Indian Railway Finance PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indian Railway Finance Bundle

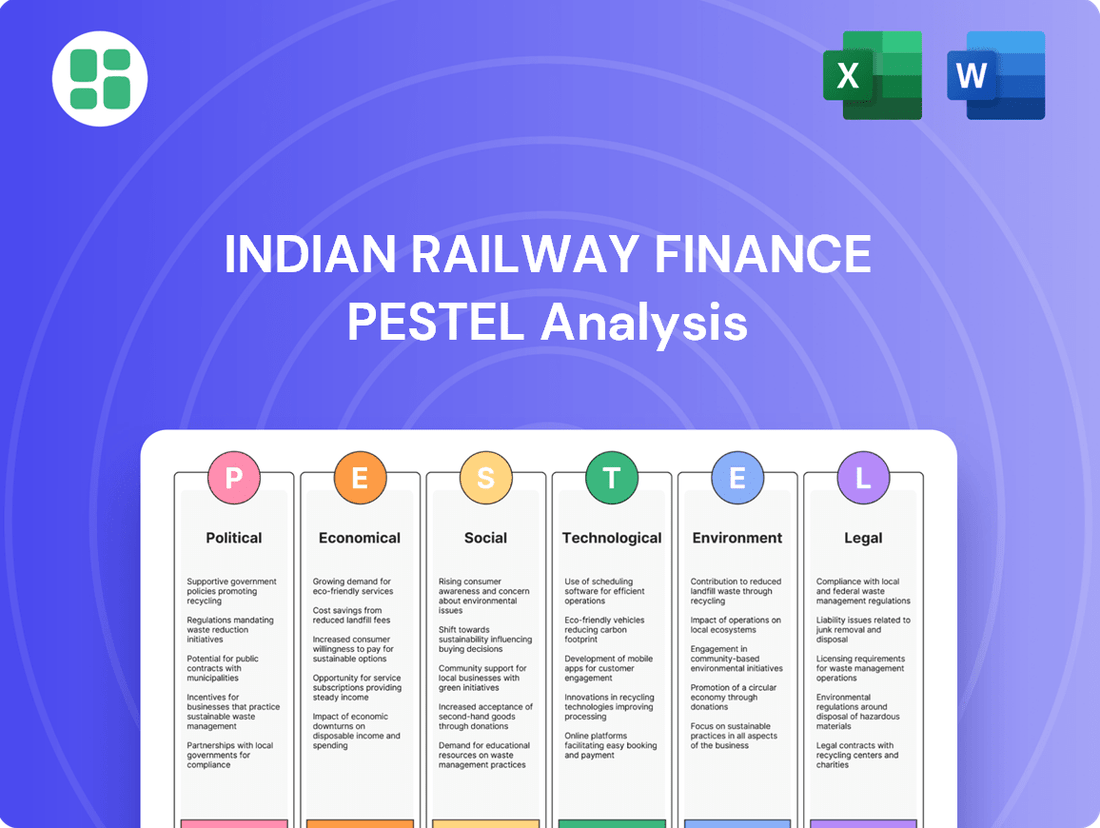

Unlock the critical external factors shaping Indian Railway Finance's trajectory. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental forces at play, offering you a strategic advantage. Don't guess about the future; understand it. Purchase the full analysis now to gain actionable intelligence for your investment or business strategy.

Political factors

As a government-owned entity, IRFC enjoys substantial backing from the Indian administration, which is keenly focused on railway development. This policy alignment translates into consistent financial backing for crucial infrastructure upgrades.

The government's commitment to modernizing India's rail network is evident in its substantial capital expenditure plans. For instance, the Union Budget 2024-25 has earmarked ₹2.55 lakh crore for Indian Railways, a significant increase from the previous year, signaling strong support for projects like the Vande Bharat program and the expansion of freight corridors.

This robust governmental support ensures a predictable revenue stream for IRFC, as it finances these large-scale, government-mandated railway projects. The sustained investment in rail infrastructure directly fuels the demand for IRFC's financial instruments and services.

The annual railway budget is a significant driver for IRFC, shaping the scope of infrastructure development and rolling stock procurement it funds. For the fiscal year 2024-25, Indian Railways saw its capital expenditure allocation reach an unprecedented ₹2.65 lakh crore. A considerable part of this substantial outlay is supported by budgetary allocations.

This record-breaking capital expenditure directly expands the borrowing avenues available to IRFC, as it is instrumental in financing these large-scale projects. The increased government investment signals a robust pipeline of future financing needs for railway modernization and expansion.

Indian Railway Finance Corporation (IRFC) is subject to a stringent regulatory environment dictated by the Indian government, particularly its Ministry of Railways and Ministry of Finance. This oversight covers critical aspects like borrowing limits and adherence to Public Sector Undertaking (PSU) guidelines, ensuring financial discipline.

