Guosen Securities Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guosen Securities Bundle

Guosen Securities operates within a dynamic financial landscape, where understanding the intensity of competition, the power of buyers and suppliers, and the threat of new entrants and substitutes is crucial. Our analysis unpacks these forces, revealing the strategic levers Guosen can pull.

The full Porter's Five Forces Analysis provides a comprehensive, data-driven examination of Guosen Securities’s competitive environment, offering actionable insights into market pressures and strategic positioning. Unlock key insights into Guosen Securities’s industry forces—from buyer power to substitute threats—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

Guosen Securities' operations are deeply entwined with specialized technology and data providers, who supply critical trading platforms and real-time market information. These suppliers possess considerable bargaining power because their offerings, such as unique bond quotes and sophisticated IT infrastructure, are often essential and difficult to substitute. For instance, the reliance on proprietary algorithms for high-frequency trading means few alternatives exist, allowing these tech firms to command higher prices. In 2024, the global FinTech market saw significant investment, further solidifying the position of key technology enablers.

The availability of highly skilled financial professionals, such as investment bankers and asset managers, is a critical input for Guosen Securities. A constrained supply of top-tier talent within China's competitive financial landscape can amplify the bargaining power of these individuals or specialized recruitment firms.

In 2024, the demand for experienced financial talent in China remained robust, with reports indicating a significant talent gap in specialized areas like quantitative finance and ESG investing. Guosen Securities, like its peers, must therefore dedicate substantial resources to talent acquisition and retention to ensure the high quality of its services.

The China Securities Regulatory Commission (CSRC) and other governmental bodies are significant suppliers to Guosen Securities, providing essential operating licenses and establishing the compliance frameworks within which it must function. These regulators dictate the rules of engagement for financial services in China, directly influencing Guosen's ability to operate and its associated costs.

Evolving regulations, such as those introduced in 2024 concerning data security and cross-border business operations, can significantly alter Guosen's operational landscape and necessitate substantial investments in compliance. For instance, increased scrutiny on fintech operations and stricter capital requirements for certain business lines, as observed throughout 2024, can elevate Guosen's cost of doing business and limit its strategic flexibility.

Infrastructure and Utility Providers

Guosen Securities relies heavily on infrastructure and utility providers like telecommunications, power, and data centers. While often fragmented, the limited number of high-quality, secure data center operators in key financial centers can grant them significant bargaining power. For instance, in 2024, the demand for advanced cloud infrastructure and secure data hosting surged, with major providers reporting increased utilization rates, potentially leading to higher costs for services Guosen depends on.

The concentration of specialized network connectivity providers in major financial hubs also strengthens their position. Guosen's operational efficiency is directly tied to the reliability and speed of these services. A 2024 report indicated that the cost of high-bandwidth, low-latency network solutions saw a modest increase, reflecting the specialized nature of these essential inputs.

- Concentration of high-quality data centers in financial hubs.

- Dependence on reliable and high-speed network connectivity.

- Potential for cost increases from essential infrastructure services.

- Impact of provider reliability on operational efficiency.

Financial Market Infrastructure

Financial market infrastructure providers, such as exchanges and clearing houses, are critical for Guosen Securities' operations, enabling trading and settlement. These entities often have significant leverage due to their near-monopolistic or duopolistic positions in the market. In 2024, for instance, the average trading fee on major global exchanges remained a key cost for securities firms.

Guosen's reliance on these infrastructures means they possess considerable bargaining power, influencing the costs and efficiency of Guosen's core business activities. For example, a 2023 report indicated that transaction fees from market infrastructure can represent a notable percentage of a brokerage's operating expenses.

- High Barriers to Entry: The establishment of new exchanges or clearing houses involves substantial regulatory hurdles and capital investment, limiting competition.

- Essential Services: Securities firms cannot operate without access to these foundational market services, creating a captive customer base for infrastructure providers.

- Fee Structures: The pricing models and service level agreements set by these entities directly impact Guosen's profitability and operational capacity.

