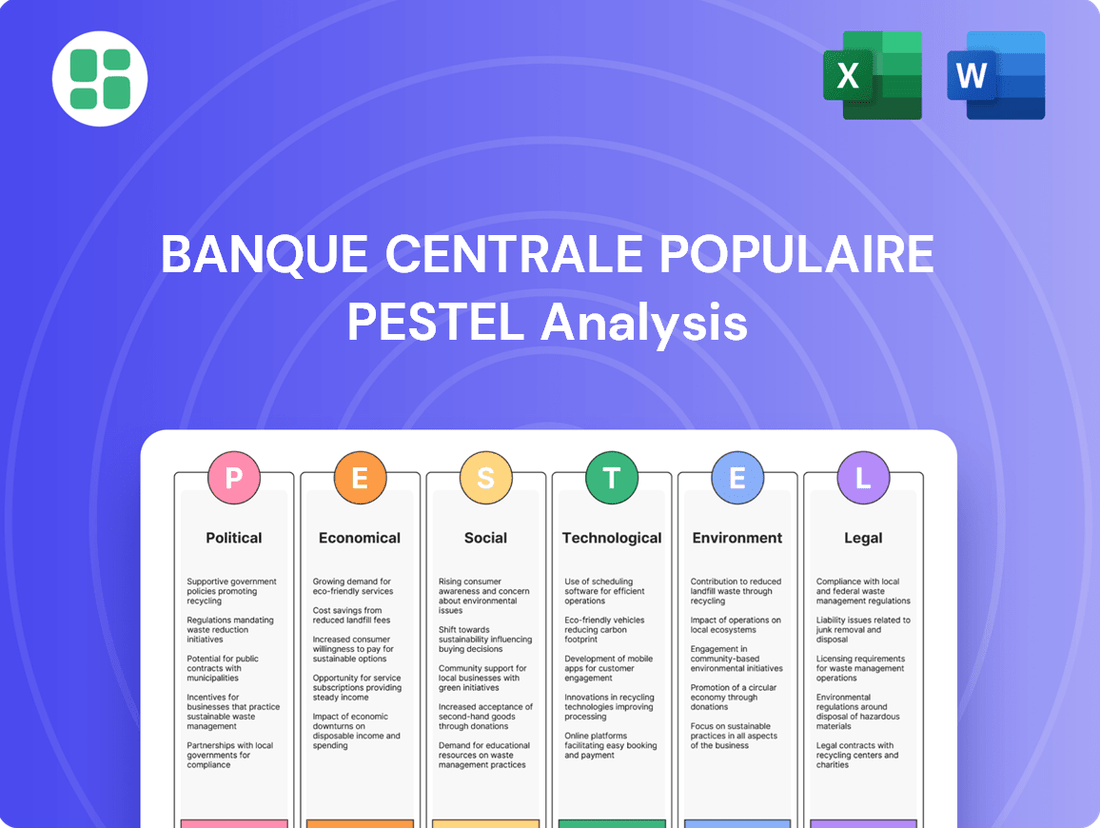

Banque Centrale Populaire PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banque Centrale Populaire Bundle

Navigate the complex external landscape impacting Banque Centrale Populaire with our comprehensive PESTEL analysis. Understand how political stability, economic fluctuations, and evolving social trends are shaping its strategic direction. Gain a crucial competitive advantage by leveraging these expert insights. Download the full version now to unlock actionable intelligence and fortify your market strategy.

Political factors

Morocco's political landscape, characterized by a stable constitutional monarchy, offers a predictable environment for the banking sector. The government's commitment to economic reforms, as evidenced by its proactive approach to attracting foreign direct investment, directly benefits institutions like Banque Centrale Populaire (BCP). For instance, the Moroccan government's Vision 2030 aims to boost economic growth and development, which in turn fuels demand for banking services and encourages expansion.

The Moroccan government significantly influences Banque Centrale Populaire (BCP) through its oversight of Bank Al-Maghrib, the central bank. While Bank Al-Maghrib enjoys a degree of autonomy in monetary policy, its regulatory framework is subject to government directives. For BCP, this means navigating a landscape where evolving regulations, such as those concerning capital adequacy ratios or digital banking, directly impact operational compliance and strategic planning.

