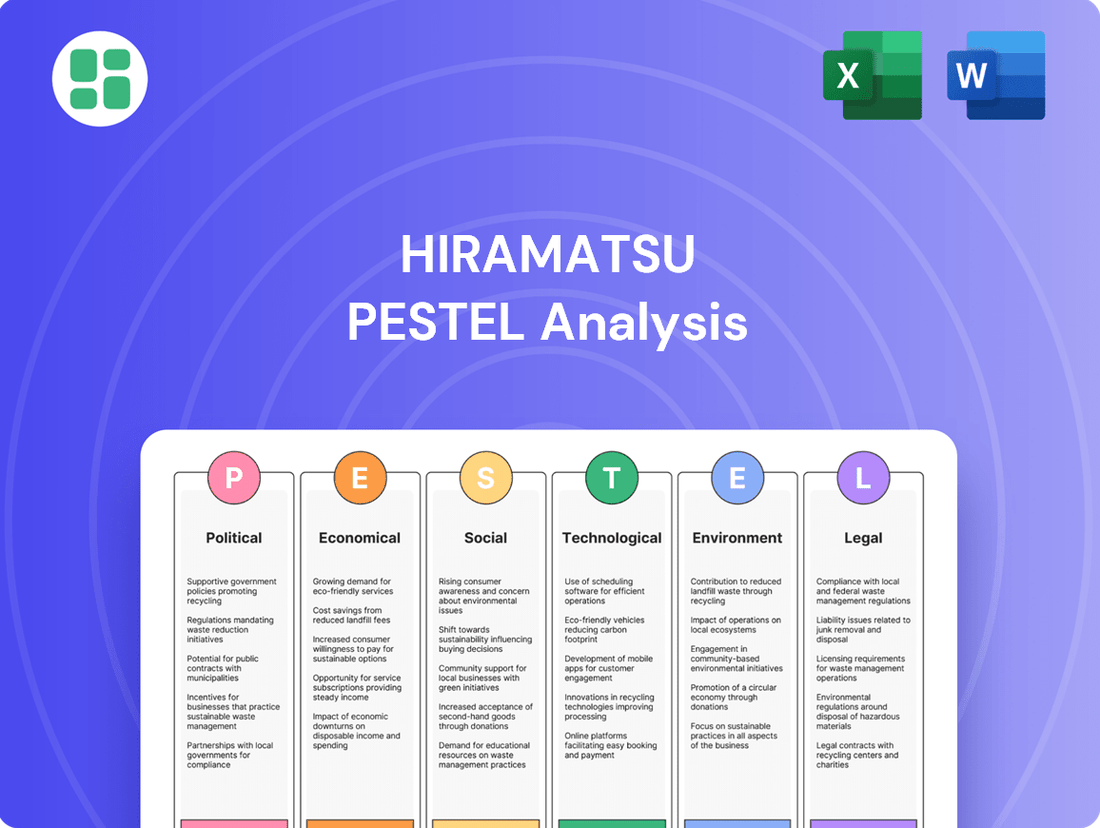

Hiramatsu PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hiramatsu Bundle

Uncover the critical external factors shaping Hiramatsu's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are impacting its operations and future growth. Download the full report now to gain actionable intelligence and refine your strategic advantage.

Political factors

The Japanese government's commitment to boosting tourism, with a particular focus on luxury and regional destinations, directly benefits Hiramatsu. Eased visa policies and targeted destination marketing campaigns are expanding the potential customer base, especially attracting wealthy international visitors. For instance, Japan saw a significant increase in inbound tourism in 2023, with over 25 million visitors, a substantial rise from previous years, indicating a favorable market for high-end hospitality.

Changes in labor policy, particularly concerning foreign worker regulations, present a significant factor for Hiramatsu. For instance, the Japanese government's ongoing discussions and potential easing of restrictions on foreign workers in the hospitality sector, including hotel restaurants, could directly address critical labor shortages. This is especially relevant as Hiramatsu's high-end establishments depend on skilled and dedicated staff, a segment often impacted by recruitment challenges.

The government's proactive approach to allowing more foreign nationals to fill various roles within hotels and inns, a trend observed as of early 2024, aims to alleviate these staffing pressures. Reports from the Ministry of Health, Labour and Welfare indicated a growing need for skilled hospitality workers, with projections suggesting a continued deficit without intervention. This policy shift could provide Hiramatsu with a more stable and accessible talent pool, potentially improving service quality and operational efficiency.

