Glacier Media Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Glacier Media Group Bundle

Glacier Media Group navigates a complex media landscape where buyer power and the threat of substitutes significantly shape its strategic options. Understanding these forces is crucial for any stakeholder looking to grasp its competitive positioning.

The complete report reveals the real forces shaping Glacier Media Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Glacier Media's increasing focus on business information and data services heightens its dependence on specialized data providers. Should these suppliers offer proprietary or difficult-to-replicate data, their leverage over Glacier Media grows considerably.

This is especially pronounced in specialized markets such as environmental risk or commodity intelligence, where the pool of data sources can be restricted and highly specific. For example, in 2024, the market for specialized ESG data providers saw significant growth, with several niche players commanding premium pricing due to their unique datasets and analytical capabilities.

The availability of content creators and journalists presents a mixed picture for Glacier Media Group. While a large number of freelance writers exist, those with specialized knowledge in Glacier's core sectors like agriculture, energy, and mining are less common. This scarcity of niche expertise can give these specialized creators more leverage.

The media industry's ongoing transformations, including consolidation and some closures, have indeed increased the pool of generalist journalists. However, for publications requiring deep industry insights, the supply of truly expert writers remains limited, potentially driving up costs for Glacier.

Glacier Media's reliance on specialized technology and software for its digital operations, including content management and advanced analytics, is a significant factor in its supplier bargaining power. For instance, dependence on vendors for AI-driven content personalization tools or robust cloud infrastructure can grant these suppliers considerable leverage.

This leverage is amplified if Glacier faces high switching costs. These costs can arise from the intricate integration of proprietary systems or the need for extensive retraining of staff on new platforms. For example, if a key analytics platform is deeply embedded in Glacier's workflow, the effort and expense to migrate to an alternative could be substantial, giving the current supplier more power in negotiations.

Printing Service Providers for Remaining Print Operations

Even though Glacier Media has significantly transitioned to digital platforms, it still maintains some print operations for community media and publications. For these remaining print segments, the bargaining power of printing service providers and paper suppliers can be substantial. This is especially true in areas with fewer printing options or when specialized printing techniques are needed.

The overall decline in print revenue for the industry does, however, somewhat temper the leverage these suppliers hold. For instance, the global paper and pulp market, while experiencing fluctuations, saw its market size estimated at around $350 billion in 2023, with ongoing shifts impacting pricing dynamics for remaining print customers.

- Printing Service Providers: Their power is influenced by the number of available commercial printers in a region and the specialization required for Glacier Media's print products.

- Paper Suppliers: The cost and availability of paper, a key input for print, directly affect profitability and can be a point of negotiation.

- Impact of Digital Shift: As print volumes decrease industry-wide, suppliers may face overcapacity, potentially leading to more competitive pricing for remaining print contracts.

Event Venue and Logistics Suppliers

Glacier Media Group's events segment, particularly its farm shows, relies heavily on specialized venue and logistics suppliers. The distinct needs for event space, from specific sizes to unique facilities, combined with fluctuating seasonal demand, can grant considerable leverage to venue owners and logistics providers. For instance, in 2024, the demand for large-scale agricultural exhibition spaces saw a notable increase, driven by a rebound in in-person events post-pandemic.

The bargaining power of these suppliers is amplified when Glacier Media requires locations with very specific attributes or faces tight scheduling constraints. Building long-term partnerships or having unique logistical requirements for transporting specialized equipment can further strengthen the suppliers' position. In 2023, the cost of specialized transportation for agricultural machinery saw an average increase of 7% year-over-year, reflecting the specialized nature and demand for these services.

- Event Dependence: Glacier Media's farm shows require specific venues and logistics, making these suppliers critical.

- Supplier Leverage: Unique location, size, facility needs, and seasonal demand empower venue and logistics providers.

- Market Dynamics: In 2024, increased demand for agricultural exhibition spaces bolstered supplier bargaining power.

- Relationship Impact: Long-term contracts or specialized needs can solidify supplier negotiating strength.

