ICICI Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICICI Bank Bundle

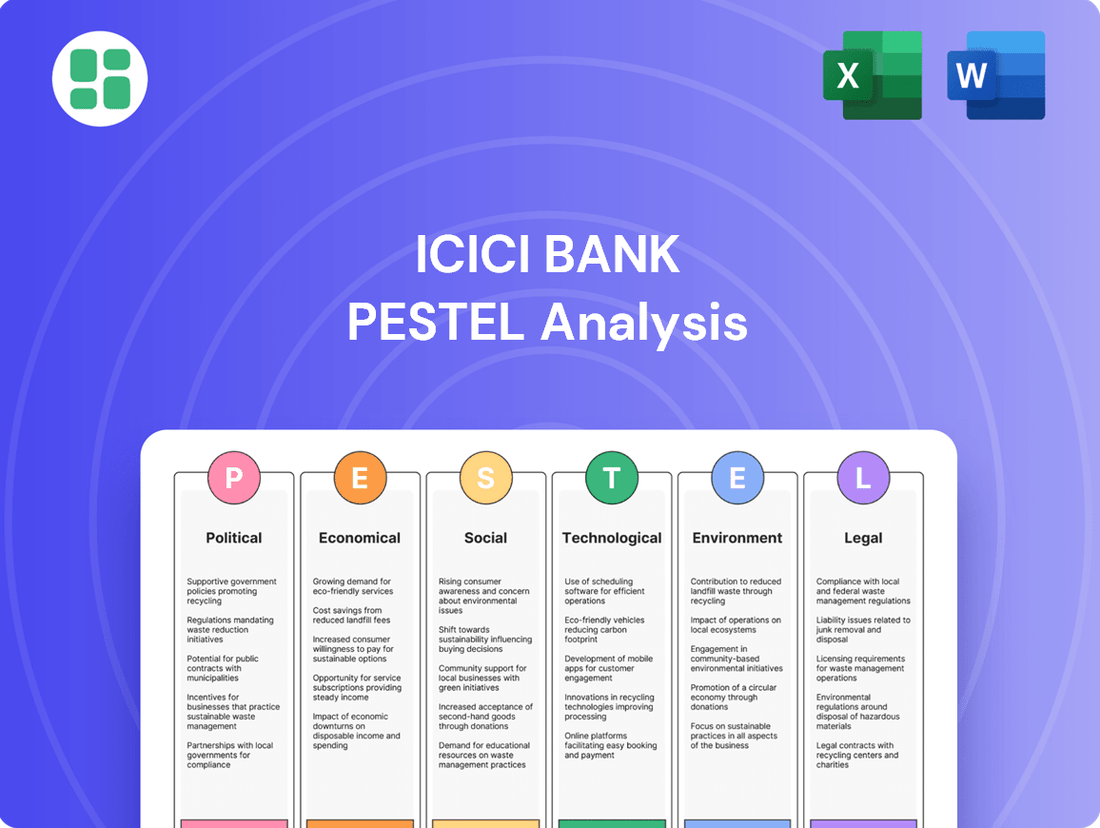

Unlock the strategic landscape of ICICI Bank with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, social shifts, technological advancements, environmental regulations, and legal frameworks are shaping its future. This detailed report offers actionable insights to inform your investment and business strategies. Download the full PESTLE analysis now to gain a competitive edge.

Political factors

Government policies, like the 'Digital India' initiative, significantly shape ICICI Bank's operational landscape. The Reserve Bank of India (RBI) sets a stringent regulatory framework that influences everything from capital adequacy ratios to lending practices. For instance, the RBI's recent directives on digital lending and cybersecurity, effective from late 2023 and continuing into 2024, necessitate robust compliance measures and technological investments for banks like ICICI.

The government's focus on financial inclusion and digital payments directly impacts ICICI Bank's growth strategies and market penetration. By encouraging the adoption of digital channels, policies aim to expand banking services to underserved populations. This aligns with ICICI Bank's own digital transformation efforts, as evidenced by its significant investments in mobile banking platforms and fintech partnerships throughout 2024, aiming to capture a larger share of the growing digital transaction market.

The Reserve Bank of India's (RBI) stringent regulatory framework significantly shapes ICICI Bank's operational landscape. Adherence to evolving capital adequacy ratios, such as Basel III norms, and strict oversight on lending practices and corporate governance are paramount. For instance, in the fiscal year 2024, Indian banks, including ICICI Bank, were focused on maintaining robust capital buffers amidst global economic uncertainties, with the banking sector's overall Capital to Risk-Weighted Assets Ratio (CRAR) remaining healthy.

Political stability in India remains a crucial factor for ICICI Bank. The government's commitment to economic reforms and stable governance directly influences investor confidence and the overall business environment. For instance, the upcoming general elections in 2024 will be closely watched for their potential impact on policy continuity and economic direction.

