Dada Nexus Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dada Nexus Bundle

Dada Nexus operates within a competitive landscape shaped by intense rivalry and significant buyer power. Understanding these forces is crucial for navigating its market effectively.

The full Porter's Five Forces Analysis reveals the real forces shaping Dada Nexus’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Dada Nexus heavily utilizes a crowdsourced model for its delivery riders, particularly on its Dada Now platform. While individual riders might seem to have little power due to their fragmented nature, their collective bargaining strength can increase significantly during peak demand periods or if they organize. In 2023, Dada Nexus reported a substantial number of active delivery partners, highlighting the scale of this workforce and the potential for their collective influence.

Dada Nexus's reliance on JD.com, particularly JD Logistics, for a significant portion of its delivery orders through Dada Now, highlights the considerable bargaining power this strategic partner wields. JD Group's substantial 63.2% ownership stake underscores its controlling influence, directly impacting Dada's operational direction and strategic decisions.

The financial interdependence is clear, with JD Group contributing significantly to Dada's service revenue. This deep integration and financial tie-in mean JD Logistics effectively acts as a critical 'supplier' of business volume, giving them considerable leverage in negotiations and partnership terms.

Dada Nexus's reliance on cutting-edge technology for its logistics operations means that providers of specialized AI, machine learning, and cloud infrastructure solutions can wield significant bargaining power. If these technological components are proprietary or have few viable alternatives, Dada Nexus faces higher costs and potential disruptions if suppliers dictate terms. For instance, in 2023, the global market for AI in logistics was estimated to be worth over $10 billion, indicating substantial investment and reliance on these specialized providers.

Retail Merchant Partners

For Dada Nexus's JD NOW platform, the vast network of retailers and brand owners functions as its supplier base. While individual small merchants might possess minimal leverage, the collective bargaining power of larger chain merchants and key supermarket partnerships is substantial. These relationships are vital for Dada's market standing and its ability to generate revenue.

Major retail partners can exert significant influence. For instance, in 2023, Dada Nexus continued to expand its partnerships with leading supermarket chains, which are critical for ensuring a diverse and high-quality product selection on its platform. The ability of these larger suppliers to negotiate terms, pricing, and promotional support directly impacts Dada's cost of goods sold and overall profitability.

- Significant Supplier Concentration: While Dada partners with numerous retailers, a few large supermarket chains and prominent brands represent a significant portion of its product sourcing.

- Negotiating Power of Key Partners: Major retail chains can demand favorable terms, impacting Dada's margins. Their ability to withhold products or shift to competing platforms poses a risk.

- Strategic Importance of Partnerships: Dada's competitive edge relies on securing exclusive or preferred access to popular brands and product assortments from these key suppliers.

- Impact on Revenue and Costs: The bargaining power of these retail merchant partners directly influences Dada's gross profit margins and its capacity to offer competitive pricing to consumers.

Regulatory and Labor Environment

The Chinese government's intensified focus on regulating its platform economy, particularly concerning worker welfare and pricing, directly influences Dada Nexus's operational costs and strategic maneuverability. Directives aimed at enhancing rider safety and capping service fees for restaurants act as significant external pressures, akin to suppliers dictating terms.

These regulatory shifts can be viewed as an external force shaping Dada Nexus's bargaining power. For instance, in 2023, China's State Administration for Market Regulation continued to emphasize fair competition and consumer protection, which can translate into mandates affecting Dada Nexus’s fee structures and rider compensation models. Such regulations effectively increase the cost of doing business, limiting the platform's ability to pass these costs onto consumers or reduce rider pay, thereby strengthening the implicit bargaining power of both riders and restaurants.

- Regulatory Directives: Government mandates on worker safety and service charges directly impact Dada Nexus's cost structure.

- Worker Welfare: Increased focus on rider protection can lead to higher labor costs for platforms.

- Service Fee Caps: Regulations limiting service charges reduce revenue opportunities for delivery platforms.

