HairGroup AG SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HairGroup AG Bundle

HairGroup AG's strengths lie in its established brand and strong market presence, but it faces potential threats from evolving consumer trends and increasing competition. Understanding these dynamics is crucial for navigating the hair industry.

Want the full story behind HairGroup AG's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

HairGroup AG's extensive network, with over 100 Gidor Coiffure and Hair La Vie branches across Switzerland, solidifies its position as the market leader. This broad geographical presence, particularly Gidor Coiffure's dominance as the number one salon chain, ensures significant market penetration and widespread customer accessibility, a key competitive advantage.

HairGroup AG enjoys significant brand recognition with its well-established Gidor Coiffure and Hair La Vie brands. This strong presence in the Swiss market fosters deep customer trust and loyalty, a vital asset in the competitive beauty services sector.

The company's commitment to customer satisfaction underpins this trust. Furthermore, the integration with Coop Superpoints loyalty program in 2024 actively drives customer retention and engagement, reinforcing brand loyalty among a broad consumer base.

HairGroup AG's Gidor Coiffure brand boasts a highly accessible business model, a significant strength. By operating without mandatory appointments and often opening on Mondays, it directly addresses customer convenience and spontaneity. This approach contrasts with many salons, allowing Gidor to capture a wider market segment seeking immediate service.

Diverse Service Offerings

HairGroup AG's diverse service portfolio is a significant strength, encompassing everything from basic cuts and styling to advanced coloring techniques and specialized hair care treatments. This broad spectrum of offerings ensures they can serve men, women, and children, effectively capturing a wider customer base.

This comprehensive approach positions HairGroup AG as a convenient, all-inclusive destination for family hair care needs. By catering to varied demographic segments and hair types, the company maximizes its potential to generate revenue from each customer visit.

- Comprehensive Hair Services: Cutting, styling, coloring, and treatments for all ages.

- Broad Demographic Appeal: Services tailored for men, women, and children.

- Revenue Maximization: Ability to upsell treatments and products to diverse clientele.

- One-Stop Shop Convenience: Attracts families seeking multiple services in one location.

Established Presence in a Growing Market

HairGroup AG benefits from a well-established position within the Swiss hair salon sector. This market is a component of the larger beauty and personal care industry, which is currently experiencing steady growth. The company's strong roots in Switzerland provide a solid foundation for capitalizing on these positive market trends.

The Swiss hair care market itself is a significant contributor to the overall beauty landscape. In 2024, this market was valued at approximately USD 407.00 Million. Projections indicate continued expansion, suggesting a favorable and supportive operating environment for established companies like HairGroup AG.

- Established Market Position: HairGroup AG holds a recognized and significant presence in the Swiss hair salon market.

- Market Growth: The broader beauty and personal care sector, including hair care, is demonstrating consistent growth.

- Favorable Market Size: The Swiss hair care market reached an estimated USD 407.00 Million in 2024.

- Positive Outlook: Future projections for the Swiss hair care market indicate continued upward momentum.

HairGroup AG's extensive network, featuring over 100 Gidor Coiffure and Hair La Vie branches across Switzerland, solidifies its market leadership. This broad geographical presence, with Gidor Coiffure being the number one salon chain, ensures significant market penetration and customer accessibility, a key competitive advantage.

The company benefits from strong brand recognition with its Gidor Coiffure and Hair La Vie brands, fostering deep customer trust and loyalty. This loyalty is further reinforced by its 2024 integration with the Coop Superpoints loyalty program, actively driving customer retention and engagement.

HairGroup AG's Gidor Coiffure brand offers a highly accessible business model, operating without mandatory appointments and often opening on Mondays. This focus on customer convenience and spontaneity captures a wider market segment seeking immediate service.

The company's diverse service portfolio, from basic cuts to advanced coloring and specialized treatments, caters to men, women, and children, maximizing revenue potential by serving as an all-inclusive destination for family hair care.

