National Presto Industries SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

National Presto Industries Bundle

National Presto Industries leverages its established brand recognition and diverse product portfolio, but faces challenges from evolving consumer preferences and intense competition. Understanding these dynamics is crucial for any investor or strategist.

Want the full story behind Presto's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

National Presto Industries' strength lies in its diversified business model, operating across distinct segments. This includes Housewares/Small Appliance, Defense, and a Safety segment. This multi-faceted approach reduces dependency on any single market, offering a resilient operational base.

National Presto Industries' defense segment is a key strength, demonstrating impressive growth. In the first half of fiscal year 2025, this segment saw significant sales increases and improved operating earnings. This performance is underpinned by a substantial backlog, which stood at over $1 billion as of February 2025, providing a strong foundation for future revenue.

The robust backlog ensures predictable income, a critical factor in the defense industry. Recent contract awards further bolster this segment's position, signaling continued demand for its products and services. This sustained performance highlights the company's competitive edge in the defense sector.

National Presto Industries benefits from its PRESTO® brand, a name synonymous with quality and innovation in housewares and small appliances. This established reputation, built over a long history, fosters customer loyalty and recognition.

The company actively demonstrates its commitment to innovation through continuous product development. Recent introductions like the Presto Precise® digital canner and updated waffle makers highlight their ongoing efforts to meet evolving consumer needs and maintain a competitive edge in the market.

Consistent Profitability and Financial Discipline

National Presto Industries has a strong track record of consistent profitability, a testament to its sound financial management. For instance, the company reported net earnings growth in 2024, further bolstered by a profitable first quarter in 2025, showcasing its resilience and ability to generate earnings even amidst market fluctuations.

This sustained financial health is further evidenced by the company's substantial cash and investments. This financial discipline not only supports ongoing operations but also provides a solid foundation for future growth and strategic initiatives.

- Consistent Profitability: Demonstrated by net earnings growth in 2024 and a profitable Q1 2025.

- Financial Discipline: Maintained substantial cash and investments, indicating prudent financial management.

- Resilience: Ability to generate earnings despite challenges in certain business segments.

Long-standing Relationship with U.S. Department of Defense

National Presto Industries' Defense segment benefits immensely from its long-standing relationship with the U.S. Department of Defense (DoD). This key customer represents a stable and significant revenue stream, underpinned by substantial, multi-year contracts.

A prime example is the company's five-year Indefinite Delivery Indefinite Quantity (IDIQ) contract for 40mm ammunition. This type of contract ensures consistent demand and provides a predictable revenue base, crucial for operational planning and investment.

This deep-seated relationship with the DoD not only guarantees a strong foundation for the defense business but also positions National Presto Industries as a reliable supplier in a critical sector. The ongoing demand from such a major client offers considerable stability and growth potential.

Key aspects of this strength include:

- Primary Customer Reliance: The U.S. Department of Defense is the principal customer for the Defense segment.

- Long-Term Contractual Agreements: The company holds significant long-term contracts, including a notable five-year IDIQ for 40mm ammunition.

- Predictable Revenue Stream: These contracts ensure a steady and reliable demand for the company's defense products.

- Strategic Importance: This strong customer relationship provides a solid base and strategic advantage in the defense industry.

National Presto Industries' defense segment is a significant strength, evidenced by its substantial backlog exceeding $1 billion as of February 2025. This robust order book, combined with recent contract awards, ensures predictable revenue and highlights the company's competitive position in the defense sector.

The PRESTO® brand is another key asset, recognized for quality and innovation in housewares, fostering strong customer loyalty. Continuous product development, such as the Presto Precise® digital canner, demonstrates the company's commitment to meeting evolving consumer demands.

Financial health is a core strength, marked by consistent profitability, including net earnings growth in 2024 and a profitable first quarter of 2025. Substantial cash reserves further underscore prudent financial management and provide a solid foundation for future initiatives.

