Frontier Services Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Frontier Services Group Bundle

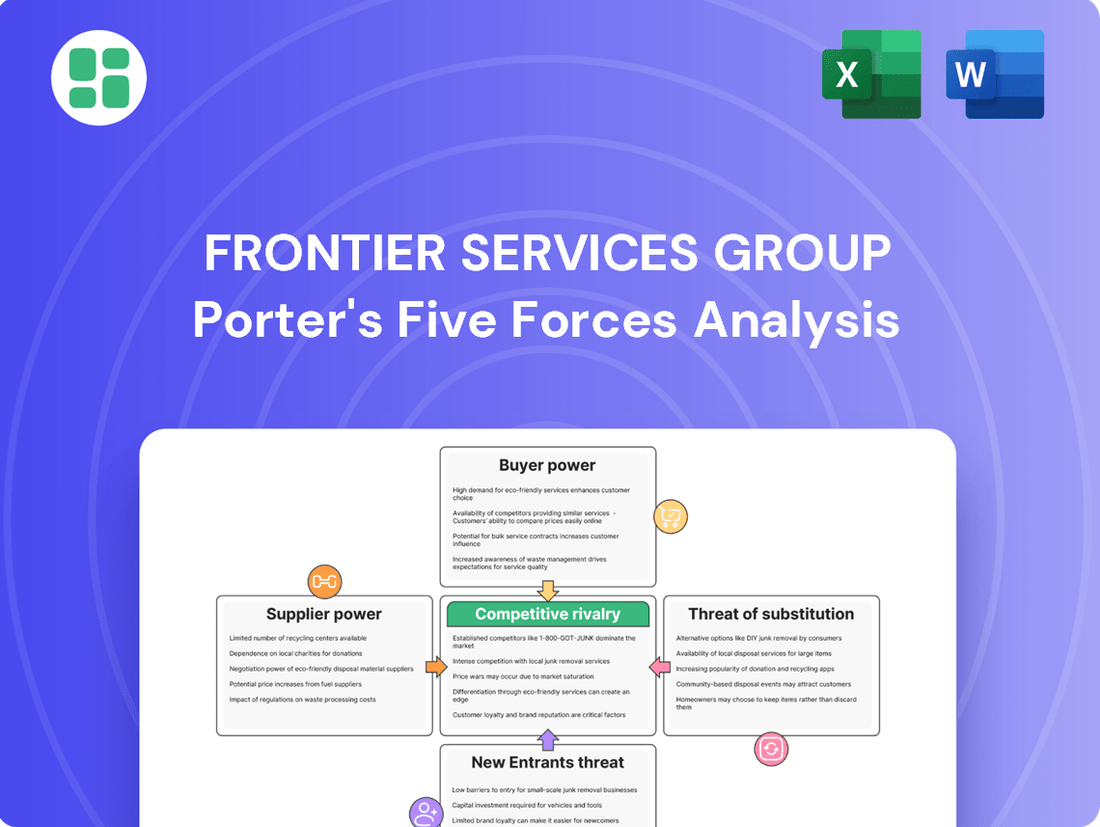

Frontier Services Group faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers being particularly noteworthy. Understanding these forces is crucial for navigating its market landscape effectively.

The complete report reveals the real forces shaping Frontier Services Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Frontier Services Group (FSG) depends on suppliers for critical, specialized equipment like advanced security tech and modern aviation assets. The bargaining power of these providers can be significant, especially if their technology is proprietary or if FSG faces high costs and operational disruptions when switching vendors. For instance, in 2024, the global defense and aerospace sectors saw continued demand for advanced, integrated systems, potentially increasing supplier leverage.

The provision of integrated security and logistics services in challenging markets, like those Frontier Services Group (FSG) operates in, heavily relies on highly trained personnel. This includes specialized roles like security experts, pilots, and logistics coordinators.

Suppliers of this niche human capital, such as specialized training academies or recruitment firms, hold considerable bargaining power. This is due to the scarcity of individuals with the necessary skills and the substantial investment required for their training and ongoing retention. For instance, the global shortage of qualified pilots, a critical component for FSG's aviation services, has been a persistent issue, impacting recruitment costs and availability.

This strong supplier power can directly translate into higher labor costs for FSG. It also poses a risk to the consistent quality of service delivery, as the availability and cost of skilled personnel become significant operational considerations.

Frontier Services Group (FSG), as an aviation and ground logistics operator, faces significant bargaining power from fuel and energy providers. Their substantial reliance on fuel means that price volatility directly impacts FSG's operational costs and overall profitability.

The limited availability of large, dependable suppliers in certain frontier markets further amplifies the leverage held by these energy providers. For instance, in 2024, global jet fuel prices experienced considerable fluctuations, with benchmarks like the average price of jet fuel in Singapore hovering around $1.10 per liter at various points, demonstrating this inherent volatility.