Geopolitical risks, such as global trade tensions or regional conflicts, also present challenges. These events can affect international capital flows and currency exchange rates, indirectly impacting the banking sector's profitability and risk exposure. For example, disruptions in global supply chains stemming from geopolitical events could slow down economic growth, affecting loan demand and asset quality for banks like ICICI.

Financial Inclusion Initiatives

Government-led financial inclusion initiatives, like India's Pradhan Mantri Jan Dhan Yojana (PMJDY), present significant opportunities and obligations for banks such as ICICI Bank. These programs are designed to bring banking services to previously unbanked populations, driving demand for accessible financial products.

These initiatives encourage banks to innovate and expand their reach, particularly into rural and semi-urban areas, fostering broader economic participation. For instance, as of August 2023, the PMJDY had facilitated the opening of over 51 crore (510 million) bank accounts, highlighting the scale of government efforts to deepen financial inclusion.

- Expanded Customer Base: Government schemes create a larger pool of potential customers for banks, especially in underserved regions.

- Product Development: Banks are incentivized to create simplified and low-cost banking products to cater to new segments.

- Rural Reach: These initiatives necessitate and support the expansion of banking infrastructure and services into remote areas.

- Regulatory Compliance: Banks must align their strategies with government mandates to support financial inclusion goals.

Changes in Banking Laws and Acts

Amendments to banking laws, such as potential updates to the Banking Regulation Act, directly impact ICICI Bank's operational framework. These changes can introduce new capital adequacy requirements or alter rules for non-performing assets, influencing how the bank manages its financial health.

Recent regulatory shifts, like those seen in the Reserve Bank of India's (RBI) pronouncements on digital lending or cybersecurity norms, necessitate adjustments in ICICI Bank's compliance and technology investments. For instance, the RBI's focus on strengthening governance in shadow banking entities might indirectly affect ICICI Bank's partnerships or its approach to certain financial products.

- Banking Laws Amendment: Ongoing discussions around potential amendments to the Banking Regulation Act, 1949, could introduce stricter provisioning norms or changes in corporate governance for banks like ICICI.

- Digital Lending Regulations: The RBI's guidelines on digital lending, effective from 2022 and subject to ongoing review, require ICICI Bank to ensure fair practices and data privacy in its digital offerings.

- Cybersecurity Mandates: Increased regulatory emphasis on cybersecurity, with potential for enhanced reporting requirements and stricter data protection measures, directly impacts ICICI Bank's IT infrastructure and risk management protocols.

Government policies, particularly those promoting financial inclusion and digital transformation, directly influence ICICI Bank's strategic direction and operational expansion. The Reserve Bank of India (RBI) plays a pivotal role by setting stringent regulatory frameworks covering capital adequacy, lending practices, and cybersecurity, necessitating continuous adaptation by banks like ICICI. For example, the RBI's ongoing focus on strengthening governance in digital lending platforms, as reinforced through guidelines applicable in 2024, requires ICICI Bank to maintain robust compliance and invest in secure technological infrastructure.

Political stability and economic reforms are crucial for fostering investor confidence and creating a conducive business environment for ICICI Bank. The government's stance on economic liberalization and its commitment to stable governance directly impact the bank's risk assessment and growth prospects. The outcomes of the 2024 general elections, for instance, will be closely monitored for their implications on policy continuity and the overall economic trajectory.

Geopolitical shifts and global economic uncertainties can indirectly affect ICICI Bank through impacts on capital flows and currency exchange rates. Disruptions in international trade or regional conflicts can slow economic growth, potentially influencing loan demand and asset quality for the bank. For example, persistent global supply chain issues in 2024 continue to pose a risk to economic stability.

Government-led financial inclusion programs, such as the Pradhan Mantri Jan Dhan Yojana (PMJDY), create both opportunities and obligations for ICICI Bank. These initiatives aim to expand banking access to unbanked populations, driving demand for simplified financial products and encouraging the development of rural banking infrastructure. As of August 2023, the PMJDY had successfully opened over 51 crore (510 million) accounts, underscoring the significant scale of these government efforts.

What is included in the product

This PESTLE analysis of ICICI Bank examines the impact of political, economic, social, technological, environmental, and legal factors on its operations and strategy.

It provides a comprehensive understanding of the external forces shaping the banking sector in India, enabling strategic decision-making.

A concise PESTLE analysis for ICICI Bank offers a clear, summarized view of external factors, simplifying strategic discussions and alleviating the pain of information overload during planning sessions.

Economic factors

India's projected GDP growth for the fiscal year 2024-25, estimated to be around 6.5% to 7.0%, significantly fuels demand for banking services. This robust economic expansion translates into increased credit needs for both individuals and businesses, directly benefiting institutions like ICICI Bank by expanding their loan portfolios.

A healthy GDP growth environment fosters greater consumer spending and corporate investment, creating a fertile ground for banks to grow their assets and improve profitability. For ICICI Bank, this means a higher likelihood of loan origination and a reduced risk of non-performing assets, solidifying its financial standing.

