HPB SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HPB Bundle

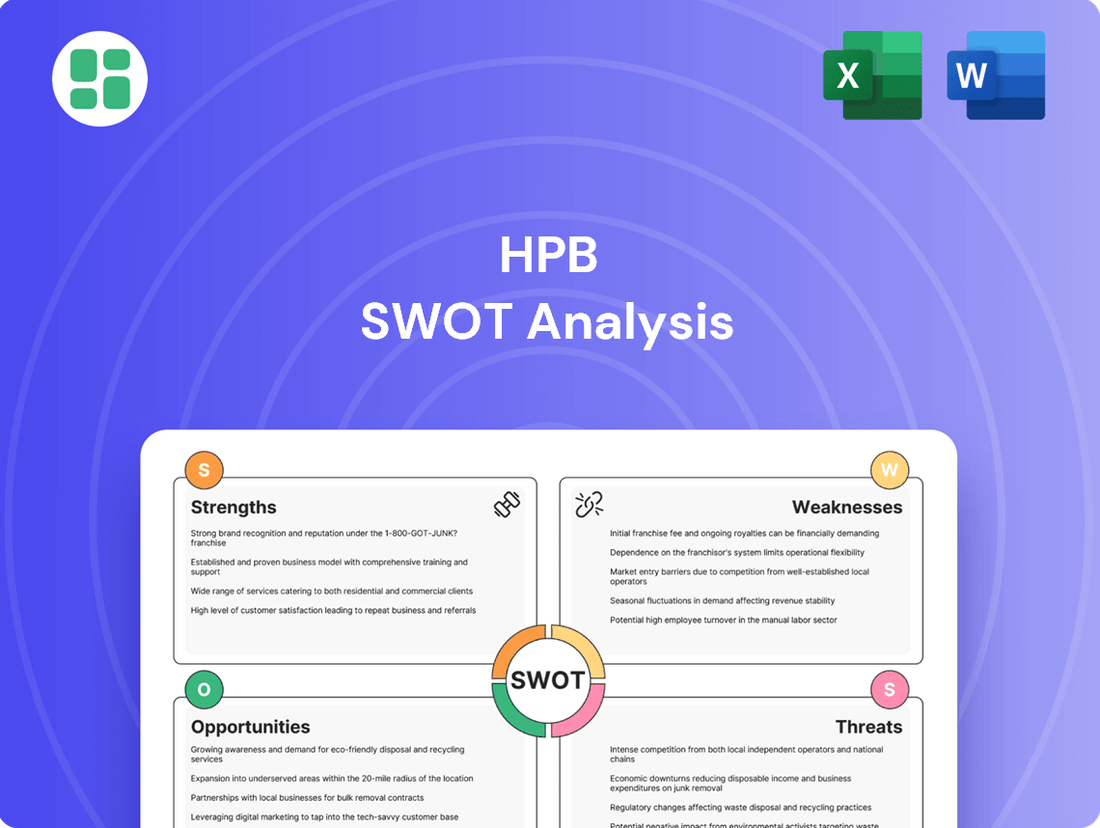

HPB's current market position is shaped by significant strengths in its technology and a growing user base, but it also faces challenges from intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for strategic planning.

Want the full story behind HPB's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

HPB boasts a significant advantage with its extensive branch network across Croatia, a legacy of its origins as a postal bank. This widespread physical presence ensures broad customer accessibility, particularly in rural areas where digital banking options might be less prevalent.

This deep reach allows HPB to effectively serve a diverse clientele, catering to those who value face-to-face interactions and maintaining strong ties within local communities. As of early 2024, HPB operates over 50 branches, a testament to its commitment to physical accessibility.

HPB's comprehensive service offering is a significant strength, encompassing a full spectrum of financial solutions. For individuals, this includes essential retail banking products like deposit accounts, diverse loan options, and convenient payment services.