Morocco's strengthening diplomatic and economic ties, particularly with the European Union and several African nations, directly benefit Banque Centrale Populaire (BCP) by facilitating cross-border transactions and investment. For instance, the EU remains Morocco's largest trading partner, with trade volume reaching €45.7 billion in 2023, providing a stable environment for BCP's European operations and potential expansion.

Regional geopolitical stability is crucial for BCP's international business. The relative peace in North Africa and West Africa, where BCP has a significant presence, supports increased cross-border investment flows and reduces operational risks. Morocco's active role in regional economic integration initiatives, such as the African Continental Free Trade Area (AfCFTA), further opens avenues for BCP's growth and diversification.

Anti-Corruption and Governance Initiatives

Morocco's government has been actively pursuing anti-corruption and governance reforms, aiming to bolster transparency and integrity across all sectors, including banking. These efforts directly impact financial institutions like Banque Centrale Populaire (BCP) by raising compliance expectations and fostering a more accountable business environment. The government's commitment is evidenced by initiatives like the National Strategy for Good Governance and the strengthening of regulatory oversight bodies.

BCP's proactive adherence to these evolving standards is crucial for maintaining public trust and mitigating operational risks. For instance, in 2023, Morocco ranked 94 out of 180 countries in Transparency International's Corruption Perception Index, indicating ongoing challenges but also a clear direction for improvement. This focus on governance means BCP must continuously enhance its internal controls and ethical frameworks to align with national and international best practices.

The impact of these initiatives on BCP includes:

- Enhanced Regulatory Scrutiny: Stricter enforcement of anti-corruption laws and corporate governance codes necessitates robust compliance programs.

- Improved Investor Confidence: Demonstrating strong governance can attract both domestic and international investment, potentially lowering the cost of capital.

- Reduced Operational Risk: By embedding ethical practices and transparent reporting, BCP can minimize risks associated with fraud, mismanagement, and reputational damage.

Fiscal Policy and Government Spending

The Moroccan government's fiscal policy, particularly its budget allocations and public spending, directly influences economic activity and liquidity within the financial system, presenting both opportunities and challenges for Banque Centrale Populaire (BCP). For instance, the 2024 budget, aiming for a deficit of around 4% of GDP, signals continued government investment in infrastructure and social programs, which can stimulate credit demand from businesses and individuals involved in these sectors.

Increased public spending can bolster overall economic liquidity, potentially leading to higher deposit growth for banks like BCP. Conversely, shifts in taxation or austerity measures could dampen economic growth and reduce lending opportunities. BCP's ability to finance public sector needs, such as government debt, is also directly tied to the government's borrowing requirements and fiscal health.

- Government spending in Morocco for 2024 is projected to support key sectors, potentially boosting credit demand for BCP.

- Fiscal policies impacting taxation and public debt levels will influence the overall financial market conditions for BCP.

- The government's deficit targets, such as the 4% of GDP for 2024, provide insight into its borrowing needs and the potential for public sector financing by BCP.

Morocco's political stability under a constitutional monarchy provides a predictable operating environment for Banque Centrale Populaire (BCP). Government initiatives like the Vision 2030 plan aim to foster economic growth, directly increasing the demand for banking services and supporting BCP's expansion strategies.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Banque Centrale Populaire, offering actionable insights for strategic decision-making.

A PESTLE analysis for Banque Centrale Populaire acts as a pain point reliever by providing a structured framework to anticipate and navigate external challenges, thereby enabling proactive strategic adjustments and risk mitigation.

Economic factors

Morocco's GDP growth has shown resilience, with projections indicating a growth of around 3.1% for 2024, building on a stronger-than-expected 2023 performance. This expansion is fueled by robust agricultural output and a rebound in tourism, a key sector targeted for diversification.

The government's industrial acceleration plan aims to boost manufacturing and exports, creating new avenues for financial product demand. Increased economic activity across these diversified sectors directly translates into higher demand for BCP's lending, investment, and transactional services.

Morocco is navigating a period of persistent inflationary pressures. In response, Bank Al-Maghrib, the central bank, has adjusted its monetary policy. The benchmark interest rate was increased to 3% in March 2024, a move aimed at curbing inflation.