- Operational Flexibility: Compliance with new regulations can constrain Dada Nexus's ability to adapt pricing and operational strategies.

Dada Nexus faces significant bargaining power from its key retail partners, particularly large supermarket chains and major brands, which are crucial for its product sourcing. These partners can negotiate favorable terms, impacting Dada's margins and its ability to offer competitive pricing. Their leverage is amplified by their ability to potentially shift business to rival platforms or limit product availability.

| Key Supplier Type | Bargaining Power Factor | Impact on Dada Nexus |

| Major Supermarket Chains | Concentration of sales volume, brand recognition | Can dictate terms, pricing, and promotional support; risk of product delisting |

| Prominent Brands | Brand loyalty, consumer demand | Negotiate exclusivity, marketing contributions; potential to withdraw products |

| JD.com (JD Logistics) | Majority ownership, critical logistics partner | Significant influence on operational terms, pricing, and strategic direction |

| Technology Providers (AI/Cloud) | Proprietary solutions, limited alternatives | Can command higher prices for essential infrastructure; risk of service disruption |

| Delivery Riders (Collective) | Scale of workforce, potential for organization | Increased leverage during peak demand or unionization, leading to potential wage pressures |

What is included in the product

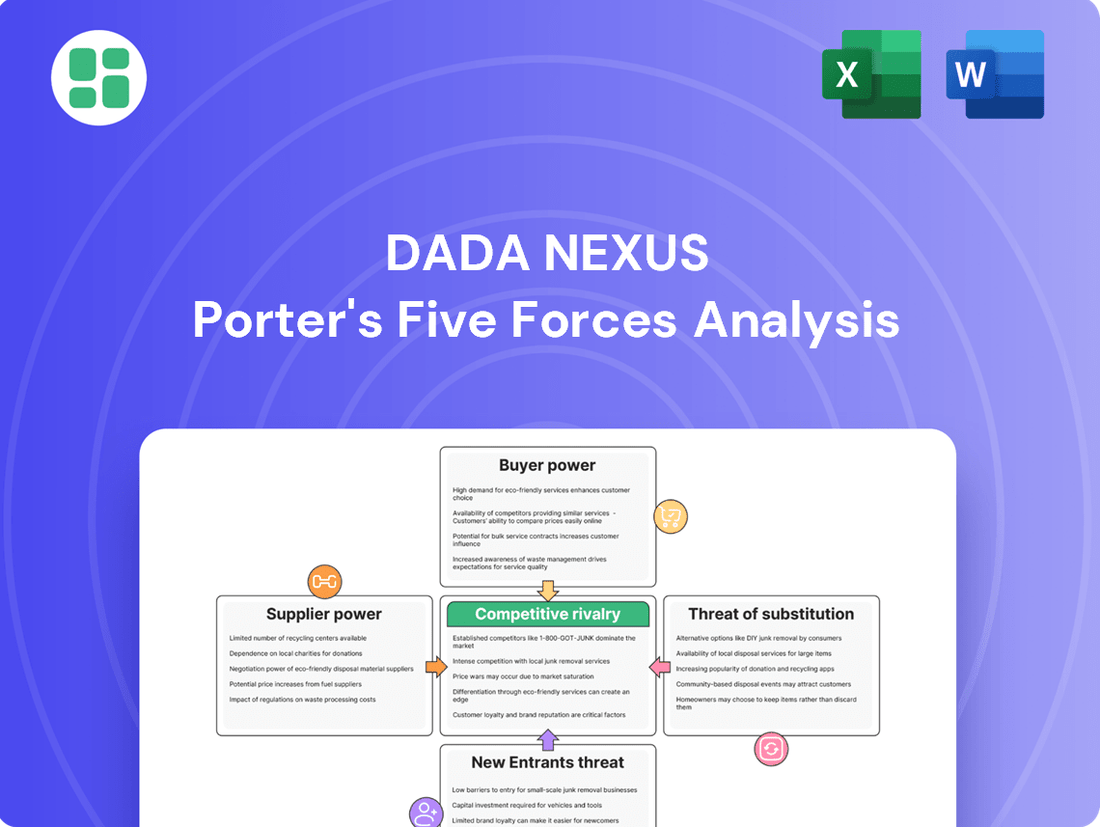

This analysis provides a comprehensive examination of the competitive forces impacting Dada Nexus, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces model, allowing for rapid identification of strategic threats and opportunities.

