Hydro One Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hydro One Bundle

Hydro One faces a complex competitive landscape, with significant power held by buyers and a moderate threat from new entrants due to high capital requirements. Understanding the intensity of these forces is crucial for strategic planning. The full analysis reveals the real forces shaping Hydro One’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hydro One's bargaining power with suppliers is significantly shaped by the stringent regulatory and policy framework it operates within. The Ontario Energy Board (OEB) and provincial policies dictate essential operational aspects, including capital expenditure approvals and rate-setting, which can constrain supplier pricing power. For instance, OEB decisions in 2024 regarding capital investment plans for transmission and distribution infrastructure directly influence the scale and cost parameters of projects, thereby limiting how much suppliers can leverage their position.

Hydro One's dependence on a select group of manufacturers for critical high-voltage transmission and distribution equipment, including transformers and advanced grid technologies, significantly amplifies supplier bargaining power. The specialized nature of this technology and the substantial costs associated with switching suppliers grant these manufacturers considerable leverage.

Despite this, Hydro One's significant capital expenditure plans, with an estimated $3.542 billion allocated for 2025, create a substantial and stable demand for these specialized suppliers. This consistent market opportunity helps to somewhat balance the power dynamic.

Hydro One relies heavily on a specialized workforce, with unions like the Power Workers' Union (PWU) holding considerable sway. The PWU recently finalized tentative collective agreements in March 2025, demonstrating their ongoing influence.

The critical nature of utility operations and the potential for widespread service disruptions if labor relations sour give these skilled workers significant bargaining leverage. This power dynamic is managed through Hydro One's commitment to safety and employee engagement, as detailed in their 2024 Sustainability Report.

Electricity Generators

Electricity generators, while not directly supplying Hydro One with a physical product in the traditional sense, are crucial suppliers of the electricity that Hydro One transports. The concentration of generation capacity, especially from large-scale producers like nuclear or major hydroelectric facilities, can grant these entities significant bargaining power. This leverage can influence the cost of electricity that ultimately reaches Hydro One's customers, though this impact is often moderated by regulated rate structures.

In Ontario, the Independent Electricity System Operator (IESO) manages the grid and the flow of electricity, meaning Hydro One's direct contractual relationships with generators are part of a larger system. However, the underlying cost of generation remains a key factor. For instance, in 2024, Ontario's electricity market continues to see a diverse mix of generation sources, with nuclear and hydroelectric power forming the backbone, alongside growing contributions from renewables. The long-term nature of many generation contracts and the capital-intensive nature of building new generation capacity can solidify the position of existing large suppliers.

- Concentration of Generation: A few large generators controlling a significant portion of Ontario's electricity supply can exert more influence.

- Long-Term Contracts: Existing power purchase agreements with major generators can lock in prices and limit Hydro One's flexibility.

- Regulatory Framework: While generators have power, regulated rates for transmission and distribution mean that significant cost increases from generators are typically reviewed and approved by regulators before being passed on to consumers.

- Diversification of Supply: The increasing role of renewable energy sources, often with different contracting models, can potentially dilute the bargaining power of traditional large-scale generators over time.

IT and Cybersecurity Service Providers

Hydro One's reliance on specialized IT and cybersecurity service providers is significant, given its role as a critical infrastructure operator. The increasing sophistication of cyber threats and the continuous demand for advanced digital solutions bolster the bargaining power of these specialized vendors.

- Specialized Expertise: IT and cybersecurity vendors possess niche skills and knowledge essential for protecting Hydro One's complex systems, making them difficult to replace.

- Increasing Demand: The escalating frequency and severity of cyberattacks, coupled with the push for digital transformation, elevate the demand for these services.

- Technological Investments: Hydro One's technology-related expenditures saw a notable increase in Q1 2025, underscoring the growing dependence on and investment in these critical IT and cybersecurity services.

Hydro One faces significant supplier bargaining power from specialized equipment manufacturers due to the critical nature of their products and high switching costs. For instance, the company's substantial capital expenditure plans, projected at $3.542 billion for 2025, create a consistent demand for these niche suppliers, thereby strengthening their negotiating position.