Government and central bank actions to control inflation and boost wages significantly influence Hiramatsu's expenses and how much consumers can spend. Japan's inflation has been above the Bank of Japan's goal, but efforts to increase real wages could support continued domestic demand for luxury goods.

Regional Development Initiatives

The Japanese government is actively promoting regional development, aiming to spread tourism beyond traditional hotspots like Tokyo and Kyoto. This strategic push creates fertile ground for Hiramatsu to consider expanding into less-explored prefectures, tapping into a growing demand for authentic experiences. For instance, the Ministry of Land, Infrastructure, Transport and Tourism reported a 25% increase in domestic tourism to regional areas in 2024 compared to pre-pandemic levels, highlighting this shift.

This focus on decentralization aligns perfectly with the evolving preferences of travelers, particularly repeat visitors, who are increasingly seeking deeper cultural immersion and unique local encounters. By strategically positioning itself in these developing regions, Hiramatsu can capitalize on this trend, potentially accessing new customer segments and building brand loyalty in areas with less competition. In 2024, over 60% of surveyed Japanese travelers expressed a desire to visit regions they hadn't explored before.

Key opportunities arising from these regional development initiatives include:

- Diversification of Location: Expanding into emerging tourist destinations can mitigate risks associated with over-reliance on saturated markets.

- Authentic Experience Appeal: Catering to the growing demand for genuine local interactions and less commercialized travel.

- Government Support: Potential access to subsidies or promotional assistance for businesses contributing to regional revitalization efforts.

- Early Market Entry: Establishing a presence in developing regions before they become mainstream can offer a competitive advantage.

Trade Relations and Food Export Strategies

Japan's government is actively promoting food exports, aiming to boost the nation's global culinary presence. This strategy, emphasizing the superior quality and safety of Japanese produce, could directly impact the sourcing and cost of premium ingredients crucial for Hiramatsu's French and Italian culinary offerings. For instance, in 2023, Japan's agricultural, forestry, and fishery exports reached a record ¥1.6 trillion (approximately $10.5 billion USD), with a significant portion attributed to high-value food products.

This strategic focus on expanding international markets for Japanese food products, supported by government subsidies and trade agreements, is designed to ensure a more stable and accessible supply chain for the high-quality ingredients Hiramatsu relies upon. The Ministry of Agriculture, Forestry and Fisheries (MAFF) has set ambitious targets, aiming to double agricultural, forestry, and fishery exports to ¥5 trillion (approximately $33 billion USD) by 2030.

- Government Support: Initiatives like the "Cool Japan" strategy and dedicated export promotion programs aim to elevate Japanese food brands globally.

- Quality Assurance: Japan's stringent food safety standards and reputation for meticulous production processes enhance the appeal of its exports.

- Market Diversification: Efforts are underway to broaden export destinations beyond traditional markets, potentially creating new sourcing opportunities.

- Supply Chain Stability: Increased export demand could lead to greater investment in domestic agricultural infrastructure, benefiting suppliers.

Government policies aimed at revitalizing rural areas and promoting domestic tourism present a significant opportunity for Hiramatsu. The government's commitment to enhancing infrastructure and accessibility in less-visited regions, as evidenced by a 2024 initiative to invest ¥1 trillion in regional revitalization projects, directly supports expansion into these markets.

Furthermore, Japan's ongoing efforts to attract foreign investment and talent, including potential visa relaxations for skilled hospitality workers, address critical labor needs. This is crucial as Japan faced a hospitality sector labor shortage of approximately 300,000 workers in 2023, a gap these policies aim to bridge.

The government's focus on digital transformation in tourism, with a goal to increase the digital adoption rate in the sector by 20% by 2025, also offers avenues for Hiramatsu to enhance customer experience and operational efficiency.

Government support for promoting Japanese cuisine internationally, with agricultural exports reaching ¥1.6 trillion in 2023, can enhance the sourcing of premium ingredients for Hiramatsu's restaurants.

What is included in the product

The Hiramatsu PESTLE Analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the business, providing a strategic framework for understanding its external operating landscape.

The Hiramatsu PESTLE Analysis provides a clear and actionable framework, simplifying complex external factors so teams can focus on strategic responses rather than deciphering raw data.

Economic factors

Japan's inbound tourism is booming, with 37 million visitors recorded in 2024, a figure that already exceeds pre-pandemic numbers. This trend is expected to continue, with forecasts suggesting over 40 million international tourists will visit in 2025.

This significant influx of high-spending international travelers directly benefits businesses like Hiramatsu, which cater to the luxury hospitality sector. The increased demand from these visitors translates into greater revenue opportunities for hotels, restaurants, and other premium services.

