Itho Daalderop Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itho Daalderop Bundle

Understanding the competitive landscape for Itho Daalderop through Porter's Five Forces reveals the intricate balance of power within its industry. Key forces like buyer bargaining power and the threat of substitutes significantly shape its strategic options.

The complete report reveals the real forces shaping Itho Daalderop’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of specialized components, such as compressors for heat pumps and advanced sensors for ventilation units, wield considerable influence. Similarly, providers of essential raw materials like copper, aluminum, and steel are key players. These suppliers can leverage their positions to impact Itho Daalderop's production expenses.

The bargaining power of these suppliers is amplified by persistent supply chain disruptions and volatile raw material prices. For instance, the price of copper, a critical material for HVAC systems, saw significant fluctuations in early 2024, impacting manufacturing costs across the industry. This trend directly translates to increased HVAC equipment prices, a factor Itho Daalderop must carefully manage.

Suppliers who offer unique or highly specialized technologies, particularly in areas like energy-efficient systems and smart controls, wield significant bargaining power. This is especially true for components crucial to advanced heat recovery units. Itho Daalderop's commitment to innovative, sustainable solutions naturally increases its dependence on suppliers who are leaders in these technological advancements.

The HVAC sector, encompassing both manufacturing and installation, is grappling with a significant shortage of skilled labor. This scarcity directly impacts suppliers, driving up their labor costs, which can then be passed on to companies like Itho Daalderop. For instance, in 2024, the U.S. Bureau of Labor Statistics projected that employment for HVAC technicians would grow 6% from 2022 to 2032, faster than the average for all occupations, indicating persistent demand for skilled workers.

This widespread labor scarcity creates a bottleneck across the entire supply chain. Suppliers may experience production delays and increased expenses as they compete for a limited pool of qualified workers. Consequently, the bargaining power of these suppliers is amplified, as they can command higher prices and more favorable terms due to the essential nature of their services and the difficulty in finding replacements.

Limited Number of Key Suppliers

When a few dominant suppliers control essential components or services, Itho Daalderop faces heightened supplier bargaining power. This concentration means fewer viable alternatives, potentially forcing the company into less advantageous pricing or contract terms for critical inputs. For instance, in the HVAC sector, reliance on a small number of specialized component manufacturers for advanced heat exchanger technology can significantly shift negotiation leverage towards those suppliers.

This dynamic can directly impact Itho Daalderop's cost structure and operational flexibility. If these key suppliers are also experiencing high demand or have limited production capacity, their ability to dictate terms intensifies.

- Supplier Concentration: A market dominated by a few key suppliers for specialized HVAC components grants those suppliers significant leverage.

- Limited Alternatives: Itho Daalderop's reduced options for sourcing critical parts directly increase the bargaining power of these dominant suppliers.

- Potential for Higher Costs: Concentration can lead to less favorable pricing and contract terms for Itho Daalderop, impacting profitability.

- Impact on Innovation: Dependence on a few suppliers might also limit Itho Daalderop's ability to source cutting-edge technologies if suppliers are unwilling to share or innovate at competitive rates.

Switching Costs for Itho Daalderop

The bargaining power of suppliers for Itho Daalderop is significantly influenced by the substantial switching costs associated with their complex, integrated systems. For instance, replacing a core component in their advanced heating, ventilation, and hot water solutions often necessitates extensive re-engineering, rigorous testing, and new certification processes. These hurdles translate directly into higher expenses and longer lead times for any potential change, thereby strengthening the leverage of existing suppliers.

The high degree of integration within Itho Daalderop's product ecosystem means that altering a fundamental supplier is far from a simple substitution. This interconnectedness creates a dependency that suppliers can exploit. For example, if a key supplier of specialized heat exchangers or advanced control modules were to increase prices, Itho Daalderop would face considerable disruption and cost implications to find and implement an alternative. This situation is common in industries where product performance relies on proprietary or highly customized components.