Suppliers of specialized technology and data are critical for Guosen Securities, with their unique offerings like proprietary trading algorithms and essential IT infrastructure being difficult to substitute. In 2024, the FinTech market's growth further cemented the power of these key technology providers, allowing them to command premium pricing due to Guosen's dependence.

Financial market infrastructure providers, such as exchanges and clearing houses, hold significant bargaining power due to their near-monopolistic positions. Guosen's reliance on these essential services means that fee structures and service level agreements directly impact its profitability and operational capabilities, as evidenced by the notable percentage of operating expenses transaction fees can represent.

| Supplier Type | Bargaining Power Factors | Impact on Guosen Securities | 2024 Data/Trend |

|---|---|---|---|

| Technology & Data Providers | Unique offerings, high switching costs | Higher costs for essential platforms/data | Increased FinTech investment |

| Market Infrastructure (Exchanges, Clearing Houses) | Monopolistic/duopolistic positions, high entry barriers | Direct impact on transaction costs & profitability | Stable trading fees observed |

What is included in the product

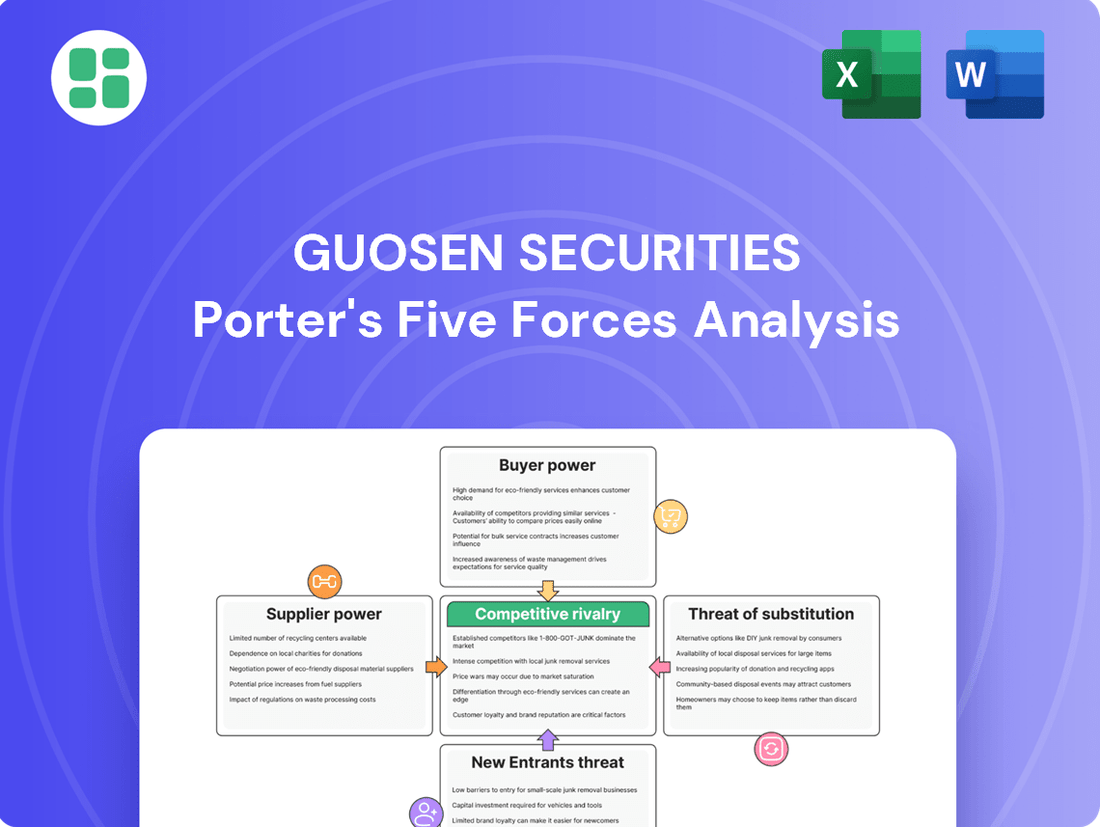

Guosen Securities' Porter's Five Forces analysis reveals the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes within the Chinese securities market.

