Hang Seng Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hang Seng Bank Bundle

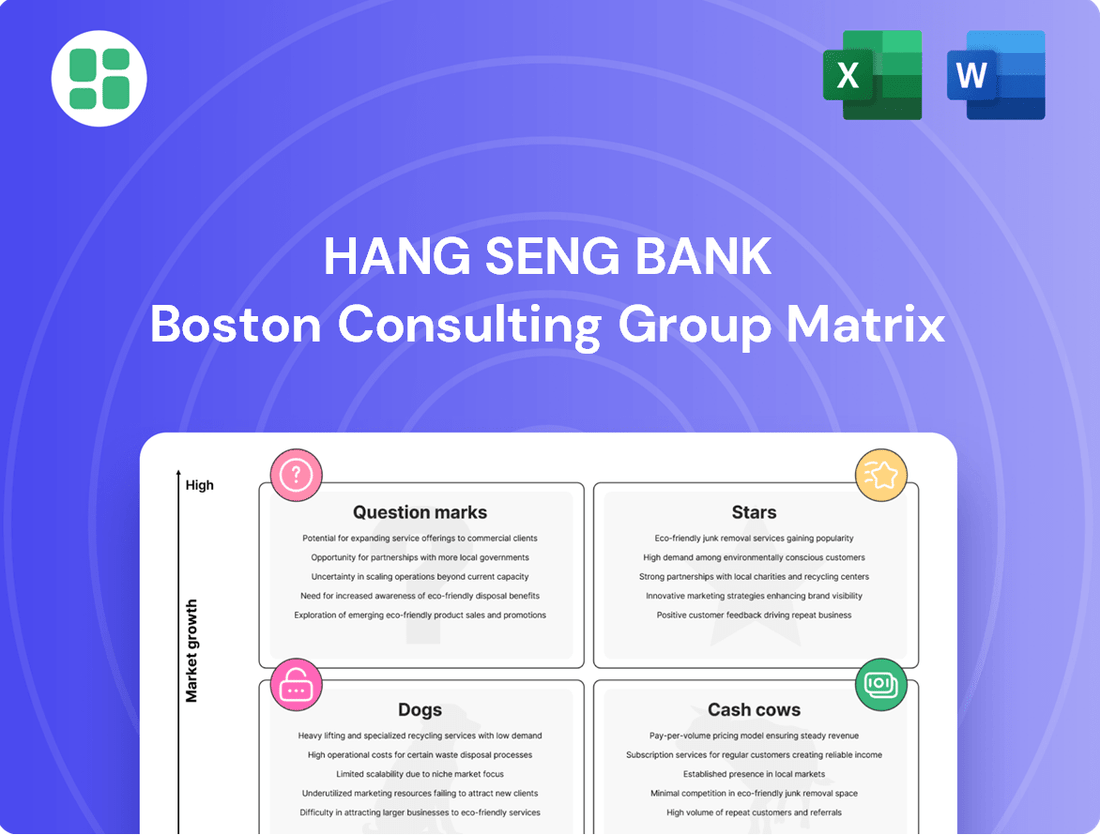

Curious about Hang Seng Bank's strategic positioning? This glimpse into their BCG Matrix highlights key areas, but imagine unlocking the full picture. Discover which of their offerings are market leaders (Stars), reliable income generators (Cash Cows), potential growth opportunities (Question Marks), or underperforming assets (Dogs).

Don't just get a snapshot; get the entire strategic blueprint. Purchase the full Hang Seng Bank BCG Matrix report to gain detailed quadrant placements, data-backed recommendations, and a clear roadmap for optimizing their product portfolio and investment decisions.

This is your opportunity to gain a competitive edge. Invest in the complete BCG Matrix for Hang Seng Bank and equip yourself with the insights needed to navigate the financial landscape with confidence and make impactful strategic choices.

Stars

Hang Seng Bank is making significant strides in cross-boundary wealth management, especially within the Greater Bay Area (GBA). This strategic focus is paying off handsomely.