The Reserve Bank of India's (RBI) monetary policy, particularly its stance on the repo rate and Cash Reserve Ratio (CRR), significantly shapes ICICI Bank's financial performance. For instance, the repo rate, which stood at 6.50% as of early 2024, directly influences the bank's cost of borrowing and lending rates, impacting net interest margins (NIMs).

Higher inflation, a persistent concern in 2024, often prompts the RBI to maintain or increase interest rates to curb price rises. This can lead to higher funding costs for ICICI Bank and potentially reduce credit demand from consumers and businesses due to increased borrowing expenses.

Conversely, a stable or declining interest rate environment, coupled with controlled inflation, would likely benefit ICICI Bank by lowering its cost of funds and potentially stimulating loan growth, thereby boosting profitability.

The demand for credit across retail, corporate, and MSME segments remains robust, fueled by economic expansion and government initiatives. For instance, India's retail credit growth was estimated to be around 15-17% in FY24, showcasing strong consumer spending and borrowing appetite.

Concurrently, the banking sector's asset quality shows a positive trend, with Gross Non-Performing Asset (GNPA) ratios for Scheduled Commercial Banks (SCBs) declining to a multi-year low of approximately 3.2% by September 2023, according to Reserve Bank of India data.

This combination of sustained credit growth and improving asset quality indicates a healthy and profitable banking environment, directly benefiting institutions like ICICI Bank by reducing provisioning needs and enhancing lending capacity.

Disposable Income and Consumer Spending

Changes in disposable income and consumer spending are crucial for retail banking. When individuals have more money left after taxes and essential expenses, they tend to spend more, which directly impacts the demand for products like personal loans, mortgages, and credit cards offered by banks like ICICI. This increased spending fuels financial transactions and investment activity, creating more business opportunities for the banking sector.

In India, disposable income has seen a steady rise. For instance, projections indicated that India's per capita disposable income could reach approximately $3,000 by 2025, a significant increase from earlier years. This trend is expected to continue, driving higher consumer spending across various categories, from durables to services.

The impact on banks is substantial:

- Increased Demand for Credit: Higher disposable incomes often lead to greater consumer confidence and a willingness to take on loans for major purchases like homes and vehicles.

- Growth in Retail Banking Products: Banks like ICICI can expect a surge in demand for personal loans, credit cards, and wealth management services as consumers have more discretionary funds.

- Higher Transaction Volumes: More spending means more transactions, benefiting banks through fees and interest income generated from these activities.

- Investment Activity: As disposable income grows, so does the potential for investment in mutual funds, stocks, and other financial instruments, which banks facilitate.

Foreign Investment and Capital Flows

Foreign institutional investments (FII) and other capital movements significantly shape the liquidity and stability of India's financial markets. In 2023, FIIs were net buyers in Indian equities, investing approximately $20.7 billion, a notable rebound from previous outflows.

While the Indian financial services sector has demonstrated a capacity to absorb FII outflows, substantial shifts in global capital can still affect exchange rates and overall market sentiment. This, in turn, impacts a bank like ICICI Bank's treasury operations and its international business dealings.

- FII Equity Inflows (2023): Approximately $20.7 billion.

- Impact on Banks: Influences treasury yields and foreign exchange exposure.

- Market Sentiment: Significant capital shifts can lead to volatility, affecting investor confidence.

- Exchange Rate Fluctuations: Capital flows directly impact the INR's value against major currencies.

India's economic trajectory remains a primary driver for ICICI Bank's performance, with projected GDP growth around 6.5% to 7.0% for FY2024-25. This expansion fuels demand for credit across retail and corporate sectors, directly benefiting the bank's loan portfolios and asset growth.

The Reserve Bank of India's monetary policy, including the repo rate which stood at 6.50% in early 2024, significantly influences ICICI Bank's net interest margins by affecting borrowing and lending costs. Inflationary pressures in 2024 may lead to higher rates, increasing funding costs and potentially dampening credit demand.

Rising disposable incomes, with per capita disposable income projected to reach around $3,000 by 2025, boost consumer spending and demand for retail banking products like loans and credit cards. This also drives higher transaction volumes and investment activity, benefiting banks through fees and interest income.

Foreign institutional investment plays a crucial role in market liquidity; FIIs invested approximately $20.7 billion in Indian equities in 2023. While the sector can absorb outflows, significant capital shifts can impact treasury operations and exchange rates for ICICI Bank.

| Economic Factor | 2024/2025 Projection/Data | Impact on ICICI Bank |

|---|---|---|

| GDP Growth | 6.5% - 7.0% (FY2024-25) | Increased credit demand, asset growth, improved profitability. |

| Repo Rate | 6.50% (Early 2024) | Influences cost of funds and lending rates, impacting Net Interest Margins. |

| Inflation | Persistent concern in 2024 | May lead to higher interest rates, increasing funding costs and potentially reducing credit demand. |

| Per Capita Disposable Income | Projected ~$3,000 by 2025 | Drives consumer spending, demand for retail products, and transaction volumes. |

| FII Equity Inflows | ~$20.7 billion (2023) | Impacts market liquidity, treasury operations, and exchange rates. |

Same Document Delivered

ICICI Bank PESTLE Analysis

The preview shown here is the exact ICICI Bank PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting ICICI Bank, providing valuable strategic insights.

