HD Korea Shipbuilding & Offshore Engineering Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HD Korea Shipbuilding & Offshore Engineering Bundle

HD Korea Shipbuilding & Offshore Engineering operates in a highly competitive landscape, facing moderate buyer power from large shipping companies and significant rivalry among established players. The threat of substitutes is relatively low, given the specialized nature of shipbuilding, but the bargaining power of suppliers, particularly for specialized components and raw materials, can be substantial.

The complete report reveals the real forces shaping HD Korea Shipbuilding & Offshore Engineering’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The shipbuilding sector, including giants like HD Korea Shipbuilding & Offshore Engineering (HD KSOE), faces considerable supplier bargaining power due to its reliance on a concentrated group of providers for critical inputs. Essential raw materials such as steel plates, along with specialized components like marine engines and advanced propulsion systems, are often sourced from a limited number of high-quality suppliers. This scarcity of options, particularly for cutting-edge technology, grants these suppliers substantial leverage in negotiations with shipbuilders.

This concentration of power means that suppliers can significantly influence pricing and terms. For instance, fluctuations in the global price of steel, a primary input for shipbuilding, directly translate into increased production costs for HD KSOE. In 2023, steel prices saw volatility, impacting the cost structures of major shipyards. This dependence on a few key players for vital machinery and materials means HD KSOE must carefully manage supplier relationships to mitigate cost pressures and ensure timely delivery of essential components.

Suppliers of specialized, eco-friendly technologies and smart ship solutions wield significant influence over HD Korea Shipbuilding & Offshore Engineering (HD KSOE). These providers, offering critical systems like LNG containment and dual-fuel engines, cater to a niche market, giving them considerable leverage.

HD KSOE's reliance on these advanced maritime innovations for its strategic direction means it must often accept terms dictated by a limited pool of technology providers. The proprietary nature of these essential systems further amplifies the suppliers' bargaining power, restricting HD KSOE's alternatives.

The availability of highly skilled labor, such as naval architects, specialized engineers, and experienced shipyard workers, is a significant factor influencing the bargaining power of suppliers for HD Korea Shipbuilding & Offshore Engineering. A scarcity of this expertise can drive up labor costs and cause project timelines to slip, thereby strengthening the hand of the workforce and specialized recruitment agencies within the shipbuilding sector.

Global Supply Chain Dependencies

HD Korea Shipbuilding & Offshore Engineering (HD KSOE) navigates a global landscape where supplier power significantly impacts its operations. The shipbuilding industry relies on a complex network of international suppliers for everything from specialized steel to advanced engine components. Disruptions, such as those experienced in 2023 and early 2024 due to geopolitical tensions and shipping route issues like the Red Sea crisis, have demonstrably increased freight costs and delivery times. This volatility can grant suppliers who can ensure consistent and timely delivery a stronger hand in price negotiations.

The bargaining power of suppliers for HD KSOE is amplified by the concentration of specialized component manufacturers and the inherent risks in global logistics. For instance, the availability and pricing of high-efficiency marine engines or sophisticated navigation systems often depend on a limited number of global producers. When these suppliers face production challenges or are affected by trade restrictions, their ability to dictate terms to buyers like HD KSOE increases. The cost of raw materials, like steel, also plays a crucial role; fluctuations in global commodity prices, influenced by factors such as energy costs and demand from other major industries, directly affect HD KSOE's input expenses.

- Supplier Concentration: Key components like advanced propulsion systems are sourced from a few dominant global manufacturers, giving them considerable leverage.

- Geopolitical Impact: Events impacting major shipping lanes, such as the Red Sea disruptions in late 2023 and early 2024, have increased shipping costs by an estimated 100-200% for certain routes, directly affecting the landed cost of components for HD KSOE.

- Raw Material Volatility: Fluctuations in global steel prices, a primary input for shipbuilding, can significantly alter the cost structure and empower steel suppliers during periods of high demand or restricted supply.

- Lead Times and Reliability: Suppliers who can guarantee shorter lead times and consistent quality in a volatile market environment gain an advantage in negotiating terms with shipbuilders.

Proprietary Component Control

HD Korea Shipbuilding & Offshore Engineering (KSOE) faces significant bargaining power from suppliers of proprietary components, particularly for high-value vessels like LNG carriers. These specialized parts, often protected by patents, are manufactured by a limited number of firms, granting them leverage. This exclusivity means KSOE is dependent on these suppliers, who can dictate higher prices. The substantial costs and technical complexities associated with switching to alternative component providers further solidify this supplier power.