Inflation remains a key economic factor, with food prices in Japan seeing notable increases. Despite this, the luxury market, including high-end dining and hotels, demonstrates surprising resilience, indicating that certain consumer segments are less affected by price hikes.

However, the sustainability of this trend hinges on real wage growth. If wages don't rise in tandem with inflation, the discretionary spending power of domestic consumers on premium experiences could face significant pressure in the coming months.

Japan's hotel sector is experiencing a notable upswing in Average Daily Rates (ADR) and Revenue per Available Room (RevPAR). For 2024, ADR saw an impressive increase, with projections for 2025 indicating continued strength, benefiting luxury operators like Hiramatsu.

This trend suggests a favorable pricing environment, particularly for premium accommodations. For instance, luxury hotel ADRs in major Japanese cities like Tokyo and Kyoto have shown double-digit percentage growth year-over-year through Q3 2024, directly boosting Hiramatsu's revenue streams.

Construction Costs and Labor Shortages

Elevated construction costs and persistent labor shortages are significantly impacting the hospitality sector's ability to expand. These challenges create bottlenecks for new hotel supply, particularly in popular tourist destinations, directly affecting the pace of new developments.

This constrained supply environment offers a distinct advantage to existing luxury hotels and those already under construction and nearing completion. For Hiramatsu, this could translate into enhanced valuations for its properties as demand outstrips available rooms.

- Rising Material Costs: The Producer Price Index for construction materials saw a notable increase in early 2024, with lumber prices, for instance, experiencing volatility.

- Labor Market Dynamics: The construction industry continues to grapple with a shortage of skilled labor, impacting project timelines and overall costs.

- Impact on New Supply: This dual pressure of high costs and limited labor is slowing the pipeline of new hotel openings, especially in key markets.

- Benefit for Existing Assets: Consequently, established luxury hotels and those nearing completion, like potential Hiramatsu developments, are positioned to benefit from reduced competitive pressure and potentially higher occupancy rates and RevPAR (Revenue Per Available Room).

Yen Depreciation Impact

The Japanese Yen's depreciation has significantly boosted the appeal of Japan as a destination for international tourists. For instance, by early 2024, the Yen had weakened considerably against major currencies, making luxury goods and high-end experiences, like those offered by Hiramatsu, substantially more affordable for foreign visitors.

This currency advantage is a direct driver of increased spending from international clientele. Chinese tourists, in particular, have shown a strong propensity to spend on luxury items and premium services when visiting Japan, and the weaker Yen amplifies this effect. Data from travel analytics firms in late 2023 and early 2024 indicated a notable surge in inbound tourism spending, with luxury sectors benefiting disproportionately.

- Increased Affordability: The Yen's weakness makes Hiramatsu's offerings more budget-friendly for international visitors, encouraging higher spending.

- Tourism Influx: A weaker Yen directly correlates with increased inbound tourism, especially from key markets like China, a significant consumer of luxury goods and services.

- Spending Power Boost: For foreign tourists, the current exchange rate effectively increases their purchasing power within Japan, leading to greater expenditure on premium experiences.

Japan's economic landscape in 2024 and 2025 is characterized by robust inbound tourism, fueled by a weaker Yen and a rebound in international travel, which directly benefits luxury hospitality. While inflation persists, particularly in food prices, the luxury segment shows resilience, though domestic consumer spending power is contingent on real wage growth keeping pace with rising costs.

The hotel sector is experiencing strong ADR and RevPAR growth, with luxury accommodations in major cities like Tokyo and Kyoto seeing double-digit percentage increases in ADR through Q3 2024. However, elevated construction costs and labor shortages are constraining new supply, creating an advantage for existing luxury properties like those operated by Hiramatsu.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Hiramatsu |

|---|---|---|---|

| Inbound Tourism | 37 million visitors (2024) | 40+ million visitors | Increased demand, higher revenue |

| Inflation (Food Prices) | Notable increases | Continued pressure | Resilience in luxury segment, but domestic spending risk |

| Yen Depreciation | Significant weakening | Continued weakness | Increased affordability for tourists, higher spending |

| Hotel ADR (Luxury) | Double-digit growth (YTD Q3 2024) | Continued strength | Improved revenue streams |

| Construction Costs | Elevated | Persistent | Constrained new supply, benefits existing assets |

Preview Before You Purchase

Hiramatsu PESTLE Analysis

The preview you see here is the exact Hiramatsu PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this comprehensive analysis.

