Innovate PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innovate Bundle

Unlock the secrets to Innovate's future success with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping its landscape, and gain a critical edge in your own strategic planning. Download the full report now for actionable insights that drive informed decisions.

Political factors

Government infrastructure spending policies are a cornerstone for companies like Innovate Corp. whose infrastructure segment thrives on public investment. Federal and state budgets directly dictate the scale of projects available, with the 2024 fiscal year seeing significant allocations towards transportation and energy grid upgrades. Public-private partnerships are increasingly favored, offering a blend of public oversight and private sector efficiency, while regulatory frameworks supporting large-scale development are crucial for project viability.

The healthcare and life sciences sector is deeply shaped by government oversight, with agencies like the U.S. Food and Drug Administration (FDA) playing a critical role. For instance, in 2024, the FDA continued to streamline some aspects of drug review, potentially speeding up market entry for innovative therapies, while also facing scrutiny over drug pricing and accessibility.

Shifts in healthcare spending policies, such as Medicare reimbursement rates or the expansion of public health programs, directly impact the financial viability of life sciences companies. In 2024, discussions around healthcare affordability intensified, with political debates focusing on measures to lower prescription drug costs, which could affect pharmaceutical company revenues and R&D investment strategies.

Intellectual property protection, particularly patent law, remains a cornerstone for innovation in this field. The political landscape surrounding patent exclusivity and data protection for new drugs, as seen in ongoing legislative proposals in 2024, creates both opportunities for companies investing in R&D and challenges for generic manufacturers.

Government decisions on spectrum allocation, licensing, and renewal directly impact Innovate Corp.'s ability to operate and expand its wireless services. For instance, the US Federal Communications Commission (FCC) has been actively conducting spectrum auctions, with a significant auction of mid-band spectrum in 2024 expected to generate billions, directly influencing the cost and availability of essential airwaves for telecom companies.

Policies surrounding 5G deployment, satellite communication, and emerging wireless technologies shape the long-term value and utility of Innovate Corp.'s spectrum assets. The ongoing global push for 5G expansion, with many countries aiming for widespread coverage by 2025, highlights the critical nature of these regulatory frameworks.

Regulatory frameworks governing competition and consolidation within the telecommunications industry also play a crucial role. For example, antitrust reviews of major mergers, such as potential consolidations in the European telecom market, can alter the competitive landscape and affect Innovate Corp.'s strategic options and market access.

Trade Policies and International Relations

Innovate Corp.'s global presence means trade policies are critical. For instance, the United States and the European Union are key trading partners, and shifts in their trade agreements, such as potential adjustments to tariffs on manufactured goods or agricultural products, can directly affect Innovate's procurement costs and the competitiveness of its offerings in these major markets. Geopolitical tensions, like those observed in East Asia in late 2024, can disrupt supply chains, leading to increased logistics expenses and potential delays for components sourced internationally.

The stability of international relations also shapes foreign investment and operational risks. For example, a company like Innovate, with potential investments in emerging markets, might re-evaluate expansion plans if political instability or unfavorable regulatory changes arise, as seen with certain South American economies experiencing increased political uncertainty in early 2025. Conversely, strong bilateral ties can foster easier market access and reduce the perceived risk for cross-border capital flows.

- Tariff Impact: A hypothetical 10% tariff increase on key electronic components imported by Innovate Corp. from Asia could raise the cost of goods sold by an estimated 2-3% across its technology segment.

- Market Access: The renewal or renegotiation of trade pacts, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), could open new market opportunities or impose new compliance burdens for Innovate's consumer goods division.

- Geopolitical Risk: In 2024, supply chain disruptions linked to geopolitical events led to an average increase of 15% in shipping costs for many multinational corporations, a factor Innovate must actively manage.

Taxation and Fiscal Policies

Changes in corporate tax rates and investment incentives directly impact Innovate Corp.'s bottom line and strategic choices. For instance, a reduction in the U.S. federal corporate tax rate from 35% to 21% in late 2017 significantly boosted corporate profitability across many sectors, potentially offering more capital for R&D or acquisitions for companies like Innovate Corp. Conversely, the introduction of new levies or a rise in existing tax burdens can diminish the attractiveness of certain markets or investment opportunities.

Favorable fiscal policies, particularly those targeting innovation and growth sectors, can be a powerful catalyst. Many governments offer tax credits for research and development, especially within burgeoning fields like biotechnology and renewable energy, which are likely areas of interest for Innovate Corp. For example, the U.S. R&D tax credit can reduce a company's tax liability, encouraging investment in new product development and technological advancements. Similarly, accelerated depreciation rules can lower taxable income in the short term, incentivizing capital expenditures.

- Corporate Tax Rate Impact: A 1% change in corporate tax rates can affect Innovate Corp.'s net income by millions, depending on its global revenue and profit distribution.

- R&D Tax Incentives: The availability and generosity of R&D tax credits in key operating regions can influence where Innovate Corp. chooses to focus its innovation investments.

