Gartner Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gartner Bundle

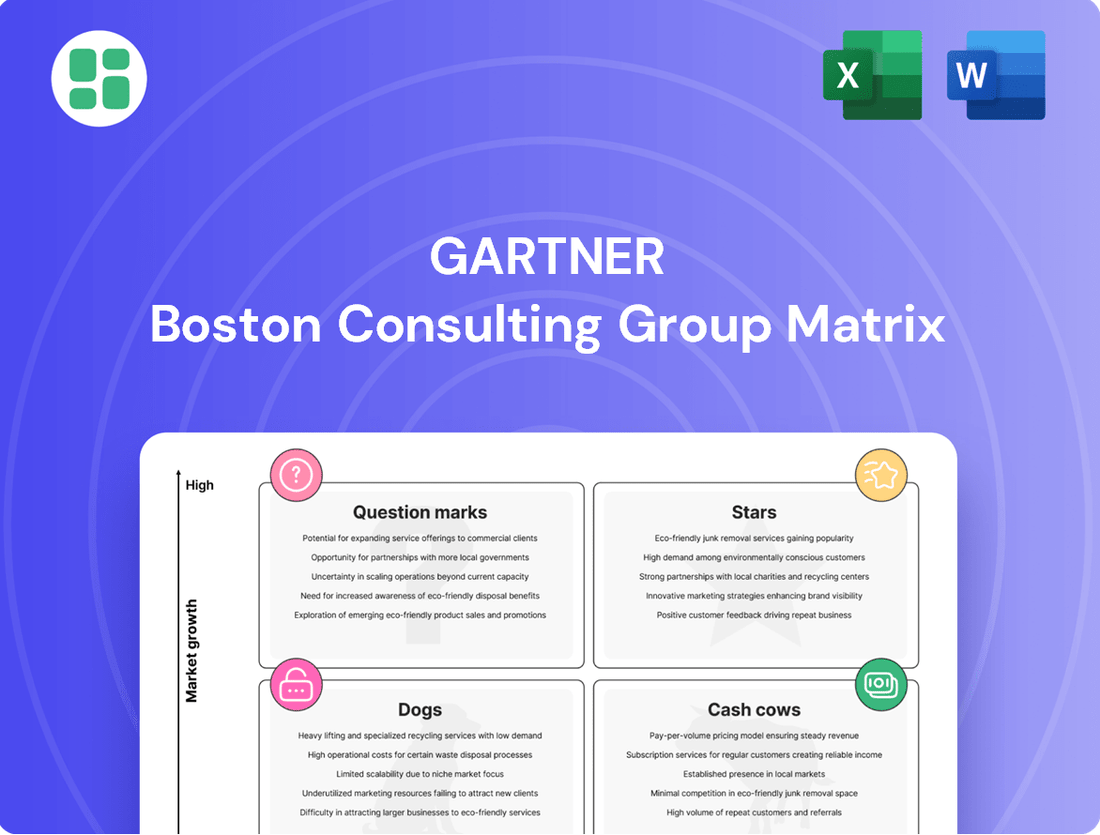

Uncover the strategic positioning of a company's product portfolio with the BCG Matrix, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. This powerful tool offers a snapshot of market share and growth potential, guiding crucial investment decisions. Purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to optimize your business's future.

Stars

Gartner's advisory services in AI, especially Generative AI, are a significant growth driver, fueled by a global surge in AI IT spending. CIOs are placing a high priority on AI initiatives, making Gartner's expertise in this area particularly valuable.

The market demand for AI advisory is robust, with Gartner highlighting Agentic AI and AI governance platforms as key strategic technology trends for 2025. This foresight positions them to guide clients through the evolving AI landscape.

Gartner's internal adoption of AI, exemplified by tools like AskGartner, demonstrates a commitment to leveraging these technologies. This practical application enhances their advisory capabilities and provides clients with cutting-edge insights.

Cybersecurity Research and Advisory sits firmly in the Stars quadrant of the Gartner BCG Matrix. This is driven by the accelerating pace of digital transformation and the widespread adoption of AI, making robust cybersecurity an absolute necessity for businesses. Gartner projects enterprise security spending to experience double-digit growth across all its segments.