Compliance with these regulations is paramount for IRFC's operations and its ability to raise capital. For instance, in FY 2023-24, IRFC's total borrowing was managed within the approved limits set by the government, reflecting the importance of this regulatory framework.

The robust oversight provided by these governmental bodies instills confidence among investors. This stability is a key factor for those considering IRFC's financial instruments, as it signals a commitment to sound financial practices and governance.

Infrastructure Development Push

India's government is heavily prioritizing infrastructure development, which directly benefits IRFC. This focus creates a robust, long-term growth outlook for the company.

Key initiatives like the PM Gati Shakti National Master Plan are spotlighting numerous railway projects. For instance, the plan aims to integrate infrastructure development across various ministries, with railways playing a central role. This signals significant future capital expenditure in the sector.

The sustained push for expanding railway networks through new lines, gauge conversion, and electrification is the bedrock of IRFC's business. These projects require substantial financing, which IRFC is positioned to provide.

- Government's infrastructure push: Overarching national policy prioritizes infrastructure, particularly railways, ensuring a steady pipeline of projects.

- PM Gati Shakti portal: Identifies and facilitates numerous railway projects, indicating substantial upcoming investment.

- Direct business driver: New lines, gauge conversion, and electrification projects directly fuel IRFC's core financing activities.

Political Stability and Long-term Vision

Political stability and a clear, long-term vision are crucial for the Indian Railway Finance Corporation (IRFC). This stability directly impacts IRFC's predictability in operations and its capacity to secure funding over the long haul. A consistent policy framework allows IRFC to plan and execute its financing strategies effectively.

The Indian government's dedication to modernizing the railways, aiming for a world-class system, offers a strong strategic compass for IRFC. This includes ambitious environmental goals, such as achieving net-zero emissions by 2030, which directly influence the types of projects IRFC will finance and the associated funding requirements.

- Government's Capital Outlay: The Indian government has consistently increased its capital outlay for railways, with the budget allocation for FY2024-25 reaching ₹2.55 lakh crore, a significant jump from previous years, signaling strong political backing for railway development.

- Net-Zero Target: IRFC's financing activities are increasingly aligned with the national goal of achieving net-zero carbon emissions by 2030, driving investments in electrification and sustainable infrastructure.

- Policy Continuity: The emphasis on continuity in railway policies ensures that IRFC can undertake large-scale, long-gestation projects with confidence in future government support.

The Indian government's strong commitment to railway infrastructure development is a primary political factor influencing IRFC. For FY2024-25, the capital expenditure for Indian Railways was set at ₹2.55 lakh crore, underscoring this focus and creating a robust demand for IRFC's financing services. This consistent policy support, coupled with national initiatives like the PM Gati Shakti Master Plan, ensures a predictable pipeline of projects, directly driving IRFC's business model and its ability to raise capital. Furthermore, the government's ambitious environmental targets, such as achieving net-zero emissions by 2030, are directing IRFC's financing towards more sustainable railway projects, including electrification.

| Political Factor | Description | Impact on IRFC | Supporting Data (FY2024-25) |

|---|---|---|---|

| Government Infrastructure Push | National policy prioritizes railway development. | Ensures a steady pipeline of projects for financing. | Capital outlay for Indian Railways: ₹2.55 lakh crore |

| Policy Continuity | Consistent government vision for railway modernization. | Facilitates long-term project planning and capital raising. | Continued focus on Vande Bharat and freight corridor expansion. |

| Environmental Goals | National commitment to net-zero emissions by 2030. | Drives financing towards sustainable and electrified projects. | Increased investment in electrification projects. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Indian Railway Finance, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for stakeholders to navigate challenges and capitalize on opportunities within the Indian railway sector's evolving landscape.

This PESTLE analysis offers a clear, summarized version of the Indian Railway Finance landscape, acting as a pain point reliver by providing easy referencing for meetings and presentations.

It allows for quick interpretation at a glance, helping stakeholders easily understand external factors impacting Indian Railway Finance and supporting discussions on risk and market positioning.

Economic factors

Indian Railway Finance Corporation's (IRFC) financial health is intrinsically linked to the capital expenditure (capex) plans of Indian Railways. For the fiscal year 2024-25, Indian Railways has been allocated a record capital outlay of ₹2.65 lakh crore, a substantial increase from previous years. This significant investment is earmarked for crucial infrastructure upgrades, including track modernization, station development, and the expansion of its rolling stock fleet.