For instance, the advanced propulsion systems and cryogenic containment technologies crucial for LNG carriers are frequently supplied by a handful of global leaders. In 2024, the demand for LNG carriers remained robust, driven by energy security concerns and the global transition to cleaner fuels. This sustained demand strengthens the negotiating position of suppliers of these critical, proprietary systems. The high barriers to entry for developing comparable technologies mean KSOE has few viable alternatives, leading to potentially higher input costs for these specialized vessels.

- Proprietary Component Control: Suppliers of patented or uniquely engineered components, such as advanced LNG containment systems, hold considerable power.

- Limited Supplier Base: For specialized shipbuilding needs, the number of capable suppliers is often restricted, concentrating power.

- High Switching Costs: KSOE faces significant financial and technical hurdles in changing suppliers for critical, integrated systems.

- Market Dynamics: Strong demand for vessels like LNG carriers in 2024 amplifies the negotiating leverage of suppliers of essential, proprietary technologies.

The bargaining power of suppliers for HD Korea Shipbuilding & Offshore Engineering (HD KSOE) is significant due to the concentration of specialized component manufacturers and the critical nature of their products. For example, suppliers of advanced propulsion systems and LNG containment technologies often operate in a niche market with few competitors, allowing them to dictate terms and prices. The global demand for eco-friendly vessels, like LNG carriers, remained strong throughout 2024, further bolstering the negotiating position of these key suppliers.

| Supplier Category | Key Components | Supplier Power Factors | Impact on HD KSOE | 2024 Market Context |

|---|---|---|---|---|

| Engine Manufacturers | Dual-fuel engines, high-efficiency marine engines | Proprietary technology, limited global producers | Higher input costs, potential delivery delays | Robust demand for LNG carriers and eco-friendly ships |

| Steel Producers | Specialized steel plates | Global commodity price volatility, supply chain disruptions | Fluctuating raw material costs | Steel prices saw moderate increases in early 2024 due to industrial demand. |

| Technology Providers | LNG containment systems, smart ship solutions | Patented technology, high switching costs for shipbuilders | Dependence on specific suppliers, price leverage | Increased focus on digitalization and emissions reduction driving demand. |

