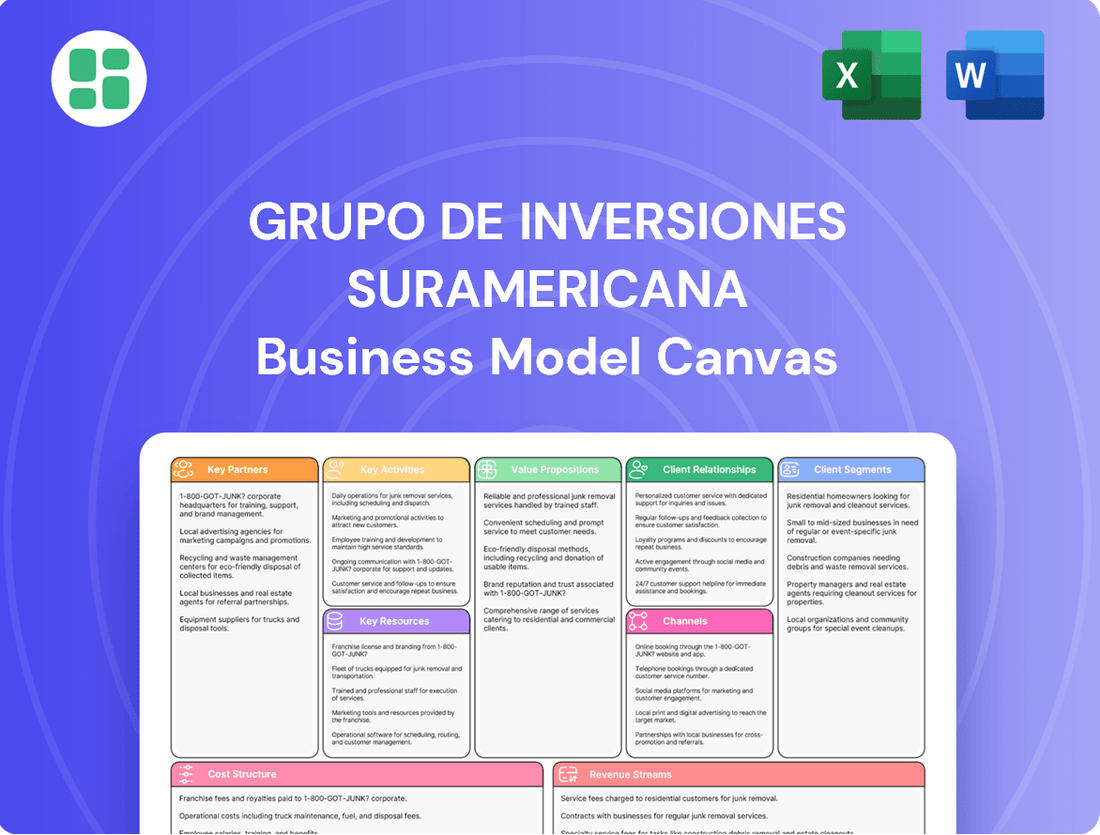

Grupo De Inversiones Suramericana Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo De Inversiones Suramericana Bundle

Unlock the strategic blueprint behind Grupo De Inversiones Suramericana's success with our comprehensive Business Model Canvas. Discover their key partners, value propositions, and revenue streams that drive their market dominance. This detailed analysis is your key to understanding their operational excellence and identifying growth opportunities.

Partnerships

Grupo SURA actively cultivates strategic alliances with technology providers, particularly in the fintech sector. These partnerships are crucial for bolstering their digital infrastructure, fortifying cybersecurity measures, and pioneering novel financial products. For instance, in 2024, Grupo SURA continued to invest in digital transformation initiatives, aiming to integrate advanced analytics and AI into their customer service platforms, enhancing user experience and operational efficiency.

These collaborations are vital for maintaining a competitive edge in the dynamic digital financial environment. By teaming up with specialized tech firms, Grupo SURA can accelerate the development and deployment of innovative solutions, ensuring they offer seamless and integrated experiences across their diverse portfolio of financial services, from insurance to banking and asset management.

Grupo SURA's strategic partnership with Bancolombia, where it holds a significant stake, is a cornerstone of its business model. This collaboration facilitates extensive cross-selling of financial products and services, enhancing customer value and deepening market penetration.

Leveraging Bancolombia's robust banking infrastructure, Grupo SURA can offer integrated solutions, creating a more comprehensive financial ecosystem. For instance, in 2024, Bancolombia reported a net income of approximately COP 4.5 trillion (USD 1.1 billion), underscoring the scale and success of this partnership.

Suramericana, a key player in the insurance sector, relies heavily on partnerships with reinsurance companies, both globally and locally. These collaborations are essential for managing significant risks, ensuring the company's financial resilience. For instance, in 2023, the global reinsurance market saw substantial growth, with premiums written by reinsurers reaching over $300 billion, highlighting the scale and importance of these relationships for insurers like Suramericana to underwrite complex policies and navigate potential catastrophic events.

Distribution Networks and Brokers

Grupo SURA actively collaborates with a diverse array of independent insurance brokers and financial advisors. These crucial partnerships are instrumental in extending the reach of its insurance, pension, and investment offerings to a broader customer base across various markets.

By engaging these intermediary networks, Grupo SURA significantly enhances its market penetration. These collaborations provide valuable local market insights and specialized knowledge, which are essential for effective product sales and customer acquisition strategies.

In 2024, Grupo SURA's distribution strategy continued to emphasize these key partnerships. For instance, its insurance segment relies heavily on broker networks, which contributed a substantial portion of new policy sales. Similarly, its pension fund administration business benefits from financial advisors who guide individuals through complex retirement planning, driving asset growth. The company reported that over 60% of its new investment product sales in the first half of 2024 were facilitated through its broker and advisor channels.

- Independent Brokers: Essential for reaching individual and small business clients for insurance and investment products.

- Financial Advisors: Crucial for pension fund sales and wealth management services, offering personalized guidance.

- Expanded Market Access: Partnerships enable deeper penetration into regional and niche markets where direct presence is challenging.

- Local Expertise: Brokers and advisors provide on-the-ground knowledge of customer needs and regulatory landscapes.