This robust capex cycle directly fuels IRFC's business model, as the company primarily finances these large-scale projects. IRFC's capacity to raise funds at competitive rates and channel them efficiently into these infrastructure developments is a key determinant of its profitability and growth trajectory. The sheer scale of the ₹2.65 lakh crore allocation for FY 2024-25 underscores a period of accelerated investment, presenting both opportunities and challenges for IRFC in managing its funding and deployment strategies effectively.

Fluctuations in domestic and global interest rates significantly influence IRFC's borrowing costs. For instance, the Reserve Bank of India's repo rate, a key benchmark, has seen adjustments, impacting the overall cost of capital in India. While IRFC benefits from its government backing, higher rates can still increase its funding expenses, potentially squeezing its net interest margin.

IRFC strategically employs instruments like zero-coupon bonds and External Commercial Borrowings (ECBs) to access capital at competitive rates. These methods help mitigate the impact of rising interest rate environments. For example, in the fiscal year 2023-24, IRFC continued to leverage these avenues to manage its financing costs effectively.

India's robust economic expansion is a primary driver for both freight and passenger rail demand, directly influencing Indian Railways' revenue streams and its capacity to meet lease obligations to IRFC. As the economy gains momentum, we observe a corresponding increase in the volume of goods transported and the number of passengers choosing rail travel.

This correlation was evident in FY 2024-25, a period characterized by strong economic activity that translated into record earnings for Indian Railways, underscoring the direct link between GDP growth and railway financial performance.

Inflation and Cost Management

Inflationary pressures remain a significant concern for the Indian economy, directly impacting the cost of large-scale infrastructure projects undertaken by Indian Railways. For IRFC, this can translate into increased financing requirements for these projects, thereby potentially widening its exposure to higher borrowing costs and project cost overruns. For instance, the Wholesale Price Index (WPI) in India saw a notable increase in early 2024, hovering around 5.0% to 5.5%, which directly affects material and labor costs for construction.

While IRFC's core business model relies on a fixed lending spread, the financial health of Indian Railways is crucial for the viability of the assets it finances. Effective cost management by Indian Railways, such as the ongoing push for electrification, can indirectly bolster IRFC's financial stability. This strategy aims to reduce reliance on expensive diesel fuel, with Indian Railways targeting over 80% electrification by the end of FY2024, a move that lowers operational expenses and enhances the long-term value of leased rolling stock and infrastructure.

- Inflationary Impact: Rising WPI figures in early 2024, around 5.0%-5.5%, increase project costs and IRFC's potential financing needs.

- Electrification Benefits: Indian Railways' drive towards 80% electrification by FY2024 reduces fuel costs, indirectly supporting IRFC by ensuring asset viability.

- Cost Management Link: Efficient cost control by Indian Railways through operational improvements is vital for maintaining the profitability of assets financed by IRFC.

Capital Market Conditions and Funding Diversification

IRFC's borrowing capacity hinges on robust capital market conditions and a strong credit profile. As of late 2024, India's capital markets have shown resilience, with a positive outlook for infrastructure financing, supporting IRFC's access to funds. Investor sentiment remains cautiously optimistic, influenced by government infrastructure spending initiatives and the company's consistent financial performance.

The company actively diversifies its funding, utilizing domestic bonds and External Commercial Borrowings (ECBs). In the fiscal year 2023-24, IRFC raised a significant portion of its capital through rupee-denominated bonds, reflecting strong domestic investor appetite. Furthermore, IRFC is strategically broadening its debt issuance to encompass other infrastructure and logistics sectors, aiming to tap into a wider pool of capital and reduce reliance solely on railway-specific funding.

- Domestic Bond Issuance: IRFC's successful issuance of rupee bonds in FY 2023-24 demonstrated strong domestic market demand.

- ECB Utilization: The company continues to leverage External Commercial Borrowings to access international capital markets and diversify its funding base.

- Credit Ratings: Maintaining strong credit ratings from agencies like ICRA and CRISIL is crucial for favorable borrowing terms.

- Sector Expansion: IRFC's strategic move to fund non-railway infrastructure projects signals a proactive approach to capital diversification.

Economic growth in India directly fuels demand for rail freight and passenger services, enhancing Indian Railways' revenue and its ability to meet financial obligations to IRFC. For instance, India's GDP growth projection for FY2024-25 is around 7.0%, indicating a robust economic environment supportive of railway expansion.

Interest rate policies by the Reserve Bank of India significantly impact IRFC's borrowing costs. As of late 2024, the repo rate has remained stable, providing a relatively predictable cost of capital, though any upward revisions would increase IRFC's financing expenses.

Inflationary pressures, exemplified by a WPI of approximately 5.0%-5.5% in early 2024, raise project costs for Indian Railways, potentially increasing the capital IRFC needs to finance.

