Harvest Oil & Gas Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harvest Oil & Gas Bundle

Harvest Oil & Gas faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers being key considerations. Understanding the intensity of these forces is crucial for navigating the volatile energy market.

The complete report reveals the real forces shaping Harvest Oil & Gas’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of advanced drilling rigs, seismic imaging technology, and specialized completion tools wield considerable power. Their offerings are often high-cost and proprietary, making them indispensable for efficient exploration and production operations.

The oilfield services sector, a key provider of these specialized inputs, experienced its strongest performance in 34 years between 2023 and 2024, underscoring the leverage these suppliers currently possess. Harvest Oil & Gas's dependence on these sophisticated technologies, coupled with limited alternatives, can translate into elevated costs and less favorable contractual terms.

The availability of highly skilled geologists, engineers, and field technicians is absolutely critical for Harvest Oil & Gas to operate successfully. Without these experts, complex projects simply can't get off the ground or be managed effectively.

A significant shortage of talented individuals capable of executing future growth plans and infrastructure development presents a serious hurdle for the entire industry. This scarcity directly impacts Harvest's ability to expand and innovate.

Data from the American Geoscience Institute projects a deficit of 130,000 geoscientists by 2029, underscoring a long-term challenge in securing qualified personnel. This persistent labor supply issue is a key factor.

This scarcity naturally boosts the bargaining power of specialized workers and the agencies that supply them. Consequently, Harvest Oil & Gas can expect increased wages and higher recruitment expenses to attract and retain this essential talent.

The bargaining power of suppliers in drilling and well services for Harvest Oil & Gas is currently moderate to low. Companies offering these specialized services often have significant capital investment in fleets and skilled labor. However, market conditions in 2024 have weakened their position.

U.S. composite day rates for drilling experienced an 11-month decline throughout 2024, ultimately decreasing by 6.19% year-over-year. Furthermore, rig utilization rates hit a low of 74.01% in December 2024, indicating an oversupply of services and diminished demand. This environment suggests that suppliers of basic drilling services faced reduced leverage towards the end of 2024.

Looking ahead to early 2025, there is cautious optimism for stable or slightly increased work volumes, which could marginally improve supplier power. Projections indicate a decline in prices for key oilfield services like OCTG, sand, and diesel fuel in 2025, a trend that will likely benefit exploration and production companies by reducing their operational costs.

Land and Mineral Rights Holders

Land and mineral rights holders wield considerable influence over Harvest Oil & Gas. Their control over essential resources, particularly in sought-after basins, allows them to dictate terms. This directly affects Harvest's operational expenses and profit margins.

In 2024, the average lease bonus payments for prime acreage in the Permian Basin, a key region for many oil and gas companies, could range from $3,000 to $7,000 per acre, reflecting the intense competition and the bargaining power of landowners. Royalty rates typically fall between 15% and 25%, further impacting the net revenue for the operating company.

- Landowner Leverage: Holders of proven resource basins control access to the fundamental asset for Harvest Oil & Gas.

- Cost Impact: Lease terms and royalty agreements directly influence Harvest's cost of production and overall profitability.

- Market Dynamics: High demand for acreage in prospective areas amplifies the bargaining power of mineral rights holders.

Financial Capital Providers

Financial capital providers, particularly lenders, can exert significant bargaining power on Harvest Oil & Gas. The upstream oil and gas sector is capital-intensive, and access to debt and equity financing is crucial. In 2024, despite high oil prices boosting the industry's overall financial health, many debt sources remain hesitant to lend to upstream operations, especially for smaller companies like Harvest that may face higher operational costs.

This reticence from lenders means companies like Harvest must often accept less favorable loan terms or pay higher interest rates. The investment landscape for 2025 anticipates a focus on strategic capital allocation towards projects with demonstrable high returns, further tightening conditions for firms unable to prove such potential. For instance, while the industry saw robust financing capabilities in 2024, the increased investor expectations for dividends and investment returns can translate into stricter lending criteria.

- Limited Debt Appetite: Many traditional debt providers are cautious about lending to the upstream oil and gas sector.

- Higher Cost of Capital: Smaller firms like Harvest may face elevated interest rates due to perceived higher risk.

- Investor Expectations: Strong 2024 performance leads to higher demands for returns, influencing capital provider decisions.

- 2025 Outlook: A focus on high-return projects may limit capital availability for less attractive ventures.