The bargaining power of electricity generators is also notable, particularly large-scale nuclear and hydroelectric facilities that form the backbone of Ontario's power supply. While regulated rates moderate direct cost pass-throughs, the long-term nature of generation contracts and the capital intensity of new capacity solidify existing suppliers' leverage.

Furthermore, Hydro One's reliance on specialized IT and cybersecurity providers, driven by increasing cyber threats and digital transformation, grants these vendors considerable power. The company's technology investments, which saw a rise in Q1 2025, highlight this growing dependence.

| Supplier Type | Key Factors Influencing Bargaining Power | Relevant Data/Context |

|---|---|---|

| Specialized Equipment Manufacturers | Critical nature of products, high switching costs, stable demand from capital expenditures | 2025 Capital Expenditure: $3.542 billion |

| Electricity Generators | Concentration of supply, long-term contracts, capital intensity of new capacity | Ontario's generation mix dominated by nuclear and hydro |

| IT & Cybersecurity Providers | Specialized expertise, increasing demand due to cyber threats, technology investments | Notable increase in technology expenditures in Q1 2025 |

What is included in the product

Tailored exclusively for Hydro One, analyzing its position within its competitive landscape by examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces model, allowing Hydro One to pinpoint and address key strategic challenges.

Customers Bargaining Power

Hydro One's bargaining power of customers is significantly diminished due to regulated rates. The Ontario Energy Board (OEB) approves the rates for transmission and distribution, leaving customers with little room for price negotiation. For instance, the OEB's 2025 rate decisions reflect this regulatory oversight, balancing Hydro One's financial requirements with consumer affordability.

Furthermore, electricity transmission and distribution are considered essential services. This means customers cannot readily switch to alternative providers for these fundamental needs, further reducing their leverage. The OEB's mandate is to ensure fair pricing for ratepayers while allowing Hydro One to maintain its infrastructure and operations.

Hydro One serves around 1.5 million residential and small business customers, a group that is highly fragmented. Individually, these customers have very little sway. Their collective voice is amplified through organizations that advocate for them and the Ontario Energy Board's role in protecting consumers.

In 2024, Hydro One reported high customer satisfaction, with 88% of residential and small business customers expressing satisfaction. This suggests that most customers find the service acceptable and are content with the regulated pricing structure.

Large industrial customers and local distribution companies (LDCs) possess some bargaining leverage with Hydro One due to their substantial electricity consumption and the possibility of on-site generation or direct access to the transmission network. However, their choices for alternative transmission and distribution providers remain exceptionally restricted, limiting their overall power.

The Ontario Energy Board (OEB) also influences these larger entities through its rate decisions, though specific industrial tariffs may apply, moderating their independent bargaining capacity.

Limited Switching Costs

For the fundamental service of electricity transmission and distribution, customers face virtually no switching costs. This is because there are no alternative providers for the physical infrastructure itself; customers are inherently connected to and reliant on Hydro One's network.

While customers can indeed choose different electricity retailers to purchase their power commodity, this choice does not extend to selecting a different company to manage the wires and poles that deliver that electricity. This inherent lack of choice in the physical delivery network significantly limits their bargaining power in this specific regard.

- Limited Switching Costs: Customers are geographically bound to Hydro One's transmission and distribution infrastructure.

- No Alternative Providers: There are no competing companies for the physical delivery of electricity in Hydro One's service territory.

- Retailer vs. Distributor: Customers can switch electricity suppliers, but not the underlying wire service provider.

Information Asymmetry and Regulatory Advocacy

Customers, especially residential users, often grapple with information asymmetry concerning Hydro One's intricate rate structures and underlying operational expenses. This complexity can make it challenging for consumers to fully understand their bills and the factors influencing them.

The presence of the Office of the Hydro One Ombudsman serves as a crucial avenue for customers to voice grievances and pursue resolutions. This independent body plays a vital role in balancing the power dynamic between the utility and its customer base.

Data from the Office of the Hydro One Ombudsman's 2024 annual report highlights its effectiveness, indicating a significant 17% decrease in customer complaints when compared to the previous year, 2023. This reduction suggests improved complaint resolution processes and potentially greater customer satisfaction.

- Information Asymmetry: Residential customers may find it difficult to fully comprehend Hydro One's complex rate structures and operational costs.