Customers Bargaining Power

Dada Nexus experiences significant bargaining power from its customers due to high customer concentration, most notably its deep integration with JD.com. The substantial volume of on-demand delivery orders originating from JD NOW, a key platform for JD.com, directly contributes to Dada NOW's overall order volume and operational density.

This close relationship grants JD.com, as a primary customer for Dada's delivery services, considerable leverage. In 2023, JD.com continued to be a cornerstone of Dada Nexus's business, with its platforms driving a significant portion of Dada NOW's revenue, underscoring the impact of this concentrated customer relationship on Dada's pricing and service terms.

Customers in China's on-demand delivery sector, including both individuals ordering food and merchants listing their services, are quite sensitive to price. They're always on the lookout for the best deals and the easiest ways to get what they need. This means that if prices go up, they'll likely look elsewhere.

The market is crowded with major players like Meituan and Ele.me. This abundance of choice gives customers significant leverage. They can easily switch between different delivery apps if one offers a better price or a higher quality of service. For instance, in 2024, the competition for user acquisition and retention remained fierce, with platforms frequently offering discounts and promotions to attract and keep customers.

For individual consumers, switching between on-demand delivery apps is remarkably simple, often requiring nothing more than downloading a different application. This ease of transition means consumers can readily opt for platforms that provide superior deals, quicker delivery times, or a more extensive range of products.

This low switching cost directly amplifies consumer bargaining power. For instance, in 2024, the online food delivery market in China, where Dada Nexus operates, saw intense competition with numerous players vying for market share. This competitive landscape inherently favors consumers, as they can easily shift their spending to the service that best meets their immediate needs and price sensitivities.

Merchant Bargaining Power

The bargaining power of customers, particularly larger retail chains and brand owners on Dada Nexus's JD NOW platform, is a significant factor. These substantial merchants, due to their high transaction volumes, can effectively negotiate terms regarding commission rates, delivery logistics, and marketing assistance. This ability to influence Dada Nexus's service agreements directly impacts the company's revenue generation from its retail platform operations.

For instance, in 2024, major supermarket chains that leverage JD NOW for their last-mile delivery services often negotiate tiered commission structures based on sales volume. A large chain might secure a commission rate of 5-8% on sales, whereas smaller independent stores could face rates of 10-12%. This disparity highlights how the scale of a merchant's operations directly translates into their leverage.

- Negotiation Leverage: Large retailers and brand owners can negotiate commission rates, delivery terms, and marketing support from Dada Nexus.

- Volume Impact: Higher business volumes for these merchants grant them greater influence over platform service agreements.

- Revenue Stream Influence: Merchant negotiations directly affect Dada Nexus's revenue streams from its retail platform services.

- Competitive Landscape: The ability of merchants to switch between delivery platforms if terms are unfavorable further strengthens their bargaining position.

Demand for Speed and Convenience

The fundamental customer demand for instant delivery and convenient access to local goods significantly amplifies customer bargaining power. This means customers expect high service levels, including speed, accuracy, and product variety, and can readily switch to competitors if these expectations aren't met.

In 2024, the e-commerce landscape continued to be shaped by this demand. For instance, platforms offering rapid fulfillment, often within hours, saw increased user engagement. Data from early 2024 indicated that over 60% of online shoppers in major urban centers prioritized same-day delivery options when available.

- Customer Expectation: Consumers increasingly expect near-immediate gratification for their purchases, driving demand for rapid delivery services.

- Competitive Landscape: With numerous platforms vying for market share, customers can easily compare and switch based on delivery speed and convenience.