Suppliers of specialized equipment, such as advanced drilling rigs and seismic imaging technology, hold significant leverage due to the proprietary nature and high cost of their offerings. This makes them essential for Harvest Oil & Gas's exploration and production activities. The oilfield services sector, a primary supplier, demonstrated its strongest performance in 34 years between 2023 and 2024, indicating strong supplier power.

The bargaining power of suppliers for basic drilling and well services is currently moderate to low. This is due to market conditions in 2024, which saw U.S. composite day rates for drilling decline by 6.19% year-over-year, with rig utilization rates falling to 74.01% in December 2024. This suggests an oversupply of services and reduced demand, weakening supplier leverage.

Suppliers of critical human capital, like skilled geoscientists and engineers, possess considerable bargaining power. The projected deficit of 130,000 geoscientists by 2029 highlights a long-term scarcity, leading to increased wages and recruitment costs for companies like Harvest Oil & Gas.

| Supplier Type | Bargaining Power | Key Factors | 2024 Data/Trend |

|---|---|---|---|

| Specialized Technology/Equipment | High | Proprietary, high cost, indispensable | Oilfield services sector saw strongest performance in 34 years (2023-2024) |

| Basic Drilling/Well Services | Moderate to Low | Oversupply, reduced demand | Day rates down 6.19% YoY; Rig utilization at 74.01% (Dec 2024) |

| Skilled Human Capital | High | Critical shortage, essential expertise | Projected 130,000 geoscientist deficit by 2029 |

What is included in the product

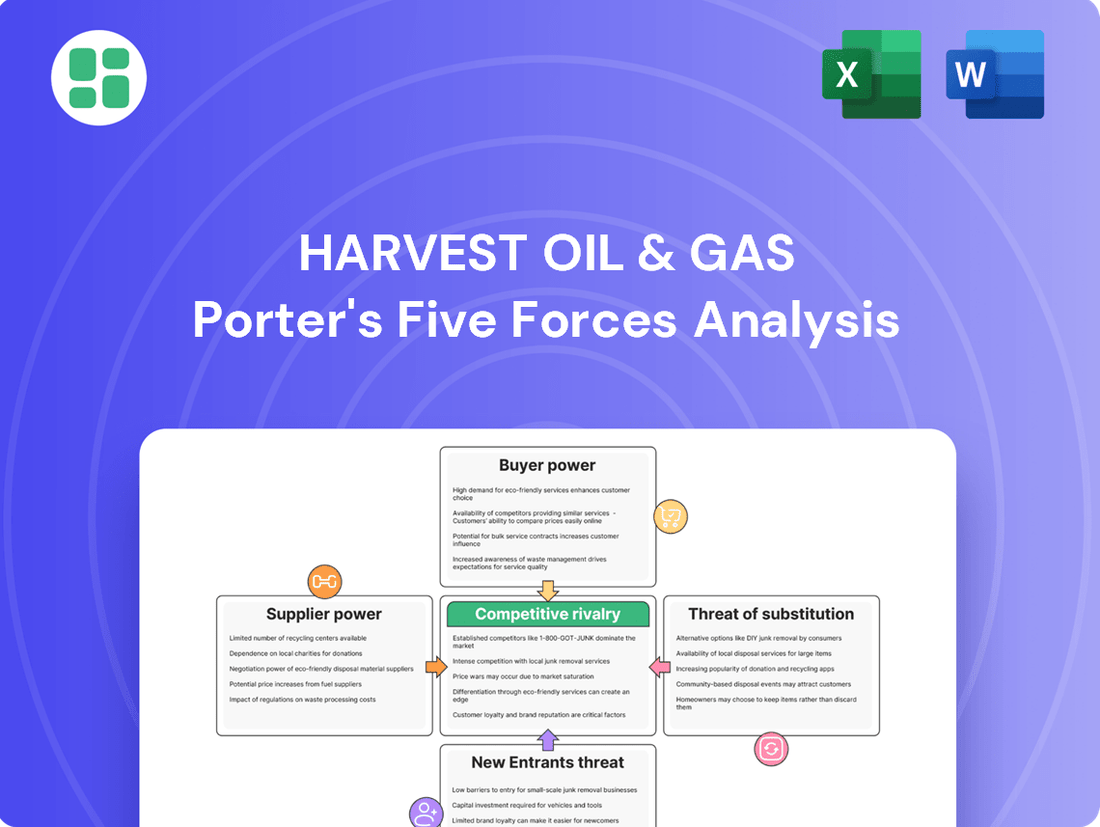

This analysis examines the competitive landscape for Harvest Oil & Gas, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for Harvest Oil & Gas.