- Significant Re-engineering Costs: Upgrading or replacing integrated components within Itho Daalderop's systems can require substantial modifications to existing designs, impacting development budgets.

- Rigorous Testing and Certification: New components must undergo extensive quality assurance and meet stringent regulatory standards, adding time and expense to the supplier change process.

- High Integration of Systems: The interconnected nature of Itho Daalderop's heating, ventilation, and hot water solutions means that a change in one supplier can have cascading effects on other parts of the system.

- Supplier Leverage: These factors collectively grant current suppliers greater bargaining power, as the cost and complexity of switching make Itho Daalderop more inclined to maintain existing relationships.

The bargaining power of suppliers for Itho Daalderop is substantial, particularly for specialized components like compressors and advanced sensors, as well as essential raw materials such as copper and aluminum. These suppliers can significantly influence Itho Daalderop's production costs, a trend exacerbated by ongoing supply chain volatility and fluctuating material prices, as seen with copper in early 2024. Furthermore, the HVAC sector's skilled labor shortage, projected to continue with HVAC technician employment growing faster than the average, drives up supplier labor costs, which are then passed on to manufacturers like Itho Daalderop.

High switching costs, stemming from the complex integration of Itho Daalderop's heating, ventilation, and hot water systems, further empower suppliers. Replacing critical components necessitates extensive re-engineering, testing, and certification, creating significant financial and time barriers for Itho Daalderop, thereby reinforcing the leverage of existing suppliers.

| Factor | Impact on Itho Daalderop | Example/Data Point (2024) |

|---|---|---|

| Specialized Component Dependence | Increases supplier leverage | Reliance on proprietary heat exchanger technology |

| Raw Material Price Volatility | Directly impacts production costs | Copper prices fluctuated significantly in early 2024 |

| Skilled Labor Shortage | Drives up supplier labor costs | HVAC technician employment projected to grow 6% (2022-2032) |

| High Switching Costs | Discourages supplier changes | Re-engineering and certification for integrated systems |