Local Government and Regulatory Bodies for Permits and Licenses

Local government and regulatory bodies wield considerable bargaining power over Frontier Services Group (FSG) due to the essential nature of permits and licenses for its operations in frontier markets. These entities can dictate terms, impose fees, and set operational standards, directly impacting FSG's costs and timelines. For instance, in 2024, regions with evolving regulatory frameworks often saw increased compliance costs for companies operating in sensitive sectors, a trend likely to continue.

The ability of these bodies to grant, deny, or revoke essential operating permits gives them significant leverage. This is particularly true for FSG, which operates in diverse and often politically sensitive regions where bureaucratic processes can be complex and subject to change. Delays in obtaining or renewing licenses, or unexpected regulatory changes, can lead to substantial operational disruptions and increased expenses for FSG.

- Regulatory Hurdles: Obtaining and maintaining permits and licenses are critical for FSG's operations in frontier markets.

- Governmental Leverage: Local government and regulatory bodies act as powerful gatekeepers, influencing operational costs and timelines.

- Geopolitical Impact: Complex bureaucratic landscapes and geopolitical sensitivities in operating regions amplify the bargaining power of these authorities.

- Compliance Costs: In 2024, companies faced rising compliance costs in regions with dynamic regulatory environments, a factor that directly affects FSG.

Local Infrastructure and Support Service Providers

Frontier Services Group's reliance on local infrastructure and support services in challenging operational areas grants significant bargaining power to these providers. For instance, in 2024, FSG's operations in remote regions of Africa, where access to reliable airfields and ground transport is critical, meant that local service providers for aircraft maintenance and logistics could command premium pricing due to limited competition. This dependency can directly impact FSG's operational costs and efficiency.

The quality and availability of local support, such as security forces for convoy coordination and specialized maintenance facilities, are crucial for FSG's ability to deliver its services reliably. If these local providers are few or of lower quality, their leverage increases, potentially leading to higher costs or disruptions. For example, a scarcity of certified aviation mechanics in a particular operational theater in 2024 could force FSG to pay higher rates or face extended downtime.

- Limited Alternatives: In many of FSG's operating environments, the number of qualified local infrastructure and support service providers is often scarce, concentrating power in the hands of a few key entities.

- Operational Criticality: The essential nature of services like air traffic control, ground handling, and local security for FSG's logistics and personnel movement means providers of these services hold considerable sway.

- Cost Implications: This dependence can translate into higher operational expenditures for FSG, as providers can charge more when FSG has few viable alternatives, impacting overall profitability.

- Service Reliability Risks: A lack of robust local support can also compromise the consistency and reliability of FSG's services, potentially leading to project delays or client dissatisfaction.

Frontier Services Group (FSG) faces significant bargaining power from suppliers of specialized equipment and technology, particularly when these offerings are proprietary or difficult to substitute. The limited number of providers for advanced aviation assets and integrated security systems in 2024 meant FSG often had to accept supplier-dictated terms, impacting procurement costs.

The reliance on skilled personnel, such as pilots and security experts, further concentrates power with training institutions and recruitment agencies. The global pilot shortage, which persisted through 2024, with airlines worldwide reporting hundreds of unfilled cockpit positions, directly translated into higher labor costs and recruitment challenges for FSG.

Fuel suppliers also wield considerable influence. FSG's extensive use of aviation fuel means price volatility, such as the fluctuations seen in jet fuel prices in 2024, directly impacts operating expenses. Limited fuel suppliers in frontier markets amplify this leverage.

| Supplier Type | Key Dependence | Bargaining Power Factor | 2024 Impact Example | Potential Cost Impact |

|---|---|---|---|---|

| Specialized Equipment Providers | Advanced Security Tech, Aviation Assets | Proprietary Technology, Limited Alternatives | High demand for integrated systems in defense sector | Increased procurement costs |

| Human Capital Providers | Pilots, Security Experts, Logistics Coordinators | Scarcity of Skills, High Training Investment | Global pilot shortage affecting recruitment | Higher labor costs, recruitment challenges |

| Fuel and Energy Providers | Jet Fuel, Operational Energy | Essential Commodity, Price Volatility | Fluctuating jet fuel prices (e.g., Singapore benchmark) | Increased operational expenses |

What is included in the product

This analysis of Frontier Services Group examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes, providing a comprehensive view of its competitive environment.

Instantly identify and quantify competitive threats with a visual breakdown of the five forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Frontier Services Group's (FSG) clients, such as multinational corporations, NGOs, and governments, operate in demanding and high-risk regions. For these entities, FSG's integrated security and logistics services are not optional extras but essential components for their very survival and the uninterrupted continuation of their operations. This critical dependency inherently limits the bargaining power of these customers.

The indispensable nature of FSG's risk management, security, and logistics solutions in these challenging environments significantly curtails the leverage customers possess. Clients in these sectors often face severe consequences from operational disruptions or failures, making the reliability and specialized capabilities FSG offers far more valuable than simply achieving the lowest possible cost.