Glacier Media's reliance on specialized data providers, particularly for niche sectors like environmental risk or commodity intelligence, grants significant bargaining power to these suppliers. The limited availability of unique datasets, as seen with the 2024 growth in specialized ESG data providers commanding premium prices, means Glacier Media has fewer alternatives.

Similarly, the scarcity of journalists with deep expertise in Glacier's core industries—agriculture, energy, and mining—allows these specialized content creators to exert greater leverage. This situation is exacerbated by the ongoing transformation of the media industry, which, while increasing the pool of generalist writers, restricts the supply of truly expert voices.

The bargaining power of suppliers for Glacier Media's digital operations, including technology and software vendors, is substantial, especially when switching costs are high due to complex system integration or extensive retraining needs. For instance, the embedded nature of key analytics platforms can give current vendors considerable negotiating strength.

For Glacier Media's print operations, the bargaining power of printing service providers and paper suppliers remains a factor, particularly where printing options are limited or specialized techniques are required. However, the industry-wide decline in print revenue, with the global paper and pulp market valued around $350 billion in 2023, somewhat mitigates this leverage as suppliers may face overcapacity.

| Supplier Type | Glacier Media Dependence | Supplier Bargaining Power Factors | 2024/2023 Data Point |

|---|---|---|---|

| Specialized Data Providers | High (niche data, proprietary info) | Uniqueness of data, limited alternatives | Growth in specialized ESG data providers (2024) |

| Niche Journalists/Content Creators | Moderate to High (industry expertise) | Scarcity of specialized knowledge | Limited supply of expert writers in core sectors |

| Technology/Software Vendors | High (digital operations, analytics) | High switching costs, system integration | Example: Embedded analytics platforms |

| Printing Services & Paper Suppliers | Moderate (remaining print operations) | Availability of printers, paper costs, print volume decline | Global paper/pulp market ~$350B (2023) |