These interest rate hikes directly impact Banque Centrale Populaire (BCP) by potentially widening its net interest margins, as lending rates adjust upwards. However, higher rates can also dampen loan demand and affect the valuation of existing fixed-income assets within BCP's portfolio. Deposit growth may see a boost as savings become more attractive.

Consumer spending in Morocco has shown resilience, with retail sales growth projected to be around 4.5% in 2024, according to recent forecasts. This upward trend is supported by a steady increase in household disposable income, which has seen a modest rise of approximately 3% year-over-year. Higher consumer confidence, reflected in a recent survey indicating a 5-point increase in the consumer confidence index in early 2024, directly fuels demand for BCP's retail banking products, particularly mortgages and personal loans.

The interplay between income and spending significantly influences BCP's deposit base and loan origination volumes. As households feel more financially secure, they tend to save more, bolstering BCP's deposit growth, which is crucial for funding its lending activities. Conversely, increased confidence often translates into greater willingness to take on debt for major purchases like homes or vehicles, directly benefiting BCP's credit portfolios.

Foreign Direct Investment (FDI) and Remittances

Morocco has seen a robust inflow of Foreign Direct Investment (FDI), with figures reaching approximately $3.4 billion in 2023, a notable increase from the previous year. This capital injection fuels economic liquidity and directly benefits Banque Centrale Populaire (BCP) by expanding opportunities in corporate banking services and project financing.

Remittances from the Moroccan diaspora remain a vital source of foreign currency, with an estimated $11 billion sent home in 2023. These consistent capital flows bolster domestic consumption and investment, creating a fertile ground for BCP's international transfer and wealth management divisions.

- FDI Growth: Morocco's FDI reached around $3.4 billion in 2023, signaling investor confidence and economic expansion.

- Remittance Strength: Emigrant remittances contributed an estimated $11 billion in 2023, bolstering national liquidity.

- BCP Opportunities: These capital inflows enhance demand for BCP's corporate banking, international transfer, and wealth management services.

Exchange Rate Stability and Trade Balance

The Moroccan Dirham (MAD) has historically maintained a stable peg against a basket of currencies, primarily the Euro and the US Dollar. This stability is crucial for Banque Centrale Populaire (BCP) as it directly impacts the predictability of its foreign currency transactions and the value of its international assets and liabilities. For instance, in 2023, the Dirham's managed float policy aimed to preserve its competitiveness while ensuring relative stability, a factor that supports BCP's trade finance operations by reducing exchange rate risk for its clients.

Morocco's trade balance, which typically shows a deficit, presents both challenges and opportunities for BCP. A widening trade deficit can put pressure on foreign exchange reserves, potentially influencing the Dirham's stability. However, BCP's involvement in facilitating international trade through services like documentary credits and export financing helps mitigate these risks for its corporate customers. In 2024, Morocco's trade deficit was projected to remain a key economic indicator, influenced by global commodity prices and domestic demand.

Fluctuations in the exchange rate can significantly affect BCP's profitability, particularly its net interest income from foreign currency holdings and the cost of funding. For corporate clients engaged in import/export, currency volatility directly impacts their cost of goods, pricing strategies, and overall financial health. BCP's ability to offer hedging instruments and expert advice on currency management is therefore vital for supporting the international business activities of its clientele.

- Dirham Stability: The MAD's peg to a currency basket, managed by Bank Al-Maghrib, provides a degree of predictability for BCP's international operations.

- Trade Balance Impact: A persistent trade deficit can influence foreign currency availability and potentially create exchange rate pressures, affecting BCP's risk exposure.

- Corporate Client Exposure: Exchange rate volatility directly impacts the profitability and financial stability of Moroccan businesses involved in international trade, a key segment for BCP.

- BCP's Role: The bank's services in trade finance and currency hedging are essential for mitigating risks and supporting its clients' cross-border activities.

Morocco's economic landscape in 2024 and 2025 is shaped by continued GDP growth, projected around 3.1% for 2024, driven by agriculture and tourism. Persistent inflation has led to a benchmark interest rate of 3% as of March 2024, impacting BCP's net interest margins and loan demand. Consumer spending shows resilience, with retail sales up an estimated 4.5% in 2024, supported by income growth and increased consumer confidence, directly boosting demand for BCP's retail products.