Sociological factors

India's Financial Inclusion Index reached 60.1 in March 2024, showing significant progress in bringing more people into the formal financial system. Initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY) have been pivotal, enrolling over 50 crore beneficiaries by early 2024.

This expansion means banks like ICICI must now serve a broader demographic, including individuals with lower financial literacy. Consequently, there's a growing need for simplified banking products and robust financial education programs to ensure these new customers can effectively manage their finances.

Consumers are increasingly prioritizing digital channels for their banking needs. By the end of 2024, it's estimated that over 70% of banking transactions in India will be conducted digitally, a significant jump from previous years.

This shift is fueled by a growing demand for convenience and personalized experiences. Customers now expect instant access to services, tailored product offerings, and proactive communication, pushing institutions like ICICI Bank to invest heavily in mobile banking and AI-driven customer support.

India's rapid urbanization, with over 35% of its population now residing in cities as of 2023, significantly impacts banking needs. This shift creates a concentrated demand for sophisticated financial products and services, from mortgages to wealth management, tailored for urban lifestyles.

Demographic shifts, particularly a large youth population—with over 50% of India's population under 25 in 2024—are driving demand for digital banking solutions. ICICI Bank must innovate to meet the expectations of this digitally-native demographic, offering seamless mobile banking, online account opening, and instant credit facilities to capture this crucial segment.

Social Attitudes Towards Debt and Savings

Societal attitudes towards borrowing and saving money significantly influence ICICI Bank's loan and deposit portfolios. In India, a cultural emphasis on saving for the future often coexists with a growing acceptance of credit for lifestyle upgrades and essential purchases.

During periods of economic uncertainty, such as the lingering effects of global inflation and potential slowdowns projected for late 2024 and into 2025, consumer behavior often shifts. This can manifest as increased caution in taking on new debt, leading to a potential slowdown in loan growth. Conversely, a desire for financial security might boost savings rates, providing banks like ICICI with a larger deposit base.

Recent trends indicate a nuanced picture:

- Increased Financial Literacy: Growing awareness about financial planning, particularly among younger demographics, is encouraging more disciplined saving habits.

- Digital Adoption: The rise of user-friendly digital banking platforms and fintech solutions is making saving and borrowing more accessible, potentially impacting customer engagement with traditional banking products.

- Credit for Consumption: Despite economic headwinds, consumer credit, especially for durable goods and personal needs, continues to be a significant driver of loan demand, though potentially with a greater focus on manageable EMIs.

- Savings Growth: As of early 2025, reports suggest a steady increase in household financial savings in India, driven by a desire for stability amidst global economic uncertainties.

Corporate Social Responsibility (CSR) Engagement

ICICI Bank's Corporate Social Responsibility (CSR) engagement is increasingly crucial as societal expectations for positive contributions to development grow. This involves actively participating in philanthropic initiatives, fostering social empowerment, and integrating business operations with overarching social objectives. Such efforts are vital for bolstering brand image and cultivating stakeholder confidence.

In fiscal year 2023-24, ICICI Bank reported significant CSR spending, with a substantial portion allocated to rural development and skill enhancement programs. For instance, their initiatives focused on improving livelihoods in underserved communities, exemplified by programs that provided vocational training to over 50,000 individuals, directly contributing to social empowerment and economic upliftment. This commitment reflects a strategic alignment with national development goals.

- Philanthropic Activities: ICICI Foundation for Inclusive Growth, the bank's CSR arm, has been instrumental in driving various community development projects across India.

- Social Empowerment: Focus areas include financial literacy campaigns, supporting women's self-help groups, and promoting digital inclusion for marginalized populations.

- Brand Reputation: Strong CSR performance in 2023 enhanced ICICI Bank's standing, with positive mentions in sustainability reports and stakeholder surveys highlighting their commitment.

- Stakeholder Trust: By demonstrating tangible social impact, the bank aims to deepen trust with customers, employees, and the broader community, fostering long-term relationships.

Societal attitudes towards borrowing and saving are evolving, with a growing emphasis on financial literacy and digital accessibility. As of early 2025, household financial savings in India are showing a steady increase, driven by a desire for stability amid global economic uncertainties. This trend, coupled with a continued demand for consumer credit, presents a dynamic landscape for ICICI Bank.