Regulatory Bodies and Industry Associations

Grupo SURA actively cultivates relationships with financial regulators across its operating regions, such as the Superintendencia Financiera de Colombia (SFC) and the Comisión Nacional Bancaria y de Valores (CNBV) in Mexico. These partnerships are critical for ensuring adherence to evolving financial regulations, which is paramount in maintaining operational integrity and investor confidence. For instance, in 2023, the SFC implemented new guidelines on digital transformation for financial institutions, requiring significant adaptation and engagement from entities like SURA.

Participation in industry associations, including the Federación Latinoamericana de Bancos (FELABAN) and national banking associations, allows Grupo SURA to contribute to shaping industry standards and advocating for favorable policy environments. These collaborations are instrumental in navigating the diverse and often complex regulatory frameworks present throughout Latin America. Such engagement helps foster a more stable and predictable financial ecosystem, which benefits all stakeholders.

- Regulatory Compliance: Ongoing dialogue with bodies like the Superintendencia de Economía Popular y Solidaria (SEPS) in Ecuador ensures Grupo SURA's operations align with local financial sector regulations.

- Policy Influence: Active participation in associations such as the Asociación de Bancos de México (ABM) provides a platform to influence financial policy discussions and contribute to industry best practices.

- Risk Mitigation: Strong relationships with regulators help anticipate and adapt to regulatory changes, thereby mitigating compliance risks and ensuring business continuity.

Grupo SURA's key partnerships are foundational to its expansive reach and operational resilience. Collaborations with technology providers are vital for digital advancement, as seen in their 2024 investments in AI for customer service. Strategic alliances with entities like Bancolombia, in which SURA holds a significant stake, enable robust cross-selling and integrated financial ecosystems; Bancolombia's 2024 net income of approximately COP 4.5 trillion underscores the partnership's scale.

Furthermore, Suramericana's reliance on global and local reinsurance partners is critical for risk management, especially given the over $300 billion in premiums written by reinsurers globally in 2023. The company also leverages a wide network of independent brokers and financial advisors, which in the first half of 2024 facilitated over 60% of its new investment product sales, extending its market penetration and providing crucial local insights.

| Partner Type | Purpose | 2024 Impact/Data Point |

|---|---|---|

| Technology Providers | Digital infrastructure, new products | AI integration in customer service |

| Bancolombia | Cross-selling, integrated ecosystem | Bancolombia's 2024 net income: ~COP 4.5 trillion |

| Reinsurance Companies | Risk management, financial resilience | Supports underwriting complex policies |

| Brokers & Financial Advisors | Market penetration, sales | Facilitated >60% of new investment sales (H1 2024) |

What is included in the product

This Business Model Canvas outlines Grupo SURA's strategy, focusing on diverse financial services and insurance offerings to a broad customer base across Latin America, leveraging strong brand recognition and extensive distribution networks.

Grupo De Inversiones Suramericana's Business Model Canvas offers a clear, one-page snapshot of their strategy, simplifying complex financial operations and providing actionable insights for stakeholders.

This concise format alleviates the pain of navigating intricate corporate structures by presenting Grupo Suramericana's core value proposition and revenue streams in an easily digestible manner.

Activities

Suramericana's core activities revolve around assessing risks and managing insurance policies for life, property, casualty, and health. This involves sophisticated actuarial analysis and stringent risk management to accurately price policies and ensure financial stability. In 2023, Suramericana reported a combined ratio of 94.5%, indicating efficient underwriting and claims management, a key driver of its profitability.

Efficiently processing claims is paramount for customer satisfaction and maintaining the company's financial health. This requires streamlined operations and effective fraud detection mechanisms. The company processed over 1.5 million claims in 2023, with a significant portion resolved within 30 days, highlighting their operational effectiveness.

SURA Asset Management is a cornerstone of Grupo SURA's business, actively managing a diverse range of financial products. This includes significant oversight of pension funds, mutual funds, and various investment portfolios tailored for both individual savers and large institutional investors. Their core function revolves around meticulous market research and strategic investment decisions.

The advisory arm of SURA Asset Management is crucial, offering personalized financial planning to help clients optimize their investment returns. In 2024, SURA Asset Management continued to be a major player in Latin America, managing assets that represent a substantial portion of the region's investment landscape, reflecting their deep expertise and broad client base.

Grupo SURA's significant stake in Bancolombia allows it to participate in core banking functions like accepting deposits, providing loans, and facilitating payments. This indirect involvement means Grupo SURA benefits from and influences the financial services sector through its strategic partnership.

In 2024, Bancolombia, a key asset for Grupo SURA, reported robust performance, with its net income reaching approximately COP 3.4 trillion (around USD 870 million based on average exchange rates). This financial strength underscores the value of this banking operation within Grupo SURA's business model.

Product Development and Innovation

Grupo SURA is actively engaged in developing and enhancing its financial product and service portfolio to address the dynamic needs of its diverse customer base. This commitment to innovation is a cornerstone of their strategy, ensuring they remain competitive in the financial sector.

In 2024, SURA continued to invest in areas like digital transformation and personalized financial solutions. For instance, their insurance segment might have launched new health or life insurance products tailored to specific demographic trends identified through extensive market research. This focus on innovation is supported by their ongoing efforts in financial engineering and actuarial science.

- Market Research: Continuously analyzing customer behavior and market trends to identify gaps and opportunities for new financial products.

- Product Enhancement: Upgrading existing offerings, such as investment funds or pension plans, with improved features and digital accessibility.

- Technological Integration: Leveraging fintech advancements to create innovative digital banking, insurance, and investment platforms.

- Actuarial Science & Financial Engineering: Utilizing these disciplines to design and price new products, ensuring both customer value and profitability.

Digital Transformation and Technology Integration

Grupo Sura actively invests in and integrates advanced digital technologies across its diverse business units. This focus on digital transformation is crucial for boosting operational efficiency, enriching customer experiences, and fostering data-driven strategic choices. For instance, in 2024, the company continued to enhance its digital platforms and mobile applications, aiming to provide more seamless and personalized services to its clients in insurance, financial services, and healthcare.