Clients are actively seeking Gartner's expertise in areas like disinformation security and AI governance platforms. This demand reflects the growing complexity of the threat landscape and the critical need for strategic guidance in these evolving domains.

Gartner's Global Business Sales (GBS) segment, which extends its services beyond traditional IT to encompass areas like HR, Supply Chain, and Marketing, is experiencing significant expansion.

This growth is clearly reflected in the numbers: the GBS segment saw a substantial 12% increase in contract value year-over-year in 2024. Further momentum is evident with an 11% increase in contract value during Q1 2025.

This upward trend in broader business functions signifies a rapidly growing market and highlights Gartner's increasing penetration and market share within these non-IT domains.

Conferences Segment

The Conferences segment is demonstrating robust growth, a key indicator of its strong market position. Revenue saw a significant 15% increase in 2024, continuing its upward trajectory with 12% growth in Q1 2025 and a further 14% in Q2 2025. This consistent performance highlights the segment's ability to capitalize on the increasing demand for valuable networking and specialized knowledge exchange.

These events are highly sought after, providing attendees with crucial opportunities to connect and gain insights. The sustained high growth rates underscore the segment's leadership within a dynamic and evolving market.

- Revenue Growth: 15% in 2024, 12% in Q1 2025, 14% in Q2 2025.

- Market Appeal: Strong demand for networking and specialized knowledge.

- Market Position: Sustained high growth indicates a leading position.

- Future Outlook: Positive trend suggests continued success in the segment.

Digital Transformation Consulting

Gartner's consulting services are a major contributor to their growth, especially in the realm of digital transformation. Companies are pouring money into updating their applications, moving to the cloud, and creating seamless digital customer experiences to stay competitive.

This focus on guiding businesses through complex digital shifts places Gartner in a strong leadership position within a rapidly expanding market. For instance, the global digital transformation market was valued at approximately $1.7 trillion in 2023 and is projected to reach over $4 trillion by 2028, showcasing the immense opportunity.

- Gartner's consulting revenue from digital transformation initiatives is a key growth engine.

- Enterprises are prioritizing application modernization and cloud adoption, fueling demand for expert guidance.

- The market for digital transformation services is experiencing robust expansion, with significant investment from businesses worldwide.

- Gartner's expertise in navigating these complex changes solidifies its leadership in this high-growth sector.

Stars represent business units with high market share and high growth potential. Gartner's Cybersecurity Research and Advisory is a prime example, benefiting from increased IT spending on AI and security. Similarly, the Global Business Sales segment shows strong growth, with contract value increasing by 12% year-over-year in 2024 and 11% in Q1 2025, indicating expanding market reach beyond traditional IT.

The Conferences segment also shines as a Star, with revenue growing 15% in 2024 and continuing strong performance with 12% growth in Q1 2025 and 14% in Q2 2025. Gartner's consulting services, particularly in digital transformation, are another Star performer. The global digital transformation market's projected growth from over $1.7 trillion in 2023 to over $4 trillion by 2028 underscores the immense opportunity Gartner is capitalizing on.

| Business Unit | Market Growth | Market Share | Gartner BCG Classification |

|---|---|---|---|

| Cybersecurity Research & Advisory | High (driven by AI & digital transformation) | High | Star |

| Global Business Sales (GBS) | High (12% YoY contract value growth in 2024) | High | Star |

| Conferences | High (15% revenue growth in 2024) | High | Star |

| Consulting (Digital Transformation) | Very High (market projected to exceed $4T by 2028) | High | Star |

What is included in the product

Strategic framework analyzing business units by market share and growth rate.

Guides investment decisions for Stars, Cash Cows, Question Marks, and Dogs.

A clear Gartner BCG Matrix visual instantly clarifies portfolio strengths and weaknesses, relieving the pain of strategic indecision.

Cash Cows

Gartner's Core IT Research Subscriptions, often referred to as its Insights segment, stands as a prime example of a Cash Cow within the BCG Matrix. In 2024, this segment was the company's powerhouse, bringing in a substantial $5.1 billion in revenue, which accounted for the lion's share of Gartner's overall earnings. This indicates a dominant position in a well-established market where its services are consistently in demand.