- Service Level Sensitivity: Failure to meet expectations in terms of speed, accuracy, and product availability can lead to swift customer attrition.

Dada Nexus faces substantial customer bargaining power, amplified by the ease with which both individual consumers and large merchants can switch between delivery platforms. This is particularly evident with JD.com, a key partner whose significant order volume grants it considerable negotiation leverage over Dada's pricing and service terms. For example, in 2023, JD.com's continued reliance on Dada NOW underscored the impact of this concentrated customer relationship.

The competitive landscape in China's on-demand delivery sector, featuring players like Meituan and Ele.me, further empowers customers. In 2024, this intense competition led to frequent discounts and promotions, as platforms fought for market share. This environment allows consumers to readily shift to services offering better prices or superior service, as evidenced by the fact that over 60% of online shoppers in major urban centers prioritized same-day delivery options in early 2024.

| Customer Segment | Bargaining Power Driver | Impact on Dada Nexus | Example (2024 Data) |

|---|---|---|---|

| JD.com (Concentrated Customer) | High Order Volume, Deep Integration | Leverage over pricing and service terms | Continued reliance in 2023/2024 |

| Individual Consumers | Low Switching Costs, Price Sensitivity | Pressure on service fees, demand for promotions | Easy app switching, preference for discounts |

| Large Retailers/Merchants (JD NOW) | High Transaction Volumes, Negotiation Capability | Ability to negotiate commission rates and terms | Tiered commissions: 5-8% for large chains vs. 10-12% for smaller stores |

Preview the Actual Deliverable

Dada Nexus Porter's Five Forces Analysis

This preview shows the exact Dada Nexus Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual document, detailing the competitive landscape for Dada Nexus, including threats from new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitute products. Once you complete your purchase, you’ll get instant access to this exact, comprehensive analysis.

Rivalry Among Competitors

The on-demand delivery and retail arena in China is a battleground, with a few colossal entities dictating terms. Dada Nexus, despite its leading position, contends with formidable rivals. Meituan, a dominant force in food delivery, and Alibaba's Ele.me represent significant competitive pressures.

Furthermore, JD.com's aggressive expansion into quick delivery services adds another layer of intensity. This crowded market necessitates continuous innovation and operational efficiency for Dada Nexus to maintain its edge.

Dada Nexus commands a significant portion of the local on-demand delivery market, estimated at around 20%, making it the third-largest player. This strong market presence, however, is constantly challenged by intense competition.

Rival firms are actively pursuing aggressive growth tactics. These include substantial subsidies for both merchants and consumers, significant investments in cutting-edge technology such as delivery drones, and a continuous expansion of their service portfolios. Such strategies fuel ongoing battles for market share.

Intense competition within the online grocery sector has triggered significant pricing wars and widespread subsidies, directly impacting the profitability of all participants, including Dada Nexus. This aggressive pricing strategy erodes profit margins across the board.

Regulatory bodies have voiced concerns regarding the escalating level of competition, advocating for more 'rational' competitive practices among platforms. This oversight further underscores the persistent pressure on profit margins for companies like Dada Nexus.

Expanding Service Offerings and Geographical Coverage

Competitive rivalry is intensifying as players like Meituan and Ele.me broaden their offerings beyond just food delivery. They are increasingly incorporating groceries, pharmaceuticals, and a wider array of daily necessities into their platforms, effectively expanding the competitive landscape. This strategic shift necessitates that Dada Nexus continuously innovate and broaden its own service categories and geographical reach to maintain its competitive edge.

In 2023, Meituan, a major competitor, reported a significant increase in its grocery delivery segment, contributing to its overall revenue growth. Dada Nexus must respond by not only matching but exceeding these expanded service offerings and geographical footprints. For instance, by Q1 2024, Dada Nexus's expansion into new cities needs to be strategically aligned with competitor movements to capture market share effectively.

- Broadening Service Scope: Competitors are moving beyond food delivery to encompass groceries, pharmaceuticals, and other essential goods.