For clients engaged in intricate, long-term projects within frontier markets, the decision to switch from an integrated security and logistics provider like Frontier Services Group (FSG) is fraught with significant expense and operational peril. These switching costs extend beyond mere financial outlay, encompassing the arduous process of rebuilding trust with a new partner, the complex integration of dissimilar systems, the extensive retraining of personnel, and the inherent risk of disruptions to critical ongoing operations.

The very fabric of FSG's service delivery is woven into the operational protocols and supply chains of its clientele. This deep entanglement creates formidable barriers to switching, as clients would need to disentangle their established processes from FSG's integrated solutions. For instance, if a client's just-in-time inventory management relies on FSG’s real-time tracking and secure transport, replacing that system would necessitate a complete overhaul of their logistics planning and execution, a task that can easily run into millions in lost productivity and direct costs.

This profound integration significantly diminishes the bargaining power of customers. When a client's operational continuity is so tightly linked to a provider's specialized services, the cost and complexity of finding and onboarding an alternative become prohibitive. This reduces their leverage in negotiating terms or demanding concessions, as the potential disruption and expense of switching outweigh the benefits of seeking a different provider.

Frontier Services Group (FSG) benefits from limited customer alternatives when it comes to integrated risk management solutions for challenging environments. While basic security, logistics, or aviation services can be sourced from multiple providers, FSG's unique strength lies in its ability to deliver a comprehensive, end-to-end service suite. This holistic approach, particularly with its deep regional expertise across Africa and Asia, makes it difficult for clients to find comparable, all-encompassing alternatives.

Customer Sensitivity to Risk vs. Price

Clients in volatile frontier markets often place a higher value on risk reduction and consistent operations than on minor price reductions. The potential financial, reputational, and human costs associated with security lapses or operational disruptions significantly exceed the cost of comprehensive risk management solutions.

This pronounced sensitivity to risk indicates that customers are more inclined to invest in services that offer demonstrated expertise and dependability, thereby reducing their leverage to negotiate solely based on price. For instance, companies operating in regions with high political instability, such as parts of Sub-Saharan Africa or Southeast Asia, often allocate substantial budgets to security and logistics, prioritizing a secure operational environment. In 2024, the global private security market was projected to reach over $250 billion, with a significant portion driven by demand in emerging and frontier markets where security concerns are paramount.

- Risk Aversion: In frontier markets, the cost of failure in security or logistics can be catastrophic, making risk mitigation the primary driver for service selection.

- Premium for Reliability: Proven track records and demonstrated operational stability command a premium, as clients value certainty over cost savings.

- Limited Price Sensitivity: The potential losses from operational failures are so substantial that customers are less likely to push for lower prices at the expense of service quality and reliability.

Long-Term Contracts and Strategic Partnerships

Frontier Services Group (FSG) often secures its market position through long-term contracts and strategic partnerships, particularly with clients in demanding sectors like infrastructure, energy, and mining. These extended agreements foster deep client relationships, built on mutual trust and a thorough understanding of operational nuances and local conditions. By locking in clients for extended periods, FSG effectively limits their ability to switch providers frequently, thereby diminishing customer bargaining power and enhancing FSG's competitive stability.

For instance, FSG's involvement in major African infrastructure development projects often involves multi-year service agreements. These contracts, typically spanning 3-5 years or more, provide a predictable revenue stream and reduce the need for continuous client acquisition efforts. This long-term engagement model is a key factor in mitigating the bargaining power of customers who might otherwise leverage shorter contract terms to negotiate more favorable pricing or service conditions.

- Reduced Switching Costs: Long-term contracts create significant switching costs for clients, making it less attractive to move to a competitor.

- Deepened Client Understanding: Extended partnerships allow FSG to gain intimate knowledge of client operations, tailoring services for maximum efficiency and value.

- Enhanced Predictability: These agreements provide FSG with a stable revenue base, crucial for long-term planning and investment in operational capabilities.

- Strategic Alignment: Partnerships often involve aligning business objectives, further solidifying the relationship and reducing the customer's inclination to seek alternatives.

Frontier Services Group's (FSG) clients, often multinational corporations and NGOs operating in high-risk regions, depend critically on FSG's integrated security and logistics. This essential reliance means clients have limited bargaining power, as operational continuity is paramount and disruptions carry severe consequences, making reliability more valuable than cost savings.