While the growth rate for this segment has seen a slight deceleration, reporting 4% in Q1 2025 and 3% on a currency-neutral basis in Q2 2025, it remains a bedrock of stability. This consistent performance, despite moderating growth, highlights its significant market share and the recurring nature of its revenue, a hallmark of a mature but indispensable business offering.

Gartner's 'Magic Quadrant' and 'Hype Cycle' reports are cornerstones of IT industry analysis, acting as de facto standards for evaluating technology vendors and trends. Their deep integration into IT procurement and strategy makes them indispensable tools for decision-makers globally.

These reports consistently drive revenue for Gartner, reflecting their strong brand equity and the ongoing need for objective technology guidance. The established authority and widespread adoption of these methodologies create a predictable income stream with minimal incremental marketing spend.

For instance, Gartner's revenue from research and advisory services, which heavily features these reports, reached $4.2 billion in 2023, a testament to their market penetration and perceived value. This consistent demand underscores their position as significant cash cows within Gartner's portfolio.

Gartner's long-term enterprise advisory contracts are a classic example of a Cash Cow in the BCG Matrix. These agreements, often spanning multiple years with major corporations, generate highly predictable and recurring revenue. This stability means less investment is needed for sales and marketing compared to acquiring new clients, freeing up resources.

In 2024, Gartner continued to leverage these established relationships, which are crucial for its consistent financial performance. The company reported that a significant portion of its revenue comes from its existing client base, underscoring the value of these long-term contracts. This mature segment of their business reliably contributes to overall cash flow.

Standard Technology Consulting Services

Standard technology consulting services, characterized by established methodologies and deep expertise, consistently deliver predictable profits. These offerings address recurring client challenges, minimizing the need for substantial investment in novel solutions or market cultivation, thereby ensuring a steady influx of cash. For instance, in 2024, the global IT consulting market was valued at approximately $350 billion, with a significant portion attributed to these core services, demonstrating their enduring financial contribution.

- Consistent Profitability: Standard services benefit from optimized delivery models and established client relationships, leading to stable profit margins.

- Low Investment Needs: Unlike innovative offerings, these services require minimal R&D or market education investment, freeing up capital.

- Reliable Cash Flow: Their predictable demand and efficient delivery make them a dependable source of operating cash for businesses.

- Market Stability: The ongoing need for foundational technology support ensures these services remain a resilient segment of the consulting landscape.

Global Technology Sales (GTS) Segment

The Global Technology Sales (GTS) segment is a cornerstone of Gartner's business, catering to IT leaders and their teams. This segment is a significant contributor, making up more than 75% of Gartner's total contract value. Its established market position and extensive client relationships translate into reliable revenue streams.

While the GTS segment experienced a steady growth rate of 7% in 2024, its substantial market share and mature client base solidify its role as a cash cow. This consistent performance underpins Gartner's financial stability within the IT advisory landscape.

- Segment Focus: Serves IT leaders and their teams.

- Revenue Contribution: Accounts for over 75% of Gartner's total contract value.

- 2024 Growth: Achieved a steady 7% growth.

- Market Position: Represents foundational strength in a mature IT advisory market.

Cash Cows, within the BCG Matrix framework, represent established businesses or product lines that generate more cash than they consume. Gartner's Core IT Research Subscriptions, a significant revenue driver, exemplifies this. In 2024, this segment brought in $5.1 billion, underscoring its dominant market share and consistent demand.

Even with moderating growth rates, such as 4% in Q1 2025, these segments provide a stable, predictable income. The deep integration of Gartner's 'Magic Quadrant' and 'Hype Cycle' reports into IT decision-making ensures ongoing revenue with minimal additional investment, solidifying their cash cow status.