The company's deep relationship with the U.S. Department of Defense, including a five-year IDIQ contract for 40mm ammunition, provides a stable and significant revenue stream, solidifying its strategic importance in the defense industry.

| Metric | FY2024/Q1 2025 Data | Significance |

|---|---|---|

| Defense Backlog | Over $1 billion (as of Feb 2025) | Ensures predictable future revenue |

| Brand Recognition | PRESTO® | Customer loyalty and market presence |

| Net Earnings | Growth in 2024; Profitable Q1 2025 | Financial stability and management |

| Key Defense Contract | 5-year IDIQ for 40mm ammunition | Stable revenue from U.S. DoD |

What is included in the product

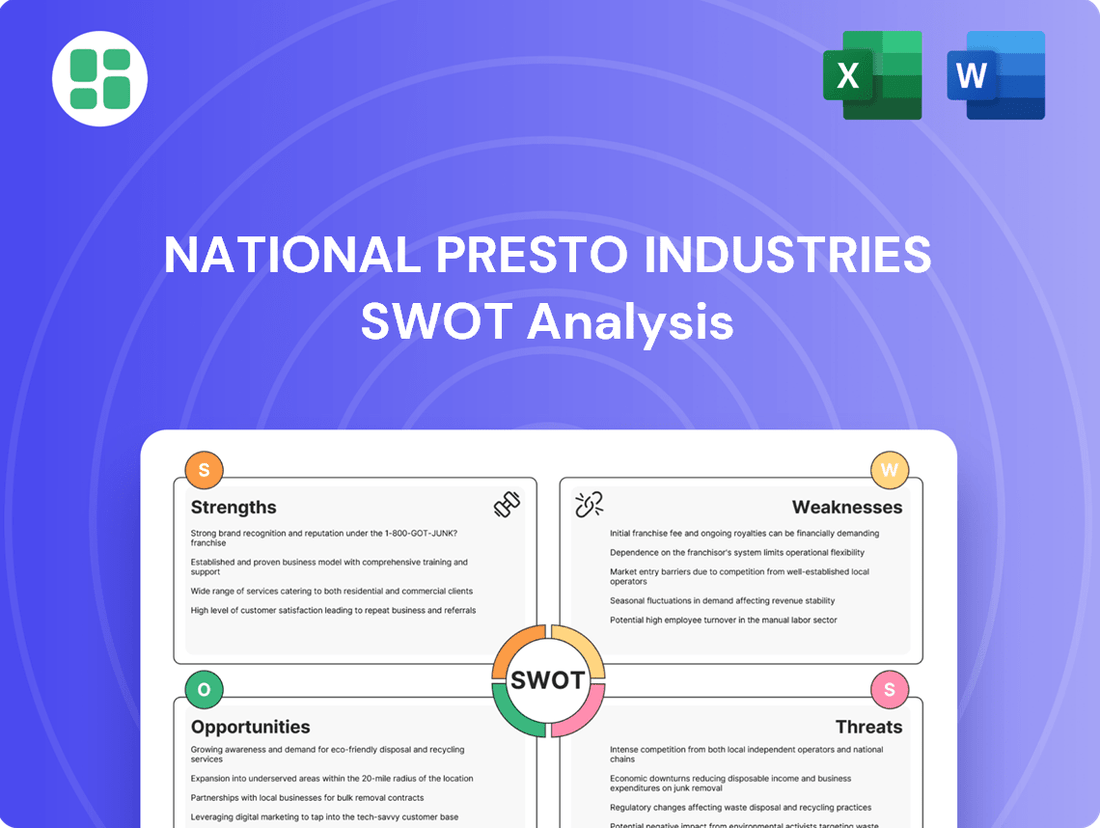

Analyzes National Presto Industries’s competitive position through key internal and external factors, detailing its strengths in product diversification and market presence, alongside weaknesses in innovation and threats from evolving consumer preferences.

Identifies key competitive advantages and areas for improvement in Presto's market position.

Highlights potential threats and weaknesses to proactively address strategic vulnerabilities.

Weaknesses

National Presto Industries' significant reliance on U.S. Department of Defense contracts, particularly within its Defense segment, presents a notable weakness. Changes in military requirements, government spending priorities, or evolving procurement regulations can directly impact contract awards and, consequently, the company's revenue streams.

For instance, a projected decline in U.S. defense spending for fiscal year 2025, estimated to be around $886 billion, could intensify competition for available contracts and potentially reduce the overall market size for Presto's defense products. This vulnerability means that shifts in national defense strategy or budget allocations can have a substantial and immediate effect on the company's financial performance.

The housewares and small appliance segment has been a persistent drag on National Presto Industries, with the company reporting operating losses in this division for recent quarters. For instance, in the fiscal third quarter of 2024, this segment experienced an operating loss, a continuation of challenges faced throughout the year.