- Geographical Expansion: Rivals are actively increasing their operational reach into new cities and regions.

- Innovation Imperative: Dada Nexus must continuously innovate its service portfolio and expand its geographical coverage to stay competitive.

- Market Share Defense: Strategic alignment with competitor expansion is crucial for Dada Nexus to defend and grow its market share.

High Exit Barriers

The significant capital outlay required for technology platforms, extensive logistics networks, and building a loyal customer base presents formidable exit barriers in the online grocery delivery sector. Companies like Dada Nexus have invested heavily, making it difficult and costly to divest operations. This situation encourages existing competitors to stay and fight for market share, rather than withdraw.

These high exit barriers mean that companies are compelled to compete fiercely to survive. Consider the substantial investments in last-mile delivery infrastructure; for instance, in 2024, major players continued to pour billions into optimizing their rider networks and warehousing capabilities to achieve faster delivery times. This ongoing investment locks companies into the market, intensifying the rivalry as they strive to recoup their expenditures and maintain their competitive position.

- High Capital Investment: Companies in this sector face substantial upfront costs for technology development, warehouse infrastructure, and delivery fleets.

- Customer Loyalty and Brand Recognition: Established brands and existing customer relationships are difficult and time-consuming to replicate, making it hard for new entrants and costly for exiting firms to abandon.

- Logistics Network Complexity: The intricate web of riders, sorting centers, and delivery routes represents a significant sunk cost, discouraging companies from simply walking away.

The competitive rivalry within China's on-demand delivery sector is exceptionally fierce, characterized by aggressive strategies from major players like Meituan and Alibaba's Ele.me. These giants are not only competing on delivery speed and breadth of services, including groceries and pharmaceuticals, but also through substantial subsidies and technological advancements. Dada Nexus, holding approximately 20% of the local on-demand delivery market, faces constant pressure to innovate and expand its offerings to counter these formidable rivals. The ongoing price wars and subsidy wars directly impact profitability, with regulatory bodies urging for more rational competition.

| Competitor | Key Competitive Actions | Market Focus |

|---|---|---|

| Meituan | Expanding grocery delivery, investing in technology, offering subsidies | Food delivery, groceries, lifestyle services |

| Ele.me (Alibaba) | Broadening service categories, leveraging Alibaba's ecosystem, aggressive marketing | Food delivery, groceries, retail |

| JD.com | Rapid expansion of quick delivery services | E-commerce, groceries, general retail |

SSubstitutes Threaten

While Dada Nexus's on-demand delivery is a significant convenience, traditional brick-and-mortar retail remains a powerful substitute. Consumers can still opt to visit physical stores like supermarkets, pharmacies, and local shops, particularly for immediate needs or when they value the ability to see and touch products before buying. This direct offline shopping experience offers an alternative that bypasses the delivery model altogether.

The rise of self-pickup options, often called 'click and collect,' presents a significant threat to delivery platforms like Dada Nexus. Many retailers, from major grocers to electronics stores, now offer this service, allowing customers to order online and collect their purchases directly from the store. This completely bypasses the need for a third-party delivery service, offering consumers a potentially faster and more cost-effective way to receive their goods, especially if they are already near the store.

Large retailers and restaurant chains are increasingly building their own delivery infrastructure. For instance, in 2024, many major grocery chains expanded their same-day delivery options, often utilizing their existing staff for these services. This direct approach bypasses third-party logistics providers like Dada Nexus, offering them more control over customer experience and potentially better cost management.

Alternative Logistics and Express Delivery Services

For non-urgent or larger parcel deliveries, traditional express logistics companies present a viable substitute for Dada Nexus's on-demand services. While these providers, such as SF Express, may not match Dada's instant, intra-city delivery speed, their established networks and different cost structures make them attractive alternatives for customers whose needs prioritize cost over immediate delivery. For instance, SF Express reported a revenue of approximately RMB 217.1 billion in 2023, demonstrating the significant market presence of these traditional players.