The bank's commitment to Corporate Social Responsibility (CSR) is also gaining prominence, with significant investments in rural development and skill enhancement programs. In fiscal year 2023-24, ICICI Bank's CSR spending supported initiatives like vocational training for over 50,000 individuals, directly contributing to social empowerment and bolstering brand reputation.

| Sociological Factor | Description | Impact on ICICI Bank | Relevant Data (2023-2025) |

|---|---|---|---|

| Financial Literacy & Savings Behavior | Increasing awareness and disciplined saving habits, especially among youth. | Potential for higher deposit growth and demand for wealth management products. | Household financial savings increasing (early 2025); Over 50% of India's population under 25 (2024). |

| Digital Adoption & Consumer Expectations | Preference for digital channels, convenience, and personalized experiences. | Need for continuous investment in mobile banking, AI, and user-friendly platforms. | Over 70% of banking transactions digital by end of 2024; Growing demand for seamless mobile banking. |

| Corporate Social Responsibility (CSR) | Societal expectations for positive social and environmental contributions. | Enhances brand image, stakeholder trust, and competitive advantage. | CSR spending in FY 2023-24 supported vocational training for 50,000+ individuals; Focus on financial literacy and digital inclusion. |

Technological factors

Digital transformation is reshaping banking, with ICICI Bank heavily investing in technologies like AI and big data to improve customer experiences and operational efficiency. By mid-2024, Indian banks, including ICICI, were channeling substantial resources into cloud migration and cybersecurity to support these digital initiatives. This focus on innovation is crucial for staying competitive in a rapidly evolving financial landscape.

The rapid expansion of digital payment systems, particularly the Unified Payments Interface (UPI), is a significant technological driver. As of February 2024, UPI transactions in India surpassed 18 billion in volume for the fiscal year, demonstrating its immense reach and user adoption. This growth necessitates that banks like ICICI Bank continue to enhance their integration with such platforms, offering seamless and secure transaction experiences to maintain competitiveness and customer loyalty.

As ICICI Bank, like all financial institutions, embraces greater digitalization, the threat landscape for cyberattacks and data breaches intensifies. This necessitates ongoing, significant investment in advanced cybersecurity infrastructure and sophisticated fraud detection systems to safeguard sensitive customer information and preserve confidence in digital banking platforms.

In 2023, the global average cost of a data breach reached $4.45 million, a figure that underscores the financial imperative for robust security. For ICICI Bank, this translates to a continuous need to upgrade its defenses, ensuring compliance with evolving data privacy regulations and protecting its reputation.

Mobile Banking and Online Platforms

Mobile banking and robust online platforms are now the main ways customers engage with banks and conduct transactions. ICICI Bank, like its peers, must ensure these digital channels are intuitive, highly secure, and packed with features to meet changing consumer expectations. As of early 2024, a significant portion of ICICI Bank's customer base actively uses its mobile app and internet banking for daily financial activities, reflecting a strong shift towards digital engagement.

The continuous evolution of these technological factors necessitates ongoing investment in platform development and cybersecurity. ICICI Bank's strategy includes enhancing its digital offerings with features like AI-powered customer service and advanced analytics, aiming to provide a seamless and personalized banking experience. This focus on digital innovation is crucial for retaining and attracting customers in a competitive landscape.

- Digital Transactions Growth: ICICI Bank has reported a substantial increase in digital transactions, with mobile banking accounting for a major share of retail banking activities.

- Platform Enhancements: The bank consistently updates its mobile app and online portal, introducing new functionalities and improving user interface based on customer feedback and market trends.

- Security Investments: Significant resources are allocated to bolstering the security of digital platforms, employing multi-factor authentication and advanced fraud detection systems to protect customer data.

- Customer Adoption: Data from 2024 indicates a high adoption rate for ICICI Bank's digital services, with a growing percentage of new customer acquisitions occurring through online channels.

Adoption of Fintech and AI for Efficiency

ICICI Bank is heavily investing in fintech and AI to boost its operations. For instance, their AI-powered chatbot, 'iPal', handles a significant volume of customer queries, freeing up human agents for more complex tasks. This focus on digital tools like biometric authentication and digital lending platforms is key to streamlining processes and cutting costs.

The bank's adoption of these technologies directly translates to improved customer experience through personalized services and faster transaction times. By automating routine tasks, ICICI Bank can allocate resources more effectively, leading to greater overall efficiency and a competitive edge in the digital banking landscape.

Key technological advancements driving efficiency include:

- AI-powered chatbots for customer service: Reducing query resolution time and operational load.

- Biometric authentication: Enhancing security and speeding up customer identification.

- Digital lending platforms: Automating loan origination and processing for faster approvals.

- Data analytics for personalization: Offering tailored financial products and services based on customer behavior.

Technological advancements are fundamentally altering how ICICI Bank operates and interacts with its customers. The bank's strategic embrace of AI and big data is geared towards creating more personalized customer journeys and optimizing internal processes. By mid-2024, the Indian banking sector, including ICICI Bank, was significantly increasing its investments in cloud infrastructure and robust cybersecurity measures to bolster these digital transformation efforts and maintain a competitive edge.