- Regulatory Advocacy: The Office of the Hydro One Ombudsman acts as a key channel for customer concerns and dispute resolution.

- Complaint Reduction: In 2024, Hydro One saw a 17% decrease in customer complaints compared to 2023, as reported by the Ombudsman's office.

Hydro One's customer bargaining power is significantly limited because electricity transmission and distribution are essential, regulated services with no direct competitors for the physical infrastructure. While customers can choose their electricity retailer, they cannot switch the company that delivers the power, effectively binding them to Hydro One's network. This lack of viable alternatives for the core service drastically reduces their ability to negotiate prices or terms.

The Ontario Energy Board (OEB) plays a crucial role in setting rates, which are approved based on Hydro One's cost of service and capital investment plans, balancing utility needs with consumer affordability. For example, the OEB's 2024 rate decisions outline the approved revenue requirement for Hydro One, influencing the prices customers ultimately pay for distribution services. This regulatory oversight means customers have minimal direct bargaining leverage.

The vast majority of Hydro One's customer base, approximately 1.5 million residential and small business accounts, is highly fragmented. Individually, these customers possess negligible bargaining power. However, their collective interests are represented through regulatory processes and advocacy groups, with the OEB acting as a key arbiter to ensure fair treatment and pricing for ratepayers.

In 2024, Hydro One reported that 88% of its residential and small business customers expressed satisfaction with the service. This high satisfaction rate suggests that, within the regulated framework, customers generally perceive the value and pricing as acceptable, further diminishing the impetus for aggressive bargaining.

| Customer Segment | Bargaining Power Factors | Hydro One's Response/Context |

|---|---|---|

| Residential & Small Business | Highly fragmented, no alternative providers for distribution, regulated rates | High customer satisfaction (88% in 2024), OEB rate approvals limit negotiation |

| Large Industrial & LDCs | Higher consumption, potential for on-site generation, limited alternative transmission access | Some leverage but still constrained by regulatory framework and lack of transmission alternatives; specific tariffs may apply |