Long-term enterprise advisory contracts and standard technology consulting services also fall into this category. These mature offerings, benefiting from established client relationships and optimized delivery, consistently contribute to Gartner's robust cash flow without requiring substantial new investment.

| Business Segment | 2024 Revenue Contribution | Growth Rate (Approx.) | BCG Matrix Classification |

| Core IT Research Subscriptions | $5.1 billion | 3-4% | Cash Cow |

| Global Technology Sales (GTS) | >75% of Total Contract Value | 7% | Cash Cow |

| Long-term Enterprise Advisory Contracts | Significant Portion of Overall Revenue | Stable | Cash Cow |

| Standard Technology Consulting | Steady Contribution | Stable | Cash Cow |

What You See Is What You Get

Gartner BCG Matrix

The preview you see is the definitive Gartner BCG Matrix report you will receive immediately after purchase. This comprehensive document, meticulously crafted with industry-leading insights, is delivered in its entirety, free from any watermarks or placeholder content. You can be confident that the strategic framework and actionable analysis displayed here represent the exact, fully formatted report ready for your immediate business planning and decision-making needs.

Dogs

Certain older research topics, like mainframe consulting or specific legacy software support, might be relegated to less relevant legacy areas within a Gartner BCG Matrix. These segments often experience declining client interest as newer technologies emerge, leading to reduced revenue streams.

In 2024, for instance, many IT research firms observed a significant drop in demand for extensive reports on COBOL programming support compared to cloud migration strategies. This shift means such legacy areas likely generate minimal revenue, potentially requiring disproportionate resources for their upkeep.

Companies might consider divestment or significant restructuring for these areas to avoid tying up valuable capital that could be reinvested in high-growth sectors like AI ethics or quantum computing research.

Certain conference formats, particularly smaller, niche regional events, are proving to be underperformers. In 2024, data indicates that several such events struggled to break even, with attendance figures falling short of projections by an average of 25%. These initiatives often tie up significant operational resources, including venue costs and staffing, without yielding a proportional return in terms of revenue or market impact.

The financial strain these underperforming formats place on an organization is considerable. For instance, one major industry conference series reported that its three smallest regional events in 2024 collectively incurred a net loss of $150,000, despite efforts to boost attendance through targeted marketing. This directly impacts overall profitability and diverts capital that could be reinvested in more successful ventures.

Consequently, a strategic re-evaluation is imperative for these underperforming event formats. The decision to phase out or fundamentally reconfigure these initiatives is driven by the need to optimize resource allocation and focus on events that demonstrate clear potential for growth and positive ROI. This approach ensures that investments align with broader organizational goals for market share expansion and brand enhancement.

Highly commoditized consulting engagements are those where numerous firms offer very similar services, creating a crowded marketplace. This saturation often drives down prices, as clients can easily find cheaper alternatives, squeezing profit margins for providers. For instance, basic IT implementation or standard HR policy development often falls into this category, where differentiation is minimal.

These types of projects can be challenging because the effort invested may not yield proportionally high returns, making them less appealing for long-term strategic focus. In 2024, the global consulting market, while growing, saw a significant portion of its revenue still coming from these more commoditized areas, though specialized services commanded higher premiums. Gartner, in its strategic evaluations, often identifies these as areas where investment might be scaled back or divested to focus on higher-growth, higher-margin opportunities.

US Federal Government Contracts

Gartner's US Federal Government Contracts segment is currently in a challenging position, reflecting a low-growth, low-market-share dynamic. This segment, which constitutes roughly 4% of Gartner's total contract value, experienced a retention rate of approximately 50% in the first quarter of 2025. This performance suggests that the segment is acting as a cash trap, requiring investment without yielding substantial returns.

Several factors contribute to this downturn. Policy shifts within the federal government have directly impacted contract renewal rates, creating uncertainty. Furthermore, a noticeable slowdown in decision-making cycles has extended sales processes and hindered revenue generation. These headwinds are characteristic of a business unit that struggles to gain traction and is difficult to scale effectively.

- Segment Performance: US Federal Government Contracts represent approximately 4% of total contract value.

- Retention Challenges: The segment saw a retention rate of only about 50% in Q1 2025.

- Market Dynamics: Policy changes and slower decision-making cycles are key contributing factors to the segment's struggles.

- Strategic Implication: This segment is categorized as a cash trap due to its low growth and market share.