The deep integration of FSG's services into client operations, coupled with substantial switching costs including retraining and system integration, significantly reduces customer leverage. For instance, clients in volatile markets prioritize risk reduction, as demonstrated by the global private security market's projected growth to over $250 billion in 2024, with a substantial driver being demand in these challenging environments.

| Factor | Impact on Customer Bargaining Power | FSG's Mitigation Strategy |

|---|---|---|

| Client Dependency | High dependency on FSG's critical services limits customer power. | FSG provides indispensable, end-to-end solutions for survival and operations. |

| Switching Costs | High financial and operational costs to switch providers reduce leverage. | Long-term contracts and deep integration create significant barriers to exit. |

| Risk Aversion | Clients prioritize reliability and risk mitigation over price, reducing price sensitivity. | FSG's proven track record and expertise command a premium in high-risk markets. |

Preview the Actual Deliverable

Frontier Services Group Porter's Five Forces Analysis

This preview showcases the complete Frontier Services Group Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you see is the exact, professionally formatted report you will receive immediately after purchase, providing actionable insights into market dynamics and strategic positioning.

Rivalry Among Competitors

The secure logistics sector is booming, with projections indicating a market size of USD 150.23 billion by 2033 and USD 195.54 billion by 2034. This expansion is fueled by rising geopolitical tensions, crucial infrastructure development, and a surge in international trade, particularly across Africa and Asia.

While this robust growth can potentially ease competitive pressures by opening new avenues for expansion, it simultaneously acts as a magnet, drawing in new entrants eager to capture a piece of this expanding market.

Frontier Services Group (FSG) operates in a market with a wide array of competitors. This includes major global security and logistics companies, as well as specialized regional players and smaller, locally focused businesses.

The competitive set for FSG is diverse, featuring established international logistics providers and agile security contractors. For instance, companies like G4S (now part of Allied Universal) and GardaWorld represent significant global competition in the security sector, while DHL and FedEx are major players in logistics, albeit with varying degrees of presence in frontier markets.

This varied landscape means FSG contends with rivals possessing different competitive advantages. Some competitors may excel in cost efficiency due to scale, while others thrive through deep understanding and established networks within specific frontier regions, or by offering highly specialized niche services.

Frontier Services Group (FSG) stands out by providing a comprehensive suite of integrated security, logistics, aviation, risk advisory, and infrastructure support. This all-encompassing, one-stop-shop model is specifically designed for the complex environments of African and Asian markets, setting it apart from competitors who may offer more specialized services.

FSG’s competitive edge is further sharpened by its multinational and multilingual teams, coupled with a strong network of established local offices. This deep local presence and understanding allow them to navigate the unique challenges of these regions effectively, offering a level of localized expertise that many rivals cannot match.

This robust differentiation, built on integrated solutions and deep regional knowledge, significantly reduces direct price-based competition. FSG can therefore command premium pricing for its tailored, high-value services, demonstrating a strong ability to mitigate rivalry by offering a superior, consolidated value proposition.

High Exit Barriers

Frontier Services Group's (FSG) operations are characterized by significant capital investment in specialized assets like aircraft and vehicles, alongside complex operational infrastructure. This inherent capital intensity acts as a substantial barrier to exiting the market. For example, the aviation services sector, where FSG operates, often involves multi-million dollar investments in aircraft alone.

These high upfront costs, combined with the need for extensive personnel training and the establishment of long-term regional operational footprints, make it exceedingly difficult for companies to divest or cease operations without incurring substantial financial penalties. This difficulty in exiting can lead to intensified competitive rivalry, as firms facing financial strain may opt to continue operating at reduced profitability rather than face the costs of liquidation.

- Capital Intensity: FSG's business requires significant outlay for specialized equipment, such as aircraft and vehicles, contributing to high exit barriers.

- Asset and Personnel Investment: Substantial investments in both physical assets and skilled personnel create a commitment that is costly to unwind.

- Contractual Obligations and Regional Presence: Long-term contracts and established operational bases further lock companies into the market, increasing exit costs.

- Impact on Rivalry: High exit barriers can compel firms to remain in the market even when unprofitable, potentially intensifying price competition.

Geopolitical Volatility and Risk Management Capabilities

Companies operating in volatile geopolitical landscapes, like those often seen in the logistics sector, must demonstrate superior risk management and adaptability. Geopolitical tensions directly impact trade routes, posing significant challenges to operations. FSG's ability to effectively navigate these complex environments and offer robust risk mitigation is a critical differentiator in this competitive arena.

This capability is particularly crucial given the ongoing global uncertainties. For instance, the Red Sea shipping disruptions in early 2024, which affected numerous logistics providers, highlighted the need for agile responses. Companies with established intelligence networks and operational resilience are better positioned to manage such events, turning potential disruptions into competitive advantages.

- Geopolitical Risk Management: FSG's expertise in navigating high-risk regions is a key competitive factor.

- Supply Chain Resilience: Adaptability to geopolitical tensions and trade route disruptions is paramount for logistics firms.

- Intelligence and Operational Agility: Robust intelligence gathering and operational flexibility provide a significant competitive edge.

Frontier Services Group (FSG) faces a competitive landscape populated by both global giants and specialized regional players. While large entities like G4S (now Allied Universal) and DHL offer broad services, FSG differentiates itself with integrated security, logistics, and aviation solutions tailored for challenging African and Asian markets. This specialized approach, combined with deep local knowledge and multinational teams, allows FSG to mitigate direct price competition and command premium pricing.