What is included in the product

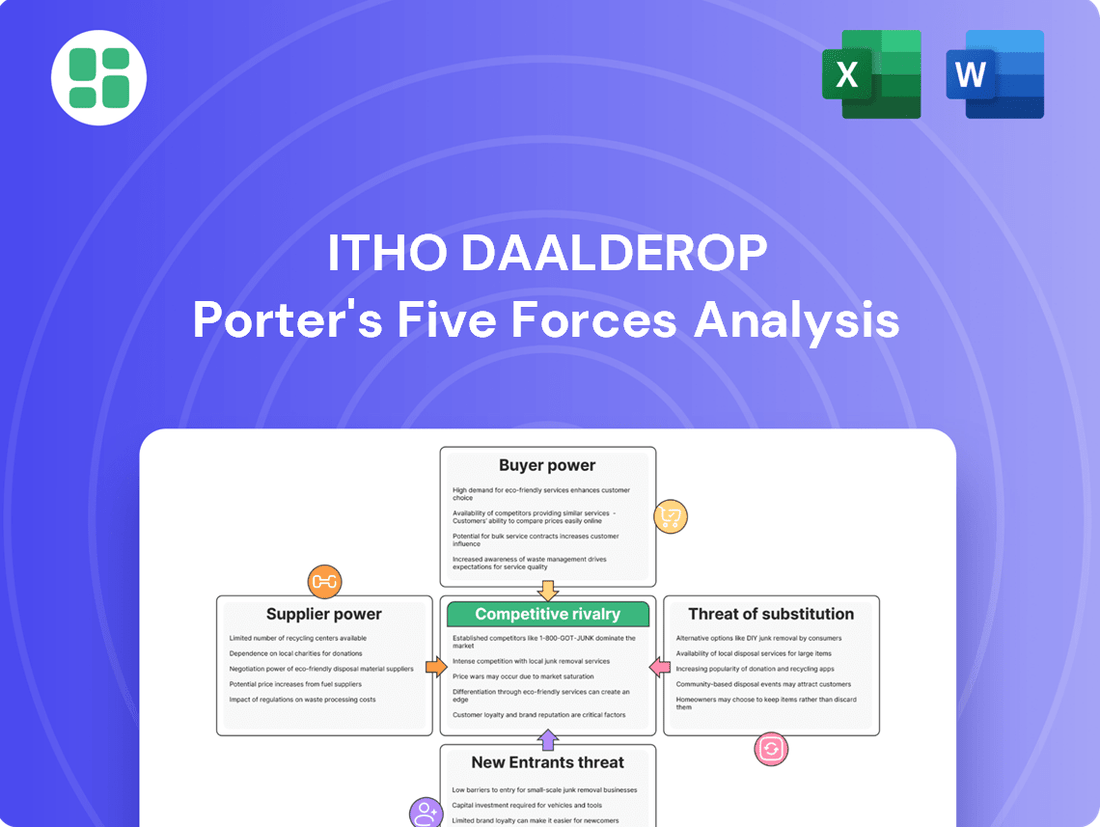

This Porter's Five Forces analysis provides a strategic overview of Itho Daalderop's competitive environment, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes.

Navigate competitive landscapes effortlessly with a visual breakdown of Itho Daalderop's Porter's Five Forces, instantly highlighting areas of strategic vulnerability.

Customers Bargaining Power

Customers, both in homes and businesses, are paying closer attention to the upfront cost of heating and hot water systems, even when long-term energy savings are offered. This price sensitivity is a significant factor influencing purchasing decisions.

The recent cooling of heat pump sales in certain European regions, partly due to economic strain, serves as a clear indicator of this heightened customer awareness regarding initial investment outlays.

The heating, ventilation, and hot water market is brimming with options. Customers can choose from traditional boilers, various types of heat pumps, and a wide array of ventilation systems. This abundance of choices directly impacts Itho Daalderop, as it means consumers have readily available alternatives, significantly reducing the company's pricing power.

Government incentives and subsidies for energy-efficient solutions, while boosting the market, also empower customers. These financial aids make certain technologies more accessible, influencing purchasing decisions. For instance, the uptake of heat pumps in Europe has been significantly shaped by varying subsidy levels across countries, allowing customers to prioritize options that offer the best financial advantage.

Information Transparency and Digitalization

Information transparency, amplified by digitalization, significantly boosts customer bargaining power. With increased access to product details, comparative reviews, and energy performance data via digital platforms, customers are better informed and can more effectively negotiate terms. For instance, the growth of online marketplaces and review sites in the home appliance sector, where Itho Daalderop operates, demonstrates this trend. Itho Daalderop's own initiative in developing a digital spare parts catalog underscores the market's demand for accessible and transparent information, directly impacting customer leverage.

This enhanced transparency allows customers to easily compare offerings from various manufacturers, driving down prices and demanding better service. The widespread availability of data means that the perceived differentiation between brands can diminish, putting more pressure on companies like Itho Daalderop to compete on price and value.

- Enhanced Customer Knowledge: Digital platforms provide access to detailed product specifications, user reviews, and performance metrics, empowering customers to make informed purchasing decisions.

- Price Sensitivity: Easy comparison of prices and features across different brands intensifies price competition, forcing manufacturers to offer more competitive pricing.

- Demand for Transparency: Companies like Itho Daalderop are responding to this trend by providing digital tools, such as spare parts catalogs, to meet customer expectations for readily available information.

- Increased Switching Likelihood: Well-informed customers are more likely to switch to competitors offering better value or more transparent dealings, thereby increasing their bargaining power.