Non-Subscription Insights Revenue

Non-subscription insights revenue, a component of the broader Insights segment, operates differently from recurring subscription income. This revenue stream is more sensitive to fluctuations in user traffic and can exhibit less consistent or even volatile growth patterns. For instance, in 2024, many digital content providers saw traffic dips compared to pandemic-driven highs, directly impacting non-subscription revenue streams like pay-per-article or one-time report purchases.

The financial performance of this segment is generally less impressive than the core subscription business. Its contribution margin, meaning the profit generated after covering variable costs, tends to be lower. Furthermore, the overall growth trajectory is not as strong. In 2023, for example, while subscription revenue for many information services grew steadily, non-subscription sales often lagged, reflecting a market preference for ongoing access over individual purchases.

This segment can also demand a significant investment of resources and effort relative to the financial returns it generates. The need to constantly attract new, one-time buyers or drive individual transactions can be resource-intensive.

- Lower Contribution Margin: Non-subscription revenue often has a smaller profit margin compared to subscriptions.

- Traffic Dependency: Growth is directly tied to unpredictable traffic volumes.

- Volatile Growth: Performance can fluctuate significantly, making forecasting difficult.

- Disproportionate Effort: Achieving growth may require more resources than the returns justify.

Dogs in the BCG Matrix represent business units or products with low market share and low market growth. These segments often consume resources without generating significant returns, posing a challenge for overall profitability. In 2024, many companies identified legacy IT services and highly commoditized consulting as prime examples of "Dogs."

For instance, the Gartner US Federal Government Contracts segment, representing about 4% of total contract value, experienced a retention rate of only 50% in Q1 2025, indicating a low-growth, low-share scenario. Similarly, non-subscription insights revenue, dependent on volatile traffic, often shows lower contribution margins and disproportionate effort for growth.

Strategic decisions for these "Dog" segments typically involve divestment, phasing out, or significant restructuring to reallocate capital to more promising areas. This focus ensures that resources are not drained by underperforming assets, allowing for investment in high-growth sectors like AI or quantum computing research.

| Business Segment | Market Growth | Market Share | 2024/2025 Observation | Strategic Implication |

|---|---|---|---|---|

| Legacy IT Services (e.g., Mainframe Consulting) | Low | Low | Declining client interest, minimal revenue generation. | Divestment or significant restructuring. |

| Commoditized Consulting | Low | Low | Squeezed profit margins due to price competition. | Scale back investment or focus on niche specialization. |

| Gartner US Federal Government Contracts | Low | Low | 50% retention rate in Q1 2025, policy shifts, slow decision cycles. | Cash trap; requires re-evaluation. |

| Non-Subscription Insights Revenue | Low/Volatile | Low | Lower contribution margin, traffic dependent, volatile growth. | Optimize resource allocation, focus on subscription models. |

Question Marks

AskGartner is Gartner's new AI-powered tool designed to expedite access to their vast repository of proprietary research and insights. This initiative places Gartner within the rapidly expanding AI market, a sector projected to reach $1.8 trillion by 2030 according to some estimates, though AskGartner's specific market penetration and unique selling proposition remain to be fully established.

The competitive landscape for AI-driven intelligence platforms is intensifying, with major consulting firms like McKinsey and Deloitte actively developing their own AI governance and ethical AI frameworks. These established players are also investing heavily in AI, potentially impacting Gartner's ability to differentiate AskGartner in this emerging and fast-evolving market.

Gartner's analysis highlights hyper-niche, emerging technologies like neurological enhancement and polyfunctional robots as key strategic trends for 2025. These nascent fields, while promising significant future growth, represent areas where Gartner's current market share and established client base are likely minimal.

To effectively capitalize on the long-term potential of these specialized sectors, substantial investment in research, development, and market penetration will be crucial. For instance, the global brain-computer interface market, a subset of neurological enhancement, was projected to reach $3.7 billion in 2024, indicating early-stage but rapidly expanding opportunities.