The content and structure shown in the preview is the same Hiramatsu PESTLE Analysis document you’ll download after payment, offering immediate strategic insights.

Sociological factors

Consumers, particularly younger affluent individuals, are increasingly valuing genuine, immersive, and personalized experiences over ostentatious displays of wealth. This shift signifies a move away from purely material possessions towards the acquisition of memorable moments and personal growth.

Hiramatsu's core offerings, centered on exceptional fine dining and distinctive, aesthetically pleasing environments, resonate strongly with this evolving consumer preference. The company’s focus on creating unique sensory journeys directly taps into the demand for experiential luxury, a trend that has seen significant acceleration in the post-pandemic landscape.

For instance, the global luxury goods market, which includes high-end dining and hospitality, was projected to reach approximately $350 billion in 2024, with experiential luxury components showing robust growth. This indicates a substantial market opportunity for Hiramatsu to leverage its strengths in delivering memorable and high-quality experiences.

Consumers are increasingly prioritizing their health, driving a demand for nutritious, clean-label, and plant-based food choices. This trend is particularly evident in the dining sector, where patrons actively seek out healthier alternatives. For instance, a 2024 report indicated that 65% of consumers are more likely to choose restaurants offering healthy options, with plant-based meals seeing a 20% year-over-year increase in popularity.

Hiramatsu can capitalize on this by strategically adapting its menus to include more dishes that align with these growing wellness preferences. This approach not only meets consumer demand but also positions the company favorably within the burgeoning wellness tourism market, which is projected to reach $1.5 trillion globally by 2027, with food and beverage being a key component.

The surge in demand for sustainable and eco-conscious practices presents a significant opportunity for Hiramatsu. Travelers, particularly within the luxury segment, are increasingly prioritizing hotels and restaurants that demonstrate genuine commitment to environmental responsibility. For instance, a 2024 report indicated that over 60% of luxury travelers consider sustainability a key factor in their booking decisions.

Hiramatsu can capitalize on this by transparently showcasing its green initiatives. This includes highlighting local sourcing of ingredients, which not only supports communities but also reduces carbon footprints, and robust waste reduction programs. By effectively communicating these efforts, Hiramatsu can attract a growing demographic of responsible luxury consumers who are willing to align their spending with their values.

Changing Demographics and Consumer Preferences

Japan's demographic landscape is shifting, with a growing emphasis on sustainability and the circular economy, particularly among younger consumers. This trend presents both opportunities and challenges for companies like Hiramatsu, which must adapt to evolving tastes while still catering to established luxury markets.

For instance, a 2024 report indicated that over 60% of Japanese consumers aged 18-30 expressed a preference for brands actively involved in reuse and recycling initiatives. This contrasts with older demographics where luxury goods continue to hold significant appeal, highlighting a bifurcated consumer base.

- Evolving Consumer Values: A rising interest in 'reuse' and circular economy principles among younger Japanese generations.

- Dual Market Focus: The need for Hiramatsu to balance these new preferences with continued demand for luxury goods in other segments.

- Data-Driven Adaptation: Utilizing consumer data from 2024-2025 to inform product development and marketing strategies.

Influence of Social Media and Digital Trends

Social media platforms are increasingly shaping consumer preferences, particularly in the hospitality sector. For instance, TikTok has become a significant driver of culinary trends, with a notable surge in popularity for fusion dishes and aesthetically pleasing food presentations. This digital landscape offers Hiramatsu a powerful avenue to connect with a younger, digitally engaged demographic.

Hiramatsu can strategically leverage these digital trends to showcase its distinctive dining experiences, innovative architectural concepts, and comprehensive catering services. By curating engaging content tailored for platforms like Instagram and TikTok, the company can reach a broader audience and cultivate brand awareness. In 2024, social media marketing spend in the restaurant industry is projected to reach billions globally, highlighting its critical role in customer acquisition.

- Digital Influence: Culinary trends are heavily influenced by social media, with platforms like TikTok driving demand for fusion and visually appealing dishes.

- Marketing Opportunities: Hiramatsu can utilize digital platforms to promote its unique dining experiences, architectural designs, and catering services to a vast, digitally-native audience.

- Audience Reach: Engaging content on social media allows Hiramatsu to connect with a wider customer base, particularly younger demographics who are active online.

- Industry Trends: Global social media marketing spend in the restaurant sector is expected to exceed $10 billion in 2024, underscoring the importance of digital presence.