The government's record capital outlay of ₹2.65 lakh crore for Indian Railways in FY 2024-25 is a direct economic stimulus for IRFC, driving its financing business.

| Economic Factor | Impact on IRFC | Supporting Data (as of late 2024/early 2025) |

|---|---|---|

| GDP Growth | Increases rail traffic and revenue for Indian Railways, improving its financial health and ability to service debt to IRFC. | Projected Indian GDP growth for FY2024-25: ~7.0% |

| Interest Rates (Repo Rate) | Higher rates increase IRFC's borrowing costs, potentially reducing its net interest margin. | Repo rate stable in late 2024, but sensitivity to increases remains. |

| Inflation (WPI) | Raises the cost of railway infrastructure projects, increasing IRFC's financing requirements and potential for higher borrowing costs. | WPI around 5.0%-5.5% in early 2024. |

| Government Capex Allocation | Directly drives IRFC's business by providing a large pipeline of projects to finance. | Record ₹2.65 lakh crore for Indian Railways in FY 2024-25. |

Same Document Delivered

Indian Railway Finance PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Indian Railway Finance delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the sector. It provides a detailed overview of the opportunities and challenges, offering valuable insights for strategic planning.

Sociological factors

India's rapid urbanization and growing population are fueling a surge in demand for better rail services. People are looking for trains that are not only efficient but also comfortable and modern.

Indian Railways anticipates a massive 7.47 billion passenger journeys in the fiscal year 2025. To meet this, significant investments are being made in new train technologies, such as the Vande Bharat and Amrit Bharat trains, with IRFC playing a crucial role in financing these upgrades.

IRFC's financing of massive railway projects, like the ongoing Golden Quadrilateral network expansion, directly fuels job creation. Estimates suggest these infrastructure endeavors can generate millions of direct and indirect employment opportunities, particularly in construction and manufacturing sectors, impacting livelihoods across India.

Beyond direct jobs, the enhanced connectivity provided by these railway lines acts as a powerful catalyst for socio-economic upliftment. Improved access to markets and services in previously underserved regions fosters local economic growth and boosts social mobility, aligning with national development priorities and contributing to a more equitable society.

Public sentiment and government emphasis on passenger safety and improved amenities are pivotal in shaping Indian Railways' investment strategies. This focus directly impacts the types of projects IRFC prioritizes for financing.

IRFC's financing activities are geared towards projects that bolster safety, such as the Kavach automatic train protection system, and those enhancing passenger experience, like the Amrit Bharat Station Scheme. For instance, the Amrit Bharat Station Scheme aims to redevelop 1309 stations, with a significant portion of FY24 capex allocated to such upgrades, reflecting this societal demand for better travel conditions.

Accessibility and Inclusivity

Indian Railways, through its ongoing expansion and modernization efforts, is increasingly focusing on enhancing accessibility for all citizens. This commitment is reflected in the integration of features designed to cater to diverse needs, including those of persons with disabilities.

Newer train coaches are being equipped with facilities such as accessible toilets, and stations are incorporating Braille signage. These developments underscore a societal shift towards demanding more inclusive public transportation systems, a trend that IRFC's financing indirectly facilitates by enabling these infrastructure upgrades.

- Increased Accessibility Features: By 2024, Indian Railways aimed to have a significant portion of its fleet equipped with accessibility features, with a target of 1,000 stations to be made fully accessible by March 2024.

- Disability Inclusion Focus: The push for inclusivity is evident in the design of new rolling stock, with many new trains now featuring dedicated spaces and amenities for passengers with disabilities.

- Societal Demand: Growing awareness and advocacy for equal access are driving the demand for more inclusive public infrastructure, pushing railway development towards greater social equity.

- IRFC's Role: IRFC's financial backing is crucial for these large-scale infrastructure projects, enabling the implementation of accessibility and inclusivity measures across the vast railway network.

Public Perception and Trust

Indian Railway Finance Corporation's (IRFC) ability to raise funds is significantly influenced by public sentiment towards Indian Railways. When passengers experience reliable service, enhanced safety, and expanded connectivity, it bolsters confidence in the entire railway ecosystem, including IRFC's financial stability. For instance, the ongoing modernization efforts, including the introduction of Vande Bharat trains, have generally received positive public feedback, potentially aiding IRFC's fundraising endeavors.

Public trust is paramount for IRFC, as it finances a critical public utility. A strong perception of Indian Railways as efficient and safe translates into greater investor confidence in IRFC's financial instruments. Conversely, any perceived decline in service quality or safety incidents can negatively impact IRFC's reputation and its capacity to attract capital. The government's focus on improving passenger amenities and punctuality, as seen in recent performance reports, directly supports this trust-building process.