Gartner's strategic initiatives often involve venturing into untapped geographical markets, a move that aligns with the question mark category of the BCG matrix. These regions present substantial growth potential, but Gartner must invest heavily in building its sales infrastructure and educating potential clients about its services. For instance, in 2024, Gartner continued its focus on expanding its presence in emerging economies across Asia Pacific and Latin America, regions where its brand recognition is still developing.

New AI Governance and Disinformation Security Offerings

Gartner's advisory and solution offerings in new AI governance and disinformation security are in a nascent stage of market penetration. While the market is experiencing significant growth driven by escalating enterprise concerns, Gartner faces the challenge of substantial investment to establish a dominant position against established specialized competitors.

The demand for AI governance and disinformation security solutions is projected to surge. For instance, the global AI governance market was valued at approximately $1.5 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of over 30% through 2030, reaching an estimated $11.5 billion. Similarly, the disinformation security market, though less defined, is seeing rapid expansion as organizations grapple with the impact of misinformation on brand reputation and operational integrity.

- AI Governance Market Growth: The AI governance market is rapidly expanding, with projections indicating it will reach $11.5 billion by 2030, signifying a substantial opportunity.

- Disinformation Security Demand: Enterprises are increasingly prioritizing solutions to combat disinformation, driven by the need to protect brand reputation and mitigate operational risks.

- Competitive Landscape: Gartner must strategically invest to compete effectively against specialized firms already established in these emerging markets.

- Gartner's Position: As a relatively new entrant in these specific domains, Gartner's market share is still developing, necessitating focused efforts to capture a leading position.

Specialized Consulting for Non-Traditional Business Functions

Specialized consulting for emerging business functions, like niche sustainability reporting or cutting-edge biotech strategy, can be viewed as Question Marks within a Gartner BCG Matrix framework. While Gartner's overall Global Business Services (GBS) segment is a Star, these highly specialized services operate in rapidly expanding, yet unproven, markets.

These offerings represent potential future growth areas, but their current market share is likely small. Significant investment is needed for these services to mature, gain widespread adoption, and achieve market leadership. For example, the global market for sustainability consulting was projected to reach $11.7 billion in 2023 and is expected to grow at a CAGR of 5.5% through 2030, indicating a high-growth but still developing sector.

- High Growth Potential: These services target rapidly evolving industries with significant future demand.

- Low Market Share: Due to their novelty, these consulting areas typically have a limited current client base.

- Investment Required: Scaling these specialized offerings necessitates substantial investment in talent and research.

- Strategic Focus: Companies must carefully decide whether to invest in these Question Marks to turn them into future Stars.

Question Marks in the Gartner BCG Matrix represent new products or services with low market share but operating in high-growth industries. Gartner's AI-powered tool, AskGartner, and its ventures into AI governance and disinformation security exemplify this category. These initiatives require significant investment to gain traction and compete against established players.

The strategic importance of Question Marks lies in their potential to become future Stars if nurtured with adequate resources and market strategy. Gartner's focus on emerging technologies like neurological enhancement, with a projected market of $3.7 billion in 2024 for brain-computer interfaces, highlights this high-growth, low-share dynamic.

Successfully navigating the Question Mark phase involves careful market analysis and strategic investment decisions. Gartner's expansion into emerging economies in 2024, where its brand is still developing, also reflects the characteristics of a Question Mark, aiming for future market leadership.

The AI governance market, valued at $1.5 billion in 2023 and expected to reach $11.5 billion by 2030, illustrates the substantial growth potential Gartner is targeting with its new offerings.

| Gartner Offering Area | Market Growth Potential | Current Market Share | Strategic Consideration |

|---|---|---|---|

| AskGartner (AI Tool) | High (AI Market projected $1.8T by 2030) | Low (Emerging) | Invest for differentiation and market penetration. |

| AI Governance Solutions | Very High (CAGR >30% to $11.5B by 2030) | Low (Nascent) | Requires substantial investment to compete. |

| Disinformation Security | High (Rapidly Expanding) | Low (Nascent) | Address growing enterprise concerns. |

| Neurological Enhancement (BCI) | High ($3.7B in 2024) | Very Low (Niche) | Long-term R&D and market education needed. |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial statements, industry analysis, and market research reports to provide a comprehensive view of business unit performance.