar identity resolution and data syncing functionalities. This broad competitive set directly impacts LiveRamp's pricing power and market positioning.

- Intense Competition: Rivals like Hightouch and TransUnion's TruAudience offer similar data connectivity and activation services.

- Pricing Pressure: A crowded market with many similar solutions forces LiveRamp to be competitive on pricing.

- Market Share Challenges: The presence of numerous active competitors makes it difficult to consistently grow or defend market share.

Complexity of Navigating Evolving Data Privacy Laws

Navigating the intricate and ever-changing landscape of global data privacy laws poses a significant challenge for LiveRamp. The introduction of new regulations, such as those taking effect in Iowa, Delaware, Nebraska, New Hampshire, and New Jersey in January 2025, demands constant vigilance and adaptation from the company and its data partners.

This dynamic regulatory environment requires substantial resources and expertise to ensure ongoing compliance. Failure to adapt swiftly can result in operational disruptions and potential legal repercussions, impacting LiveRamp's ability to facilitate data onboarding and activation services effectively.

- Regulatory Complexity: Keeping pace with diverse and evolving data privacy laws across multiple jurisdictions is a constant operational hurdle.

- Resource Intensity: Ensuring compliance requires significant investment in legal counsel, technology, and process adjustments.

- Risk of Non-Compliance: Misinterpretation or delayed adaptation to new regulations can expose LiveRamp and its partners to legal penalties and reputational damage.

- Impact on Data Flow: Strict privacy mandates can complicate the seamless transfer and utilization of data, potentially affecting service delivery.

LiveRamp's reliance on the advertising sector makes it vulnerable to economic downturns, as reduced ad spending directly impacts revenue. For example, a significant slowdown in marketing budgets could lead to lower sales and increased customer churn.

The company faces intense competition from players like Hightouch and TransUnion's TruAudience, who offer similar data connectivity and activation solutions. This crowded market exerts pressure on LiveRamp's pricing and market share growth.

Navigating the complex and evolving global data privacy landscape, including new regulations effective January 2025 in states like Iowa and Delaware, requires significant resources for compliance and poses operational risks if not managed effectively.

| Weakness | Description | Impact |

|---|---|---|

| Sector Concentration | Heavy reliance on the advertising and marketing industry. | Vulnerability to economic downturns affecting ad spend. |

| Competitive Landscape | Presence of strong competitors like Hightouch and TransUnion's TruAudience. | Pricing pressure and challenges in market share defense. |

| Regulatory Environment | Complex and evolving global data privacy laws. | Increased compliance costs and operational disruption risks. |

Full Version Awaits

LiveRamp SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of LiveRamp's Strengths, Weaknesses, Opportunities, and Threats. The preview you see is the same detailed report that will be unlocked after your purchase.

Opportunities

The digital advertising landscape is rapidly evolving with the deprecation of third-party cookies and a heightened consumer focus on data privacy. This seismic shift is creating a substantial market opportunity for privacy-first, authenticated identity solutions. LiveRamp's established expertise in building durable, authenticated identities, coupled with its investment in privacy-enhancing technologies, positions it favorably to meet this growing demand. Businesses are actively seeking compliant and effective methods to engage with their customers, and LiveRamp's offerings directly address this critical need.

LiveRamp is well-positioned to leverage the burgeoning retail media network (RMN) trend, offering a significant opportunity to expand its data collaboration solutions. As RMNs continue to grow, the need for standardized measurement and cross-platform identity solutions becomes paramount, areas where LiveRamp excels. For instance, by Q1 2024, the US retail media ad spend was projected to reach $45 billion, highlighting the scale of this market.

Beyond advertising, LiveRamp can tap into new industry verticals like travel and hospitality, where data collaboration is increasingly vital for personalized customer experiences and operational efficiency. The company's existing infrastructure and expertise in data onboarding and identity resolution provide a strong foundation for these expansions. This diversification not only broadens LiveRamp's addressable market but also strengthens its overall value proposition by demonstrating its adaptability across various data-intensive sectors.

The surge in AI adoption, particularly large language models and generative AI, within the ad tech sector offers LiveRamp a significant opportunity to bolster its services. By embedding AI into its core platform, LiveRamp can unlock greater efficiencies in ad operations and customer behavior modeling.

This AI integration can translate into more refined targeting capabilities and improved measurement accuracy for its clients, potentially driving better campaign performance. For instance, by mid-2024, many ad tech companies were exploring AI for predictive analytics to optimize ad spend, a trend LiveRamp can capitalize on.