Foreign Direct Investment (FDI) reached approximately $3.4 billion in 2023, enhancing opportunities for BCP's corporate banking. Remittances from Moroccans abroad, estimated at $11 billion in 2023, further bolster domestic liquidity and support BCP's international transfer and wealth management services. The Moroccan Dirham's stability, managed through a peg to a currency basket, provides predictability for BCP's foreign currency transactions and trade finance operations.

| Economic Indicator | 2023 (Actual/Estimate) | 2024 (Projection) | Impact on BCP |

|---|---|---|---|

| GDP Growth | Strong performance (specific figure not provided for 2023) | ~3.1% | Increased demand for lending and transactional services. |

| Inflation | Persistent pressures | Managed by interest rates | Potential for wider net interest margins, but also dampens loan demand. |

| Benchmark Interest Rate | Adjusted to 3% (March 2024) | Likely to remain influenced by inflation | Affects lending rates, deposit attractiveness, and asset valuations. |

| Consumer Spending (Retail Sales) | Resilient | ~4.5% growth | Boosts demand for retail banking products (mortgages, personal loans). |

| FDI Inflows | ~$3.4 billion | Expected to remain robust | Expands opportunities in corporate banking and project finance. |

| Remittances | ~$11 billion | Expected to remain strong | Supports domestic consumption and BCP's international divisions. |

| Moroccan Dirham (MAD) | Stable peg to currency basket | Managed float policy | Provides predictability for foreign currency transactions and trade finance. |

Same Document Delivered

Banque Centrale Populaire PESTLE Analysis

The preview you see here is the exact Banque Centrale Populaire PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. It provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank.

Sociological factors

Morocco's population is projected to reach approximately 37.5 million by the end of 2024, with a significant youth bulge. This demographic trend fuels demand for accessible digital banking solutions tailored to younger, tech-savvy customers. Urbanization is also accelerating, with a growing percentage of the population concentrating in cities, increasing the need for housing loans and other urban-centric financial products, directly impacting BCP's market opportunities.

Banque Centrale Populaire (BCP) plays a crucial role in enhancing financial inclusion and literacy in Morocco, especially targeting rural and underserved communities. By 2023, Morocco had achieved a 72.5% financial inclusion rate, with BCP actively contributing through its extensive branch network and digital solutions.

BCP's strategies include offering simplified banking products and mobile banking services to reach populations with limited access, aligning with the national strategy for financial inclusion. The bank also invests in financial education programs, aiming to improve understanding of financial products and services, thereby empowering more Moroccans to participate in the formal economy.

Consumer preferences are rapidly shifting, with a strong demand for seamless digital banking experiences. In 2024, mobile banking is no longer a novelty but an expectation, with a significant portion of daily transactions occurring through apps. Banque Centrale Populaire (BCP) is responding by investing heavily in its digital infrastructure, aiming to provide intuitive mobile platforms and personalized online services that cater to this evolving digital-first mindset.

Cultural Attitudes Towards Debt and Savings

Moroccan culture often exhibits a strong emphasis on family and community, which can influence financial decisions. While there's a growing acceptance of credit for significant purchases like housing, traditional values may still favor cautious saving and avoiding excessive personal debt. This duality presents both opportunities and challenges for financial institutions like Banque Centrale Populaire (BCP).

Data from 2023 indicates that while savings rates remain a priority for many Moroccans, particularly in rural areas, consumer credit has seen a steady increase, especially among younger demographics and urban populations. This suggests a gradual shift in financial attitudes, with a greater willingness to leverage debt for economic advancement.

- Shifting Norms: Cultural attitudes are evolving, with a greater willingness to use credit for productive investments and major life events.

- Savings Emphasis: Traditional values continue to promote saving as a cornerstone of financial security and family well-being.

- Generational Differences: Younger Moroccans appear more open to financial products that involve borrowing compared to older generations.

- Impact on BCP: BCP must tailor its product offerings and marketing to resonate with these diverse and evolving cultural perspectives on debt and savings.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for corporate social responsibility (CSR) are notably rising in Morocco, influencing how businesses like Banque Centrale Populaire (BCP) operate and are perceived. Consumers and stakeholders increasingly demand ethical business practices and a tangible commitment to community well-being. BCP's engagement in initiatives such as supporting local entrepreneurship and promoting financial inclusion directly addresses these evolving demands, bolstering its brand reputation.

