ICZ AS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICZ AS Bundle

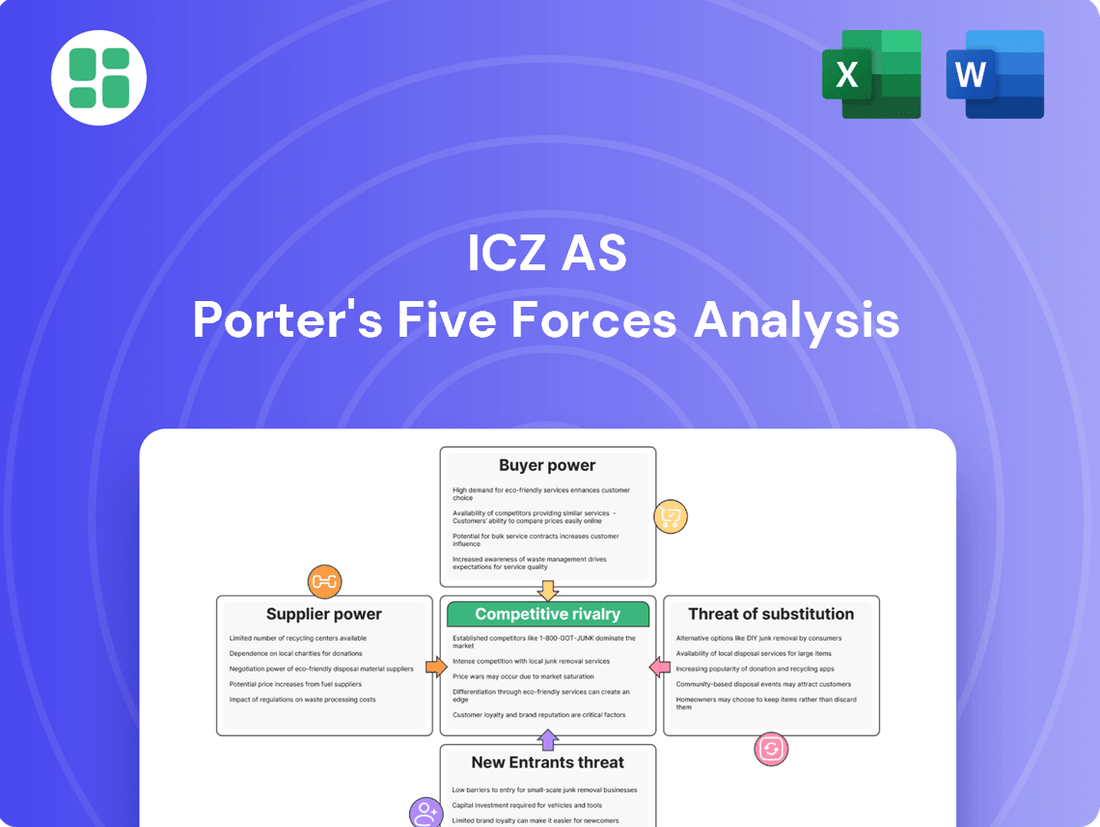

ICZ AS navigates a landscape shaped by intense rivalry, powerful buyers, and the ever-present threat of substitutes. Understanding these forces is crucial for any stakeholder looking to grasp the company's competitive position.

The complete report reveals the real forces shaping ICZ AS’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for ICZ a.s. is significantly shaped by how concentrated and specialized the providers of its essential technologies are. If ICZ relies heavily on a few dominant software or cloud service providers, such as Microsoft for operating systems or a major cloud platform like Amazon Web Services (AWS) or Microsoft Azure, these suppliers gain considerable leverage. This leverage can translate into higher prices, less favorable contract terms, or limited flexibility for ICZ.

For example, in 2024, the global cloud computing market saw continued dominance by AWS, Microsoft Azure, and Google Cloud, collectively holding over 60% of the market share. This concentration means that for companies like ICZ that utilize these services, the primary cloud providers possess substantial bargaining power. Their specialized offerings, often deeply integrated into a company's infrastructure, make switching costs high, further strengthening the suppliers' position.

The criticality of advanced hardware components, robust cybersecurity tools, and specialized software licenses significantly amplifies supplier power for ICZ. If these inputs are indispensable for ICZ to deliver its sophisticated IT solutions, particularly in sensitive sectors like defense or national security, and if alternative suppliers are scarce, then these suppliers hold a stronger bargaining position.