What is included in the product

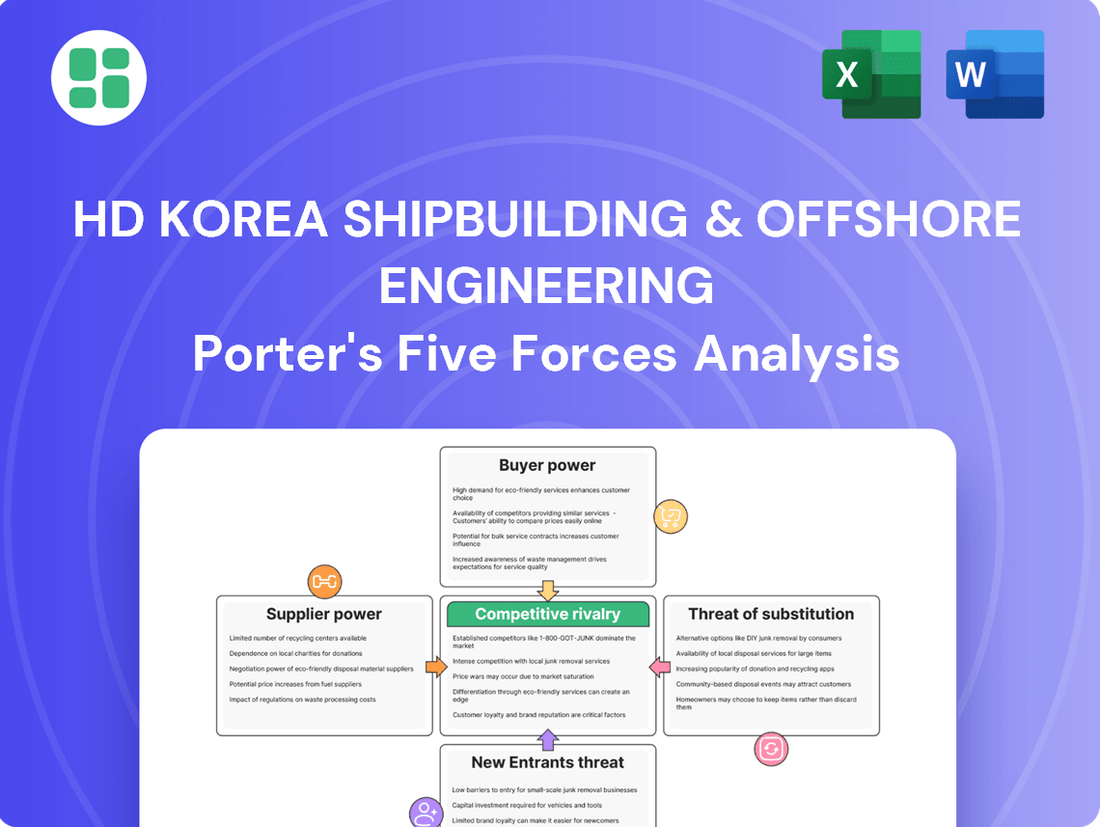

This analysis details the competitive forces shaping HD Korea Shipbuilding & Offshore Engineering's market, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the shipbuilding sector.

A dynamic dashboard that visually breaks down Porter's Five Forces for HD Korea Shipbuilding & Offshore Engineering, simplifying complex competitive pressures into actionable insights.

Customers Bargaining Power

HD Korea Shipbuilding & Offshore Engineering's (HD KSOE) primary customers are major players in the shipping and energy sectors, including large shipping companies, energy corporations, and governments. These entities typically procure multiple vessels or substantial offshore projects, giving them considerable leverage.

The consolidated nature of HD KSOE's customer base means that a few large buyers account for a significant portion of its revenue. For instance, in 2023, HD KSOE secured orders totaling $23.7 billion, with a substantial portion coming from these key client segments, highlighting their concentrated purchasing power.

This concentration allows these large customers to negotiate favorable terms, including pricing, payment schedules, and delivery timelines. Their ability to place large, recurring orders empowers them to demand better conditions, thereby increasing their bargaining power against HD KSOE.

Customers who place orders for complex vessels like LNG carriers and offshore facilities often enter into high-value, long-term contracts. These contracts represent significant investments for the buyers, leading them to engage in thorough negotiations. They typically demand precise specifications, robust performance guarantees, and the most competitive pricing possible.

HD Korea Shipbuilding & Offshore Engineering (HD KSOE) has been strategically focusing on building these high-value-added ships. This shift aims to bolster profitability, but it also means customers wield considerable bargaining power due to the substantial commitment and the specialized nature of the projects. For instance, in 2023, HD KSOE secured orders for 34 LNG carriers, reflecting the demand for these high-value assets and the associated customer negotiation leverage.

Customers are increasingly focused on operational efficiency and green technologies, a trend that significantly influences their bargaining power. This shift is driven by a dual pressure: tightening environmental regulations worldwide and the persistent need to reduce operating costs. For instance, the International Maritime Organization's (IMO) 2020 sulfur cap has already pushed shipowners towards cleaner fuels and more efficient engines, a demand that is only expected to grow with future environmental targets.

This heightened customer focus on sustainability and cost-effectiveness translates directly into greater leverage for buyers. They can now demand advanced, fuel-efficient vessel designs and proven performance in emissions reduction, effectively dictating the technological direction and pricing of new shipbuilding orders. The demand for smart ship solutions, incorporating advanced automation and data analytics for optimized performance, further amplifies this customer power, as shipyards must invest in and demonstrate these capabilities to secure contracts.

Availability of Global Shipbuilders

The availability of global shipbuilders significantly influences the bargaining power of customers. While HD Korea Shipbuilding & Offshore Engineering (KSOE) is a major player, clients can turn to numerous other prominent shipyards worldwide, especially those in China and other South Korean companies. This broad competitive landscape allows customers to solicit bids from various sources, amplifying their leverage and compelling shipbuilders like HD KSOE to maintain competitive pricing and high-quality standards to secure contracts.

In 2024, the global shipbuilding order book reflects this intense competition. For instance, Chinese shipyards have consistently secured a substantial portion of new vessel orders, often leveraging cost advantages. As of early 2024, Chinese shipbuilders accounted for over 40% of the global shipbuilding market share by tonnage, directly challenging established players like HD KSOE and providing customers with viable alternatives.

This competitive environment translates into tangible benefits for customers:

- Price Negotiation: Customers can leverage quotes from multiple shipyards to negotiate more favorable prices for new builds.

- Contract Terms: The presence of numerous global options allows buyers to push for more flexible or advantageous contract terms.