What is included in the product

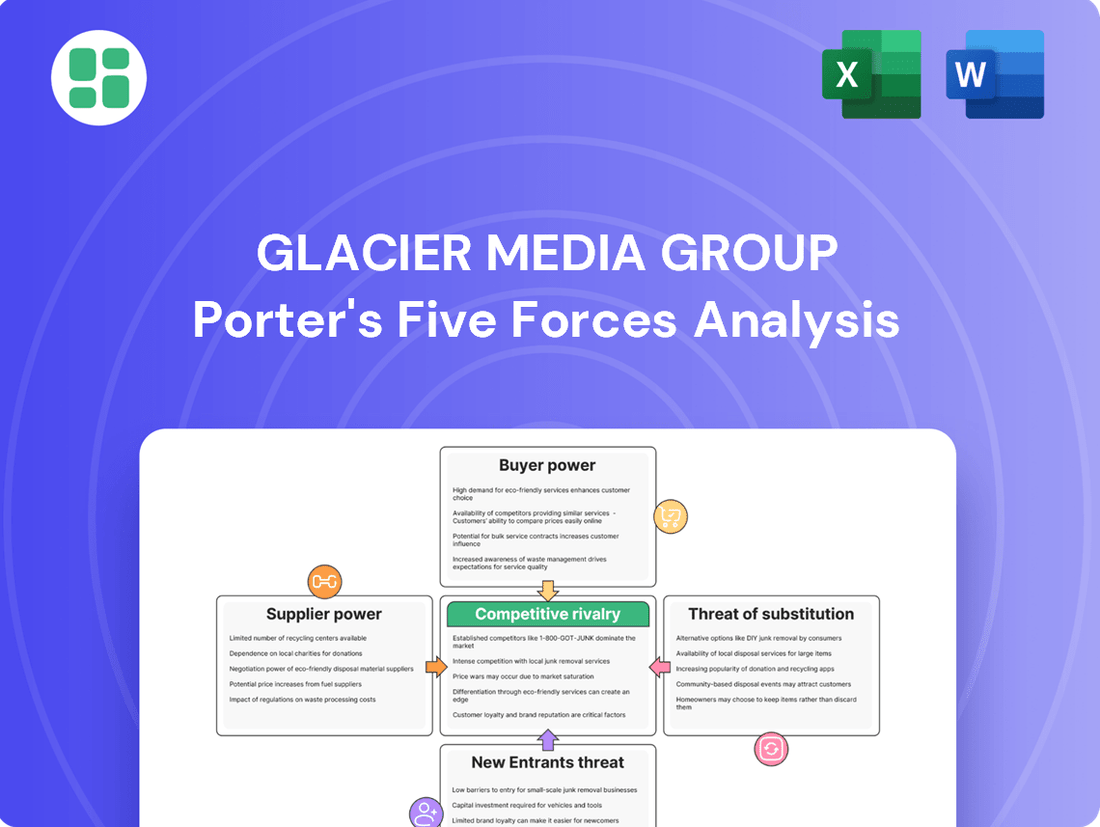

This analysis delves into the competitive forces impacting Glacier Media Group, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its industry.

Quickly identify and mitigate competitive threats with a visual representation of each force's impact.

Customers Bargaining Power

Glacier Media Group caters to a broad spectrum of clients needing advertising services. The bargaining power of customers is a key consideration, particularly when looking at the concentration of their advertising spend.

Large-scale advertisers, often with substantial budgets and significant media buying experience, can leverage their volume to negotiate favorable pricing and terms. This is especially true in the highly competitive digital advertising market, where alternatives are readily available. For instance, in 2024, the digital advertising market continued to see intense competition, with major platforms like Google and Meta commanding significant market share, giving large advertisers considerable leverage.

Conversely, while individual small businesses may not possess the same individual negotiating clout, their collective presence forms a vital segment of Glacier Media's revenue. The aggregation of these smaller clients can, in certain contexts, provide a counterbalance to the power of larger advertisers, though their individual impact on pricing is typically less pronounced.

Customers looking for digital marketing services in Canada have an overwhelming number of options. They can choose from a multitude of specialized digital marketing agencies, directly utilize social media platforms, or leverage search engines for their advertising needs.

This extensive competition within the Canadian digital marketing landscape significantly boosts customer bargaining power. Clients can readily shift their business to providers offering better performance, more competitive pricing, or tailored service packages.

For instance, in 2024, the Canadian digital advertising market was projected to reach over $9 billion, indicating a highly fragmented and competitive environment where customer choice is paramount.

Consumers today have an almost overwhelming amount of free news and entertainment readily available online. Platforms like social media, YouTube, and countless blogs offer alternatives to traditional paid content. This widespread accessibility to substitutes directly impacts Glacier Media Group's consumer digital and community media segments.

The sheer volume of free content available significantly diminishes the bargaining power of individual consumers. They are less inclined to pay for Glacier's digital offerings when similar information or entertainment can be accessed without cost elsewhere. This puts downward pressure on subscription fees and advertising rates for Glacier.

For instance, in 2024, a significant portion of online news consumption in many developed markets is still driven by free access, with paid subscriptions representing a smaller, though growing, segment. This trend highlights the challenge Glacier faces in monetizing its digital content against a backdrop of abundant free alternatives.

Niche Business Information Subscribers' Switching Costs

While Glacier Media Group operates in niche business information markets, customers in these specialized sectors might experience some switching costs once they've integrated Glacier's data and intelligence services into their operations. These costs could include the effort and expense of migrating data, retraining staff on new platforms, or the loss of accumulated historical insights within Glacier's system.

However, the bargaining power of these customers can increase if alternative data sources become available or if clients develop robust in-house data analysis capabilities. This increased power allows them to demand higher value and greater accuracy from Glacier's offerings, potentially impacting pricing and service level agreements.

- Niche Market Integration: Customers in specialized sectors often embed Glacier's data into their workflows, creating a reliance that can represent a switching cost.