This leverage is further magnified in markets characterized by rapid technological innovation and the prevalence of proprietary solutions, where switching costs can be substantial, and the availability of comparable alternatives is limited.

High switching costs for ICZ are a significant factor in supplier bargaining power. Migrating from one technology stack to another, or retraining staff on new systems, involves considerable effort and expense. For instance, if ICZ has deeply integrated a specific vendor's cloud infrastructure or proprietary software, the cost and disruption of moving to a competitor could run into millions of dollars, impacting project timelines and operational continuity.

Threat of Forward Integration by Suppliers

Suppliers possessing the capability and strategic drive to deliver integrated IT solutions or services directly to ICZ's customer base represent a significant threat. For instance, a large enterprise resource planning (ERP) provider might decide to offer comprehensive e-government platforms, effectively bypassing intermediaries like ICZ.

This potential for forward integration by suppliers directly escalates their bargaining power. They could transition from being mere component providers to direct competitors, capturing market share and diminishing ICZ's opportunities. In 2024, the trend of platformization in IT services has accelerated, with major cloud providers and software giants increasingly offering end-to-end solutions, making this threat more pronounced.

- Increased Competition: Suppliers moving into direct service delivery can directly compete with ICZ for client contracts.

- Reduced Market Access: ICZ's role as a solutions integrator could be marginalized if suppliers offer integrated packages.

- Margin Compression: Direct competition from powerful suppliers can lead to downward pressure on ICZ's pricing and profitability.

Scarcity of Skilled IT Professionals

The scarcity of skilled IT professionals, a global trend amplified in regions like the Czech Republic, directly bolsters the bargaining power of these in-demand workers. For companies like ICZ AS, which depend on specialized IT talent such as software developers, system architects, and cybersecurity experts, this shortage means professionals can negotiate for higher compensation and more favorable employment terms. This dynamic can lead to increased operational expenses and potential delays in project execution for ICZ.

The ongoing demand for IT expertise means that companies face intense competition to attract and retain top talent. In 2024, the IT sector continued to experience significant wage growth for specialized roles, with some senior positions seeing increases of 10-15% year-over-year in many European markets. This competitive landscape forces ICZ to allocate a larger portion of its budget to personnel costs, directly impacting its profitability and ability to invest in other areas.

- Global IT Skills Gap: Reports from 2023 and early 2024 consistently highlighted a widening gap between the demand for IT skills and the available workforce.

- Wage Inflation in Tech: The average salary for experienced software developers in the Czech Republic saw an approximate 12% increase in 2024 compared to the previous year.

- Impact on Project Delivery: Delays in securing specialized IT personnel can extend project timelines, affecting revenue recognition and client satisfaction for companies like ICZ.

- Increased Recruitment Costs: The competitive market drives up recruitment expenses, including agency fees and the time invested in sourcing and vetting candidates.

The bargaining power of suppliers for ICZ a.s. is notably high due to the specialized nature of its technology needs and the concentration within key IT markets. When ICZ relies on a limited number of providers for critical software, cloud services, or hardware, these suppliers gain significant leverage, potentially leading to increased costs and less favorable terms.

The IT sector's reliance on a few dominant players, such as the major cloud providers like AWS and Microsoft Azure, which held over 60% of the market share in 2024, illustrates this concentration. High switching costs, stemming from deep integration and the need for specialized retraining, further solidify supplier influence, making it challenging for ICZ to change providers without substantial disruption and expense.

| Supplier Characteristic | Impact on ICZ | Supporting Data/Trend (2024) |

|---|---|---|

| Supplier Concentration | Increased leverage for dominant providers | AWS, Azure, Google Cloud held >60% of cloud market share |

| Switching Costs | Limits ICZ's flexibility, strengthens supplier position | Proprietary software integration can cost millions to migrate |

| Availability of Alternatives | Scarcity of comparable suppliers enhances power | Proprietary solutions often lack direct, cost-effective substitutes |

| Potential for Forward Integration | Suppliers may become direct competitors | Platformization trend sees IT giants offering end-to-end solutions |

What is included in the product

This analysis delves into the competitive forces impacting ICZ AS, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Quickly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces, enabling targeted strategy development.

Customers Bargaining Power

ICZ a.s. operates in sectors such as e-government, healthcare, and finance, which are characterized by a few large, influential customers. For instance, a significant portion of ICZ's revenue might be tied to contracts with national e-government platforms or major financial institutions.