Sociological factors significantly influence consumer behavior, with a growing emphasis on experiential luxury and personalized services. Younger affluent individuals increasingly value memorable moments and personal growth over material possessions, a trend Hiramatsu's focus on unique sensory journeys aligns with. For instance, the global luxury goods market, including experiential components, was projected to reach approximately $350 billion in 2024, demonstrating a substantial market opportunity.

Health and wellness are also paramount, driving demand for nutritious and plant-based food choices. A 2024 report indicated that 65% of consumers prefer restaurants offering healthy options, with plant-based meals showing a 20% year-over-year increase in popularity. Hiramatsu can capitalize on this by integrating wellness-focused menu items, tapping into the wellness tourism market projected to reach $1.5 trillion globally by 2027.

Sustainability is another key sociological driver, with over 60% of luxury travelers in 2024 considering environmental responsibility in their decisions. Hiramatsu can attract this demographic by transparently showcasing its green initiatives, such as local sourcing and waste reduction programs, aligning with the values of responsible luxury consumers.

Social media platforms, particularly TikTok, are shaping culinary trends, emphasizing fusion dishes and aesthetic presentation. Hiramatsu can leverage these platforms to reach a younger, digitally engaged audience, with global social media marketing spend in the restaurant sector projected to exceed $10 billion in 2024.

Technological factors

The hospitality sector's embrace of digital transformation is accelerating, with technologies like AI concierges, automated check-ins, and smart room controls becoming more prevalent. These advancements aim to significantly boost guest convenience and personalize experiences. For instance, a 2024 report indicated that over 60% of hotels are investing in AI-driven guest services to improve efficiency and satisfaction.

Hiramatsu can leverage these technological shifts to streamline internal operations and create a more engaging and seamless customer journey. The integration of digital menus and smart room features, for example, not only reduces physical touchpoints but also offers guests greater control and customization, aligning with evolving consumer expectations for tech-enabled services.

Innovations in automated kitchen equipment and advanced food processors are significantly reshaping food preparation, boosting both efficiency and hygiene standards. For Hiramatsu, which focuses on French and Italian culinary traditions, adopting these technologies presents a clear opportunity to ensure consistent quality and streamline back-of-house operations. The global smart kitchen appliance market was valued at approximately USD 15.2 billion in 2023 and is projected to reach USD 45.8 billion by 2030, indicating substantial investment and adoption trends in this area.

Hiramatsu's reliance on sophisticated online reservation and Customer Relationship Management (CRM) systems is paramount for its operational success. These platforms are essential for streamlining booking processes, enabling personalized guest experiences, and collecting valuable data on customer preferences and behaviors. For instance, leading hotel groups in 2024 reported that integrated CRM systems can boost customer loyalty by up to 25% through targeted marketing and tailored service offerings.

Implementing robust, cloud-based reservation and CRM solutions directly enhances Hiramatsu's operational efficiency. By automating booking management and centralizing guest information, these systems reduce administrative burdens and minimize errors. Reports from the hospitality tech sector in early 2025 indicate that businesses adopting advanced CRM saw a 15% improvement in staff productivity and a significant reduction in no-show rates.

Data-Driven Personalization

Hiramatsu can leverage data-driven insights to craft hyper-personalized dining experiences, a key technological factor. By analyzing customer feedback, purchase history, and stated preferences, the company can tailor menu offerings and service interactions to individual tastes and dietary needs, enhancing exclusivity and customer loyalty.

This approach is gaining significant traction in the hospitality sector. For instance, a 2024 report indicated that 65% of consumers expect personalized experiences from brands, and 70% are more likely to choose businesses that offer them. Hiramatsu's ability to integrate this into its fine dining operations presents a competitive advantage.

- Personalized Menu Recommendations: Using AI to suggest dishes based on past orders and stated preferences.

- Dietary Restriction Management: Proactively identifying and catering to allergies or specific diets from reservation data.

- Customized Ambiance Settings: Potentially adjusting lighting or music based on guest profiles for special occasions.

- Targeted Promotions: Offering exclusive deals on favorite dishes or new menu items to specific customer segments.

Supply Chain and Inventory Management Systems

Technological advancements in supply chain and inventory management are pivotal for Hiramatsu, particularly in maintaining the high standards of its French and Italian cuisine. These systems can streamline everything from sourcing premium ingredients to minimizing waste, directly impacting quality and cost-effectiveness. For instance, the global supply chain management market was valued at approximately $25.8 billion in 2023 and is projected to reach $49.3 billion by 2030, indicating significant investment and innovation in this area.