Several factors contribute to these ongoing difficulties. An unfavorable product mix, meaning a higher proportion of lower-margin items being sold, has impacted profitability. Compounding this are rising material costs, which squeeze margins further, and the persistent impact of trade tariffs, which increase the cost of imported components and finished goods, making it harder to maintain competitive pricing and profitability.

The Housewares segment faces significant headwinds due to import tariffs. Specifically, the 'Trump tariffs,' which reached a substantial 145% by May 2025, have directly eroded the segment's profitability.

These tariffs are accounted for as period costs, forcing a pause in new product introductions and capital expenditures within the Housewares division. This strategic hold directly impedes potential growth and innovation in a critical market segment.

Safety Segment Operating Losses

The Safety segment of National Presto Industries has been a persistent source of financial strain, consistently reporting operating losses. Despite dedicated efforts to achieve product certifications, this segment continues to weigh down overall profitability. While the crucial smoke alarm certification was secured in January 2025, the segment's performance indicates a need for ongoing investment without a clear, immediate path to positive returns.

This ongoing drain necessitates continued capital allocation, impacting the company's ability to reinvest in more profitable areas or return capital to shareholders. The segment’s inability to generate positive earnings, even after obtaining key certifications, highlights underlying challenges in market demand, competitive pressures, or operational efficiency within this division.

High Inventory Investment for Defense Backlog

National Presto Industries' substantial investment in inventory to fulfill its large Defense segment backlog ties up a significant amount of the company's liquid assets. This can potentially limit the availability of cash for other strategic initiatives or investments, impacting overall financial flexibility. For instance, if inventory levels are unusually high relative to sales, it could suggest inefficiencies in production or forecasting, potentially hindering comparative portfolio earnings.

The need to maintain high inventory levels for defense contracts, which often have long lead times and specific material requirements, means a larger portion of National Presto's capital is committed to goods that may not be immediately sold. This can affect key financial metrics such as return on assets and cash conversion cycle, especially when compared to companies with less capital-intensive inventory management. As of early 2024, many defense contractors have reported increased inventory levels due to supply chain disruptions and the need to secure components for future production runs.

National Presto Industries faces challenges with its Housewares segment, which has been consistently unprofitable due to an unfavorable product mix, rising material costs, and the impact of trade tariffs. These tariffs, reaching up to 145% by May 2025, have forced a halt on new product introductions and capital expenditures in this division, hindering growth potential.

The Safety segment also presents a significant weakness, continuing to report operating losses despite securing crucial smoke alarm certification in January 2025. This segment demands ongoing investment without a clear immediate path to profitability, impacting overall financial flexibility and the ability to reinvest in more promising areas.

Furthermore, the company's substantial investment in inventory for its Defense segment backlog ties up significant liquid assets. This can limit cash availability for other strategic initiatives, potentially indicating inefficiencies in production or forecasting, and impacting key financial metrics like return on assets.

| Segment | Recent Performance | Key Weaknesses |

|---|---|---|

| Housewares | Operating Losses (Q3 2024) | Unfavorable product mix, rising material costs, trade tariffs (up to 145% by May 2025), halted new product introductions. |

| Safety | Operating Losses | Ongoing investment required, no immediate path to profitability despite certification (Jan 2025). |

| Defense | N/A (Segment focused) | High inventory levels tying up capital, potential impact of U.S. defense spending fluctuations (est. $886 billion FY2025). |

Preview the Actual Deliverable

National Presto Industries SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear overview of National Presto Industries' Strengths, Weaknesses, Opportunities, and Threats. You'll gain valuable insights into the company's strategic position.

Opportunities

The current global geopolitical climate, marked by heightened national security concerns, presents a significant opportunity for National Presto Industries to expand its defense contract portfolio. This environment directly fuels increased demand for the company's specialized products and services.

National Presto Industries is well-positioned to capitalize on this trend, evidenced by its substantial existing backlog of defense orders. For instance, in the fiscal year ending September 30, 2023, the company reported a robust backlog, signaling strong future revenue streams within its Defense segment.

Recent significant contract awards further underscore this favorable market. These wins not only bolster current performance but also demonstrate the company's competitive edge and ability to secure substantial business in a growing sector, projecting continued expansion for the foreseeable future.

National Presto Industries has a significant opportunity to boost its Housewares and Small Appliance segment through forward-thinking product development. Introducing innovative items like digital canners and smart appliances that integrate with home ecosystems can capture consumer interest.