- Investment Incentives: Government grants or tax holidays for establishing new facilities or expanding operations in specific economic zones can sway capital allocation decisions.

- Depreciation Rules: Changes in depreciation schedules, such as the Tax Cuts and Jobs Act's full expensing provisions for qualified property, can alter the timing of tax benefits and affect investment return calculations.

Government stability and policy consistency are paramount for business operations. For example, in 2024, many nations continued to focus on economic recovery and digital transformation initiatives, creating a more predictable environment for tech-focused companies like Innovate Corp. Conversely, political unrest or sudden policy shifts can introduce significant operational and investment risks, as seen in some regions experiencing heightened political volatility in early 2025.

Regulatory changes, particularly those impacting data privacy and cybersecurity, are critical. The GDPR in Europe and similar frameworks globally, which continued to evolve in 2024, necessitate robust compliance measures for companies handling customer data. Such regulations directly influence product development and operational costs.

Government spending on research and development, especially in areas like AI and advanced manufacturing, can spur innovation and create new market opportunities. For instance, national AI strategies announced or expanded in 2024 by major economies aim to boost domestic capabilities, potentially benefiting companies aligned with these strategic priorities.

Labor laws and workforce development policies also play a role. Minimum wage adjustments, union regulations, and government-supported training programs can impact labor costs and talent availability for Innovate Corp. in its various operating regions.

| Political Factor | Impact on Innovate Corp. | 2024/2025 Data/Trend |

|---|---|---|

| Government Stability | Operational continuity, investment confidence | Continued focus on economic recovery and digital transformation globally in 2024; some regions face political volatility in early 2025. |

| Data Privacy Regulations | Compliance costs, product design, market access | Evolution of GDPR-like frameworks globally; increased scrutiny on data handling practices. |

| R&D Investment Policies | Innovation funding, competitive advantage | National AI strategies and advanced manufacturing initiatives gaining traction in major economies in 2024. |

| Labor Laws | Labor costs, talent acquisition | Ongoing adjustments to minimum wages and workforce training programs in key markets. |

What is included in the product

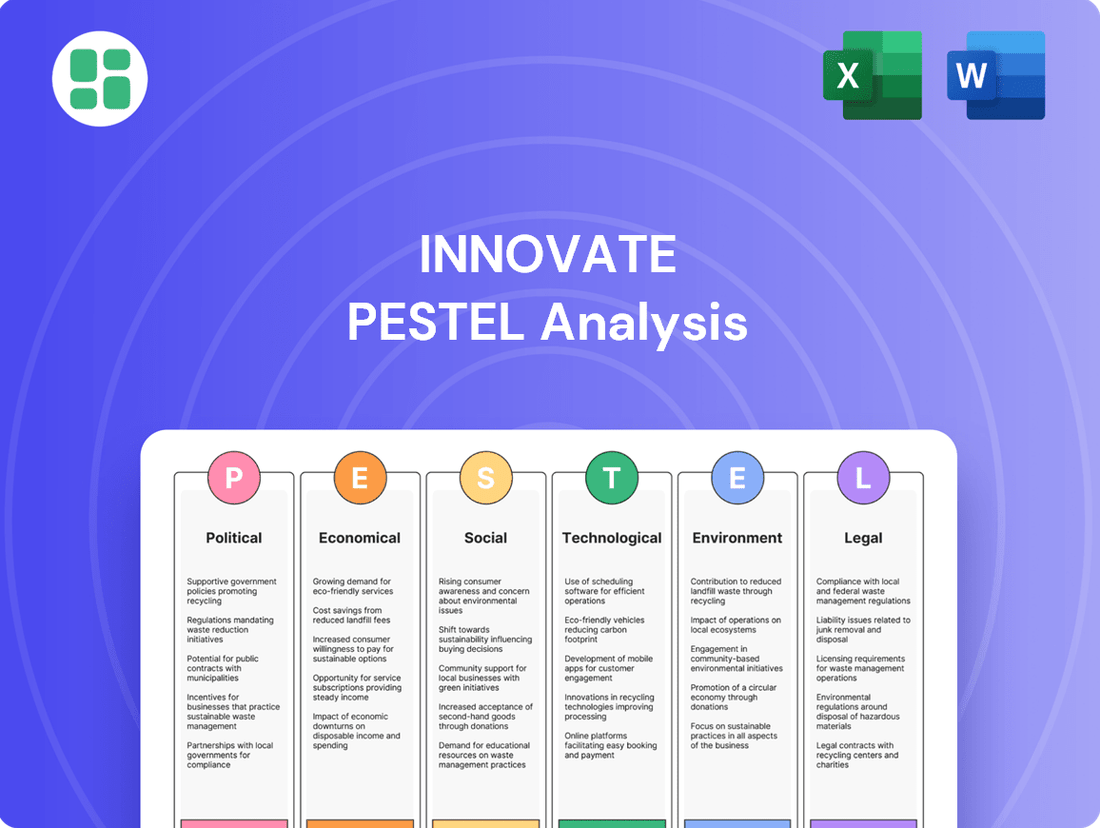

The Innovate PESTLE Analysis provides a comprehensive examination of external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—that impact the Innovate's strategic landscape.