These established logistics giants offer a broad range of services that can cater to various customer requirements. Although Dada Nexus excels in rapid, localized deliveries, these larger competitors can handle bulk shipments and offer more economical options for less time-sensitive needs. This differentiation in service allows customers to choose the most appropriate and cost-effective solution based on their specific delivery parameters.

- Traditional express logistics companies offer a substitute for non-urgent or larger parcel deliveries.

- Companies like SF Express, with RMB 217.1 billion in 2023 revenue, represent significant competition.

- These substitutes cater to customers prioritizing cost over immediate delivery speed.

- Dada Nexus's strength in instant, intra-city delivery contrasts with the broader networks of traditional providers.

Emerging Technologies and New Business Models

The threat of substitutes for Dada Nexus is amplified by emerging technologies and evolving business models. New technologies like drone delivery and autonomous vehicles are on the horizon, potentially offering faster and more cost-effective delivery solutions that could bypass traditional logistics platforms. For instance, by 2024, the global drone delivery market was projected to reach significant growth, indicating a tangible shift towards these alternative methods.

Furthermore, shifts in consumer behavior and e-commerce strategies present other substitute threats. The rise of community-based purchasing groups or direct-to-consumer models could allow consumers to acquire goods through channels that bypass the need for on-demand delivery platforms. These alternative models might offer greater personalization or cost savings, directly challenging Dada Nexus's core value proposition.

- Emerging Technologies: Drone delivery and autonomous vehicles promise faster, potentially cheaper delivery.

- Evolving E-commerce Models: Community purchasing groups and direct-to-consumer sales offer alternative access to goods.

- Market Trends: The global drone delivery market was expected to see substantial expansion by 2024, highlighting the growing viability of these substitutes.

The threat of substitutes for Dada Nexus is multifaceted, encompassing traditional retail, retailer-owned delivery, and alternative logistics. Consumers can opt for in-store purchases or click-and-collect services, bypassing delivery altogether. Furthermore, large retailers are increasingly developing their own delivery fleets, as seen with grocery chains expanding same-day delivery in 2024, which directly competes with Dada Nexus's model by offering more control and potentially better cost management.

Traditional express logistics companies also pose a substitute threat, particularly for non-urgent or larger shipments. While not offering Dada Nexus's instant delivery, their established networks and cost-effectiveness for less time-sensitive needs are attractive. For instance, SF Express's significant 2023 revenue of approximately RMB 217.1 billion underscores the market presence of these alternative providers.

| Substitute Type | Key Characteristics | Dada Nexus's Advantage | Example/Data Point |

|---|---|---|---|

| In-Store Shopping | Immediate access, product inspection | Convenience, doorstep delivery | Traditional brick-and-mortar retail |

| Click & Collect | Bypasses delivery fees, faster pickup | On-demand delivery | Retailers' online order, in-store pickup |

| Retailer-Owned Delivery | Control over customer experience, cost management | Extensive network, on-demand focus | Grocery chains expanding same-day delivery (2024) |

| Traditional Express Logistics | Cost-effective for non-urgent/bulk, established networks | Speed and intra-city focus | SF Express (approx. RMB 217.1 billion revenue in 2023) |

Entrants Threaten

Entering China's competitive on-demand retail and delivery sector demands massive upfront capital. Companies need to invest heavily in creating sophisticated technology platforms, establishing widespread logistics and delivery infrastructure, and aggressively marketing to attract both merchants and consumers. For instance, in 2023, major players like Meituan and Ele.me continued to pour billions into expanding their services and user base, setting a high bar for any new competitor.

Established players like Dada Nexus, Meituan, and Ele.me benefit from powerful network effects. More consumers using their platforms attract more merchants, which in turn draws even more consumers, creating a self-reinforcing cycle that’s hard for newcomers to break into. In 2023, Dada Nexus reported a significant increase in its gross transaction volume, a testament to its entrenched user base and merchant partnerships.