By aligning with the growing demand for convenience and sophisticated features in household gadgets, Presto can enhance its market position. For instance, the smart home market is projected to reach $150 billion by 2027, indicating a substantial appetite for connected devices.

National Presto Industries can seize opportunities by developing robust strategies to counteract the negative impacts of tariffs and supply chain disruptions. This could involve diversifying their supplier base beyond regions with high tariff exposure, potentially exploring nearshoring or reshoring options for key components in their Housewares division. For instance, if a significant portion of their small appliance components were sourced from a country imposing new tariffs in late 2024, actively seeking domestic or friendly-nation suppliers could insulate them from those cost increases.

Optimizing logistics and inventory management presents another avenue for growth. By investing in more resilient and agile supply chain networks, Presto can reduce lead times and buffer against unexpected delays, thereby improving their ability to meet consumer demand consistently. This strategic shift could lead to enhanced operational efficiency and a stronger competitive position, particularly in a volatile global trade environment expected to persist through 2025.

Leveraging E-commerce and Digital Marketing

The robust expansion of e-commerce presents a significant opportunity for National Presto Industries' Housewares segment. By bolstering its online presence and adopting direct-to-consumer (DTC) strategies, the company can tap into a wider customer base and diversify its sales channels beyond traditional retail. This digital shift allows for more personalized marketing and direct engagement with consumers, potentially leading to increased brand loyalty and sales growth.

Digital marketing initiatives, including targeted advertising and social media campaigns, can effectively reach a broader demographic interested in home goods. For instance, the global e-commerce market was projected to reach over $6 trillion in 2024, with significant growth in online home goods sales. National Presto can leverage this trend by:

- Expanding its product offerings on major online marketplaces.

- Developing a more robust DTC e-commerce platform for direct sales.

- Implementing data-driven digital marketing campaigns to target specific consumer segments.

- Utilizing social media influencers and content marketing to drive product awareness and engagement.

Increased Consumer Focus on Home Cooking

The enduring trend of home cooking, amplified by post-pandemic lifestyle shifts, continues to be a significant tailwind for kitchenware and small appliance manufacturers like National Presto. Consumers are increasingly investing in their home kitchens, seeking to replicate restaurant-quality meals or simply enjoy the convenience and cost-effectiveness of preparing food at home. This sustained interest presents a prime opportunity for National Presto to leverage its established product portfolio and innovate with new offerings that align with current culinary interests and the desire for efficient, user-friendly kitchen solutions.

National Presto can capitalize on this by:

- Highlighting the versatility and durability of its existing product lines, such as pressure cookers and electric skillets, in marketing campaigns that showcase their utility in everyday home cooking.

- Developing new products that cater to emerging culinary trends, like air frying or sous vide cooking, which are gaining traction among home cooks seeking healthier and more sophisticated meal preparation methods.

- Emphasizing the ease of use and time-saving benefits of its appliances, directly addressing consumer desires for convenient meal solutions without sacrificing quality or taste.

- Leveraging digital platforms and social media to engage with home cooking communities, sharing recipes and tips that feature National Presto products, thereby fostering brand loyalty and product adoption.

The increasing global focus on national security and defense spending, projected to continue through 2025, offers a substantial growth avenue for National Presto Industries' defense segment. This trend is supported by significant defense budget allocations worldwide, creating consistent demand for specialized defense equipment.

Furthermore, the persistent consumer interest in home cooking and kitchen innovation presents a prime opportunity for Presto's Housewares division. The market for small kitchen appliances is robust, with consumers actively seeking convenient and efficient solutions, a trend expected to persist into 2025.

The digital transformation of retail, particularly the expansion of e-commerce, provides a direct channel for National Presto to broaden its reach and engage consumers more effectively. This online growth is a key factor in the housewares market, with projections indicating continued upward momentum for online sales of home goods.

National Presto Industries can also capitalize on the growing demand for smart home technology by integrating connected features into its housewares. The smart home market's projected growth underscores the consumer appetite for convenience and advanced functionality in everyday appliances.

Threats

A significant threat for National Presto Industries is the volatility of government defense spending. Shifts in U.S. Department of Defense priorities, such as those seen with evolving geopolitical landscapes in 2024 and projected budget allocations for 2025, can directly impact contract awards. For instance, a decrease in overall defense outlays or a reallocation of funds away from areas where National Presto operates could lead to reduced revenue streams for its defense segment.