What You See Is What You Get

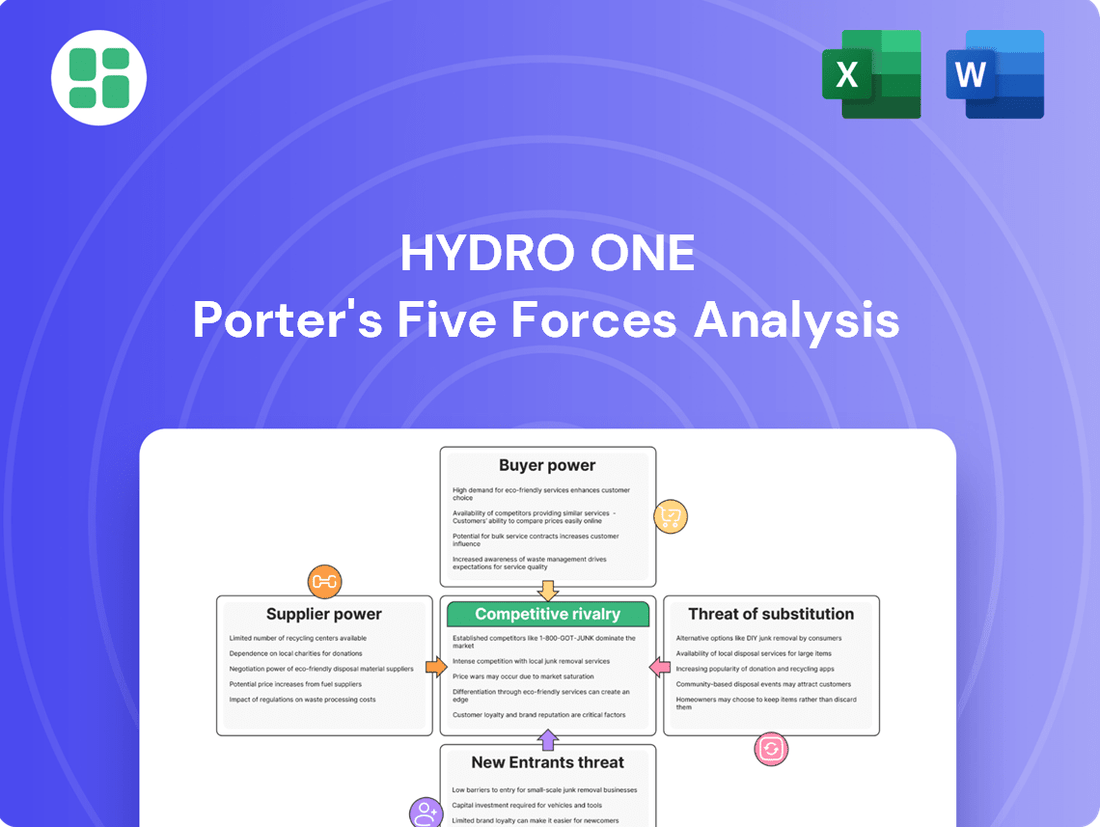

Hydro One Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual Hydro One Porter's Five Forces Analysis, meticulously detailing the competitive landscape of the electricity transmission and distribution sector. Once you complete your purchase, you’ll get instant access to this exact file, providing comprehensive insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Rivalry Among Competitors

Hydro One's position as a regulated natural monopoly in Ontario significantly curtails direct competitive rivalry in its core electricity transmission and distribution services. The Ontario Energy Board (OEB) meticulously regulates its operations and sets rates, creating a stable, albeit non-competitive, landscape for these essential services. This regulatory framework effectively eliminates traditional head-to-head competition within its primary business segments.

Hydro One faces limited direct competition in Ontario's electricity transmission and distribution sector. High capital investment and regulatory hurdles create significant barriers to entry, effectively limiting the number of new players. While numerous Local Distribution Companies (LDCs) operate within the province, their service territories are geographically defined, meaning they don't directly vie for the same customers or transmission rights as Hydro One.

Government policy is actively shaping the competitive landscape for transmission infrastructure development. The Independent Electricity System Operator (IESO) in Ontario, for instance, has implemented a Transmitter Selection Framework, introducing competitive procurement for new transmission lines. This framework aims to foster competition among entities looking to build and operate these critical assets.

However, this policy also carves out exceptions. For priority projects that don't meet certain predefined criteria, incumbent transmitters like Hydro One are automatically designated to undertake the work. This dual approach means that while competition is encouraged for some projects, others are directly awarded, creating a mixed competitive environment.

Industry Consolidation and Growth

The competitive rivalry within the electricity transmission and distribution sector, particularly for a company like Hydro One, is shaped by substantial capital requirements and a focus on infrastructure development. The urgency to modernize and expand the grid, fueled by rising electricity demand in Ontario, necessitates significant financial outlays. For instance, Hydro One committed $3.1 billion to its networks in 2024 and has earmarked $3.542 billion for 2025, often involving strategic acquisitions of stakes in new transmission lines. This environment emphasizes growth and infrastructure enhancement over direct competition for existing market share.

This strategic direction is evident in how companies approach expansion:

- Significant Capital Investment: The industry demands large investments for grid modernization and expansion, driven by increasing electricity demand.

- 2024 Investment: Hydro One invested $3.1 billion in its networks during 2024.

- 2025 Planned Investment: The company plans to invest $3.542 billion in 2025.

- Acquisition Strategy: Growth is often pursued through strategic acquisitions of interests in new transmission lines, rather than direct market share battles.

Focus on Reliability and Efficiency

Competitive rivalry in the utility sector, including for Hydro One, frequently centers on operational reliability and efficiency rather than solely on price. Companies strive for superior performance metrics to differentiate themselves.

Hydro One's focus on reliability is crucial, as demonstrated by its efforts to reduce outage durations. In 2023, the company reported investing $1.1 billion in capital expenditures, with a significant portion dedicated to grid modernization and asset renewal, directly impacting service reliability.

Key performance indicators like safety records and customer satisfaction are paramount. For instance, Hydro One aims to maintain high customer satisfaction scores, which are often influenced by the frequency and length of power interruptions. Their 2023 performance reports highlight ongoing initiatives to improve these areas.

- Focus on Operational Excellence: Utilities compete on the quality and consistency of their service delivery.