This concentration means that a small number of clients can account for a substantial percentage of ICZ's total sales. In 2024, it's estimated that the top five clients could represent over 40% of the company's revenue, giving these entities considerable leverage in negotiations.

The ability of these key customer segments to switch providers or demand concessions due to the high revenue they generate directly amplifies their bargaining power over ICZ a.s.

Customer price sensitivity is a significant factor for ICZ AS, particularly within the public administration and healthcare sectors. These sectors often face stringent budget limitations and public oversight, directly translating into a strong demand for competitive pricing. For instance, in 2024, government IT spending in Europe saw a notable focus on cost-efficiency, with many public tenders prioritizing bids that offered the lowest price point for comparable services.

This heightened price sensitivity empowers customers in these segments to negotiate for favorable contract terms and robust service level agreements. Such demands can place considerable pressure on ICZ's profit margins, especially when undertaking long-term projects where initial pricing is locked in. The ability of these customers to leverage their budget constraints as a bargaining tool is a key aspect of their influence.

Customer switching costs are a significant factor influencing bargaining power. For ICZ, the highly customized nature of its IT solutions means clients invest heavily in integration and training, making a switch to a competitor a costly and complex undertaking. For instance, if a government agency uses ICZ's e-government platform, migrating citizen data and retraining staff could cost millions and disrupt essential services, thereby limiting their ability to demand lower prices or better terms.

Potential for Backward Integration by Customers

Large customers, particularly those with substantial IT resources or financial clout, might consider developing their IT systems internally. This move, termed backward integration, presents a significant bargaining chip. For instance, a major enterprise could theoretically reallocate a portion of its IT budget, which in 2024 might be in the tens or hundreds of millions of dollars depending on scale, to build proprietary solutions, thereby reducing reliance on external vendors like ICZ AS.

Even if backward integration is not fully realized due to its inherent costs and complexity, especially for highly specialized IT functions, the mere threat of it empowers customers. This credible alternative allows them to negotiate more aggressively on pricing and service terms with ICZ AS. The potential for a customer to insource IT services, even if only partially, directly impacts ICZ AS's pricing power and contract flexibility.

- Customer Threat of Backward Integration: Large clients may possess the capability to develop their IT systems in-house, reducing dependence on external providers.

- Cost and Complexity Barrier: While theoretically possible, building specialized IT solutions internally is often prohibitively expensive and complex for most customers.

- Negotiating Leverage: The mere possibility of backward integration grants customers significant leverage in price and service negotiations with IT service providers like ICZ AS.

- Market Dynamics in 2024: Increased cloud adoption and the availability of scalable IT infrastructure in 2024 make the prospect of insourcing IT more feasible for some large organizations than in previous years.

Information Asymmetry and Customer Expertise

ICZ's customer base in finance, healthcare, and government is characterized by a high degree of technical understanding. These clients are typically well-versed in market pricing, available alternatives, and industry standards. For instance, in the financial sector, institutional investors often conduct extensive due diligence, comparing various service providers on metrics like transaction costs and execution speed.

This elevated customer expertise significantly reduces information asymmetry, empowering clients to articulate precise demands and negotiate with greater leverage. Such informed customers necessitate that ICZ continuously showcases its unique value proposition and deep industry knowledge to win and maintain business. A 2024 survey indicated that over 70% of financial institutions prioritize demonstrable ROI and specialized expertise when selecting technology partners.

- Informed Demands: Customers can articulate specific technical requirements and performance benchmarks.

- Price Sensitivity: Well-informed customers are more likely to compare pricing across multiple vendors.

- Negotiating Power: Reduced information gaps give customers a stronger hand in contract discussions.

- Value Demonstration: ICZ must prove superior service and specialized knowledge to retain clients.

The bargaining power of customers for ICZ a.s. is substantial, primarily due to the concentrated nature of its client base in sectors like e-government, healthcare, and finance. A few large clients can represent a significant portion of revenue, giving them considerable leverage. For example, in 2024, it's estimated that the top five clients could account for over 40% of ICZ's revenue, amplifying their ability to negotiate favorable terms.

Customer price sensitivity is another key factor, especially in public administration and healthcare where budget constraints are paramount. In 2024, European IT spending in these sectors heavily favored cost-efficiency, with many public tenders prioritizing the lowest price for comparable services. This empowers customers to push for competitive pricing and robust service level agreements, potentially impacting ICZ's profit margins.