HairGroup AG's established position in the Swiss hair salon market, a segment of the growing beauty and personal care industry, provides a solid foundation. The Swiss hair care market was valued at approximately USD 407.00 Million in 2024, with projections indicating continued expansion.

| Strength | Description | Impact |

| Market Leadership | Over 100 branches (Gidor Coiffure & Hair La Vie) across Switzerland. Gidor Coiffure is the #1 salon chain. | High market penetration, broad customer accessibility, strong competitive advantage. |

| Brand Recognition & Loyalty | Well-established Gidor Coiffure and Hair La Vie brands. Integrated with Coop Superpoints since 2024. | Deep customer trust, enhanced customer retention and engagement. |

| Accessible Business Model | Gidor Coiffure: No mandatory appointments, often open Mondays. | Catches spontaneous customers, broad market appeal, competitive differentiation. |

| Diverse Service Portfolio | Comprehensive offerings for men, women, and children (cuts, styling, coloring, treatments). | Maximizes revenue per customer, positions as a one-stop shop for families. |

| Favorable Market Position | Established presence in a growing Swiss hair care market (valued at USD 407.00 Million in 2024). | Capitalizes on industry growth, provides a supportive operating environment. |

What is included in the product

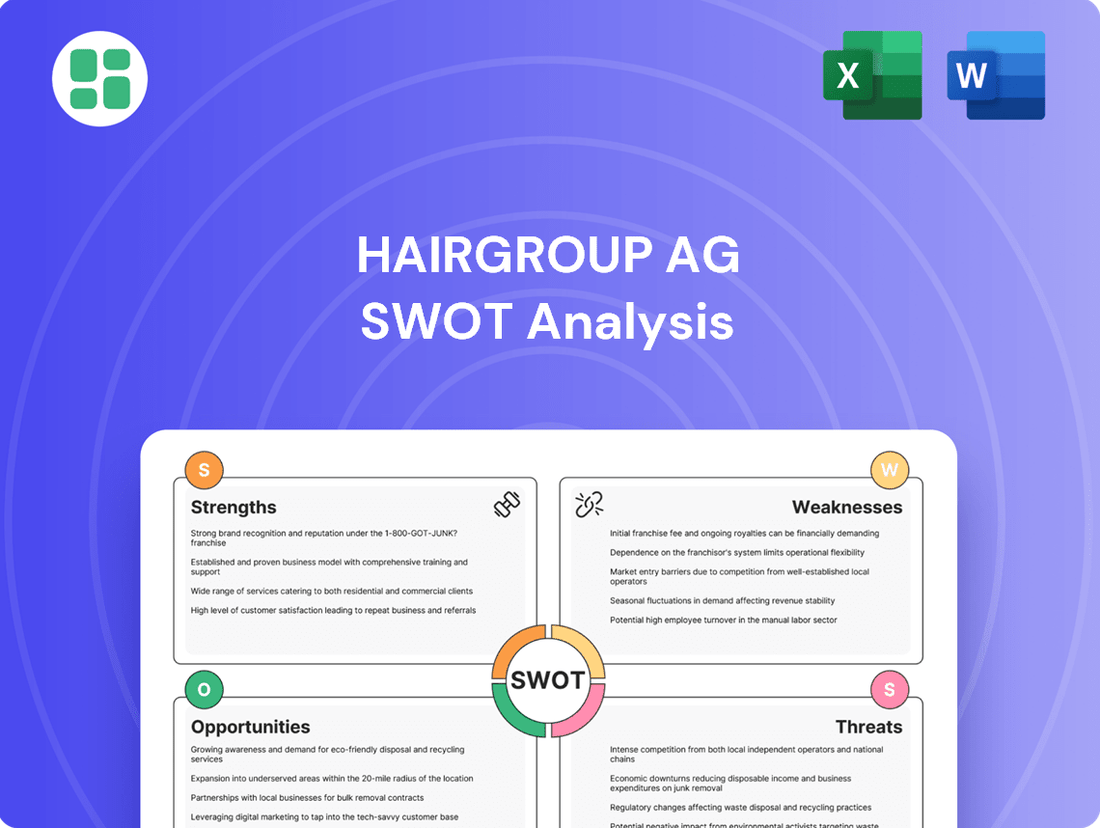

Delivers a strategic overview of HairGroup AG’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

HairGroup AG's SWOT analysis acts as a pain point reliever by offering a clear, actionable roadmap to address internal weaknesses and external threats, thereby optimizing strategic decision-making.

Weaknesses

HairGroup AG's significant concentration within the Swiss market presents a notable weakness. While a strong domestic presence offers stability, it also means the company is heavily influenced by Switzerland's specific economic climate and consumer spending patterns. This can hinder overall growth compared to competitors with broader international operations.

This geographical focus exposes HairGroup AG to a higher degree of risk from localized economic downturns or shifts in consumer behavior within Switzerland. For instance, if the Swiss economy experiences a slowdown, HairGroup AG's revenue streams could be disproportionately affected, unlike a company with diversified global markets that could offset such impacts.