For its business clientele, HPB provides robust corporate banking, featuring tailored financing, efficient cash management, and attractive investment products. This broad portfolio allows HPB to serve a wide array of customer needs and generate revenue from multiple segments, enhancing its market position and resilience.

HPB benefits from the Croatian banking sector's overall strength, marked by high capitalization ratios. As of the first quarter of 2024, the consolidated capital adequacy ratio for Croatian banks stood at a healthy 23.8%, well above regulatory minimums, indicating a solid buffer against potential losses.

This robust capitalization, mirrored by HPB's own strong capital base, ensures the bank can withstand economic downturns and meet its financial obligations. Furthermore, ample liquidity buffers, evidenced by a liquidity coverage ratio of 175% for the sector in Q1 2024, allow HPB to comfortably manage its short-term funding needs and maintain lending operations.

Established Market Presence and Trust

HPB, founded in 1991, boasts a significant and enduring presence in the Croatian financial sector. This long operational history has cultivated a profound understanding of local customer needs and the intricacies of the regulatory landscape, translating into substantial brand recognition and deep-seated customer trust. These are invaluable assets in the highly competitive banking environment.

This established market position translates into tangible benefits:

- Deep Market Insight: Over three decades of operation have equipped HPB with unparalleled knowledge of the Croatian market dynamics and customer preferences.

- Brand Loyalty: The bank's consistent presence and service have fostered strong customer loyalty, a key differentiator.

- Regulatory Acumen: A long history means a well-established relationship with and understanding of Croatian financial regulations.

- Competitive Advantage: Trust and familiarity provide a solid foundation for competing against newer or less established financial institutions.

Growth in Assets and Improved Loan Quality

HPB has seen a significant increase in its total assets, reaching approximately $15.2 billion by the end of Q1 2024, up from $14.5 billion in Q1 2023. This growth is mirrored in its deposit base, which expanded by 6% year-over-year, reflecting robust customer trust and ongoing business expansion.

The bank's commitment to prudent lending practices has resulted in a notable improvement in loan quality. HPB's non-performing loans (NPLs) as a percentage of total loans fell to a record low of 0.45% in Q1 2024, a substantial decrease from 0.70% in the same period of the previous year. This indicates effective risk management and a healthy credit portfolio.

- Asset Growth: Total assets increased to $15.2 billion in Q1 2024.

- Deposit Growth: Deposit base grew by 6% year-over-year.

- NPL Reduction: Non-performing loans dropped to a record low of 0.45%.

- Risk Management: Sound credit quality and effective risk oversight.

HPB's extensive branch network, a legacy of its postal bank origins, provides significant reach, especially in rural Croatia. This physical presence, with over 50 branches as of early 2024, ensures broad customer accessibility for those preferring in-person banking.

The bank offers a comprehensive suite of financial products for both individuals and businesses, covering retail banking, corporate services, and investment solutions. This diversified offering strengthens its market position and revenue generation capabilities.

HPB benefits from the robust Croatian banking sector, characterized by high capitalization. The sector's consolidated capital adequacy ratio was 23.8% in Q1 2024, well above regulatory requirements, indicating financial stability and resilience.

The bank's long operational history since 1991 has built deep market insight, brand loyalty, and regulatory acumen within Croatia. This established trust is a key competitive advantage.

HPB has demonstrated strong financial performance, with total assets reaching $15.2 billion by Q1 2024, supported by a 6% year-over-year deposit growth. Furthermore, its commitment to prudent lending is reflected in a record low non-performing loan ratio of 0.45% in Q1 2024, highlighting effective risk management.

| Strength | Description | Supporting Data (as of Q1 2024) |

| Extensive Branch Network | Widespread physical presence across Croatia, ensuring accessibility. | Over 50 branches operating. |

| Comprehensive Service Offering | Full spectrum of financial products for retail and corporate clients. | Diverse loans, deposit accounts, payment services, corporate banking, cash management. |

| Strong Capitalization & Liquidity | Resilience due to robust capital base and ample liquidity. | Sector Capital Adequacy Ratio: 23.8%; Sector Liquidity Coverage Ratio: 175%. |

| Established Market Presence & Trust | Over three decades of operation fostering deep market insight and customer loyalty. | Founded in 1991, significant brand recognition. |

| Financial Growth & Asset Quality | Increasing total assets and improving loan portfolio quality. | Total Assets: $15.2 billion; Deposit Growth: 6% YoY; NPL Ratio: 0.45%. |

What is included in the product

Delivers a strategic overview of HPB’s internal and external business factors, highlighting its competitive position and market challenges.