In 2024, the bank saw an impressive 81% year-on-year increase in new account openings for retail mainland China customers. This surge highlights the growing demand for its services in this dynamic region.

Further cementing its strong market presence, Hang Seng Bank was honored as the 'Best Domestic Bank for the Greater Bay Area' at the Euromoney Greater Bay Area Awards 2024. This accolade underscores its leadership and commitment to serving clients across this key economic zone.

Hang Seng Bank's 'Wealth Master' platform and its enhanced digital investment services are significantly boosting customer engagement. These digital advancements are a key driver for the bank's growth in the wealth management sector.

The impact of these digital initiatives is clearly visible in the 2024 figures, where Hang Seng Bank reported an impressive 324% year-on-year surge in investment account openings. This substantial increase highlights the successful adoption of their digital wealth management solutions by customers and a notable expansion of their market presence in this digital-first landscape.

Hang Seng Bank's life insurance segment is a star performer, demonstrating remarkable expansion. The business saw new business premiums skyrocket by an impressive 80% in the third quarter of 2024. This substantial growth propelled Hang Seng to become the second-largest life insurer in the market based on new business premiums.

Sustainable Finance Solutions

Hang Seng Bank is strategically positioning itself in the sustainable finance sector, recognizing its significant growth potential. The bank launched the HKD 80 billion Sustainability Power Up Fund in 2024, demonstrating a substantial commitment to this area.

These sustainable finance solutions are designed to support businesses in their transition towards more environmentally conscious operations. This focus taps into an expanding market demand for green and sustainable financing options.

- Market Growth: The global sustainable finance market is experiencing robust expansion, driven by increasing investor and regulatory focus on environmental, social, and governance (ESG) factors.

- Product Development: Hang Seng Bank is developing a range of financial products, including green bonds and sustainability-linked loans, to cater to diverse client needs in this evolving landscape.

- Impact Investment: The bank aims to facilitate impactful investments that contribute to positive environmental and social outcomes, aligning with its corporate responsibility goals.

- Partnerships: Collaborations with various stakeholders, including businesses and environmental organizations, are key to scaling sustainable finance solutions and driving systemic change.

Digital Currency Innovation

Hang Seng Bank is a leader in digital currency innovation, actively engaging in the e-HKD pilot program and becoming one of the first foreign banks in China to join the e-CNY platform.

This forward-thinking approach places them at the forefront of the rapidly expanding digital and tokenized assets sector. In the first half of 2025, this market experienced significant growth, with local banks seeing a 233% increase in activity.

- e-HKD Pilot Program Participation: Demonstrates commitment to exploring central bank digital currencies in Hong Kong.

- e-CNY Platform Integration: Positions Hang Seng Bank as an early adopter in mainland China's digital yuan ecosystem.

- Digital Asset Market Growth: Capitalizes on a high-potential market segment with substantial recent expansion.

- Strategic Positioning: Leverages innovation to capture future opportunities in tokenized finance.

Hang Seng Bank's life insurance business is a clear star performer, showing exceptional growth. In Q3 2024, new business premiums surged by 80%, making Hang Seng the second-largest life insurer by this metric. This strong performance indicates a highly successful strategy in a competitive market, driven by effective product offerings and customer acquisition.

The bank's digital wealth management initiatives, particularly the 'Wealth Master' platform, are also standout successes. The 324% year-on-year increase in investment account openings in 2024 reflects the strong customer adoption of these digital tools. This rapid growth in digital engagement positions Hang Seng Bank favorably for continued expansion in the wealth management sector.

Hang Seng Bank's strategic entry into sustainable finance, highlighted by the HKD 80 billion Sustainability Power Up Fund launched in 2024, represents another star segment. This commitment taps into the rapidly growing global demand for ESG-focused financial solutions, positioning the bank as a leader in this critical area.