Importance of Installation and After-Sales Service

For complex systems like heat pumps and integrated climate solutions, the quality of installation and ongoing maintenance is paramount. This critical dependency grants installers and large commercial clients significant bargaining power, as improper setup can lead to costly inefficiencies and dissatisfaction. Itho Daalderop's strategic emphasis on bolstering its after-sales service is a direct acknowledgment of this leverage, aiming to improve customer satisfaction and foster long-term loyalty.

The bargaining power of customers in the HVAC sector is amplified by the essential nature of proper installation and reliable after-sales support. For instance, a poorly installed heat pump can result in energy wastage and reduced lifespan, making the installer's expertise a key differentiator. In 2024, customer reviews and service response times are increasingly influencing purchasing decisions, with many end-users prioritizing providers with proven track records in maintenance and support. This trend underscores why Itho Daalderop's investment in its service network is not just about customer retention but also a crucial factor in managing customer power.

- Customer Leverage: The complexity of HVAC systems elevates the importance of skilled installation and dependable after-sales service, empowering customers.

- Itho Daalderop's Response: The company's focus on enhancing its after-sales support directly addresses this customer influence.

- Market Impact: In 2024, service quality is a significant driver of customer satisfaction and retention in the climate solutions market.

Customers are increasingly price-sensitive, scrutinizing upfront costs for heating and hot water systems, as seen in the 2024 cooling of heat pump sales in some European markets due to economic pressures. The wide availability of alternative systems, from traditional boilers to various heat pumps, significantly dilutes Itho Daalderop's pricing power.

Government incentives empower customers by making energy-efficient technologies more accessible, allowing them to prioritize financially advantageous options, as evidenced by varying heat pump subsidy levels across European countries influencing uptake.

Digitalization has boosted customer knowledge and bargaining power through enhanced transparency, with readily available product details, comparative reviews, and energy performance data. This trend is evident in the growth of online marketplaces and Itho Daalderop's own development of a digital spare parts catalog, directly increasing customer leverage.

The critical need for quality installation and after-sales support for complex systems like heat pumps grants significant bargaining power to installers and commercial clients. In 2024, customer reviews and service response times are increasingly influencing purchasing decisions, making Itho Daalderop's investment in its service network a crucial factor in managing customer influence.

| Factor | Impact on Itho Daalderop | 2024 Trend/Data Point |

|---|---|---|

| Price Sensitivity | Reduces pricing power | Cooling heat pump sales in some European markets due to economic strain. |

| Availability of Alternatives | Increases customer choice, lowers switching costs | Wide range of heating and hot water system options available. |

| Information Transparency | Empowers customers, drives demand for competitive pricing | Growth of online reviews and digital product information platforms. |

| Importance of Installation/Service | Grants power to installers and service providers | Customer reviews increasingly factor in service quality and response times. |

Preview the Actual Deliverable

Itho Daalderop Porter's Five Forces Analysis

This preview displays the complete Itho Daalderop Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within its industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning. Gain immediate access to this professionally formatted analysis, empowering you with actionable insights into market dynamics and competitive positioning.

Rivalry Among Competitors

The European HVAC market, a significant sector encompassing heat pumps, ventilation, and water heaters, is characterized by a high number of competitors, both large international corporations and smaller regional specialists. This crowded field includes prominent names like Vaillant, NIBE, Daikin, Bosch, and Mitsubishi Electric, all vying for dominance.

This intense competition directly impacts market share dynamics. For instance, in 2024, the global heat pump market was projected to reach over $70 billion, with Europe being a key growth driver, indicating substantial revenue potential but also fierce battles for customer acquisition and retention among these diverse players.

The push for decarbonization is certainly fueling growth in the energy-efficient solutions market, with governments worldwide setting ambitious targets. However, this growth isn't always a straight line. For instance, in 2024, several European countries experienced a noticeable slowdown in heat pump installations compared to previous years, partly due to shifting subsidy landscapes and economic uncertainties. This volatility can ramp up competitive rivalry as businesses vie for market share in a less predictable sales environment.