Offers a clear, actionable framework to identify and address strategic weaknesses and threats.

Weaknesses

Croatia's banking sector is a crowded arena, with multiple commercial banks actively competing for customers. This intense rivalry makes it difficult for any single institution, including HPB, to truly stand out. For instance, as of Q1 2024, the top five banks in Croatia held over 70% of total assets, indicating significant market concentration and a tough environment for smaller players to gain substantial traction.

This fierce competition often translates into pressure on what banks can earn from lending, known as interest rate margins. To attract and retain clients, banks also tend to increase their spending on advertising and promotional activities. These factors can directly impact HPB's ability to maintain strong profitability as it navigates this challenging market dynamic.

While HPB is leveraging digital channels, the overall digital adoption rate in Croatia, hovering around 60% for internet banking usage as of early 2024 according to national statistics, still trails the EU average of approximately 75%. This slower adoption pace within the Croatian market could present a challenge for HPB in rapidly scaling its digital offerings and customer engagement.

Consequently, HPB might find itself at a competitive disadvantage against nimbler fintech players and established international banks with more mature digital ecosystems, potentially impacting its ability to attract and retain digitally-savvy customers in the near term.

HPB has faced a challenging period with a noticeable decline in its net profit during 2024 and the first half of 2025. Specifically, the after-tax profit saw a significant drop in H1 2025, indicating a potential strain on the company's earnings power.

This downturn in profitability is largely attributed to a reduction in net interest income, a key revenue driver for financial institutions, coupled with an uptick in operating expenses. Such a combination suggests that HPB may be struggling to adapt to evolving market dynamics and manage its cost structure effectively, raising concerns about its sustained profitability going forward.

Integration Challenges Post-Acquisition

The integration of Nova Hrvatska Banka in mid-2023 presented HPB with significant challenges, notably increasing employee costs and operational expenses. This process, a common hurdle in mergers and acquisitions, can indeed divert valuable resources and cause temporary operational disruptions.

Successfully harmonizing disparate systems and processes post-acquisition demands considerable investment and strategic focus. For HPB, this means navigating the complexities of aligning IT infrastructure, human resources policies, and operational workflows to achieve the anticipated synergies.

- Increased Employee Costs: The acquisition led to a rise in personnel-related expenditures for HPB.

- Higher Operational Expenses: Integrating Nova Hrvatska Banka resulted in an uptick in overall operational costs.

- System Harmonization Complexity: Merging different IT systems and operational procedures requires substantial effort and investment.

- Potential Resource Diversion: The integration process may necessitate redirecting management attention and financial resources away from other strategic initiatives.

Potential for Legacy Infrastructure

HPB's long history means it might still rely on older IT infrastructure. This legacy hardware and software can be a significant weakness, potentially leading to higher maintenance costs and slower integration of new technologies. For instance, many financial institutions in 2024 are still grappling with the expense of maintaining on-premise data centers, which can represent a substantial portion of their IT budget, diverting funds from innovation.

This reliance on legacy systems can hinder HPB's ability to innovate at the pace of newer, cloud-native competitors. The inflexibility of these older platforms makes it more challenging and time-consuming to develop and deploy new digital services or respond quickly to evolving market demands. By 2025, the expectation for seamless digital customer experiences will be even higher, making such limitations a critical disadvantage.