- Technological Choice: Customers can select shipyards offering specific technological advancements or specialized vessel designs, as competition drives innovation across the industry.

Impact of Freight Rates and Trade Volumes

HD Korea Shipbuilding & Offshore Engineering (HD KSOE) faces significant customer bargaining power, particularly as it relates to global freight rates and trade volumes. When these economic indicators are unfavorable, customers gain leverage.

For instance, a downturn in global trade, which impacts freight rates, can lead to reduced demand for new vessels. In 2023, while the Baltic Dry Index saw fluctuations, a general slowdown in global economic growth, coupled with geopolitical uncertainties, contributed to periods of lower freight rates. This environment allows shipping companies, HD KSOE's customers, to push for more competitive pricing on new builds or even postpone orders, thereby strengthening their negotiating position.

- Impact of Freight Rates: Lower freight rates directly reduce the profitability of shipping operations, making customers more sensitive to the cost of new vessels.

- Trade Volume Sensitivity: Declining global trade volumes signal a potential oversupply of shipping capacity or reduced cargo demand, prompting customers to delay or cancel new shipbuilding orders.

- Customer Leverage: In such market conditions, customers can demand lower prices or more favorable contract terms from shipbuilders like HD KSOE, increasing their bargaining power.

- 2024 Outlook: Projections for 2024 suggest continued economic headwinds in certain regions, which could maintain pressure on freight rates and trade volumes, thus keeping customer bargaining power elevated.

The bargaining power of customers for HD Korea Shipbuilding & Offshore Engineering (HD KSOE) is substantial due to the concentrated nature of its client base and the high value of its orders. Large shipping firms and energy corporations, often placing orders for multiple, specialized vessels like LNG carriers, possess significant leverage. In 2023, HD KSOE's order book reached $23.7 billion, underscoring the immense financial commitment these clients make, which naturally leads to rigorous price and term negotiations.

Customers are increasingly dictating terms based on demands for fuel efficiency and green technologies, driven by environmental regulations and cost-saving imperatives. This trend amplifies their power, as they can specify advanced designs and performance metrics. For instance, the push for lower emissions means buyers can demand specific technological solutions, influencing shipyard investment and pricing strategies.

The global shipbuilding market, with numerous competitors particularly in China, provides customers with ample alternatives. This competitive landscape allows buyers to solicit multiple bids, pushing HD KSOE to offer competitive pricing and terms to secure contracts. In early 2024, Chinese shipyards held over 40% of the global market share by tonnage, directly impacting HD KSOE's negotiating position.

Economic conditions significantly sway customer bargaining power. When global trade volumes and freight rates decline, as seen with fluctuations in the Baltic Dry Index in 2023, customers become more cost-sensitive. This can lead to postponed orders or demands for lower prices, strengthening their leverage against shipbuilders like HD KSOE.

| Factor | Impact on HD KSOE Customer Bargaining Power | Supporting Data/Observation |

| Customer Concentration | High | Few large clients account for a significant portion of revenue. |

| Order Value & Complexity | High | High-value, long-term contracts for specialized vessels (e.g., LNG carriers) involve substantial customer investment and negotiation. |

| Technological Demands | High | Customer focus on green tech and efficiency allows them to specify requirements and influence pricing. |

| Global Competition | High | Availability of alternative shipyards worldwide (e.g., China's >40% market share in early 2024) enables price and term shopping. |

| Economic Conditions (Freight Rates/Trade Volumes) | Variable (High during downturns) | Lower freight rates in 2023 made customers more price-sensitive, increasing their leverage. |

Preview the Actual Deliverable

HD Korea Shipbuilding & Offshore Engineering Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for HD Korea Shipbuilding & Offshore Engineering, detailing the competitive landscape including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the industry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This analysis provides crucial insights into the strategic positioning and potential challenges faced by HD Korea Shipbuilding & Offshore Engineering, enabling informed decision-making for stakeholders.

Rivalry Among Competitors

The global shipbuilding landscape is highly concentrated, with a few dominant players from South Korea, China, and Japan driving intense competition. This oligopolistic structure means HD Korea Shipbuilding & Offshore Engineering (KSOE) faces formidable rivals for lucrative shipbuilding contracts.

HD KSOE's primary competitors include giants like China State Shipbuilding Corporation (CSSC), Samsung Heavy Industries, and Hanwha Ocean. These companies actively compete for high-value projects, particularly in segments like LNG carriers and containerships, where technological sophistication and capacity are paramount.