The housewares and small appliance sector is a battlefield, with established giants and nimble startups constantly duking it out for consumer attention. This fierce rivalry often translates into price wars, squeezing profit margins for companies like Presto. For instance, in 2024, the small appliance market saw significant promotional activity from major players, impacting average selling prices.

Economic downturns, particularly recessions, represent a significant threat to National Presto Industries. During these periods, consumers typically cut back on non-essential purchases. This directly impacts the housewares and small appliance segment, as these items are often considered discretionary. For example, in early 2023, inflation concerns led many consumers to delay big-ticket purchases, a trend that would likely extend to smaller appliances if economic conditions worsen.

Persistent Trade Tariffs and Rising Material Costs

Persistent trade tariffs, such as the notable 145% tariffs previously reported, continue to exert pressure on National Presto Industries. This, coupled with a general upward trend in material costs throughout 2024 and into early 2025, directly impacts the profitability of the Housewares segment. These combined economic headwinds force difficult pricing adjustments, potentially affecting sales volume and overall financial performance.

The ongoing imposition of tariffs and escalating material expenses present a clear threat, particularly for the Housewares division. For instance, reports from late 2024 indicated that the cost of key raw materials like steel and plastics saw an average increase of 8-12% year-over-year, directly squeezing profit margins. This necessitates strategic decisions regarding price increases, which could deter some consumer spending.

- Tariff Impact: Continued high tariffs, exemplified by past rates of 145%, directly reduce the competitiveness of imported components and finished goods, increasing operational costs.

- Material Cost Inflation: Rising prices for essential materials like steel, aluminum, and plastics, experienced throughout 2024 and projected to continue into 2025, erode profit margins.

- Pricing Dilemmas: The need to pass on increased costs through higher product prices presents a significant challenge, potentially impacting consumer demand and market share.

- Supply Chain Volatility: Trade disputes and economic uncertainties contribute to supply chain disruptions, further exacerbating material cost volatility and availability issues.

Supply Chain Disruptions and Supplier Bankruptcies

Vulnerabilities within National Presto Industries' supply chain pose a significant threat. A recent supplier bankruptcy in the Housewares segment during Q2 2025 directly impacted operations, highlighting the risks associated with single-source dependencies or financially unstable partners. This type of disruption can lead to production delays and increased costs.

These supply chain disruptions can have a ripple effect, affecting order fulfillment across both the Housewares and Defense segments. For instance, a key component shortage due to a supplier failure could halt production lines, leading to missed sales targets and potential loss of market share. The company's reliance on external suppliers means that their financial health and operational stability are critical factors for National Presto's own performance.

- Supplier Bankruptcy Impact: A Q2 2025 supplier bankruptcy in the Housewares segment directly caused production delays.

- Cost Increases: Disruptions often lead to higher material acquisition costs and expedited shipping fees.

- Order Fulfillment Challenges: Inability to secure necessary components can hinder timely order completion across all business units.

- Segment-Wide Ramifications: Issues in one segment's supply chain can negatively affect the Defense segment's output and delivery schedules.

The company faces significant pressure from intense competition in the housewares market, a situation exacerbated by economic downturns that reduce consumer discretionary spending. Furthermore, ongoing trade tariffs and rising material costs, with key inputs like steel seeing an estimated 8-12% year-over-year increase in late 2024, directly impact profitability and necessitate difficult pricing decisions.

Geopolitical shifts and evolving U.S. defense priorities in 2024 and 2025 create volatility in government contract awards, posing a direct threat to National Presto's defense segment revenue. Supply chain vulnerabilities, highlighted by a Q2 2025 supplier bankruptcy in the housewares division, can lead to production delays and increased costs across the entire organization.

| Threat Category | Specific Example/Data | Impact |

|---|---|---|

| Market Competition | Intense rivalry and price wars in housewares | Reduced profit margins |

| Economic Conditions | Consumer spending cuts during downturns | Lower sales for discretionary items |

| Trade & Costs | Tariffs (e.g., 145%) and material cost inflation (8-12% for steel in late 2024) | Eroded profitability, pricing challenges |

| Defense Spending | Shifting U.S. DoD priorities (2024-2025) | Uncertainty in contract awards |

| Supply Chain | Supplier bankruptcy (Q2 2025) | Production delays, increased costs |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from National Presto Industries' official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.