High switching costs for customized IT solutions can limit customer power, but the threat of backward integration, or developing solutions in-house, remains a potent bargaining tool. While complex, the feasibility of insourcing IT increased for some large organizations in 2024 due to cloud adoption. This potential alternative allows informed customers to negotiate more aggressively on pricing and service terms.

| Factor | Impact on ICZ a.s. | 2024 Data/Observation |

|---|---|---|

| Customer Concentration | High leverage for a few large clients | Top 5 clients potentially > 40% of revenue |

| Price Sensitivity | Pressure on profit margins | Public sector IT spending focused on cost-efficiency |

| Switching Costs | Barrier to switching, but not absolute | High integration and training costs for clients |

| Threat of Backward Integration | Negotiating leverage for clients | Increased feasibility for some large organizations due to cloud adoption |

| Customer Expertise | Informed negotiation, demand for value | Financial institutions prioritize demonstrable ROI and expertise |

Full Version Awaits

ICZ AS Porter's Five Forces Analysis

This preview showcases the complete ICZ AS Porter's Five Forces Analysis, providing a thorough examination of competitive forces within the industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring you get the full, ready-to-use analysis without any alterations or placeholders.

Rivalry Among Competitors

The IT services market in the Czech Republic and Central Europe is quite crowded, featuring a blend of local specialists, regional companies, and massive global IT giants like Accenture, IBM, Microsoft, and Capgemini. This wide array of competitors, from focused niche providers to companies offering comprehensive solutions, fuels intense competition across different market segments.

The Czech IT market is on a solid growth trajectory, with the services sector projected to be the main driver. Areas like e-government, healthcare IT, and cybersecurity are particularly poised for strong expansion. For instance, the Czech IT services market was valued at approximately CZK 70 billion in 2023 and is expected to grow at a CAGR of around 7% through 2028.

While robust industry growth typically tempers direct rivalry, it simultaneously acts as a magnet for new players and prompts existing companies to ramp up their investments. This dynamic ensures that the competition for market share remains intense, as companies vie to capture a larger piece of the expanding pie.

ICZ AS differentiates itself by offering comprehensive, tailored IT solutions and system integration specifically designed for niche sectors. This specialization provides a distinct advantage, moving beyond generic IT services.

However, the IT services landscape is highly competitive, with rivals also focusing on specialized offerings and adopting new technologies. For instance, in 2024, the global IT services market was valued at approximately $1.3 trillion, with significant growth in areas like AI and cloud computing, indicating intense competition to offer cutting-edge solutions.

To maintain its edge, ICZ AS must consistently innovate and highlight its proven expertise and successful project history. This focus on unique value propositions is crucial to prevent its services from becoming commoditized in a market where many players are leveraging similar emerging technologies.

High Fixed Costs and Exit Barriers

The IT solutions and system integration sector is characterized by substantial fixed costs. These include significant investments in research and development, securing highly skilled IT professionals, and maintaining sophisticated technological infrastructure. For instance, major system integration projects often require upfront capital for software licenses, hardware, and specialized engineering teams, creating a high cost of doing business.

High exit barriers further exacerbate competitive rivalry. Companies may be locked into long-term contracts with clients, or possess specialized assets that are difficult to sell or repurpose. This forces firms to continue operating and competing aggressively, even in challenging market conditions, to cover their fixed expenses and maintain their market standing. This can lead to price wars and reduced profitability across the industry.

- Significant R&D Investment: Companies in this space often allocate 10-15% of their revenue to R&D to stay competitive.

- Talent Acquisition Costs: The demand for specialized IT talent can drive up salaries by 20-30% year-over-year.

- Infrastructure Maintenance: Maintaining cloud services, data centers, and cybersecurity requires ongoing substantial expenditure.

- Contractual Commitments: Many system integration projects span multiple years, creating long-term financial obligations.

Technological Advancements and Innovation Pace

The competitive rivalry within the technology sector, where ICZ AS operates, is significantly driven by the relentless pace of technological advancements. Innovations in areas such as artificial intelligence, cloud computing, and robust cybersecurity solutions are constantly reshaping the market. This rapid evolution compels companies like ICZ AS to engage in a continuous race to develop and deploy cutting-edge offerings, directly intensifying competition.