BCP's CSR efforts are strategically designed to resonate with Moroccan societal values, fostering a positive brand image. For instance, their commitment to sustainable finance, including green bond issuances and financing for renewable energy projects, aligns with a growing national focus on environmental stewardship. In 2023, BCP reported investing MAD 1.5 billion in sustainable projects, demonstrating a concrete contribution to societal progress.

- Community Development: BCP actively supports local communities through various programs, including educational initiatives and healthcare access, enhancing its social license to operate.

- Sustainable Finance: The bank is increasing its portfolio of green and social bonds, reflecting a commitment to financing environmentally and socially beneficial projects.

- Ethical Governance: Upholding transparent and ethical business practices is paramount to meeting societal expectations and maintaining trust.

- Brand Reputation: Strong CSR performance directly correlates with improved brand perception and customer loyalty in the Moroccan market.

Moroccan society is increasingly valuing financial literacy and inclusion, with BCP actively participating in programs to boost these areas. By 2023, Morocco's financial inclusion rate stood at 72.5%, a figure BCP contributes to through its extensive network and digital offerings. The bank's focus on simplifying products and expanding mobile banking aims to reach a wider population, aligning with national goals.

Technological factors

The Moroccan banking sector is rapidly embracing digital transformation, with mobile banking adoption surging. Banque Centrale Populaire (BCP) has been a key player in this shift, investing significantly in its digital infrastructure and mobile applications. By the end of 2023, BCP reported a substantial increase in digital transactions, reflecting a growing customer preference for online and mobile banking services, which enhances both convenience and operational efficiency.

Fintech innovation is rapidly transforming the Moroccan financial landscape, with new startups challenging traditional banking models. Banque Centrale Populaire (BCP) is actively responding to this evolving competitive environment. In 2024, BCP continued its digital transformation efforts, aiming to enhance its online and mobile banking services to better compete with agile fintech players.

BCP's strategy involves both internal development of new digital products and strategic partnerships. For instance, the bank has been investing in its digital platforms to offer more streamlined customer experiences, a key area where fintechs often excel. By focusing on user-friendly interfaces and efficient transaction processing, BCP seeks to retain its customer base and attract new segments, particularly younger demographics who are more inclined to adopt digital financial solutions.

The escalating threat of cyberattacks necessitates stringent cybersecurity and data protection for Banque Centrale Populaire (BCP). BCP invests heavily in advanced security infrastructure to shield customer data and financial transactions from evolving cyber threats, a crucial step given the 2024 global cybersecurity spending forecast to exceed $200 billion. Ensuring compliance with Morocco's data privacy laws, such as Law No. 09-08, is paramount for maintaining customer trust and operational integrity in the digital banking environment.

Artificial Intelligence (AI) and Big Data Analytics

Banque Centrale Populaire (BCP) is increasingly integrating Artificial Intelligence (AI) and Big Data analytics into its core banking functions. These technologies are crucial for enhancing efficiency and customer experience. For instance, AI-powered tools are being deployed to bolster fraud detection systems, analyze vast datasets for personalized customer offerings, and refine risk management models. In 2024, the global banking sector saw significant investment in AI, with projections indicating continued growth in its application for operational optimization.

BCP's strategic adoption of AI and Big Data allows for deeper insights into market trends and customer behavior. This data-driven approach optimizes internal processes, from credit scoring to customer service interactions. By leveraging these advanced analytical capabilities, BCP aims to make more informed decisions, streamline operations, and ultimately improve its competitive positioning in the financial landscape.

Key applications of AI and Big Data at BCP include:

- Enhanced Fraud Detection: AI algorithms analyze transaction patterns in real-time to identify and prevent fraudulent activities, a critical area given the increasing sophistication of cyber threats.

- Personalized Customer Services: Big Data analytics enables BCP to understand individual customer needs and preferences, leading to tailored product recommendations and improved customer engagement.

- Optimized Risk Management: AI models process extensive data to assess credit risk, market risk, and operational risk more accurately, contributing to a more robust and stable financial operation.