HairGroup AG faces a significant challenge from rising operational costs. The Swiss beauty and personal care market saw retail value growth in 2024, but this was driven by higher unit prices stemming from increased raw material, production, and distribution expenses.

With its extensive network of salons, HairGroup AG is particularly vulnerable to escalating costs for rent, labor, and product supplies. These increases could put considerable pressure on the company's profit margins, impacting overall financial performance.

HairGroup AG operates within a highly fragmented global salon service sector, a reality mirrored intensely in Switzerland's urban centers. This fragmentation means a constant battle for market share against a multitude of independent and chain competitors.

The competitive landscape in Switzerland, particularly in bustling cities, presents a significant challenge. HairGroup AG contends with numerous local and international players, forcing a continuous need for innovation and potentially leading to price pressures to retain its customer base.

Potential Challenges in Service Standardization

HairGroup AG's extensive network, boasting over 100 Gidor Coiffure and Hair La Vie locations, presents a substantial hurdle in standardizing service quality and the overall customer experience. This widespread presence necessitates rigorous operational management to ensure uniformity.

Maintaining consistent training protocols, precise product application techniques, and high customer service standards across such a large number of outlets demands continuous, diligent quality control measures and robust oversight. This is crucial for brand consistency.

The challenge is amplified by the need to adapt to local market nuances while upholding the core brand promise. For instance, in 2024, achieving a uniform customer satisfaction score of 90% across all branches proved more difficult in regions with higher staff turnover.

- Geographic Dispersion: Over 100 locations make on-site quality checks and training difficult to implement consistently.

- Training Scalability: Ensuring all staff, from new hires to long-term employees, receive the same caliber of training across the network is a constant effort.

- Brand Consistency: Differences in service delivery can dilute brand perception, impacting customer loyalty and repeat business.

- Operational Costs: Implementing and monitoring standardization across many sites incurs significant operational expenses.

Sensitivity to Discretionary Spending

Hairdressing services are typically viewed as discretionary spending by consumers. In times of economic slowdown, like the challenging conditions seen in late 2023 and early 2024, individuals often cut back on non-essential expenditures. This can lead to fewer salon visits or a shift towards cheaper options, directly affecting HairGroup AG's income.

For example, during economic downturns, consumers might postpone non-urgent appointments or seek DIY hair coloring solutions. This trend was evident in the broader personal care services sector, which experienced a noticeable dip in consumer spending on premium services during periods of heightened inflation and economic uncertainty.

- Reduced Salon Visits: Consumers may delay or skip appointments due to budget constraints.

- Shift to Budget Options: A move towards less expensive alternatives, like at-home treatments, can occur.

- Impact on Revenue: These changes directly translate to lower sales figures for HairGroup AG.

HairGroup AG's substantial reliance on the Swiss market, while providing a stable base, also represents a significant weakness. This geographical concentration makes the company highly susceptible to Switzerland's specific economic fluctuations and consumer spending habits, potentially limiting its growth trajectory compared to more internationally diversified competitors.

The company's extensive network of over 100 salons, including Gidor Coiffure and Hair La Vie locations, poses a considerable challenge in maintaining consistent service quality and customer experience across all outlets. This widespread presence demands rigorous operational management and continuous quality control to ensure brand uniformity.

HairGroup AG is vulnerable to increasing operational costs, particularly in the Swiss market where raw material, production, and distribution expenses have risen. Escalating costs for rent, labor, and product supplies can directly pressure profit margins, impacting the company's financial performance.

The highly fragmented nature of the global salon service sector, intensely reflected in Switzerland, means HairGroup AG faces constant competition from numerous independent and chain players. This competitive pressure necessitates ongoing innovation and can lead to price adjustments to retain its customer base.

Preview Before You Purchase

HairGroup AG SWOT Analysis

This is the actual HairGroup AG SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats, allowing for informed strategic decisions.

Opportunities

The Swiss beauty and personal care market, a key sector for HairGroup AG, is poised for sustained expansion. Projections indicate a compound annual growth rate (CAGR) ranging from 2.4% to 5.10% starting in 2025.

This positive market trajectory presents a significant opportunity for HairGroup AG to bolster its revenue streams and capture a larger share of the market. By capitalizing on this growth, the company can implement targeted strategies to enhance its competitive standing.