The bank's pioneering work in digital currencies, including participation in the e-HKD pilot and joining the e-CNY platform, showcases its innovative approach. This positions Hang Seng Bank to capitalize on the significant growth observed in the digital asset market, which saw a 233% increase in activity for local banks in H1 2025.

| Segment | 2024 Performance Highlight | Growth Metric | Market Position |

|---|---|---|---|

| Life Insurance | New business premiums surge | +80% (Q3 2024) | 2nd largest insurer |

| Digital Wealth Management | 'Wealth Master' platform success | +324% (Investment accounts) | Strong digital adoption |

| Sustainable Finance | Sustainability Power Up Fund | HKD 80 billion | Emerging leader |

| Digital Currency | e-CNY platform integration | +233% (Digital asset activity H1 2025) | Early adopter |

What is included in the product

This BCG Matrix overview details Hang Seng Bank's product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

The Hang Seng Bank BCG Matrix offers a clear, one-page overview, relieving the pain point of scattered business unit performance data.

Cash Cows

Hang Seng Bank's traditional retail banking segment is a classic Cash Cow. With nearly 4 million customers and over 250 service outlets in Hong Kong, it holds a dominant market share in core services like deposits and mortgages.

These mature offerings, while experiencing low growth, consistently generate substantial and stable cash flows for the bank. This strong, established customer base and extensive network solidify its position as a reliable source of income.

Hang Seng Bank's core corporate banking relationships are a true cash cow, holding a substantial and stable market share. This is driven by their deep, long-standing ties with businesses and a full suite of essential services.

Traditional lending and transaction banking form the backbone of these consistent revenue streams, serving a loyal base of established corporate clients. In 2024, Hang Seng Bank reported a robust performance in its corporate banking segment, with net interest income from this area remaining a significant contributor to overall profitability.

Hang Seng Bank's established investment services, catering to its affluent clientele, are a crucial part of its non-interest income, functioning as a Cash Cow in its BCG Matrix. These offerings hold a significant market share within a mature investment landscape, consistently producing dependable fee-based revenue.

In 2024, Hang Seng reported robust performance in its wealth management and investment segments. For instance, its wealth management business saw a notable increase in assets under management, contributing significantly to the bank's overall profitability. This segment benefits from a loyal customer base and a well-established reputation.

Payment and Remittance Infrastructure

Hang Seng Bank's payment and remittance infrastructure, a cornerstone of its operations, functions as a Cash Cow within the BCG Matrix. These services, including sophisticated cross-boundary liquidity management and a wide array of digital payment solutions, cater to a substantial and loyal customer base.

The sheer volume of transactions processed through these established channels generates consistent fee income, a hallmark of a mature and stable business. In 2024, the bank continued to see strong uptake in its digital payment offerings, with transactions processed through its mobile app increasing by approximately 15% year-on-year. This sustained high transaction volume solidifies its position as a reliable revenue generator.

Key aspects contributing to its Cash Cow status include:

- High Transaction Volumes: The infrastructure supports millions of daily transactions, ensuring a constant revenue stream.

- Mature Market Presence: Established brand trust and extensive network foster continued customer loyalty and usage.

- Fee-Based Revenue: Remittance fees and service charges provide predictable and stable income.

- Digital Innovation: Ongoing investment in digital payment solutions maintains relevance and efficiency, driving continued adoption.

Extensive Branch Network

Hang Seng Bank's extensive branch network in Hong Kong, despite the digital shift, remains a significant asset. This physical footprint ensures continued accessibility for a large customer segment, maintaining a robust market share in traditional banking activities and deposit gathering. As of 2024, Hang Seng operated over 200 branches, a testament to its commitment to physical presence.

This network supports a substantial portion of its customer base, facilitating traditional banking services and fostering strong customer relationships. The bank's physical presence is crucial for attracting and retaining customers who prefer in-person interactions, particularly for complex financial needs or wealth management services. In 2023, approximately 60% of Hang Seng's new retail customers in Hong Kong utilized branch services for their initial onboarding.

The continued relevance of its branch network contributes to Hang Seng's status as a Cash Cow. This is supported by:

- High Market Share: The extensive network helps maintain a leading position in Hong Kong's retail banking sector.

- Stable Deposits: Physical branches are key drivers for attracting and holding significant customer deposits.