- Reliability Metrics: Safety records and outage management are critical differentiators.

- Customer Satisfaction: Positive customer experiences are directly linked to grid performance.

- Investment in Infrastructure: Significant capital is allocated to enhance grid value and efficiency, as seen in Hydro One's 2023 expenditures.

Hydro One's competitive rivalry is minimal in its core transmission and distribution due to its regulated monopoly status in Ontario, with high barriers to entry. While new transmission projects may see competitive procurement, regulatory frameworks often designate incumbents like Hydro One for priority work, creating a mixed competitive environment.

The company's competitive focus is on operational reliability and efficiency, driven by substantial capital investments in grid modernization. For example, Hydro One invested $3.1 billion in its networks in 2024 and planned $3.542 billion for 2025, often through strategic acquisitions rather than direct market share battles.

| Metric | 2023 Actual | 2024 Planned | 2025 Planned |

|---|---|---|---|

| Capital Investment (billions) | $1.1 (grid modernization/renewal) | $3.1 | $3.542 |

| Focus | Reliability, Asset Renewal | Network Investment | Grid Expansion |

SSubstitutes Threaten

The rise of distributed energy resources (DERs) like rooftop solar and battery storage presents a significant threat of substitution for traditional utility services. As more customers adopt these technologies, their dependence on Hydro One's centralized grid diminishes, impacting revenue streams. For instance, by 2024, residential solar installations in Ontario have seen a steady increase, offering consumers a direct alternative to purchasing all their power from the utility.

Improvements in energy efficiency technologies and heightened consumer awareness regarding conservation can significantly curb overall electricity consumption. This directly impacts Hydro One by reducing the demand for its transmission and distribution services, presenting a clear threat of substitutes.

Government programs and initiatives actively promoting energy efficiency, such as those seen in Ontario's evolving energy framework proposals, further amplify this trend. For instance, Ontario's Long-Term Energy Plan has consistently emphasized conservation measures, aiming to reduce peak demand and overall energy usage, thereby lessening reliance on traditional utility services.

Large industrial customers, particularly those with substantial and consistent power needs, can explore on-site generation. For instance, a large manufacturing plant might invest in a co-generation facility that produces both electricity and heat, thereby reducing its reliance on Hydro One's grid. This bypasses transmission and distribution costs, making it a significant threat for utilities serving such clients.

Transition to Alternative Heating/Cooling Systems

The increasing global focus on decarbonization and electrification presents a significant threat of substitution for traditional energy sources. For instance, a strong push towards cleaner alternatives could see a substantial shift away from natural gas for heating purposes, with electric heat pumps gaining prominence. This transition, while potentially boosting overall electricity demand, fundamentally substitutes one energy source for another, impacting Hydro One's load profiles and necessitating grid upgrades rather than a direct replacement of its core electricity delivery service.

In 2024, the energy sector continued to witness this trend. For example, government incentives and growing consumer awareness of climate change are driving the adoption of electric heating solutions. This move represents a substitution of natural gas, a fossil fuel, with electricity, which can be generated from renewable sources. While this may increase overall electricity consumption, it also means Hydro One must adapt its infrastructure to handle potentially different peak load patterns and the integration of more distributed energy resources.

- Electrification of Heating: A growing number of households and businesses are exploring or adopting electric heat pumps as a primary heating source, directly substituting natural gas furnaces.

- Government Mandates and Incentives: Policies aimed at reducing greenhouse gas emissions often include subsidies for electric heating installations and potential future restrictions on natural gas hookups in new constructions.

- Grid Modernization Needs: The shift to widespread electric heating requires significant investment in grid infrastructure to manage increased demand, particularly during peak heating seasons, and to ensure reliability.

- Changing Energy Mix: While electricity demand rises, the substitution effect means Hydro One is not necessarily selling more kilowatt-hours to the same end-use, but rather facilitating a change in the primary energy source for heating.

Technological Advancements in Energy Management

Technological advancements are increasingly posing a threat of substitution for traditional utility services. For instance, the proliferation of smart home technologies and sophisticated energy management systems allows consumers to actively control and optimize their electricity usage. These innovations enable demand response programs, where customers can voluntarily reduce consumption during peak hours or shift usage to off-peak times. This directly impacts the volume of electricity that Hydro One needs to transmit and distribute, particularly during periods of high demand.