ICZ AS faces the imperative of substantial and ongoing investment in research and development (R&D) alongside dedicated talent development initiatives. This is crucial to ensure its service portfolio remains not only relevant but also competitive. Rivals are equally aggressive in harnessing these transformative technologies to bolster their own service portfolios, creating a dynamic environment where staying ahead requires constant adaptation and innovation.

- AI Integration: Companies are increasingly embedding AI into their core services, with global AI market revenue projected to reach $200 billion in 2024, according to Statista.

- Cloud Adoption: The worldwide public cloud services market is expected to grow by 20.4% in 2024, reaching $678.8 billion, highlighting a key area for competitive differentiation.

- Cybersecurity Spending: Global cybersecurity spending is anticipated to exceed $200 billion in 2024, underscoring the critical nature of secure and advanced solutions.

The competitive landscape for ICZ AS is characterized by intense rivalry due to the presence of numerous global, regional, and local IT service providers. This high degree of competition is fueled by rapid technological advancements, particularly in AI and cloud computing, forcing companies to continuously innovate to maintain market share. High fixed costs associated with R&D and talent acquisition, coupled with significant exit barriers like long-term contracts, compel companies to compete aggressively, often leading to price pressures.

| Metric | 2023 Value (CZK Billion) | 2024 Projection (CZK Billion) | Key Driver |

|---|---|---|---|

| Czech IT Services Market Value | 70 | ~75 | E-government, Healthcare IT, Cybersecurity growth |

| Global IT Services Market Value | ~1,300 (USD Trillion) | ~1,400 (USD Trillion) | AI, Cloud, Cybersecurity adoption |

| AI Market Revenue (Global) | ~180 | 200 | Increased enterprise adoption |

SSubstitutes Threaten

Large organizations, especially in sectors like government, finance, and healthcare, increasingly possess the capacity to develop and manage their IT infrastructure internally. This in-house capability acts as a significant substitute for external IT service providers such as ICZ AS. For instance, many large financial institutions in 2024 are investing heavily in cybersecurity and data analytics platforms, aiming to reduce reliance on third-party vendors for critical operations.

While building and maintaining sophisticated IT systems internally can be more resource-intensive and complex, particularly for cutting-edge or niche solutions, it offers clients an alternative path. This is especially true for core business functions or when dealing with highly sensitive data, where complete control and customization are paramount. The trend in 2024 shows a growing comfort among these large entities to leverage their own IT departments for a wider range of services.

The rise of generic software and SaaS solutions presents a significant threat of substitution for ICZ AS. Many businesses can now access cost-effective, off-the-shelf platforms for common functions, bypassing the need for custom integration. For instance, the global SaaS market was projected to reach over $200 billion in 2024, demonstrating the widespread adoption of these alternatives.

This trend means clients might choose simpler, pre-built SaaS products instead of engaging ICZ for complex, tailored system integration. For example, a company needing a new CRM might opt for Salesforce or HubSpot rather than a custom-built solution integrated with their existing infrastructure, directly impacting demand for ICZ's core services.

Clients, especially those mindful of their budgets or prioritizing cost savings, might look towards large global outsourcing firms or offshore companies. These providers often present comparable IT services at a more attractive price point.

This international competition acts as a considerable substitute for ICZ's services within its domestic and regional markets. It puts pressure on ICZ's pricing strategies and highlights the need for ICZ to strongly communicate the value of its local knowledge, superior quality, and specialized expertise.

For instance, the global IT outsourcing market was projected to reach $400 billion in 2024, with a significant portion driven by cost-conscious clients seeking offshore solutions. This underscores the competitive landscape ICZ navigates.

Manual Processes or Legacy Systems

For clients hesitant to adopt new IT solutions, existing manual processes or legacy systems can serve as significant substitutes for ICZ's modernization services. This inertia, often fueled by cost anxieties or a perceived steep learning curve, can directly impact the demand for ICZ's offerings, particularly among less technologically inclined segments or those with highly specialized, niche operational needs.

The persistence of these older methods represents a tangible threat. Consider that in 2024, a significant portion of small and medium-sized businesses still rely on manual data entry and paper-based workflows for core operations. For instance, a survey by Tech.co indicated that as of early 2024, approximately 30% of SMBs reported using at least one entirely manual process for critical business functions like invoicing or customer relationship management.

- Manual Processes as Substitutes: Clients may opt to continue with existing manual workflows rather than investing in ICZ's integrated IT solutions.