- Customer Loyalty: Traditional banking relationships fostered through branches contribute to customer retention.

- Brand Visibility: The widespread presence enhances brand recognition and trust within the community.

Hang Seng Bank's established mortgage and personal loan portfolio represents a significant Cash Cow. These mature products benefit from a large, loyal customer base and a well-penetrated market, generating consistent interest income. The bank's strong brand recognition and extensive distribution channels, including both digital and physical touchpoints, further solidify its market position in these segments.

In 2024, Hang Seng Bank continued to leverage its strong market position in mortgages, with its mortgage portfolio remaining a key driver of net interest income. The bank reported a steady growth in mortgage lending, reflecting its ability to attract and retain customers in this competitive market. This segment's maturity, coupled with consistent demand, ensures a reliable cash flow.

The bank's retail deposit base, comprising current and savings accounts, is another prime example of a Cash Cow. With millions of customers and a significant share of Hong Kong's deposit market, these accounts provide a stable and low-cost source of funding for the bank's lending activities. The consistent inflow of deposits fuels its lending operations and contributes significantly to profitability.

In 2024, Hang Seng Bank's deposit growth remained robust, underscoring the strength of its retail banking franchise. The bank actively managed its deposit mix to optimize funding costs, ensuring that its deposit base remained a cost-effective source of capital. This stability in funding is crucial for maintaining profitability in its lending businesses.

| Segment | BCG Category | Key Characteristics | 2024 Performance Indicator |

|---|---|---|---|

| Mortgages & Personal Loans | Cash Cow | Mature products, loyal customer base, consistent interest income | Steady growth in lending, significant contributor to net interest income |

| Retail Deposits | Cash Cow | Large customer base, significant market share, stable low-cost funding | Robust deposit growth, optimized funding costs |

Full Transparency, Always

Hang Seng Bank BCG Matrix

The Hang Seng Bank BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, will be delivered to you without any watermarks or demo content, ready for immediate professional use. You can confidently expect the same in-depth market insights and ready-to-use report that you see here, ensuring no surprises and full value. This is the final, analysis-ready file, crafted by experts to aid your business planning and competitive analysis.

Dogs

Certain legacy banking products at Hang Seng Bank, those lacking robust digital integration or compelling new features, are likely experiencing a downturn in their market relevance and a shrinking market share. These older offerings often come with higher operational expenses compared to the income they generate, acting as a drain on the bank's overall efficiency. By the end of 2023, a significant portion of traditional banking services still relied on manual processes, contributing to higher overheads for institutions like Hang Seng.

Niche Unprofitable SME Lending within Hang Seng Bank's portfolio often represents segments where the bank has a limited market share and faces low profitability. These areas might involve highly specialized industries or traditional business models that haven't adapted to digital transformation, leading to higher operational costs and credit risks. For instance, in 2024, while overall SME lending growth was a focus, specific sub-sectors might have shown stagnant or declining loan volumes due to intense competition from fintech lenders or a general economic downturn affecting those particular niches.

Services that absolutely require a physical branch visit for simple tasks, like basic account inquiries or small cash withdrawals, are increasingly becoming a bottleneck. Many customers, especially those comfortable with technology, now expect these services to be available online or via mobile apps. This shift means that physical branches might be spending resources on transactions that could easily be handled digitally.

For instance, in 2024, many banks reported a significant drop in over-the-counter transactions for routine matters. Hang Seng Bank, like its peers, likely sees a portion of its branch traffic dedicated to these easily digitized services. This can lead to underutilized branch capacity and increased operational costs per transaction, as the overhead of maintaining a physical presence remains while the volume of these specific transactions declines.

Less Competitive Credit Card Offerings

Hang Seng Bank's credit card offerings with less competitive features, such as weaker reward programs or limited digital capabilities, are likely to be in the Dogs quadrant of the BCG Matrix. These products face a challenging environment where newer, more innovative competitors are capturing market share.