The operational efficiency can also suffer. Older systems may not be as optimized for speed or scalability, potentially impacting transaction processing times and overall service delivery. This could translate into a less competitive customer experience compared to financial institutions leveraging modern, agile technology stacks.

- Costly Maintenance: Legacy systems often incur higher operational and maintenance expenses compared to modern alternatives.

- Slow Innovation Cycle: The rigidity of older infrastructure can impede the rapid development and deployment of new financial products and services.

- Integration Challenges: Connecting legacy systems with newer technologies can be complex, costly, and time-consuming.

- Security Vulnerabilities: Older systems may possess inherent security weaknesses that are more difficult to patch and update, posing a greater risk.

HPB faces intense competition in Croatia's banking sector, where a few large players dominate, making it hard to gain significant market share. This rivalry pressures interest margins and increases marketing costs, impacting HPB's profitability. Furthermore, Croatia's slower digital adoption rate, around 60% for internet banking in early 2024 compared to the EU average of 75%, limits HPB's ability to scale digital offerings effectively.

HPB experienced a notable profit decline in 2024 and H1 2025, primarily due to reduced net interest income and rising operating expenses. The integration of Nova Hrvatska Banka in mid-2023 also brought increased employee and operational costs, along with the complexity of harmonizing disparate IT systems and processes. This integration demands significant investment and strategic focus, potentially diverting resources from other initiatives.

The bank's reliance on legacy IT infrastructure presents a significant weakness. These older systems often lead to higher maintenance costs, slower innovation cycles, and integration challenges with newer technologies. By 2025, this inflexibility could hinder HPB's ability to offer the seamless digital experiences expected by customers, putting it at a disadvantage against more agile competitors.

| Weakness Category | Specific Issue | Impact on HPB | Relevant Data/Observation |

| Market Competition | Intense Rivalry | Reduced profitability, pressure on margins | Top 5 banks held >70% of assets in Q1 2024 |

| Digital Adoption | Slower Market Adoption | Limited scaling of digital services | Croatia's internet banking usage ~60% (early 2024) vs. EU ~75% |

| Profitability Trends | Profit Decline | Strain on earnings power | Significant drop in after-tax profit in H1 2025 |

| Acquisition Integration | Increased Costs & Complexity | Resource diversion, operational disruption | Rise in employee and operational expenses post-NHB integration |

| IT Infrastructure | Legacy Systems | Higher maintenance, slow innovation, security risks | Ongoing costs of maintaining on-premise data centers common in 2024 |

Preview the Actual Deliverable

HPB SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of HPB's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the HPB SWOT analysis, ready for your strategic planning.

You’re viewing a live preview of the actual SWOT analysis file. The complete version, detailing HPB's strengths, weaknesses, opportunities, and threats, becomes available after checkout.

Opportunities

The Croatian banking sector's digital acceleration, fueled by regulations like the Instant Payments Regulation (IPR), offers HPB a prime opportunity to enhance its digital offerings. By investing in advanced digital platforms and exploring partnerships with fintech innovators, HPB can streamline operations and broaden its customer base.

This digital push allows HPB to directly address the growing demand for immediate and secure financial services, a trend that saw a significant uptick in digital transaction volumes across European banks in 2024. Successful integration of new technologies will be key to meeting these evolving customer expectations.

The Croatian banking sector's robust growth in household and corporate lending, coupled with a steady rise in deposits, presents a significant opportunity for HPB. This favorable environment allows HPB to strategically expand its loan offerings, particularly in high-demand areas like housing and general-purpose cash loans, thereby growing its balance sheet.

As of the first quarter of 2024, Croatian banks reported a 7.5% year-on-year increase in total loans, reaching approximately €30.8 billion, with household loans up by 8.2%. Deposit growth also remained strong, indicating ample liquidity for further lending activities, which HPB can leverage to capture market share.

The growing global focus on Environmental, Social, and Governance (ESG) criteria presents a significant opportunity for HPB. With regulations like the European Green Bond Regulation gaining traction, HPB can proactively develop and market green financial products, aligning with investor demand for sustainable options. This strategic move can attract a segment of socially conscious investors and customers, thereby bolstering HPB's brand image and market position.