Customers Bargaining Power

Harvest Oil & Gas's primary customers are refineries for crude oil and midstream companies for natural gas. These entities often buy in substantial quantities, and their considerable size and market consolidation grant them considerable sway in price discussions.

The growing global appetite for U.S. liquefied natural gas (LNG) exports, bolstered by new export facilities expected to begin operations in 2025, is a significant factor. This expansion is projected to increase the U.S. share of the global LNG market, directly impacting the bargaining power of natural gas purchasers.

For Harvest Oil & Gas, industrial and large commercial consumers are a key customer group for natural gas. These entities are projected to see their energy consumption rise between 5% and 32% from 2022 to 2050, indicating a growing demand base.

While individual buyers have limited sway, these major industrial purchasers possess considerable bargaining power. They can leverage this to negotiate better pricing and contract terms, particularly if they have access to alternative energy sources or the ability to scale back their consumption, making them very responsive to price changes.

The bargaining power of customers in the oil and gas sector is largely dictated by global and regional commodity market dynamics, rather than individual negotiation. For instance, Brent crude oil prices are projected to average $69 per barrel in 2025, but increasing global oil inventories are expected to exert consistent downward pressure on these prices.

This market-driven pricing significantly limits the ability of individual buyers to negotiate favorable terms. In contrast, natural gas prices are anticipated to rise substantially in 2025, with an average forecast of $4.25 per million British thermal units (MMBtu), enabling gas operators to shift towards expansion.

Long-term Contracts and Spot Markets

Harvest Oil & Gas faces varying customer bargaining power depending on whether it utilizes long-term supply contracts or operates within the spot market. Long-term contracts can offer revenue predictability by locking in prices and volumes. However, this can also limit Harvest's ability to capitalize on price increases, effectively shifting some pricing power to the customer.

Conversely, the spot market exposes Harvest to immediate and volatile pricing, heavily influenced by global supply and demand. In this environment, buyers gain leverage by having the freedom to source from the lowest-cost producer. For instance, fluctuations in global oil prices, such as the Brent crude benchmark which averaged around $82 per barrel in early 2024, directly impact the negotiating power of spot market buyers.

- Long-Term Contracts: Provide revenue stability for Harvest but can reduce pricing flexibility, giving customers more power to negotiate favorable terms.

- Spot Market: Offers immediate sales but exposes Harvest to price volatility, allowing buyers to exert power by choosing the cheapest available supply.

- Geopolitical Influence: Events impacting global oil supply, like production cuts announced by OPEC+ in late 2023, can significantly alter spot market dynamics and buyer leverage.

- Price Sensitivity: In periods of high oil prices, customers with contract flexibility or those on the spot market will actively seek the most cost-effective options, increasing their bargaining power.

Customer Price Sensitivity

Customers for oil and natural gas exhibit significant price sensitivity because these products are essentially commodities with numerous suppliers available. Even minor price fluctuations can prompt buyers to switch to a competitor, compelling producers like Harvest Oil & Gas to prioritize cost reduction and operational enhancements to safeguard their profits.

- Customer Price Sensitivity: Oil and gas customers are highly sensitive to price changes.

- Commoditized Market: The nature of oil and gas as commodities with many suppliers intensifies this sensitivity.

- Impact on Producers: This forces companies like Harvest Oil & Gas to focus on efficiency to remain profitable.

- Market Trend: U.S. spot crude prices are projected to decrease for the third consecutive year in 2025, further highlighting customer price awareness.

Harvest Oil & Gas's customers, primarily large refineries and midstream companies, wield significant bargaining power due to their substantial purchasing volumes and the commoditized nature of oil and gas. This power is amplified by their ability to switch suppliers if prices are not competitive, as evidenced by the projected decrease in U.S. spot crude prices for the third consecutive year in 2025, which heightens customer price awareness.

The bargaining power of customers is also influenced by market dynamics. While natural gas prices are forecast to rise to an average of $4.25 per MMBtu in 2025, allowing producers to expand, the global oil market, with Brent crude projected to average $69 per barrel in 2025, faces downward pressure from increasing inventories, which can empower buyers.

Harvest's strategy regarding long-term contracts versus the spot market directly impacts customer leverage. Long-term agreements offer stability but can lock in prices, potentially benefiting buyers, while spot market sales expose Harvest to price volatility, allowing buyers to source from the most cost-effective producer.