For instance, in 2024, the credit card market saw continued growth in digital-first offerings and personalized rewards. Products that haven't kept pace with these trends may experience declining customer engagement. Data from early 2024 indicated that credit card issuers focusing on enhanced mobile app experiences and tailored cashback or points programs saw higher customer acquisition rates compared to those with more traditional product structures.

- Low Market Share: Products with less attractive reward structures or outdated digital features often struggle to gain or maintain significant market share.

- Stagnant Growth: These offerings are likely to experience minimal to no market growth, or even a decline, as customer preferences shift.

- Reduced Investment: Given their poor performance, these credit card products may receive limited further investment or development from Hang Seng Bank.

- Potential Divestment: In the long term, Hang Seng Bank might consider phasing out or divesting these underperforming credit card lines.

Non-Strategic International Ventures

Non-Strategic International Ventures, for a bank like Hang Seng, would represent operations outside its core strengths in Hong Kong and Mainland China. These might be smaller branches or less developed banking services in other regions that haven't yet established a strong foothold.

These ventures often face significant challenges. Intense global competition means they struggle to capture market share, and a lack of concentrated investment can hinder their ability to become profitable. For instance, many smaller international banking operations globally reported net interest margins below 2% in 2024, significantly lower than established players in core markets.

- Limited Market Share: These ventures typically hold a negligible percentage of the local banking market, often less than 0.5% in developed economies.

- Low Profitability: High operating costs and intense competition frequently lead to losses or minimal profits for these operations.

- Lack of Strategic Alignment: They may not align with the bank's primary strategic objectives, leading to underfunding and reduced management focus.

- High Risk, Low Reward: The potential return on investment is often outweighed by the considerable risks associated with entering and competing in unfamiliar markets.

Hang Seng Bank's credit card products with less competitive features, such as weaker reward programs or limited digital capabilities, are likely categorized as Dogs in the BCG Matrix. These offerings are struggling to gain traction in a market increasingly dominated by innovative competitors, leading to a low market share and stagnant growth. Consequently, these products may see reduced investment and could eventually be considered for divestment.

Non-strategic international ventures, operating outside Hang Seng Bank's core strengths in Hong Kong and Mainland China, also fall into the Dog category. These operations often struggle with low market share and profitability due to intense global competition and a lack of focused investment. The high risks associated with these unfamiliar markets often outweigh the potential rewards, making them prime candidates for divestment or strategic repositioning.

| Product Category | BCG Quadrant | Market Share | Market Growth | Profitability | Strategic Implication |

|---|---|---|---|---|---|

| Legacy Banking Products | Dog | Low | Declining | Low/Negative | Consider phasing out or modernizing |

| Unprofitable SME Lending Niches | Dog | Low | Stagnant/Declining | Low | Evaluate for divestment or restructuring |

| Branch Services for Basic Tasks | Dog | Low (for these tasks) | Declining | Low (due to overhead) | Accelerate digital channel adoption |

| Underperforming Credit Cards | Dog | Low | Stagnant | Low | Review for discontinuation or enhancement |

| Non-Strategic International Ventures | Dog | Low | Low | Low/Negative | Assess for divestment or exit |

Question Marks

Hang Seng Bank is actively embracing generative AI through its Future Banking 2.0 strategy, a move that positions it to capitalize on the rapidly expanding AI-driven financial services market. This integration is crucial as financial institutions globally are investing heavily in AI, with the global AI in banking market projected to reach $100 billion by 2028, growing at a CAGR of over 35%.

While the long-term growth prospects for AI-powered banking services are substantial, Hang Seng Bank's current market penetration in these specific, emerging generative AI applications is likely modest. This necessitates substantial investment in technology and talent to develop and scale these offerings, placing them in the question mark quadrant of the BCG matrix.

Hang Seng Bank, like many established players, is navigating the burgeoning digital-only banking landscape. The retail banking sector in Hong Kong is rapidly evolving, with a significant push towards digital solutions. This presents a clear opportunity for Hang Seng to either develop its own digital-only offerings or collaborate with existing fintech disruptors.