- Emergence of Alternatives: The availability of competing data providers or the development of in-house analytical tools directly challenges Glacier's customer lock-in.

- Demand for Value: As clients enhance their data literacy and analytical capacity, they become more discerning, pushing Glacier to continuously prove its value proposition through accuracy and actionable insights.

Event Exhibitors and Attendees' Choices

Exhibitors and attendees at Glacier Media Group events, like their agricultural trade shows, have a significant number of alternatives. These include other industry expos, online webinars, and a wide array of digital marketing tools for reaching their target audiences. This abundance of choices directly translates into considerable bargaining power.

Businesses and individuals can therefore exert pressure on Glacier Media Group to demonstrate a clear return on investment (ROI) and provide truly valuable networking and lead-generation opportunities. If Glacier's events don't meet these expectations, customers can easily shift their resources elsewhere.

- High Availability of Alternatives: Exhibitors and attendees can choose from numerous competing trade shows, virtual events, and digital marketing platforms.

- Demand for ROI: Customers expect tangible benefits and a strong return on their investment in participation.

- Price Sensitivity: The availability of alternatives can make customers more sensitive to pricing structures and package offerings.

- Focus on Value Proposition: Glacier Media Group must continuously enhance the unique value and networking capabilities of its events to retain customers.

Glacier Media Group faces considerable customer bargaining power due to the fragmented nature of its markets and the abundance of alternatives available to its clients. This power is particularly evident in digital advertising and consumer media, where free content and numerous competing platforms dilute the value proposition of paid services.

In 2024, the Canadian digital advertising market, exceeding $9 billion, exemplified this, offering clients ample choice and leverage to demand competitive pricing and superior performance. Similarly, the widespread availability of free online content pressures Glacier's consumer-facing segments, making it challenging to monetize digital offerings against a backdrop of readily accessible substitutes.

While niche business information markets might present some switching costs, the potential for alternative data providers or in-house capabilities can still empower these customers to negotiate for greater value and accuracy from Glacier.

The bargaining power of customers for Glacier Media Group is influenced by several factors, including the availability of substitutes and the concentration of their spending.

| Customer Segment | Key Factors Influencing Bargaining Power | Impact on Glacier Media Group |

|---|---|---|

| Large-Scale Advertisers (Digital) | High volume, media buying experience, numerous digital platform alternatives (e.g., Google, Meta) | Ability to negotiate favorable pricing and terms; pressure on ad rates. |

| Small Businesses (Digital) | Collective presence provides some counterbalance; individual impact less pronounced. | Less individual leverage but crucial as a revenue segment; potential for bundled offerings. |

| Consumers (Digital & Community Media) | Abundance of free online content (social media, YouTube); low switching costs. | Diminished willingness to pay for content; downward pressure on subscription fees and ad rates. |

| Niche Business Information Clients | Potential switching costs (data migration, retraining); development of in-house capabilities. | Can demand higher value and accuracy; potential impact on service level agreements and pricing. |

| Exhibitors & Attendees (Events) | Numerous alternative industry expos, webinars, and digital marketing tools. | Demand for clear ROI; pressure to demonstrate value and networking opportunities; price sensitivity. |

Same Document Delivered

Glacier Media Group Porter's Five Forces Analysis

This preview displays the comprehensive Glacier Media Group Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the industry. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information. You can trust that the insights into threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry are precisely what you'll gain access to, ready for your strategic planning.

Rivalry Among Competitors

Glacier Media contends with formidable competition from major Canadian media conglomerates such as Postmedia, Bell Media, Rogers, and Quebecor Inc. These giants operate extensive networks encompassing print, digital, and broadcast media, directly challenging Glacier Media for audience engagement and advertising revenue.

These diversified players often benefit from significant economies of scale and a broader market reach, enabling them to invest more heavily in content creation and cross-promotional strategies. For instance, Postmedia, a key competitor, reported total revenue of CAD 704.9 million for its fiscal year ending August 31, 2023, highlighting its substantial operational capacity.

