Intercontinental Hotels Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intercontinental Hotels Group Bundle

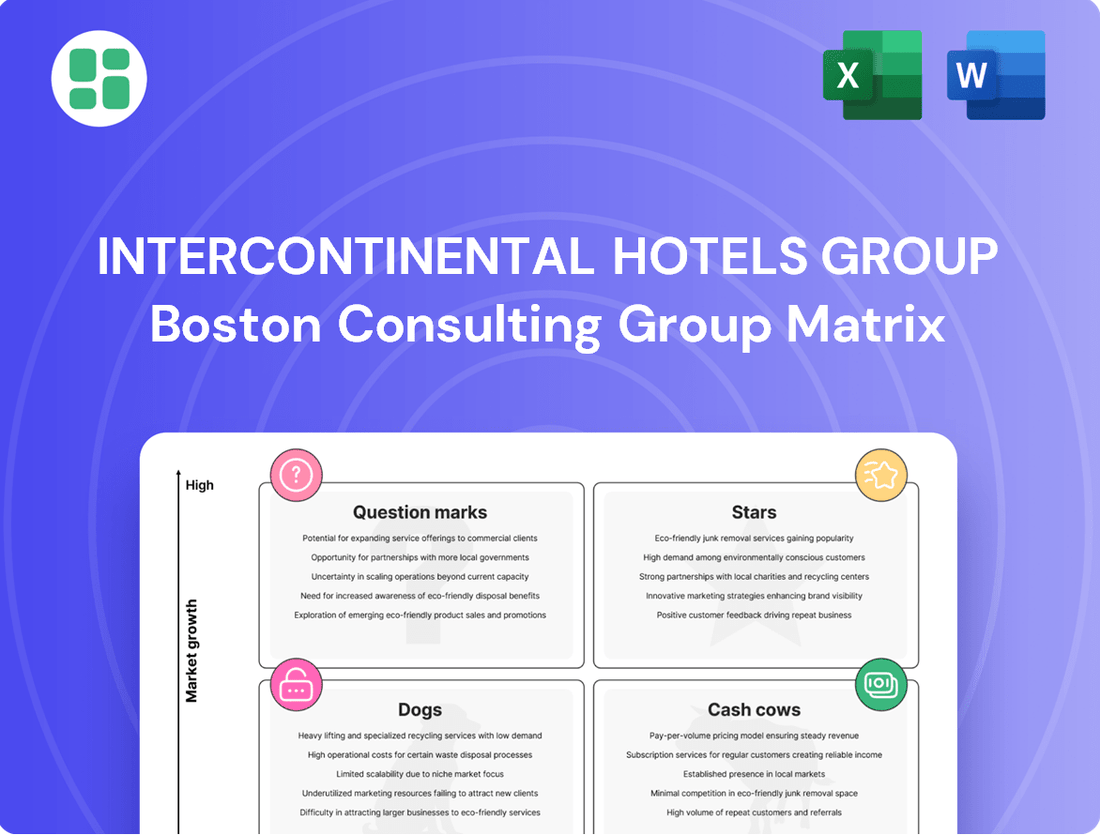

Explore the strategic positioning of InterContinental Hotels Group's diverse brands within the BCG Matrix. Understand which brands are market leaders and which require careful resource allocation.

This preview offers a glimpse into how IHG's portfolio is segmented, but the full BCG Matrix report unlocks detailed quadrant placements and data-driven recommendations. Purchase the complete analysis to gain a clear roadmap for optimizing your investments and product strategy within the dynamic hospitality sector.

Stars

Intercontinental Hotels Group (IHG) is making substantial investments in its Luxury & Lifestyle portfolio, a strategic move targeting a rapidly expanding market segment. Brands like Six Senses, Regent, and Vignette Collection are at the forefront of this expansion, capitalizing on the increasing global demand for premium and distinctive travel experiences.

These luxury brands are demonstrating robust growth, capturing significant market share as travelers increasingly seek unique and immersive stays. For instance, Six Senses, known for its wellness and sustainability focus, continues to open new properties, with a development pipeline that underscores its ambition to lead in the eco-luxury space.