The intense rivalry is somewhat tempered by FSG's unique, comprehensive service offering, acting as a significant differentiator. Competitors often focus on narrower segments, allowing FSG to leverage its one-stop-shop model. For example, while many logistics firms struggled with the Red Sea disruptions in early 2024, FSG’s integrated risk management and intelligence capabilities provided a more resilient operational framework.

FSG's competitive advantage is rooted in its ability to provide end-to-end solutions in complex environments, a capability not easily replicated by less integrated competitors. This focus on high-value, tailored services in frontier markets positions FSG to navigate intense rivalry effectively by offering a superior, consolidated value proposition.

SSubstitutes Threaten

Clients developing in-house capabilities represent a significant threat, particularly for large multinational corporations with substantial operations in frontier markets. These organizations may opt to build their own security, logistics, or aviation departments to gain greater control and potentially reduce costs. For instance, a major energy company with a long-term presence in a volatile region might assess the cost-benefit of internalizing services that Frontier Services Group (FSG) currently provides.

The decision to insource is often driven by a desire to mitigate risks and ensure operational continuity. However, the high capital expenditure, specialized expertise required, and the inherent complexities of managing such functions in challenging environments often make outsourcing to a specialist like FSG a more practical and cost-effective solution. FSG's established infrastructure and experienced personnel in 2024, for example, provide a competitive edge that is difficult for most individual clients to replicate efficiently.

In certain frontier markets, clients may choose to engage numerous local, unspecialized vendors for distinct services like security, transportation, or aviation. This fragmented strategy, while appearing cost-effective for individual tasks, bypasses the comprehensive risk management, adherence to international standards, and unified operational backing that Frontier Services Group (FSG) provides. For instance, in 2024, the average cost of securing a single logistics route with multiple local providers could be 15% lower than an integrated FSG solution, but this often translates to a 25% increase in administrative burden and a higher probability of operational disruptions.

Technological advancements are increasingly presenting substitutes for traditional logistics and security services. For instance, the rise of advanced surveillance systems and the deployment of drones for logistics operations, as seen in various pilot programs globally throughout 2024, offer alternative ways to monitor and transport goods. Autonomous ground vehicles are also entering the logistics landscape, potentially reducing the need for human drivers in certain scenarios.

While these innovations, including the projected growth of the global drone logistics market to over $15 billion by 2029, boost efficiency, they don't entirely replace the need for human intervention. Critical situations in high-risk areas still demand the nuanced judgment and on-the-spot decision-making capabilities of human personnel, especially when facing unpredictable challenges or requiring immediate, adaptive responses.

Furthermore, the increasing reliance on automated and remote systems introduces new vulnerabilities. Cybersecurity threats to logistics networks are a significant concern, as demonstrated by numerous reported breaches affecting supply chains in 2024, highlighting that technological solutions themselves can create new points of failure and require robust human oversight and security measures.

Alternative Transport Routes and Supply Chain Strategies

Clients increasingly explore alternative supply chain strategies like nearshoring or friendshoring, and different transportation modes, such as rail, to bypass high-risk zones or lower expenses. This shift can impact demand for specific Frontier Services Group (FSG) logistics offerings but simultaneously generates new needs for security and risk advisory services in these emerging trade routes.

Global trade patterns are in constant flux, directly influencing logistics requirements. For instance, the International Monetary Fund (IMF) projected global trade volume growth to be 2.5% in 2024, a slight uptick from previous years, but disruptions can easily alter these forecasts. Companies are actively seeking ways to build more resilient supply chains, which could mean diversifying away from traditional, potentially vulnerable, routes.

- Shifting Client Needs: Demand for FSG's core logistics may fluctuate as clients adopt nearshoring or friendshoring, potentially reducing reliance on long-haul, high-risk routes.

- Emergence of New Services: Conversely, these strategic shifts create opportunities for FSG in providing security and risk advisory for new or evolving supply chain corridors.

- Global Trade Volatility: The 2.5% projected global trade volume growth for 2024, per the IMF, highlights an environment where adaptability in logistics and security is paramount.

Insurance as a Financial Substitute for Risk Mitigation

Clients may see insurance as a direct substitute for Frontier Services Group's (FSG) proactive risk management. This perspective views insurance as a financial safety net for losses rather than a tool to prevent those losses from occurring in the first place. For example, in 2024, the global insurance market continued its growth trajectory, with premiums expected to exceed $7 trillion, highlighting the significant financial resources allocated to risk transfer.

FSG counters this by integrating insurance into a broader, holistic risk management strategy. The emphasis is on the complementary nature of risk mitigation and risk transfer. While insurance compensates for financial damages after an event, FSG's services focus on preventing the event itself, thereby avoiding associated operational disruptions and reputational harm.