The Canadian digital advertising market is overwhelmingly dominated by global tech giants like Google and Meta. These platforms command a substantial portion of digital ad spending, estimated to be over 70% of the Canadian digital ad market in 2024, making it incredibly difficult for local players like Glacier Media to compete effectively for advertiser budgets.

This intense rivalry means Glacier Media faces significant challenges in attracting and retaining advertisers. Advertisers are drawn to the unparalleled reach and sophisticated targeting capabilities offered by these global platforms, often at competitive price points, which puts pressure on Glacier Media's digital advertising services and revenue streams.

The media landscape is increasingly crowded with digital-first news outlets and independent online publishers, all vying for audience attention and advertising revenue. This proliferation intensifies competitive rivalry, forcing established players like Glacier Media Group to adapt quickly.

These agile digital competitors, often utilizing AI for content generation and distribution, present a significant challenge. For instance, by mid-2024, the digital advertising market continued its robust growth, with Google and Meta still dominating but facing increased pressure from a multitude of specialized online content creators and platforms.

Competition in Specialized Digital Marketing Services

Glacier Media Digital faces intense competition from a burgeoning landscape of specialized digital marketing agencies. These firms, focusing on areas like search engine optimization (SEO), pay-per-click (PPC) advertising, and social media management, are constantly innovating to attract clients.

The market for these niche services is characterized by fierce rivalry, with agencies differentiating themselves through demonstrated expertise, verifiable success metrics, and customized client strategies. This pressure compels Glacier to consistently enhance its offerings and clearly articulate its unique value proposition.

- Market Specialization: Many agencies now focus on hyper-specific digital marketing niches, creating fragmented competition.

- Client Acquisition Costs: The need to stand out drives up marketing and sales expenses for agencies like Glacier.

- Talent Wars: Competition for skilled digital marketing professionals is escalating, impacting operational costs and service quality.

- Agility and Innovation: Smaller, specialized firms can often adapt more quickly to digital marketing trends, posing a challenge to larger players.

Consolidation and Restructuring in the Media Industry

The Canadian media landscape is characterized by intense competition, fueled by ongoing consolidation and restructuring. Glacier Media Group's own strategic decision to close underperforming print assets in 2023, as reported, highlights the pressure on traditional media outlets. This move reflects a broader industry trend where companies are actively seeking greater efficiency and market dominance.

This pursuit of market share often translates into aggressive pricing strategies and a rapid pace of innovation as companies vie for audience attention and advertising revenue. Companies are constantly evaluating their portfolios, divesting non-core assets and acquiring complementary businesses to strengthen their competitive position.

- Industry Consolidation: Major media players continue to merge or acquire smaller entities, aiming to achieve economies of scale and broader reach. For instance, in late 2023, Corus Entertainment announced significant cost-cutting measures, including layoffs, signaling the financial pressures within the sector.

- Digital Transformation: The shift to digital platforms necessitates continuous investment in technology and content creation, intensifying rivalry among those who can adapt quickly.

- Content Diversification: Companies are diversifying their content offerings across various platforms to capture a wider audience, leading to increased competition for talent and intellectual property.

- Advertising Market Dynamics: Fluctuations in the advertising market, with a significant portion now directed towards digital channels, create a challenging environment for traditional media companies.

Glacier Media faces intense competition from large Canadian media conglomerates like Postmedia, Bell Media, Rogers, and Quebecor Inc., which possess extensive print, digital, and broadcast operations. These established players leverage economies of scale and wider market reach, enabling greater investment in content and cross-promotion, as evidenced by Postmedia's CAD 704.9 million revenue in fiscal 2023.

The digital advertising landscape is heavily dominated by global tech giants, with Google and Meta capturing over 70% of the Canadian market in 2024. This dominance makes it difficult for local companies like Glacier Media to compete for advertiser budgets, which are increasingly drawn to the superior reach and targeting capabilities of these platforms.