IHG's commitment is evident in the accelerated development of these brands. By 2024, the company aims to significantly increase the number of luxury and lifestyle rooms, projecting a substantial contribution to its overall portfolio growth and profitability. This focus positions IHG to capture a larger share of the high-margin luxury travel market.

InterContinental Hotels Group's (IHG) extended-stay brands, including Staybridge Suites and Candlewood Suites, are strong performers within the BCG matrix, benefiting from the segment's robust growth. This sector is experiencing heightened demand from both business and leisure travelers, a trend that has been particularly evident in 2024. IHG's strategic expansion and focus on this resilient market position it to capitalize on sustained high performance.

Intercontinental Hotels Group (IHG) is making significant strides in emerging markets, with a particular emphasis on Greater China and broader Asia. This strategic push is fueled by rapid urbanization and a growing middle class, both of which are creating substantial demand for quality hotel services.

IHG's development pipeline in these regions indicates a strong market position, suggesting its brands collectively operate in a high-growth, high-share quadrant of the BCG matrix. For instance, by the end of 2023, IHG had over 170 hotels in its Greater China pipeline, showcasing a robust commitment to this key growth area.

Technology-Driven Guest Experience Initiatives

InterContinental Hotels Group (IHG) is heavily investing in technology to elevate the guest experience, a key strategy for maintaining a competitive edge. These initiatives, focusing on digital platforms and personalization, are crucial for driving growth and loyalty across its diverse brand portfolio.

By leveraging data analytics and artificial intelligence, IHG aims to create more tailored and seamless stays for its guests. This proactive approach positions IHG as an innovator in the hospitality sector, attracting a broader customer base and fostering repeat business. For example, in 2024, IHG reported a significant increase in digital bookings, demonstrating the effectiveness of these tech-forward strategies.

- Digital Platform Investment: IHG's commitment to advanced digital platforms enhances booking, check-in, and in-room services, improving overall guest satisfaction.

- Personalization through AI: Utilizing AI and data analytics allows for personalized offers and recommendations, creating a unique experience for each guest.

- Market Leadership: These innovations are designed to solidify IHG's position as a leader in hospitality technology, attracting and retaining guests in a dynamic market.

- Enhanced Value Proposition: The technology-driven guest experience directly boosts the value proposition of all IHG brands, contributing to increased market share.

Premium Brand Revitalization (e.g., voco, Hotel Indigo)

Brands like voco and Hotel Indigo are showing robust growth, capturing a larger slice of the market. They achieve this by providing unique, locally-inspired experiences that resonate with today's travelers. This strategic expansion into prime urban and leisure spots highlights their considerable growth potential and solid performance in the premium and lifestyle sectors.

IHG's commitment to refreshing and growing these distinctive brands is paying off. For instance, voco hotels saw a significant increase in openings and conversions in 2023, with a pipeline of over 30 hotels. Hotel Indigo continues its global expansion, with new openings in key markets like the US and Europe, underscoring their strong appeal.

- Strong Market Share Growth: voco and Hotel Indigo are actively gaining market share by differentiating through unique, localized guest experiences.

- Strategic Expansion: IHG is prioritizing the expansion of these brands in high-demand urban and leisure destinations, reflecting their strong potential.

- Financial Performance: These brands are key contributors to IHG's premium and lifestyle portfolio, demonstrating healthy revenue growth and increasing brand recognition.

- Future Outlook: The ongoing investment in refreshing and expanding these unique offerings positions them as star performers within IHG's brand portfolio.

IHG's Luxury & Lifestyle brands, including Six Senses and Regent, are positioned as Stars in the BCG matrix. These brands are experiencing high growth and hold a significant market share, driven by increasing consumer demand for premium and unique travel experiences.

The company's strategic investments in this segment, particularly in wellness and sustainability, are yielding strong results, with a robust development pipeline indicating continued success. By 2024, IHG anticipates a substantial increase in its luxury and lifestyle room count, bolstering their contribution to the group's profitability and market standing.