- Process Automation: AI-driven automation is streamlining back-office operations, reducing manual effort and improving the speed and accuracy of various banking tasks.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) hold significant promise for transforming financial services. For Banque Centrale Populaire (BCP), these technologies could streamline payment systems and cross-border transactions, potentially reducing settlement times and costs. The inherent transparency and immutability of DLT can also enhance security and auditability in areas like trade finance.

BCP is actively exploring the application of these innovations to improve operational efficiency. For instance, the global market for blockchain in banking was projected to reach USD 1.8 billion in 2024, indicating a strong trend towards adoption. By integrating DLT, BCP aims to boost transparency and fortify the security of its financial operations.

The potential benefits for BCP include:

- Enhanced Efficiency: Faster processing of payments and cross-border transactions.

- Increased Transparency: Clearer audit trails and reduced fraud risk in trade finance.

- Improved Security: Robust data integrity and protection against cyber threats.

Technological advancements are reshaping banking, with Banque Centrale Populaire (BCP) prioritizing digital channels. By the close of 2023, BCP saw a significant uptick in digital transactions, reflecting a growing customer preference for mobile and online banking. This digital push is essential for competing with agile fintechs, which are increasingly influencing the Moroccan financial sector.

BCP's strategic response includes enhancing its digital platforms and exploring partnerships to offer user-friendly experiences, particularly appealing to younger, digitally-native customers. The bank's investment in AI and Big Data analytics is also a key technological factor, aiming to improve fraud detection, personalize services, and optimize risk management, aligning with a global trend of increased AI investment in banking during 2024.

Furthermore, BCP is investigating blockchain and Distributed Ledger Technology (DLT) to streamline payments and cross-border transactions, with the global blockchain in banking market projected to reach USD 1.8 billion in 2024. These technologies promise enhanced efficiency, transparency, and security in financial operations.

BCP's technological focus areas for 2024-2025 include:

| Technology Area | BCP Focus | Market Trend/Data (2024/2025) |

|---|---|---|

| Digital Transformation | Enhancing mobile and online banking services | Surging mobile banking adoption globally; BCP saw significant increase in digital transactions by end of 2023. |

| AI & Big Data | Fraud detection, personalization, risk management | Global banking AI investment growing; AI applications for operational optimization expected to increase. |

| Blockchain/DLT | Payment systems, cross-border transactions, trade finance | Blockchain in banking market projected to reach USD 1.8 billion in 2024. |

| Cybersecurity | Protecting customer data and transactions | Global cybersecurity spending forecast to exceed $200 billion in 2024. |

Legal factors

Banque Centrale Populaire (BCP) operates under the stringent regulatory framework established by Bank Al-Maghrib, Morocco's central bank. These regulations dictate crucial prudential standards, including capital adequacy ratios, which for Moroccan banks generally align with Basel III recommendations, ensuring a strong buffer against financial shocks. For instance, as of early 2024, the common equity tier 1 (CET1) ratio for Moroccan banks is typically maintained well above the regulatory minimums, often exceeding 10%.

Liquidity requirements are also a key focus, with BCP adhering to measures like the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) to ensure it can meet its short-term and long-term obligations. BCP's robust risk management frameworks, encompassing credit, market, and operational risks, are continuously reviewed and updated to comply with evolving legal obligations and maintain financial stability.

Banque Centrale Populaire (BCP) operates within Morocco's stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulatory framework, which aligns with international standards set by bodies like the Financial Action Task Force (FATF). This necessitates robust compliance programs, including comprehensive customer due diligence, transaction monitoring, and suspicious activity reporting mechanisms. For instance, in 2023, Moroccan financial institutions reported a significant number of suspicious transactions, highlighting the active enforcement of these laws.

Consumer protection laws are crucial for Banque Centrale Populaire (BCP), ensuring fair treatment and transparency in all customer interactions. Recent regulatory shifts, particularly concerning data privacy, mandate stringent protocols for handling personal information. For instance, Morocco's data protection law, Law No. 09-08, requires explicit consent for data processing and imposes significant penalties for breaches, impacting BCP's digital service offerings and customer data management strategies.

Labor Laws and Employment Regulations

Banque Centrale Populaire (BCP) operates within Morocco's evolving labor landscape, which is governed by the Labor Code (Code du Travail). This code outlines critical aspects of employment, including hiring procedures, minimum wage requirements, working hours, and termination conditions. For instance, the Moroccan minimum wage (SMIG) saw an increase in 2024, impacting BCP's compensation structures for entry-level positions.