The proliferation of digital-first news outlets and specialized marketing agencies further intensifies rivalry. These agile competitors, often utilizing AI, challenge established players by offering niche services and adapting quickly to market trends, forcing Glacier Media to continually enhance its offerings and value proposition.

| Competitor Type | Key Characteristics | Impact on Glacier Media |

| Major Canadian Media Conglomerates | Extensive networks, economies of scale, broad market reach | Direct competition for audience and advertising revenue |

| Global Digital Platforms (Google, Meta) | Dominant digital ad market share (>70% in 2024), advanced targeting | Significant pressure on Glacier Media's digital ad revenue |

| Digital-First Outlets & Specialized Agencies | Agility, AI adoption, niche specialization | Fragmented competition, pressure to innovate and differentiate |

SSubstitutes Threaten

Social media platforms are increasingly becoming the go-to source for news and information, directly challenging traditional media outlets like Glacier Media. In 2024, it's estimated that over 50% of adults in many developed nations now rely on social media for their daily news consumption, a significant shift from previous years.

Furthermore, businesses are reallocating substantial advertising budgets to social media due to its precise audience targeting and perceived higher return on investment. For instance, global social media ad spending was projected to exceed $200 billion in 2024, a clear indication of this trend and a direct substitute for Glacier Media's advertising revenue streams.

The rise of direct-to-consumer (D2C) content creation presents a significant threat. Businesses and individuals can now bypass traditional media outlets like Glacier Media Group, producing and distributing their own blogs, podcasts, newsletters, and corporate websites. This allows for direct engagement with audiences, effectively substituting Glacier's role as an intermediary for information and marketing.

This shift is fueled by accessible technology and a growing desire for unfiltered communication. For instance, the global creator economy was projected to reach $250 billion by the end of 2023, highlighting the scale of independent content production. Such platforms enable companies to build their own communities and deliver targeted messages without relying on third-party media, diminishing the need for traditional media's reach and influence.

The rise of accessible marketing technology and data analytics tools empowers businesses to build strong in-house capabilities. This trend directly diminishes the reliance on external providers like Glacier Media for marketing execution and specialized business intelligence.

For instance, in 2024, the global marketing technology market was valued at over $50 billion, showcasing the widespread adoption of these tools. Companies can now manage campaigns and analyze customer data internally, reducing the perceived need for specialized external services.

Free and User-Generated Content Platforms

The proliferation of free, user-generated content platforms poses a substantial threat to Glacier Media Group. Platforms like YouTube, TikTok, and various blogs offer an endless stream of articles, videos, and discussions that directly compete with Glacier's professionally produced content. This abundance of free material makes it harder for consumers to justify paying for premium content, impacting Glacier's revenue streams.

Consider the sheer volume: In 2024, it's estimated that over 100 hours of video are uploaded to YouTube every minute. This vast library of free entertainment and information acts as a direct substitute for the professionally curated content Glacier Media offers in its consumer digital and community media segments. The challenge lies in differentiating Glacier's value proposition when so much is available at no cost.

- Vast Availability: Free platforms offer an overwhelming amount of content, from news articles to video tutorials.

- Low Cost Barrier: User-generated content is typically free, eliminating the financial incentive for consumers to pay for similar professional content.

- Audience Fragmentation: Attention is divided across numerous free platforms, making it difficult for Glacier to capture and retain a paying audience for its digital offerings.

- Monetization Challenge: The readily available free alternatives directly challenge Glacier Media's ability to effectively monetize its consumer digital and community media products.

Alternative Professional Networking and Information Channels

The threat of substitutes for Glacier Media Group's business information and events is significant. Alternatives like LinkedIn, industry-specific online forums, and specialized consulting reports offer comparable networking and market intelligence. For instance, LinkedIn had over 1 billion members globally as of late 2023, providing a vast platform for professional connection and information dissemination, directly competing with Glacier's core offerings.