The strong performance of these luxury offerings is a testament to IHG's ability to cater to evolving traveler preferences, solidifying their status as key growth drivers for the company.

| Brand Category | Market Growth Rate | Relative Market Share | BCG Status |

|---|---|---|---|

| Luxury & Lifestyle (e.g., Six Senses, Regent) | High | High | Stars |

| Extended Stay (e.g., Staybridge Suites, Candlewood Suites) | High | High | Stars |

| Premium/Lifestyle (e.g., voco, Hotel Indigo) | High | High | Stars |

| Greater China & Asia Emerging Markets | High | High | Stars |

What is included in the product

IHG's BCG Matrix likely analyzes its diverse hotel brands, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

The InterContinental Hotels Group BCG Matrix offers a clear, one-page overview of each business unit's market position, alleviating the pain of strategic uncertainty.

Cash Cows

The Holiday Inn brand family, encompassing Holiday Inn and Holiday Inn Express, is IHG's cornerstone, dominating the midscale and economy hotel segments. These brands boast a substantial global presence and strong brand recognition, translating into consistently high occupancy rates and robust, dependable cash flows. In 2024, IHG reported that the Holiday Inn brand family continued to be a primary driver of revenue, reflecting its status as a mature, cash-generating asset within the company's portfolio.

Crowne Plaza Hotels & Resorts, a key player within Intercontinental Hotels Group (IHG), operates as a classic Cash Cow in the BCG Matrix. Its established premium positioning and substantial global footprint, especially within the mature but stable business and group travel sectors, generate consistent and significant cash flow for IHG.

The brand benefits from a loyal corporate customer base and a well-developed operational infrastructure, ensuring steady profitability. For instance, in 2023, IHG reported robust performance, with Crowne Plaza contributing to the group's overall revenue growth, reflecting its strong market share in its defined segments.

The IHG One Rewards loyalty program is a cornerstone of InterContinental Hotels Group's strategy, functioning as a prime cash cow. This program is instrumental in fostering repeat business and ensuring customer loyalty across IHG's diverse portfolio of brands. Its significant membership base translates directly into consistent booking volumes and reliable revenue streams, offering a cost-effective avenue for driving demand.

As of the first quarter of 2024, IHG reported that its loyalty program members accounted for approximately 60% of its room nights. This high penetration rate underscores the program's effectiveness in securing a substantial portion of IHG's revenue. The program's maturity and widespread appeal mean it contributes significantly to the company's profitability and market presence without necessitating major new capital outlays for marketing or development.

Global Franchise and Management Business Model

Intercontinental Hotels Group's (IHG) asset-light strategy, heavily reliant on franchising and management agreements, positions its established brands as significant cash cows. This approach minimizes capital outlays while maximizing returns through consistent fee-based income streams.

This model generates predictable revenue from royalties, management fees, and marketing contributions, benefiting from IHG's strong brand recognition and operational expertise across a vast global network. For instance, in 2023, IHG reported a revenue of $4.2 billion, a substantial portion of which is derived from these fee-based activities.

- Asset-Light Model: IHG primarily franchises and manages hotels, reducing the need for direct capital investment in property ownership.

- Fee-Based Revenue: Predictable income is generated through royalties, management fees, and marketing contributions from franchisees.

- High Profit Margins: Leveraging brand power and operational expertise leads to strong profitability from its global footprint.

- 2023 Performance: IHG's revenue reached $4.2 billion in 2023, underscoring the financial strength of its established brands and business model.

Established International Markets

Intercontinental Hotels Group's (IHG) established international markets, particularly North America and Europe, function as its cash cows. These regions represent mature economies where IHG boasts a deep-rooted presence and significant brand loyalty across its portfolio. The stability of these markets allows IHG to generate consistent and substantial revenue through its extensive network of hotels operating under franchise and management agreements.

These mature markets contribute significantly to IHG's overall financial performance. For instance, in 2024, IHG reported strong performance in its established regions, with the Americas and EMEAA (Europe, Middle East, Africa, and Asia) contributing a substantial portion of its revenue. The low growth environment in these areas necessitates minimal incremental investment to maintain their leading market positions and profitability, making them reliable sources of free cash flow for the group.