Guosen Securities' Porter's Five Forces analysis provides a clear, visual representation of competitive pressures, allowing for immediate identification of strategic vulnerabilities and opportunities.

Customers Bargaining Power

Guosen Securities operates within the Chinese brokerage sector, a landscape populated by over 140 firms. This sheer volume of competitors means individual and institutional clients have a wealth of choices, making it easy to switch providers based on price or service. For instance, in 2023, the market saw significant competition among these numerous players, with many vying for market share through aggressive pricing and enhanced digital platforms.

The fragmentation of the market significantly bolsters customer bargaining power. Clients can readily compare the fees, research quality, and technological offerings of various brokerages. Guosen's success in retaining its customer base, therefore, hinges on its capacity to deliver superior value and service compared to its many rivals.

The Chinese securities market, especially in brokerage and underwriting, is incredibly competitive. This means companies like Guosen often have to offer very low fees to attract customers. In 2024, many retail investors in China are highly attuned to fees, readily switching between brokers for even small savings. This intense competition directly translates to strong bargaining power for customers, who can easily find alternative providers if pricing isn't attractive.

The digital transformation in China's financial sector is significantly lowering the barriers for customers to switch between service providers. Traditionally, financial services had inherent switching costs related to paperwork, account transfers, and established relationships. However, with the rise of digital platforms, these hurdles are diminishing, making it more convenient for clients to move their business.

Guosen Securities' substantial digital trading volume, reaching 7.8 trillion yuan in equity trading in 2023, highlights this trend. This high adoption of digital channels suggests that customers are comfortable with and actively using these platforms, which in turn empowers them to readily explore and switch to competitors if they find better offerings or service.

Access to Information and Investor Protection

Enhanced regulatory oversight, particularly from bodies like the China Securities Regulatory Commission (CSRC), significantly bolsters customer bargaining power. In 2024, the CSRC continued its focus on investor protection and transparency, pushing financial firms to provide clearer, more accessible information about products and services. This increased transparency empowers customers, allowing them to make better-informed choices and demand greater accountability from institutions like Guosen Securities.

This heightened transparency directly translates to a stronger customer voice. With more data readily available, customers can more effectively compare offerings, identify potential risks, and negotiate for better terms or services. Guosen Securities, therefore, must prioritize maintaining exceptionally high standards of disclosure and customer service to retain its competitive edge and manage this increased customer leverage.

- Increased Information Availability: Regulatory focus on transparency in 2024 means customers have more data on financial products.

- Informed Decision-Making: Access to information empowers customers to make choices aligned with their needs and risk tolerance.

- Holding Firms Accountable: Transparency allows customers to scrutinize firm practices and demand better service and ethical conduct.

- Negotiating Power: Well-informed customers are better positioned to negotiate fees, service levels, and product features.

Diverse and Evolving Client Needs

Guosen Securities caters to a broad spectrum of clients, from individual retail investors to large institutional players. This diversity means their needs are varied and constantly changing, particularly regarding investment options and personalized wealth management strategies.

The increasing wealth of China's middle class directly translates to greater customer bargaining power. As these individuals seek more complex and customized financial services, firms like Guosen are compelled to innovate, offering tailored solutions and unique investment products to meet these evolving demands.

- Diverse Client Base: Serves both individual and institutional investors.

- Evolving Needs: Clients demand diversified investment options and personalized wealth management.

- Growing Affluence: The expanding Chinese middle class fuels demand for sophisticated financial services.

- Increased Bargaining Power: Pushes firms to offer tailored solutions and innovative products.