These substitutes can erode Glacier Media's customer base by providing similar value at potentially lower costs or with greater convenience. Professional social networks offer continuous access to industry news and connections, while specialized reports from firms like Gartner or Forrester deliver in-depth market analysis that might be more targeted than Glacier's broader publications.

The availability of these alternatives directly impacts Glacier Media's pricing power and market share. Businesses can choose to allocate their budgets towards these substitute channels if they perceive them as more effective or cost-efficient for their needs. This competitive pressure necessitates that Glacier Media continuously innovate and demonstrate unique value in its products and events.

- Online Professional Networks: Platforms like LinkedIn offer extensive networking and content sharing, attracting users seeking industry insights and connections.

- Industry-Specific Forums and Communities: Niche online groups provide focused discussions and information exchange, catering to specialized professional interests.

- Specialized Consulting and Research Reports: Firms offering in-depth market analysis and strategic advice present a direct substitute for curated business intelligence.

- Direct Industry Association Engagement: Many associations provide their members with exclusive networking events, publications, and market data, bypassing third-party providers.

The threat of substitutes for Glacier Media Group is substantial, driven by the widespread availability of free and low-cost alternatives across various content and information sectors. Social media platforms and user-generated content sites offer vast libraries of news, entertainment, and professional insights, often at no direct cost to the consumer. This abundance directly challenges Glacier's revenue models by reducing the perceived value of professionally produced content and diminishing the need for traditional media intermediaries.

Businesses are also shifting advertising budgets towards digital platforms that offer precise audience targeting and potentially higher ROI, such as social media and in-house marketing capabilities enabled by accessible technology. Furthermore, professional networks and specialized research reports serve as direct substitutes for Glacier's business information and events, providing comparable value through alternative channels.

| Substitute Category | Key Platforms/Examples | Impact on Glacier Media |

|---|---|---|

| Social Media News & Information | Facebook, X (formerly Twitter), Instagram, TikTok | Diversion of audience attention and advertising revenue from traditional news outlets. Over 50% of adults in developed nations now rely on social media for daily news in 2024. |

| User-Generated Content | YouTube, Blogs, Podcasts, Forums | Competition with professionally produced content; erosion of perceived value for paid content. Over 100 hours of video uploaded to YouTube per minute in 2024. |

| Direct-to-Consumer (D2C) Content | Company blogs, newsletters, corporate websites | Bypassing traditional media as an information intermediary; direct audience engagement. The creator economy was projected to reach $250 billion by end of 2023. |

| In-House Marketing & Analytics | Marketing technology (MarTech) platforms | Reduced reliance on external media for marketing execution and business intelligence. Global MarTech market valued over $50 billion in 2024. |

| Professional Networking & Intelligence | LinkedIn, Industry forums, Consulting reports | Competition for professional audience and market intelligence revenue. LinkedIn had over 1 billion members globally as of late 2023. |

Entrants Threaten

The digital landscape significantly lowers the barriers to entry for new players in the media industry. Launching an online news site, a blog, or a niche content platform requires considerably less capital than establishing traditional print or broadcast media. This ease of entry means Glacier Media Group faces a constant potential influx of new competitors, especially in local news markets or specialized content verticals where digital-native startups can quickly gain traction.

While it's relatively simple for individuals to create content, establishing a comprehensive digital information and marketing solutions company akin to Glacier Media Group, complete with advanced data analytics, sophisticated digital platforms, and a broad service range, requires substantial technological investment and operational infrastructure. This high barrier effectively deters large-scale new entrants.

Building brand trust and reputation in the media sector is a steep climb for newcomers. It takes years and significant investment to earn the credibility that established players like Glacier Media Group have. For instance, in 2024, major media outlets continued to leverage decades of brand building, with consumer trust surveys consistently showing established brands outperforming newer ones by a considerable margin, often by over 20% in key demographics.

New entrants must overcome the inertia of consumer loyalty to established media brands. This means not only delivering quality content but also consistently demonstrating reliability and accuracy, a process that can take many years. Glacier Media's long-standing presence, for example, means they’ve had ample opportunity to build a deep reservoir of goodwill and a recognized authority that is difficult for any new competitor to replicate quickly.