China's shipbuilding sector has notably expanded its market share in recent years, significantly intensifying the competitive pressure on established players like HD KSOE. For instance, in 2023, Chinese shipyards secured a substantial portion of global orders, challenging the historical dominance of South Korean firms in certain vessel types.

As the market for standard vessels intensifies, major shipbuilders like HD Korea Shipbuilding & Offshore Engineering are strategically shifting focus to high-value-added ships, including LNG carriers and eco-friendly vessels. This pivot intensifies competition in these profitable niches, where technological advancement and operational efficiency are paramount for differentiation.

The shipbuilding industry, while experiencing robust demand for certain vessel types like LNG carriers, can also face overcapacity. This situation often triggers intense price competition among shipbuilders. For instance, in 2023, the global shipbuilding order book reached a significant level, yet the capacity to build remained a key factor influencing pricing power.

Despite strong demand, some major players, including HD Korea Shipbuilding & Offshore Engineering, have secured order backlogs that extend into 2028. While this indicates healthy business, it also means longer delivery times. This can subtly shift competitive dynamics as clients may consider shipbuilders with shorter lead times.

Technological Race and R&D Investment

Competitive rivalry in the shipbuilding sector, particularly for companies like HD Korea Shipbuilding & Offshore Engineering (HD KSOE), is intensely fueled by a relentless technological race. This race is most evident in the development of eco-friendly and smart ship technologies, areas where significant R&D investment is paramount. Companies are pouring resources into innovation to stay ahead, as technological prowess is a key differentiator in securing lucrative shipbuilding orders and maintaining a competitive edge in the global market.

- R&D Investment: HD KSOE’s commitment to innovation is reflected in its substantial R&D expenditures. For instance, in 2023, the company and its affiliates were actively developing technologies like ammonia-fueled engines and advanced autonomous navigation systems, signaling a significant investment in future-proofing its offerings.

- Technological Advancements: The focus on eco-friendly solutions, such as vessels capable of running on LNG, methanol, and eventually hydrogen, is a direct response to increasing environmental regulations and customer demand. This necessitates continuous innovation in engine design, fuel systems, and hull efficiency.

- Smart Ship Development: The integration of digital technologies for smart shipping, including AI-powered navigation, predictive maintenance, and remote monitoring, further intensifies the competitive landscape. Companies that can offer integrated smart solutions are better positioned to attract clients seeking operational efficiency and safety improvements.

- Market Impact: Staying at the forefront of these technological trends is not merely about innovation; it's a strategic imperative. Companies that fail to invest and adapt risk falling behind, potentially losing market share to rivals who offer more advanced and sustainable shipbuilding solutions.

Government Support and Subsidies

Government support and subsidies significantly impact competitive rivalry in the shipbuilding sector. Many major shipbuilding nations offer financial aid, tax breaks, or strategic initiatives to bolster their domestic industries, creating an uneven playing field. For instance, in 2024, South Korea's government continued its commitment to supporting its shipbuilding sector through various programs aimed at fostering innovation and competitiveness.

This state backing can allow some competitors to offer more aggressive pricing or invest more readily in new technologies and capacity expansions. Such advantages can put pressure on companies like HD Korea Shipbuilding & Offshore Engineering that may not receive equivalent levels of direct government assistance in all markets. The extent of these subsidies can vary greatly by region, influencing global market dynamics.

- Uneven Playing Field: Government support in major shipbuilding nations creates disparities in pricing and investment capabilities.

- Strategic Initiatives: State backing enables some competitors to pursue capacity expansion and technological advancements more aggressively.

- Global Market Impact: Varying levels of subsidies across regions influence international competition and market share distribution.

Competitive rivalry for HD Korea Shipbuilding & Offshore Engineering is exceptionally intense due to the concentrated nature of the global shipbuilding market, dominated by a few key players from South Korea, China, and Japan. HD KSOE faces direct competition from major shipbuilders like China State Shipbuilding Corporation (CSSC) and Samsung Heavy Industries, particularly in high-value segments such as LNG carriers and eco-friendly vessels. This rivalry is further amplified by China's increasing market share, which has put pressure on South Korean firms. For example, in 2023, Chinese shipyards secured a significant portion of global orders, challenging established players.