The bargaining power of customers for Guosen Securities is significantly influenced by the highly competitive and increasingly transparent Chinese financial market. With numerous brokerage firms and readily available digital platforms, clients can easily compare services and switch providers, forcing Guosen to offer competitive pricing and superior value to retain business.

| Factor | Impact on Bargaining Power | Guosen Securities Context |

|---|---|---|

| Market Fragmentation | High | Over 140 brokerage firms in China offer clients many choices. |

| Digitalization & Low Switching Costs | High | Digital platforms make it easy for clients to move between brokers. |

| Regulatory Transparency (CSRC) | High | Increased disclosure empowers clients to make informed decisions and demand better service. |

| Client Sophistication & Affluence | Moderate to High | Growing middle class seeks tailored services, increasing demand for specialized offerings. |

Preview the Actual Deliverable

Guosen Securities Porter's Five Forces Analysis

This preview showcases the comprehensive Guosen Securities Porter's Five Forces Analysis, offering a deep dive into the competitive landscape of the securities industry. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, providing actionable insights without any placeholders or surprises. This detailed report is ready for your immediate use, equipping you with a thorough understanding of the forces shaping Guosen Securities' market position.

Rivalry Among Competitors

The Chinese securities market is incredibly crowded, with more than 140 firms vying for business. This fragmentation means competition is fierce across the board, from basic stock trading to more complex investment banking and wealth management services. Guosen Securities, even as a leading player, has to contend with a wide array of competitors, including massive state-backed institutions and nimble private firms.

This intense rivalry naturally pushes companies like Guosen Securities to compete aggressively on price and the quality of their services. For instance, brokerage fees can become a key differentiator in such a crowded space, forcing firms to constantly innovate and offer more value to attract and retain clients. The sheer number of participants means that market share gains are hard-won and often come at the expense of lower margins.

China's securities regulator, the CSRC, is actively driving consolidation within the financial sector, aiming to build globally competitive investment banks. This policy encourages mega-mergers among leading firms, creating larger, more powerful entities.

This push for consolidation intensifies competition, particularly at the upper echelon of the industry. As these larger banks emerge, they possess enhanced market power and a broader spectrum of services, raising the stakes for all participants.

For instance, in 2024, the groundwork for significant mergers continued, with reports indicating potential combinations involving several major Chinese brokerages. This strategic move by the government is designed to create financial institutions capable of competing on the international stage, thereby increasing rivalry among the top-tier players vying for market dominance.

The securities industry, including Guosen Securities, often grapples with significant overcapacity. This is driven by the sheer number of firms competing for market share, which naturally leads to intense pressure on service fees and commissions. For instance, underwriting fees in China have seen a notable decline, with some IPO underwriting fees reportedly falling below 1% in recent years, a stark indicator of this pricing war.

This aggressive pricing environment directly squeezes profit margins for all players. Companies like Guosen must therefore focus on innovation and service differentiation to justify their fees and maintain profitability. Simply competing on price is a losing strategy when capacity is abundant and demand is not growing fast enough to absorb it.

Emphasis on Comprehensive Service Offerings

Competitive rivalry within the securities industry, including firms like Guosen Securities, extends far beyond mere price competition. The focus is increasingly on the comprehensive nature and caliber of services provided. This encompasses a wide array, from investment banking and underwriting to sophisticated asset management and personalized wealth management solutions.

Companies are actively building integrated financial service platforms to create a sticky client base. This strategic imperative requires substantial and ongoing investment in developing a diverse range of capabilities and embracing cutting-edge technology. For instance, in 2024, major Chinese securities firms continued to allocate significant capital towards digital transformation initiatives, aiming to enhance client experience and operational efficiency across their service lines.

- Service Breadth: Competitors differentiate by offering a full spectrum of financial services, not just brokerage.

- Quality of Offerings: The depth and effectiveness of services like asset management and wealth advisory are key differentiators.

- Integrated Platforms: Firms aim to provide a seamless, one-stop-shop experience for clients.

- Investment in Capabilities: Continuous investment in technology and talent is crucial to maintain a competitive edge.

Market Volatility and Economic Conditions

The competitive rivalry within Guosen Securities is amplified by the inherent volatility of the Chinese capital market and prevailing economic conditions. When economic growth decelerates, such as the projected 4.6% GDP growth for China in 2024 according to IMF estimates, or when market downturns occur, the competition for a shrinking pool of profitable business intensifies. This makes it considerably harder for firms like Guosen Securities to expand their revenue streams.