- Legacy Systems as Substitutes: Outdated but functional legacy systems can deter adoption of new technologies, acting as a barrier to ICZ's market penetration.

- Cost and Complexity Concerns: Resistance often stems from perceived high implementation costs and the complexity of transitioning from familiar, albeit inefficient, systems.

- Market Limitation: This tendency limits the addressable market for ICZ, especially within segments prioritizing cost containment or resistant to technological change.

Disruptive Emerging Technologies and No-Code/Low-Code Platforms

The rise of disruptive technologies like advanced AI agents and automation tools presents a significant threat of substitution for traditional software development and system integration services. These innovations can diminish the necessity for bespoke solutions, impacting companies like ICZ AS. For instance, the global no-code/low-code development platform market was valued at approximately $11.5 billion in 2023 and is projected to reach over $45 billion by 2028, indicating a substantial shift towards self-service solutions.

These emerging technologies empower clients to build or modify applications with minimal or no traditional coding expertise. This reduces their dependence on external IT specialists, directly substituting the core offerings of many IT service providers. The increasing accessibility and capability of these platforms mean clients can achieve functionalities previously requiring custom development, thereby bypassing established service providers.

- Autonomous AI agents can automate complex tasks previously handled by integration specialists.

- Advanced automation tools streamline workflows, reducing the need for custom system connections.

- No-code/low-code platforms enable end-users to build applications, bypassing traditional development lifecycles.

- The no-code/low-code market is experiencing rapid growth, with projections indicating significant expansion in the coming years.

The threat of substitutes for ICZ AS is multifaceted, stemming from clients' increasing capacity for in-house IT development, the proliferation of generic SaaS solutions, and the availability of lower-cost outsourcing options. Additionally, the persistence of manual processes and legacy systems, coupled with the rise of no-code/low-code platforms and AI automation, presents significant competitive pressures by offering alternative ways for businesses to meet their IT needs without relying on specialized integration services.

| Threat of Substitute | Description | Impact on ICZ AS | Relevant 2024 Data/Trends |

|---|---|---|---|

| In-house IT Capabilities | Large organizations can develop and manage IT infrastructure internally, reducing reliance on external providers. | Decreased demand for ICZ's core integration and development services. | Financial institutions in 2024 are increasing cybersecurity and data analytics investments, aiming for greater internal control. |

| Generic SaaS Solutions | Off-the-shelf software and SaaS platforms offer cost-effective alternatives for common business functions. | Clients may opt for simpler, pre-built solutions instead of custom integrations. | The global SaaS market was projected to exceed $200 billion in 2024, indicating widespread adoption of these alternatives. |

| Cost-Competitive Outsourcing | Global outsourcing firms and offshore companies offer comparable IT services at lower price points. | Puts pressure on ICZ's pricing and necessitates highlighting value-added local expertise. | The global IT outsourcing market was projected to reach $400 billion in 2024, with cost-conscious clients driving significant demand for offshore solutions. |

| Manual Processes & Legacy Systems | Existing manual workflows or outdated systems can be perceived as sufficient, deterring new IT investments. | Limits market penetration, especially among cost-sensitive or technology-averse segments. | In early 2024, approximately 30% of SMBs reported using at least one entirely manual process for critical functions. |

| Emerging Technologies (No-code/Low-code, AI) | Tools enabling self-service application development and task automation reduce the need for custom IT solutions. | Diminishes the necessity for bespoke software development and system integration. | The no-code/low-code market was valued at approximately $11.5 billion in 2023 and is projected for substantial growth. |

Entrants Threaten

Entering the specialized IT solutions and system integration market, particularly for complex sectors such as e-government and healthcare, necessitates significant upfront capital. This includes substantial investment in acquiring highly skilled talent, building advanced technological infrastructure, and maintaining continuous research and development efforts. For instance, a recent analysis of the IT services market in 2024 indicated that companies entering this space often require initial seed funding upwards of $5 million to establish a competitive foothold, covering everything from software licenses to cybersecurity protocols.

These considerable financial barriers effectively deter many potential new entrants. Startups or smaller firms often lack the necessary funding to match the operational scale and innovation capacity of established players like ICZ. In 2023, the average R&D spending for leading IT integration firms reached 15% of their revenue, a figure that is challenging for newcomers to replicate without deep pockets.