Strategic Acquisitions and Partnerships

LiveRamp can bolster its market position through strategic acquisitions, mirroring its successful integration of Habu. This move enhances technological prowess and facilitates smoother data collaboration, especially within the burgeoning clean room sector. For instance, in 2023, LiveRamp acquired Habu for an undisclosed sum, aiming to strengthen its identity resolution capabilities and expand its reach in privacy-centric data environments.

Furthermore, cultivating turnkey partnerships and ensuring seamless integration with major cloud providers like AWS, Google Cloud, and Azure, alongside a diverse array of data partners, presents a significant avenue for growth. These integrations are crucial for unlocking accelerated value and creating new revenue streams by making data collaboration more accessible and efficient for a wider client base.

- Acquisition Strategy: Continued pursuit of acquisitions like Habu to enhance technological offerings and address data collaboration challenges in clean rooms.

- Partnership Ecosystem: Development of turnkey partnerships with cloud infrastructures and data providers to accelerate value realization.

- Market Expansion: Leveraging integrations to unlock new growth opportunities and expand service accessibility across various platforms.

Growing Adoption of Data Clean Rooms

The increasing demand for secure data collaboration is a major tailwind for LiveRamp, particularly in the burgeoning data clean room market. As businesses grapple with privacy regulations and the need for more sophisticated data insights, clean rooms offer a compliant solution for sharing sensitive information. LiveRamp's established leadership in this space positions it to capitalize on this trend.

This growing adoption presents a significant opportunity for LiveRamp to expand its footprint. By onboarding more premium publishers and retail media networks, the company can further scale its clean room ecosystem. This expansion will enable more businesses to securely share data, unlocking advanced analytics and more effective activation strategies. For instance, the global data clean room market was valued at approximately $1.5 billion in 2023 and is projected to grow substantially in the coming years, with some estimates suggesting it could reach over $7 billion by 2028, highlighting the immense potential for companies like LiveRamp.

- Market Growth: The data clean room market is experiencing rapid expansion, driven by privacy concerns and the need for secure data collaboration.

- LiveRamp's Position: LiveRamp is recognized as a leader in this segment, providing a strong foundation for future growth.

- Expansion Potential: The opportunity exists to onboard more premium publishers and retail media networks, broadening the reach and utility of LiveRamp's clean room solutions.

- Customer Benefits: This allows for enhanced secure data sharing, leading to deeper insights and more effective marketing activation.

The ongoing shift away from third-party cookies presents a significant opportunity for LiveRamp to solidify its position as a leader in privacy-first identity solutions. Businesses are actively seeking compliant and effective ways to reach consumers, and LiveRamp's authenticated identity capabilities directly address this critical market need.

The rapid growth of retail media networks (RMNs) offers a substantial avenue for LiveRamp to expand its data collaboration services. With US RMN ad spend projected to reach $45 billion by Q1 2024, the demand for standardized measurement and cross-platform identity solutions is immense, playing directly to LiveRamp's strengths.

Expanding into new industry verticals such as travel and hospitality, where data collaboration is key for personalization and efficiency, represents another growth opportunity. LiveRamp's existing infrastructure for data onboarding and identity resolution provides a solid base for this diversification.

The increasing adoption of AI, including generative AI, within the ad tech sector provides LiveRamp with a chance to enhance its offerings. Integrating AI can lead to more efficient ad operations, improved customer behavior modeling, and more precise targeting for clients.

Strategic acquisitions, similar to the integration of Habu, can further bolster LiveRamp's market standing and technological capabilities, particularly in the expanding data clean room sector. This approach enhances data collaboration and strengthens its position in privacy-centric environments.

Cultivating strong partnerships with major cloud providers like AWS, Google Cloud, and Azure, along with a broad network of data partners, is crucial for unlocking new revenue streams and increasing the accessibility of data collaboration solutions.

| Opportunity Area | Market Trend | LiveRamp's Advantage | 2024/2025 Data Point |

| Privacy-First Identity | Deprecation of third-party cookies | Established authenticated identity solutions | Projected growth in privacy-enhancing technologies market |

| Retail Media Networks (RMNs) | Explosive RMN growth | Expertise in data collaboration and measurement | US RMN ad spend projected at $45 billion by Q1 2024 |

| New Verticals Expansion | Demand for data collaboration in travel/hospitality | Existing data onboarding and identity resolution infrastructure | Increasing data utilization in customer experience management |

| AI Integration | Rise of AI in ad tech | Potential for enhanced operational efficiency and targeting | Many ad tech firms exploring AI for predictive analytics in 2024 |

| Strategic Acquisitions | Consolidation in data collaboration | Proven success with integrations like Habu | Acquisition of Habu in 2023 to bolster clean room capabilities |

| Partnership Ecosystem | Cloud and data provider integrations | Enabling broader accessibility and new revenue streams | Focus on seamless integration with major cloud platforms |