This heightened competition is evident in several ways:

- Increased Price Sensitivity: In a slower economic environment, clients become more price-conscious, leading to greater pressure on brokerage fees and commission rates, squeezing profit margins for all players.

- Focus on Market Share: Firms may prioritize gaining or maintaining market share over profitability, engaging in aggressive client acquisition strategies that further fuel rivalry.

- Demand for Value-Added Services: To differentiate and retain clients amidst economic uncertainty, firms are compelled to offer more sophisticated research, advisory, and wealth management services, increasing operational costs and competitive pressure.

The competitive rivalry for Guosen Securities is intense due to a fragmented market with over 140 firms, pushing for aggressive pricing and service quality. Government-led consolidation efforts in 2024 aimed at creating larger, globally competitive entities further intensify this rivalry at the top tier.

This rivalry manifests in a constant drive for service differentiation beyond price, with firms investing heavily in integrated platforms and digital transformation, as seen in 2024 capital allocations. The pressure is on to offer a broad spectrum of high-quality services to retain clients in a market characterized by overcapacity and declining underwriting fees, with some IPO underwriting fees reportedly falling below 1%.

Economic slowdowns, like the projected 4.6% GDP growth for China in 2024, exacerbate this competition by reducing profitable business opportunities and increasing client price sensitivity. This forces firms to prioritize market share and invest more in value-added services, increasing operational costs.

| Metric | Guosen Securities (Example) | Industry Average (China Securities) | Year |

|---|---|---|---|

| Number of Competitors | N/A | 140+ | 2024 |

| Average IPO Underwriting Fee | N/A | <1% (reported) | Recent Years (incl. 2024) |

| Digital Transformation Investment | Significant Capital Allocation | Significant Capital Allocation | 2024 |

SSubstitutes Threaten

The proliferation of intuitive online trading platforms and FinTech innovations has empowered individual investors to bypass traditional brokerage firms and directly engage with financial markets. This shift, particularly pronounced in China's tech-savvy population, presents a potent substitute for Guosen Securities' core brokerage offerings.

The threat of substitutes for Guosen Securities' offerings is significant, particularly from bank wealth management products (WMPs). China's banking sector saw substantial growth in WMPs in 2024, with banks actively introducing a wide array of these products.

These bank-issued WMPs provide investors with an alternative channel for managing their wealth, directly challenging the asset management and investment advisory services traditionally provided by securities firms like Guosen. The sheer volume and accessibility of these bank products present a considerable competitive pressure.

Technological advancements, particularly the rise of AI-driven platforms and robo-advisors, are significantly altering the wealth management landscape. These automated solutions offer personalized investment advice at a lower cost, presenting a compelling alternative to traditional advisory services. For instance, by the end of 2023, the global robo-advisory market was valued at over $20 billion, with projections indicating substantial growth in the coming years, driven by their appeal to a younger, digitally inclined investor base.

Alternative Financing Channels for Corporations

Corporations are increasingly exploring alternative financing channels, potentially reducing their reliance on traditional investment banking services for tasks like underwriting. For instance, direct bond issuance and peer-to-peer lending platforms offer viable options, particularly for smaller corporate finance mandates. While these alternatives may not fully replace traditional IPO underwriting, they represent a growing threat by offering competitive avenues for capital raising.

The landscape of corporate finance is evolving, with a notable shift towards diverse funding sources. In 2024, the global alternative lending market was projected to reach over $3.5 trillion, indicating a significant appetite for non-traditional financing. This trend directly impacts investment banks as companies seek to diversify their funding strategies.

- Direct Bond Issuance: Companies can bypass intermediaries and issue bonds directly to investors, often achieving lower costs.

- Peer-to-Peer Lending Platforms: These platforms connect businesses directly with individual or institutional lenders, streamlining the borrowing process.

- Crowdfunding: While more common for startups, equity and debt crowdfunding are also emerging as options for established businesses seeking smaller capital injections.