Itho Daalderop distinguishes itself by concentrating on sophisticated, eco-friendly, and energy-saving systems designed to elevate indoor climate comfort. This focus on advanced technology and sustainability is a key driver in their market approach.

The company's commitment to continuous innovation is evident in their development of smart features, quieter operational designs, and seamless integration capabilities with renewable energy sources. For instance, in 2024, Itho Daalderop reported a 15% increase in R&D investment, specifically targeting smart home climate control advancements.

High Exit Barriers

The HVAC manufacturing sector, including companies like Itho Daalderop, faces substantial exit barriers. Significant investments in specialized production machinery, extensive research and development for new technologies, and established global distribution channels mean that exiting the market is a costly and complex undertaking.

These high capital requirements and sunk costs compel manufacturers to remain active even when facing economic downturns or intense competition. For instance, the average capital expenditure for a new HVAC manufacturing plant can easily run into tens of millions of dollars. In 2024, the global HVAC market was valued at approximately $130 billion, with projections indicating continued growth, yet the initial investment to capture even a small market share remains a considerable hurdle for new entrants and a deterrent for existing players considering divestment.

- High Capital Investment: Setting up and maintaining advanced manufacturing facilities for HVAC systems requires substantial upfront capital, often in the tens of millions of dollars.

- R&D Commitment: Continuous innovation in energy efficiency and smart technology necessitates ongoing investment in research and development, creating a long-term financial commitment.

- Distribution Networks: Establishing and managing a robust network of distributors and service providers is a significant investment that is difficult to replicate or abandon quickly.

- Specialized Assets: The industry relies on specialized machinery and intellectual property, which have limited alternative uses, increasing the cost of exiting.

Mergers, Acquisitions, and Strategic Alliances

The building technology sector, including players like Itho Daalderop, experiences significant competitive rivalry fueled by mergers, acquisitions, and strategic alliances. Companies actively pursue these avenues to achieve greater economies of scale, broaden their product offerings, and solidify their standing in the market. This ongoing consolidation reshapes the competitive arena, presenting distinct hurdles for businesses that remain independent.

For instance, in 2024, the global building automation market, a segment relevant to Itho Daalderop's operations, saw continued M&A activity. Companies like Schneider Electric and Siemens have consistently been involved in strategic acquisitions to enhance their smart building solutions portfolios. This trend indicates a clear industry movement towards larger, more integrated players.

- Industry Consolidation: Ongoing mergers and acquisitions are a hallmark of the building technology sector, aiming for enhanced market share and operational efficiencies.

- Strategic Partnerships: Companies form alliances to share R&D, expand distribution networks, and offer more comprehensive solutions, thereby increasing competitive pressure.

- Impact on Independent Players: Businesses not participating in consolidation may face challenges in competing with the expanded capabilities and market reach of merged entities.

- Market Reshaping: These corporate actions directly influence market dynamics, potentially leading to new dominant players and altered competitive strategies for all participants.

The competitive rivalry within the European HVAC market, where Itho Daalderop operates, is intense due to a large number of established players and a growing demand for energy-efficient solutions. This dynamic is further amplified by ongoing industry consolidation through mergers and acquisitions, as seen in the building automation sector in 2024, where major companies like Schneider Electric and Siemens actively expanded their portfolios. Consequently, independent players face increasing pressure to innovate and scale to remain competitive against these larger, integrated entities.

SSubstitutes Threaten

Despite the ongoing transition towards greener energy, traditional fossil fuel-based heating systems, such as gas boilers and direct electric water heaters, continue to pose a threat of substitution. Their lower initial purchase price often makes them an attractive option for consumers, especially in the short term.

However, the landscape is shifting. New European Union regulations, set to take effect from 2025, are designed to phase out fossil fuel boilers and eliminate subsidies for their installation. This regulatory push is expected to gradually diminish the appeal and availability of these traditional systems as viable substitutes.