The utilization of Artificial Intelligence (AI) and advanced analytics is a cornerstone of this strategy. These technologies enable Grupo Sura to offer more tailored financial products, improve risk assessment, and streamline internal processes. By leveraging data insights, the group can better understand customer needs and market trends, leading to more effective service delivery and product development.

- Digital Platform Enhancement: Continued investment in user-friendly online portals and mobile apps for banking, insurance, and investment services.

- AI and Analytics Integration: Deployment of AI for personalized customer recommendations, fraud detection, and operational optimization across business lines.

- Data-Driven Decision Making: Utilizing advanced analytics to inform strategic planning, product innovation, and risk management.

- Cybersecurity Measures: Strengthening digital infrastructure to ensure the security and privacy of customer data in an increasingly digital landscape.

Grupo SURA's key activities center on managing a broad portfolio of financial services, including insurance, asset management, and banking investments. This involves rigorous risk assessment, claims processing, and strategic investment oversight to ensure profitability and client satisfaction. The group's commitment to innovation drives continuous enhancement of its product offerings and digital platforms, leveraging data analytics and AI for personalized solutions and operational efficiency.

| Activity Area | Key Functions | 2023/2024 Highlights |

|---|---|---|

| Insurance (Suramericana) | Risk assessment, policy management, claims processing | Combined ratio of 94.5% (2023), processed over 1.5 million claims (2023) |

| Asset Management (SURA AM) | Managing pension funds, mutual funds, investment portfolios | Significant player in Latin America, managing substantial assets (2024) |

| Banking Investment (Bancolombia) | Facilitating deposits, loans, payments | Net income of approx. COP 3.4 trillion (2024) |

| Innovation & Digitalization | Product development, digital platform enhancement, AI integration | Continued investment in digital transformation and personalized solutions (2024) |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas for Grupo De Inversiones Suramericana you are currently previewing is the exact document you will receive upon purchase. This comprehensive overview details their strategic approach, including key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You can be assured that the content and formatting you see here are precisely what will be delivered, allowing you to immediately utilize this valuable analysis.

Resources

Grupo SURA's substantial financial capital, encompassing equity, reserves, and diverse investment portfolios, forms the bedrock of its operations. This robust financial foundation, evidenced by its strong solvency ratios, is critical for underwriting insurance policies and managing a wide array of assets.

The company's significant reserves and investment portfolios, totaling billions of dollars in assets under management as of early 2024, empower it to absorb considerable risks and maintain unwavering liquidity. This financial strength ensures Grupo SURA can consistently meet its obligations to policyholders and clients.

This deep financial wellspring is not merely for stability; it actively fuels strategic growth. Grupo SURA leverages its capital to pursue new market opportunities, invest in innovative solutions, and expand its service offerings across Latin America, reinforcing its competitive edge.

Grupo de Inversiones Suramericana's human capital is a cornerstone, featuring highly skilled actuaries, financial analysts, investment managers, IT specialists, and customer service representatives. These professionals are vital for driving product innovation, managing risk effectively, and building strong client relationships, forming the intellectual core of the company.

In 2024, the company continued to invest in its workforce, recognizing that specialized expertise is key to navigating complex financial markets and delivering superior client value. This focus on talent ensures the organization remains agile and competitive.

Grupo Sura leverages advanced IT infrastructure and proprietary software for critical functions like risk assessment, investment management, and customer relationship management (CRM). This technological backbone is essential for their operations.

The company's extensive customer data and market intelligence are paramount. For instance, in 2023, Grupo Sura reported a significant increase in digital interactions, highlighting the growing importance of their data assets in driving personalized services and predictive analytics.

These key resources empower Grupo Sura to make informed strategic decisions, enhancing their ability to adapt to market dynamics and deliver tailored solutions to their diverse client base.

Brand Reputation and Trust

Grupo De Inversiones Suramericana's brand reputation and trust are cornerstones of its business model, cultivated through decades of reliable service in Latin America. This deep-seated trust is a powerful draw for new clients and a key factor in retaining existing ones, ensuring a stable customer base. For instance, in 2023, Suramericana's insurance segment maintained a strong market position, reflecting continued customer confidence.

This established trust translates directly into strategic advantages. It simplifies the process of forming new partnerships and collaborations within the financial ecosystem, as other entities are more willing to engage with a reputable firm. Furthermore, it significantly bolsters investor confidence, making the company a more attractive proposition for capital investment, which is crucial for growth and expansion.

The tangible benefits of this strong brand equity are evident in several areas:

- Customer Acquisition and Retention: A trusted brand naturally attracts more customers and reduces churn, leading to predictable revenue streams.

- Partnership Facilitation: Strong reputation opens doors for strategic alliances and distribution agreements with other businesses.

- Investor Confidence: Investors are more likely to allocate capital to companies with a proven track record and a trustworthy image, potentially lowering the cost of capital.

- Competitive Differentiation: In a crowded financial market, brand trust serves as a significant differentiator, setting Suramericana apart from competitors.

Extensive Branch and Digital Network

Grupo de Inversiones Suramericana leverages its extensive branch and digital network as a core resource. This includes Bancolombia's significant physical presence, complemented by increasingly sophisticated digital platforms like mobile banking and online services. This dual approach ensures broad customer accessibility and convenience.

The combination of physical branches and digital channels is crucial for customer acquisition and service delivery. As of early 2024, Bancolombia reported serving over 15 million customers across its various channels, highlighting the reach of this strategy. This multi-channel approach allows Suramericana to cater to diverse customer preferences and maintain a wide market presence.

- Branch Network: Bancolombia operates hundreds of physical branches across Colombia and other Latin American countries, offering face-to-face banking services.

- Digital Channels: Robust online banking portals and mobile applications provide 24/7 access to financial services, including transactions, inquiries, and account management.

- Customer Reach: This integrated network facilitates engagement with a broad customer base, from those who prefer traditional banking to digitally-savvy users.

- Service Delivery: The network is fundamental for efficient customer service, product distribution, and building strong customer relationships.

Grupo SURA's financial capital, including robust equity and extensive investment portfolios totaling billions in assets under management as of early 2024, underpins its capacity to absorb risk and ensure liquidity. This financial strength fuels strategic growth initiatives and market expansion across Latin America.