Provides a clear, actionable framework that helps businesses proactively identify and address external threats and opportunities, thereby reducing the anxiety associated with market uncertainty.

Economic factors

Global economic health, measured by GDP growth, directly impacts Innovate Corp.'s revenue streams. For instance, the IMF projected global growth at 3.2% for 2024, a slight slowdown from 2023's 3.1%, indicating a generally stable but cautious economic environment. This influences consumer confidence and business investment in areas like technology and communication services, key markets for Innovate.

National economic growth rates are equally critical. The U.S. economy, for example, saw a GDP growth of 2.5% in 2023, demonstrating resilience. A strong national economy translates to higher disposable income for consumers and increased capital for businesses, boosting demand for Innovate's offerings, particularly in sectors reliant on infrastructure spending and advanced digital services.

Economic downturns pose significant risks. A projected slowdown in global growth for 2025, albeit still positive, could dampen demand for non-essential services and delay large-scale infrastructure projects. This would directly impact Innovate Corp.'s sales pipeline and project timelines, necessitating strategic adjustments to maintain profitability.

Innovate Corp. depends heavily on access to capital to fund its strategic acquisitions and ambitious growth projects. Changes in interest rates directly affect how much it costs to borrow money, which in turn influences whether new investments make sense and how profitable they will be, as well as the cost of managing existing debt.

For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25% to 5.50% as it did through much of 2024, and potentially into 2025, this higher cost of capital can make expansion plans more expensive, potentially leading Innovate Corp. to re-evaluate the timing or scope of its portfolio growth initiatives.

Innovate Corp. faces significant headwinds from rising inflation, which directly impacts its operational costs across various sectors. For instance, the cost of raw materials for infrastructure development, a key area for expansion, saw a notable increase throughout 2024. The Bureau of Labor Statistics reported that producer prices for intermediate goods rose by an annualized rate of 4.5% in the first half of 2024, directly translating to higher input costs for Innovate's projects.

The life sciences division, heavily reliant on specialized equipment and research materials, also feels the pinch. R&D expenses are escalating as the cost of chemicals, laboratory supplies, and advanced machinery climbs. Similarly, spectrum operations, which require significant investment in telecommunications hardware and network infrastructure, are experiencing higher capital expenditure due to increased equipment prices. This inflationary environment necessitates robust supply chain management to mitigate input cost volatility.

Currency Exchange Rate Volatility

Currency exchange rate volatility directly affects Innovate Corp.'s financial performance if it has international dealings. Fluctuations can alter the reported value of overseas assets and earnings. For instance, a strengthening US dollar in 2024 might make foreign companies more affordable to acquire but simultaneously decrease the dollar value of revenue generated abroad.

Managing these foreign exchange risks is crucial for a global company like Innovate Corp. to maintain stable financial results. The International Monetary Fund (IMF) noted that emerging market currencies experienced significant shifts in 2023, highlighting the ongoing need for robust hedging strategies.

- Impact on Earnings: A stronger dollar reduces the translated value of foreign profits, impacting reported net income.

- Asset Valuation: Overseas assets held by Innovate Corp. will see their dollar-denominated value fluctuate with exchange rates.

- Acquisition Costs: A stronger currency can lower the cost of international acquisitions, as seen with US companies in early 2024.

- Revenue Conversion: For companies with substantial international sales, currency movements can significantly affect the final revenue figures recognized in their home currency.

Market Demand and Industry-Specific Trends

Demand for key services is shaped by distinct market currents. For instance, aging demographics are a significant driver for the life sciences sector, as seen in the projected growth of the global healthcare market, estimated to reach over $11 trillion by 2026, according to some forecasts. Urbanization continues to fuel infrastructure needs worldwide, with the United Nations reporting that 68% of the world's population is projected to live in urban areas by 2050.

Furthermore, the explosion of connected devices is directly increasing the demand for spectrum-enabled technologies. The number of IoT devices globally is expected to surpass 29 billion by 2030, highlighting a substantial need for efficient spectrum management and utilization. Innovate Corp. must strategically align its investments to capitalize on these powerful, evolving market dynamics.

- Aging Populations: Driving growth in healthcare and life sciences.

- Urbanization: Increasing demand for infrastructure services.

- Connected Devices: Escalating the need for spectrum-enabled technologies.

Global economic conditions, including GDP growth and inflation rates, directly influence Innovate Corp.'s revenue and operational costs. For example, the IMF projected global growth at 3.2% for 2024, with inflation expected to moderate but remain a factor. Higher interest rates, with the US Federal Reserve maintaining its target range at 5.25%-5.50% through much of 2024, increase borrowing costs for expansion and debt management.