Growth of Mutual Funds and Diversified Investments

The growing popularity of mutual funds and diversified investment vehicles in China presents a significant threat of substitutes for traditional brokerage services like those offered by Guosen Securities. Investors are increasingly seeking broader market exposure and professional management, moving away from solely direct stock purchases.

By mid-2024, China's mutual fund market saw substantial growth, with assets under management reaching new highs. For instance, the total assets managed by Chinese mutual funds surpassed 27 trillion yuan by the end of 2023, indicating a strong preference for these pooled investment products. Guosen, through its asset management division, participates in this trend, but the widespread availability of similar diversified products from numerous competitors intensifies this substitute threat.

- Increased Investor Demand for Diversification: A rising number of Chinese investors are prioritizing diversification to mitigate risk, making mutual funds and ETFs attractive alternatives to single-stock investments.

- Availability of Alternative Investments: Products like private equity and hedge funds, managed by various financial institutions, offer further substitutes by catering to investors seeking higher potential returns and different risk profiles.

- Competitive Landscape: The broad accessibility and active promotion of these diversified investment options by a wide array of financial firms mean Guosen faces robust competition not just in direct stock trading but also in the asset management space.

The rise of online trading platforms and FinTech has significantly lowered the barrier to entry for individual investors, offering direct market access. This trend, particularly strong in China's tech-savvy population, directly challenges Guosen Securities' traditional brokerage services by providing accessible and often lower-cost alternatives.

Bank wealth management products (WMPs) represent a substantial substitute, especially given their robust growth in China throughout 2024. These products offer an alternative avenue for wealth management, directly competing with Guosen's asset management and advisory services.

AI-driven platforms and robo-advisors are increasingly offering personalized, low-cost investment advice, making them a compelling substitute for traditional advisory models. The global robo-advisory market, valued at over $20 billion by the end of 2023, demonstrates this growing trend.

Corporations are exploring alternative financing channels like direct bond issuance and peer-to-peer lending, reducing reliance on investment banks for capital raising. The global alternative lending market's projected growth to over $3.5 trillion in 2024 underscores this shift.

| Substitute Offering | Key Characteristics | Impact on Guosen Securities |

|---|---|---|

| Online Trading Platforms | Direct market access, lower fees, user-friendly interfaces | Reduces demand for traditional brokerage execution services |

| Bank Wealth Management Products (WMPs) | Wide variety, perceived safety, integrated banking services | Competes directly with asset management and investment advisory |

| Robo-Advisors/AI Platforms | Automated, personalized advice, lower cost | Threatens traditional financial advisory revenue streams |

| Direct Bond Issuance/Alternative Lending | Bypasses intermediaries, potentially lower financing costs | Reduces reliance on investment banking for corporate finance |

Entrants Threaten

Entering the Chinese securities market demands significant upfront capital, with new firms needing to invest heavily in technology, compliance, and talent. For instance, in 2024, regulatory capital requirements for securities firms in China often range in the hundreds of millions of U.S. dollars, creating a substantial barrier.

Established players like Guosen Securities already leverage considerable economies of scale. This allows them to spread fixed costs over a larger revenue base, leading to lower per-unit operating expenses and the ability to offer a wider array of services more competitively than a newcomer could initially match.

The China Securities Regulatory Commission (CSRC) maintains a rigorous licensing framework and a complex regulatory landscape, which includes evolving rules for initial public offerings (IPOs) and quantitative trading strategies. These demanding entry barriers are intentionally crafted to foster market stability and safeguard investor interests, thereby posing a significant deterrent to prospective new participants in the financial sector.

Established firms like Guosen Securities benefit from years of building trust and strong client relationships. For instance, in 2023, Guosen Securities reported a net profit of RMB 10.2 billion, indicating a stable and profitable operation that fosters client loyalty.

New entrants must overcome the significant hurdle of replicating these deeply entrenched connections and trust. Acquiring clients in a market where Guosen already possesses extensive distribution networks and a recognized brand requires substantial investment and time, making it a costly endeavor.