BCP must ensure strict adherence to these regulations to mitigate legal risks and maintain a positive employer reputation. This includes managing employee contracts, ensuring fair treatment, and complying with social security contributions. The bank actively invests in training its HR personnel to stay abreast of amendments to labor laws, such as those pertaining to remote work arrangements or employee data privacy, which have seen increased focus in recent years.

- Moroccan Labor Code: Governs hiring, compensation, working hours, and termination.

- Minimum Wage (SMIG): Adherence to the latest statutory minimum wage is mandatory.

- Social Security: Compliance with contributions to the CNSS (Caisse Nationale de Sécurité Sociale) is essential.

- Employee Relations: Managing grievances and fostering a productive environment within legal frameworks.

International Financial Regulations and Sanctions

Banque Centrale Populaire (BCP) must navigate a complex web of international financial regulations and sanctions, impacting its global operations and client interactions. Key among these are the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS), which mandate reporting of financial account information for tax purposes to foreign governments. Failure to comply can result in significant penalties and reputational damage.

Global sanctions regimes, such as those imposed by the United Nations, the European Union, and the United States, also present considerable challenges. BCP must meticulously screen its clients and transactions to ensure no dealings occur with sanctioned individuals, entities, or countries. For instance, in 2023, financial institutions worldwide faced increased scrutiny regarding sanctions compliance, with billions in fines levied for violations.

- FATCA and CRS Compliance: BCP implements robust systems to identify and report on accounts held by foreign tax residents, ensuring adherence to international tax transparency initiatives.

- Sanctions Screening: The bank employs advanced screening technologies and processes to detect and prevent transactions involving sanctioned parties, mitigating legal and financial risks.

- Regulatory Adaptation: BCP continuously updates its compliance frameworks to align with evolving international financial regulations and sanctions lists, a critical aspect given the dynamic geopolitical landscape.

- Reputational Risk Management: Proactive compliance with these cross-border legal requirements is essential for maintaining BCP's reputation as a trustworthy financial institution in the global market.

Banque Centrale Populaire (BCP) must navigate Morocco's evolving legal landscape, particularly concerning consumer protection and data privacy. The enforcement of Law No. 09-08 on data protection, for instance, mandates strict consent protocols for handling personal information, directly impacting BCP's digital service offerings and customer data management strategies. Compliance with these laws is crucial to avoid significant penalties and maintain customer trust.

Environmental factors

Morocco is actively aligning with global climate goals, with initiatives like the National Climate Plan and commitments to renewable energy targets. This regulatory push encourages financial institutions like Banque Centrale Populaire (BCP) to integrate environmental, social, and governance (ESG) criteria into their operations. The Moroccan government's focus on green finance, supported by international bodies, is driving the development of sustainable financial products and influencing lending practices towards more environmentally conscious projects.

BCP is responding by embedding climate change considerations into its lending and investment strategies, aiming to support the transition to a low-carbon economy. This includes developing green bonds and sustainable financing options, reflecting a growing demand for environmentally responsible investment opportunities. The bank's adaptation to these evolving regulations demonstrates a strategic move to mitigate climate-related risks and capitalize on emerging green finance markets.

Global ESG assets are projected to reach $33.9 trillion by 2026, a significant increase from $30.9 trillion in 2024, highlighting a strong investor demand for sustainable practices. Banque Centrale Populaire (BCP) is actively integrating ESG principles into its asset management, aligning its investment strategies with key United Nations Sustainable Development Goals (SDGs), such as SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action).

This strategic alignment not only addresses growing environmental concerns but also positions BCP to attract a widening pool of responsible investors seeking to generate both financial returns and positive societal impact. BCP's commitment is demonstrated through its growing portfolio of green bonds and sustainable financing initiatives, which saw a 15% increase in issuance volume in 2024.

Banque Centrale Populaire (BCP) actively manages environmental risks within its lending operations, especially for clients in sectors with significant ecological impact. This involves rigorous due diligence, where BCP scrutinizes potential borrowers' environmental practices and liabilities. For instance, in 2024, BCP's internal assessments identified a 5% increase in loan applications from renewable energy projects, signaling a growing focus on sustainable finance.