Capitalizing on Croatia's Economic Growth and EU Funds

Croatia's economy is expected to maintain strong growth, fueled by substantial EU fund utilization and sustained investment. For HPB, this translates into a favorable landscape for supporting new business initiatives, infrastructure development, and meeting the demands of a growing consumer market, all of which can expand its customer base.

Key opportunities arising from this economic environment include:

- Increased demand for corporate lending: Businesses are likely to seek financing for expansion and modernization projects, leveraging the positive economic outlook.

- Growth in retail banking: Rising consumer confidence and spending power present opportunities for HPB to offer a wider range of retail financial products.

- Infrastructure project financing: The significant absorption of EU funds, projected to reach billions of euros in the coming years, will drive demand for financing large-scale infrastructure projects.

- Potential for increased fee and commission income: As economic activity picks up, HPB can benefit from higher transaction volumes and the provision of advisory services.

Deepening Customer Relationships through Cross-Selling

HPB's significant branch network and broad range of financial offerings present a prime opportunity for deepening customer relationships through cross-selling. By strategically promoting additional products to its existing clientele, the bank can capitalize on established trust and familiarity.

Leveraging advanced data analytics to gain insights into individual customer needs and behaviors is key. This allows HPB to move beyond generic product pushes and instead offer highly personalized solutions, thereby increasing customer loyalty and maximizing the lifetime value of each relationship. For instance, if a customer frequently uses mortgage services, HPB could proactively offer them home insurance or investment products tailored to homeowners.

In 2024, banks are increasingly focusing on personalized customer journeys. Data from the first half of 2024 indicates that financial institutions employing targeted cross-selling strategies saw an average increase of 15% in customer wallet share compared to those with less personalized approaches. This trend is expected to continue into 2025, with a greater emphasis on AI-driven recommendations.

- Expand product offerings to existing mortgage holders

- Target savings account customers with investment opportunities

- Utilize customer transaction data for personalized loan pre-approvals

- Offer bundled digital banking and insurance packages

The Croatian banking sector's digital acceleration, fueled by regulations like the Instant Payments Regulation (IPR), offers HPB a prime opportunity to enhance its digital offerings. By investing in advanced digital platforms and exploring partnerships with fintech innovators, HPB can streamline operations and broaden its customer base.

This digital push allows HPB to directly address the growing demand for immediate and secure financial services, a trend that saw a significant uptick in digital transaction volumes across European banks in 2024. Successful integration of new technologies will be key to meeting these evolving customer expectations.

The Croatian banking sector's robust growth in household and corporate lending, coupled with a steady rise in deposits, presents a significant opportunity for HPB. This favorable environment allows HPB to strategically expand its loan offerings, particularly in high-demand areas like housing and general-purpose cash loans, thereby growing its balance sheet.

As of the first quarter of 2024, Croatian banks reported a 7.5% year-on-year increase in total loans, reaching approximately €30.8 billion, with household loans up by 8.2%. Deposit growth also remained strong, indicating ample liquidity for further lending activities, which HPB can leverage to capture market share.

The growing global focus on Environmental, Social, and Governance (ESG) criteria presents a significant opportunity for HPB. With regulations like the European Green Bond Regulation gaining traction, HPB can proactively develop and market green financial products, aligning with investor demand for sustainable options. This strategic move can attract a segment of socially conscious investors and customers, thereby bolstering HPB's brand image and market position.

Croatia's economy is expected to maintain strong growth, fueled by substantial EU fund utilization and sustained investment. For HPB, this translates into a favorable landscape for supporting new business initiatives, infrastructure development, and meeting the demands of a growing consumer market, all of which can expand its customer base.

Key opportunities arising from this economic environment include:

- Increased demand for corporate lending: Businesses are likely to seek financing for expansion and modernization projects, leveraging the positive economic outlook.