The competition is not solely based on price but increasingly on technological innovation, especially in areas like eco-friendly propulsion systems and smart ship technologies. HD KSOE, alongside its rivals, is investing heavily in R&D to develop capabilities in ammonia-fueled engines and advanced navigation systems to maintain a competitive edge. This technological race is crucial for securing future contracts, as clients prioritize advanced and sustainable solutions. The market for standard vessels is also becoming more competitive, pushing companies like HD KSOE to focus on these specialized, high-margin niches.

Government support and subsidies also play a significant role, creating an uneven playing field. Many nations provide financial aid and strategic initiatives to their domestic shipbuilding industries. In 2024, South Korea continued its support for its shipbuilding sector, aiming to foster innovation and competitiveness. This state backing can enable some competitors to offer more competitive pricing or invest more aggressively in new technologies, directly impacting HD KSOE's market position.

| Competitor | Key Strengths | 2023 Market Share (Approximate % of Global Orders) | Focus Areas |

|---|---|---|---|

| China State Shipbuilding Corporation (CSSC) | Massive scale, strong government backing, cost competitiveness | 30-40% | Container ships, LNG carriers, offshore structures |

| Samsung Heavy Industries | Advanced technology, high-value vessels, offshore expertise | 15-20% | LNG carriers, containerships, offshore platforms |

| Hanwha Ocean (formerly Daewoo Shipbuilding & Marine Engineering) | LNG carrier expertise, eco-friendly technology development | 10-15% | LNG carriers, containerships, defense vessels |

SSubstitutes Threaten

For the large-scale, cost-effective movement of goods across continents, ocean shipping stands as the dominant force, with very few direct substitutes. This makes the industry less vulnerable to the threat of substitutes.

While air freight offers speed, its significantly higher cost and limited capacity for bulk cargo render it an impractical alternative for the massive shipments that define maritime trade, a key market for HD Korea Shipbuilding & Offshore Engineering.

Land-based transportation networks, while extensive, are not viable substitutes for the intercontinental reach and volume capacity that ocean carriers provide, further solidifying the position of shipbuilding.

The increasing adoption of alternative fuels like methanol, ammonia, and hydrogen, alongside wind-assisted propulsion, presents a significant threat of substitution for traditional fuel-powered vessels. HD KSOE needs to actively integrate these technologies into its shipbuilding designs to meet growing customer demand for eco-friendly and cost-effective shipping solutions. For instance, the International Maritime Organization's (IMO) 2023 greenhouse gas strategy aims for net-zero emissions by or around 2050, driving this shift.

While modular construction and on-site assembly offer potential alternatives for certain offshore components, they present a limited threat to HD Korea Shipbuilding & Offshore Engineering's core business. For instance, the development of smaller, prefabricated modules for offshore wind substructures can bypass traditional shipyard construction for specific elements. However, the complexity and scale of major offshore platforms, like FPSOs (Floating Production, Storage, and Offloading units), still necessitate the specialized, integrated capabilities that large shipyards provide. In 2023, the global offshore wind market saw significant investment, with new project announcements often involving modular components, but the demand for large, integrated offshore energy production facilities remains robust, underscoring the continued reliance on shipyard expertise.

Digitalization and Logistics Optimization

Digitalization in logistics, particularly AI-driven route planning and smart port technologies, can significantly boost the efficiency of existing shipping fleets. This optimization allows for better utilization of current vessels, potentially dampening the demand for new builds. For instance, by reducing idle time and improving transit speeds, companies can extend the effective lifespan of their existing assets.

While these advancements enhance operational efficiency, they don't entirely remove the need for new shipbuilding. Fleet aging remains a critical factor, with many vessels approaching their end-of-life. Furthermore, specialized vessel requirements for new energy sources or specific cargo types continue to drive demand for new construction, even with optimized logistics.

The threat of substitutes, in this context, is moderate. Improved logistics efficiency can substitute for some new vessel orders, but it's not a complete replacement.

- Increased Fleet Utilization: Advances in logistics can lead to a 10-15% improvement in vessel utilization rates through better route and cargo management.

- Fleet Aging Factor: Approximately 20% of the global merchant fleet is over 20 years old, necessitating replacements regardless of efficiency gains.

- Specialized Vessel Demand: The transition to greener fuels and new cargo types, like LNG carriers, creates demand for new, specialized vessels that cannot be substituted by existing fleets.

- Impact on New Builds: While efficiency gains might defer 5-10% of planned new builds, the fundamental need for fleet renewal and technological advancement persists.