The proliferation of digital payment systems, notably UPI, is a major technological force. By February 2024, UPI transactions in India had already exceeded 18 billion for the fiscal year, highlighting its widespread adoption. This growth underscores the necessity for ICICI Bank to continually enhance its integration with such platforms, ensuring seamless and secure transactions to retain customer loyalty.

ICICI Bank's commitment to digital innovation is evident in its AI-powered customer service, with chatbots handling a substantial volume of inquiries. Furthermore, the bank is leveraging data analytics to offer personalized financial products, a strategy that aligns with the increasing customer expectation for tailored services. These technological integrations are crucial for streamlining operations and enhancing overall efficiency.

| Technology Area | ICICI Bank Focus | Impact | 2024 Data/Trend |

|---|---|---|---|

| Artificial Intelligence | Customer service chatbots, personalized recommendations | Improved customer experience, operational efficiency | High adoption of AI in customer query resolution |

| Digital Payments | UPI integration, mobile banking | Seamless transactions, increased customer engagement | UPI transactions exceeding 18 billion (FY 2023-24) |

| Cybersecurity | Advanced threat detection, data protection | Safeguarding customer data, maintaining trust | Increased investment in security infrastructure |

| Cloud Computing | Migration of services, scalability | Enhanced agility, cost optimization | Significant resource allocation to cloud migration |

Legal factors

The Reserve Bank of India (RBI) mandates a robust regulatory framework for banks, including capital adequacy ratios like the Basel III norms. As of March 2024, ICICI Bank maintained a Capital Adequacy Ratio (CAR) of 18.37%, well above the regulatory minimums, demonstrating its strong financial footing.

These prudential norms, covering asset classification, provisioning, and risk management, are crucial for ICICI Bank's stability. For instance, the Net Non-Performing Assets (NPA) ratio stood at a healthy 0.47% as of March 2024, reflecting effective credit risk management and adherence to RBI's asset quality guidelines.

ICICI Bank, like all financial institutions, operates under stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules mandate rigorous customer identification, continuous transaction monitoring, and prompt reporting of any suspicious activities to authorities. Failure to comply can result in substantial financial penalties and severe damage to the bank's reputation.

In 2023, Indian banks collectively reported over 3.7 lakh suspicious transaction reports (STRs) to the Financial Intelligence Unit-India (FIU-IND), highlighting the scale of AML efforts. For ICICI Bank, maintaining robust compliance frameworks is not just a legal necessity but a critical component of maintaining trust and operational integrity in the financial ecosystem.

Consumer protection laws in India are robust, mandating transparency in financial dealings and fair lending practices. For ICICI Bank, this means clear communication on product terms, interest rates, and fees, crucial for building customer trust and preventing disputes. The Reserve Bank of India (RBI) plays a significant role in enforcing these regulations.

The Banking Ombudsman Scheme provides a vital grievance redressal mechanism for bank customers. In the financial year 2022-23, the Banking Ombudsman offices received over 3.7 lakh complaints, highlighting the importance of efficient dispute resolution for banks like ICICI. Compliance ensures customer satisfaction and mitigates potential legal liabilities.

Data Protection and Privacy Regulations

The evolving landscape of data protection and privacy laws, like India's Digital Personal Data Protection Act (DPDP Act) of 2023, directly impacts how financial institutions like ICICI Bank collect, store, and process customer data. Compliance is paramount for safeguarding sensitive information and avoiding significant legal penalties. For instance, the DPDP Act mandates clear consent for data processing and outlines penalties for non-compliance, potentially reaching substantial fines for breaches.

ICICI Bank must navigate these regulations to maintain customer trust and operational integrity. The increasing focus on data privacy means robust security measures and transparent data handling practices are no longer optional but essential for business continuity and reputation management. Failure to adhere to these evolving legal frameworks could lead to reputational damage and financial liabilities, impacting the bank's market standing.

- DPDP Act 2023: Mandates consent-based data processing and imposes penalties for non-compliance.

- Customer Trust: Adherence to data protection laws is crucial for maintaining customer confidence.

- Legal Repercussions: Non-compliance can result in substantial fines and legal challenges.

- Operational Integrity: Robust data security is vital for the bank's day-to-day functioning.

Guidelines on Green Finance and Climate Risk Disclosure

Emerging legal and regulatory guidelines are significantly shaping green finance and climate risk disclosure for banks. These frameworks are pushing institutions to embed environmental factors into their core lending operations and to transparently report their exposure to climate-related financial risks. For instance, by the end of 2024, many global financial regulators are expected to finalize or implement enhanced climate risk disclosure requirements, building on frameworks like the Task Force on Climate-related Financial Disclosures (TCFD). This directly influences how banks, including ICICI Bank, develop and execute their sustainable finance strategies, aiming to align with a low-carbon economy.