The increasing global demand for U.S. LNG, with new export facilities coming online in 2025, is a key factor. This expansion is expected to boost the U.S. share in the global LNG market, potentially influencing the bargaining power of natural gas purchasers.

| Customer Type | Bargaining Power Drivers | Impact on Harvest Oil & Gas | Key Market Factor (2025) |

| Refineries (Crude Oil) | Volume purchasing, commodity nature, price sensitivity | Pressure on crude oil prices, need for cost efficiency | Brent Crude Avg: $69/barrel; Increasing inventories |

| Midstream Companies (Natural Gas) | Volume purchasing, contract terms, alternative sources | Negotiation on transport fees and supply agreements | Natural Gas Avg: $4.25/MMBtu; Rising demand |

| Industrial/Commercial Consumers | Energy consumption growth, alternative energy options | Price sensitivity, demand stability | Projected consumption increase (5%-32% from 2022-2050) |

What You See Is What You Get

Harvest Oil & Gas Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces analysis for Harvest Oil & Gas, detailing the competitive landscape and strategic implications for the company. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ready for your immediate use.

Rivalry Among Competitors

The U.S. oil and gas sector features a vast array of independent producers alongside established integrated giants, creating a complex competitive environment. While market consolidation has led to fewer operators controlling more rigs, this dynamic still presents diverse competitive pressures for companies like Harvest Oil & Gas.

Harvest faces rivalry from a broad spectrum of players, from nimble, privately owned businesses to substantial publicly traded exploration and production (E&P) firms. This diversity means competition is fierce for prime acreage, essential capital, and ultimately, market share, particularly within concentrated operational basins.

The U.S. oil and gas market is expected to see a Compound Annual Growth Rate (CAGR) of 3.26% between 2025 and 2033. However, this overall growth masks the reality that many specific basins and segments are already quite mature.

Harvest Oil & Gas's strategy of focusing on proven resource basins means they are likely operating in these more established, mature areas. This maturity intensifies competition as companies vie for existing assets and market share.

Adding to this competitive pressure, declining oil prices in 2025 have prompted U.S. producers to scale back their drilling and completion activities, further concentrating competition among those still actively exploring and producing.

The oil and gas sector is notoriously capital-intensive, meaning companies like Harvest Oil & Gas face substantial fixed costs. These include the expenses for drilling new wells, maintaining extensive infrastructure like pipelines and refineries, and adhering to stringent regulatory compliance. For instance, in 2024, the average cost to drill an onshore oil well can range from $2 million to $8 million, depending on depth and complexity.

High exit barriers further intensify competitive rivalry. Decommissioning old wells, a process often mandated by environmental regulations, can cost hundreds of thousands to millions of dollars per well. Contractual obligations, such as long-term supply agreements or debt covenants, can also lock companies into continued production. This forces them to keep operating even when market prices are low, potentially leading to oversupply and increased pressure on margins.

This environment directly impacts Harvest's strategic decisions. The need to service debt and cover these significant fixed costs often dictates maintaining production levels, regardless of prevailing market prices. This can create a difficult balancing act, where operational continuity is prioritized to manage financial obligations, even if it means accepting lower profitability in the short term due to competitive pressures.

Product Differentiation and Switching Costs

The oil and natural gas industry, including players like Harvest Oil & Gas, largely deals with undifferentiated commodities. This means a barrel of crude oil or a thousand cubic feet of natural gas from one producer is essentially the same as from another. Consequently, competition often boils down to price and operational efficiency, as customers face minimal hurdles in switching suppliers.

This inherent lack of product differentiation results in very low switching costs for customers. For Harvest and its peers, this dynamic exerts continuous downward pressure on prices and profit margins. It underscores the critical importance of achieving operational excellence and maintaining rigorous cost management to remain competitive.

- Commodity Nature: Oil and gas are primarily seen as interchangeable goods, limiting differentiation opportunities.

- Price-Driven Competition: With little to distinguish products, price becomes the main competitive lever.

- Low Switching Costs: Customers can easily move between suppliers without incurring significant penalties or effort.

- Margin Pressure: This environment forces producers to focus intensely on cost control to maintain profitability.