Technological and Talent Barriers

The threat of new entrants for Guosen Securities is significantly shaped by substantial technological and talent barriers. Developing and maintaining cutting-edge trading platforms, robust cybersecurity infrastructure, and sophisticated analytical tools demands immense capital and specialized knowledge. For instance, the global fintech market, a key area for technological advancement in securities, was projected to reach over $300 billion in 2024, highlighting the scale of investment required.

Furthermore, attracting and retaining highly skilled financial professionals, including quantitative analysts and cybersecurity experts, is a major hurdle. The competition for talent is fierce, with top firms often offering substantial compensation packages. In 2023, the average salary for a data scientist in the finance sector in China, a key market for Guosen, was reported to be around ¥450,000, indicating the high cost of acquiring essential human capital.

- High Capital Investment: Significant upfront costs for advanced trading technology and cybersecurity.

- Specialized Expertise: Need for deep technological knowledge in platform development and data analytics.

- Talent Acquisition Costs: Intense competition for skilled financial professionals drives up recruitment and retention expenses.

- Regulatory Compliance: New entrants must also navigate complex and costly regulatory landscapes, adding to the barrier.

Controlled Market Access and Government Policy

The financial sector in China, including securities services, remains a heavily regulated domain. Despite efforts to shorten the overall market access 'negative list,' explicit prohibitions prevent non-financial entities from using terms like 'securities company,' creating a significant barrier to entry.

While FinTech has seen innovation, recent trends indicate a slowdown. For instance, global FinTech funding saw a notable decrease in early 2024 compared to previous years, largely attributed to increased regulatory scrutiny. This suggests that disruptive new players face a challenging landscape, potentially limiting the threat of new entrants into the securities market.

- Government Policy: Strict regulations and licensing requirements act as a substantial deterrent for new firms.

- Sector Control: The financial industry's tightly controlled nature, particularly for securities, limits who can operate and under what terms.

- FinTech Funding Trends: Declining FinTech investment in 2024 signals a more cautious environment for innovative newcomers.

- Brand Loyalty & Switching Costs: Established firms benefit from existing client relationships and the inertia of switching providers.

The threat of new entrants for Guosen Securities is considerably low, primarily due to formidable barriers to entry in China's securities market. These include substantial capital requirements, stringent regulatory oversight, and the significant advantage of established brand loyalty and extensive client networks that incumbents like Guosen have cultivated over years of operation. For instance, in 2024, regulatory capital requirements for securities firms in China often necessitate hundreds of millions of U.S. dollars, a substantial hurdle for any aspiring new participant.

Newcomers must also contend with the high cost of acquiring specialized talent and replicating the technological infrastructure that firms like Guosen already possess. The intense competition for skilled professionals, such as quantitative analysts, further escalates these entry costs, with average salaries for data scientists in China’s finance sector around ¥450,000 in 2023. Additionally, recent trends showing a slowdown in FinTech funding in early 2024, partly due to increased regulatory scrutiny, suggest a more challenging environment for innovative newcomers, further dampening the threat of new entrants.

| Barrier Type | Description | 2024/2023 Data Point |

|---|---|---|

| Capital Requirements | Upfront investment for technology, compliance, and talent. | Hundreds of millions of USD for regulatory capital. |

| Regulatory Hurdles | Rigorous licensing and complex compliance framework. | Strict CSRC regulations on IPOs and trading. |

| Economies of Scale | Established firms spread fixed costs over larger revenue. | Guosen's RMB 10.2 billion net profit in 2023 indicates scale. |

| Brand Loyalty & Trust | Long-standing client relationships and recognized brands. | High client loyalty due to established networks. |

| Talent & Technology | Need for cutting-edge platforms and skilled professionals. | Average data scientist salary ~¥450,000 in 2023. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Guosen Securities is built upon a foundation of publicly available financial statements, investor relations materials, and official company disclosures.

We supplement this with insights from reputable financial news outlets, industry-specific research reports, and macroeconomic data to provide a comprehensive view of the competitive landscape.