- Positive Public Perception: Enhances IRFC's creditworthiness and lowers borrowing costs.

- Trust in Indian Railways: Directly correlates with investor willingness to finance railway infrastructure projects.

- Service Improvements: Initiatives like the expansion of high-speed rail corridors contribute to a favorable public image.

- Safety Record: A strong safety record is crucial for maintaining public trust and, by extension, IRFC's financial standing.

The growing demand for improved rail travel, driven by urbanization and a young demographic, pushes for modernization and better passenger experiences. Indian Railways anticipates a significant increase in passenger journeys, projected to reach 7.47 billion in FY25, necessitating substantial investment in new technologies and infrastructure, with IRFC playing a vital financing role.

Societal expectations for enhanced safety and comfort are directly influencing railway development. Projects like the Kavach system and the Amrit Bharat Station Scheme, aimed at upgrading 1309 stations, are prioritized to meet these demands, with IRFC facilitating the necessary capital infusion.

There's a strong societal push for greater inclusivity in public transport, leading to increased demand for accessibility features for persons with disabilities. Indian Railways is actively integrating these features into new rolling stock and station designs, a trend supported by IRFC's financing of these infrastructure upgrades.

Technological factors

Technological advancements in rolling stock are a significant driver for Indian Railways, requiring substantial financial backing. The introduction of trains like the Vande Bharat and Amrit Bharat represents a leap forward in passenger comfort and operational efficiency, but also a considerable capital investment.

Indian Railway Finance Corporation (IRFC) is instrumental in financing these modern fleets. For instance, IRFC's financing for the Vande Bharat project alone underscores its commitment to upgrading India's rail infrastructure. As of FY24, IRFC's loan book stood at over ₹2.6 lakh crore, a portion of which is allocated to these advanced train sets.

Indian Railways is heavily investing in advanced signaling and safety systems, a key technological factor influencing its operations and IRFC's financing role. The rollout of Electronic Interlocking (EI) across thousands of route kilometers is a significant step towards modernizing network control.

The indigenously developed Kavach, an Automatic Train Protection (ATP) system, is being deployed to prevent Signal Passed at Danger (SPAD) and over-speeding incidents. By the end of fiscal year 2024, Kavach was implemented on over 1,500 route kilometers, with ambitious targets for further expansion in 2025, directly supported by IRFC's financial instruments.

Indian Railways is actively pursuing a digital transformation, integrating advanced technologies like AI-powered predictive maintenance for tracks and digital platforms to streamline ticketing, freight management, and internal processes. IRFC's financing plays a crucial role in these technological upgrades.

These investments are designed to significantly boost operational efficiency. For instance, the implementation of real-time track monitoring systems is expected to reduce downtime and improve safety. This focus on modernization aims to cut operational costs and elevate the quality of services offered to passengers and freight customers.

Electrification and Green Technologies

Indian Railways is aggressively pursuing electrification, with a target of 100% network electrification by the fiscal year 2025-26. This major technological overhaul, supported by IRFC, is crucial for reducing operational costs and environmental impact. As of March 2024, over 90% of the broad gauge network has been electrified, demonstrating significant progress.

Beyond electrification, Indian Railways is exploring and piloting hydrogen-powered trains. This initiative, which IRFC can finance, marks a forward-thinking approach to sustainable mobility, aiming to decarbonize sectors where battery-electric solutions are less feasible. These green technologies are central to modernizing the railway infrastructure.

- 100% Electrification Target: Indian Railways aims for complete electrification of its broad gauge network by FY 2025-26.

- Progress Achieved: Over 90% of the broad gauge network was electrified as of March 2024.

- Hydrogen Train Development: Piloting and introduction of hydrogen-powered trains are underway to enhance sustainability.

- IRFC's Role: IRFC's financing is pivotal in enabling these technological advancements in green rail transport.

Data Analytics and AI Integration

The Indian Railways is increasingly looking at data analytics and AI to transform its operations. This includes predictive maintenance for rolling stock and infrastructure, aiming to reduce downtime and enhance safety. For instance, by analyzing sensor data, potential equipment failures can be identified before they occur, minimizing disruptions.

Optimizing logistics and train scheduling through AI-powered systems is another key area. This can lead to more efficient use of resources, faster transit times, and improved punctuality, directly impacting operational costs and customer satisfaction. The railways have been investing in digital transformation initiatives to support these advancements.

IRFC's financing strategy can play a crucial role in enabling these technological upgrades. By providing capital for projects that incorporate AI and advanced data analytics, IRFC can help build a more efficient, responsive, and technologically advanced railway network. This aligns with the broader national push towards smart infrastructure and digital India.