The company's human capital comprises specialized professionals such as actuaries and financial analysts, critical for product innovation and effective risk management. Continued investment in talent throughout 2024 ensures agility and competitiveness in complex financial markets.

Grupo SURA's technological infrastructure, including advanced IT systems and proprietary software for risk and investment management, is essential for operations. The increasing volume of customer data, with digital interactions rising significantly in 2023, enhances personalized services and predictive analytics.

Brand reputation and customer trust, built over decades, are key differentiators, fostering customer loyalty and facilitating strategic partnerships. In 2023, Suramericana's insurance segment maintained a strong market position, underscoring this continued customer confidence.

The extensive branch and digital network, exemplified by Bancolombia's reach of over 15 million customers by early 2024, ensures broad accessibility and convenience. This multi-channel approach is fundamental for customer acquisition, service delivery, and relationship building.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Financial Capital | Equity, reserves, investment portfolios | Billions in Assets Under Management (early 2024) |

| Human Capital | Skilled actuaries, analysts, IT specialists | Continued investment in workforce development (2024) |

| Technology & Data | IT infrastructure, customer data, market intelligence | Significant increase in digital interactions (2023) |

| Brand Reputation | Trust, reliability, market position | Strong market position in insurance segment (2023) |

| Distribution Network | Branch and digital channels | Over 15 million customers served by Bancolombia (early 2024) |

Value Propositions

Grupo SURA provides a complete range of financial services, encompassing insurance, retirement plans, savings accounts, and investment opportunities. This integrated approach allows customers to manage various aspects of their financial well-being through a single, convenient provider.

In 2024, Grupo SURA’s commitment to comprehensive solutions was evident in its robust performance. The company reported significant growth in its insurance and investment segments, reflecting customer trust in its diverse product offerings.

Grupo SURA's value proposition centers on delivering robust financial stability and security, a critical element for its diverse clientele. As a major financial holding company, its established presence and stringent capital and risk management frameworks cultivate a deep sense of trust and reliability. This assurance is paramount for clients engaging with long-term financial products, such as pensions and life insurance, where the safety of their investments is a primary concern.

In 2024, Grupo SURA continued to demonstrate this commitment through its solid financial performance and strategic capital allocation. For instance, the company maintained a strong solvency ratio, exceeding regulatory requirements, which directly translates to enhanced client security. This financial resilience underpins its ability to offer dependable long-term solutions, reinforcing its reputation as a secure partner for wealth preservation and growth.

Grupo SURA leverages its profound expertise in insurance and asset management to offer professional, personalized advice. This tailored approach ensures individuals and businesses receive solutions designed to meet their unique financial objectives.

In 2023, Grupo SURA managed over COP 250 trillion in assets, demonstrating the scale of its financial advisory capabilities. This deep industry knowledge allows them to guide clients effectively through complex financial landscapes.

By focusing on personalized strategies, Grupo SURA empowers clients to make informed decisions, optimize their investments, and ultimately achieve their specific financial goals, fostering long-term client relationships.

Digital Accessibility and Convenience

Grupo SURA is heavily invested in its digital transformation to ensure customers can easily access its wide range of financial services. This focus on digital accessibility means you can manage your insurance policies, investment portfolios, and banking needs smoothly through their online portals and mobile apps. For instance, in 2023, Grupo SURA reported that over 70% of its customer interactions occurred through digital channels, highlighting a significant shift towards this convenient model.

This commitment to convenience is a core part of their value proposition. It allows for flexibility, letting you handle your financial affairs on your schedule, whether that's late at night or during a busy workday. The company's ongoing efforts to enhance these platforms mean that tasks like checking your investment performance or making a premium payment are becoming increasingly intuitive and user-friendly.

- Enhanced Customer Experience: Digital platforms offer intuitive interfaces for managing financial products.

- Anytime, Anywhere Access: Customers can conduct transactions and access information 24/7.

- Streamlined Operations: Digitalization reduces processing times for various financial services.

- Increased Engagement: Mobile apps and online portals foster greater customer interaction and self-service.

Regional Presence and Local Understanding

Grupo SURA's regional presence is a cornerstone of its business model, enabling a deep understanding of diverse Latin American markets. By operating in countries like Colombia, Mexico, Peru, and Chile, the company gains invaluable insights into local economic conditions, consumer behaviors, and regulatory frameworks.

This granular, on-the-ground knowledge is critical for tailoring financial products and services. For instance, Grupo SURA's ability to adapt its insurance offerings to specific regional needs, such as agricultural insurance in Colombia or microinsurance in Peru, directly stems from this localized understanding. In 2023, the company reported that its diversified operations across these regions contributed significantly to its overall revenue, with Latin America remaining its primary market.

- Market Penetration: Grupo SURA operates in over 10 Latin American countries, giving it a broad geographical footprint.

- Tailored Offerings: Local understanding allows for customized financial solutions that resonate with specific customer segments.

- Regulatory Navigation: Expertise in diverse regulatory environments facilitates smoother business operations and product launches.

- Customer Trust: A strong regional presence builds credibility and fosters deeper relationships with local communities and clients.

Grupo SURA's value proposition is built on offering comprehensive financial solutions, ensuring financial stability and security, and leveraging deep expertise for personalized advice. This integrated approach simplifies financial management for customers, while its strong capital frameworks and solvency ratios, consistently exceeding regulatory requirements as seen in 2024, build significant trust.

The company's commitment to digital transformation enhances customer experience through intuitive platforms, enabling 24/7 access and streamlined operations, with over 70% of customer interactions in 2023 occurring digitally. Furthermore, its extensive regional presence across Latin America allows for tailored financial products that cater to specific market needs, contributing significantly to its revenue streams.

| Value Proposition Element | Description | 2023/2024 Data Point |

|---|---|---|

| Comprehensive Financial Solutions | Integrated offerings across insurance, retirement, savings, and investments. | Managed over COP 250 trillion in assets in 2023. |

| Financial Stability & Security | Established presence and robust risk management frameworks. | Maintained strong solvency ratios exceeding regulatory requirements in 2024. |

| Expertise & Personalized Advice | Tailored solutions based on deep industry knowledge. | Over 70% of customer interactions via digital channels in 2023. |

| Digital Accessibility & Convenience | Easy access to services through online portals and mobile apps. | Regional presence in over 10 Latin American countries. |

Customer Relationships

Grupo De Inversiones Suramericana cultivates deep client loyalty through personalized advisory services. Dedicated financial advisors and relationship managers offer tailored guidance across insurance, investments, and retirement planning, fostering trust and addressing unique client aspirations.