Shift to Localized Production/Supply Chains

The increasing emphasis on localized production and shorter supply chains presents a potential threat of substitution for traditional long-haul shipping services. This shift, while a long-term trend, could theoretically reduce the volume of goods transported by sea. For instance, in 2024, many manufacturers continued to explore regional sourcing to mitigate geopolitical risks and improve delivery times, potentially impacting the demand for large-scale maritime transport.

However, the economic realities of global trade mean this substitution is likely to be gradual and incomplete. The cost-effectiveness of seaborne transport, especially for bulk commodities and manufactured goods, remains a significant barrier to widespread adoption of fully localized models. In 2024, the cost per ton-mile for container shipping remained considerably lower than alternative transport methods for long distances.

- Reduced Demand: A move towards regionalized manufacturing could decrease the need for extensive international shipping routes.

- Cost Efficiency: Seaborne transport continues to offer superior cost efficiency for bulk and manufactured goods over long distances.

- Gradual Impact: The shift to localized production is a slow process, meaning the threat to maritime shipping volume is not immediate or absolute.

- Global Trade Dependence: Many industries rely on global supply chains for raw materials and specialized components, making complete localization impractical.

The threat of substitutes for HD Korea Shipbuilding & Offshore Engineering's core business is moderate, primarily stemming from technological advancements and evolving logistics rather than direct replacements for ocean shipping itself. While improved logistics efficiency, like AI-driven route planning, can boost fleet utilization and potentially defer some new builds, it doesn't eliminate the fundamental need for new vessels due to fleet aging and specialized requirements. For instance, approximately 20% of the global merchant fleet is over 20 years old, necessitating replacements. Furthermore, the shift towards greener fuels and new cargo types, such as LNG, drives demand for new, specialized vessels that existing fleets cannot substitute.

The push for localized production and shorter supply chains presents a longer-term, gradual threat by potentially reducing the volume of goods transported internationally. However, the inherent cost-effectiveness of seaborne transport for bulk and manufactured goods over long distances remains a strong counter-argument, with per-ton-mile costs for container shipping in 2024 still significantly lower than alternatives for intercontinental trade. This means complete substitution is unlikely, though a partial impact on shipping volumes is possible.

| Factor | Impact on HD KSOE | Supporting Data (2024/Recent) |

|---|---|---|

| Logistics Efficiency Gains | Moderate threat to new build demand | Potential 10-15% improvement in vessel utilization; may defer 5-10% of planned new builds. |

| Fleet Aging | Drives demand for new builds | ~20% of global merchant fleet is over 20 years old, requiring replacement. |

| Greener Fuels & Specialization | Creates demand for new, specialized vessels | IMO 2023 GHG strategy pushes for net-zero by 2050, increasing demand for eco-friendly designs. |

| Localized Production | Gradual, long-term threat to shipping volumes | Manufacturers exploring regional sourcing to mitigate risks, but seaborne transport remains cost-efficient for bulk goods. |

Entrants Threaten

The shipbuilding sector demands colossal upfront investments in infrastructure like shipyards, dry docks, and specialized heavy machinery. This significant capital intensity acts as a formidable barrier, deterring potential new entrants from challenging established players.

For instance, building a new, modern shipyard capable of competing with industry leaders can easily cost billions of dollars. HD Korea Shipbuilding & Offshore Engineering, as a major player, has already made these substantial investments, creating a high hurdle for any newcomers aiming to enter the market.

The shipbuilding industry, particularly for advanced vessels like LNG carriers and smart ships, requires immense technical expertise and ongoing research and development. New companies entering this space would need to invest heavily and for a considerable period to build the necessary engineering capabilities and knowledge base. For instance, the development of advanced propulsion systems and eco-friendly technologies for these complex vessels demands specialized skills that are not easily replicated.

Established shipbuilders like HD Korea Shipbuilding & Offshore Engineering (KSOE) benefit from deep-rooted relationships with major global shipping lines, energy corporations, and government entities. These long-standing connections are built on years of demonstrated reliability and consistent quality, making it difficult for newcomers to penetrate the market.

New entrants would struggle to replicate the trust and credibility that HD KSOE has cultivated. Securing initial orders from these discerning clients, who often prioritize a proven track record over novelty, presents a formidable barrier to entry, especially in an industry where project failures can have severe financial and reputational consequences.