- Predictive Maintenance: Indian Railways aims to reduce breakdowns by 10-15% through AI-driven predictive maintenance by 2025.

- Logistics Optimization: AI is expected to improve freight train utilization by up to 20% through better route planning and scheduling.

- Smart Infrastructure: Investments in IoT sensors and data platforms are crucial for enabling AI integration across the network.

- IRFC's Role: Financing for AI and data analytics projects will be key to realizing the efficiency gains envisioned by Indian Railways.

Technological advancements are reshaping Indian Railways, demanding significant financial support from entities like IRFC. The ongoing deployment of the Kavach ATP system, with over 1,500 route kilometers covered by March 2024 and ambitious expansion plans for 2025, highlights this commitment to safety and efficiency. Furthermore, the push for 100% broad gauge network electrification by FY 2025-26, with over 90% achieved by March 2024, is a major technological and financial undertaking, directly facilitated by IRFC's funding.

| Technology Initiative | Status (as of March 2024) | Target/Goal | IRFC Financing Role |

|---|---|---|---|

| Kavach (ATP System) | 1,500+ route km deployed | Nationwide rollout | Financing for system procurement and implementation |

| Network Electrification | 90%+ broad gauge electrified | 100% by FY 2025-26 | Funding for electrification projects |

| Vande Bharat/Amrit Bharat Trains | Ongoing induction | Fleet expansion | Financing for rolling stock procurement |

Legal factors

As a Public Sector Undertaking (PSU), the Indian Railway Finance Corporation (IRFC) operates under a stringent regulatory framework set by the Indian government. These regulations, which cover financial management, corporate governance, and accountability, are crucial for maintaining its operational integrity and public confidence. For instance, IRFC’s borrowing limits and investment strategies are often influenced by government directives and the broader economic policies impacting PSUs.

Recent data from the fiscal year 2023-24 highlights IRFC's role in financing the Indian Railways' capital expenditure. The company raised ₹25,000 crore through tax-free bonds in FY24, demonstrating its continued access to capital markets under PSU guidelines. This adherence to regulatory norms ensures its financial stability and its ability to support the massive infrastructure development plans of the Indian Railways.

Indian Railway Finance Corporation (IRFC) operates under the strict purview of SEBI and RBI. These bodies dictate the rules for IRFC's significant fundraising, especially its issuance of bonds and other debt. For instance, in the fiscal year 2023-24, IRFC raised approximately ₹30,000 crore through its public sector unit (PSU) bond issuance, adhering to SEBI's disclosure norms and RBI's prudential guidelines for borrowing.

Compliance with these financial market regulations is paramount for IRFC, as it directly impacts investor confidence and the cost of capital. SEBI's regulations ensure that IRFC's disclosures are transparent, providing investors with accurate information about its financial health and borrowing plans. Similarly, RBI's directives, such as those on foreign exchange management and interest rate policies, influence the terms and accessibility of IRFC's international and domestic debt offerings.

Indian Railway Finance Corporation (IRFC) operates under a stringent legal framework governing leasing and financing. Its primary function is leasing rolling stock and infrastructure to Indian Railways, making adherence to specific leasing laws and financial regulations paramount for contract validity and revenue realization. These laws ensure that IRFC's revenue-generating agreements are legally sound and enforceable within the Indian financial ecosystem.

Taxation Policies

Changes in India's taxation policies, especially concerning corporate tax rates and capital gains, directly influence Indian Railway Finance Corporation's (IRFC) profitability and its ability to attract investors. For instance, a reduction in corporate tax could boost IRFC's net income, making its shares more appealing. Conversely, changes to capital gains tax might affect the attractiveness of its financial instruments.

IRFC relies significantly on tax-exempt instruments, such as Section 54EC capital gains tax exemption bonds, to raise substantial capital for its infrastructure financing needs. The fiscal year 2023-24 saw continued emphasis on infrastructure spending, which IRFC supports. Any alterations to the tax benefits associated with these bonds could impact IRFC's cost of borrowing and its overall funding strategy.

- Corporate Tax Impact: A stable or reduced corporate tax rate, such as the 22% (plus surcharge and cess) applicable to domestic companies under certain conditions in India, benefits IRFC's bottom line.

- Capital Gains Tax: Modifications to capital gains tax rules can influence investor demand for IRFC's debt issuances, particularly those offering tax advantages.

- Tax-Exempt Bonds: The continued availability and attractiveness of tax-exempt bonds are crucial for IRFC's capital raising efficiency, especially for funding large-scale railway projects.

- Government Fiscal Policy: Broader shifts in government fiscal policy and tax reforms, such as those potentially introduced in the Union Budget 2024-25, will be closely monitored for their implications on IRFC's financial operations and investment appeal.