While these new ventures represent high-growth potential, Hang Seng's market share in these nascent digital-only segments might currently be modest. For instance, by the end of 2023, Hong Kong saw the licensing of eight virtual banks, indicating a competitive and early-stage market. Hang Seng's focus here would likely be on capturing future market share rather than dominating existing digital-only spaces.

Hang Seng Bank is actively pursuing innovation through strategic fintech partnerships, notably with Cyberport, to foster new business models and nurture startup ecosystems. These collaborations are crucial for exploring uncharted territory and identifying future growth avenues within the rapidly evolving financial landscape.

Investments in emerging technologies like Distributed Ledger Technology (DLT) exemplify Hang Seng's commitment to high-growth potential areas, even if their current market share in these specific niches is minimal. This strategic positioning aligns with a 'question mark' category, indicating a need for further development and market penetration.

Expansion into New Mainland China Regions

Expanding into new Mainland China regions positions Hang Seng Bank's offerings as potential Stars or Question Marks within the BCG matrix. These emerging markets, while offering substantial long-term growth potential, typically begin with a low market share for any new entrant. For instance, while Tier 1 and Tier 2 cities are well-penetrated, cities in western China are showing rapid economic development.

Hang Seng Bank's strategy here would involve significant investment in infrastructure, talent acquisition, and localized marketing to gain traction. The bank's total assets in Mainland China reached HKD 261.4 billion by the end of 2023, indicating a growing but still relatively small footprint compared to domestic giants in these less saturated areas.

- High Growth Potential: Emerging regions in Western and Central China are experiencing GDP growth rates often exceeding the national average, presenting a fertile ground for new financial services.

- Low Initial Market Share: Entering these markets means starting from a low base, requiring substantial capital expenditure to establish brand recognition and customer relationships.

- Investment Requirements: Building a physical presence, developing digital banking capabilities tailored to local needs, and compliance with evolving regulations necessitate significant upfront investment.

- Strategic Focus: The bank might initially focus on specific customer segments, such as SMEs or affluent individuals, where its expertise can be leveraged to build a competitive advantage.

Specialized Digital Solutions for Niche Demographics

Developing highly tailored digital banking solutions for specific, underserved or emerging demographic groups, such as segments of the youth market or gig economy workers, presents a significant opportunity for Hang Seng Bank. These specialized offerings cater to growing market needs, but Hang Seng's current penetration in these areas may be relatively low, positioning them as question marks within the BCG matrix. Strategic investment is crucial to capitalize on this potential.

For instance, a focus on the burgeoning gig economy, projected to grow substantially in Asia by 2025, could involve creating digital tools for flexible income management, instant payment options, and tailored loan products. In 2024, digital banking adoption among younger demographics in Hong Kong continued to rise, with a significant portion of Gen Z preferring mobile-first banking experiences. Hang Seng could leverage this trend by enhancing its digital platforms to offer features specifically designed for these users.

- Targeted Youth Features: Implementing gamified savings tools and educational financial content within the mobile app to attract and retain younger customers.

- Gig Worker Solutions: Developing integrated platforms for freelance income tracking, tax preparation assistance, and access to flexible credit lines.

- Market Growth Potential: The digital banking market for niche demographics is expanding, with estimates suggesting double-digit annual growth in Asia-Pacific over the next few years.

- Investment Rationale: Early investment in these specialized solutions can build brand loyalty and establish a strong market position before competitors fully enter these segments.

Hang Seng Bank's ventures into generative AI and specialized digital banking for niche demographics represent classic "Question Marks." These areas offer substantial future growth, but currently have low market share and require significant investment to develop and gain traction.

The bank's expansion into less penetrated regions of Mainland China also falls into this category, where initial market share is low despite high growth potential, necessitating considerable investment in infrastructure and localized strategies.

These initiatives, while promising, demand careful resource allocation and strategic planning to convert potential into market dominance, mirroring the inherent uncertainty and high investment needs of BCG's Question Mark quadrant.

BCG Matrix Data Sources

Our Hang Seng Bank BCG Matrix is built on comprehensive financial disclosures, robust market analytics, and industry-specific growth forecasts to provide accurate strategic insights.