Banks are increasingly expected to integrate environmental, social, and governance (ESG) considerations into their credit assessment and portfolio management processes. This involves identifying and quantifying the financial implications of climate change, such as physical risks (e.g., extreme weather events impacting collateral) and transition risks (e.g., policy changes affecting carbon-intensive industries). For example, a 2024 report by S&P Global indicated that a growing number of banks are incorporating climate scenarios into their stress testing, a direct response to regulatory pressure and the need for robust risk management.

- Regulatory Scrutiny: Financial authorities worldwide are intensifying their focus on climate risk management and disclosure, with new regulations expected to be implemented or refined throughout 2024 and 2025.

- ESG Integration: There's a growing mandate for banks to embed ESG factors, particularly climate considerations, into lending practices, risk assessment, and strategic planning.

- Disclosure Standards: Banks are increasingly required to adhere to standardized frameworks for disclosing their climate-related financial exposures and transition plans.

- Sustainable Finance Growth: These legal and regulatory shifts are driving the expansion of green finance products and services as banks adapt to meet evolving compliance and market demands.

The legal framework for financial institutions in India is dynamic, with significant implications for ICICI Bank. Adherence to regulations set by the Reserve Bank of India (RBI) regarding capital adequacy, asset quality, and risk management remains paramount. For instance, ICICI Bank's reported Capital Adequacy Ratio (CAR) of 18.37% as of March 2024 demonstrates compliance with Basel III norms, ensuring financial resilience.

Furthermore, stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations necessitate robust compliance mechanisms to prevent illicit financial activities. India's commitment to consumer protection, evident in the Banking Ombudsman Scheme, also requires ICICI Bank to maintain transparency and fair practices, with over 3.7 lakh complaints handled nationally in FY 2022-23 underscoring the importance of effective grievance redressal.

The recent enactment of the Digital Personal Data Protection Act (DPDP Act) in 2023 introduces new mandates for data privacy and security, requiring ICICI Bank to implement stringent consent-based data processing and robust cybersecurity measures to avoid penalties. The evolving landscape of green finance and climate risk disclosure also presents legal challenges and opportunities, pushing banks like ICICI to integrate ESG factors into their operations and reporting by 2024-2025.

| Regulation/Area | Key Requirement | ICICI Bank Compliance Example (as of latest available data) | Impact/Consideration |

|---|---|---|---|

| Capital Adequacy (Basel III) | Maintain minimum CAR | CAR of 18.37% (March 2024) | Ensures financial stability and ability to absorb losses. |

| Asset Quality (RBI Norms) | Manage NPAs, adhere to provisioning | Net NPA ratio of 0.47% (March 2024) | Reflects effective credit risk management. |

| AML/KYC | Customer identification, transaction monitoring | Ongoing rigorous compliance, reporting suspicious transactions | Mitigates financial crime risk and reputational damage. |

| Data Protection (DPDP Act 2023) | Consent-based data processing, data security | Implementing enhanced data handling protocols | Crucial for customer trust and avoiding legal penalties. |

| Climate Risk Disclosure | Reporting climate-related financial risks | Increasing integration of ESG into risk assessment and reporting | Adapting to growing regulatory expectations for sustainable finance. |

Environmental factors

Climate change is increasingly a tangible threat to ICICI Bank's operations and investments. The growing frequency and severity of extreme weather events, such as floods and heatwaves, can directly impact physical assets and disrupt business continuity. For instance, a study by the Reserve Bank of India in 2023 highlighted that climate-related disasters cost India an estimated $13 billion in 2022 alone, a figure that could rise significantly.

These physical risks translate into financial risks for banks like ICICI. Loan portfolios exposed to sectors heavily reliant on stable weather patterns, like agriculture or real estate in vulnerable areas, face higher default probabilities. Asset valuations, particularly for properties in flood-prone regions, could also be negatively affected, impacting collateral values and the bank's balance sheet strength. Ensuring resilience against these climate-induced disruptions is therefore critical for ICICI Bank's long-term stability and profitability.

Policies pushing for a low-carbon economy, like carbon taxes and renewable energy goals, pose transition risks for banks. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully in effect from 2026, will impact trade and potentially the carbon footprint of companies ICICI Bank lends to, requiring careful assessment.

Lending to industries with high emissions, such as coal or oil, could see increased scrutiny. As these sectors adapt to stricter environmental regulations, the risk of non-performing assets may rise. For example, in 2024, global fossil fuel subsidies still amounted to trillions, highlighting the ongoing economic reliance that decarbonization policies aim to shift.

The growing emphasis on Environmental, Social, and Governance (ESG) factors significantly shapes investor sentiment, corporate reputation, and access to capital for institutions like ICICI Bank. As of early 2025, global sustainable investment assets are projected to exceed $50 trillion, highlighting the market's strong preference for ESG-aligned companies.

Banks are increasingly expected to weave ESG principles into their fundamental business strategies. This includes adopting responsible financing practices, ensuring sustainable operations, and providing clear, transparent reporting on their environmental impact, such as carbon emissions and water usage.