Environmental and Social Governance (ESG) Compliance

Indian Railway Finance Corporation (IRFC) faces growing legal and regulatory scrutiny regarding Environmental and Social Governance (ESG) compliance. This is driven by a global push for sustainable finance, impacting how IRFC structures its funding. For example, the issuance of green bonds necessitates strict adherence to established green financing frameworks and transparent disclosure of how proceeds are utilized, directly tying legal obligations to environmental performance.

IRFC's commitment to ESG principles is increasingly codified in its operational and financial strategies, influenced by evolving Indian and international environmental laws. The company's adherence to these regulations is crucial for maintaining investor confidence and accessing capital markets. Failure to comply can lead to penalties and reputational damage, underscoring the legal imperative for robust ESG integration.

- Green Bond Framework Adherence: IRFC must comply with the SEBI (Issue of Green Debt Securities) Regulations, 2021, ensuring its green bond issuances meet specific eligibility criteria and reporting standards.

- Disclosure Requirements: Legal mandates require comprehensive reporting on the environmental impact and social benefits of projects funded by IRFC, aligning with national sustainability goals.

- Climate Risk Legislation: As climate change legislation strengthens, IRFC may face new legal obligations related to assessing and mitigating climate-related financial risks in its lending and investment portfolios.

- Corporate Governance Standards: Compliance with corporate governance norms, including those related to social responsibility and ethical conduct, is a legal requirement that impacts IRFC's overall operations.

The legal landscape significantly shapes IRFC's operations, particularly its role as a government-owned entity. Compliance with SEBI and RBI regulations is paramount for its bond issuances and overall financial dealings. For instance, in FY23-24, IRFC raised approximately ₹30,000 crore via PSU bonds, strictly adhering to SEBI's disclosure norms and RBI's prudential guidelines.

Taxation policies directly influence IRFC's profitability and investor appeal. The availability of tax-exempt instruments, like Section 54EC bonds, is crucial for its capital raising, as seen in its continued support for infrastructure spending in FY23-24. Any changes to these tax benefits could impact its borrowing costs.

IRFC must also navigate evolving ESG regulations, including SEBI's Green Debt Securities Regulations, 2021, for its green bond issuances. Adherence to these legal mandates ensures transparency and is vital for maintaining investor confidence and accessing capital markets for its extensive financing activities.

| Key Legal Factor | Impact on IRFC | FY23-24 Data/Context |

| SEBI & RBI Regulations | Governs fundraising, disclosure, and financial practices. | ₹30,000 crore raised via PSU bonds, adhering to norms. |

| Taxation Policies | Affects profitability and investor demand for debt. | Reliance on tax-exempt bonds for capital raising. |

| ESG Compliance | Mandates transparency in green financing and reporting. | Adherence to SEBI Green Debt Securities Regulations, 2021. |

Environmental factors

Indian Railways is aggressively pursuing decarbonization, aiming for net-zero carbon emissions by 2030. A key milestone is achieving Scope 1 net-zero by 2025, primarily through widespread electrification. This initiative is crucial for reducing the environmental impact of rail transport.

IRFC plays a pivotal role in facilitating this transition by providing essential financing for railway electrification projects. These funds are channeled into electrifying existing lines and acquiring modern electric locomotives and rolling stock. For instance, IRFC's financing supports projects like the dedicated freight corridor electrification, a significant step towards a greener railway network.

By supporting these green initiatives, IRFC directly contributes to Indian Railways' ambitious climate targets. This focus on electrification not only lowers operational costs due to reduced fuel dependency but also significantly cuts down greenhouse gas emissions, aligning with global sustainability goals and India's climate commitments.

Indian Railway Finance Corporation (IRFC) is increasingly leveraging green financing, including issuing green offshore bonds, to support the development of environmentally sustainable railway infrastructure. This strategic move aims to attract investors prioritizing Environmental, Social, and Governance (ESG) factors.

These green bonds are crucial for Indian Railways in meeting its ambitious emission reduction targets. For instance, in the fiscal year 2023-24, IRFC successfully raised ₹1,000 crore through its maiden green bond issuance, with a tenor of 10 years, demonstrating a commitment to sustainable funding mechanisms.

The focus on green financing aligns with India's broader national climate goals and international commitments, such as the Paris Agreement. By channeling funds into projects like electrification and energy efficiency upgrades, IRFC plays a vital role in decarbonizing the railway sector.

Indian Railways is aggressively pursuing renewable energy integration, aiming for 30 GW of capacity by 2029-30. This strategic shift towards solar and wind power reduces operational costs and environmental impact.

IRFC plays a crucial role by expanding its debt financing for these green projects, thereby supporting India's broader renewable energy goals and tapping into a burgeoning market segment.