Implementing sophisticated technology allows Hiramatsu to ensure the consistent freshness and superior quality of its ingredients, which is non-negotiable for its target market. This includes real-time tracking of perishable goods and predictive analytics for demand forecasting. By optimizing inventory levels, the company can reduce spoilage, a common challenge in the food service industry, where food waste can account for substantial financial losses. In 2024, the restaurant industry continues to grapple with efficiency improvements, making robust technological solutions increasingly attractive.

- Enhanced Ingredient Sourcing: Technology enables better supplier vetting and real-time quality checks for premium ingredients.

- Optimized Inventory Control: Advanced systems reduce overstocking and spoilage, improving cost efficiency.

- Reduced Food Waste: Predictive analytics and smart inventory management contribute to a more sustainable operation.

- Improved Quality Assurance: Tracking systems ensure ingredients meet Hiramatsu's high standards from farm to table.

Technological advancements are fundamentally reshaping guest experiences and operational efficiency in hospitality. Hiramatsu can capitalize on AI for personalized service, with a significant portion of hotels investing in AI-driven guest services in 2024 to boost satisfaction. Innovations in smart kitchen technology, a market projected to grow substantially, offer opportunities to enhance culinary quality and streamline back-of-house operations.

Sophisticated online reservation and CRM systems are vital for Hiramatsu, as these platforms enhance customer loyalty and streamline booking processes. Leading hotel groups in 2024 reported substantial gains in customer loyalty through integrated CRM systems. The adoption of advanced CRM solutions by businesses in early 2025 led to notable improvements in staff productivity and reduced no-show rates.

Data-driven insights enable hyper-personalized dining, a key expectation for 65% of consumers in 2024. Hiramatsu can leverage this by tailoring menu offerings and service interactions, thereby enhancing exclusivity and customer loyalty. This strategic use of technology directly addresses evolving consumer demand for customized brand experiences.

Technological integration in supply chain and inventory management is critical for maintaining Hiramatsu's high culinary standards and cost-effectiveness. The global supply chain management market's projected growth underscores the importance of these systems for ingredient sourcing and waste reduction. Optimizing inventory levels through advanced technology is crucial for minimizing spoilage, a significant challenge in the food service industry.

| Technology Area | Impact on Hiramatsu | Supporting Data (2024/2025) |

|---|---|---|

| AI & Automation | Enhanced guest services, streamlined operations | 60%+ hotels investing in AI guest services (2024) |

| Smart Kitchen Tech | Improved culinary quality, operational efficiency | Global smart kitchen market projected to reach USD 45.8B by 2030 |

| CRM & Reservations | Increased customer loyalty, operational efficiency | CRM can boost loyalty by up to 25%; 15% staff productivity increase reported (2025) |

| Supply Chain Management | Optimized sourcing, reduced waste, cost savings | Global SCM market projected to reach USD 49.3B by 2030 |

Legal factors

Japan's commitment to food safety is stringent, with significant regulatory updates anticipated for 2025. These include revisions to the Foods with Function Claims system, which governs health-related food labeling, and the Food Contact Materials Positive List, detailing approved substances for packaging. Hiramatsu must proactively adapt its product development and sourcing strategies to align with these evolving standards.

Failure to comply with these updated regulations, such as those impacting food additives or labeling accuracy, could result in substantial fines and reputational damage. For instance, the Japanese government has been increasingly enforcing stricter penalties for mislabeled or unsafe food products. Hiramatsu's ability to navigate these legal requirements will be crucial for sustained market access and consumer trust.

Japan's labor laws saw significant revisions in 2024, with further amendments scheduled for 2025. These changes affect critical areas like notification requirements for dismissals, regulations around fixed-term employment, and the scope of discretionary working hours. Hiramatsu must adapt its employment contracts and daily operations to align with these evolving legal frameworks, ensuring compliance and fostering a fair work environment.

Specifically, upcoming 2025 amendments will introduce new stipulations for childcare leave, potentially impacting workforce planning and support systems. Hiramatsu's proactive approach to understanding and implementing these legal adjustments is crucial for mitigating risks associated with non-compliance, such as potential fines or legal disputes, and for maintaining a positive employee relations strategy.

Operating high-end establishments like Hiramatsu's restaurants, hotels, and wedding halls necessitates a complex web of licenses and operational permits. These are not static; Hiramatsu must diligently track and comply with evolving local and national regulations specific to the hospitality sector. This includes stringent adherence to entertainment business laws for any venues within their properties that host live performances or events.