These emergent technologies, while not a direct replacement for the fundamental need for electricity, function as substitutes by diminishing the overall demand for grid-supplied power. For example, by 2024, the adoption of smart thermostats and energy monitoring devices has become more widespread, giving consumers greater agency over their consumption patterns. This can lead to a reduction in the total kilowatt-hours purchased from utilities like Hydro One, thereby eroding its revenue base and market share in the long run.

- Smart Home Adoption: By the end of 2023, it was estimated that over 30% of Canadian households had at least one smart home device, with energy management devices showing significant growth.

- Demand Response Participation: In Ontario, demand response programs have seen increasing participation, with some programs offering incentives that can lead to a reduction in peak electricity demand by several hundred megawatts.

- Energy Efficiency Gains: Ongoing improvements in appliance efficiency and building insulation, driven by technological innovation, contribute to a lower overall electricity demand per capita.

The threat of substitutes for Hydro One is amplified by the growing adoption of distributed energy resources (DERs) like rooftop solar and battery storage. By 2024, residential solar installations in Ontario have continued to rise, allowing consumers to generate their own power, thus reducing reliance on the utility. Similarly, advancements in energy efficiency and smart home technologies enable customers to manage and reduce their electricity consumption, directly impacting Hydro One's demand for transmission and distribution services.

The electrification of heating, particularly the shift towards electric heat pumps from natural gas, represents another significant substitution. While this increases overall electricity demand, it alters the energy source for heating, potentially changing load profiles and necessitating grid adaptation. For instance, government incentives in Ontario actively promote these cleaner heating solutions, aligning with broader decarbonization goals.

Large industrial customers also pose a substitution threat by investing in on-site generation, such as co-generation facilities, to meet their substantial power needs. This strategy bypasses traditional utility infrastructure, reducing costs and dependence on Hydro One's grid.

| Substitution Factor | Impact on Hydro One | 2024 Data/Trend |

|---|---|---|

| Distributed Energy Resources (DERs) | Reduced demand for grid services, potential revenue erosion | Steady increase in residential solar installations in Ontario |

| Energy Efficiency & Smart Home Tech | Lower overall electricity consumption, reduced peak demand | Widespread adoption of smart thermostats and energy monitoring devices |

| Electrification of Heating | Shift in energy source for heating, altered load profiles | Government incentives promoting electric heat pumps in Ontario |

| On-site Industrial Generation | Bypassing transmission and distribution infrastructure | Exploration by large industrial customers for cost savings |

Entrants Threaten

The electricity transmission and distribution sector demands substantial initial capital for building essential infrastructure like high-voltage lines and substations. Hydro One's asset base, valued at $36.7 billion at the close of 2024, clearly illustrates the immense financial hurdle that deters new companies from entering this market.

New entrants into the electricity transmission and distribution sector, like Hydro One, confront formidable regulatory obstacles. Securing necessary licenses from the Ontario Energy Board (OEB) is a prerequisite, a process that can be lengthy and demanding. For instance, in 2023, the OEB continued its rigorous review of rate applications, ensuring adherence to established performance standards and financial prudence.

Beyond OEB approvals, prospective entrants must also navigate intricate environmental assessments and complex land acquisition procedures. These steps are critical for infrastructure development and require substantial time and capital investment. The sheer complexity and cost associated with these requirements effectively deter most potential new competitors, thereby reinforcing the existing market structure.

Hydro One possesses an immense advantage due to its established infrastructure, a vast network spanning Ontario and serving 1.5 million customers. This extensive reach and operational history create significant barriers for potential new entrants who would face the daunting and costly task of replicating such a widespread system.

The sheer scale of Hydro One's operations allows it to achieve substantial economies of scale, driving down per-unit costs for electricity transmission and distribution. New competitors would struggle to match these efficiencies, making it difficult to compete on price or service quality without comparable scale.

Incumbent Advantage and Network Effects

As the incumbent utility, Hydro One benefits from significant advantages that deter new entrants. Its extensive operational knowledge, honed over years of managing Ontario's vast transmission and distribution network, is a formidable barrier. This deep understanding of the grid's intricacies, regulatory landscape, and maintenance requirements is not easily replicated by newcomers.