Access to Proprietary Content and Data Networks

Glacier Media Group's strength in specialized business information and its deeply entrenched content networks present a significant barrier to new entrants. Replicating the proprietary data, access to expert contributors, and the accumulated industry knowledge that underpins Glacier's offerings is a formidable challenge for any newcomer. This established infrastructure makes it difficult for new players to gain a foothold and compete effectively.

The threat of new entrants is therefore considerably low due to these high barriers to entry. For instance, in 2024, the business information sector continues to see consolidation, with established players like Glacier Media leveraging their existing data assets and subscriber bases. New entrants would face substantial hurdles in building similar, trusted networks and acquiring the necessary proprietary data to offer comparable value.

- High Capital Investment: New entrants require significant upfront investment to build data infrastructure and acquire content rights.

- Established Brand Loyalty: Glacier Media benefits from long-standing relationships and trust with its professional clientele.

- Network Effects: The value of Glacier's content and data increases with its user base, creating a virtuous cycle that is hard for new companies to break into.

- Regulatory Hurdles: Depending on the specific data and regions, new entrants might face complex regulatory compliance requirements.

Challenges in Monetization and Advertising Revenue Acquisition

New entrants into the media landscape face a formidable challenge in securing advertising revenue. The digital advertising market in 2024 is intensely competitive, with a significant portion of ad spend already captured by established global tech giants. This concentration makes it difficult for newcomers to gain traction and build a sustainable revenue stream, particularly for general content that struggles to differentiate itself.

Developing effective monetization strategies beyond traditional advertising also presents a substantial hurdle. While subscription models and other direct-to-consumer approaches are gaining traction, they require significant investment in content quality and user experience to attract and retain paying audiences. For instance, in 2023, digital advertising spending worldwide reached an estimated $603.7 billion, with major platforms like Google and Meta capturing a substantial share, leaving less for emerging players.

- Market Dominance: Large technology companies control a significant portion of the digital advertising market, making it hard for new entrants to compete for ad budgets.

- Revenue Acquisition Difficulty: Acquiring sufficient advertising revenue is a major challenge for new media companies, especially those focused on general content.

- Monetization Hurdles: Developing sustainable monetization models beyond advertising, such as subscriptions, requires substantial investment and differentiation.

- Ad Spend Shift: A considerable amount of advertising expenditure has shifted towards global tech platforms, further concentrating market power and revenue opportunities.

The threat of new entrants for Glacier Media Group is considerably low. While digital platforms ease content creation, building a comprehensive, data-driven media company requires substantial investment in technology and infrastructure, deterring many potential rivals. Established brand loyalty and trust, cultivated over years, also present a significant barrier, with consumer trust surveys in 2024 consistently showing established brands outperforming newer ones by over 20% in key demographics.

Glacier Media's specialized content networks and proprietary data are difficult to replicate, creating a strong competitive moat. Furthermore, the digital advertising market in 2024 is dominated by tech giants, making it challenging for newcomers to secure ad revenue, with global ad spending reaching an estimated $603.7 billion in 2023, much of it captured by major platforms.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | Building data infrastructure and acquiring content rights requires significant upfront capital. | High barrier, limiting the number of well-funded entrants. |

| Brand Loyalty & Trust | Glacier Media benefits from long-standing relationships and established credibility. | New entrants struggle to gain customer trust and loyalty, often taking years. |

| Network Effects | The value of Glacier's content increases with its user base. | Difficult for new companies to achieve critical mass and break into established networks. |

| Advertising Market Concentration | Major tech platforms dominate digital ad spend. | New entrants face intense competition for advertising revenue, impacting sustainability. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Glacier Media Group is built upon a foundation of comprehensive data, including their annual reports, investor presentations, and public financial filings. We supplement this with insights from industry-specific trade publications and market research reports that track the media and information services sector.