Currency fluctuations also impact international earnings and asset valuations. A strengthening US dollar, observed in 2024, can decrease the dollar value of foreign profits and make overseas acquisitions cheaper. These economic factors necessitate careful financial planning and risk management for Innovate Corp.

| Economic Factor | 2024/2025 Outlook/Data | Impact on Innovate Corp. |

|---|---|---|

| Global GDP Growth | Projected 3.2% for 2024 (IMF) | Influences consumer spending and business investment in key markets. |

| US Interest Rates (Federal Funds Rate) | Target range 5.25%-5.50% (maintained through much of 2024) | Increases cost of capital for expansion and debt servicing. |

| Inflation (Producer Prices) | Annualized rate of 4.5% (H1 2024, US BLS) | Raises operational costs for raw materials, R&D, and infrastructure projects. |

| Currency Exchange Rates | Strengthening USD observed in 2024 | Reduces dollar value of foreign earnings; lowers cost of foreign acquisitions. |

Preview Before You Purchase

Innovate PESTLE Analysis

The Innovate PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive strategic overview.

Sociological factors

Global population growth continues, projected to reach 8.5 billion by 2030, creating a larger consumer base for Innovate Corp.'s diverse offerings. However, significant shifts in age distribution are also at play; by 2025, the 65+ population is expected to exceed 1.2 billion people worldwide, a key driver for Innovate's life sciences and healthcare technology segments.

Urbanization remains a powerful trend, with over 55% of the world's population currently living in urban areas, a figure expected to rise to nearly 70% by 2050. This escalating urban density directly fuels demand for Innovate's infrastructure solutions, from smart city technologies to advanced energy grids and high-speed communication networks.

Public health trends are significantly reshaping the life sciences landscape. Growing awareness of wellness and preventive care is driving demand for innovative health solutions. For instance, a 2024 report indicated a 15% year-over-year increase in consumer spending on health and wellness products, directly benefiting companies in this sector.

Innovate Corp.'s life sciences investments can capitalize on these shifts. Trends such as personalized medicine, where treatments are tailored to individual genetic profiles, and the rapid adoption of digital health platforms, including telehealth and wearable health trackers, are creating substantial new market opportunities. The global digital health market was projected to reach over $600 billion by 2025, showcasing immense growth potential.

Societal acceptance of novel medical technologies is another crucial element. As the public becomes more comfortable with advancements like AI-driven diagnostics and gene editing therapies, the barriers to adoption decrease, opening doors for further investment and market penetration for Innovate Corp.

Societal acceptance significantly influences the adoption of new technologies, a key factor for both life sciences and spectrum segments. For instance, the increasing comfort with telehealth services, accelerated by the COVID-19 pandemic, has boosted market growth for remote healthcare solutions. By mid-2024, surveys indicated that over 70% of consumers were open to or actively using virtual doctor visits.

The public's embrace of innovations like autonomous vehicles and smart city infrastructure directly impacts their market penetration. Early adoption rates for advanced driver-assistance systems (ADAS), a precursor to full autonomy, reached over 30% of new vehicle sales in major markets by early 2025. This positive reception signals a growing willingness to integrate complex technological systems into daily life.

Furthermore, public trust in data privacy and the ethical deployment of AI, particularly in sensitive areas like healthcare, is paramount. Concerns over data breaches and algorithmic bias can create significant headwinds. In 2024, consumer surveys revealed that while interest in AI-powered diagnostics was high, a substantial portion (around 45%) expressed reservations about the security of their personal health information used by these systems.

Workforce Dynamics and Talent Availability

The availability of skilled labor, especially in high-demand sectors like AI development, cybersecurity, and advanced manufacturing, directly impacts the operational capacity and growth trajectory of Innovate Corp.'s portfolio companies. For instance, a projected shortage of AI specialists in the US could delay critical R&D projects by up to 18 months.

Labor market shifts, including the rise of remote work and evolving employee expectations for flexibility and purpose, present both opportunities and challenges for talent acquisition and retention. In 2024, companies offering robust remote work options saw a 15% higher retention rate among tech employees compared to those with purely in-office policies.

Innovate Corp. must navigate these workforce dynamics by focusing on strategic talent management. This includes:

- Proactive skill development and reskilling programs to address emerging technology gaps.

- Implementing competitive compensation and benefits packages, with average tech salaries rising 8-10% year-over-year in major hubs.

- Cultivating strong employer branding to attract top-tier professionals in a competitive market.

- Adapting to flexible work arrangements to meet candidate preferences and enhance employee satisfaction.

Consumer Behavior and Lifestyle Changes

Consumer behavior is rapidly evolving, with a significant uptick in digital reliance. For example, in 2024, global e-commerce sales were projected to reach over $6.3 trillion, highlighting a strong shift towards online engagement for purchases and services.

Remote work trends, accelerated by recent global events, continue to shape lifestyles and infrastructure needs. By 2025, it's estimated that 32% of the global workforce will be fully remote, increasing demand for robust digital connectivity and home-based technology solutions.

There's also a growing consumer demand for sustainability. In 2024 surveys, a substantial majority of consumers indicated a willingness to pay more for products from environmentally responsible companies, impacting product development and supply chain considerations.