Grupo Sura enhances customer relationships through digital self-service, offering robust online platforms and mobile apps. These tools allow clients to independently manage accounts, access information, and conduct transactions, providing significant convenience and efficiency. This approach directly appeals to a growing segment of tech-savvy customers who value autonomy and speed in their interactions.

Grupo SURA actively engages communities through financial literacy programs, aiming to empower individuals with essential money management skills. In 2023, their initiatives reached over 500,000 people across Latin America, demonstrating a commitment to social impact beyond core financial services.

These educational efforts, including workshops and online resources, not only build goodwill and enhance brand perception but also cultivate a more informed consumer base. This strategic approach fosters deeper connections, moving beyond simple transactions to establish trust and long-term relationships.

Proactive Communication and Updates

Grupo Sura prioritizes keeping clients informed through proactive communication. This includes regular updates on policy changes, how their investments are performing, and valuable market insights. For instance, in the first quarter of 2024, Grupo Sura reported a net income of COP 396.8 billion, demonstrating their commitment to transparency even amidst market fluctuations.

This approach fosters strong customer relationships by ensuring clients feel engaged and aware of their financial journey. By sharing information about new product offerings, Grupo Sura also highlights their dedication to meeting evolving client needs and supporting their long-term financial well-being.

- Policy Updates: Informing clients about any changes to their insurance or investment policies.

- Investment Performance: Providing regular reports on how client portfolios are performing.

- Market Insights: Sharing analysis and outlooks on current market conditions.

- New Product Offerings: Announcing and explaining new financial products designed to meet client needs.

Dedicated Customer Service Centers

Grupo De Inversiones Suramericana prioritizes accessible and responsive customer service. They offer support through multiple channels, including call centers, online chat, and physical branches. This multi-channel approach ensures customers can easily get help with inquiries or issues.

In 2024, the company reported a significant increase in customer interactions across digital platforms, with online chat resolution rates improving by 15% compared to the previous year. This focus on digital accessibility complements their traditional call center and branch support.

- Multi-channel Support: Call centers, online chat, and physical branches provide diverse access points for customer assistance.

- Responsiveness: Emphasis on quick and effective resolution of customer inquiries and issues.

- Enhanced Experience: Multiple avenues for support aim to improve overall customer satisfaction and engagement.

- Digital Growth: Increased customer interaction via digital channels in 2024 highlights a strategic shift and success in online support.

Grupo Sura fosters enduring customer relationships through a blend of personalized advisory, digital self-service, and proactive communication. Their commitment to financial literacy initiatives, such as the 2023 outreach to over 500,000 individuals, builds trust and positions them as a supportive partner.

Accessibility is key, with multi-channel support ensuring clients can connect easily. In 2024, Grupo Sura saw a 15% improvement in online chat resolution rates, underscoring their focus on efficient digital customer service.

| Customer Relationship Strategy | Key Actions | Impact/Data Point |

|---|---|---|

| Personalized Advisory | Tailored guidance across insurance, investments, retirement | Fosters trust and addresses unique client aspirations |

| Digital Self-Service | Robust online platforms and mobile apps | Provides convenience and efficiency for tech-savvy clients |

| Financial Literacy Programs | Workshops and online resources | Reached over 500,000 people in 2023, building goodwill |

| Proactive Communication | Regular updates on policies, performance, market insights | Ensures clients feel informed and engaged |

| Multi-channel Support | Call centers, online chat, physical branches | Improved online chat resolution by 15% in 2024 |

Channels

Grupo SURA leverages its dedicated direct sales force and a robust network of independent agents to connect with potential clients for its insurance and investment offerings. This approach facilitates in-depth, personalized discussions crucial for explaining intricate financial products, especially to corporate entities and affluent individuals.

In 2024, the direct sales channel remains a cornerstone for Grupo SURA, enabling tailored advice and relationship building. For instance, the company's life insurance segment often relies on these personal interactions to address complex needs and secure long-term commitments from clients.

Grupo de Inversiones Suramericana leverages its digital platforms, including websites and mobile apps, for seamless customer onboarding and efficient policy management. These channels offer investors the convenience of tracking their investments in real-time and accessing self-service options, enhancing overall user experience.

By providing accessible digital tools, Suramericana caters to a growing segment of tech-savvy individuals and businesses actively seeking convenient financial management solutions. For instance, in 2024, the company reported a significant increase in digital transactions, demonstrating the growing reliance on these platforms for core financial activities.

Grupo SURA leverages Bancolombia's vast physical branch network, which as of the first quarter of 2024, comprised over 10,000 points of presence across Colombia and other Latin American countries, to facilitate cross-selling opportunities for its insurance and investment products. This extensive physical footprint provides a crucial touchpoint for customer engagement and product distribution, complementing its digital offerings.

Bancolombia's robust digital ecosystem, serving millions of active users in 2024, acts as a powerful engine for customer acquisition and retention for Grupo SURA's financial services. Through digital channels, Grupo SURA can efficiently reach a broader customer base, offering tailored solutions and enhancing the overall customer experience, thereby driving significant growth in its financial services segment.

Broker and Advisor Networks

Grupo SURA leverages extensive broker and advisor networks to broaden its reach and distribute its financial products. This strategic channel involves collaborations with independent financial advisors, insurance brokers, and wealth management firms.

These partnerships are crucial for accessing specialized customer segments that might be difficult to reach directly. By tapping into these established networks, SURA enhances its market penetration and gains valuable local expertise, making its products more accessible to a wider audience.

In 2024, the financial services industry saw continued reliance on these intermediary channels. For instance, the independent broker-dealer channel in the US reported significant growth, with industry-wide revenues estimated to be in the tens of billions of dollars, underscoring the importance of these networks for product distribution.