Strategic Objectives and Aggressiveness

Competitors in the oil and gas exploration and production (E&P) sector exhibit a range of strategic objectives. Some focus on maximizing current production volumes, while others prioritize reserve growth or a strong emphasis on shareholder returns through dividends and buybacks. This diversity in goals shapes the competitive landscape.

The strategic direction of competitors directly impacts Harvest Oil & Gas. For instance, independent E&P companies surveyed by TD Cowen indicated plans to reduce capital expenditures by approximately 4% in 2025 compared to 2024. This suggests a prevailing trend towards capital discipline and a greater focus on shareholder returns over aggressive production expansion.

- Strategic Focus Shift: Competitors are increasingly prioritizing capital discipline and shareholder returns over aggressive production increases.

- Capital Expenditure Trends: Independent E&P firms planned a 4% cut in capital expenditures for 2025 from 2024 levels.

- Impact on Harvest: This competitor behavior may compel Harvest to adjust its own investment strategies, leaning towards efficiency and value creation for shareholders.

Harvest Oil & Gas operates in a highly competitive arena populated by numerous independent producers and major integrated companies. This intense rivalry is amplified by the commodity nature of oil and gas, where products are largely undifferentiated, driving competition primarily through price and operational efficiency. In 2024, the average cost to drill an onshore oil well ranged from $2 million to $8 million, highlighting the capital-intensive nature of the industry and the pressure to maintain efficient operations.

Competitors' strategic shifts, such as a planned 4% reduction in capital expenditures by independent E&P firms in 2025 compared to 2024, indicate a growing focus on capital discipline and shareholder returns. This trend compels Harvest to also prioritize efficiency and value creation to remain competitive in a market where low switching costs for customers exert continuous downward pressure on margins.

| Competitive Factor | Description | Impact on Harvest Oil & Gas |

| Number of Competitors | Vast array of independent producers and integrated giants. | Intensifies competition for acreage, capital, and market share. |

| Product Differentiation | Oil and gas are undifferentiated commodities. | Competition driven by price and operational efficiency; low switching costs for customers. |

| Capital Intensity | High fixed costs for drilling, infrastructure, and compliance. | Pressure to maintain production to cover costs, even in low price environments. |

| Exit Barriers | High costs for well decommissioning and contractual obligations. | Forces continued operation, potentially leading to oversupply and margin erosion. |

| Competitor Strategy | Focus on production volume, reserve growth, or shareholder returns. | Requires strategic adaptation; observed trend towards capital discipline in 2025. |

SSubstitutes Threaten

The increasing integration of renewable energy sources presents a substantial threat to traditional fossil fuel demand. By 2025, renewables are projected to supply 25% of U.S. electricity, a notable increase from 21% in 2024.

Globally, renewables already generated 30% of electricity in 2024, and their cost-effectiveness continues to improve, making them increasingly competitive for power generation and other energy applications. This trend could diminish the market share for Harvest Oil & Gas's core products.

The accelerating shift towards electric vehicles (EVs) poses a significant threat to Harvest Oil & Gas by directly impacting the demand for crude oil. As more consumers opt for EVs, the need for gasoline and diesel, key refined products from crude oil, diminishes. This trend is already visible, with global demand for road transportation fuels projected to grow by a mere 1% between 2024 and 2034, despite anticipated strong growth in 2025 due to global monetary easing.

Improvements in energy efficiency across various sectors directly reduce the need for traditional energy sources like oil and natural gas. While U.S. energy consumption is projected to rise between 0% and 15% by 2050 from 2022 levels, these efficiency gains can still curb expansion prospects for oil and gas companies.

This persistent trend of conservation acts as a broad substitute for new energy demand. It compels companies such as Harvest Oil & Gas to enhance their operational efficiency to remain profitable in a market that might see its overall demand growth constrained.

Hydrogen and Alternative Fuels

Emerging alternative fuels represent a significant threat of substitutes for Harvest Oil & Gas. Technologies like green hydrogen, biofuels, and advanced battery storage are increasingly viable alternatives for sectors traditionally dependent on natural gas and refined petroleum. For instance, the European Union's commitment to an energy transition includes a substantial $300 billion investment, much of which is directed towards developing green hydrogen infrastructure and utilization.

- Green Hydrogen's Rise: Significant global investment, like the EU's €300 billion energy transition fund, is accelerating green hydrogen development, positioning it as a cleaner substitute for fossil fuels in industrial processes and transportation.

- Biofuels Advancement: Ongoing research and development in advanced biofuels are creating alternatives for road transport and aviation, potentially reducing demand for conventional gasoline and jet fuel.