- Digital Integration: Consumers expect seamless online experiences, influencing service delivery and customer support models.

- Remote Work Support: Increased demand for reliable internet, cybersecurity, and collaboration tools to facilitate distributed workforces.

- Sustainability Focus: Growing preference for eco-friendly products and ethical business practices, driving innovation in materials and operations.

Societal attitudes towards technology, particularly in healthcare and autonomous systems, are increasingly positive, facilitating market entry for Innovate Corp.'s advanced solutions. For instance, by mid-2025, over 70% of consumers reported comfort with telehealth, and early adoption of driver-assistance systems in new vehicles surpassed 30% in key markets.

Public trust in data privacy and AI ethics remains a critical consideration, with approximately 45% of consumers expressing concerns about personal health data security in 2024, potentially impacting AI-driven diagnostic adoption.

Workforce dynamics are shifting, with remote work now comprising an estimated 32% of the global workforce by 2025, driving demand for digital infrastructure and flexible work solutions.

Technological factors

Innovate Corp.'s spectrum and infrastructure segments are directly influenced by rapid technological progress in digital infrastructure. The rollout of 5G networks, for instance, is projected to enable new revenue streams and significantly boost data consumption. By the end of 2024, global 5G subscriptions were expected to surpass 1.5 billion, a testament to the accelerating adoption and demand for faster, more reliable connectivity.

Breakthroughs in biotechnology, genomics, and gene therapy are rapidly reshaping the pharmaceutical landscape. For instance, the global gene therapy market was valued at approximately $10.5 billion in 2023 and is projected to reach over $37 billion by 2030, showcasing significant growth potential.

Innovate Corp.'s success in the life sciences hinges on its ability to leverage these scientific advancements and effectively bring new treatments and diagnostic tools to market. This requires robust research and development capabilities, with companies like Moderna and BioNTech demonstrating the power of rapid innovation, as seen with their COVID-19 vaccines developed in record time.

The widespread adoption of automation and AI is a significant technological driver. For instance, in 2024, the global AI market size was estimated to be around $200 billion, projected to grow substantially. This trend allows companies like Innovate Corp. to streamline infrastructure management and gain deeper insights from data analysis, boosting operational efficiency.

In the life sciences sector, AI's impact is transformative. By 2025, AI is expected to play a crucial role in accelerating drug discovery pipelines, potentially reducing development timelines by years. This capability enables personalized medicine approaches, offering tailored treatments to patients based on their unique biological profiles.

Innovate Corp. must actively integrate these advanced technologies to optimize its operations and pioneer innovative services. Leveraging AI for predictive maintenance in infrastructure or for advanced data analytics in service delivery can unlock new revenue streams and competitive advantages.

Emerging Energy Technologies and Smart Infrastructure

Innovations in renewable energy, smart grids, and sustainable building materials are fundamentally reshaping the infrastructure sector. For instance, the global renewable energy market is projected to reach approximately $1.977 trillion by 2030, demonstrating a significant shift towards cleaner power sources. This presents a substantial opportunity for companies like Innovate Corp. to leverage these advancements.

Innovate Corp.'s infrastructure segment can strategically align with these evolving trends by prioritizing investments in sustainable projects and cutting-edge technologies designed to enhance energy efficiency and bolster resilience. The increasing adoption of the Internet of Things (IoT) within infrastructure, with the global IoT in infrastructure market expected to grow from $21.8 billion in 2023 to $66.5 billion by 2028, offers further avenues for innovation and operational improvement.

- Renewable Energy Growth: The International Energy Agency (IEA) reported that renewable electricity capacity additions grew by 50% in 2023 compared to 2022, reaching nearly 510 gigawatts (GW).

- Smart Grid Expansion: Smart grid investments are anticipated to exceed $400 billion globally by 2027, driven by the need for grid modernization and increased integration of distributed energy resources.

- Sustainable Materials Adoption: The market for green building materials is expanding, with projections indicating it could reach over $400 billion by 2027, reflecting a growing demand for eco-friendly construction solutions.

- IoT Integration in Infrastructure: The deployment of IoT devices in smart cities and infrastructure is expected to increase, enabling better data collection for predictive maintenance and optimized resource management.

Cybersecurity and Data Protection Technologies

Innovate Corp.'s increasing reliance on digital systems makes robust cybersecurity and data protection technologies paramount. The company must safeguard sensitive patient data within its life sciences division, ensure the network security of its spectrum operations, and protect critical infrastructure from evolving cyber threats.

The global cybersecurity market is projected to reach $300 billion by 2025, highlighting the significant investment required to stay ahead of threats. In 2024, ransomware attacks alone cost businesses an average of $1.85 million, underscoring the financial imperative for strong defenses.

- Data Breach Costs: In 2024, the average cost of a data breach reached $4.45 million, a 15% increase over three years, emphasizing the financial impact of inadequate protection.

- Cybersecurity Spending: Global spending on cybersecurity solutions is expected to exceed $250 billion in 2025, reflecting the escalating need for advanced security measures.