The threat of substitutes for Itho Daalderop's heating solutions is significant, particularly from other renewable energy sources. For instance, solar thermal systems, which directly harness solar energy for heating water, present a viable alternative, especially in sunnier climates. In 2024, the global solar thermal market was valued at approximately $6.5 billion, indicating substantial consumer adoption of this substitute technology.

Biomass boilers, utilizing organic matter like wood pellets or chips, also offer a renewable heating option, particularly appealing in regions with readily available biomass resources. The global biomass energy market was estimated to be worth over $100 billion in 2024, showcasing its widespread use. Furthermore, district heating networks, which supply heat from a central source to multiple buildings, can also act as a substitute, especially in urban areas where infrastructure is already in place.

The increasing adoption of passive building design and enhanced insulation techniques presents a notable threat of substitution for traditional HVAC systems, a core offering of companies like Itho Daalderop. These advanced building methods, focusing on airtightness and superior thermal performance, drastically cut down the energy required for heating and cooling. For instance, a certified Passive House building can reduce heating energy demand by up to 90% compared to a typical building, as reported by the Passive House Institute.

This trend directly impacts the market for high-capacity HVAC units. As more buildings are designed to retain heat in winter and stay cool in summer through passive means, the demand for powerful, active climate control systems diminishes. While Itho Daalderop's focus on energy efficiency aligns with these principles, the fundamental reduction in the *need* for such systems represents a substitution threat, potentially lowering overall sales volume for their core HVAC products.

Behavioral Changes and Smart Energy Management

The increasing consumer interest in smart energy management systems (HEMS) presents a potential threat. By optimizing the use of existing infrastructure, these systems might postpone the need for consumers to invest in newer, more efficient Itho Daalderop products. For instance, a 2024 report indicated that 45% of homeowners surveyed were actively seeking ways to reduce energy consumption through smart technology, even if it meant delaying appliance upgrades.

However, this trend also creates an opportunity for integration. Itho Daalderop's smart solutions can be designed to work seamlessly with these HEMS, enhancing their functionality and potentially creating a new revenue stream. This symbiotic relationship could mitigate the threat of substitution by making Itho Daalderop products an essential component of a broader smart home energy ecosystem.

- Consumer adoption of HEMS: Growing awareness and implementation of smart home energy management.

- Impact on product upgrades: Potential delay in consumers purchasing new, efficient Itho Daalderop systems.

- Integration opportunity: Itho Daalderop's smart products can be designed to complement existing HEMS.

- Market data: In 2024, 45% of surveyed homeowners expressed interest in smart energy optimization, impacting upgrade cycles.

Hybrid Systems and Integrated Solutions

The increasing prevalence of hybrid heat pump systems presents a significant threat of substitution for Itho Daalderop. These systems often integrate heat pumps with other energy sources, such as solar thermal or existing gas boilers, offering consumers a more adaptable and potentially cost-effective heating solution. For instance, in 2024, the demand for integrated home energy systems, including those with hybrid heat pump configurations, saw a notable uptick as homeowners sought to balance upfront costs with long-term energy savings.

Itho Daalderop's competitive strategy must account for these hybrid setups. If their standalone heat pump offerings cannot match the combined performance or cost-efficiency of these integrated solutions, customers may opt for alternatives. This necessitates a focus on either making their individual products highly competitive within these hybrid frameworks or developing their own superior, seamlessly integrated solutions that offer a clear advantage.

- Hybrid systems offer flexibility by combining heat pumps with solar or gas boilers.

- Consumer adoption of integrated home energy systems increased in 2024.

- Itho Daalderop must compete by offering competitive standalone products or superior integrated solutions.

Alternative heating and cooling technologies, particularly those leveraging renewable sources, pose a significant threat. Solar thermal systems, valued at approximately $6.5 billion globally in 2024, offer direct solar energy utilization, while biomass boilers, part of a market exceeding $100 billion in 2024, utilize organic matter. These options provide consumers with choices that bypass traditional HVAC systems.