Insurance policies, by their nature, do not address the non-financial consequences of incidents. These can include:

- Operational Downtime: Disruptions to business continuity and productivity.

- Reputational Damage: Negative impact on brand image and customer trust.

- Human Cost: The impact on employee safety, morale, and well-being.

FSG's value proposition lies in its ability to mitigate these multifaceted impacts, which fall outside the scope of traditional insurance coverage, reinforcing the idea that insurance is a component of, not a replacement for, comprehensive risk management.

Clients developing in-house capabilities represent a significant threat, particularly for large multinational corporations with substantial operations in frontier markets. These organizations may opt to build their own security, logistics, or aviation departments to gain greater control and potentially reduce costs. For instance, a major energy company with a long-term presence in a volatile region might assess the cost-benefit of internalizing services that Frontier Services Group (FSG) currently provides.

The decision to insource is often driven by a desire to mitigate risks and ensure operational continuity. However, the high capital expenditure, specialized expertise required, and the inherent complexities of managing such functions in challenging environments often make outsourcing to a specialist like FSG a more practical and cost-effective solution. FSG's established infrastructure and experienced personnel in 2024, for example, provide a competitive edge that is difficult for most individual clients to replicate efficiently.

In certain frontier markets, clients may choose to engage numerous local, unspecialized vendors for distinct services like security, transportation, or aviation. This fragmented strategy, while appearing cost-effective for individual tasks, bypasses the comprehensive risk management, adherence to international standards, and unified operational backing that Frontier Services Group (FSG) provides. For instance, in 2024, the average cost of securing a single logistics route with multiple local providers could be 15% lower than an integrated FSG solution, but this often translates to a 25% increase in administrative burden and a higher probability of operational disruptions.

Technological advancements are increasingly presenting substitutes for traditional logistics and security services. For instance, the rise of advanced surveillance systems and the deployment of drones for logistics operations, as seen in various pilot programs globally throughout 2024, offer alternative ways to monitor and transport goods. Autonomous ground vehicles are also entering the logistics landscape, potentially reducing the need for human drivers in certain scenarios.

While these innovations, including the projected growth of the global drone logistics market to over $15 billion by 2029, boost efficiency, they don't entirely replace the need for human intervention. Critical situations in high-risk areas still demand the nuanced judgment and on-the-spot decision-making capabilities of human personnel, especially when facing unpredictable challenges or requiring immediate, adaptive responses.

Furthermore, the increasing reliance on automated and remote systems introduces new vulnerabilities. Cybersecurity threats to logistics networks are a significant concern, as demonstrated by numerous reported breaches affecting supply chains in 2024, highlighting that technological solutions themselves can create new points of failure and require robust human oversight and security measures.

Clients increasingly explore alternative supply chain strategies like nearshoring or friendshoring, and different transportation modes, such as rail, to bypass high-risk zones or lower expenses. This shift can impact demand for specific Frontier Services Group (FSG) logistics offerings but simultaneously generates new needs for security and risk advisory services in these emerging trade routes.

Global trade patterns are in constant flux, directly influencing logistics requirements. For instance, the International Monetary Fund (IMF) projected global trade volume growth to be 2.5% in 2024, a slight uptick from previous years, but disruptions can easily alter these forecasts. Companies are actively seeking ways to build more resilient supply chains, which could mean diversifying away from traditional, potentially vulnerable, routes.

- Shifting Client Needs: Demand for FSG's core logistics may fluctuate as clients adopt nearshoring or friendshoring, potentially reducing reliance on long-haul, high-risk routes.

- Emergence of New Services: Conversely, these strategic shifts create opportunities for FSG in providing security and risk advisory for new or evolving supply chain corridors.

- Global Trade Volatility: The 2.5% projected global trade volume growth for 2024, per the IMF, highlights an environment where adaptability in logistics and security is paramount.

Clients may see insurance as a direct substitute for Frontier Services Group's (FSG) proactive risk management. This perspective views insurance as a financial safety net for losses rather than a tool to prevent those losses from occurring in the first place. For example, in 2024, the global insurance market continued its growth trajectory, with premiums expected to exceed $7 trillion, highlighting the significant financial resources allocated to risk transfer.

FSG counters this by integrating insurance into a broader, holistic risk management strategy. The emphasis is on the complementary nature of risk mitigation and risk transfer. While insurance compensates for financial damages after an event, FSG's services focus on preventing the event itself, thereby avoiding associated operational disruptions and reputational harm.

Insurance policies, by their nature, do not address the non-financial consequences of incidents. These can include:

- Operational Downtime: Disruptions to business continuity and productivity.

- Reputational Damage: Negative impact on brand image and customer trust.

- Human Cost: The impact on employee safety, morale, and well-being.

FSG's value proposition lies in its ability to mitigate these multifaceted impacts, which fall outside the scope of traditional insurance coverage, reinforcing the idea that insurance is a component of, not a replacement for, comprehensive risk management.