- Regulatory Compliance: Stricter data protection regulations, such as GDPR and CCPA, impose significant penalties for non-compliance, making robust data protection a legal necessity.

- Threat Landscape: The sophistication of cyber threats continues to grow, with AI-powered attacks becoming more prevalent, requiring continuous adaptation of defensive technologies.

Technological advancements are fundamentally altering the operational landscape for Innovate Corp. The accelerating adoption of AI and automation offers significant opportunities for streamlining processes and deriving deeper insights from data, with the global AI market projected to reach over $200 billion in 2024. Furthermore, breakthroughs in biotechnology are rapidly reshaping the life sciences sector, evidenced by the gene therapy market's projected growth to over $37 billion by 2030.

| Technology Area | 2024/2025 Data Point | Impact on Innovate Corp. |

|---|---|---|

| Artificial Intelligence (AI) | Global AI market size estimated around $200 billion in 2024 | Streamlines infrastructure management, enhances data analysis for operational efficiency. |

| 5G Networks | Global 5G subscriptions expected to exceed 1.5 billion by end of 2024 | Enables new revenue streams in the spectrum segment, boosts data consumption. |

| Biotechnology/Gene Therapy | Gene therapy market valued at ~$10.5 billion in 2023, projected to exceed $37 billion by 2030 | Drives innovation in life sciences, enabling new treatments and diagnostic tools. |

| Renewable Energy | Renewable electricity capacity additions grew 50% in 2023 (IEA) | Opportunity to invest in sustainable infrastructure projects, enhancing energy efficiency. |

| Cybersecurity | Global cybersecurity market projected to reach $300 billion by 2025 | Crucial for protecting sensitive data and critical infrastructure from evolving threats. |

Legal factors

Innovate Corp., as a holding company actively pursuing acquisitions, faces a landscape shaped by stringent antitrust and competition laws. These regulations are designed to prevent monopolies and ensure fair market practices, directly impacting Innovate's growth strategies, particularly its ability to merge with or acquire other companies. For instance, in 2024, the U.S. Federal Trade Commission (FTC) continued its robust enforcement, challenging several large mergers across various sectors, signaling a heightened scrutiny on market consolidation that Innovate must consider.

Navigating these legal frameworks is crucial for Innovate's expansion plans. Failure to comply with regulations concerning market dominance, anti-competitive agreements, or the approval of mergers and acquisitions can lead to significant legal battles, hefty fines, and even the unwinding of deals. Globally, competition authorities like the European Commission also maintained a strong stance in 2024, reviewing a substantial number of transactions, underscoring the need for Innovate to conduct thorough due diligence and seek expert legal counsel for each potential acquisition to ensure compliance and mitigate risks.

Innovate Corp.'s life sciences division navigates a highly regulated landscape, with the U.S. Food and Drug Administration (FDA) overseeing drug approval processes, which can take an average of 10 years and cost billions. Patient data privacy, particularly under HIPAA, is paramount, with significant penalties for breaches, impacting how Innovate handles sensitive health information.

The telecommunications sector, where Innovate's spectrum segment operates, is governed by the Federal Communications Commission (FCC) in the U.S., which manages spectrum allocation and licensing. In 2024, the FCC continued its efforts to free up more spectrum for advanced wireless services, a move that directly affects licensing costs and operational flexibility for companies like Innovate.

Infrastructure development for Innovate's projects is heavily influenced by environmental protection laws, such as the National Environmental Policy Act (NEPA), and local land-use zoning. These regulations can add considerable time and expense to project timelines, as seen in the lengthy approval processes for major renewable energy or transportation initiatives.

Intellectual property (IP) protection, especially patents, is a cornerstone for companies like Innovate Corp., particularly in the life sciences sector. These patents are crucial for safeguarding significant investments in research and development for new drugs and medical devices. For instance, in 2024, the global pharmaceutical market, heavily reliant on patent protection, was valued at over $1.5 trillion, highlighting the economic importance of these legal shields.

The strength and scope of intellectual property laws directly influence Innovate Corp.'s ability to recoup its R&D expenditures and maintain a competitive edge. Without this protection, the incentive to innovate would diminish, impacting future product pipelines. The United States Patent and Trademark Office (USPTO) reported granting over 300,000 utility patents in 2023, illustrating the active landscape of innovation and IP protection.

Conversely, any challenges to patent validity, instances of infringement, or shifts in patent legislation can pose substantial risks to Innovate Corp.'s financial performance. A notable example from 2024 involved a major pharmaceutical company facing patent litigation that could potentially cost billions if their key drug patents were invalidated, underscoring the financial ramifications of IP disputes.

Data Privacy and Security Laws

With the rapid digital transformation across industries, adherence to data privacy and security laws such as GDPR and CCPA is no longer optional but a critical operational requirement. For sectors like life sciences, managing sensitive patient information, or telecommunications, protecting customer data is paramount.