Furthermore, advancements in building design, such as passive house standards that reduce heating energy demand by up to 90%, directly diminish the need for high-capacity HVAC units. This trend represents a substitution threat by fundamentally lowering the energy required for climate control, impacting the market for active systems.

The rise of smart home energy management systems (HEMS) also presents a substitution threat, as 45% of surveyed homeowners in 2024 sought to optimize energy use, potentially delaying appliance upgrades. However, this trend also offers an integration opportunity for Itho Daalderop's smart products.

Hybrid heat pump systems, which combine heat pumps with other energy sources, are gaining traction as adaptable and cost-effective solutions. The increasing demand for integrated home energy systems in 2024 highlights this trend, requiring Itho Daalderop to either offer competitive standalone products or develop superior integrated solutions.

| Substitute Technology | Market Context (2024) | Impact on HVAC Demand |

|---|---|---|

| Solar Thermal | Global Market: ~$6.5 billion | Directly provides heating, reducing reliance on active systems. |

| Biomass Boilers | Global Market: >$100 billion | Offers a renewable alternative to conventional heating. |

| Passive Building Design | Reduces heating energy demand by up to 90% (Passive House Institute) | Significantly lowers the need for HVAC systems. |

| Smart Energy Management Systems (HEMS) | 45% of homeowners surveyed interested in energy optimization | Can delay HVAC upgrades by improving existing system efficiency. |

| Hybrid Heat Pump Systems | Increased demand for integrated home energy systems | Offers combined performance, potentially outcompeting standalone solutions. |

Entrants Threaten

Entering the competitive HVAC manufacturing sector, especially for sophisticated products like heat pumps, demands significant upfront investment. Companies need to allocate substantial funds towards research and development to innovate, establish state-of-the-art manufacturing plants, and build robust supply chains. For instance, in 2024, the global heat pump market is projected to reach over $60 billion, indicating the scale of investment required to capture even a small share.

Established brand loyalty is a significant barrier for new entrants. Companies like Itho Daalderop have cultivated deep trust and recognition among consumers and professionals over decades. For instance, in the competitive HVAC market, brand reputation often dictates purchasing decisions, with installers frequently preferring known quantities for reliability and ease of service.

Furthermore, extensive distribution networks are crucial. Itho Daalderop's long-standing relationships with installers, contractors, and retailers create a formidable hurdle for newcomers. Building a comparable network, which involves training, support, and logistical infrastructure, requires substantial time and investment, making it difficult for new brands to gain widespread market access and product availability.

The HVAC industry, particularly for companies like Itho Daalderop, faces significant regulatory barriers. Stringent energy efficiency standards, such as those mandated by the EU's Ecodesign directive, and evolving environmental regulations, like the phase-out of certain refrigerants, create substantial compliance costs. For instance, the F-gas Regulation in the EU continues to drive a transition to lower global warming potential refrigerants, requiring new product development and investment from any potential entrant. Navigating these complex and often changing rules adds considerable expense and technical expertise requirements, making market entry challenging.

Technological Complexity and R&D Intensity

The threat of new entrants in the HVAC sector, particularly for companies like Itho Daalderop, is significantly mitigated by the high technological complexity and R&D intensity involved. Developing cutting-edge heating, ventilation, and hot water systems demands substantial expertise in areas like thermodynamics, smart controls, and sustainable energy integration. This technical barrier means newcomers need considerable time and capital to achieve product parity, let alone innovation.

The continuous need for research and development to stay competitive further elevates this barrier. For instance, the global HVAC market is projected to reach over $150 billion by 2026, with a significant portion driven by innovation in energy efficiency and smart home technology. Companies must invest heavily in R&D to develop products that meet evolving environmental regulations and consumer demand for connected, efficient systems. This ongoing investment makes it challenging for new players to enter and compete effectively against established firms with proven R&D capabilities.