Threats

The global data privacy landscape is tightening, with new regulations set to impact businesses across the US in 2025. These evolving laws, mirroring frameworks like the California Consumer Privacy Act (CCPA), create a persistent risk of non-compliance for companies like LiveRamp and their clients. Navigating this complex web of rules requires significant operational adjustments and carries the threat of substantial financial penalties.

LiveRamp navigates a fiercely competitive environment. Beyond direct rivals in data activation, it contends with major tech players, often termed 'walled gardens,' who control vast proprietary data sets. For instance, companies like Google and Meta leverage their immense user data to offer integrated advertising and analytics solutions, presenting a significant challenge to LiveRamp's interoperability model.

Furthermore, the rise of cloud providers such as Amazon Web Services (AWS) and Microsoft Azure, which are increasingly embedding data management and activation tools within their platforms, adds another layer of competition. This broad spectrum of competitors, from tech giants to infrastructure providers, can indeed constrain LiveRamp's market expansion and exert downward pressure on its service pricing.

Economic downturns pose a significant threat to LiveRamp's business. During recessions, companies tend to cut back on marketing and advertising spending, which directly impacts demand for LiveRamp's services. For instance, during the COVID-19 pandemic's initial impact in early 2020, many businesses saw sharp declines in advertising budgets, a trend that could repeat in a future economic contraction.

Legal Challenges and Privacy Litigation

LiveRamp faces significant legal threats stemming from its data handling practices. The company has been involved in class-action lawsuits alleging privacy violations, with some rulings in 2023 and early 2024 allowing these claims to move forward. These legal battles are costly, potentially impacting profitability and forcing operational adjustments.

- Legal Scrutiny: Ongoing litigation concerning data privacy.

- Reputational Risk: Negative publicity from lawsuits can erode customer trust.

- Operational Impact: Potential for court-ordered changes to data collection and usage.

- Financial Strain: Substantial legal fees and potential settlement costs.

Rapid Technological Shifts and Deprecation of Identifiers

The digital advertising landscape is in constant flux, with traditional identifiers like third-party cookies facing deprecation. This ongoing shift, exemplified by Google's Privacy Sandbox initiatives, requires companies like LiveRamp to continuously innovate and adapt its identity solutions. While LiveRamp has been a leader in developing alternative frameworks, a slower-than-anticipated industry-wide adoption of these new standards could pose a significant threat.

The emergence of unforeseen technological advancements or shifts in consumer privacy expectations could also disrupt LiveRamp's business model. For instance, if privacy-preserving technologies evolve in ways that bypass current identity resolution methods, LiveRamp's market relevance could be challenged. The company's reliance on its ability to maintain accurate and privacy-compliant identity graphs is central to its value proposition.

LiveRamp's strategic response to these threats includes significant investment in R&D for new identity solutions. In fiscal year 2024, the company continued to focus on expanding its Authenticated Traffic Solution (ATS) and exploring new data collaboration environments. The success of these initiatives hinges on broad industry buy-in and the ability to stay ahead of rapid technological evolution.

The increasing global focus on data privacy, with new regulations impacting businesses in 2025, presents a significant compliance risk and potential for substantial financial penalties for LiveRamp and its clients. Intense competition from tech giants and cloud providers offering integrated data solutions also constrains market expansion and pricing power.

Economic downturns can directly reduce demand for LiveRamp's services as companies cut marketing budgets, a trend seen during the early COVID-19 pandemic. Furthermore, ongoing litigation concerning data handling practices poses legal and reputational threats, potentially leading to costly settlements and operational changes.

The deprecation of third-party cookies and the rapid evolution of digital advertising identifiers necessitate continuous innovation in identity solutions, with industry-wide adoption of new standards being a critical factor for LiveRamp's success.

SWOT Analysis Data Sources

This LiveRamp SWOT analysis is built upon a robust foundation of data, incorporating publicly available financial statements, comprehensive industry market research, and expert analyses of the digital advertising landscape.