- Product Distribution: Partnering with independent financial advisors and insurance brokers to sell SURA's diverse financial products.

- Market Penetration: Expanding reach into specialized customer segments through third-party networks.

- Local Expertise: Utilizing the on-the-ground knowledge of these intermediaries to better serve regional markets.

- Enhanced Accessibility: Making SURA's offerings more available to a broader customer base.

Corporate and Institutional Partnerships

Grupo SURA actively cultivates Corporate and Institutional Partnerships by directly engaging with corporations, small and medium-sized enterprises (SMEs), and institutional clients. This strategic channel focuses on building robust business-to-business (B2B) relationships, offering a suite of financial products including group insurance, pension plans, and highly customized investment solutions designed to meet the specific needs of each client. These partnerships are often solidified through tailored service agreements, ensuring a deep understanding and fulfillment of client objectives.

In 2024, Grupo SURA continued to expand its B2B offerings, recognizing the significant market opportunity within this segment. For instance, the company reported a substantial increase in the number of corporate clients secured for its pension fund management services, demonstrating the growing demand for comprehensive retirement planning solutions. This growth is underpinned by a commitment to providing specialized financial advice and product innovation, making Grupo SURA a preferred partner for businesses seeking to enhance their employee benefits and investment strategies.

Key aspects of this channel include:

- B2B Focus: Direct engagement with businesses and institutions for tailored financial services.

- Product Offerings: Group insurance, pension plans, and customized investment solutions.

- Clientele: Corporations, SMEs, and institutional investors.

- Service Model: Emphasis on customized service agreements and long-term relationships.

Grupo SURA utilizes a multi-channel strategy, encompassing direct sales, digital platforms, strategic partnerships with Bancolombia, independent brokers, and direct corporate/institutional engagement. This diverse approach allows them to cater to a broad spectrum of clients, from individual investors to large enterprises, ensuring wide market coverage and product accessibility.

In 2024, the digital channel saw significant traction, with Grupo SURA reporting a substantial increase in online transactions, reflecting a growing preference for convenient, self-service financial management. Simultaneously, the Bancolombia partnership, leveraging its extensive physical and digital footprint, continued to be a critical driver for customer acquisition and cross-selling opportunities.

The company's reliance on independent brokers and advisors in 2024 remained strong, facilitating access to specialized market segments and reinforcing local market penetration. Direct engagement with corporate and institutional clients also expanded, with a notable rise in pension fund management services, highlighting the demand for tailored B2B financial solutions.

| Channel | Key Activities | 2024 Highlights |

|---|---|---|

| Direct Sales | Personalized product explanation and relationship building | Crucial for life insurance, securing long-term commitments. |

| Digital Platforms | Online onboarding, investment tracking, self-service options | Significant increase in digital transactions, catering to tech-savvy users. |

| Bancolombia Network | Cross-selling via physical branches and digital ecosystem | Over 10,000 points of presence; millions of active digital users. |

| Brokers & Advisors | Product distribution through third-party networks | Continued reliance, accessing specialized segments; industry growth in broker-dealer channel. |

| Corporate & Institutional | B2B solutions: group insurance, pensions, custom investments | Substantial increase in corporate pension fund clients. |

Customer Segments

Individual retail clients represent a vast and diverse group, looking for a wide array of personal financial solutions. This includes essential protection like life, health, and auto insurance, alongside avenues for wealth building through savings and investment accounts. Their financial journeys are varied, from simply securing basic coverage to meticulously planning for long-term wealth accumulation and a comfortable retirement.

In 2024, the demand for personalized financial advice and accessible digital platforms continues to shape this segment. Many individuals are seeking user-friendly tools to manage their finances and make informed investment decisions. For instance, the growth in digital insurance platforms and robo-advisory services indicates a strong preference for convenience and technology-driven solutions among retail investors.

Small and Medium-sized Enterprises (SMEs) are a crucial customer segment, needing comprehensive financial services. This includes essential commercial insurance like property and liability coverage, alongside employee benefits such as group health plans and pension solutions to attract and retain talent. In 2024, SMEs continue to be a significant driver of economic activity, with many actively seeking integrated and scalable financial products to support their growth and operational stability.

Grupo SURA's offerings cater to these needs, providing access to business loans, often facilitated indirectly through partnerships like the one with Bancolombia, and tailored investment solutions for managing corporate funds. The demand for such bundled services is high, as SMEs value efficiency and the ability to manage multiple financial aspects through a single, reliable provider.

Large corporations and institutions represent a crucial customer segment for Grupo de Inversiones Suramericana, including government bodies and other large organizations with intricate financial requirements. These clients often seek sophisticated offerings like tailored corporate insurance programs, comprehensive employee pension plans, advanced treasury management solutions, and dedicated institutional asset management.

In 2024, the demand for these specialized services remained robust, with a particular emphasis on risk management and long-term capital preservation. For instance, the institutional asset management sector, a key area for Suramericana, saw significant inflows driven by the need for diversified portfolios to navigate evolving market conditions.

High-Net-Worth Individuals (HNWIs)

High-Net-Worth Individuals (HNWIs) represent a crucial customer segment for Grupo de Inversiones Suramericana, seeking comprehensive and tailored financial solutions. This group requires sophisticated wealth management services, including personalized investment portfolios designed to preserve and grow substantial assets. Estate planning and specialized insurance products are also key demands, reflecting their need for long-term financial security and legacy management. For instance, in 2024, the global HNWI population grew by 4.7%, reaching 6.1 million individuals, with their total wealth increasing by 7.5% to $70.1 trillion, underscoring the significant market opportunity.

Grupo de Inversiones Suramericana caters to this discerning clientele by offering a high degree of personalized service. Expert advice is paramount, with dedicated relationship managers providing exclusive financial solutions. This approach ensures that the unique financial objectives and risk appetites of each HNWI are met effectively. The firm's commitment to understanding and addressing the intricate needs of these clients is a cornerstone of its strategy.

The offerings for HNWIs extend beyond traditional investment management. They include access to alternative investments, philanthropic advisory services, and robust risk management strategies. These specialized services are designed to provide a holistic financial ecosystem that supports the complex lifestyles and aspirations of this affluent demographic.