- High R&D Spending: Leading HVAC manufacturers often allocate 5-10% of their revenue to R&D, a substantial hurdle for startups.

- Intellectual Property: Patents on advanced technologies, such as heat pump efficiency or smart grid integration, create exclusive rights and market advantages.

- Skilled Workforce: A shortage of engineers with specialized knowledge in areas like advanced refrigerants and IoT integration for building management systems further restricts new entrants.

- Product Development Cycles: The lengthy and costly process of designing, testing, and certifying new HVAC products can take years, delaying market entry.

Access to Skilled Labor and Expertise

The availability of skilled labor is a significant hurdle for new entrants in the HVAC sector, extending beyond just manufacturing to encompass installation and ongoing maintenance. Securing a qualified workforce presents a substantial challenge, particularly given the existing labor shortages impacting the HVAC industry. For instance, reports from 2023 indicated a substantial deficit in skilled trades, with many companies struggling to find qualified technicians.

New companies would need to invest heavily in training programs or competitive recruitment to attract experienced personnel. This difficulty in accessing a trained workforce acts as a deterrent, making it harder for new players to establish a strong operational footing and compete effectively with established firms that already possess this critical resource.

- Skilled Labor Shortage: The HVAC industry faced a notable shortage of skilled technicians in 2023, impacting operational capacity.

- Training Investment: New entrants must allocate significant resources to training or recruitment to build a competent workforce.

- Competitive Recruitment: Attracting experienced technicians requires competitive compensation and benefits, adding to startup costs.

- Operational Barrier: Difficulty in securing skilled labor directly hinders a new company's ability to provide installation and maintenance services, a key aspect of the HVAC market.

The threat of new entrants for Itho Daalderop is generally low due to substantial capital requirements for R&D, manufacturing, and distribution, alongside strong brand loyalty and established networks. Regulatory hurdles and the need for specialized technical expertise further deter newcomers, making market entry a costly and complex undertaking.

New entrants face significant barriers in the HVAC sector, including the need for extensive R&D to match technological advancements and the high cost of developing and certifying new products. The industry's reliance on skilled labor, which is currently in short supply, adds another layer of difficulty for companies looking to establish a presence.

For Itho Daalderop, the threat of new entrants is effectively managed by high switching costs for customers, who are often locked into existing installer relationships and product ecosystems. The complexity of HVAC systems also means that consumers and installers often prefer established brands with proven reliability and readily available support, making it difficult for new players to gain traction.

The significant capital investment required for advanced manufacturing and the lengthy product development cycles, which can span several years, act as substantial deterrents. In 2024, the global HVAC market's growth, projected to exceed $150 billion by 2026, is largely driven by innovation, demanding continuous R&D investment that new entrants may struggle to match.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High costs for R&D, manufacturing facilities, and distribution networks. | Significant financial hurdle for market entry. |

| Brand Loyalty & Reputation | Established trust and recognition among consumers and professionals. | Difficult for new brands to gain market acceptance. |

| Distribution Networks | Existing relationships with installers, contractors, and retailers. | Challenging for newcomers to achieve widespread product availability. |

| Regulatory Compliance | Adherence to stringent energy efficiency and environmental standards. | Adds complexity and cost to product development and market entry. |

| Technical Expertise & R&D | Need for specialized knowledge in thermodynamics, smart controls, etc. | Requires substantial investment in innovation to compete. |

| Skilled Labor Availability | Shortage of qualified technicians for installation and maintenance. | Hinders operational capacity and service delivery for new companies. |

Porter's Five Forces Analysis Data Sources

Our Itho Daalderop Porter's Five Forces analysis is built upon a foundation of industry-specific market research reports, company annual filings, and expert commentary from trade publications. We also incorporate data from government statistics and economic databases to provide a comprehensive view of the competitive landscape.