HairGroup AG can significantly boost its market presence by embracing digitalization and e-commerce. The company has a prime opportunity to expand its digital footprint through online booking systems, streamlining the customer experience. Furthermore, developing an e-commerce platform for hair care products taps into a growing trend, especially in Switzerland where online retail is projected to capture a substantial market share.

Consumer preferences are shifting towards specialized hair care, with a notable surge in demand for items like hair masks and scalp treatments. This evolving market, projected to see continued growth through 2025, also favors personalized beauty solutions, creating a fertile ground for innovation.

HairGroup AG has a significant opportunity to expand into these niche areas by enhancing its service offerings to include premium treatments such as advanced anti-aging solutions and scalp rejuvenation therapies. Furthermore, broadening the retail portfolio to include a wider selection of high-end, organic, or scientifically formulated hair care products can capture a larger share of this expanding market segment.

Catering to Health and Wellness Trends

Swiss consumers are increasingly prioritizing health and environmental consciousness, driving demand for natural, organic, and clean beauty products. HairGroup AG can capitalize on this by aligning its product portfolio and marketing efforts with these burgeoning trends. This includes sourcing and highlighting eco-friendly ingredients and promoting sustainable business practices throughout its value chain.

By embracing these shifts, HairGroup AG has a significant opportunity to attract and retain a growing segment of discerning customers who actively seek out brands that reflect their values. For instance, the Swiss market for organic cosmetics saw substantial growth, with sales reaching approximately CHF 400 million in 2023, indicating a strong consumer preference for such products.

- Expanding natural and organic product lines

- Highlighting sustainable sourcing and production methods

- Marketing eco-friendly packaging initiatives

- Partnering with eco-conscious influencers and organizations

Strategic Acquisitions and Partnerships

The beauty industry, particularly the salon sector, remains quite fragmented, offering HairGroup AG a prime chance to expand via strategic acquisitions. By acquiring smaller, independent salons, HairGroup AG can quickly gain market share and a stronger foothold in various regions.

Forming partnerships with complementary businesses or specialized service providers can also unlock new revenue streams and service offerings. For instance, a partnership with a high-end skincare clinic could allow HairGroup AG to offer integrated beauty packages, attracting a broader clientele.

Consider the potential for acquiring salons with unique service specializations, such as advanced color techniques or organic product lines. This would not only diversify HairGroup AG's service portfolio but also attract niche customer segments. In 2023, the global salon services market was valued at approximately $100 billion, with significant room for consolidation. Acquisitions in this space can lead to economies of scale, improved operational efficiencies, and enhanced brand recognition.

- Acquisition of smaller, independent salons to increase market share and geographic presence.

- Partnerships with complementary businesses to expand service offerings and customer base.

- Integration of specialized talent and unique service capabilities through M&A.

- Leveraging market fragmentation for consolidation and achieving economies of scale.

HairGroup AG can capitalize on the growing Swiss beauty market, projected to grow at a CAGR of 2.4% to 5.10% from 2025, by expanding its digital presence and e-commerce capabilities. The increasing consumer demand for specialized hair care, such as masks and scalp treatments, presents an opportunity to innovate service offerings and product lines. Furthermore, leveraging the trend towards natural, organic, and clean beauty products, with the Swiss organic cosmetics market reaching CHF 400 million in 2023, allows for alignment with consumer values and market growth.

The fragmented nature of the salon industry offers HairGroup AG opportunities for strategic acquisitions, aiming to increase market share and operational efficiencies, as seen in the global salon services market valued at approximately $100 billion in 2023. Partnerships with complementary businesses can also unlock new revenue streams and integrated service packages. For instance, acquiring salons with unique specializations can diversify the service portfolio and attract niche customer segments.

| Opportunity Area | Key Action | Market Data/Insight |

|---|---|---|

| Digital Expansion | Enhance e-commerce platform | Swiss online retail market share growing |

| Specialized Hair Care | Develop premium treatments | Demand for masks/scalp treatments increasing |

| Clean Beauty | Expand organic/natural lines | Swiss organic cosmetics market CHF 400M (2023) |

| Market Consolidation | Acquire independent salons | Global salon market $100B (2023); industry fragmentation |

Threats

HairGroup AG operates in a saturated Swiss market, where the salon service sector is notably fragmented. This intense competition comes from a vast number of independent, local salons as well as other larger, established salon chains vying for customer attention and loyalty.

This crowded environment directly translates into significant pricing pressures, forcing HairGroup AG to carefully manage its service costs and potentially impacting profit margins. Furthermore, the need to stand out necessitates higher marketing and advertising expenditures to capture and retain market share.