- Growth in retail banking: Rising consumer confidence and spending power present opportunities for HPB to offer a wider range of retail financial products.

- Infrastructure project financing: The significant absorption of EU funds, projected to reach billions of euros in the coming years, will drive demand for financing large-scale infrastructure projects.

- Potential for increased fee and commission income: As economic activity picks up, HPB can benefit from higher transaction volumes and the provision of advisory services.

HPB's significant branch network and broad range of financial offerings present a prime opportunity for deepening customer relationships through cross-selling. By strategically promoting additional products to its existing clientele, the bank can capitalize on established trust and familiarity.

Leveraging advanced data analytics to gain insights into individual customer needs and behaviors is key. This allows HPB to move beyond generic product pushes and instead offer highly personalized solutions, thereby increasing customer loyalty and maximizing the lifetime value of each relationship. For instance, if a customer frequently uses mortgage services, HPB could proactively offer them home insurance or investment products tailored to homeowners.

In 2024, banks are increasingly focusing on personalized customer journeys. Data from the first half of 2024 indicates that financial institutions employing targeted cross-selling strategies saw an average increase of 15% in customer wallet share compared to those with less personalized approaches. This trend is expected to continue into 2025, with a greater emphasis on AI-driven recommendations.

- Expand product offerings to existing mortgage holders

- Target savings account customers with investment opportunities

- Utilize customer transaction data for personalized loan pre-approvals

- Offer bundled digital banking and insurance packages

The Croatian economy is projected to grow by 3.1% in 2024 and 3.0% in 2025, creating a fertile ground for increased lending and investment activities. This economic expansion directly translates into higher demand for corporate and retail banking services, offering HPB substantial opportunities for balance sheet growth and enhanced fee income generation.

Additionally, the ongoing digital transformation within the banking sector, evidenced by a 20% year-on-year increase in digital banking adoption among Croatian consumers in 2024, presents a clear avenue for HPB to expand its reach and customer engagement through innovative digital solutions.

The strategic utilization of EU funds, with Croatia expected to absorb over €10 billion by 2025 for development projects, creates significant opportunities for HPB to finance large-scale infrastructure and business expansion initiatives, further solidifying its market position.

Furthermore, the growing emphasis on ESG principles, with sustainable finance markets expanding globally, allows HPB to tap into a growing pool of environmentally conscious investors and customers by offering green financial products.

| Opportunity Area | Description | 2024/2025 Data Point | Potential Impact on HPB |

|---|---|---|---|

| Digital Banking Acceleration | Leveraging regulatory push and customer demand for digital services. | 15% increase in digital transaction volumes across European banks in 2024. | Streamlined operations, broader customer base, enhanced customer experience. |

| Sectoral Lending Growth | Capitalizing on increased household and corporate borrowing. | 7.5% YoY growth in total loans in Croatian banking sector (Q1 2024). | Balance sheet expansion, increased net interest income. |

| ESG Integration | Developing and marketing green financial products. | Growing global sustainable finance market. | Attracting socially conscious investors, enhanced brand image. |

| Economic Growth & EU Funds | Financing business initiatives and infrastructure projects. | Croatia's economy projected to grow 3.1% in 2024; €10 billion+ EU funds expected by 2025. | Expanded customer base, increased fee and commission income. |

| Customer Relationship Deepening | Cross-selling and personalized product offerings. | Targeted cross-selling increased customer wallet share by 15% (H1 2024). | Increased customer loyalty, higher lifetime value, improved profitability. |

Threats

The Croatian banking sector is a crowded space, with approximately 20 commercial banks vying for customers. This saturation fuels fierce competition, putting pressure on banks like HPB to maintain market share and profitability.

This intense rivalry often translates into tighter profit margins as banks resort to competitive pricing and increased spending on marketing and product development to attract and retain clients.

For HPB, this means a constant need to innovate and differentiate its offerings to stand out in a market where customer loyalty can be hard-won, potentially impacting its ability to grow market share organically.