ICICI Bank, for instance, has been actively enhancing its ESG disclosures. In its FY23-24 reporting, the bank detailed its progress in areas like renewable energy financing and reducing its operational carbon footprint, aligning with the evolving expectations of regulators and stakeholders.

Green Financing and Sustainable Lending Initiatives

The demand for and supply of green finance products, such as green bonds and sustainability-linked loans, are rapidly expanding. ICICI Bank has an opportunity to grow its green financing portfolio, aligning with India's ambitious sustainability goals and attracting a growing pool of environmentally conscious investors. For instance, the Indian green bond market saw significant growth, with issuances reaching approximately $10 billion in 2023, a substantial increase from previous years.

Banks like ICICI are increasingly offering financing for renewable energy projects, a key driver of sustainable development. This includes solar power, wind energy, and other clean technologies. The Indian government's push for renewable energy, targeting 500 GW of non-fossil fuel energy capacity by 2030, creates a robust pipeline for such financing. ICICI Bank’s commitment to sustainable lending is demonstrated through its active participation in financing large-scale renewable energy projects across the country.

- Growing Green Bond Market: India's green bond market is projected to reach $15 billion by the end of 2024, indicating strong investor appetite for sustainable debt instruments.

- Renewable Energy Financing: ICICI Bank is a significant player in financing renewable energy projects, contributing to India's clean energy transition.

- Sustainability-Linked Loans: The bank is also expanding its offerings in sustainability-linked loans, where borrowing costs are tied to achieving specific environmental, social, and governance (ESG) targets.

- Investor Demand: There's a clear upward trend in demand from institutional investors, both domestic and international, for financial products that demonstrate strong ESG credentials.

Operational Environmental Footprint and Resource Management

ICICI Bank, like other financial institutions, faces increasing pressure to minimize its operational environmental footprint. This involves a concerted effort towards enhancing energy efficiency across its extensive network of branches and critical data centers, alongside robust waste reduction and water conservation programs. For instance, many banks are setting ambitious targets for carbon neutrality, actively integrating renewable energy sources into their operations, and significantly reducing paper consumption through digital transformation initiatives, demonstrating a commitment to environmental stewardship.

In 2023, ICICI Bank reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions by 15% compared to its 2020 baseline, driven by energy efficiency upgrades and increased use of renewable energy at its facilities. The bank has also committed to achieving net-zero emissions by 2040.

- Energy Efficiency: Implementing smart building technologies and upgrading to energy-efficient lighting and HVAC systems in its branches and corporate offices.

- Renewable Energy Adoption: Increasing the proportion of electricity sourced from renewable sources, such as solar power, for its operational needs.

- Waste Management: Focusing on reducing, reusing, and recycling waste generated from operations, with a particular emphasis on paper consumption through digitalization.

- Water Conservation: Implementing water-saving measures in its facilities to minimize water usage.

Environmental factors present both risks and opportunities for ICICI Bank. The increasing frequency of extreme weather events, costing India billions in 2022, poses physical risks to assets and loan portfolios, particularly in agriculture and real estate. Transition risks arise from policies promoting a low-carbon economy, potentially impacting lending to high-emission sectors and necessitating careful assessment of trade-related carbon footprints, like those affected by the EU's CBAM from 2026.

The growing demand for ESG-aligned investments, projected to exceed $50 trillion globally by early 2025, highlights a significant market shift. ICICI Bank's proactive approach to ESG, including enhanced disclosures and a 15% reduction in Scope 1 and 2 emissions by 2023 from a 2020 baseline, positions it favorably. The bank's commitment to net-zero by 2040 and its expansion in green finance, including renewable energy financing and sustainability-linked loans, align with India's ambitious sustainability goals and capitalize on the growing green bond market, which reached approximately $10 billion in India in 2023.

| Environmental Factor | Impact on ICICI Bank | Key Data/Initiatives (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Physical risks to assets, loan defaults, collateral devaluation. | India's climate disaster costs: $13 billion in 2022. |

| Low-Carbon Transition Policies | Transition risks for high-emission sectors, regulatory scrutiny. | EU CBAM in effect from 2026 impacts trade. Global fossil fuel subsidies remain high in 2024. |

| ESG Investor Demand | Enhanced access to capital, improved corporate reputation. | Global sustainable investment assets projected to exceed $50 trillion by early 2025. |

| Green Finance & Renewable Energy | Growth opportunities in green bonds, sustainability-linked loans, and renewable energy project financing. | Indian green bond market issuance ~ $10 billion in 2023. India's target: 500 GW non-fossil fuel capacity by 2030. |

| Operational Footprint Reduction | Cost savings, enhanced brand image, regulatory compliance. | 15% reduction in Scope 1 & 2 GHG emissions by 2023 (vs. 2020 baseline). Net-zero commitment by 2040. |

PESTLE Analysis Data Sources

Our ICICI Bank PESTLE Analysis draws on a comprehensive blend of data from official government publications, financial regulatory bodies like the RBI, and reputable economic and market research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing the Indian banking sector.