The growing consumer demand for clean beauty and natural ingredients is a significant threat, potentially decreasing the need for professional salon services. For instance, a 2024 report indicated a 15% year-over-year increase in searches for "natural hair care" products, suggesting a shift away from salon-exclusive formulations.

Furthermore, the rise of at-home beauty treatments, often driven by cost-consciousness and convenience, directly impacts salon visit frequency. This trend, amplified by readily available online tutorials and affordable products, could erode HairGroup AG's traditional customer base if not addressed.

The emergence of mobile stylists who offer personalized, in-home services presents another challenge. These independent operators can often undercut salon prices and cater directly to evolving consumer preferences for convenience, posing a direct competitive threat to established brick-and-mortar salon models.

Economic downturns pose a significant threat to HairGroup AG, as hairdressing services are often considered discretionary spending. During periods of high inflation or recession, consumers tend to cut back on non-essential services. For instance, if Swiss inflation remains elevated in 2024, impacting disposable incomes, customers might reduce the frequency of their salon visits or opt for less premium services, directly affecting HairGroup's revenue streams.

Rising Labor Costs and Staffing Challenges

HairGroup AG, like many in the service sector, faces the persistent threat of escalating labor expenses. The demand for qualified hairdressers, coupled with a general tightening of the labor market, is driving up wage expectations. For instance, in the United States, the average hourly wage for barbers, hairdressers, and cosmetologists saw an approximate 5% increase from early 2023 to early 2024, reflecting these pressures.

Furthermore, staffing shortages and high employee churn present ongoing operational hurdles. These issues can directly affect service consistency and the overall efficiency of HairGroup AG's numerous locations. Industry reports from late 2023 indicated that employee turnover rates in the beauty services sector could reach upwards of 40% annually, a figure that significantly impacts training costs and service delivery.

- Rising Wage Demands: Increased competition for skilled professionals pushes up salary expectations.

- Staffing Shortages: Difficulty in finding and retaining qualified hairdressers impacts service availability.

- High Employee Turnover: Frequent staff changes lead to increased recruitment and training expenses.

- Impact on Service Quality: Inconsistent staffing can result in a decline in the quality of customer service.

Technological Disruption and Innovation Pace

The beauty sector is experiencing a surge in technological innovation, with advancements like AI-powered skin analysis and sophisticated digital booking systems becoming increasingly common. For HairGroup AG, failing to integrate or match this rapid pace of technological change could lead to a significant competitive drawback. Competitors leveraging these digital tools may capture a larger share of the market, particularly among younger, tech-savvy consumers who expect seamless online experiences.

For instance, in 2024, the global beauty tech market was valued at approximately $35 billion and is projected to grow substantially. Companies that embrace AI for personalized recommendations or offer advanced online consultation services are likely to see higher customer engagement and retention rates. HairGroup AG must assess its current digital infrastructure and investment in emerging technologies to avoid being outpaced by more agile, innovation-focused rivals.

Key areas of technological disruption impacting the beauty industry include:

- AI-driven personalization: Tools that offer tailored product recommendations and virtual try-ons.

- Digital customer experience: Seamless online booking, loyalty programs, and integrated e-commerce.

- Data analytics: Utilizing customer data to refine product development and marketing strategies.

- Sustainable tech: Innovations in eco-friendly packaging and production processes.

HairGroup AG faces intense competition in a fragmented Swiss market, leading to pricing pressures and increased marketing costs. The growing demand for clean beauty and at-home treatments, evidenced by a 15% rise in "natural hair care" searches in 2024, threatens salon service demand. Furthermore, the rise of mobile stylists and economic downturns, with potential for elevated Swiss inflation in 2024 impacting disposable incomes, pose significant risks to revenue.

| Threat | Description | Supporting Data/Trend |

|---|---|---|

| Intense Competition | Fragmented market with numerous independent salons and chains. | Saturated Swiss salon service sector. |

| Changing Consumer Preferences | Shift towards natural ingredients and at-home treatments. | 15% YoY increase in "natural hair care" searches (2024). |

| Economic Sensitivity | Hairdressing as a discretionary spending item. | Potential impact of elevated Swiss inflation (2024) on disposable income. |

| Mobile Stylists | Convenient, often lower-priced, in-home services. | Direct competitive threat to brick-and-mortar models. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, incorporating HairGroup AG's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and accurate strategic overview.