- Battery Storage Impact: Improvements in battery technology and cost reductions are making electric vehicles and grid-scale energy storage more competitive, directly impacting the demand for oil and gas in transportation and power generation.

- Sectoral Substitution: While still developing, these alternatives pose a growing long-term threat, particularly in sectors like heavy industry, transportation, and power generation, which are key markets for Harvest's products.

Policy and Regulatory Environment

Government policies focused on decarbonization and climate change mitigation directly impact the threat of substitutes for Harvest Oil & Gas. Regulations like carbon pricing, stringent emissions standards, and substantial subsidies for renewable energy sources make traditional fossil fuels less economically appealing, thereby encouraging a shift towards cleaner alternatives.

While there's a global push for decarbonization, the policy landscape remains complex. For instance, in 2024, G7 nations presented a mixed picture regarding fossil fuel support. Despite this, the overarching trend points towards an accelerated adoption of alternative energy sources driven by these evolving governmental mandates.

- Policy Impact: Decarbonization policies increase the threat of substitutes by making fossil fuels less competitive.

- Regulatory Drivers: Carbon pricing and emissions standards are key mechanisms driving this shift.

- Subsidies: Financial incentives for renewables further accelerate the adoption of alternatives.

- Global Trend: Despite mixed signals from some G7 members in 2024, the long-term policy direction favors cleaner energy.

The threat of substitutes for Harvest Oil & Gas is significant, driven by the increasing competitiveness and adoption of renewable energy sources and electric vehicles. These alternatives directly challenge the demand for oil and gas products across various sectors.

Emerging technologies like green hydrogen and advanced biofuels are gaining traction, supported by substantial global investments aimed at decarbonization. For example, the EU's €300 billion energy transition fund is a key driver for green hydrogen development.

Government policies promoting decarbonization, such as carbon pricing and subsidies for renewables, further enhance the attractiveness of substitutes. While the policy landscape can be mixed, the overarching trend favors cleaner energy alternatives, impacting Harvest Oil & Gas's market position.

| Substitute | Impact on Harvest Oil & Gas | Key Trend/Data Point |

| Renewable Energy (Solar, Wind) | Reduces demand for natural gas in power generation. | Renewables supplied 30% of global electricity in 2024. |

| Electric Vehicles (EVs) | Decreases demand for gasoline and diesel. | Global road transport fuel demand growth projected at 1% (2024-2034). |

| Green Hydrogen | Offers an alternative for industrial processes and transportation. | EU investing €300 billion in energy transition, including green hydrogen. |

| Biofuels | Provides alternatives for road and air transport. | Advancements in biofuels aim to replace conventional fuels. |

Entrants Threaten

Entering the oil and gas exploration and production (E&P) sector demands substantial financial resources. This includes the costs associated with securing mineral rights, the complex process of drilling wells, and establishing the necessary infrastructure for extraction and transportation.

The sheer scale of these upfront investments creates a significant barrier, effectively limiting the number of new companies that can realistically enter the market. For context, industry capital expenditures have seen a notable increase, rising by 53% over the past four years, underscoring the immense financial commitment required.

The threat of new entrants in the oil and gas sector, particularly for companies like Harvest Oil & Gas, is significantly mitigated by the immense challenge of accessing proven reserves and acreage. Newcomers face a steep uphill battle in identifying and securing economically viable land positions, as established players often control vast tracts of prospective territory. For instance, as of early 2024, major oil companies continue to hold substantial undeveloped acreage, a legacy of decades of exploration and acquisition, making it prohibitively expensive and complex for new entities to replicate this advantage.

Established companies possess proprietary geological data and extensive experience in evaluating basins, giving them a distinct edge in pinpointing high-potential areas. This deep understanding of subsurface geology, honed over years of operation, is not easily replicated by new entrants. The most attractive and readily accessible reserves are frequently already under the control of incumbents, creating a significant barrier to entry. This existing control over prime assets means that new players must often pursue more challenging, higher-cost, or less proven areas, thereby increasing their risk profile and capital requirements.

The oil and gas sector faces substantial regulatory and environmental obstacles that significantly deter new entrants. Stringent federal, state, and local rules govern everything from environmental protection to operational safety, requiring extensive permitting and compliance efforts. These complex frameworks demand considerable time and financial investment, creating a steep climb for newcomers without established expertise and resources.