Regulatory Hurdles and Compliance Costs

The shipbuilding sector faces significant regulatory barriers. International Maritime Organization (IMO) regulations, such as those targeting emissions reduction (e.g., IMO 2020, with future targets for 2030 and 2050), demand substantial investment in new technologies and retrofitting. For instance, the need for advanced ballast water treatment systems and stricter emission controls adds considerable upfront costs for any new player aiming to enter the market.

Compliance with these evolving environmental and safety standards, alongside national labor laws, presents a steep learning curve and financial commitment for potential new entrants. The complexity and cost of navigating these diverse regulatory landscapes effectively deter many would-be competitors from entering the established shipbuilding market.

- Stringent Regulations: International and national rules on safety, environmental impact (e.g., IMO 2020/2030/2050 emissions targets), and labor practices create high entry barriers.

- Compliance Costs: New entrants face significant financial outlays and time investments to meet complex and evolving regulatory frameworks.

- Technological Adaptation: Adhering to new standards often requires investment in advanced technologies, such as cleaner fuel systems or improved hull designs, further increasing the cost of entry.

Economies of Scale and Experience Curve

HD Korea Shipbuilding & Offshore Engineering, like other major players in the shipbuilding industry, benefits significantly from economies of scale. This means that as they produce more ships, their cost per ship tends to decrease. This advantage is built through efficient procurement of raw materials, streamlined production processes, and sophisticated project management. For instance, securing large orders allows them to negotiate better prices for steel and components, directly impacting their bottom line.

New companies entering the shipbuilding market face a substantial hurdle in achieving similar cost efficiencies. They would initially operate at a higher cost per unit until they can match the production volume and operational experience of established firms. This learning curve, often referred to as the experience curve, allows incumbents to refine their techniques, reduce waste, and improve output quality over time. Without this accumulated experience, new entrants would struggle to compete on price against the lower costs enjoyed by companies like HD Korea Shipbuilding & Offshore Engineering.

The capital-intensive nature of shipbuilding further reinforces this barrier. Building and equipping a shipyard requires massive upfront investment. Established companies have already made these investments and are amortizing them over many years and numerous projects. New entrants would need to secure substantial funding not only for the shipyard itself but also to absorb the initial cost disadvantages inherent in starting operations at a smaller scale.

The threat of new entrants is therefore moderated by these factors:

- Economies of Scale: Incumbent shipbuilders like HD Korea Shipbuilding & Offshore Engineering leverage bulk purchasing power for materials and components, leading to lower per-unit costs.

- Experience Curve Benefits: Years of operational experience translate into optimized production processes, reduced waste, and improved efficiency, giving established players a cost advantage.

- High Capital Requirements: The significant upfront investment needed to establish a modern shipbuilding facility acts as a substantial barrier to entry for potential new competitors.

- Procurement Power: Large, ongoing orders allow established shipyards to negotiate more favorable terms with suppliers, further reducing their input costs compared to smaller, new operations.

The threat of new entrants in the shipbuilding industry, particularly for a major player like HD Korea Shipbuilding & Offshore Engineering, is generally low due to several significant barriers. These include the immense capital required for shipyards, specialized equipment, and advanced technology, often running into billions of dollars for a single facility. Furthermore, deep-seated customer relationships, stringent regulatory compliance, and the benefits of economies of scale and experience curve advantages held by established firms create formidable hurdles for any potential newcomers.

| Barrier Type | Description | Impact on New Entrants |

| Capital Intensity | Building a modern shipyard requires billions in investment. | Extremely high barrier; deters most potential entrants. |

| Technical Expertise & R&D | Developing advanced shipbuilding technology and engineering capabilities is crucial. | Requires significant time and investment to match incumbents. |

| Customer Relationships | Established players have long-standing trust with major clients. | New entrants struggle to secure initial contracts without a proven track record. |

| Economies of Scale | Large-scale production leads to lower per-unit costs. | New entrants start with higher costs, making price competition difficult. |

| Regulatory Compliance | Adhering to strict environmental and safety standards is costly. | Adds substantial upfront and ongoing financial burdens for new firms. |

Porter's Five Forces Analysis Data Sources

Our HD Korea Shipbuilding & Offshore Engineering Porter's Five Forces analysis is built upon a foundation of robust data, including financial statements from the company and its peers, industry-specific market research reports, and global economic indicators to capture the competitive landscape.

We leverage insights from trade publications, regulatory filings, and analyst reports to thoroughly assess the bargaining power of buyers and suppliers, the threat of new entrants, and the intensity of rivalry within the shipbuilding and offshore engineering sector.