Clients developing in-house capabilities represent a significant threat, particularly for large multinational corporations with substantial operations in frontier markets. These organizations may opt to build their own security, logistics, or aviation departments to gain greater control and potentially reduce costs. For instance, a major energy company with a long-term presence in a volatile region might assess the cost-benefit of internalizing services that Frontier Services Group (FSG) currently provides.

The decision to insource is often driven by a desire to mitigate risks and ensure operational continuity. However, the high capital expenditure, specialized expertise required, and the inherent complexities of managing such functions in challenging environments often make outsourcing to a specialist like FSG a more practical and cost-effective solution. FSG's established infrastructure and experienced personnel in 2024, for example, provide a competitive edge that is difficult for most individual clients to replicate efficiently.

In certain frontier markets, clients may choose to engage numerous local, unspecialized vendors for distinct services like security, transportation, or aviation. This fragmented strategy, while appearing cost-effective for individual tasks, bypasses the comprehensive risk management, adherence to international standards, and unified operational backing that Frontier Services Group (FSG) provides. For instance, in 2024, the average cost of securing a single logistics route with multiple local providers could be 15% lower than an integrated FSG solution, but this often translates to a 25% increase in administrative burden and a higher probability of operational disruptions.

Technological advancements are increasingly presenting substitutes for traditional logistics and security services. For instance, the rise of advanced surveillance systems and the deployment of drones for logistics operations, as seen in various pilot programs globally throughout 2024, offer alternative ways to monitor and transport goods. Autonomous ground vehicles are also entering the logistics landscape, potentially reducing the need for human drivers in certain scenarios.

While these innovations, including the projected growth of the global drone logistics market to over $15 billion by 2029, boost efficiency, they don't entirely replace the need for human intervention. Critical situations in high-risk areas still demand the nuanced judgment and on-the-spot decision-making capabilities of human personnel, especially when facing unpredictable challenges or requiring immediate, adaptive responses.

Furthermore, the increasing reliance on automated and remote systems introduces new vulnerabilities. Cybersecurity threats to logistics networks are a significant concern, as demonstrated by numerous reported breaches affecting supply chains in 2024, highlighting that technological solutions themselves can create new points of failure and require robust human oversight and security measures.

Clients increasingly explore alternative supply chain strategies like nearshoring or friendshoring, and different transportation modes, such as rail, to bypass high-risk zones or lower expenses. This shift can impact demand for specific Frontier Services Group (FSG) logistics offerings but simultaneously generates new needs for security and risk advisory services in these emerging trade routes.

Global trade patterns are in constant flux, directly influencing logistics requirements. For instance, the International Monetary Fund (IMF) projected global trade volume growth to be 2.5% in 2024, a slight uptick from previous years, but disruptions can easily alter these forecasts. Companies are actively seeking ways to build more resilient supply chains, which could mean diversifying away from traditional, potentially vulnerable, routes.

- Shifting Client Needs: Demand for FSG's core logistics may fluctuate as clients adopt nearshoring or friendshoring, potentially reducing reliance on long-haul, high-risk routes.

- Emergence of New Services: Conversely, these strategic shifts create opportunities for FSG in providing security and risk advisory for new or evolving supply chain corridors.

- Global Trade Volatility: The 2.5% projected global trade volume growth for 2024, per the IMF, highlights an environment where adaptability in logistics and security is paramount.

Clients may see insurance as a direct substitute for Frontier Services Group's (FSG) proactive risk management. This perspective views insurance as a financial safety net for losses rather than a tool to prevent those losses from occurring in the first place. For example, in 2024, the global insurance market continued its growth trajectory, with premiums expected to exceed $7 trillion, highlighting the significant financial resources allocated to risk transfer.

FSG counters this by integrating insurance into a broader, holistic risk management strategy. The emphasis is on the complementary nature of risk mitigation and risk transfer. While insurance compensates for financial damages after an event, FSG's services focus on preventing the event itself, thereby avoiding associated operational disruptions and reputational harm.

Insurance policies, by their nature, do not address the non-financial consequences of incidents. These can include:

- Operational Downtime: Disruptions to business continuity and productivity.

- Reputational Damage: Negative impact on brand image and customer trust.

- Human Cost: The impact on employee safety, morale, and well-being.

FSG's value proposition lies in its ability to mitigate these multifaceted impacts, which fall outside the scope of traditional insurance coverage, reinforcing the idea that insurance is a component of, not a replacement for, comprehensive risk management.

Entrants Threaten

Entering the integrated security, logistics, and aviation services sector, particularly in challenging frontier regions, requires a massive upfront investment. Think about needing to purchase specialized aircraft, robust armored vehicles, and sophisticated communication technology. This financial hurdle alone makes it tough for new players to even get started.