While a new federal administration might relax some drilling restrictions, the overarching regulatory landscape remains demanding. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Air Act, which impacts emissions from oil and gas operations, adding to compliance costs and complexities for any new player.

Technological Expertise and Infrastructure

The threat of new entrants in the oil and gas exploration and production (E&P) sector is significantly influenced by the substantial technological expertise and infrastructure required. Successful E&P operations demand highly specialized knowledge in fields such as seismic data interpretation, advanced drilling techniques, and sophisticated reservoir management. New companies entering the market would need to invest heavily in acquiring or developing this deep technical know-how and establishing the complex operational infrastructure, a process that is both time-consuming and capital-intensive. For instance, the average cost to drill an onshore oil well can range from $2 million to $7.5 million, with offshore wells costing considerably more.

Harvest Oil & Gas's strategic approach to bolstering production from acquired assets through operational enhancements and focused development drilling effectively creates a formidable barrier for potential new entrants. This strategy capitalizes on existing expertise and established infrastructure, making it difficult for newcomers to compete on a cost or efficiency basis. In 2023, Harvest reported a 15% increase in production from its acquired Permian Basin assets following the implementation of these operational improvements, demonstrating the value of their integrated approach.

- High Capital Investment: New entrants face substantial upfront costs for acquiring technology, talent, and physical infrastructure.

- Specialized Knowledge Gap: The need for deep technical expertise in areas like reservoir engineering and advanced drilling creates a significant entry hurdle.

- Operational Scale: Achieving economies of scale in E&P requires significant production volumes, which new entrants may struggle to reach initially.

- Regulatory Hurdles: Navigating complex environmental and operational regulations adds another layer of difficulty and cost for new players.

Economies of Scale and Experience Curve

Existing oil and gas giants leverage significant economies of scale, driving down per-unit costs in exploration, production, and refining. For instance, major integrated oil companies in 2024 often operate vast portfolios of assets, allowing for bulk purchasing of equipment and services, as well as optimized logistics. This scale provides a substantial cost advantage that new entrants, operating at a much smaller capacity, struggle to match.

Market consolidation further amplifies these advantages. As of early 2024, the trend of fewer, larger operators controlling significant drilling rig capacity means that established players can negotiate better terms and achieve greater operational efficiencies. This concentration makes it exceedingly difficult for a new company to enter the market and compete on price against these deeply entrenched entities.

An experience curve advantage also acts as a formidable barrier. Decades of accumulated knowledge in specific geological basins translate to improved drilling success rates, enhanced production techniques, and better risk management. New entrants lack this historical data and practical know-how, putting them at a distinct disadvantage in terms of efficiency and profitability from the outset.

- Economies of Scale: Major oil companies in 2024 benefit from lower per-unit costs due to large-scale operations in purchasing, logistics, and financing.

- Market Consolidation: Increased concentration of drilling rigs under fewer, larger operators enhances scale advantages for incumbents.

- Experience Curve: Established companies possess invaluable accumulated knowledge in specific basins, leading to more efficient and successful operations compared to new entrants.

The threat of new entrants for Harvest Oil & Gas is low due to the immense capital required, estimated at billions for significant exploration and production projects. New companies also face a steep learning curve and must navigate complex regulations, which can take years and substantial investment to master. For example, obtaining permits for a single new well can involve multiple agencies and extensive environmental reviews.

Established players like Harvest benefit from economies of scale, with major oil companies in 2024 often operating vast portfolios that allow for bulk purchasing and optimized logistics, driving down per-unit costs. Market consolidation further reinforces this, as fewer, larger operators control more drilling capacity, enabling better negotiation terms and operational efficiencies that are difficult for newcomers to match.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Billions of dollars needed for exploration, drilling, and infrastructure. | Extremely high, limiting the number of potential entrants. |

| Technical Expertise | Specialized knowledge in geology, reservoir engineering, and drilling. | Significant gap for new firms; requires years to develop or acquire. |

| Regulatory Compliance | Complex and time-consuming permitting and environmental regulations. | Adds significant cost and delays, favoring established, experienced companies. |

| Economies of Scale | Lower per-unit costs for established operators due to large-scale operations. | New entrants struggle to compete on cost efficiency. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Harvest Oil & Gas is built upon a robust foundation of data, including company annual reports, SEC filings, and industry-specific market research from firms like Wood Mackenzie and IHS Markit. We also incorporate macroeconomic data from sources such as the EIA and OPEC to understand broader market influences.