- North America and Europe are mature markets with high brand recognition for IHG.

- Stable revenue streams are generated through established franchises and management contracts.

- Low market growth in these regions requires less capital expenditure to maintain market share.

- These markets provide consistent profitability and are key contributors to IHG's cash flow.

The Holiday Inn brand family, including Holiday Inn and Holiday Inn Express, is a core cash cow for IHG. These brands consistently deliver strong, dependable cash flows due to their broad appeal in the midscale and economy segments and high occupancy rates. In 2024, IHG highlighted the continued revenue generation from this brand family, solidifying its status as a mature, cash-producing asset.

Crowne Plaza Hotels & Resorts also operates as a significant cash cow for IHG. Its established premium positioning and strong global presence, particularly in the business and group travel markets, generate consistent and substantial cash flow. The brand benefits from a loyal customer base and efficient operations, ensuring steady profitability.

IHG's asset-light strategy, focusing on franchising and management agreements, is a key driver of its cash cow status. This model generates predictable, fee-based income from royalties and management fees, leveraging IHG's brand strength and operational expertise. In 2023, IHG's revenue of $4.2 billion reflects the financial success of this approach.

Established international markets, especially North America and Europe, are critical cash cows for IHG. These mature regions with deep brand loyalty and extensive hotel networks provide stable and substantial revenue. Minimal investment is needed to maintain their leading positions and profitability, making them consistent sources of free cash flow.

| Brand/Segment | BCG Matrix Category | Key Characteristics | 2023/2024 Data Point |

| Holiday Inn Family | Cash Cow | Midscale/Economy leader, high occupancy, dependable cash flow | Continued primary revenue driver in 2024 |

| Crowne Plaza | Cash Cow | Premium positioning, strong in business travel, loyal customer base | Contributed to revenue growth in 2023 |

| Asset-Light Model | Cash Cow Driver | Franchising/Management, fee-based income, low capital outlay | $4.2 billion total revenue in 2023 |

| North America & Europe | Cash Cow Markets | Mature economies, deep brand loyalty, extensive network | Substantial revenue contributors in 2024 |

Full Transparency, Always

Intercontinental Hotels Group BCG Matrix

The BCG Matrix analysis of InterContinental Hotels Group you are previewing is the exact, comprehensive document you will receive upon purchase. This report, meticulously crafted with industry data, provides a clear strategic overview of IHG's diverse brand portfolio, categorizing each under Stars, Cash Cows, Question Marks, and Dogs. You can confidently expect this fully formatted, ready-to-use analysis, free from watermarks or demo content, to be instantly downloadable for your immediate business planning and strategic decision-making.

Dogs

Certain older, less competitive individual properties within established Intercontinental Hotels Group (IHG) brands, especially those in declining markets or with outdated infrastructure, can struggle to remain profitable. These isolated units, while not a distinct brand, function as 'dogs' in the BCG matrix, generating low revenue and attracting minimal franchisee investment.

For instance, in 2024, IHG's overall revenue growth was robust, but a small percentage of legacy properties, particularly in less dynamic secondary markets, may have experienced stagnant or declining RevPAR (Revenue Per Available Room). While IHG doesn't publicly break down performance by individual underperforming hotels, the group's strategy often involves encouraging owners of such assets to invest in significant renovations or consider rebranding to align with current market demands.

Some of IHG's older or more niche brands, those not recently updated or distinctly positioned, might find it tough to gain ground in today's crowded hotel market. These brands could struggle to attract new hotel owners or travelers, lagging behind IHG's more energetic brands in growth and market presence.

For instance, brands like Kimpton Hotels & Restaurants, while having a distinct niche, might require ongoing investment to maintain their unique appeal against newer, more aggressively marketed boutique competitors. In 2024, the hospitality sector saw continued emphasis on guest experience and digital integration, areas where older brands may need significant upgrades to remain competitive.

Certain Intercontinental Hotels Group (IHG) brands, while perhaps strong in niche markets, face challenges in expanding globally. These brands might not resonate with a broad international audience or could be hindered by regional operational complexities, limiting their growth potential. For instance, a brand heavily reliant on a specific cultural experience might find it difficult to replicate that success across diverse global markets.