Furthermore, these incumbents have cultivated substantial brand recognition and customer loyalty. This deep-seated trust makes it considerably challenging for new entrants to attract and retain customers who are already satisfied with existing, reliable services. For instance, Meituan's extensive marketing efforts and consistent service delivery have solidified its position as a go-to platform for many Chinese consumers.

The Chinese government's intensified oversight of the platform economy presents a significant barrier. New regulations focusing on fair competition, data privacy, and employee rights create substantial compliance burdens. For instance, in 2023, China's State Council issued guidelines aimed at fostering a more equitable environment for platform companies, impacting how they operate and interact with users and workers.

Access to Supply and Merchant Partnerships

For Dada Nexus, a significant threat from new entrants stems from the difficulty in replicating established access to supply chains and merchant partnerships. Building a robust network of suppliers and securing exclusive or preferential agreements with a wide range of retailers and brand owners takes considerable time and investment.

Existing players have cultivated these relationships over years, creating a barrier for newcomers. For instance, in 2024, major e-commerce platforms continued to leverage their long-standing partnerships, offering exclusive product launches and promotions that are hard for nascent competitors to match. Dada Nexus, like others in the sector, relies on these strong merchant ties to offer a compelling and diverse product selection to consumers.

New entrants face an uphill battle in quickly onboarding a competitive array of merchants, as these established players have already invested heavily in building trust and operational integration. This makes it challenging for them to quickly offer a comparable breadth and depth of products.

- Merchant Acquisition Costs: New entrants often face higher initial costs to onboard merchants compared to established players who benefit from existing infrastructure and reputation.

- Exclusive Partnerships: Many popular brands and retailers have exclusive agreements with incumbent platforms, limiting the product selection available to new entrants.

- Supplier Relationships: Securing reliable and high-quality product supply requires building strong, long-term relationships with suppliers, which new entrants lack.

- Brand Trust: Consumers often trust established platforms more, making it harder for new entrants to attract both merchants and buyers without a proven track record.

Intense Retaliation from Incumbents

The threat of new entrants for Dada Nexus is significantly amplified by the intense retaliation expected from established players. In China's highly competitive on-demand delivery and retail services market, dominant companies like Meituan and Ele.me are known for their aggressive tactics to maintain market share.

These incumbents often engage in price wars, offering deep discounts and subsidies to new customers, making it difficult for newcomers to gain a foothold. For instance, during promotional periods in 2023 and early 2024, consumers frequently saw substantial discounts on delivery fees and order prices, a strategy designed to lock in users and deter switching.

Furthermore, existing players can leverage their vast user bases and extensive logistics networks to enhance service offerings, such as faster delivery times or broader product selections. This makes it challenging for new entrants to compete on service quality and operational efficiency, thereby increasing the barrier to entry.

- Aggressive Pricing: Incumbents may lower prices or offer significant subsidies, as seen with widespread delivery fee discounts in major Chinese cities throughout 2023.

- Enhanced Services: Existing platforms can quickly improve delivery speed or expand product variety, leveraging their established infrastructure.

- Loyalty Programs: Strong customer loyalty programs can further entrench dominant players, making it harder for new entrants to attract and retain users.

- Market Saturation: The high level of competition means that any new entrant faces an uphill battle to carve out a significant market share against well-entrenched competitors.

The threat of new entrants in China's on-demand retail and delivery sector is considerably low due to immense capital requirements for technology, logistics, and marketing. Established players like Dada Nexus, Meituan, and Ele.me have built strong network effects and brand loyalty, making it difficult for newcomers to gain traction. Government regulations and the challenge of replicating existing merchant partnerships further solidify the position of incumbents, as seen in continued investments and exclusive deals throughout 2023 and 2024.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dada Nexus is built upon a robust foundation of data, incorporating financial statements, investor relations disclosures, and market research reports. This blend allows for a comprehensive understanding of industry rivalry, supplier and buyer power, and the threat of new entrants and substitutes.