Established players like ICZ AS leverage significant economies of scale in software development, project management, and customer service. This allows them to spread fixed costs over a larger output, leading to a lower cost per unit of service. For instance, in 2024, major cloud service providers, a comparable sector, saw operating expenses decrease by as much as 15% due to increased scale.

New entrants often struggle to match these cost efficiencies. They lack the accumulated experience that drives down per-unit costs on the experience curve, making it difficult to compete on price. Without the volume of operations that ICZ AS enjoys, new companies face higher initial overheads and a steeper climb to profitability, acting as a substantial barrier.

ICZ AS benefits from a robust brand reputation and deeply entrenched client relationships, cultivated since its founding in 1997. These strong ties are particularly evident in sensitive sectors like public administration, healthcare, and finance, where trust and reliability are paramount.

New competitors entering the market must overcome the considerable hurdle of establishing credibility and a demonstrable track record. Securing contracts with large, risk-averse organizations requires significant time and effort to build the necessary trust, making it a substantial barrier to entry for potential new entrants.

Regulatory and Compliance Hurdles

The IT solutions ICZ AS offers to sectors like e-government, healthcare, and finance face significant regulatory and compliance hurdles. These include stringent data privacy laws, such as GDPR, and sector-specific compliance standards. For instance, in 2024, the healthcare IT sector saw increased scrutiny on patient data security, with fines for non-compliance reaching millions of euros for some organizations.

New entrants must invest substantial resources in understanding and adhering to these complex legal frameworks. This includes obtaining specialized certifications and building robust compliance infrastructure. The cost of achieving and maintaining these standards can be a major deterrent, requiring specialized legal and technical expertise that emerging companies may lack. In 2024, the average cost for a new fintech company to achieve PCI DSS compliance was estimated to be upwards of $50,000, not including ongoing audit fees.

- High Compliance Costs: Significant investment is needed for certifications and legal adherence.

- Specialized Knowledge Required: Navigating complex regulatory landscapes demands expert legal and technical teams.

- Data Privacy Laws: Strict regulations like GDPR and HIPAA create substantial barriers for new entrants.

- Sector-Specific Standards: Industries like finance and healthcare have unique, demanding compliance requirements.

Access to Specialized Talent and Distribution Channels

The threat of new entrants is amplified by the scarcity of specialized talent. For instance, in 2024, the global cybersecurity talent gap was estimated to be around 3.4 million professionals, making it difficult for newcomers to build robust teams capable of competing with established players who already possess these critical skills.

Accessing established distribution channels presents another significant hurdle. New companies often struggle to secure partnerships with major IT service providers or gain traction with large enterprise clients who prefer vendors with a proven track record and existing relationships, limiting their ability to scale quickly.

- Talent Scarcity: The global IT talent shortage, particularly in cybersecurity, hinders new entrants' ability to form competitive teams.

- Distribution Barriers: Gaining access to established distribution networks and securing initial contracts with large clients is a major challenge.

- Network Effects: Incumbents benefit from existing client relationships and proven delivery capabilities, creating a barrier to entry.

The threat of new entrants in the specialized IT solutions and system integration market, particularly for sectors like e-government and healthcare, is significantly mitigated by high capital requirements, robust regulatory compliance, and strong brand loyalty enjoyed by incumbents like ICZ AS. These factors create substantial barriers, making it difficult and costly for new players to establish a competitive presence.

| Barrier Type | Description | Example Data (2024) |

|---|---|---|

| Capital Requirements | High upfront investment in talent, infrastructure, and R&D. | New IT service entrants often need over $5 million in seed funding. |

| Regulatory Compliance | Adherence to strict data privacy (e.g., GDPR) and sector-specific standards. | Healthcare IT compliance costs can exceed $50,000 for new entrants. |

| Brand Reputation & Client Relationships | Established trust and long-term contracts in sensitive sectors. | Incumbents benefit from deep-rooted relationships, making it hard for new firms to secure initial large clients. |

| Economies of Scale | Cost efficiencies derived from large-scale operations. | Established IT firms can achieve operating cost reductions of up to 15% due to scale. |

Porter's Five Forces Analysis Data Sources

Our ICZ AS Porter's Five Forces analysis is built upon a robust foundation of data, drawing from official company filings, industry-specific market research reports, and reputable financial news outlets. This comprehensive approach ensures we capture accurate insights into competitive rivalry, supplier and buyer power, and the threat of new entrants and substitutes.