Furthermore, Hydro One's established relationships with local communities and Indigenous partners are crucial. These long-standing ties foster trust and facilitate smoother operations, a significant hurdle for any new entity seeking to gain social license and operational access. The company also boasts a highly skilled and specialized workforce, essential for the safe and efficient operation of critical infrastructure.

The existing grid infrastructure itself creates a powerful natural monopoly. Connecting new customers or renewable energy generators necessitates integration with Hydro One's established network. The sheer cost and complexity of building parallel transmission and distribution lines make it economically impractical for new, competing networks to emerge, effectively locking out potential entrants.

In 2024, Hydro One's capital investment program highlights its commitment to maintaining and upgrading its existing assets, further solidifying its position. For instance, their planned investments in grid modernization and expansion, totaling billions of dollars over several years, directly enhance the efficiency and capacity of the current system, making it even more challenging for new players to compete.

- Incumbent Operational Expertise: Hydro One's deep understanding of Ontario's complex electricity grid, developed over decades, represents a significant knowledge barrier for potential new entrants.

- Established Stakeholder Relations: Strong, long-term relationships with communities and Indigenous groups provide Hydro One with essential social license and operational advantages that are difficult for new companies to build.

- Network Interdependence: The necessity for new generators or customers to connect to Hydro One's existing infrastructure creates a natural monopoly, as duplicating the extensive grid is prohibitively expensive and impractical.

- Capital Investment Reinforcement: Ongoing substantial capital investments by Hydro One in grid infrastructure and modernization (e.g., billions planned for 2024-2028) continuously strengthen its incumbent position and raise the barrier to entry.

Government Policy and Strategic Designation

Government policy and strategic designations significantly influence the threat of new entrants in Ontario's electricity transmission sector. The Ontario government and the Independent Electricity System Operator (IESO) often favor existing utilities, including Hydro One, for critical transmission infrastructure projects. This prioritization can create substantial barriers for new companies seeking to enter the market.

While a competitive procurement process exists for new transmission projects, certain criteria can lead to automatic designation for incumbents. Projects not meeting these specific benchmarks may be directly awarded to established players like Hydro One. This policy framework inherently limits the avenues for large-scale new entrants to gain a foothold in the market.

- Policy Prioritization: Ontario's government and IESO often designate major transmission projects to incumbent utilities, limiting opportunities for new entrants.

- Designation Criteria: Projects not meeting specific criteria can be automatically assigned to existing utilities, effectively barring new competition for those initiatives.

- Market Access Barriers: These policies create significant hurdles for new companies aiming to participate in large-scale transmission development, reinforcing the position of established players.

The threat of new entrants for Hydro One is exceptionally low, primarily due to the immense capital requirements and stringent regulatory environment. Building new transmission infrastructure demands billions in investment, a barrier that few companies can overcome. For instance, Hydro One's 2024 asset base of $36.7 billion underscores the scale of investment needed.

Existing regulatory frameworks, managed by bodies like the Ontario Energy Board (OEB), impose lengthy and complex approval processes, including environmental assessments and land acquisition. These hurdles, coupled with the need for specialized expertise and established community relationships, effectively deter potential competitors.

Furthermore, government policies often favor incumbent utilities like Hydro One for significant transmission projects, limiting market access for new players. The inherent nature of the electricity grid, where new infrastructure must integrate with existing networks, also creates a natural monopoly, making duplication economically unfeasible.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Building transmission infrastructure requires substantial upfront investment, exemplified by Hydro One's $36.7 billion asset base in 2024. | Extremely High Barrier |

| Regulatory Hurdles | Obtaining licenses and approvals from entities like the OEB is a lengthy and complex process. | High Barrier |

| Existing Infrastructure & Scale | Hydro One's extensive network and economies of scale are difficult and costly to replicate. | High Barrier |

| Government Policy | Prioritization of incumbents for major projects limits new market participation. | Moderate to High Barrier |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hydro One leverages data from Hydro One's annual reports, Ontario Energy Board filings, and industry-specific publications. We also incorporate insights from market research reports and macroeconomic data to assess competitive pressures.