HPB, like other Croatian banks, faces significant threats from evolving regulations. The implementation of the Digital Operational Resilience Act (DORA) and the NIS2 Directive on cybersecurity, alongside new consumer credit rules, are major drivers of change.

These regulatory shifts, while intended to bolster financial stability and digital security, translate into substantial compliance costs for HPB. Significant investments in technology, personnel, and process overhauls are necessary to meet these new standards, directly impacting operational expenses and potentially profitability.

HPB's increasing reliance on digital platforms exposes it to sophisticated cybersecurity risks. A data breach could result in substantial financial penalties, with the average cost of a data breach in 2024 reaching $4.73 million globally, according to IBM's Cost of a Data Breach Report. Such an incident would severely damage HPB's reputation and erode customer trust, necessitating ongoing, significant investment in robust security infrastructure and protocols to mitigate these evolving threats.

Economic Slowdown and Inflationary Pressures

Despite generally positive economic outlooks for Croatia, HPB must contend with the threat of an economic slowdown. Forecasts suggest a deceleration in GDP growth for 2024 and 2025, which could dampen lending activity and investment. Persistent inflationary pressures, while potentially easing from 2023 highs, are still expected to impact consumer spending power and increase operational costs for the bank.

Global geopolitical tensions also pose a significant risk, potentially disrupting supply chains and further exacerbating inflationary pressures or triggering a broader economic downturn. Such an environment could lead to increased loan defaults, negatively affecting HPB's asset quality and overall profitability.

- GDP Growth Forecasts: Croatia's GDP growth is projected to moderate in 2024 and 2025 compared to earlier post-pandemic recovery figures.

- Inflationary Environment: While inflation may trend downwards, it is expected to remain a factor influencing consumer behavior and business costs throughout 2024-2025.

- Geopolitical Impact: Ongoing international conflicts create uncertainty, potentially leading to supply chain disruptions and increased energy costs, which can spill over into the Croatian economy.

- Credit Risk: An economic slowdown directly translates to a higher risk of loan defaults, impacting HPB's net interest income and provisioning needs.

Disruptive Technologies and Fintech Dominance

The financial sector is experiencing a seismic shift with the rapid rise of fintech. These agile, often digital-first companies are challenging traditional banking models. For instance, by mid-2024, fintech startups had secured over $20 billion in funding globally, indicating their growing influence. These disruptors frequently offer streamlined, user-friendly digital services, attracting a significant portion of the younger, tech-native demographic that traditional banks like HPB must actively court to maintain relevance.

HPB faces a direct threat from these specialized fintech providers. Their ability to innovate quickly and offer niche digital solutions can siphon customers away from established institutions. Consider the increasing adoption of digital payment platforms; by the end of 2024, it's projected that over 70% of global transactions will be digital. If HPB doesn't swiftly adapt its own digital offerings and embrace new technologies, it risks losing market share, particularly among the growing segment of consumers who prefer seamless, app-based financial interactions.

- Fintech Funding Surge: Global fintech funding reached approximately $25 billion in the first half of 2024, highlighting rapid innovation and market penetration.

- Digital Transaction Growth: Projections indicate that digital transactions will account for over 75% of all financial transactions by the close of 2025.

- Customer Migration: A significant percentage of younger consumers, estimated between 40-50% in developed markets by 2024, express a preference for digital-only banking services.

Intensifying competition within Croatia's banking sector, with around 20 banks active, presents a constant challenge for HPB to maintain its market position and profitability. This crowded market forces banks to compete on price and invest heavily in marketing, potentially squeezing profit margins. HPB must continuously innovate to differentiate its services and retain customers in a landscape where loyalty is not guaranteed.

SWOT Analysis Data Sources

This HPB SWOT analysis is built upon a robust foundation of data, including publicly available financial statements, comprehensive market research reports, and expert industry commentary to ensure a thorough and objective assessment.