Consumer Protection Laws

Consumer protection laws are paramount for a luxury service provider like Hiramatsu, ensuring fairness and transparency in dealings. These regulations cover crucial aspects such as service quality guarantees, clear pricing structures, and effective mechanisms for resolving customer disputes. Adherence to these standards is not just a legal obligation but a cornerstone for building and maintaining customer trust and satisfaction in the competitive luxury market.

In 2024, regulatory bodies continued to emphasize consumer rights, with a focus on digital marketplaces and service contracts. For Hiramatsu, this means ensuring all service agreements are unambiguous and that pricing for bespoke experiences is fully transparent, avoiding hidden fees. Proactive compliance can prevent costly penalties and reputational damage, which are particularly detrimental in the high-touch luxury sector.

Key areas of focus for Hiramatsu in relation to consumer protection laws include:

- Service Quality Standards: Ensuring that all services delivered meet or exceed the promised luxury benchmarks, with clear recourse for any deviations.

- Pricing Transparency: Clearly communicating all costs associated with services, including any potential surcharges or additional fees, to prevent misunderstandings.

- Dispute Resolution: Establishing accessible and efficient channels for addressing customer grievances, aiming for timely and satisfactory resolutions.

- Data Privacy: Complying with stringent data protection regulations to safeguard client information, a critical component of trust in luxury services.

Intellectual Property Rights

Hiramatsu’s brand name, unique architectural designs, and culinary innovations are safeguarded through intellectual property rights. This protection is crucial for maintaining its market position and competitive edge.

Trademarks are vital for Hiramatsu’s restaurant and hotel brands, ensuring brand recognition and preventing confusion with competitors. For instance, the Hiramatsu name itself is a registered trademark, a key asset in its hospitality portfolio.

The company also explores design patents for distinctive venue features, such as unique interior layouts or specially crafted furniture. This legal framework helps protect the aesthetic and functional originality of its physical spaces, contributing to its premium brand experience.

Intellectual property rights are a cornerstone of Hiramatsu's strategy, underpinning its ability to differentiate itself and command premium pricing in the competitive hospitality sector.

Hiramatsu must remain vigilant regarding evolving intellectual property laws in Japan, particularly concerning digital content and brand protection. The Japanese government has been active in updating regulations to address online counterfeiting and unauthorized use of brand assets. For example, recent enforcement actions in 2024 have targeted online platforms facilitating the sale of counterfeit luxury goods, a trend expected to continue into 2025.

Environmental factors

Growing consumer and governmental pressure for sustainability is reshaping the hospitality industry. For instance, a 2024 report indicated that 65% of travelers consider sustainability when booking accommodations. Hiramatsu can leverage this by showcasing waste reduction programs, such as composting food scraps, and by prioritizing locally sourced ingredients, which can reduce transportation emissions.

Implementing energy-efficient technologies, like LED lighting and smart thermostats, is another key strategy. Hotels globally are seeing significant savings; a study found that hotels adopting comprehensive energy management systems can reduce energy consumption by up to 20% by 2025. These initiatives not only appeal to an environmentally aware customer base but also contribute to operational cost savings for Hiramatsu.

Climate change poses a significant threat to Hiramatsu's supply chain, particularly impacting the availability and cost of high-quality ingredients essential for its French and Italian culinary offerings. Extreme weather events, such as droughts and floods, can disrupt agricultural production, leading to scarcity and price volatility for key components like specific olive oils, truffles, or premium produce. For instance, a severe drought in a major olive-producing region in 2024 led to a reported 30% increase in extra virgin olive oil prices globally, directly affecting input costs for restaurants specializing in Mediterranean cuisine.

To counter these environmental risks, Hiramatsu must prioritize diversifying its sourcing strategies and investing in building more resilient supply chains. This involves identifying and establishing relationships with suppliers in varied geographical locations less susceptible to specific climate impacts. Furthermore, exploring partnerships with agricultural technology firms focused on climate-resilient farming practices and sustainable ingredient sourcing can provide a buffer against future disruptions, ensuring consistent quality and supply for Hiramatsu's discerning clientele.

Resource scarcity, particularly concerning water and energy, is a growing challenge for businesses like Hiramatsu. The increasing awareness of environmental impact and the upward trend in utility prices make efficient resource management crucial. For instance, in 2023, global energy prices saw significant volatility, with oil prices averaging around $77 per barrel, impacting operational costs for businesses reliant on energy.

Hiramatsu can mitigate these pressures by adopting water-saving technologies and investing in energy-efficient designs across its venues. This proactive approach not only reduces the company's environmental footprint but also offers tangible cost savings. For example, hotels implementing smart energy management systems have reported reductions in electricity consumption by as much as 15-20%.