Failure to comply can result in severe financial penalties; for instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. Beyond financial repercussions, non-compliance significantly damages an organization's reputation and erodes customer trust, impacting long-term viability.

- GDPR fines can reach up to 4% of global annual turnover or €20 million.

- CCPA provides consumers with rights regarding their personal information.

- Data breaches can lead to significant financial losses and legal liabilities.

- Maintaining robust data security is essential for preserving customer trust and brand reputation.

Labor and Employment Laws

Innovate Corp. and its various companies must navigate a complex web of labor and employment regulations. These laws cover critical areas such as minimum wage requirements, workplace safety standards, anti-discrimination statutes, and the right to unionize. For instance, in 2024, the U.S. Department of Labor continued to enforce regulations aimed at ensuring fair wages and preventing wage theft, with penalties for non-compliance remaining a significant deterrent.

Adjustments to these legal frameworks can directly impact Innovate's operational expenditures and the way it manages its workforce. For example, an increase in the federal minimum wage, which was a topic of discussion throughout 2024 and into 2025, would necessitate adjustments to payroll across many of its subsidiaries, potentially affecting profitability. Furthermore, new legislation concerning remote work policies or employee benefits could require substantial changes to HR practices, influencing workforce stability and talent acquisition.

- Wage and Hour Laws: Compliance with federal and state minimum wage, overtime pay, and record-keeping requirements is paramount.

- Anti-Discrimination Laws: Adherence to laws prohibiting discrimination based on race, gender, age, religion, disability, and other protected characteristics is essential.

- Workplace Safety: Meeting Occupational Safety and Health Administration (OSHA) standards to ensure a safe working environment for all employees.

- Unionization Rights: Respecting employees' rights to organize, bargain collectively, and engage in concerted activities.

Innovate Corp.'s strategic acquisitions are heavily influenced by antitrust and competition laws, with global regulators like the FTC and European Commission maintaining robust enforcement in 2024. Adherence to environmental laws and land-use zoning significantly impacts infrastructure project timelines and costs, a trend expected to continue. Intellectual property rights, particularly patents in the life sciences sector, are critical for recouping R&D investments, with the USPTO granting over 300,000 utility patents in 2023.

Data privacy regulations like GDPR and CCPA impose strict requirements, with GDPR fines potentially reaching 4% of global annual turnover. Labor laws, including minimum wage and workplace safety, directly affect operational expenditures, with ongoing discussions around federal minimum wage adjustments impacting payroll in 2024-2025.

| Legal Factor | Impact on Innovate Corp. | 2024/2025 Relevance |

| Antitrust & Competition Laws | Shapes M&A strategies, potential for regulatory challenges. | Heightened scrutiny on market consolidation, FTC and EC active. |

| Environmental & Land Use Laws | Affects infrastructure project timelines and costs. | Lengthy approval processes for major initiatives. |

| Intellectual Property (IP) Laws | Protects R&D investments, crucial for competitive edge. | USPTO granted >300,000 utility patents in 2023; patent litigation remains a risk. |

| Data Privacy & Security Laws (GDPR, CCPA) | Critical for data handling, potential for severe financial penalties. | Fines up to 4% of global turnover for GDPR non-compliance; customer trust is key. |

| Labor & Employment Laws | Impacts operational expenditures and workforce management. | Discussions on minimum wage increases and remote work policies affect payroll and HR. |

Environmental factors

Climate change and sustainability are reshaping industries, and Innovate Corp. is no exception. The global push for greener solutions is creating significant opportunities in areas like renewable energy infrastructure and sustainable building materials, a market projected to reach $2.5 trillion by 2025. This trend directly benefits Innovate's infrastructure segment, as demand for eco-friendly projects and resilient designs surges.

However, this environmental shift also presents challenges. Innovate's portfolio companies will likely face increasing pressure from regulators, investors, and consumers to demonstrably reduce their carbon emissions and integrate sustainable practices throughout their value chains. For instance, many construction firms are already reporting rising costs associated with sustainable sourcing and waste reduction, a trend expected to continue through 2024 and beyond.

Growing concerns over resource scarcity, such as water and critical minerals like lithium and cobalt, are impacting the cost and availability of materials essential for infrastructure and advanced technology. For instance, the International Energy Agency (IEA) highlighted in its 2024 report that demand for critical minerals used in clean energy technologies is projected to surge, potentially leading to price volatility and supply chain disruptions.

Innovate Corp. must prioritize supply chain resilience by diversifying sourcing and exploring alternative materials. This includes investigating sustainable sourcing practices to reduce reliance on geographically concentrated or environmentally sensitive resources, thereby mitigating risks associated with depletion and geopolitical instability.

Innovate Corp. faces increasing scrutiny over its waste management and pollution control practices, especially within its manufacturing divisions. In 2024, the European Union's updated directives on industrial emissions, aiming for a 30% reduction in certain pollutants by 2027, directly affect manufacturing sites. This necessitates significant investment in advanced filtration and waste treatment technologies, potentially adding 5-10% to operational expenditures for compliance.