Environmental Impact Assessments (EIAs)

Environmental Impact Assessments (EIAs) are critical for Indian Railway Finance Corporation (IRFC) when funding new railway infrastructure. Projects requiring substantial land acquisition or development in sensitive ecological zones necessitate rigorous EIAs. IRFC's financing strategies must integrate these assessment outcomes to guarantee adherence to environmental regulations and to proactively manage associated risks.

For instance, the development of new dedicated freight corridors or high-speed rail lines often traverses areas with biodiversity concerns. IRFC's role in financing these projects means scrutinizing the EIA reports to ensure mitigation strategies for habitat disruption and pollution are robust. This diligence is paramount for long-term project viability and corporate social responsibility, especially as India pushes for greener infrastructure in its 2024-2025 development plans.

- EIA Mandates: Projects exceeding certain thresholds, as defined by the Environment (Protection) Act, 1986, and subsequent notifications, require mandatory EIAs.

- Ecological Sensitivity: Railway projects impacting forest land, wildlife habitats, or coastal zones are subject to particularly stringent EIA scrutiny.

- Risk Mitigation: Financing decisions are influenced by the identification of environmental risks in EIAs, such as water pollution, soil erosion, and noise pollution, and the proposed mitigation measures.

- Compliance Framework: IRFC's financing frameworks incorporate compliance with the Ministry of Environment, Forest and Climate Change (MoEF&CC) guidelines and the National Green Tribunal's directives.

Climate Change Adaptation

Climate change presents significant challenges for Indian Railways, necessitating substantial investments in adaptation. More frequent and intense extreme weather events, such as floods and heatwaves, threaten existing infrastructure. For instance, the monsoon season often brings heavy rainfall, leading to waterlogging and damage to tracks and bridges. Similarly, rising temperatures can cause rail buckling, disrupting services.

Indian Railway Finance Corporation (IRFC) will likely see its financing portfolio shift towards climate resilience projects. This could involve upgrading existing infrastructure and building new climate-proof assets. These investments are crucial for ensuring the operational continuity and safety of the vast railway network. The Indian government's focus on infrastructure development, coupled with climate action goals, will drive this trend.

- Increased expenditure on flood protection measures for vulnerable sections of track.

- Investment in heat-resistant materials for railway lines to prevent buckling during heatwaves.

- Development of early warning systems for extreme weather events impacting railway operations.

- Potential for green financing to support climate adaptation initiatives within IRFC's lending activities.

Indian Railways is committed to environmental sustainability, with a target of net-zero carbon emissions by 2030, focusing heavily on electrification. IRFC supports this by financing projects like the dedicated freight corridor electrification, aiming to reduce greenhouse gas emissions and operational costs.

IRFC is increasingly utilizing green financing, such as issuing green offshore bonds, to fund environmentally friendly railway infrastructure. In FY 2023-24, IRFC successfully raised ₹1,000 crore via a 10-year green bond, reinforcing its commitment to ESG principles and India's climate goals.

Environmental Impact Assessments (EIAs) are vital for IRFC when financing new infrastructure, particularly for projects affecting ecologically sensitive areas. This ensures compliance with regulations and mitigation of risks like habitat disruption, aligning with India's 2024-2025 development plans.

Climate change necessitates adaptation investments for Indian Railways, with IRFC likely to finance projects enhancing infrastructure resilience against extreme weather events like floods and heatwaves, ensuring operational continuity.

| Environmental Factor | Indian Railways' Initiatives | IRFC's Role | Key Data/Targets |

|---|---|---|---|

| Decarbonization | Net-zero emissions by 2030; Scope 1 net-zero by 2025 via electrification | Financing electrification projects, electric locomotives, and rolling stock | Aiming for 30 GW renewable energy capacity by 2029-30 |

| Green Financing | Issuance of green bonds to fund sustainable infrastructure | Facilitating green bond issuances; raised ₹1,000 crore in FY 2023-24 | Focus on ESG factors and attracting sustainable investment |

| Environmental Impact Assessment (EIA) | Rigorous EIAs for projects in sensitive ecological zones | Integrating EIA outcomes into financing decisions; scrutinizing mitigation strategies | Compliance with MoEF&CC guidelines and National Green Tribunal directives |

| Climate Change Adaptation | Upgrading infrastructure for resilience against extreme weather | Financing climate-resilient infrastructure development | Increased expenditure on flood protection and heat-resistant materials |

PESTLE Analysis Data Sources

Our Indian Railway Finance PESTLE Analysis is built on a robust foundation of data from official Indian government sources, including the Ministry of Railways and NITI Aayog, alongside reports from international financial institutions and reputable economic research firms.