Local Sourcing and Carbon Footprint Reduction

Hiramatsu's commitment to local sourcing directly addresses environmental concerns by minimizing transportation emissions. For instance, a 2024 report by the Food and Agriculture Organization of the United Nations (FAO) highlighted that food miles can contribute significantly to a restaurant's carbon footprint, with some estimates suggesting up to 11% of global greenhouse gas emissions are linked to the food system. By prioritizing local suppliers, Hiramatsu can demonstrably reduce these miles.

This strategy also aligns with growing consumer demand for sustainable and ethically sourced food. In 2025 surveys, over 60% of consumers indicated a preference for restaurants that actively support local communities and demonstrate environmental responsibility. Hiramatsu's emphasis on local farmers and suppliers taps into this trend, potentially boosting brand loyalty and attracting environmentally conscious diners.

Furthermore, local sourcing can enhance the perceived freshness and quality of ingredients, a key differentiator in the competitive fine dining sector. Studies in 2024 indicated that consumers are willing to pay a premium for produce that is known to be locally grown and harvested recently. This focus can translate into a stronger value proposition for Hiramatsu's offerings.

- Reduced Carbon Footprint: Local sourcing cuts down on emissions from long-distance food transportation.

- Consumer Alignment: Meets growing demand for eco-friendly and community-supported dining options.

- Enhanced Ingredient Quality: Prioritizes freshness and potentially higher quality produce from nearby farms.

- Supply Chain Resilience: Shorter supply chains can be less vulnerable to global disruptions, a factor noted in 2024 agricultural reports.

Environmental Regulations and Compliance

Hiramatsu's operations are significantly shaped by environmental regulations, particularly concerning waste management, emissions control, and construction standards. Navigating these rules is not just about avoiding penalties but also about building trust with stakeholders.

Japan's commitment to sustainable tourism, a key growth area, places an even greater emphasis on environmental compliance. For instance, the country aims to reduce CO2 emissions from the tourism sector by 50% by 2030 compared to 2013 levels, a target that impacts hospitality providers like Hiramatsu.

- Waste Management: Strict adherence to Japan's Waste Management and Public Cleansing Act is crucial, requiring proper sorting and disposal of various waste streams.

- Emissions Standards: Compliance with air and water quality standards, as well as energy efficiency mandates for buildings, is non-negotiable.

- Sustainable Tourism Initiatives: Hiramatsu must align with national and local initiatives promoting eco-friendly practices, such as reducing single-use plastics and conserving water.

- Fines and Reputation: Non-compliance can result in substantial fines, impacting profitability and severely damaging Hiramatsu's brand image, especially in a market increasingly valuing environmental responsibility.

Hiramatsu faces increasing pressure to adopt sustainable practices, driven by consumer demand and government regulations. For example, a 2024 survey revealed that 70% of diners consider a restaurant's environmental impact when choosing where to eat. This trend necessitates investments in eco-friendly operations, such as reducing food waste and minimizing energy consumption.

Climate change presents significant risks to Hiramatsu's supply chain, impacting ingredient availability and cost. Extreme weather events in 2024 led to a 25% increase in the price of certain imported wines due to poor harvests in key European regions. Diversifying suppliers and investing in climate-resilient sourcing are crucial for mitigating these disruptions.

Resource scarcity, particularly water and energy, is a growing concern. Global energy prices remained volatile throughout 2024, with oil averaging around $80 per barrel. Hiramatsu can achieve cost savings and reduce its environmental footprint by implementing water-saving technologies and energy-efficient designs, with hotels adopting such measures reporting up to 15% energy reduction.

| Environmental Factor | Impact on Hiramatsu | Mitigation Strategy | 2024/2025 Data Point |

|---|---|---|---|

| Sustainability Demand | Increased customer preference for eco-friendly dining | Highlight waste reduction and local sourcing | 70% of diners consider environmental impact |

| Climate Change | Supply chain disruptions and price volatility for ingredients | Diversify suppliers and invest in resilient sourcing | 25% price increase for certain imported wines |

| Resource Scarcity | Rising operational costs for water and energy | Implement water-saving tech and energy-efficient designs | 15% energy reduction reported by adopting hotels |

PESTLE Analysis Data Sources

Our Hiramatsu PESTLE Analysis is meticulously constructed using a robust blend of official government publications, reputable economic databases, and leading industry research reports. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in timely and authoritative data.