This limited scalability can translate into lower market share growth compared to IHG's more universally recognized brands. Consequently, these brands might be viewed as less strategic for significant capital allocation or aggressive international expansion initiatives by the parent company. Their contribution to overall global revenue might remain modest, placing them in a position where they require careful management rather than substantial investment.

Divested or Phased-Out Brands/Initiatives

Brands or initiatives that Intercontinental Hotels Group (IHG) has divested or phased out typically represent past efforts that didn't achieve their intended market position or strategic goals. These are the 'dogs' in the BCG matrix context, signifying low market share and low growth potential. For example, IHG has historically reviewed its portfolio, and any brands that consistently underperformed or became obsolete would be candidates for divestiture or discontinuation. This strategic pruning allows IHG to reallocate capital and management focus to more robust and growing segments of the hospitality market.

While specific financial data on every phased-out brand isn't publicly detailed, the principle of divestiture is driven by performance metrics. For instance, if a brand's contribution to IHG's overall revenue remained consistently low, perhaps below 1% of total revenue, and showed no signs of future growth, it would likely be considered for exit. Such decisions are crucial for maintaining a healthy and profitable brand portfolio.

- Divestiture Rationale: Brands are divested when they exhibit persistent low profitability and market share, failing to align with IHG's growth strategy.

- Resource Reallocation: Phasing out underperforming brands frees up capital and management attention for investment in more promising IHG brands.

- Portfolio Optimization: This process is a key component of portfolio management, ensuring IHG focuses on brands with the highest potential for return.

- Historical Examples: While specific names are often not highlighted, brands that haven't kept pace with market trends or guest expectations fall into this category.

Properties with High Operating Costs and Low Revenue

Individual hotels within IHG, irrespective of their brand, that consistently show high operating expenses compared to their income are categorized as 'dogs'. This situation is often exacerbated in markets that are highly competitive or have too many similar offerings.

These underperforming properties can face difficulties in becoming profitable and may not significantly boost the group's overall financial performance. For instance, a hotel in a saturated tourist destination might experience lower occupancy rates, leading to higher per-room operating costs and, consequently, lower profitability.

IHG's strategy of shifting ownership risk through its management and franchising model helps to buffer the company from direct financial losses associated with these properties. However, these hotels still represent the lowest performers within IHG's extensive network.

- High Operating Costs: Hotels with expenses like staffing, utilities, and maintenance exceeding revenue.

- Low Revenue Generation: Properties struggling with occupancy or average daily rates (ADR).

- Market Saturation: Hotels in competitive or oversupplied markets are more prone to becoming 'dogs'.

- Profitability Challenges: These units often fail to achieve or sustain profitability, impacting the portfolio's average performance.

Within IHG's portfolio, 'dogs' represent brands or individual hotels that are not growing and have a low market share. These might be older properties in declining markets or brands that haven't adapted to current travel trends. For example, in 2024, while IHG saw strong overall growth, a small segment of legacy hotels in less dynamic secondary markets likely experienced stagnant RevPAR, functioning as 'dogs'.

These underperforming assets often require significant owner investment for renovations or rebranding to remain competitive. IHG's franchise model helps mitigate direct financial risk, but these hotels still represent the weakest performers in the group's network. Their limited profitability can impact the overall portfolio's average performance metrics.

Brands that IHG has divested or phased out are also considered 'dogs', signifying past efforts with low market share and growth potential. While specific financial data on every exit isn't public, a brand contributing consistently low revenue, perhaps under 1% of the total, with no growth prospects, would be a candidate for discontinuation.

These 'dogs' often have high operating costs relative to their revenue, struggling with occupancy or average daily rates, particularly in saturated markets. This makes them challenging to bring to profitability and reduces their contribution to IHG's financial performance.

Question Marks

Atwell Suites, IHG's newer upper-midscale extended-stay offering, is positioned in a segment experiencing robust growth. As of early 2024, the extended-stay market continues to show resilience, with brands like Atwell Suites aiming to capture a share of this expanding demand.