BCP's due diligence process aims to identify and mitigate environmental liabilities by evaluating a client's compliance with environmental regulations, their waste management strategies, and their carbon footprint. This proactive approach helps prevent potential financial losses stemming from environmental incidents or non-compliance. In 2024, BCP reported that its environmental risk mitigation strategies led to a reduction of approximately 3% in potential loan defaults attributed to environmental factors.

Resource Scarcity and Operational Footprint

Resource scarcity, particularly concerning water and energy, presents a significant challenge for Banque Centrale Populaire's (BCP) operational footprint and the broader Moroccan business landscape. As a major financial institution, BCP's physical infrastructure and digital operations have an inherent environmental impact.

BCP is actively pursuing initiatives to mitigate its environmental impact. These efforts focus on enhancing energy efficiency across its branches and data centers, implementing robust waste management programs, and prioritizing sustainable procurement practices for goods and services. For instance, Morocco aims to increase its renewable energy share to over 52% of installed capacity by 2030, a national trend BCP aligns with through its operational strategies.

- Energy Efficiency: BCP is investing in energy-saving technologies for its buildings, aiming to reduce electricity consumption per square meter.

- Waste Management: The bank is enhancing its recycling and waste reduction programs, with a target to decrease non-recyclable waste by 15% by the end of 2025.

- Sustainable Procurement: BCP is integrating environmental criteria into its supplier selection process, favoring partners with strong sustainability commitments.

- Water Conservation: Initiatives are in place to reduce water usage in facilities, especially in water-stressed regions of Morocco.

Corporate Social Responsibility (CSR) and Environmental Initiatives

Banque Centrale Populaire (BCP) actively integrates environmental considerations into its Corporate Social Responsibility (CSR) framework, emphasizing sustainable development in Morocco. The bank's commitment extends to concrete initiatives aimed at reducing its ecological footprint and fostering environmental awareness.

BCP's environmental strategy includes several key programs and partnerships designed to promote sustainability. For instance, the bank has been involved in initiatives supporting renewable energy projects and eco-friendly agricultural practices, aligning with national environmental goals.

- Green Financing: BCP offers financial products and services that support environmentally sound projects, contributing to Morocco's green economy transition.

- Carbon Footprint Reduction: The bank implements internal measures to reduce energy consumption and waste across its operations, aiming for a lower environmental impact.

- Environmental Partnerships: BCP collaborates with environmental organizations and governmental bodies to support conservation efforts and promote sustainable practices within the Moroccan community.

- Awareness Campaigns: The bank engages in educational campaigns to raise awareness among its employees and customers about environmental protection and the importance of sustainability.

Morocco's commitment to climate action, including a target of over 52% renewable energy by 2030, directly influences BCP's operational and strategic focus. This national push towards sustainability encourages financial institutions to adopt greener practices and invest in eco-friendly projects, creating both opportunities and compliance requirements.

BCP is actively managing its environmental footprint through energy efficiency measures in its facilities and waste reduction programs, aiming for a 15% decrease in non-recyclable waste by the end of 2025. The bank also prioritizes sustainable procurement, aligning with Morocco's broader environmental goals and increasing its portfolio of green bonds and sustainable financing options.

Environmental risks, such as water and energy scarcity, are key considerations for BCP, prompting initiatives like water conservation in its facilities. The bank's due diligence process in 2024 identified a 5% increase in loan applications from renewable energy projects, reflecting a strategic shift towards supporting sustainable development.

| Environmental Initiative | Target/Status | Year |

|---|---|---|

| Renewable Energy Share in Morocco | Over 52% of installed capacity | 2030 |

| BCP Non-Recyclable Waste Reduction | 15% decrease | End of 2025 |

| BCP Loan Applications from Renewable Energy Projects | 5% increase | 2024 |

| BCP Environmental Risk Mitigation Effectiveness | 3% reduction in potential loan defaults | 2024 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Banque Centrale Populaire integrates data from Moroccan government publications, the Bank of Africa, and leading financial news outlets. We also incorporate insights from international financial institutions like the IMF and World Bank, alongside reports on technological advancements and socio-economic trends in the region.