The sheer scale of capital needed to establish a comparable operational footprint to Frontier Services Group (FSG) is immense. For instance, acquiring a fleet of suitable aircraft and the necessary ground support infrastructure can easily run into tens or even hundreds of millions of dollars. This significant financial commitment acts as a formidable barrier, deterring many potential competitors from entering the market and challenging FSG's established position.

Operating effectively in challenging African and Asian markets, as Frontier Services Group does, demands more than just security and logistics skills. It requires a deep understanding of local cultures, customs, and established relationships with government bodies and local communities. This intricate blend of operational know-how and trusted networks is not easily replicated.

Building these essential capabilities and networks takes significant time and investment, creating a substantial hurdle for potential new entrants looking to compete in these specific markets. For instance, navigating complex regulatory environments in countries like South Sudan or Afghanistan, where Frontier Services Group has significant operations, requires years of on-the-ground experience and cultivated trust, a barrier that new firms would struggle to overcome quickly.

The security and logistics sectors, especially those operating in challenging international locales, are burdened by intricate and often demanding regulations, licensing mandates, and compliance obligations. For instance, the global security services market was valued at approximately $247 billion in 2023 and is projected to reach $373 billion by 2028, indicating a substantial regulatory landscape to navigate.

Successfully traversing varied national and international legal structures, particularly across multiple frontier markets, presents formidable regulatory obstacles. New participants would likely encounter significant difficulties and incur substantial costs in meeting these diverse requirements promptly, acting as a strong deterrent.

Brand Reputation and Client Trust

In the demanding world of frontier services, where operations often occur in challenging and sensitive environments, a strong brand reputation and deep client trust are absolutely critical. Frontier Services Group (FSG) has cultivated a significant advantage by consistently delivering integrated risk management solutions in these complex settings. New competitors entering this space would find it exceptionally difficult to rapidly build the same level of credibility and assurance with clients who place a premium on established, proven capabilities rather than untested options.

The barrier to entry related to brand reputation and client trust is substantial for new players looking to compete with FSG. Clients in this sector, often dealing with high-stakes situations, are unlikely to switch to unproven providers, especially when FSG's track record demonstrates reliability, safety, and discretion. For instance, in 2024, the global private security services market, a closely related sector, was valued at approximately $250 billion, with a significant portion driven by specialized services in high-risk regions, underscoring the importance of established trust.

- Brand Reputation: FSG's history of successful operations in frontier markets builds a powerful brand image.

- Client Trust: Discerning clients prioritize proven reliability and discretion, making it hard for new entrants to gain immediate trust.

- High Switching Costs: The perceived risk associated with switching to an unknown provider in critical operations is a significant deterrent.

- Track Record: FSG's established track record in integrated risk management solutions provides a substantial competitive moat.

Access to Talent and Established Networks

Frontier Services Group (FSG) operates in a niche where specialized talent is paramount. The ability to recruit and retain individuals with backgrounds in military, intelligence, logistics, and aviation is a significant barrier to entry. For instance, in 2024, the global demand for cybersecurity professionals, a key skill set for FSG's operational security, continued to outstrip supply, with millions of unfilled positions reported by various industry surveys.

Newcomers would struggle to replicate FSG's established global network of multinational, multilingual teams and strategic partnerships. Building these relationships, crucial for operating effectively in complex and often challenging regions, takes considerable time and investment. Consider the extensive vetting and onboarding processes required for personnel operating in high-risk environments, a hurdle that new entrants would find particularly daunting.

- Talent Acquisition Challenge: New entrants face difficulties in attracting and retaining specialized personnel, such as former military and intelligence professionals, which are critical for FSG's operations.

- Network Development Difficulty: Building the extensive, multinational, and multilingual operational networks that FSG possesses requires significant time, resources, and established trust.

- Operational Expertise Gap: The specialized skills and experience needed to deliver services effectively in FSG's target regions are not easily acquired or replicated by new market participants.

The threat of new entrants into the specialized integrated security, logistics, and aviation services sector, particularly in frontier markets, is significantly mitigated by substantial barriers. These include the immense capital required for specialized assets, the complex regulatory landscape, and the critical need for established brand reputation and client trust. Furthermore, acquiring the necessary specialized talent and building extensive operational networks presents considerable challenges for potential competitors.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Acquisition of specialized aircraft, armored vehicles, and technology. | High upfront investment deters entry. |

| Regulatory Complexity | Navigating diverse licensing, compliance, and legal structures across frontier markets. | Significant costs and time delays for new firms. |

| Brand Reputation & Client Trust | FSG's proven track record in high-risk environments. | Difficult for new entrants to quickly establish credibility with risk-averse clients. |

| Specialized Talent & Networks | Recruiting experienced personnel and building established relationships. | Time-consuming and resource-intensive, creating an expertise gap. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Frontier Services Group is built upon a foundation of publicly available company filings, including annual reports and investor presentations. We also incorporate industry-specific market research reports and news articles to capture current competitive dynamics.