Given its recent launch, Atwell Suites can be viewed as a Question Mark in the BCG matrix. It requires substantial investment to build brand awareness and expand its footprint, mirroring the typical resource needs of new ventures in high-potential but competitive markets.

The brand's success hinges on its ability to gain traction and increase its market share within the growing extended-stay sector. If it can effectively differentiate itself and attract a significant customer base, Atwell Suites has the potential to transition into a Star performer for IHG.

The Vignette Collection, IHG's independent hotel brand launched in 2021, is positioned as a star in the BCG matrix. It operates in the rapidly growing independent and boutique hotel segment, catering to travelers seeking unique experiences. As of early 2024, while the overall independent hotel market is experiencing robust growth, Vignette Collection is still in its nascent stages of portfolio development and brand establishment, giving it a relatively low market share within this competitive space.

This strategic positioning suggests that Vignette Collection requires significant investment and focused efforts to attract new properties and build brand awareness. The goal is to transition from its current status to a more dominant market presence. IHG's commitment to this segment reflects a broader industry trend, with many travelers increasingly valuing distinctive and personalized stays over standardized offerings.

Intercontinental Hotels Group (IHG) might strategically invest in niche luxury segments like ultra-boutique wellness retreats or hyper-personalized digital luxury experiences. These are question marks because, while offering high growth potential and premium margins, they are nascent. IHG's market share in these very specific sub-segments is still being established, demanding careful execution and consumer validation.

Expansion into Untapped Geographic Markets

Intercontinental Hotels Group's (IHG) expansion into untapped geographic markets, such as certain regions in Africa or Southeast Asia where its presence is minimal, can be viewed as question marks in its BCG Matrix. These areas represent significant growth opportunities, but they also demand considerable upfront investment in brand building and operational setup. IHG's success hinges on its ability to effectively navigate these new territories and establish a strong foothold.

- Market Potential: Emerging economies in Africa and parts of Asia offer substantial demographic growth and increasing disposable incomes, indicating a strong future demand for hospitality services. For instance, Sub-Saharan Africa's tourism sector is projected to grow significantly in the coming years, with some forecasts suggesting a contribution to GDP that could double by 2030.

- Investment Requirements: Entering these markets necessitates considerable capital for developing new properties, marketing campaigns to build brand awareness, and adapting services to local preferences. This investment is crucial for overcoming initial low brand recognition and market share.

- Strategic Importance: These question mark markets are vital for IHG's long-term diversification strategy, reducing reliance on more mature markets and tapping into new revenue streams. By 2024, IHG was actively exploring opportunities in over 50 new countries, demonstrating a clear strategic intent to broaden its global footprint.

Advanced Digital Transformation Initiatives

Intercontinental Hotels Group's (IHG) advanced digital transformation initiatives, such as AI-powered personalized guest services and blockchain-based loyalty programs, represent potential question marks in the BCG matrix. These cutting-edge projects are in early adoption phases, targeting the high-growth digital technology market. While the potential for significant market share gains and enhanced guest experiences exists, their ultimate success and impact are still uncertain, necessitating substantial investment. For example, in 2024, IHG continued to invest in enhancing its digital platforms, aiming to improve booking conversion rates and guest engagement, though specific ROI on these nascent programs remains under evaluation.

- AI-driven personalization: Implementing AI to tailor offers and in-room experiences based on guest preferences, aiming to boost ancillary revenue.

- Blockchain loyalty programs: Exploring blockchain for a more secure and transparent loyalty system, potentially increasing member engagement and reducing fraud.

- Next-gen booking engine: Developing a more intuitive and integrated booking platform that leverages data analytics for optimized pricing and package creation.

Atwell Suites, a newer extended-stay brand for IHG, is currently a question mark. It operates in a growing market segment but requires significant investment to establish its brand and capture market share. Its future success depends on its ability to differentiate itself and attract a loyal customer base.

BCG Matrix Data Sources

Our Intercontinental Hotels Group BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official IHG reports to ensure reliable, high-impact insights.