- Sophisticated Wealth Management: Tailored strategies for asset growth and preservation.

- Personalized Investment Portfolios: Customized allocations based on individual risk tolerance and goals.

- Estate Planning: Comprehensive solutions for wealth transfer and legacy building.

- Specialized Insurance: Products designed for high-value assets and complex risk profiles.

Pension Fund Members and Retirees

Pension fund members and retirees represent a crucial customer segment for Grupo SURA, particularly through its SURA Asset Management division. These individuals are actively engaged in saving for their future or are already drawing income from their retirement accounts. Their core requirements center on effective retirement planning, the secure growth of their long-term savings, and the assurance of consistent income once they transition into retirement. This necessitates a focus on stable, reliable investment management strategies designed to preserve capital while generating steady returns.

SURA Asset Management caters to this segment by offering a range of investment products and advisory services tailored to retirement goals. For instance, in 2024, SURA continued to emphasize diversified investment portfolios, aiming to mitigate risk for its pension clients. The company's commitment to long-term value creation is evident in its ongoing efforts to adapt to evolving market conditions and regulatory landscapes, ensuring the security and growth of its members' retirement assets.

Key aspects of serving this segment include:

- Retirement Planning: Providing tools and guidance to help individuals estimate their retirement needs and develop savings strategies.

- Long-Term Savings Growth: Managing investment portfolios with a focus on capital appreciation over extended periods, aiming for consistent, risk-adjusted returns.

- Stable Income Streams: Offering products and strategies that generate reliable income for retirees, such as annuity options or dividend-paying investments.

- Security and Trust: Maintaining a strong reputation for financial stability and transparent operations to build and retain the trust of members and retirees.

Grupo SURA serves a broad spectrum of clients, from individual retail customers seeking basic insurance and savings to high-net-worth individuals requiring sophisticated wealth management. The company also caters to small and medium-sized enterprises (SMEs) needing commercial insurance and employee benefits, as well as large corporations and institutions looking for advanced financial solutions and institutional asset management.

In 2024, the demand for digital financial services and personalized advice continued to grow across all segments. SMEs, in particular, showed a strong need for integrated and scalable financial products to support their expansion. Pension fund members and retirees remained a key focus, with SURA Asset Management concentrating on secure, long-term investment strategies to ensure retirement income stability.

The high-net-worth individual segment experienced notable growth in 2024, with a 4.7% increase in the global HNWI population, reaching 6.1 million individuals. Their total wealth also rose by 7.5% to $70.1 trillion, highlighting the significant market opportunity for tailored wealth management services.

Grupo SURA's strategy involves providing comprehensive financial ecosystems that address the diverse needs of these customer segments, from everyday financial security to complex wealth preservation and legacy planning.

Cost Structure

Grupo SURA's employee salaries and benefits represent a substantial operational cost, reflecting its large and diverse workforce. This includes highly skilled actuaries, financial advisors, IT specialists, and administrative personnel crucial for its insurance, investment, and banking operations.

In 2023, Grupo SURA reported total employee-related expenses, including salaries, wages, and social security contributions, amounting to approximately COP 3.7 trillion (around USD 950 million at the average 2023 exchange rate). These compensation costs are a fundamental component of its business model, directly impacting profitability across all its subsidiaries.

Grupo SURA's commitment to a digital-first approach necessitates significant expenditure on its technology infrastructure. In 2024, the company continued to allocate substantial resources towards maintaining and upgrading its IT systems, robust cybersecurity measures, and advanced data analytics capabilities. These investments are vital for ensuring operational efficiency and fostering innovation.

These ongoing technological investments are directly tied to enhancing customer experience and developing new digital platforms. For instance, the company's focus on digital transformation aims to streamline processes and offer more personalized services, requiring continuous development and integration of cutting-edge technologies. This strategic spending underpins SURA's competitive edge in the evolving financial services landscape.

Grupo de Inversiones Suramericana's marketing and sales expenses encompass significant investments in advertising, promotional campaigns, and customer acquisition across diverse channels. These costs are crucial for building brand recognition and penetrating new markets.

In 2024, the company likely allocated substantial resources to digital marketing, social media engagement, and traditional advertising to reach its broad customer base. Sales commissions for agents and brokers also represent a key component, directly tied to revenue generation and market reach.

Regulatory Compliance and Legal Costs

Operating in the financial sector, especially across diverse international markets, means Grupo Sura faces substantial expenses related to regulatory compliance and legal matters. These costs are essential for navigating complex legal frameworks and staying ahead of ever-changing financial regulations in countries like Colombia, Chile, Peru, and Mexico.

These expenses are critical for ensuring the company's operations remain lawful and to prevent costly penalties or reputational damage. For instance, in 2024, financial institutions globally saw increased spending on compliance technology and personnel to meet new data privacy laws and anti-money laundering directives.

- Regulatory Compliance: Costs associated with adhering to financial regulations in each operating country, including reporting, audits, and system upgrades.

- Legal Advisory: Fees paid to legal experts for counsel on contracts, mergers, acquisitions, and dispute resolution.

- Risk Management: Investments in systems and personnel to manage legal and regulatory risks effectively.

- Penalties and Fines: Potential costs incurred from non-compliance, which the company actively works to avoid through robust compliance programs.

Claims Payouts and Reinsurance Premiums

For Grupo de Inversiones Suramericana's insurance segment, Suramericana, the most significant cost driver is the direct payout of insurance claims to policyholders. These payouts represent the core promise of the insurance business, covering events like accidents, health issues, or property damage. In 2023, Suramericana reported significant claims activity, reflecting the inherent risks managed within its operations.

Another substantial expense is the cost of reinsurance premiums. Suramericana transfers a portion of its risk to reinsurers, which helps stabilize its financial results and protect against catastrophic losses. These premiums are a critical component of managing the overall risk exposure and ensuring solvency.

- Claims Payouts: Essential cost for fulfilling policyholder obligations.

- Reinsurance Premiums: Paid to transfer risk and mitigate large-scale losses.

- Operational Efficiency: Managing claim settlements and reinsurance negotiations directly impacts profitability.