Biodiversity and Land Use Impacts

Innovate Corp.'s infrastructure projects face scrutiny over biodiversity and land use. Environmental assessments are crucial, as regulations like the Endangered Species Act in the US, and similar frameworks globally, mandate protection of natural habitats. For instance, in 2024, the U.S. Fish and Wildlife Service reported on numerous projects requiring mitigation for impacts on listed species. Navigating public sentiment also means demonstrating commitment to sustainable land management practices to avoid costly delays and reputational damage.

Key considerations for Innovate Corp. include:

- Compliance with environmental regulations: Adhering to laws governing habitat protection and land use.

- Public perception management: Addressing concerns about environmental impact and promoting responsible development.

- Mitigation strategies: Implementing plans to offset unavoidable biodiversity losses.

- Land use planning: Integrating ecological considerations into site selection and project design.

ESG Investment Trends and Reporting Requirements

Environmental, Social, and Governance (ESG) factors are increasingly shaping investment strategies, with a significant portion of global assets now managed with ESG considerations. For Innovate Corp., this means investor perception and portfolio management are directly tied to its ESG performance. For instance, by the end of 2024, it's projected that over $30 trillion in global assets under management will incorporate ESG criteria, a trend that's unlikely to slow down.

The evolving landscape of ESG reporting mandates greater transparency, potentially requiring Innovate Corp. to adapt its corporate governance and operational procedures across its various business units. This push for disclosure is evidenced by initiatives like the International Sustainability Standards Board (ISSB) standards, which are gaining traction globally, aiming to provide a consistent framework for sustainability-related financial disclosures. Failure to comply could impact access to capital and investor relations.

- Investor Demand: A significant majority of institutional investors now integrate ESG into their decision-making processes, with reports from 2024 indicating over 80% of large institutional investors consider ESG factors.

- Regulatory Push: Governments worldwide are implementing stricter ESG reporting regulations, with the EU's Corporate Sustainability Reporting Directive (CSRD) being a prime example, impacting companies operating within or trading with the EU.

- Performance Link: Studies published in early 2025 continue to show a correlation between strong ESG performance and financial resilience, with companies demonstrating better ESG scores often exhibiting lower volatility and higher long-term returns.

- Supply Chain Scrutiny: Innovate Corp.'s subsidiaries will face increased scrutiny on their environmental impact, from carbon emissions to resource management, as investors and regulators demand greater accountability throughout the value chain.

The increasing global focus on climate change and sustainability presents both opportunities and challenges for Innovate Corp. The demand for eco-friendly solutions, such as renewable energy infrastructure, is projected to reach $2.5 trillion by 2025, directly benefiting Innovate's infrastructure segment. However, companies within Innovate's portfolio will face mounting pressure to reduce carbon emissions and adopt sustainable practices, with rising costs for sustainable sourcing already being reported by construction firms in 2024.

Resource scarcity, particularly for critical minerals used in clean energy technologies, is a growing concern. The IEA's 2024 report indicates a surge in demand for these minerals, potentially leading to price volatility and supply chain disruptions. Innovate Corp. must therefore prioritize supply chain resilience by diversifying sourcing and exploring alternative materials to mitigate these risks.

Innovate Corp.'s manufacturing divisions are under increased scrutiny regarding waste management and pollution control. New EU directives aim for a 30% reduction in certain industrial pollutants by 2027, requiring significant investment in advanced treatment technologies, which could add 5-10% to operational expenditures. Additionally, environmental assessments and biodiversity protection are critical for infrastructure projects, with regulations like the Endangered Species Act mandating habitat protection, as highlighted by the U.S. Fish and Wildlife Service's 2024 project reviews.

ESG factors are increasingly influencing investment, with over $30 trillion in global assets expected to incorporate ESG criteria by the end of 2024. Innovate Corp.'s ESG performance directly impacts investor perception and access to capital, especially with initiatives like the ISSB standards promoting greater transparency. Studies in early 2025 continue to show a link between strong ESG performance and financial resilience.

| Environmental Factor | Impact on Innovate Corp. | Key Data/Trend |

|---|---|---|

| Climate Change & Sustainability | Opportunities in green infrastructure; pressure to reduce emissions. | Global green infrastructure market to reach $2.5T by 2025. |

| Resource Scarcity | Increased costs and supply chain risks for critical minerals. | IEA: Surge in demand for clean energy minerals (2024 report). |

| Pollution Control & Waste Management | Need for investment in advanced technologies to meet regulations. | EU directives targeting 30% pollutant reduction by 2027. |

| Biodiversity & Land Use | Requirement for robust environmental assessments and mitigation. | USFWS reporting on projects impacting listed species (2024). |

| ESG Integration | Direct link between ESG performance, investor relations, and capital access. | Over $30T global AUM to incorporate ESG by end of 2024. |

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data sourced from reputable international organizations, government publications, and leading market research firms. We meticulously gather insights on political stability, economic indicators, technological advancements, environmental regulations, and socio-cultural trends to provide a comprehensive overview.