- 2023 Financials: Suramericana's claims and reinsurance expenses were a major factor in its cost structure for the year.

Grupo SURA's cost structure is heavily influenced by employee compensation, with salaries, benefits, and social security contributions representing a significant outlay. In 2023, these employee-related expenses reached approximately COP 3.7 trillion (around USD 950 million), underscoring the importance of its human capital. Continued investment in technology and digital transformation is also a key cost driver, essential for operational efficiency and innovation in the competitive financial services sector.

Marketing and sales efforts, including digital campaigns and agent commissions, are vital for customer acquisition and market penetration. Furthermore, substantial resources are dedicated to regulatory compliance and legal advisory, ensuring adherence to the complex financial regulations across its operating countries. For its insurance arm, Suramericana, the primary costs involve claims payouts and reinsurance premiums, fundamental to managing risk and fulfilling policyholder obligations.

| Cost Category | 2023 (Approx. COP Trillions) | Key Drivers |

|---|---|---|

| Employee Compensation | 3.7 | Salaries, benefits, social security for a diverse workforce |

| Technology & Digitalization | Significant investment | IT infrastructure, cybersecurity, data analytics, platform development |

| Marketing & Sales | Substantial allocation | Advertising, digital campaigns, customer acquisition, sales commissions |

| Regulatory & Legal | Essential expenditure | Compliance adherence, legal counsel, risk management |

| Insurance Claims & Reinsurance | Major component (Suramericana) | Policyholder payouts, reinsurance premiums for risk transfer |

Revenue Streams

Grupo de Inversiones Suramericana's primary revenue stream, insurance premiums, is generated from policyholders across a wide spectrum of insurance products. This includes life insurance, health coverage, auto insurance, property protection, and general liability policies. These collected premiums are the fundamental income source that fuels the company's operations and growth in the insurance sector.

In 2024, the insurance segment of Grupo Suramericana demonstrated robust performance. For instance, Suramericana S.A., a key subsidiary, reported significant premium growth, reflecting strong market demand and effective product offerings. This growth is a testament to the company's ability to attract and retain a large customer base by providing essential financial protection.

SURA Asset Management's primary revenue driver is asset management fees. These are calculated as a percentage of the total assets they manage, which includes a diverse range of products like pension funds, mutual funds, and various investment portfolios.

In 2024, SURA Asset Management continued to leverage its extensive AUM. For instance, by the end of the first quarter of 2024, the company reported significant growth in its managed assets, reflecting the trust investors place in their expertise and the effectiveness of their investment strategies.

Grupo SURA generates significant investment income by strategically deploying its own capital, along with technical reserves from its insurance businesses and float from its diverse financial operations. This income stream is crucial for the company's profitability and growth.

In 2024, Grupo SURA's investment portfolio delivered robust returns. For instance, its holdings in fixed-income securities generated substantial interest income, while dividends from its equity investments provided a steady flow of earnings. The company also realized capital gains from judiciously managed asset sales, further bolstering its investment income.

Banking Service Fees (via Bancolombia stake)

Grupo SURA indirectly benefits from Bancolombia's robust revenue streams, which are largely driven by service fees. These fees encompass a wide array of banking activities, providing a consistent income source for the subsidiary and, by extension, for Grupo SURA.

Bancolombia's fee-based income includes charges for account maintenance, processing various transactions, credit card usage, and a host of other financial services offered to its diverse customer base. These diverse fee streams contribute significantly to Bancolombia's overall profitability, bolstering the value of Grupo SURA's investment.

For instance, in 2024, Bancolombia reported substantial growth in its fee and commission income, reflecting the effective monetization of its banking services. This performance directly translates into increased dividends and capital appreciation for Grupo SURA.

- Account Maintenance Fees: Charges for holding and managing customer accounts.

- Transaction Fees: Income generated from processing payments, transfers, and other financial operations.

- Credit Card Fees: Revenue from annual fees, interest, and late payment charges on credit cards.

- Other Service Charges: Income from a variety of specialized banking services and products.

Commissions and Brokerage Fees

Grupo de Inversiones Suramericana generates revenue through commissions earned from selling a wide array of financial products. This includes products that Suramericana itself does not underwrite, broadening its income base within the financial sector.

Additionally, the company collects brokerage fees for facilitating investment transactions. This dual approach, encompassing both product sales and transaction facilitation, diversifies its revenue streams and strengthens its position in the financial ecosystem.

- Commissions on Financial Product Sales: Revenue from selling various financial products, including those not directly underwritten by Suramericana.

- Brokerage Fees: Income generated from facilitating investment transactions for clients.

- Diversified Income: These streams contribute to a more stable and varied income profile for the company.

Grupo SURA's diversified revenue streams are anchored by insurance premiums, asset management fees, investment income, and service fees from its banking subsidiary, Bancolombia. Commissions from selling a broad range of financial products and brokerage fees for transactions further bolster its income.

In 2024, the insurance segment saw continued premium growth, while SURA Asset Management benefited from increasing Assets Under Management (AUM). Bancolombia reported substantial growth in fee and commission income, underscoring the effectiveness of its service monetization strategies.

| Revenue Stream | Primary Source | 2024 Performance Indicator |

|---|---|---|

| Insurance Premiums | Policyholders for various insurance products | Significant premium growth reported by subsidiaries like Suramericana S.A. |

| Asset Management Fees | Percentage of Assets Under Management (AUM) | Continued growth in AUM, reflecting investor trust in SURA Asset Management. |

| Investment Income | Strategic deployment of capital and reserves | Robust returns from fixed-income, equity dividends, and capital gains realized. |

| Banking Service Fees (Bancolombia) | Account maintenance, transactions, credit cards, etc. | Substantial growth in fee and commission income for Bancolombia. |

| Commissions & Brokerage Fees | Sales of financial products and transaction facilitation | Diversified income base through product sales and investment transaction facilitation. |

Business Model Canvas Data Sources

The Grupo de Inversiones Suramericana Business Model Canvas is built upon a foundation of robust financial disclosures, comprehensive market research reports, and internal strategic planning documents. These sources provide the necessary data to accurately define customer segments, value propositions, and revenue streams.